This isn’t the “Big One.”

This isn’t even a Middle One.”

This is no more than a 10%-15% correction typical for long term bull markets.

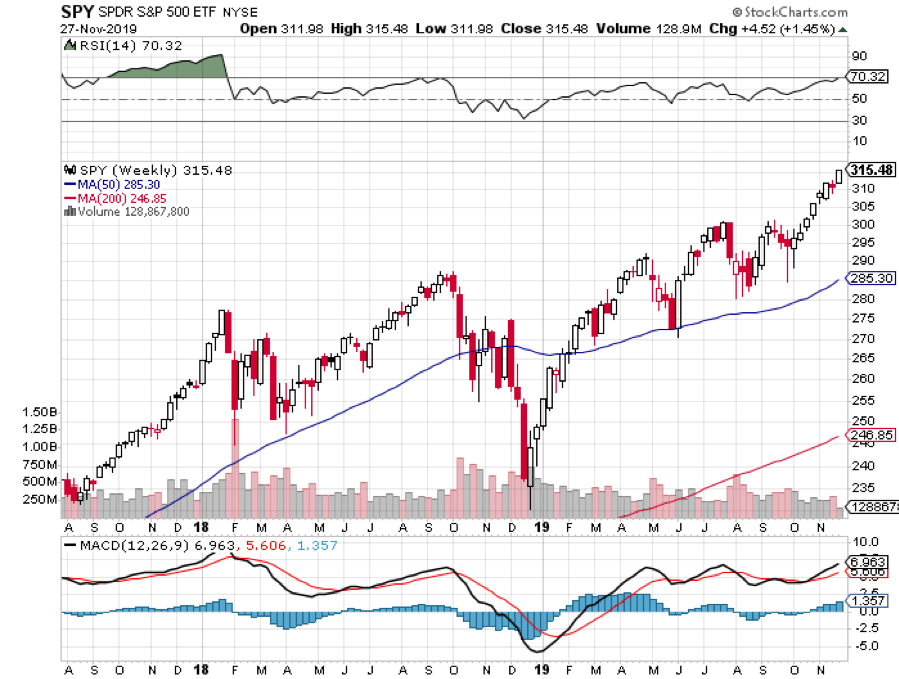

Sure, we saw every technical indicator known to man scream “SELL” in the run-up to the recent market top. There were other factors at play as well.

The bulk of the buying focused on only the top six stocks, more concentrated than seen during the Dotcom Bubble Top in 2000.

There really was only one buyer. That would be my friend Masayoshi Son’s Softbank (SFTBY). He bought $4 billion worth of big tech call options in the run-up to the top with an exercise value of $30 billion. When he started to sell last Monday, the market for these options vaporized and stocks plunged.

The fact that both Apple (AAPL) and Tesla (TSLA) shares split the same day also defined a market top that I have been warning readers about for weeks.

This is all in the face of the incredible reality that 50% of all S&P 500 (SPY) stocks are down over the past two years. It really has been a stock picker’s market with a turbocharger.

And this isn’t just any old bull market. We are in fact 11 ½ years into a bull market that started in March 2009 that has another decade to run. We have completed the first 400% gain. What lies ahead of us is another stock market increase of 400%, taking us up to 120,000 in the Dow Average by 2030.

And this is a bull market that has suffered plenty of 10%-15% corrections since its inception. The one that began in Thursday is no different. The sole exception to this analysis was the COVID-19-induced 37% meltdown that began in February. That little event only lasted six weeks.

For you see, the fundamentals have not changed one iota. No, I’m not talking about earnings, valuations, or sales growth. That is so 20th century.

No, I’m referring to the only fundamental that counts in the 21st century: Liquidity.

And liquidity isn’t shrinking, it is in fact increasing. That includes the unprecedented expansion of quantitative easing by the Federal Reserve, massive deficit spending by the US government, and zero interest rates, which Fed governor Jay Powell has promised us will continue for another five years.

During the last Dotcom Bubble top, the FAANGs and Tesla (TSLA) did not even exist. Apple was just coming out of its flirtation with bankruptcy and Amazon (AMZN) had just barely gone public. Google (GOOGL) and Facebook (FB) were still but glimmers in their founders’ eyes.

Except now we have a new bullish fundamental to discount: a Biden win in November. Since Biden decisively pulled ahead in the polls in May, the stock market has risen almost every day. He is 4%-10% ahead in every battleground state poll.

Even if Trump were to win every red and red-leaning state accounting for 163 electoral college votes, plus all 63 votes from toss-up states (AZ, NC, IA, FL, GA, OH), he would still lose the election, where 270 votes are needed to win. Just THAT is a 1:100 event, on the scale of Harry Truman’s historic 1948 compact, and Trump is no Harry Truman.

So what of Biden wins?

You can count on the $3 trillion stimulus bill passed by the House in March to go through, which primarily allocates money to keep states and local municipalities from firing policemen, firemen, and teachers.

Next to come are another $3 trillion in infrastructure spending. And I absolutely know from past experience that markets love this kind of stuff. It enhanced liquidity even more.

As I say, cash is still trash, and it may remain so for years.

The Top is in, with a horrific two-day 1,500-point selloff in the Dow Average ($INDU) coming out of the blue on no news and signaling the end of the current rally. Whatever went up the most is now going down the most as the Robinhood traders flee in panic. This was long overdue. Margin calls are running rampant.

Volatility (VIX) soared to $38, up 70% in two days, meaning that we may be close to the end of this correction. The (SPX) is down 24 points, 6.7% from the Wednesday high. The last (VIX) peak was at $44 in June and $80 in March. Time to start buying stocks for a yearend rally? Look at the banks.

Was Apple (AAPL) really up 400%? Did Tesla gain 500%? You might be fooled if you didn’t know that these stocks just split, Apple at 4:1 and Tesla for 5:1. In fact, both stocks posted robust gains in real terms, Apple up 5% and Tesla up 10%. Tesla just hit my five-year split-adjusted target of $2,500. Every other analyst had a much lower target or were bearish. Time to run a mile as splits often herald intermediate market tops.

Apple hit a $2.3 trillion in market cap at the peak, up a staggering $300 billion in days. We are truly in La La Land here. The price-earnings multiple has soared from 9X to 40X. That 5G iPhone better deliver. Didn’t you hear that 5G was causing Coronavirus, a popular internet conspiracy theory?

The Dow Average just lost its Apple turbocharger. Some 1,000 of the 2,000 points the Dow Average gained in August were due to Apple alone. With the Dow rebalancing today, with (XOM), (PFE), and (RTX) out and (CRM), (AMGN), and (HON) in, Apple’s influence has been greatly diluted. With the (VIX) back up above $26, the worst is yet to come. The stock market is screaming for a correction.

Copper (FCX) hit a new 3-year high, with demand soaring in China. They were the first to cap Covid-19 and restore their economy. The red metal is a great call on the recovery of the global economy. Those who bought the Freeport McMoRan (FCX) LEAPS I recommended in March are sitting pretty. The shares are up 228% since then.

Tesla to sell $5 billion in stock to finance the construction of new factories in Nevada, TX, and Germany. (TSLA) fell 5% on the news. I had been advising clients to sell all week. It won’t be a conventional secondary stock offering but an effort to sell into every stock spike. More proof that Elon hates Wall Street as if we needed more. With a market cap of $450 billion, investors are finally viewing Tesla as a data company rather than a car company.

US car sales recover to 15.2 million in August on an annualized basis. That brings us almost back to pre-pandemic levels. This is the best indicator yet that the US is returning to a semi-normal economy. Of course, zero interest rates and other unprecedented incentives are a big help.

Consumer Spending popped, up 1.9% in July, which accounts for two-thirds of the US economy. Those who have money are spending like there’s no tomorrow, and with a global pandemic, maybe there won’t be. New car purchases were a big winner as buyers take advantage of 0% financing everywhere.

Weekly Jobless Claims dropped to 880,000, still terrible, but less terrible than last week. California claims have topped 8 million since the pandemic began. Continuing claims drop to 13.3 million, down from the 25 million peak in May.

US Unemployment Rate plunged to 8.4% in August, from 10.2%. The August Nonfarm Payroll report jumps by 1.37 million. It’s a much faster improvement than expected. Retail gained 248,000, Education & Health Services were up 147,000, and Leisure & Hospitality were up 174,000, Government was up 344,000. It’s all thanks to the miracle of government spending. The Dow Average is down 500 points anyway.

China to dump US Treasury bonds in response to Trump's escalating trade war, putting $200 billion in paper up for sale. They hold $1.07 trillion in total and is our largest single creditor. The (TLT) is down two points on the news, where I am running a double short position. Who is going to fund America’s massive borrowing?

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old.

My Global Trading Dispatch bounced back hard with some super aggressive buying of stocks right at the Thursday and Friday market bottoms and selling short of bonds at the top.

By going full speed ahead, damn the torpedoes, I brought in the best two-day return in the 13-year history of the Mad Hedge Fund Trader, up a heroic 8.27%.

It started out as a terrible week, getting flushed out of one of my short positions in the (SPY) for a big loss as the market hit a new all-time high.

Then I got long banks (JPM), Apple (AAPL), Amazon (AMZN), Visa (V), and went triple short bonds (TLT). I still retain one short in the (SPY), which is now profitable. I would have bought Bank of America (BAC) and Citigroup (C), but the market ran away before I could write the trade alerts.

The instant crash was yet another gift. Right after I shorted bonds, the Chinese hinted that they would unload $200 million worth of their US Treasury bond holdings. The harder I work, the luckier I get.

If these positions expire at max profit in eight trading days, I will be back at new all-time highs. Notice that I am shifting my longs away from tech and toward domestic recovery plays.

You only need 50 years of practice to know when to bet the ranch.

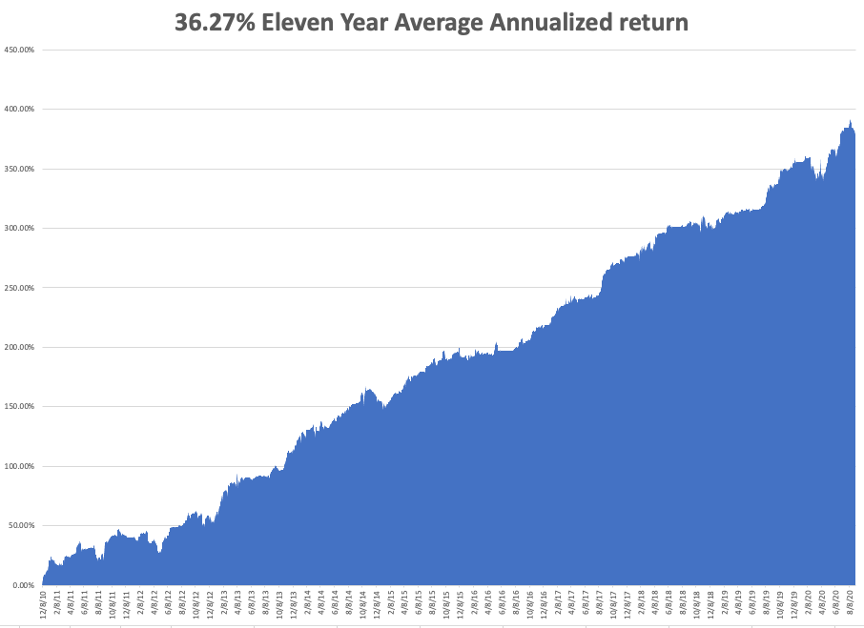

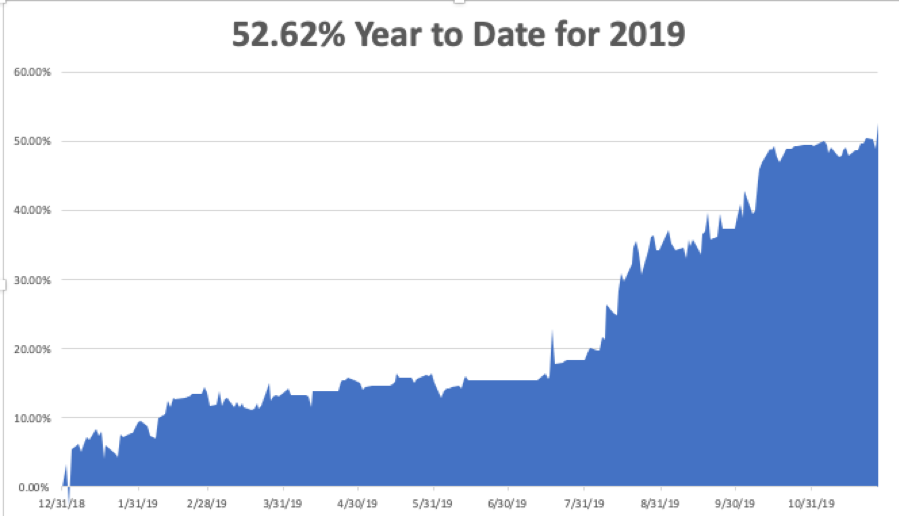

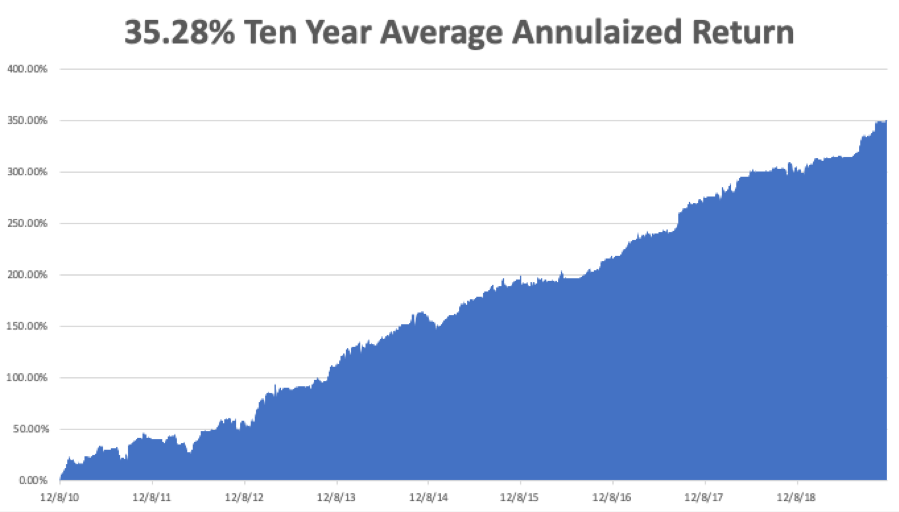

That takes our 2020 year to date back up to 30.99%, versus -0.70% for the Dow Average. September stands at 4.44%. That takes my eleven-year average annualized performance back to 36.27%. My 11-year total return returned to 386.90%. My trailing one-year return popped back up to 51.60%.

It is a quiet week as always following the fireworks of the jobs data.

The only numbers that really count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, September 7, it is Labor Day in the US, and markets are closed.

On Tuesday, September 8 at 10:00 AM EST, the Economic Optimism Index for September is released.

On Wednesday, September 9, at 8:13 AM EST, the EIA Cushing Crude Oil Stocks are out.

On Thursday, September 10 at 8:30 AM EST, the Weekly Jobless Claims are announced. US Core Producer’s Price Index for August is also out.

On Friday, September 4, at 8:30 AM EST, the US Inflation Rate for August is printed. At 2:00 PM The Bakers Hughes Rig Count is released.

As for me, I am headed back to Lake Tahoe to flee the horrific smoke in the San Francisco Bay Area drifting our way from the rampant California wildfires. If people don’t believe in global warming, they should come here where we have it in spades. We’ll even give you some.

At least we’ve been getting spectacular sunsets.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader