Global Market Comments

October 27, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE YEAREND RALLY HAS STARTED),

(NFLX), (SPY), (TLT), ($VIX), (GM), (TSLA),

(USO), (PHM), (GLD), (AAPL), (SLV), (FXI)

Global Market Comments

October 27, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE YEAREND RALLY HAS STARTED),

(NFLX), (SPY), (TLT), ($VIX), (GM), (TSLA),

(USO), (PHM), (GLD), (AAPL), (SLV), (FXI)

Global Market Comments

October 3, 2025

Fiat Lux

Featured Trade:

(OCTOBER 1 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (CCJ), (CST), (SMR), (TSLA), (F), (GM),

(USO), (FCX), (GLD), (SLV), (OXY), (BRK/B)

Global Market Comments

August 25, 2025

Fiat Lux

Featured Trade:

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or LEADING INTO A PUNCH),

(UUP), (AAPL), (GM), (F), (RKT), (PLD) (AMT),

(PEP), (DUK), (ZION), (IJR), ($SPX), (QQQ), (MS)

Global Market Comments

April 1, 2025

Fiat Lux

Featured Trade:

(REVISITING THE FIRST SILVER BUBBLE),

(SLV), (SLW)

Global Market Comments

March 31, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or STAGFLATION IS ON!)

(COST), (BRK/B), (GS), (MS), (NVDA), (AMZN), (TLT), (GLD), (GM), (TSLA)

There is no doubt that the data released out on Friday were a complete disaster for stock investors. The Dow Average futures posted a 1,000-point swing, from up 200 in the overnight markets to down 800 intraday.

Specifically, the Consumer Price Index came in at a hot 0.4%, which is 4.8% annualized. Five-year Inflation Expectations, which the Fed follows most closely, rocketed to 6.0%. Worse yet, Consumer Confidence rose only 0.1% for the second month in a row, the worst performance in 12 years. Friday was the day that the hard data met the soft data and concluded that the recession was on.

That screeching noise you hear is the economy grinding to a halt.

Stock markets absolutely hate stagflation. The last time we had stagflation was during the Ford and Carter administrations during the 1970s, when it took eight years for the Dow to rise a measly 1,000 points. Back then, Wall Street shrank to a fraction of its former self.

This all richly justifies my downside target of 5,000 for the S&P 500, off 20% from the February top, which is increasingly becoming a mainstream prediction. If I am wrong, it will plunge to 4,500, or down 30%.

We were promised animal spirits that would set markets on fire. Instead, the animals are sent back into hibernation and the markets are being snuffed out. I watch every single data release that comes out on a daily basis, and it is amazing how fast they are almost all rolling over at once.

The combination of rising inflation and a weakening economy is described by one infamous word: Stagflation. What’s worse, we are only one month into a stagflationary trend that could run for many months or years.

As a result, we have seen the worst start to a year since Q1 2020, the last time Trump was president. March was the worst month in 3 ½ years. It seems the stock market heartily agrees with my view.

It gets worse.

All earnings estimates for this year are based on record corporate profit margins. If those margins fail to hold when earnings are announced in the coming weeks, it may trigger the second 10% leg down in the major averages. More concerning is the forward guidance companies may provide.

It turns out that companies watch the daily data releases too. Companies sitting on their hands, not investing or hiring, can itself alone cause recessions. Right now, nobody knows what the heck to do.

The final shoe to fall will be a sharp spike up in the headline Unemployment Rate. We get the next read on this on Friday, April 4. It’s just a question of how soon this shows up in the data. Right now, hundreds of thousands of workers have been fired but are still receiving paychecks while their status is being challenged in the courts. So they aren’t being counted as unemployed….yet.

Some 42% of all the hiring in the US over the past three years has been in just two sectors, healthcare and education. That is where the biggest cuts are being made now. It’s all about getting ahead of the curve.

Let me tell you how bad things can get.

On Wednesday, the president announced 25% import duties for completed cars. General Motors (GM) makes about 30% of its cars in Mexico and Canada. As a result, (GM) may have to raise some car prices by 10%-25%. But the president has ordered (GM) not to raise prices at all.

It costs $20 billion and takes four years to build a new car factory in the US from scratch. This all turns (GM) into the perfect money-destruction machine. (GM) may not survive. And you wonder why I have been short (GM) stock two months in a row. Trump must really hate Detroit.

Believe it or not, there is a silver lining to all this.

If you missed the great bull market of the last five years, when the major indexes more than doubled, you are eventually going to get a second bite at the apple. Share prices are dropping so fast that we may get to a final capitulation selloff rather quickly. Then we will be spoiled for choice with stocks that have easy doubles and triples in them.

Let me tell you a trader’s trick.

Watch the shares of companies that have the sharpest rises on the rare up days. These are the ones that institutions are willing to jump into and hold on to forever, the permanent earnings compounders. If you take a look at the longs in the Mad Hedge Model Trading Portfolio, they all meet these criteria. They include (COST), (BRK/B), (GS), (MS), (NVDA), and (AMZN).

Buying bonds (TLT) and gold (GLD) going into a recession may not be a bad idea either. And for those who don’t want to play when the going gets rough, there are always 90-day US Treasury bills yielding 4.20%. They are government-guaranteed.

March is now up +3.17% so far. That takes us to a year-to-date profit of +12.64% so far in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +81.35%. That takes my average annualized return to +49.82% and my performance since inception to +764.63%.

It has been another busy week for trading. I took profits on the short in (NVDA), which collapsed in the latest tech-driven leg down. I added a new long in (COST), a position I have been trying to get into for years, and it immediately started to make money.

I also stopped out of my two auto shorts in (GM) and (TSLA) at cost. Then Trump moved up his auto tariff announcements by a week, and both positions shot up to max profits. Welcome to trading in the Trump administration. In this period of extreme uncertainty, I have tightened up my stop-loss strategy to avoid big losses.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Stagflation Accelerates, with a hot 0.4% increase in the Consumer Price Index and a tepid 0.1% increase in Consumer Spending, the worst since the Pandemic. One-year inflation expectations have shot up to 5.0%. Today is the day the hard data met the soft data and jointly agreed that we are in a recession. S&P 500 5,000 here we come!

25% Auto Import Tariffs Become Official on April 2. The auto industry, once the largest in the US, says it will trigger a recession. Car prices will rise an average of $5,000 per vehicle. Expect the economies of Michigan, Indiana, Wisconsin, and Illinois to get demolished as they feed a lot of the parts into Detroit. Steel will also be affected. Some 30% of autos made by US companies are assembled in Canada and Mexico. Which US car makers have the highest share of American content? Tesla.

US GDP Grows 2.4%, during the October-December quarter. These may be the last positive numbers we see for a while as the country heads into recession.

Bonds Rocket, with inflation now running at a 5% annual rate, and the tariffs should add another 1%. That means the next Fed move is likely to be an interest rate RISE, while the unemployment rate is rising. That’s a worst-case scenario for the economy and the stock market.

Moody’s Warns of a Downgrade of the United States, saying Trump’s trade tariffs could hamper the country’s ability to cope with a growing debt pile and higher interest rates. Recession risks are rising.

Canada Freezes Rebates for Tesla Purchasers. Canada has frozen C$43 million ($30.11 million) of rebate payments for Tesla. Buyers had been eligible for a $5,000 rebate on vehicles costing less than $65,000. Tesla’s Q1 sales out next week is expected to be terrible. Avoid (TSLA).

S&P Case Shiller National Home Price Index Rises 4.7% YOY. Home price growth held steady at 0.5% M/M, on a seasonally adjusted basis, in January, according to the S&P CoreLogic Case-Shiller Home Price Index composite for 20 cities. On an unadjusted basis, the Case-Shiller HPI for 20 cities inched up 0.1% from a month earlier, decelerating from the +0.2% consensus and accelerating from the previous month's -0.1%. On a Y/Y basis, the gauge climbed 4.7%, vs. +4.6% expected and +4.5% prior.

Consumer Confidence Plunges, by the most in five years, according to the conference. The Conference Board’s gauge of confidence decreased 7.2 points to 92.9, data released Tuesday showed. The median estimate in a Bloomberg survey of economists called for a reading of 94. The soft data for the economy continues to look horrific.

FedEx Gets Crushed, another early recession indicator. Fewer things are shipped in shrinking economies. Fears about a U.S. recession and President Donald Trump’s new reciprocal tariff rates starting April 2 could threaten FedEx’s earnings, Paterson said in a Friday note to clients. Memphis-based FedEx is generally regarded as a barometer of the global economy, as its business touches a wide variety of global industries.

Next-Gen Chips are Power Hogs. Big tech companies, which are all betting heavily on AI, will undoubtedly buy those chips, even if the price skyrockets. But there’s growing evidence that there won’t be enough electricity to power all of their AI dreams. Some new AI apps use 150 times more power than the old ones.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 31, at 8:30 AM EST, the Chicago PMI is announced.

On Tuesday, April 1, at 8:30 AM, the JOLTS Job Openings Report is released.

On Wednesday, April 2, at 1:00 PM, the ADP Employment Change is published.

On Thursday, April 3, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, April 4, at 8:30 AM, the Nonfarm Payroll Report for March is printed. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, back in 2002, I flew to Iceland to do some research on the country’s national DNA sequencing program called Decode, which analyzed the genetic material of everyone in that tiny nation of 250,000. It was the boldest project yet in the field and had already led to several breakthrough discoveries.

Let me start by telling you the downside of visiting Iceland. In the country that has produced three Miss Universes over the last 50 years, suddenly you are the ugliest guy in the country. Because guess what? The men are beautiful as well, the descendants of Vikings who became stranded there after they cut down all the forests on the island for firewood, leaving nothing with which to build long boats.

I said they were beautiful, not smart.

Still, just looking is free and highly rewarding.

While I was there, I thought it would be fun to trek across Iceland from North to South in the spirit of Shackleton, Scott, and Amundsen. I went alone because, after all, how many people do you know who want to trek across Iceland? Besides, it was only 150 miles, or ten days to cross. A piece of cake really.

Near the trailhead, the scenery could have been a scene from Lord of the Rings, with undulating green hills, craggy rock formations, and miniature Icelandic ponies galloping in herds. It was nature in its most raw and pristine form. It was all breathtaking.

Most of the central part of Iceland is covered by a gigantic glacier over which a rough trail is marked by stakes planted in the snow every hundred meters. The problem arises when fog or blizzards set in, obscuring the next stake and making it too easy to get lost. Then you risk walking into a fumarole, a vent from the volcano under the ice, always covered by boiling water. About ten people a year die this way.

My strategy for avoiding this cruel fate was very simple. Walk 50 meters. If I could see the next stake, I would proceed. If I couldn’t, I pitched my tent and waited until the storm passed.

It worked.

Every 10 kilometers stood a stone rescue hut with a propane stove for adventurers caught out in storms. I thought they were for wimps but always camped nearby for the company.

One of the challenges in trekking near the North Pole is getting to sleep. That’s because the sun never sets and it's daylight all night long. The problem was easily solved with the blindfold that came with my Icelandic Air first-class seat.

I was 100 miles into my trek, approached my hut for the night, and opened the door to say hello to my new friends.

What I saw horrified me.

Inside was an entire German Girl Scout Troop spread out in their sleeping bags all with a particularly virulent case of the flu. In the middle was a girl lying on the floor, soaking wet and shivering, who had fallen into a glacier-fed river. She was clearly dying of hypothermia.

I was pissed and instantly went into Marine Corps Captain mode, barking out orders left and right. Fortunately, my German was still pretty good then, so I instructed every girl to get out of their sleeping bags and pile them on top of the freezing scout. I then told them to strip the girl of her wet clothes and reclothe her with dry replacements. They could have their bags back when she got warm. The great thing about Germans is that they are really good at following orders.

Next, I turned the stove burners up high to generate some heat. Then I rifled through backpacks and cooked up what food I could find, force-fed it into the scouts, and emptied my bottle of aspirin. For the adult leader, a woman in her thirties who was practically unconscious, I parted with my emergency supply of Jack Daniels.

By the next morning, the frozen girl was warm, the rest were recovering, and the leader was conscious. They thanked me profusely. I told them I was an American “Adler Scout” (Eagle Scout) and was just doing my job.

One of the girls cautiously moved forward and presented me with a small doll dressed in a traditional German Dirndl, which she said was her good luck charm. Since I was her good luck, I should have it. It was the girl who was freezing to death the day before.

Some 20 years later, I look back fondly on that trip and would love to do it again.

Anyone want to go to Iceland?

Iceland 2002

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 27, 2025

Fiat Lux

Featured Trade:

(HOW TO GAIN AN ADVANTAGE WITH PARALLEL TRADING),

(GM), (F), (TM), (NSANY), (DDAIF), BMW (BMWYY), (VWAPY),

(PALL), (GS), (EZA), (CAT), (CMI), (KMTUY),

(KODK), (SLV), (AAPL)

One of the most fascinating things I learned when I first joined the equity trading desk at Morgan Stanley during the early 1980s was how to parallel trade.

A customer order would come in to buy a million shares of General Motors (GM), and what did the in-house proprietary trading book do immediately?

It loaded the boat with the shares of Ford Motors (F).

When I asked about this tactic, I was taken away to a quiet corner of the office and read the riot act.

“This is how you legally front-run a customer,” I was told.

Buy (GM) in front of a customer order, and you will find yourself in Sing Sing shortly.

Ford (F), Toyota (TM), Nissan (NSANY), Daimler Benz (DDAIF), BMW (BMWYY), and Volkswagen (VWAPY), were all fair game.

The logic here was very simple.

Perhaps the client completed an exhaustive piece of research concluding that (GM) earnings were about to rise.

Or maybe a client's old boy network picked up some valuable insider information.

(GM) doesn’t do business in isolation. It has thousands of parts suppliers for a start. While whatever is good for (GM) is good for America, it is GREAT for the auto industry.

So through buying (F) on the back of a (GM) might not only match the (GM) share performance, it might even exceed it.

This is known as a Primary Parallel Trade.

This understanding led me on a lifelong quest to understand Cross Asset Class Correlations, which continues to this day.

Whenever you buy one thing, you buy another related thing as well, which might do considerably better.

I eventually made friends with a senior trader at Salomon Brothers while they were attempting to recruit me to run their Japanese desk.

I asked if this kind of legal front-running happened on their desk.

“Absolutely,” he responded. But he then took Cross Asset Class Correlations to a whole new level for me.

Not only did Salomon’s buy (F) in that situation, they also bought palladium (PALL).

I was puzzled. Why palladium?

Because palladium is the principal metal used in catalytic converters, it removes toxic emissions from car exhaust and has been required for every U.S.-manufactured car since 1975.

Lots of car sales, which the (GM) buying implied, ALSO meant lots of palladium buying.

And here’s the sweetener.

Palladium trading is relatively illiquid.

So, if you catch a surge in the price of this white metal, you would earn a multiple of what you would make on your boring old parallel (F) trade.

This is known in the trade as a Secondary Parallel Trade.

A few months later, Morgan Stanley sent me to an investment conference to represent the firm.

I was having lunch with a trader at Goldman Sachs (GS) who would later become a famous hedge fund manager, and asked him about the (GM)-(F)-(PALL) trade.

He said I would be an IDIOT not to take advantage of such correlations. Then he one-upped me.

You can do a Tertiary Parallel Trade here by buying mining equipment companies such as Caterpillar (CAT), Cummins (CMI), and Komatsu (KMTUY).

Since this guy was one of the smartest traders I ever ran into, I asked him if there was such a thing as a Quaternary Parallel Trade.

He answered “Abso******lutely,” as was his way.

But the first thing he always did when searching for Quaternary Parallel Trades would be to buy the country ETF for the world’s largest supplier of the commodity in question.

In the case of palladium, that would be South Africa (EZA).

Since then, I have discovered hundreds of what I call Parallel Trading Chains and have been actively making money off of them. So have you, you just haven’t realized it yet.

I could go on and on.

If you ever become puzzled or confused about a trade alert I am sending out (Why on earth is he doing THAT?), there is often a parallel trade in play.

Do this for decades as I have and you learn that some parallel trades break down and die. The cross relationships no longer function.

The best example I can think of is the photography/silver connection. When the photography business was booming, silver prices rose smartly.

Digital photography wiped out this trade, and silver-based film development is still only used by a handful of professionals and hobbyists.

Oh, and Eastman Kodak (KODK) went bankrupt in 2012.

However, it seems that whenever one Parallel Trading Chain disappears, many more replace it.

You could build chains a mile long simply based on how well Apple (AAPL) or NVIDIA (NVDA) is doing.

And guess what? There is a new parallel trade in silver developing. Whenever someone builds a solar panel anywhere in the world, they use a small amount of silver for the wiring. Build several tens of millions of solar panels and that can add up to quite a lot of silver.

What goes around comes around.

Suffice it to say that parallel trading is an incredibly useful trading strategy.

Ignore it at your peril.

Global Market Comments

March 24, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or THE SPECIAL NO CONFIDENCE ISSUE)

(GM), (SH), (TSLA), (NVDA), (GLD), (TLT), (LMT), (BA), (NVDA), (GOOGL), (AAPL), (META), (AMZN), (PANW), (ZS), (CYBR), (FTNT), (COST)

(AMGN), (ABBV), (BMY), (TSLA), GM), (GLD), (BYDDF)

It’s official: Absolutely no one is confident in their long-term economic forecasts right now. I heard it from none other than the chairman of the Federal Reserve himself. The investment rule book has been run through the shredder.

It has in fact been deleted.

That explains a lot about how markets have been trading this year. It looks like it is going to be a reversion to the mean year. Forecasters, strategists, and gurus alike are rapidly paring down their stock performance targets for 2025 to zero.

When someone calls the fire department, it’s safe to assume that there is a fire out there somewhere. That’s what Fed governor Jay Powell did last week. It raises the question of what Jay Powell really knows that we don’t. Given the opportunity, markets will always assume the worst, that there’s not only a fire, but a major conflagration about to engulf us all. Jay Powell’s judicious comments last week certainly had the flavor of a president breathing down the back of his neck.

It's interesting that a government that ran on deficit reduction pressured the Fed to end quantitative tightening. That’s easing the money supply through the back door.

For those unfamiliar with the ins and outs of monetary policy, let me explain to you how this works.

Since the 2008 financial crisis, the Fed bought $9.1 trillion worth of debt securities from the US Treasury, a policy known as “quantitative easing”. This lowers interest rates and helps stimulate the economy when it needs it the most. “Quantitative easing” continued for 15 years through the 2020 pandemic, reaching a peak of $9.1 trillion by 2022. For beginners who want to know more about “quantitative easing” in simple terms, please watch this very funny video.

The problem is that an astronomically high Fed balance sheet like the one we have now is bad for the economy in the long term. They create bubbles in financial assets, inflation, and malinvestment in risky things like cryptocurrencies. That’s why the Fed has been trying to whittle down its enormous balance sheet since 2022.

By letting ten-year Treasury bonds it holds expire instead of rolling them over with new issues, the Fed is effectively shrinking the money supply. This is how the Fed has managed to reduce its balance sheet from $9.1 trillion three years ago to $6.7 trillion today and to near zero eventually. This is known as “quantitative tightening.” At its peak a year ago, the Fed was executing $120 billion a month quantitative tightening.

By cutting quantitative tightening, from $25 billion a month to only $5 billion a month, or effectively zero, the Fed has suddenly started supporting asset prices like stocks and increasing inflation. At least that is how the markets took it to mean by rallying last week.

Why did the Fed do this?

To head off a coming recession. Oops, there’s that politically incorrect “R” word again! This isn’t me smoking California’s largest export. Powell later provided the forecasts that back up this analysis. The Fed expects GDP growth to drop from 2.8% to 1.7% and inflation to rise from 2.5% to 2.8% by the end of this year. That’s called deflation. Private sector forecasts are much worse.

Just to be ultra clear here, the Fed is currently engaging in neither “quantitative easing nor “quantitative tightening,” it is only giving press conferences.

Bottom line: Keep selling stock rallies and buying bonds and gold on dips.

Another discussion you will hear a lot about is the debate over hard data versus soft data.

I’ll skip all the jokes about senior citizens and cut to the chase. Soft data are opinion polls, which are notoriously unreliable, fickle, and can flip back and forth between positive and negative. A good example is the University of Michigan Consumer Confidence, which last week posted its sharpest drop in its history. Consumers are panicking. The problem is that this is the first data series we get and is the only thing we forecasters can hang our hats on.

Hard data are actual reported numbers after the fact, like GDP growth, Unemployment Rates, and Consumer Price Indexes. The problem with hard data is that they can lag one to three months, and sometimes a whole year. This is why by the time a recession is confirmed by the hard data, it is usually over. Hard data often follows soft data, but not always, which is why both investors and politicians in Washington DC are freaking out now.

Bottom line: Keep selling stock rallies and buying bonds and gold (GLD) on dips.

A question I am getting a lot these days is what to buy at the next market bottom, whether that takes place in 2025 or 2026. It’s very simple. You dance with the guy who brought you to the dance. Those are:

Best Quality Big Tech: (NVDA), (GOOGL), (AAPL), (META), (AMZN)

Big tech is justified by Nvidia CEO Jensen Huang’s comment last week that there will be $1 trillion in Artificial Intelligence capital spending by the end of 2028. While we argue over trade wars, AI technology and earnings are accelerating.

Cybersecurity: (PANW), (ZS), (CYBR), (FTNT)

Never goes out of style, never sees customers cut spending, and is growing as fast as AI.

Best Retailer: (COST)

Costco is a permanent earnings compounder. You should have at least one of those.

Best Big Pharma: (AMGN), (ABBV), (BMY)

Big pharma acts as a safety play, is cheap, and acts as a hedge for the three sectors above.

March is now up +2.92% so far. That takes us to a year-to-date profit of +12.29% in 2025. That means Mad Hedge has been operating as a perfect -1X short S&P 500 ETF since the February top. My trailing one-year return stands at a spectacular +82.50%. That takes my average annualized return to +51.12% and my performance since inception to +764.28%.

It has been another busy week for trading. I had four March positions expire at their maximum profit points on the Friday options expiration, shorts in (GM), and longs in (GLD), (SH), and (NVDA). I added new longs in (TSLA) and (NVDA). This is in addition to my existing longs in the (TLT) and shorts in (TSLA), (NVDA), and (GM).

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

UCLA Andersen School of Business announced a “Recession Watch,” the first ever issued. UCLA, which has been issuing forecasts since 1952, said the administration’s tariff and immigration policies and plans to reduce the federal workforce could combine to cause the economy to contract. Recessions occur when multiple sectors of the economy contract at the same time.

Retail Sales Fade, with consumers battening down the hatches for the approaching economic storm. Retail sales rose by less than forecast in February and the prior month was revised down to mark the biggest drop since July 2021.

This Has Been One of the Most Rapid Corrections in History, leaving no time to readjust portfolios and put on short positions.

The rapid descent in the S&P 500 is unusual, given that it was accomplished in just 22 calendar days, far shorter than the average of 80 days in 38 other examples of declines of 10% or more going back to World War II.

Home Builder Sentiment Craters to a seven-month low in March as tariffs on imported materials raised construction costs, a survey showed on Monday. The National Association of Home Builders/Wells Fargo Housing Market Index dropped three points to 39 this month, the lowest level since August 2024. Economists polled by Reuters had forecast the index at 42, well below the boom/bust level of 50.

BYD Motors (BYDDF) Shares Rocket, up 72% this year, on news of technology that it claims can charge electric vehicles almost as quickly as it takes to fill a gasoline car. BYD on Monday unveiled a new “Super e-Platform” technology, which it says will be capable of peak charging speeds of 1,000 kilowatts/hr. The EV giant and Tesla rival say this will allow cars that use the technology to achieve 400 kilometers (roughly 249 miles) of range with just 5 minutes of charging. Buy BYD on dips. It’s going up faster than Tesla is going down.

Weekly Jobless Claims Rise 2,000, to 223,000. The number of Americans filing new applications for unemployment benefits increased slightly last week, suggesting the labor market remained stable in March, though the outlook is darkening amid rising trade tensions and deep cuts in government spending.

Copper Hits New All-Time High, at $5.02 a pound. The red metal has outperformed gold by 25% to 15% YTD. It’s now a global economic recovery that is doing this, but flight to safety. Chinese savers are stockpiling copper ingots and storing them at home distrusting their own banks, currency, and government. I have been a long-term copper bull for years as you well know. New copper tariffs are also pushing prices up. Buy (FCX) on dips, the world’s largest producer of element 29 on the Periodic Table.

Boeing (BA) Beats Lockheed for Next Gen Fighter Contract for the F-47, beating out rival Lockheed Martin (LMT) for the multibillion-dollar program. Unusually, Trump announced the decision Friday morning at the White House alongside Defense Secretary Pete Hegseth. Boeing shares rose 5.7% while Lockheed erased earlier gains to fall 6.8%. The deal raises more questions than answers, in the wake of (BA) stranding astronauts in space, their 737 MAX crashes, and a new Air Force One that is years late. Was politics involved? You have to ask this question about every deal from now on.

Carnival Cruise Lines (CCL) Raises Forecasts, on burgeoning demand from vacationers, including me. The company’s published cruises are now 80% booked. Cruise lines continue to hammer away at the value travel proposition they are offering. However, the threat of heavy port taxes from the administration looms over the sector.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, March 24, at 8:30 AM EST, the S&P Global Flash PMI is announced.

On Tuesday, March 25, at 8:30 AM, the S&P Case Shiller National Home Price Index is released.

On Wednesday, March 26, at 1:00 PM, the Durable Goods are published.

On Thursday, March 27, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get the final report for Q1 GDP.

On Friday, March 28, the Core PCE is released, and important inflation indicator. At 2:00 PM, the Baker Hughes Rig Count is printed.

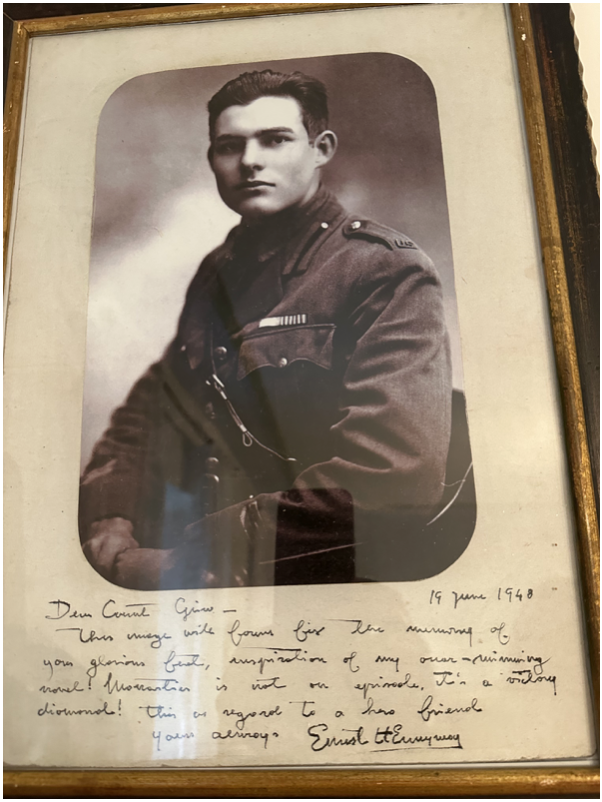

As for me, I received calls from six readers last week saying I remind them of Ernest Hemingway. This, no doubt, was the result of Ken Burns’ excellent documentary about the Nobel Prize-winning writer on PBS last week.

It is no accident.

My grandfather drove for the Italian Red Cross on the Alpine front during WWI, where Hemingway got his start, so we had a connection right there.

Since I read Hemingway’s books in my mid-teens I decided I wanted to be him and became a war correspondent. In those days, you traveled by ship a lot, leaving ample time to finish off his complete work.

I visited his homes in Key West, Cuba, and Ketchum Idaho.

I used to stay in the Hemingway Suite at the Ritz Hotel on Place Vendome in Paris where he lived during WWII. I had drinks at the Hemingway Bar downstairs where war correspondent Ernest shot a German colonel in the face at point-blank range. I still have the ashtrays.

Harry’s Bar in Venice, a Hemingway favorite, was a regular stopping-off point for me. I have those ashtrays too.

I even dated his granddaughter from his first wife, Hadley, the movie star Mariel Hemingway, before she got married, and when she was also being pursued by Robert de Niro and Woody Allen. Some genes skip generations and she was a dead ringer for her grandfather. She was the only Playboy centerfold I ever went out with. We still keep in touch.

So, I’ll spend the weekend watching Farewell to Arms….again, after I finish my writing.

Oh, and if you visit the Ritz Hotel today, you’ll find the ashtrays are now glued to the tables.

As for last summer, I stayed in the Hemingway Suite at the Hotel Post in Cortina d’Ampezzo Italy where he stayed in the late 1940’s to finish a book. Maybe some inspiration will run off on me.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.