The news from Australia?s Perth Mint was horrific last week. The refiner for the world?s second largest producer reported that sales hit a new three year low.

And the worst is yet to come.

Shipments of gold coins and bars plunged to 21,671 ounces in May, compared to 26,545 ounces in April. Silver sales have seen similar declines.

I have been warning readers for the last four years that investors want paper assets paying dividends and interest, not the hard stuff, now that the world is in a giant reach for yield.

Ten-year US Treasury yields jumping from 1.83% to 2.43% this year is pouring the fat on the fire.

This all substantially raises the opportunity cost of owning the barbarous relic. With bond yields now forecast to reach as high as 3.0% by the end of the year, the allure of the yellow metal is fading by the day.

The gold perma bulls have a lot of splainin? to do.

Long considered nut cases, crackpots, and the wearers of tin hats, lovers of the barbarous relic have just suffered miserable trading conditions since 2011. Gold has fallen some 39% since then during one of the great bull markets for risk assets of all time.

Let me recite all the reasons that perma bulls used your money to buy the yellow metal all the way down.

1) Obama is a socialist and is going to nationalize everything in sight, prompting a massive flight of capital that will send the US dollar crashing.

2) Hyperinflation is imminent, and the return of ruinous double-digit price hikes will send investors fleeing into the precious metals and other hard assets, the last true store of value.

3) The Federal Reserve?s aggressive monetary expansion through quantitative easing will destroy the economy and the dollar, triggering an endless bid for gold, the only true currency.

4) To protect a collapsing greenback, the Fed will ratchet up interest rates, causing foreigners to dump the half of our national debt they own, causing the bond market to crash.

5) Taxes will skyrocket to pay for the new entitlement state, the government?s budget deficit will explode, and burying a sack of gold coins in your backyard is the only safe way to protect your assets.

6) A wholesale flight out of paper assets of all kind will cause the stock market to crash. Remember those Dow 3,000 forecasts?

7) Misguided government policies and oppressive regulation will bring financial Armageddon, and you will need gold coins to bribe the border guards to get out of the country. You can also sew them into the lining of your jacket to start a new life abroad, presumably under an assumed name.

Needless to say, things didn?t exactly pan out that way.

The end-of-the-world scenarios that one regularly heard at Money Shows, Hard Asset Conferences, and other dubious sources of investment advice all proved to be so much bunk.

I know, because I was once a regular speaker on this circuit. I, alone, a voice in the darkness, begged people to buy stocks instead.

Eventually, I ruffled too many feathers with my politically incorrect views, and they stopped inviting me back. I think it was my call that rare earths (REMX) were a bubble that was going to collapse was the weighty stick that finally broke the camel?s back.

By the way, Molycorp (MCP), then at $70 a share, recently announced it was considering bankruptcy. Rare earths didn?t turn out to be so rare after all.

So, here we are, five years later. The Dow Average has gone from 7,000 to 18,000. The dollar has blasted through to a 14 year high against the Euro (FXE).

The deficit has fallen by 75%. Gold has plummeted from $1,920 to $1,150. And no one has apologized to me, telling me that I was right all along, despite the fact that I am from California.

Welcome to the investment business. Being wrong never seems to prevent my competitors from prospering.

Gold has more to worry about than just falling western demand. The great Chinese stock bubble, which has seen prices double in only nine months, has citizens there dumping gold in order to buy more stocks on margin.

This is a huge headache for producers, as the Middle Kingdom has historically been the world?s largest gold buyer. As long as share prices keep appreciating, demand there will continue to ebb.

So now what?

From here, the picture gets a little murky.

Certainly, none of the traditional arguments in favor of gold ownership are anywhere to be seen. There is no inflation. In fact, deflation is accelerating.

The dollar seems destined to get stronger, not weaker. There is no capital flight from the US taking place. Rather, foreigners are throwing money at the US with both hands, escaping their own collapsing economies and currencies.

And with global bond markets having topped out, the opportunity cost of gold ownership returns with a vengeance.

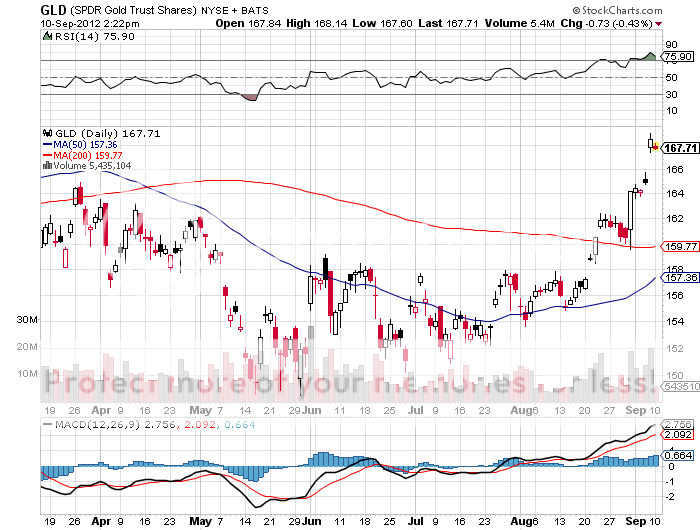

All of which adds up to the likelihood that today?s gold rally probably only has another $50 to go at best, and then it will return to the dustbin of history, and possibly new lows.

I am not a perma bear on gold. There is no need to dig up your remaining coins and dump them on the market, especially now that the IRS has a mandatory withholding tax on all gold sales. I do believe that when inflation returns in the 2020?s, the bull market for gold will return for real.

You can expect newly enriched emerging market central banks to raise their gold ownership to western levels, a goal that will require them to buy thousands of tons on the open market.

Gold still earns a permanent bid in countries with untradeable currencies, weak banks, and acquisitive governments, India, another major buyer.

Remember, too, also that they are not making gold anymore, and that all of the world?s easily accessible deposits have already been mined. The breakeven cost of opening new mines is thought to be around $1,400 an ounce, so don?t expect any new sources of supply anytime soon.

These are the factors which I think will take gold to the $3,000 handle by the end of the 2020?s, which means there is quite an attractive annualized return to be had jumping in at these levels. Clearly, that?s what many of today?s institutional buyers are thinking.

Sure, you could hold back and try to buy the next bottom. Oh, really? How good were you at calling the last low, and the one before that?

Certainly, incrementally scaling in around this neighborhood makes imminent sense for those with a long-term horizon, deep pockets, and a big backyard.

Oops!

Oops!