Global Market Comments

May 5, 2022

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY)

(TLT), (BRKB), (SPY), (CCJ), (GLD)

Global Market Comments

May 5, 2022

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY)

(TLT), (BRKB), (SPY), (CCJ), (GLD)

As I expected, the markets have continued their march to “cheap”, with the price-earnings multiple plunging in a week from 19X to 17X. This has occurred both through rising earnings and falling share prices.

“Cheap,” is now within range, a mere 10% drop in the (SPX) to $3,800 only 10% away, taking us to a 15X multiple. With the Volatility Index (VIX) at a sky-high $34, in another week we could be there.

The long-term smart money isn’t bothering to wait and has already started to scale into the best names. For now, they are overwhelmed by sellers panicking to sell the next market bottom, as they usually do. That won’t last.

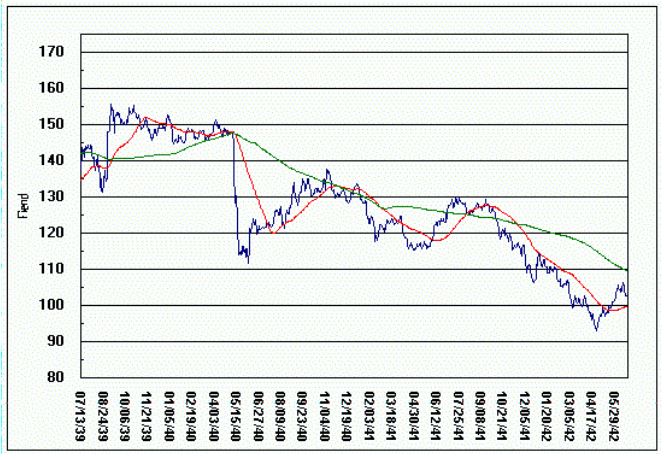

Stocks have seen their worst start to a year since 1942, right after the crushing Japanese attack on Pearl Harbor attack. They didn’t bottom until the US won the Battle of Midway in May, seven months later, even though the public didn’t learn about the strategic victory until months later.

That took the Dow Average down exactly 20%, from $115 to $92. Thereafter, the market began one of the greatest bull moves of all time, exploding from $92 to $240, up 161%.

That is how long and how much we may have to wait for a recovery this time as well with the same long-term outcome.

Those of you who have traditional 60/40 portfolios (60% stocks and 40% bonds), which are most of you, even though I advised against it, have suffered their worst start to a year since 1981, 40 years ago. Both bonds AND stocks have gone down huge.

NASDAQ, the red-headed stepchild of the day, delivered the worst monthly performance since October 2008. Playing from the short side has been like shooting fish in a barrel. The Mae Wests which have floated this market for years have been found to be full of holes.

Consumer discretionary stock delivered a horrific performance. The discretion of consumers right now is to flee stocks and own cash.

I prefer Oracle of Omaha Warren Buffet’s approach. For the first time in years, he is pouring money into stocks, some $51 billion in Q1. That includes $26 billion into California energy major Chevron (CVX), followed by a big bet on Occidental Petroleum (OXY) (click here for my piece at https://www.madhedgefundtrader.com/take-a-look-at-occidental-petroleum-oxy-4/ ).

These are clearly a bet that oil will remain high for at least five more years. That has whittled his cash position down from $147 billion to only $106 billion. Buffet likes to keep a spare $100 billion on hand so he can take over a big cap at any time.

Warren clearly eats his own cooking, buying $26 billion worth of his own stock in 2021. If you can’t afford the lofty $4,773 price for the “A” shares, try the “B” shares at $322.83, which also offer listed options on NASDAQ and in which Mad Hedge Fund Trader currently has a long position.

Rather than fleeing what you already own, because it’s too late, you’re better off building lists of what to buy at the bottom. And the farther the market falls, the more volatility I am looking for.

Investors are salivating at the demise of Cathy Wood’s Ark Innovation ETF (ARKK), which has collapsed by 72% in 14 months. In the meantime, the short Ark ETF (SARK) rose by 50% in April Alone.

You can scale into (ARKK) on the next Armageddon Day. Better yet, you can pick up their ten largest holdings. Those include:

Tesla (TSLA)

Zoom (ZM)

Roku (ROKU)

Coinbase (COIN)

Block (BLOK)

Exact Sciences (EXAS)

Unity Software (U)

Teladoc (TDOC)

Unity

UiPath (PATH)

Over five years, you can expect two of these to go bust, three to do nothing, two to get taken over at a 50% premium, one to double, one to go up ten times, and one to go up 50 times. If you do the math on this, it’s pretty attractive. Guess which one I think is going up ten times?

After listening to endless talking heads postulating about what Bitcoin is, I have finally come up with a definition. It is a small-cap non-earning stock. For that is the asset close showing the closest correlation in the current meltdown. That is not good because I expect small-cap non-earning stocks to go nowhere for the foreseeable future. Don’t hold your breath, but when they turn, you can expect a 2X-10X return on investment, as we did before.

My Ten Year View

When we come out the other side of the pandemic, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My April month-to-date performance added a decent 3.33%. My 2022 year-to-date performance ended at a chest-beating 30.18%. The Dow Average is down -13.5% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 62.56%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 542.74%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 43.71%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 81.4 million, up only 300,000 in a week, and deaths topping 993,000 and have only increased by 5,000 in the past week. Wow, we only lost the equivalent of 12 Boeing 747 crashes in a week! Great news indeed. You can find the data here at https://coronavirus.jhu.edu.

The coming week is a big one for the jobs reports.

On Monday, May 2 at 7:00 AM EST, the ISM Manufacturing PMI is published. NXP Semiconductors (NXPI) reports.

On Tuesday, May 3 at 7:00 AM, the JOLTS Job Openings report is announced. Skyworks Solutions Reports (SWKS).

On Wednesday, May 4 at 8:30 AM, ADP Private Sector Employment Change is printed. At 11:00 AM the Federal Reserve announced its interest rate decision. Jay Powell’s press conference follows at 11:30. Moderna (MRNA) reports.

On Thursday, May 5 at 8:30 AM, Weekly Jobless Claims are disclosed. Conoco Phillips (COP) reports.

On Friday, May 6 at 8:30 AM, the Nonfarm Payroll Report for April is released.

At 2:00 PM, the Baker Hughes Oil Rig Count are out.

As for me, I spent a decade flying planes without a license in various remote war zones because nobody cared.

So, when I finally obtained my British Private Pilot’s License at the Elstree Aerodrome, home of the WWII Mosquito twin-engine bomber, in 1987, it was cause for celebration.

I decided to take on a great challenge to test my newly acquired skills. So, I looked at an aviation chart of Europe, researched the availability of 100LL aviation gasoline, and concluded that the farthest I could go was the island nation of Malta.

Caution: new pilots with only 50 hours of flying time are the most dangerous people in the world!

Malta looms large in the history of aviation. At the onset of the second world war, Malta was the only place that could interfere with the resupply of Rommel’s Africa Corps, situated halfway between Sicily and Tunisia. It was also crucial for the British defense of the Suez Canal.

So, Malta was mercilessly bombed, at first by Mussolini’s Regia Aeronautica, and later by the Luftwaffe. By April 1942, the port at Valletta became the single most bombed place on earth.

Initially, Malta had only three obsolete 1934 Gloster Gladiator biplanes to mount a defense, still in their original packing crates. Flown by volunteer pilots, they came to be known as “Faith, Hope, and Charity.”

The three planes held the Italians at bay, shooting down the slower bombers in droves. As my Italian grandmother constantly reminded me, “Italians are better lovers than fighters.” By the time the Germans showed up, the RAF had been able to resupply Malta with as many as 50 infinitely more powerful Spitfires a month, and the battle was won.

So Malta it was.

The flight school only had one plane they could lend me for ten days, a clapped-out, underpowered single-engine Grumman Tiger, which offered a cruising speed of only 160 miles per hour. I paid extra for an inflatable life raft.

Flying over the length of France in good weather at 500 feet was a piece of cake, taking in endless views of castles, vineyards, and bright yellow rapeseed fields. Italy was a little trickier because only four airports offered avgas, Milan, Rome, Naples, and Palermo. Since Italy had lost the war, they never experienced a postwar aviation boom as we did.

I figured that if I filled up in Naples, I could make it all the way to Malta nonstop, a distance of 450 miles, and still have a modest reserve.

Flying the entire length of Italy at 500 feet along the east coast was grand. Genoa, Cinque Terra, the Vatican, and Mount Vesuvius gently passed by. There was a 1,000-foot-high cable connecting Sicily with the mainland that could have been a problem, as it wasn’t marked on the charts. But my US Air Force charts were pretty old, printed just after WWII. But I spotted them in time and flew over.

When I passed Cape Passero, the southeast corner of Sicily, I should have been able to see Malta, but I didn’t. I flew on, figuring a heading of 190 degrees would eventually get me there.

It didn’t.

My fuel was showing only quarter tanks left and my concern was rising. There was now no avgas anywhere within range. I tried triangulating VORs (very high-frequency omnidirectional radar ranging).

No luck.

I tried dead reckoning. No luck there either.

Then I remembered my WWII history. I recalled that returning American bombers with their instruments shot out used to tune into the BBC AM frequency to find their way back to London. Picking up the Andrews Sisters was confirmation they had the right frequency.

It just so happened that buried in my pilot’s case was a handbook of all European broadcast frequencies. I look up Malta, and sure enough, there was a high-powered BBC repeater station broadcasting on AM.

I excitedly tuned in to my Automatic Direction Finder.

Nothing. And now my fuel was down to one-eighth tanks and it was getting dark!

In an act of desperation, I kept playing with the ADF dial and eventually picked up a faint signal.

As I got closer, the signal got louder, and I recognized that old familiar clipped English accent. It was the BBC (I did work there for ten years as their Tokyo correspondent).

But the only thing I could see were the shadows of clouds on the Mediterranean below. Eventually, I noticed that one of the shadows wasn’t moving.

It was Malta.

As I was flying at 10,000 feet to extend my range, I cut my engines to conserve fuel and coasted the rest of the way. I landed right as the sunset over Africa.

While on the island, I set myself up in the historic Excelsior Grand Hotel. Malta is bone dry and has almost no beaches. It is surrounded by 100-foot cliffs. I paid homage to Faith, the last of the three historic biplanes, in the National War Museum in Valetta.

The other thing I remember about Malta is that CIA agents were everywhere. Muammar Khadafy’s Libya was a major investor in Malta, recycling their oil riches, and by the late 1980’s owned practically everything. How do you spot a CIA agent? Crewcut and pressed creased blue jeans. It’s like a uniform. What they were doing in Malta I can only imagine.

Before heading back to London, I had to refuel the plane. A truck from air services drove up, dropped a 50-gallon drum of avgas on the tarmac along with a pump then they drove off. It took me an hour to hand pump the plane full.

My route home took me directly to Palermo, Sicily to visit my ancestral origins. On takeoff to Sardinia wind shear flipped my plane over, caused me to crash, and I lost a disk in my back.

But that is a story for another day.

Who says history doesn’t pay!

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Faith”

The Andrews Sisters

Spitfire

Grumman Tiger

Global Market Comments

April 25, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE ESCALATOR UP AND THE WINDOW DOWN)

($INDU), (SPY), (TLT), (WFC), (JPM),

(TSLA), (TWTR), (FCX), (NFLX), (GLD)

On Friday, we saw the worst day in the market since October 2020. And it won’t be the last such meltdown day.

The big question for the market now is how far it can fall without actually having a recession. The answer is 20%, and we are down 8.6% so far.

The economy is as strong as ever and everyone that is predicting a recession is using outdated, useless models. If I have to wait nine months for the delivery of my sofa demand is still off the charts.

Spoiler Alert!

I have to do some math here to explain the current situation. So, don’t run down the street screaming with your hair on fire. Math is your friend, not your enemy.

With an average estimated $227.33 forecast earnings for the S&P 500, we are currently trading at a multiple of 19.29X ($4,386 divided by $227.33). At the November high, we were trading at 24X. At the 2009 Financial Crisis low, we saw 9.5X for a few nanoseconds. There’s our range, 9.5X to 24X.

So, stocks are still historically expensive. They won’t start to approach cheap until we drop to 15X, a level we haven’t seen in nearly a decade. That is another 4.29 multiple points lower, or down 22.23%.

How do we get to cheap?

Since November, the S&P 500 has earned another $60, or 1.36X multiple points. We’ll probably pick up another $55, or 1.25X multiple points in Q2. That gets us halfway there.

The (SPX) is down 8.6% so far in 2022, or $414. If Q2 earnings come in as expected, then the (SPX) only has to fall by another 1.68X multiple points, or 8.72% to $4,004 to get to our 15X downside target.

I hasten to remind you that this was exactly 10% below my downside forecast of an H1 loss of 10% in my 2022 Annual Asset Class Review (click here)for the link.

The Ukraine War and the third oil shock, neither of which I, or anybody else, predicted, account for the second 10% loss.

How long will it take to reach these new, enhanced downside targets? My guess is by the summer.

And you wondered why I was still 100% in cash….until Thursday?

So what does the Federal Reserve make of all this? Even though they say they don’t care about the stock market, it really does, especially when it is crash-prone.

Some 2.50% in expected interest rate hikes are already discounted by the futures market. The market has already done the Fed’s work, and we were short all the way, via the (TLT). We will likely get aggressive half-point rate hikes through April to June, especially if inflation goes double-digit, which it might.

At that point, the Fed may be ahead of the curve. If we get the slightest backtrack in inflation, even just for one month, the Fed may well back off a bit on its tightening strategy and skip a meeting, igniting a monster stock market rally in the second half.

Poof! Your inflation fears have gone away.

Jay Powell Thrust a Dagger into the heart of the Stock Market, sending the Dow down 1,000. At this point, the only question is whether we get two back-to-back 50 basis point rate hikes coming, or two back-to-back 75 basis point rate hikes. 75 basis points is becoming the new 25 basis points.

TINA is dead (there is no alternative to stocks) with virtually all fixed income securities offering a 3.00% yield and junk bonds paying 6%. These kinds of yields have started sucking money out of stocks into bonds, which is why I am long bonds.

There is one other sparkly asset class that is worthy of attention here. Gold, the yellow metal, the barbarous relic (GLD), may have just entered a long-term structural bull market. By evicting Russia from the global financial system, we have driven it out of dollars and into gold and Bitcoin for good. Take a look at the Gold Miners ETF (GDX).

And Russia is not alone in pouring its revenues into gold, which can’t be seized by foreign governments, so is every other country that might be subject to future sanctions, like China. This adds up to a heck of a lot of new gold buying and could take the barbarous relic to my old long-term target of $3,000 an ounce.

Bonds Crash Again, with ten-year US Treasury bond yields topping 3.02% overnight, a three-year high. Those who took my advice to buy the (TBT) in November are now up 44%. The market is now oversold in the extreme and could rally $5-$10 at any time. This could happen right around the next Fed meeting on April 28.

Tesla Earnings Soar by 87% YOY, taking the stock up $90. Musk is still predicting that 50% YOY growth in sales will continue as far as the eye can see and could reach 2 million this year if they can get the lithium. There is a one-year wait for a Tesla now. With gasoline at $6.00 a gallon everyone who bought a Tesla in the last 12 years is looking like a genius. $10,000 a share here we come! Keep buying (TSLA) on dips, as I have been begging you do to for the last 12 years.

Netflix Gets Destroyed, on horrific earnings and falling subscribers. Disney and Amazon are clearly eating their lunch. Hedge fund manager Bill Ackman dumped his position with a $400 million loss. At this point, (NFLX) is a high risk, high return trade than may take years to play out, not my cup of tea.

Corn Hits Nine-Year High, above $8 a bushel. Russia’s invasion of Ukraine may take one-third of the global wheat supply off the market and cause Africa to starve. Who is the world’s largest food importer? China, which may be why the yuan has seen a rare selloff.

Weekly Jobless Claims Fall to 184,000, why the unemployed hit a 52-year low. No need for stimulus here. It’s clear that fear of interest rate rises is not scaring off companies from hiring. Fifty basis points here we come. The unemployment rate may hit an all-time low with the April report on May 6.

Twitter Adopts Poison Pill, to fight off Elon Musk’s takeover attempt. Musk’s offer is a generous 20% higher than the Friday close. If the poison pill is successful then Musk will dump his 9.9% holding, cratering the stock. The battle of the century is on! Incredibly, the stock is up today. (TWTR) holders should take the money and run.

Investor Optimism Hits 30-Year Low, according to the Association of Individual Investors. Now only 15.8% of investors are bullish, down 9% in a week. A lot of pros are starting to see this as a “BUY” signal.

World Bank Cuts Global Growth Outlook on Russian War, from 4.1% in January to 3.2%. This compares to 5.7% in 2021. Europe and central Asia are taking the big hits.

Natural Gas Hits 13-Year High, to $7.80 per MM BTU, up 100% YTD. American exports are rushing to fill the gap in Europe. With the war showing no end in sight, prices will go higher before they go lower.

Copper is Facing a Giant Short Squeeze, and the world rushes into alternative energy, says Freeport McMoRan (FCX) CEO Richard Adkerson. World copper output will have to triple just to accommodate Tesla’s long-term target of 20 million vehicles a year. Buy (FCX) on dips, like this one.

US Housing Starts Hit 15 Year High, up 0.3% in March to 1.79 million. Applications to build top 1.87 million. The US has a structural shortage of 10 million homes caused by the large number of small builders that went under during the financial crisis and never came back.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

My March month-to-date performance retreated to a modest 2.58%. My 2022 year-to-date performance ended at a chest-beating 29.28%. The Dow Average is down -6.8% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 71.86%.

On the next capitulation selloff day, which might come with the April Q1 earnings reports, I’ll be adding long positions in technology, banks, and biotech. I am currently in a rare 100% cash position awaiting the next ideal entry point.

That brings my 13-year total return to 541.94%, some 2.10 times the S&P 500 (SPX) over the same period. My average annualized return has ratcheted up to 44.54%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 80.6 million, up only 300,000 in a week, and deaths topping 988,000 and have only increased by 3,000 in the past week. Wow, we only lost the equivalent of eight Boeing 747 crashes in a week! Great news indeed. You can find the data here. Growth of the pandemic has virtually stopped, with new cases down 98% in two months.

The coming week is a big one for tech earnings.

On Monday, April 25 at 8:30 AM EST, the Chicago Fed National Activity Index for March is out. Activision Blizzard Reports (ATVI).

On Tuesday, April 26 at 8:30 AM, US Durable Goods for March are printed. At 9:00 AM the S&P Case Shiller National Price Index is announced. Alphabet (GOOGL) and Microsoft (MSFT) report.

On Wednesday, April 27 at 8:30 AM, the Pending Homes Sales for March are released. Qualcomm and Meta (FB) report.

On Thursday, April 28 at 8:30 AM, the Weekly Jobless Claims are printed. We also get the first look at Q1 GDP. Apple (AAPL), Amazon (AMZN) and Intel (INTC) report.

On Friday, April 29 at 8:30 AM, the Personal Income and Spending for March are disclosed.At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, when you are a guest of the KGB in Russia, you get treated like visiting royalty par excellence, no extravagance spared. That was the setup I walked into when I was sent by NASA to test fly the MiG 25 in 1993.

Far a start, I was met at Moscow’s Sheremetyevo Airport by Major Anastasia Ivanova, who was to be my escort and guide for the week. She had a magic key that would open any door in Russia and gave me a tour worthy of a visiting head of state.

Anastasia was drop-dead gorgeous. She topped 5’11” with light blonde hair, and was statuesque with chiseled high cheekbones and deep blue eyes. She could easily have taken a side job as a Playboy centerfold. But I could tell from her hands she was no stranger to martial arts and was not to be taken lightly. And wherever we went people immediately tensed up. They knew.

For a start, I was met on the tarmac by a black Volga limo. No need for customs or immigration here. Anastasia simply stamped my passport and welcomed me to Russia, whisking me off to the country’s top Intourist hotel.

The next morning, I was given a VIP tour of the Kremlin and its thousand-year history. I was shown a magnificent yellow silk 18th century ball gown worn by Catherine the Great. I asked her if the story about the horse was true, and she grimaced and said yes.

In a side room were displayed the dress uniforms of Adolph Hitler. I asked what happened to the rest of him and she said he was buried under a parking lot in Magdeburg, East Germany.

Out front, I was taken to the head of the line to see Lenin’s Tomb, which looked like he was made of wax. I think he has since been buried. In front of the Kremlin Armory, I found the Tsar Cannon, a gigantic weapon meant to fire a one-ton ball.

There was only one decent restaurant in Moscow in those days and Anastasia took me out to dinner both nights. Suffice it to say that the Beluga caviar and Stolichnaya vodka were flowing hot and heavy. The service was excellent. We were never presented with a bill. I guess it just went on the company account.

After my day in the capital, I was whisked away 200 miles north to the top secret Zhukovky Airbase to fly the MiG 25. A week later, Anastasia was there in her limo to take me back to Moscow.

The next morning Anastasia was knocking on my door. “Get dressed,” she said. “There’s something you want to see.”

She drove me out to a construction site on the southwestern outskirts of the city. As Moscow was slowly westernizing, suburbs were springing up to accommodate a rising middle class. One section was taped off and surrounded by the Moscow Police. That’s where we headed.

While digging the foundation for a new home, the builders had broken into a bunker left from WWII. Moscow had grown to reach the front lines of the 1942 Battle of Moscow. In Berlin during the 1960s, I worked with a couple of survivors of this exact battle. I was handed a flashlight and we ventured inside.

There were at least 30 German bodies inside in full uniform, except that only the skeletons were left. They still wore their issued steel helmets, medals, belt buckles, and binoculars. There were also dozens of K-98 8 mm rifles, an abundance of live ammunition and potato mashers (hand grenades), and several MG-42’s (yes, I know my machines guns).

The air was dank and musty. My guess was that the bunker had taken a direct hit from a Soviet artillery shell and had remained buried ever since. As a cave in threatened, we got the hell out of there in a few minutes.

Then Anastasia continued with our planned day. Since it was Sunday, she took me to the Moscow Flea Market. Russia was suffering from hyperinflation at the time, and retirees on fixed incomes were selling whatever they had in order to eat.

Everything from the Russian military was for sale for practically nothing, including hats, uniforms, medals, and night vision glasses. I walked away with a pair of very high-powered long-range artillery binoculars for $5. I paused for a moment at an 18th century German bible printed in archaic fraktur. But then Anastasia said I might get hung up by Russia’s antique export ban on my departure.

Anastasia and I kept in touch over the years. I sent him some pressed High Sierra wildflowers, which impressed her to no end. She said such a gesture wouldn’t even occur to a Russian man.

We gradually lost contact over the years, given all the turmoil in Russia that followed. But Anastasia left me with memories I will never forget. And I still have those binoculars to use at the Cal football games.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Those in the investment business are well used to the Armageddon crowd. These are the guys who are perennially predicting the collapse of the dollar, the default of the US government, hyperinflation, and the end of the world.

Maybe after 11 years of rising, stocks are finally expensive on a relative basis?

Their perennial recommendations are to keep all your assets in gold and silver, store at least a year’s worth of canned food, and keep your untraceable guns well-oiled and supplied with ammo, preferably in high capacity magazines.

If you followed their advice, you lost your shirt.

I have broken many of these wayward acolytes of their money-losing habits. But not all of them. There seems to be an endless supply emanating from the hinterlands.

The “Oracle of Omaha” Warren Buffet often goes to great lengths to explain why he despises the yellow metal.

The sage doesn't really care about the gold, whatever the price. He sees it primarily as a bet on fear. I imagine he feels the same about Bitcoin, the modern tulips of our age.

If investors are more afraid in a year than they are today, then you make money on gold. If they aren't, then you lose money.

The only problem now is that fear ain’t working.

If you took all the gold in the world, it would form a cube 67 feet on all sides, worth $5 trillion. For that same amount of money, you could own other assets with far greater productive earning power, including:

*All the farmland in the US, about 1 billion acres, which is worth $2.5 trillion.

*Two Apple’s (AAPL), the largest capitalized company in the world at $3 trillion.

Instead of producing any income or dividends, gold just sits there and shines, making you feel like King Midas.

I don't know. With the stock market at an all-time high, and oil trading at $70.49/barrel, a bet on fear looks pretty good to me right now.

I'm still sticking with my long-term forecast of the old inflation-adjusted high of $2,300/ounce. But it might be very long term.

It is just a matter of time before emerging market central bank buying pushes it up there. And who knows? Fear might make a comeback too.

Global Market Comments

January 5, 2022

Fiat Lux

2022 Annual Asset Class Review

A Global Vision

FOR PAID SUBSCRIBERS ONLY

Featured Trades:

(SPX), (QQQ), (XLF), (XLE), (XLY),

(TLT), (TBT), (JNK), (PHB), (HYG), (PCY), (MUB), (HCP)

(FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

(BHP), (FCX), (VALE), (AMLP), (USO), (UNG),

(GLD), (GDX), (SLV), (ITB), (LEN), (KBH), (PHM)

I am once again writing this report from a first-class sleeping cabin on Amtrak’s legendary California Zephyr.

By day, I have two comfortable seats facing each other next to a panoramic window. At night, they fold into two bunk beds, a single and a double. There is a shower, but only Houdini could navigate it.

I am anything but Houdini, so I go downstairs to use the larger public hot showers. They are divine.

We are now pulling away from Chicago’s Union Station, leaving its hurried commuters, buskers, panhandlers, and majestic great halls behind. I love this building as a monument to American exceptionalism.

I am headed for Emeryville, California, just across the bay from San Francisco, some 2,121.6 miles away. That gives me only 56 hours to complete this report.

I tip my porter, Raymond, $100 in advance to make sure everything goes well during the long adventure and to keep me up-to-date with the onboard gossip.

The rolling and pitching of the car is causing my fingers to dance all over the keyboard. Microsoft’s Spellchecker can catch most of the mistakes, but not all of them.

As both broadband and cell phone coverage are unavailable along most of the route, I have to rely on frenzied Internet searches during stops at major stations along the way to Google obscure data points and download the latest charts.

You know those cool maps in the Verizon stores that show the vast coverage of their cell phone networks? They are complete BS.

Who knew that 95% of America is off the grid? That explains so much about our country today.

I have posted many of my better photos from the trip below, although there is only so much you can do from a moving train and an iPhone 12X pro.

Here is the bottom line which I have been warning you about for months. In 2022, you are going to have to work twice as hard to earn half as much money with double the volatility.

It’s not that I’ve turned bearish. The cause of the next bear market, a recession, is at best years off. However, we are entering the third year of the greatest bull market of all time. Expectations have to be toned down and brought back to earth. Markets will no longer be so strong that they forgive all mistakes, even mine.

2022 will be a trading year. Play it right, and you will make a fortune. Get lazy and complacent and you’ll be lucky to get out with your skin still attached.

If you think I spend too much time absorbing conspiracy theories or fake news from the Internet, let me give you a list of the challenges I see financial markets are facing in the coming year:

The Ten Key Variables for 2022

1) How soon will the Omicron wave peak?

2) Will the end of the Fed’s quantitative easing knock the wind out of the bond market?

3) Will the Russians invade the Ukraine or just bluster as usual?

4) How much of a market diversion will the US midterm elections present?

5) Will technology stocks continue to dominate, or will domestic recovery, and value stocks take over for good?

6) Can the commodities boom get a second wind?

7) How long will the bull market for the US dollar continue?

8) Will the real estate boom continue, or are we headed for a crash?

9) Has international trade been permanently impaired or will it recover?

10) Is oil seeing a dead cat bounce or is this a sustainable recovery?

The Thumbnail Portfolio

Equities – buy dips

Bonds – sell rallies

Foreign Currencies – stand aside

Commodities – buy dips

Precious Metals – stand aside

Energy – stand aside

Real Estate – buy dips

Bitcoin – Buy dips

1) The Economy

What happens after a surprise variant takes Covid cases to new all-time highs, the Fed tightens, and inflation soars?

Covid cases go to zero, the Fed flip flops to an ease and inflation moderates to its historical norm of 3% annually.

It all adds up to a 5% US GDP growth in 2022, less than last year’s ballistic 7% rate, but still one of the hottest growth rates in history.

If Joe Biden’s build-back batter plan passes, even in diminished form, that could add another 1%.

Once the supply chain chaos resolves inflation will cool. But after everyone takes delivery of their over orders conditions could cool.

This sets up a Goldilocks economy that could go on for years: high growth, low inflation, and full employment. Help wanted signs will slowly start to disappear. A 3% handle on Headline Unemployment is within easy reach.

2) Equities (SPX), (QQQ), (IWM) (AAPL), (XLF), (BAC)

The weak of heart may want to just index and take a one-year cruise around the world instead in 2022 (here's the link for Cunard).

So here is the perfect 2022 for stocks. A 10% dive in the first half, followed by a rip-roaring 20% rally in the second half. This will be the year when a big rainy-day fund, i.e., a mountain of cash to spend at market bottoms, will be worth its weight in gold.

That will enable us to load up with LEAPS at the bottom and go 100% invested every month in H2.

That should net us a 50% profit or better in 2022, or about half of what we made last year.

Why am I so cautious?

Because for the first time in seven years we are going to have to trade with a headwind of rising interest rates. However, I don’t think rates will rise enough to kill off the bull market, just give traders a serious scare.

The barbell strategy will keep working. When rates rise, financials, the cheapest sector in the market, will prosper. When they fall, Big Tech will take over, but not as much as last year.

The main support for the market right now is very simple. The investors who fell victim to capitulation selling that took place at the end of November never got back in. Shrinking volume figures prove that. Their efforts to get back in during the new year could take the S&P 500 as high as $5,000 in January.

After that the trading becomes treacherous. Patience is a virtue, and you should only continue new longs when the Volatility Index (VIX) tops $30. If that means doing nothing for months so be it.

We had four 10% corrections in 2021. 2022 will be the year of the 10% correction.

Energy, Big Tech, and financials will be the top-performing sectors of 2022. Big Tech saw a 20% decline in multiples in 2022 and will deliver another 30% rise in earnings in 2022, so they should remain at the core of any portfolio.

It will be a stock pickers market. But so was 2021, with 51% of S&P 500 performance coming from just two stocks, Tesla (TSLA) and Alphabet (GOOGL).

However, they are already so over-owned that they are prone to dead periods as long as eight months, as we saw last year. That makes a multipronged strategy essential.

3) Bonds (TLT), (TBT), (JNK), (PHB), (HYG), (MUB), (LQD)

Amtrak needs to fill every seat in the dining car to get everyone fed on time, so you never know who you will share a table with for breakfast, lunch, and dinner.

There was the Vietnam Vet Phantom Jet Pilot who now refused to fly because he was treated so badly at airports. A young couple desperately eloping from Omaha could only afford seats as far as Salt Lake City. After they sat up all night, I paid for their breakfast.

A retired British couple was circumnavigating the entire US in a month on a “See America Pass.” Mennonites are returning home by train because their religion forbade automobiles or airplanes.

The national debt ballooned to an eye-popping $30 trillion in 2021, a gain of an incredible $3 trillion and a post-World War II record. Yet, as long as global central banks are still flooding the money supply with trillions of dollars in liquidity, bonds will not fall in value too dramatically. I’m expecting a slow grind down in prices and up in yields.

The great bond short of 2021 never happened. Even though bonds delivered their worst returns in 19 years, they still remained nearly unchanged. That wasn’t good enough for the many hedge funds, which had to cover massive money-losing shorts into yearend.

Instead, the Great Bond Crash will become a 2022 business. This time, bonds face the gale force headwinds of three promised interest rates hikes. The year-end government bond auctions were a complete disaster.

Fed borrowing continues to balloon out of control. It’s just a matter of time before the last billion dollars in government borrowing breaks the camel’s back.

That makes a bond short a core position in any balanced portfolio. Don’t get lazy. Make sure you only sell a rally lest we get trapped in a range, as we did for most of 2021.

A Visit to the 19th Century

4) Foreign Currencies (FXE), (EUO), (FXC), (FXA), (YCS), (FXY), (CYB)

For the first time in ages, I did no foreign exchange trades last year. That is a good thing because I was wrong about the direction of the dollar for the entire year.

Sometimes, passing on bad trades is more important than finding good ones.

I focused on exploding US debt and trade deficits undermining the greenback and igniting inflation. The market focused on delta and omicron variants heralding new recessions. The market won.

The market won’t stay wrong forever. Just as bond crash is temporarily in a holding pattern, so is a dollar collapse. When it does occur, it will happen in a hurry.

5) Commodities (FCX), (VALE), (DBA)

The global synchronized economic recovery now in play can mean only one thing, and that is sustainably higher commodity prices.

The twin Covid variants put commodities on hold in 2021 because of recession fears. So did the Chinese real estate slowdown, the world’s largest consumer of hard commodities.

The heady days of the 2011 commodity bubble top are now in play. Investors are already front running that move, loading the boat with Freeport McMoRan (FCX), US Steel (X), and BHP Group (BHP).

Now that this sector is convinced of an eventual weak US dollar and higher inflation, it is once more the apple of traders’ eyes.

China will still demand prodigious amounts of imported commodities once again, but not as much as in the past. Much of the country has seen its infrastructure build out, and it is turning from a heavy industrial to a service-based economy, like the US. Investors are keeping a sharp eye on India as the next major commodity consumer.

And here’s another big new driver. Each electric vehicle requires 200 pounds of copper and production is expected to rise from 1 million units a year to 25 million by 2030. Annual copper production will have to increase 11-fold in a decade to accommodate this increase, no easy task, or prices will have to ride.

The great thing about commodities is that it takes a decade to bring new supply online, unlike stocks and bonds, which can merely be created by an entry in an excel spreadsheet. As a result, they always run far higher than you can imagine.

Accumulate commodities on dips.

6) Energy (DIG), (RIG), (USO), (DUG), (UNG), (USO), (XLE), (AMLP)

Energy may be the top-performing sector of 2022. But remember, you will be trading an asset class that is eventually on its way to zero.

However, you could have several doublings on the way to zero. This is one of those times.

The real tell here is that energy companies are drinking their own Kool-Aid. Instead of reinvesting profits back into their new exploration and development, as they have for the last century, they are paying out more in dividends.

There is the additional challenge in that the bulk of US investors, especially environmentally friendly ESG funds, are now banned from investing in legacy carbon-based stocks. That means permanently cheap valuations and shares prices for the energy industry.

Energy stocks are also massively under-owned, making them prone to rip-you-face-off short squeezes. Energy now counts for only 3% of the S&P 500. Twenty years ago it boasted a 15% weighting.

The gradual shut down of the industry makes the supply/demand situation more volatile. Therefore, we could top $100 a barrel for oil in 2022, dragging the stocks up kicking and screaming all the way.

Unless you are a seasoned, peripatetic, sleep-deprived trader, there are better fish to fry.

7) Precious Metals (GLD), (DGP), (SLV), (PPTL), (PALL)

The train has added extra engines at Denver, so now we may begin the long laboring climb up the Eastern slope of the Rocky Mountains.

On a steep curve, we pass along an antiquated freight train of hopper cars filled with large boulders.

The porter tells me this train is welded to the tracks to create a windbreak. Once, a gust howled out of the pass so swiftly, that it blew a passenger train over on its side.

In the snow-filled canyons, we saw a family of three moose, a huge herd of elk, and another group of wild mustangs. The engineer informs us that a rare bald eagle is flying along the left side of the train. It’s a good omen for the coming year.

We also see countless abandoned 19th century gold mines and the broken-down wooden trestles leading to them, relics of previous precious metals booms. So, it is timely here to speak about the future of precious metals.

Fortunately, when a trade isn’t working, I avoid it. That certainly was the case with gold last year.

2021 was a terrible year for precious metals. With inflation soaring, stocks volatile, and interest rates going nowhere, gold had every reason to rise. Instead, it fell for almost all of the entire year.

Bitcoin stole gold’s thunder, sucking in all of the speculative interest in the financial system. Jewelry and industrial demand was just not enough to keep gold afloat.

This will not be a permanent thing. Chart formations are starting to look encouraging, and they certainly win the price for a big laggard rotation. So, buy gold on dips if you have a stick of courage on you.

8) Real Estate (ITB), (LEN)

The majestic snow-covered Rocky Mountains are behind me. There is now a paucity of scenery, with the endless ocean of sagebrush and salt flats of Northern Nevada outside my window, so there is nothing else to do but write.

My apologies in advance to readers in Wells, Elko, Battle Mountain, and Winnemucca, Nevada.

It is a route long traversed by roving banks of Indians, itinerant fur traders, the Pony Express, my own immigrant forebearers in wagon trains, the transcontinental railroad, the Lincoln Highway, and finally US Interstate 80, which was built for the 1960 Winter Olympics at Squaw Valley.

Passing by shantytowns and the forlorn communities of the high desert, I am prompted to comment on the state of the US real estate market.

There is no doubt a long-term bull market in real estate will continue for another decade, although from here prices will appreciate at a 5%-10% slower rate.

There is a generational structural shortage of supply with housing which won’t come back into balance until the 2030s.

There are only three numbers you need to know in the housing market for the next 20 years: there are 80 million baby boomers, 65 million Generation Xer’s who follow them, and 86 million in the generation after that, the Millennials.

The boomers have been unloading dwellings to the Gen Xers since prices peaked in 2007. But there are not enough of the latter, and three decades of falling real incomes mean that they only earn a fraction of what their parents made. That’s what caused the financial crisis.

If they have prospered, banks won’t lend to them. Brokers used to say that their market was all about “location, location, location.” Now it is “financing, financing, financing.” Imminent deregulation is about to deep-six that problem.

There is a happy ending to this story.

Millennials now aged 26-44 are now the dominant buyers in the market. They are transitioning from 30% to 70% of all new buyers of homes.

The Great Millennial Migration to the suburbs and Middle America has just begun. Thanks to Zoom, many are never returning to the cities. So has the migration from the coast to the American heartland.

That’s why Boise, Idaho was the top-performing real estate market in 2021, followed by Phoenix, Arizona. Personally, I like Reno, Nevada, where Apple, Google, Amazon, and Tesla are building factories as fast as they can.

As a result, the price of single-family homes should rocket during the 2020s, as they did during the 1970s and the 1990s when similar demographic forces were at play.

This will happen in the context of a coming labor shortfall, soaring wages, and rising standards of living.

Rising rents are accelerating this trend. Renters now pay 35% of their gross income, compared to only 18% for owners, and less, when multiple deductions and tax subsidies are taken into account. Rents are now rising faster than home prices.

Remember, too, that the US will not have built any new houses in large numbers in 13 years. The 50% of small home builders that went under during the crash aren’t building new homes today.

We are still operating at only a half of the peak rate. Thanks to the Great Recession, the construction of five million new homes has gone missing in action.

That makes a home purchase now particularly attractive for the long term, to live in, and not to speculate with.

You will boast to your grandchildren how little you paid for your house, as my grandparents once did to me ($3,000 for a four-bedroom brownstone in Brooklyn in 1922), or I do to my kids ($180,000 for a two-bedroom Upper East Side Manhattan high rise with a great view of the Empire State Building in 1983).

That means the major homebuilders like Lennar (LEN), Pulte Homes (PHM), and KB Homes (KBH) are a buy on the dip.

Quite honestly, of all the asset classes mentioned in this report, purchasing your abode is probably the single best investment you can make now. It’s also a great inflation play.

If you borrow at a 3.0% 30-year fixed rate, and the long-term inflation rate is 3%, then, over time, you will get your house for free.

How hard is that to figure out? That math degree from UCLA is certainly earning its keep.

9) Bitcoin

It’s not often that new asset classes are made out of whole cloth. That is what happened with Bitcoin, which, in 2021, became a core holding of many big institutional investors.

But get used to the volatility. After doubling in three months, Bitcoin gave up all its gains by year-end. You have to either trade Bitcoin like a demon or keep your positions so small you can sleep at night.

By the way, right now is a good place to establish a new position in Bitcoin.

10) Postscript

We have pulled into the station at Truckee in the midst of a howling blizzard.

My loyal staff has made the ten-mile trek from my beachfront estate at Incline Village to welcome me to California with a couple of hot breakfast burritos and a chilled bottle of Dom Perignon Champagne, which has been resting in a nearby snowbank. I am thankfully spared from taking my last meal with Amtrak.

After that, it was over legendary Donner Pass, and then all downhill from the Sierras, across the Central Valley, and into the Sacramento River Delta.

Well, that’s all for now. We’ve just passed what was left of the Pacific mothball fleet moored near the Benicia Bridge (2,000 ships down to six in 50 years). The pressure increase caused by a 7,200-foot descent from Donner Pass has crushed my plastic water bottle. Nice science experiment!

The Golden Gate Bridge and the soaring spire of Salesforce Tower are just around the next bend across San Francisco Bay.

A storm has blown through, leaving the air crystal clear and the bay as flat as glass. It is time for me to unplug my Macbook Pro and iPhone 13 Pro, pick up my various adapters, and pack up.

We arrive in Emeryville 45 minutes early. With any luck, I can squeeze in a ten-mile night hike up Grizzly Peak and still get home in time to watch the ball drop in New York’s Times Square on TV.

I reach the ridge just in time to catch a spectacular pastel sunset over the Pacific Ocean. The omens are there. It is going to be another good year.

I’ll shoot you a Trade Alert whenever I see a window open at a sweet spot on any of the dozens of trades described above.

Good luck and good trading in 2022!

John Thomas

The Mad Hedge Fund Trader

Global Market Comments

December 15, 2021

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT VIDEOS ARE UP!)

(WHY WARREN BUFFET HATES GOLD),

(GLD), (GDX), (ABX), (GOLD)

Global Market Comments

December 10, 2021

Fiat Lux

Featured Trade:

(THE NEXT COMMODITY SUPERCYCLE HAS ALREADY STARTED),

(COPX), (GLD), (FCX), (BHP), (RIO), (SIL),

(PPLT), (PALL), (GOLD), (ECH), (EWZ), (IDX)

Global Market Comments

November 19, 2021

Fiat Lux

Featured Trade:

(NOVEMBER 17 BIWEEKLY STRATEGY WEBINAR Q&A),

(RIVN), (WMT), (BAC), (MS), (GS), (GLD), (SLV), (CRSP), (NVDA),

(BAC), (CAT), (DE), (PTON), (FXI), (TSLA), (CPER), (Z)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.