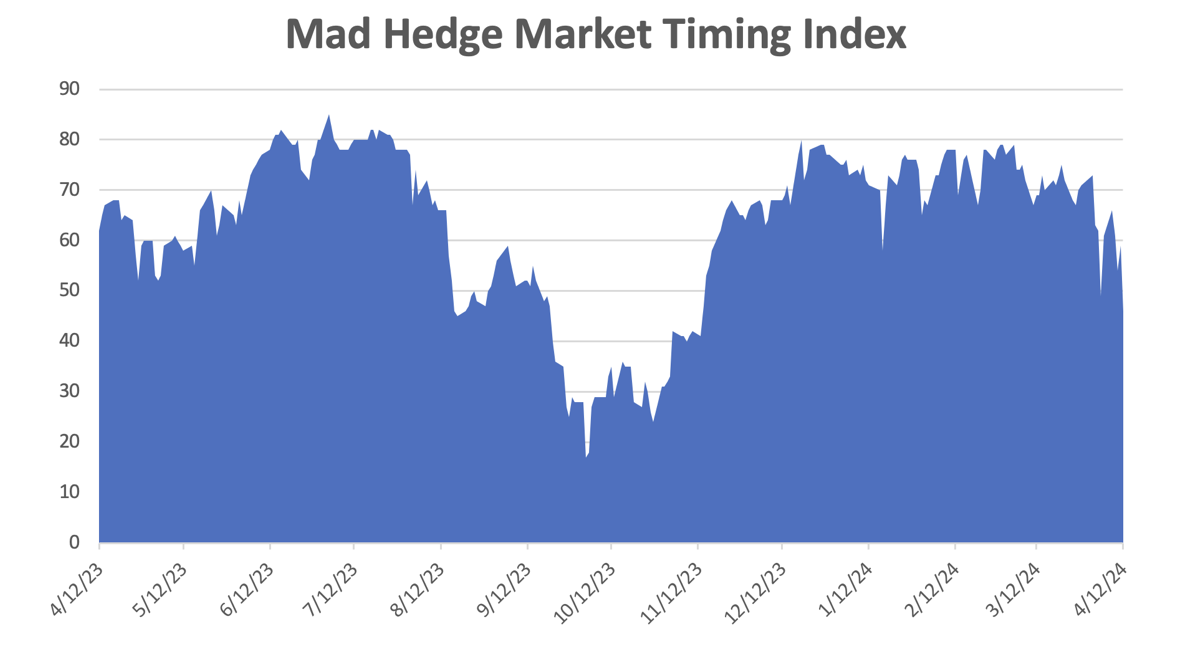

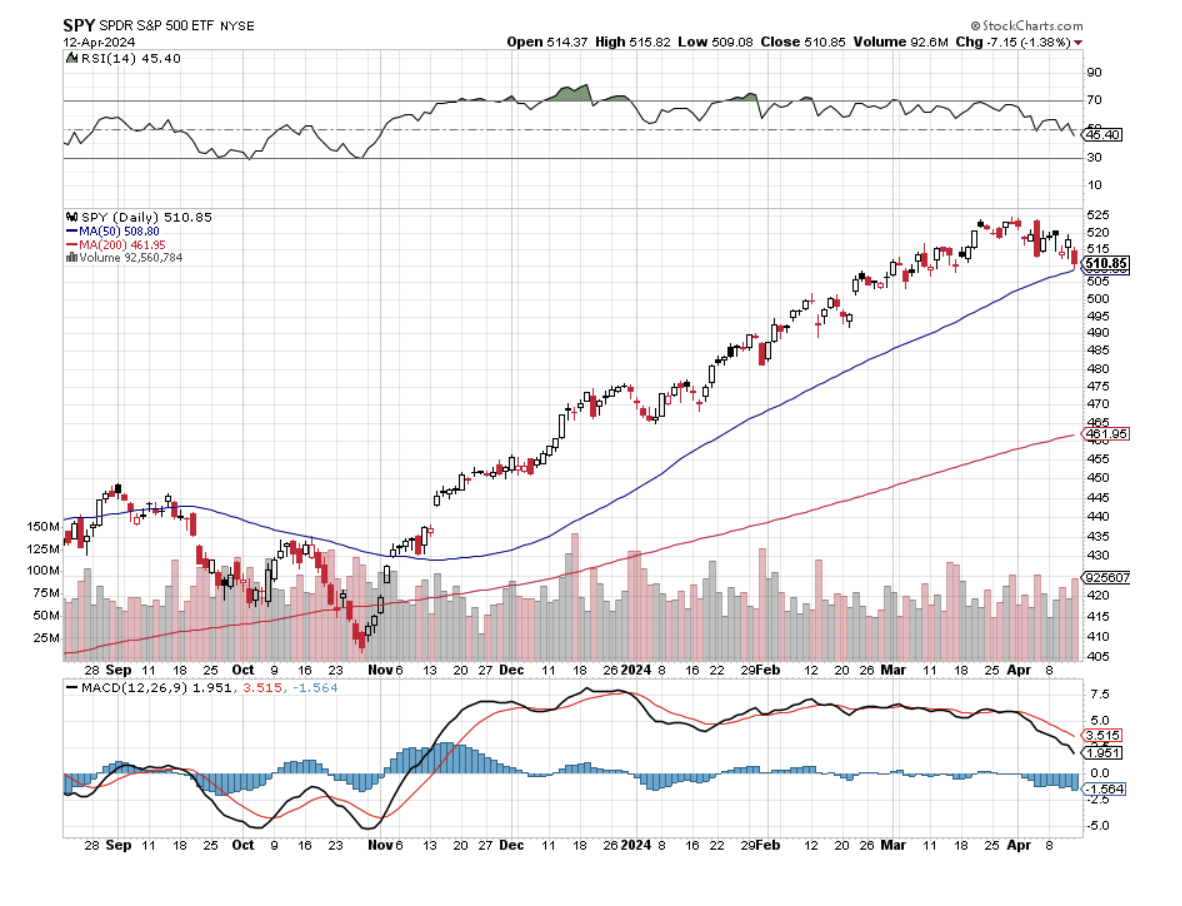

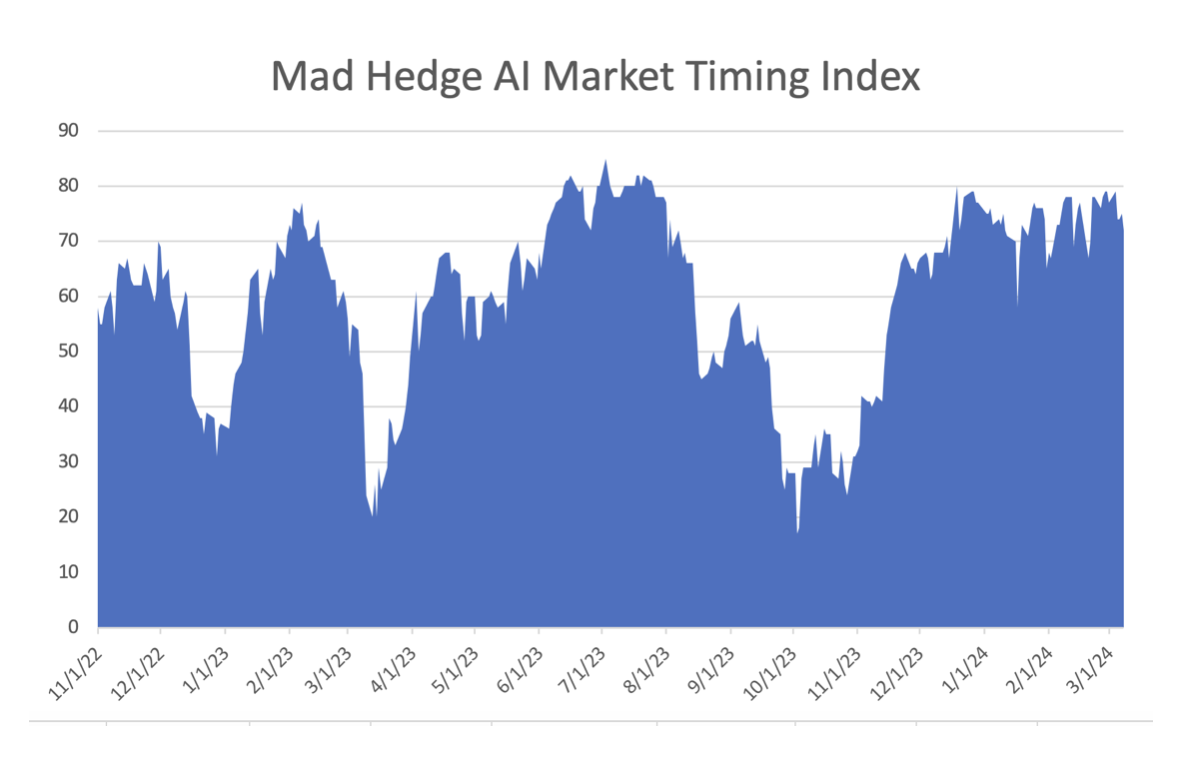

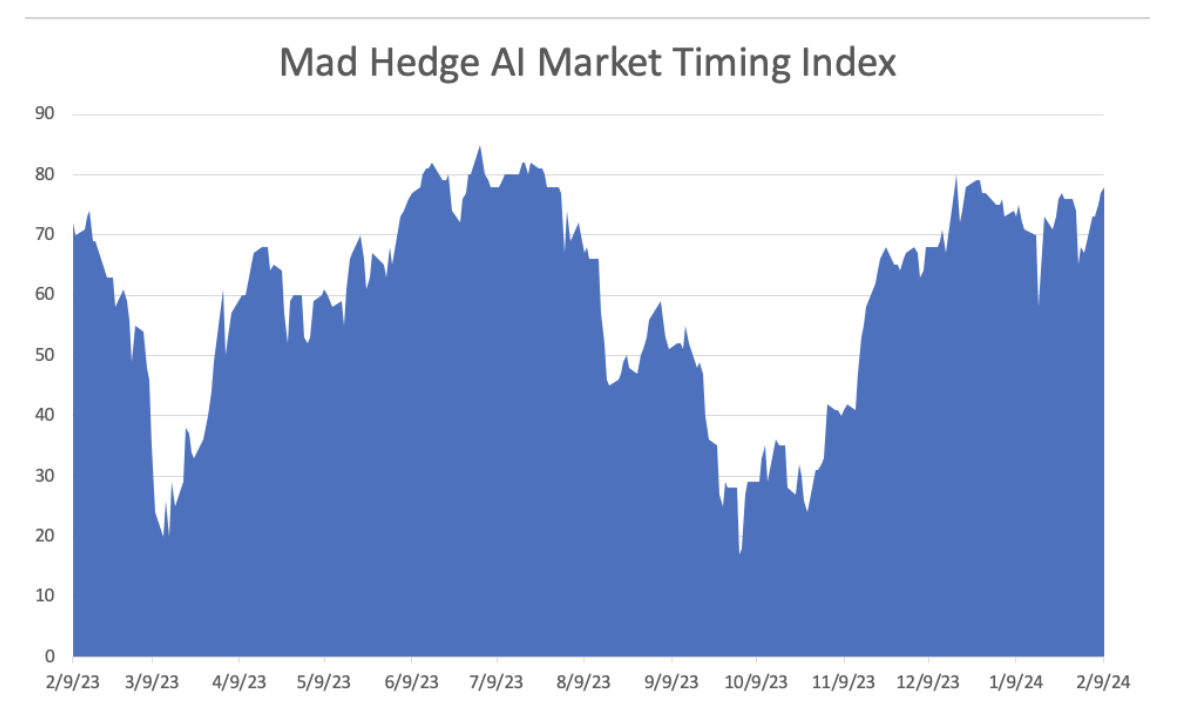

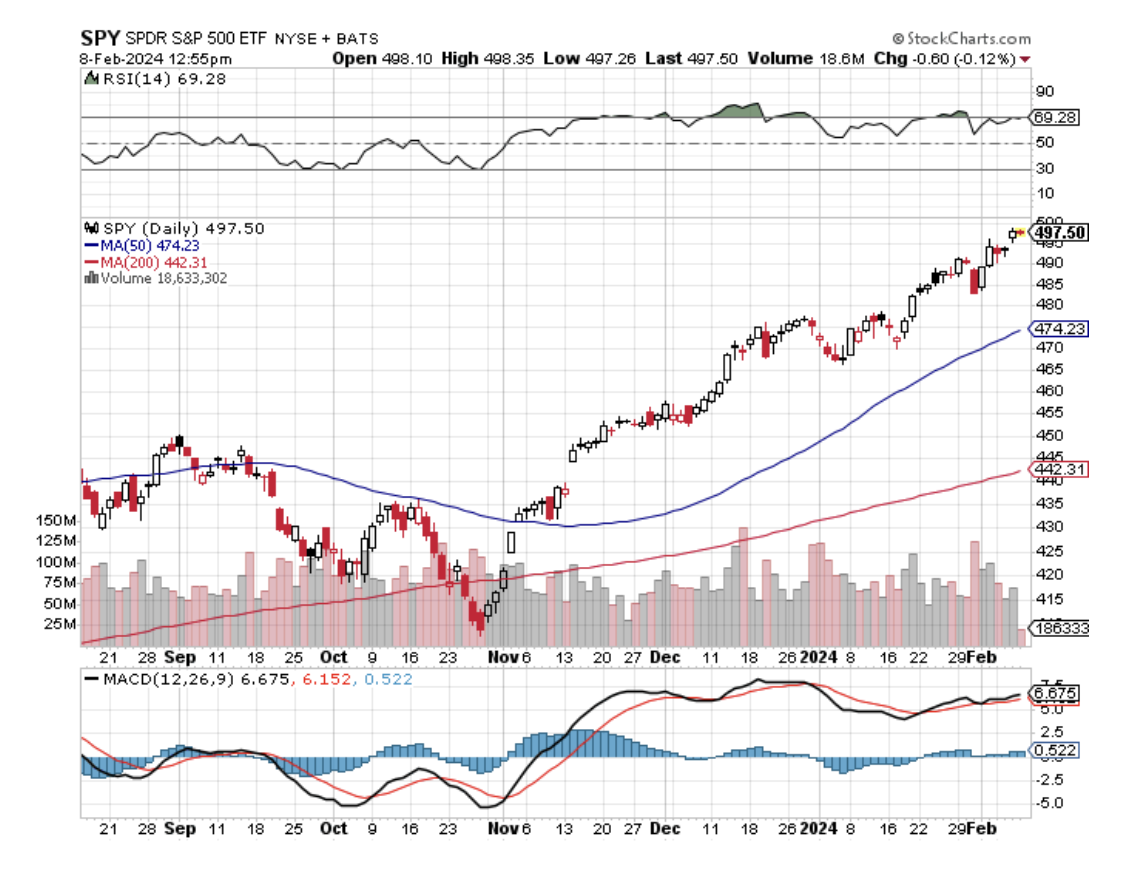

Those who expected markets to go up forever were given a rude awakening last week with a swift slap across the face with a wet kipper. The Volatility Index ($VIX) soared from $12 to $19 and higher highs will unfold this week. The Mad Hedge Market Timing Index dropped below 50 for the first time since October and lower lows beckon.

For those of us who earn our crust of bread off of volatility, its return is like a gift from the gods. The long desert has been crossed and the fresh mountain springs beckon just ahead.

What prompted this ($VIX) melt-up is that many traders and investors are finally throwing in the towel on ANY interest rate cuts in 2024. In a mere four months, we have gone from an expectation of six rate cuts to zero. Not helping matters is that the “May” thing, as in “Sell and Go away” is only two weeks away. After an overcooked Q1, we may be headed into a summer that is the next great Ice Age.

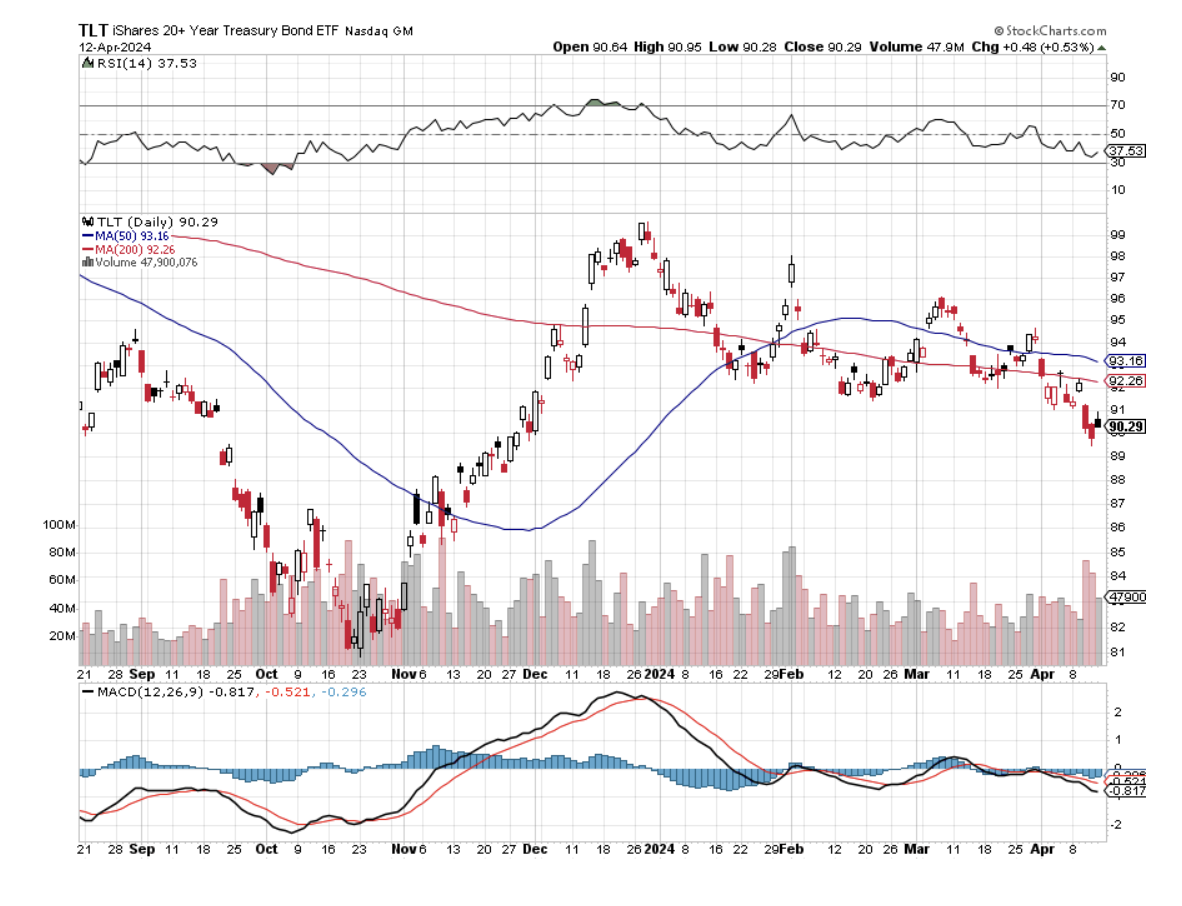

At least that is the assumption we have to make from a trading point of view for the short-term. While this represents a worst-case scenario, I don’t expect bonds to drop much from here, maybe a couple of points, as future interest rate cuts are a certainty. All that has happened is that our rate cuts have been moved out from two months to five months. The next move in interest rates is still down.

At some point, there will be a great bond trade out there, but definitely, not yet!

Watching the market action last week, it was especially impressive how well NVIDIA (NVDA) held up.

NVIDIA is so far ahead of the competition that no one will catch up for years. What the (NVDA) bears don’t get is that the company has a moat so wide it is impossible to cross. Their enormous lead in software is the result of crucial platform decisions made 20 years ago. The key staff are all locked up with ultra-cheap equity options with strike prices around $1-$2.

Virtually everyone has now raised their upside targets for the stock over $1,000/share and there are $1,400 figures out there. That’s because, with a price-earnings multiple of only 30X, it is still the cheapest Big Tech stock in the market. By comparison, its biggest customer, (META) is at 34X, AI Leader (MSFT) is at 38X, and (AMZN) is at a stratospheric 63X.

Efforts by Alphabet (GOOGL) to break into the AI chip business are feeble at best. This is a business that has a very long learning curve with very high capital costs.

Every 15% correction in (NVDA) over the last two years has been a strong “BUY”. It really owns the AI design business. It’s looking at $250-$500 BILLION in sales growth over the next several years.

Santa Clara-based NVIDIA designs and manufactures high-end, top-performing graphics cards or GPUs. There is probably one in your PC. They are essential in the artificial intelligence, automobile, PC, supercomputing, cybersecurity, and gaming industries. As a design company only company NVIDIA represents pure intellectual added value. Its chips are manufactured in Taiwan.

They are also crucial for national defense. The Biden administration recently banned NVIDIA from exporting high-end chips and their manufacturing equipment to China, which they were using to build sophisticated weapons to use against us. Last week China banned NVIDIA chips in a typical tit-for-tat gesture.

We have had a spectacular week here at Mad Hedge Fund Trader.

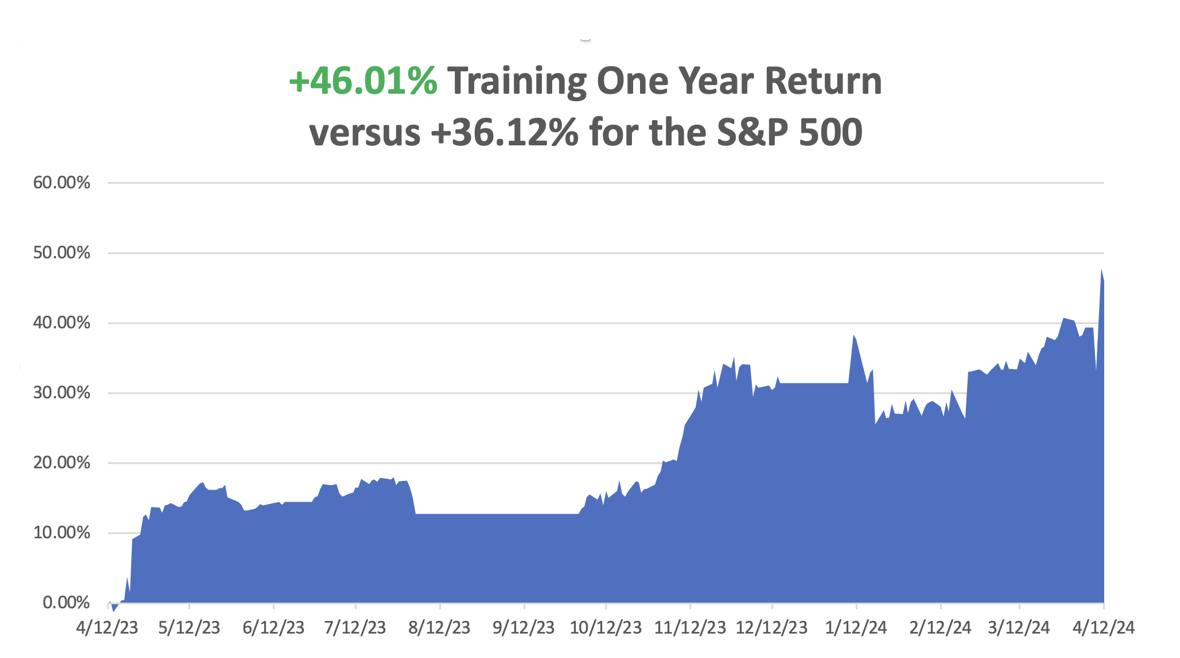

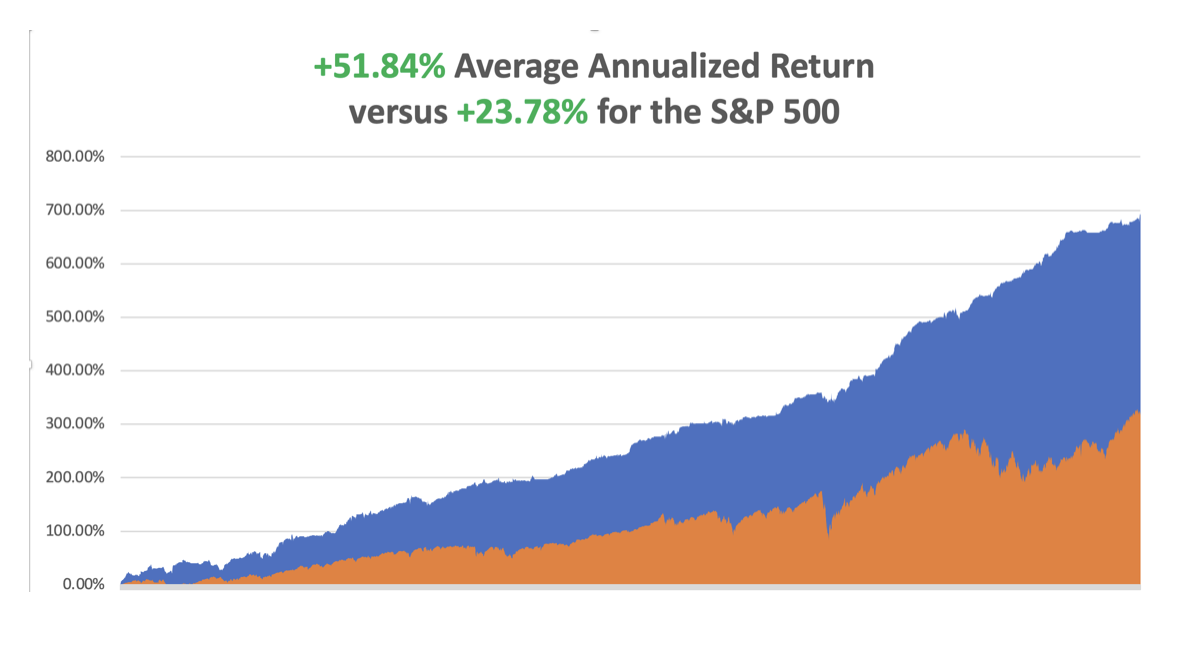

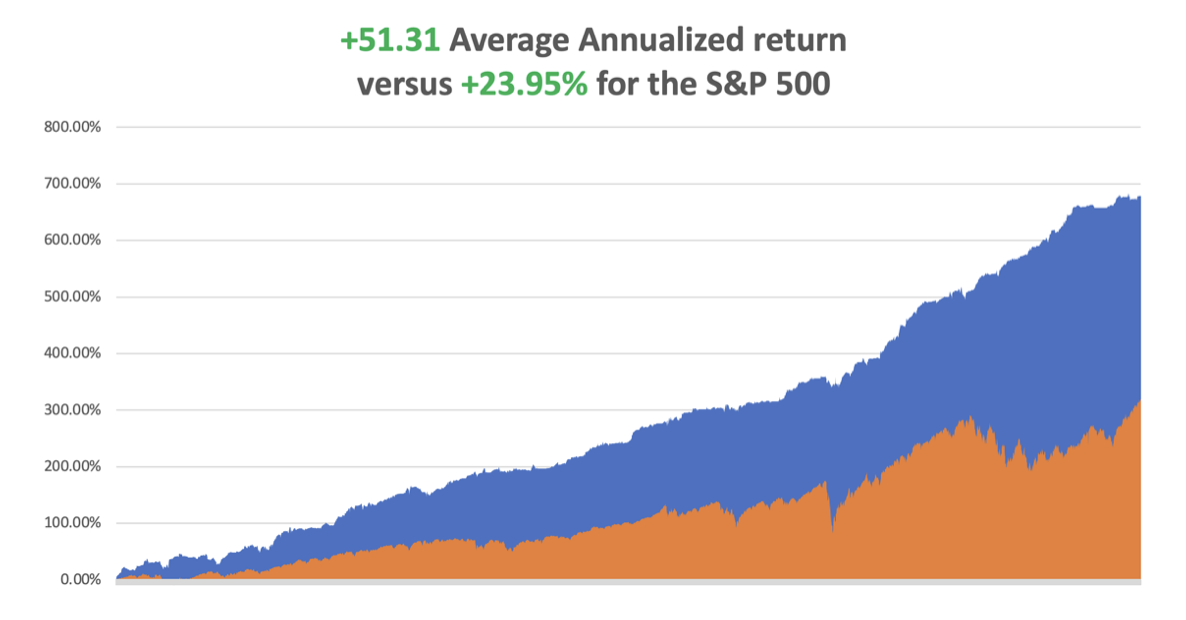

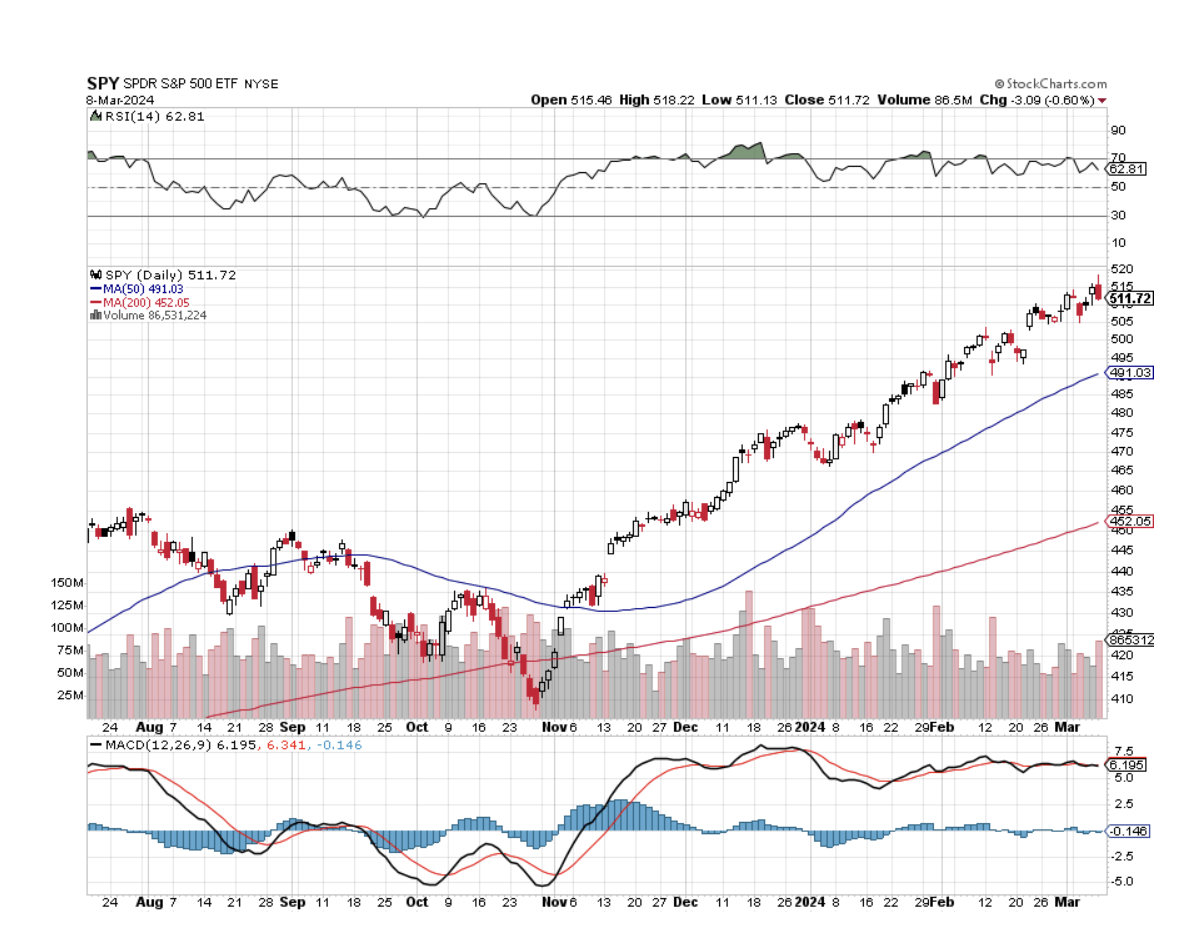

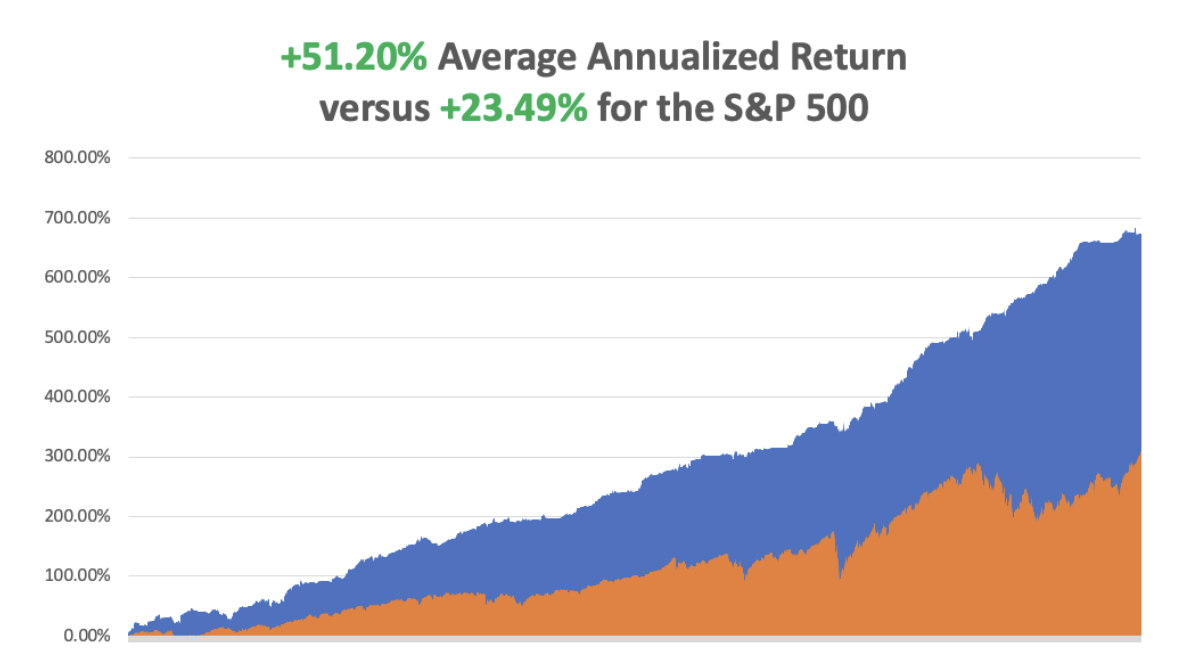

So far in April, we are up +5.20%. My 2024 year-to-date performance is at +14.47%. The S&P 500 (SPY) is up +7.22% so far in 2024. My trailing one-year return reached +46.01% versus +36.12% for the S&P 500.

That brings my 16-year total return to +691.20%. My average annualized return has recovered to +51.84%.

Some 63 of my 70 round trips were profitable in 2023. Some 20 of 26 trades have been profitable so far in 2024.

We got a rare dip last week, which I used to rush into four new May positions, double positions in (NVDA) and additional ones in (FCX) and (TLT). I will let my existing April longs expire at a max profit in four days on April 19 in Freeport McMoRan (FCX), Occidental Petroleum (OXY), ExxonMobile (XOM), Wheaton Precious Metals (WPM), Tesla (TSLA), and Gold (GLD).

I am in a rare 100% invested position with no cash given the massive upside breakout in commodity, precious metals, and energy we have witnessed. This is going to be a great month.

Consumer Price Index Comes in Hot at 0.4% for March, the same rate as in February according to the Bureau of Labor Statistics, knocking stocks down 500 points. Housing and transportation were the big badges. Hopes of a June interest rate cut have been dashed. September is now the earliest. Avoid (TLT).

Producer Price Index Comes in Cold at 0.2% for March. On a 12-month basis, the PPI rose 2.1%, the biggest gain since April 2023, indicating pipeline pressures that could keep inflation elevated. Stocks rallied 200 points.

US Dollar Rockets on Hot CPI, hitting a new 34-year high against the Japanese yen at ¥151.55. Bank of Japan's intervention to support the yen is expected. Yen shorts in the futures market hit a five-month high. Avoid (FXY).

China Continues Record Gold Buying, soaking up record amounts. Central banks bought a record 1,082 metric tonnes of gold in 2023. The Bank of China bought a record 735 tonnes of gold in 2023, two-thirds of which were purchased through covert third-party middlemen. An additional 1,411 tonnes, likely to bypass a collapsing Yuan, and a whopping 228 tonnes in January 2024 alone. This is what delivered the barbarous relic’s decisive upside breakout from a three-year trading range. This dwarf’s the record 1,082 metric tonnes of gold global central banks bought in 2023. The world gold market has been taken short and prices will continue to rise.

Gold Derivatives are Now Wagging the Dog. There are 187,000 metric tonnes of gold above ground worth a mere $14.4 billion which price is 50 times that figure in paper derivatives, like ETFs, futures contracts, and options. A metric tonne of gold today is worth $77 million. That increases the barbarous relic’s volatility once it breaks out of long-term trading ranges, which it has just done. With new volatility eventually, some bodies have to float to the surface. The bad news is that this may also be a signal that China will invade Taiwan. Buy (GLD) on dips.

Oil (USO) Spikes on New Iran War Threats, sending Brent to $92, a new 2024 high. Gold (GOLD) and silver (WPM) have gone ballistic as well. Hang on for higher highs.

JP Morgan Misses on Earnings, tanking the shares by $10. The firm earned $23.1 billion in net interest income in the first three months of 2024, up 11% from a year earlier. The bank’s NII haul ended a streak of seven quarters where it posted record levels of the metric. The bank cited deposit margin compression — tightening of profits between what the bank earns on loans and pays out on deposits — and lower deposit balances in the consumer business for the sequential decline. Buy (JPM) on dips.

China’s International Trade Collapses. Exports from China slumped 7.5% year-on-year last month by value, the biggest fall since August last year. They had risen 7.1% in the January-February period.

Hong Kong's major indexes extended losses to more than 2%.

Chinese exporters are continuing to slash prices to maintain sales amid stubbornly weak domestic demand. Avoid (FXI).

Tesla Cancels Model 2, a key part of the bull story for (TSLA). Elon Musk says “Not so fast” and instead highlights the company’s move into robotic self-driving cars. Don’t be so dismissive, as Waymo completed an eye-popping 100,000 robotic taxi rides in San Francisco in December, many with thrilled first-time users. The stock held up incredibly well on awful news indicating that it believes Elon and not the media. Buy (TSLA) on dips.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, April 15, at 7:00 AM EST, the US Retail Sales are announced.

On Tuesday, April 16 at 8:30 AM, US Housing Starts are released.

On Wednesday, April 17 at 2:00 PM, the Beige Book notes from the previous Fed meeting are published

On Thursday, April 18 at 8:30 AM, the Weekly Jobless Claims are announced. At 10:00 AM, Existing Home Sales are out.

On Friday, April 19 at 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, with the spectacular popularity of the Oppenheimer movie, I thought I’d review my own nuclear past. When the Cold War ended in 1992, the United States judiciously stepped in and bought the collapsing Soviet Union’s entire uranium and plutonium supply.

For good measure, my client George Soros provided a $50 million grant to hire every Soviet nuclear engineer. The fear then was that starving homeless scientists would go to work for Libya, North Korea, or Pakistan, which all had active nuclear programs at the time.

They ended up here instead. I just might be that the guy standing next to you in line at Safeway with a foreign accent who knows how to design a state-of-the-art nuclear bomb.

That provided the fuel to run all US nuclear power plants and warships for 20 years. That fuel has now run out and chances of a resupply from Russia are zero. The Department of Defense attempted to reopen our last plutonium factory in Amarillo, Texas, a legacy of the Johnson administration.

But the facilities were deemed too old and out of date, and it is cheaper to build a new factory from scratch anyway. What better place to do so than Los Alamos, which has the greatest concentration of nuclear expertise in the world?

Los Alamos is a funny sort of place. It sits at 7,320 feet on a mesa on the edge of an ancient volcano so if things go wrong, they won’t blow up the rest of the state. The homes are mid-century modern built when defense budgets were essentially unlimited. As a prime target in a nuclear war, there are said to be miles of secret underground tunnels hacked out of solid rock.

You need to bring a Geiger counter to garage sales because sometimes interesting items are work castaways. A friend almost bought a cool coffee table which turned out to be a radioactive part of an old cyclotron. And for a town designing the instruments to bring on the possible end of the world, it seems to have an abnormal number of churches. They’re everywhere.

I have hundreds of stories from the old nuclear days passed down from those who worked for J. Robert Oppenheimer and General Leslie Groves, who ran the Manhattan Project in the early 1940s. They were young mathematicians, physicists, and engineers at the time, in their 20s and 30s, who later became my university professors. The A-bomb was the most important event of their lives.

Unfortunately, I couldn’t relay this precious unwritten history to anyone without a security clearance. So, it stayed buried with me for a half century, until now.

Some 1,200 engineers will be hired for the first phase of the new plutonium plant, which I got a chance to see. That will create challenges for a town of 13,000 where existing housing shortages already force interns and graduate students to live in tents. It gets cold at night and dropped to 13 degrees F when I was there.

I actually started in the nuclear biz during the early 1970s when my math professor recommended me for a job there. In those days, mathematicians had only two choices. Teach or work for the Defense Department. As I was sick of school, I chose the latter.

That led me to drive down a bumpy dirt road in Mercury, Nevada to the Nuclear Test Site where underground testing was still underway. There were no signs. You could only find the road marked by four trailers occupied by hookers who did a brisk business with the nearly all-male staff. My fondest memory was the skinny dipping that took place after midnight in a small pool when the MPs were on break.

I was recently allowed to visit the Trinity site at the White Sands Missile Test Range, the first outsider to do so in many years. This is where the first atomic bomb was exploded on July 16, 1945. The 20-kiloton explosion set off burglar alarms for 200 miles and was double to ten times the expected yield.

Enormous steel targets hundreds of yards away were thrown about like toys (they are still there). Half the scientists thought the bomb might ignite the atmosphere and destroy the world but they went ahead anyway because so much money had been spent, 3% of US GDP for four years. Of the original 100-foot tower, only a tiny stump of concrete is left (picture below).

With the other visitors, there was a carnival atmosphere as people worked so hard to get there. My Army escort never left me out of their sight. Some 79 years after the explosion, the background radiation was ten times normal, so I couldn’t stay more than an hour.

Needless to say, that makes uranium plays like Cameco (CCJ), NextGen Energy (NXE), Uranium Energy (UEC), and Energy Fuels (UUUU) great long-term plays, as prices will almost certainly rise and all of which look cheap. US government demand for uranium and yellow cake, its commercial byproduct, is going to be huge. Uranium is also being touted as a carbon-free energy source needed to replace oil.

At Ground Zero in 1945

What’s Left of a Trinity Target 200 Yards Out

Playing With My Geiger Counter

Atomic Bomb No.3 Which was Never Used

What’s Left from the Original Test

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader