Below please find subscribers’ Q&A for the September 16 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Is the Russian vaccine real or just a publicity stunt?

A: I would say it’s real. Russia is much more prone to experimentation, that is a luxury they have. If they kill off a million people because the vaccine is no good, there is no litigation risk. So, it may work, but it is a high-risk drug.

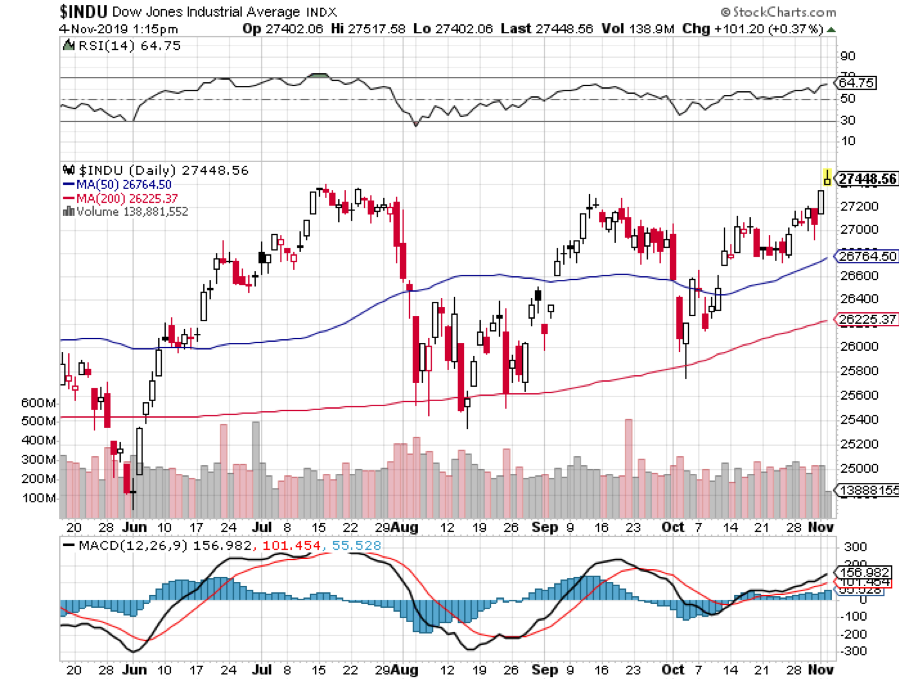

Q: What will a contested election mean for the markets?

A: The Dow (INDU) will be down 2,000 points in one day. But I don’t think it’s going to happen; I think the media has greatly exaggerated the chances of a Trump victory. I don’t think there are any undecided votes now. The only way you’d be undecided by now is if you’ve lived in a care for the past four years. The market has got this completely wrong, and once it’s clear who won, you’ll get a monster rally in the stock market that goes until this year’s end, and the game from here until election day is to try to get into the market as low as possible before then.

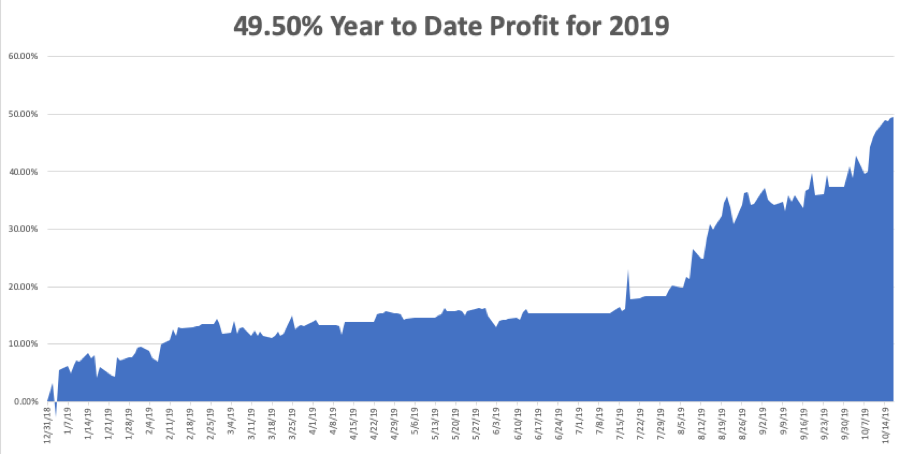

Q: Do you think big tech is a crowded trade, and what do you think will eventually happen?

A: It is an extremely crowded trade; eventually it will go down big. If you remember the Dotcom Bubble, everything dropped 80% or went to zero. Having said that, we’ve never had this amount of Fed stimulus before, so we should go higher first, especially after the election. The fact is that the big techs are growing gangbusters—30%, 40%, or 50% a year so spectacular multiples are called for. This is the argument Mad Hedge Fund Trader has been making for the last 10 years, by the way.

Q: Do you think the residential real estate market will crash before or after the election?

A: I would say well after the election because I don't think it will crash until 2030. All these millennial buyers are out there in droves, interest rates are at record lows, and you have this massive work-at-home trend going on, which is going to be largely permanent. So, all of a sudden, the demand is huge for homes that you can convert into a kitchen with 4 home offices. A lot of companies have discovered this to be a very profitable way to work. So, I don’t see any crash happening in housing, perhaps even in my lifetime. We’re not seeing all the excesses in housing now that we saw in the Great Recession 13 years ago.

Q: How will Joe Biden’s election change the wealth of America’s finances?

A: Move money from the extremely rich to the middle class. That is the one-liner. It looks like any tax increases for individuals who make less than $400,000 a year will be minimal. The big hit will be those that make over a billion a year, and that category could even see Roosevelt level tax rates of 90% or more.

Q: What do you think of the condo market in San Francisco?

A: It is terrible now with prices down about 20%. We’re seeing exactly the same thing in New York City as people flee to the suburbs, and in the meantime, we have bidding wars going on in the outer suburbs. This will continue for about another year until people pour back into the city once the pandemic all-clear signal is given. That may be in about two years.

Q: Tesla (TSLA) has retraced half of its recent losses; do you think it will go another leg higher?

A: At this point, Tesla is an extremely high-risk stock. I would only want to be day trading it. The overnight gaps are so enormous. At $500 a share, it’s discounting a best-case scenario for 2025 already, so that is kind of stretching it. Better to buy the car than the stock.

Q: Do you have any other names in the EV market to recommend?

A: Absolutely not; most of the other entrants in the market have no cars and no mass production abilities, which is the real challenge, and are lagging Tesla with terrible designs. Tesla essentially has the lock on that market, and a 10-year head start. They are accelerating their technology and the only other serious producer in volume is General Motors (GM) with their Bolt, but that hasn’t really taken off. It is cheap at $30,000 but the next thing to happen is that Tesla will drop the price of their model Y below the price of the Bolt which will kill it off. But no, I wouldn't touch any of these other things. The future is all electric. Many people also underestimate the decade-long torture Tesla had to go through to get to where they are. I remember it because I have been with Elon from day one during his PayPal (PYPL) days.

Q: Would you sell Disney (DIS) here at $130? The economic climate for 2021 doesn’t look great for public mass entertainment.

A: That is all true, but their streaming business, Disney Plus, is taking off like a rocket. They just released Mulan, which I watched over the weekend with my kids and loved it. It will undoubtedly be the largest streaming movie release in history once we get a look at the numbers next month. So, they are moving into the online business at an incredible speed, and it may be enough to offset the enormous losses they are running from their hotels, cruise ships, and parks. And also, this is a reopening play big time—one of the few quality reopening plays out there—and the only reason to sell Disney here is if you think the corona epidemic will get dramatically worse and stay worse well into next year.

Q: What about battery names?

A: Batteries are still either owned by giant companies like Tesla or they’re small startups that have a nasty habit of going bankrupt. There really aren't any good clean publicly-listed plays on batteries in the markets these days.

Q: What about a short on Nikola (NKLA)?

A: If I were an aggressive day trader, that would be right in my sights. You can expect nothing but bad news to come out about Nikola. Taking a truck with no motor and then rolling it downhill and calling it a successful trial just invites short-sellers by the hoards. It’s already off 65% from its peak.

Q: Why do you say there's no future in hydrogen?

A: You need to build a large national hydrogen distribution network to make this economically viable and it’s just too expensive. Electricity infrastructure is already in place and just needs to be upgraded and modernized. Electricity is also infinitely scalable in improvements in power output, but hydrogen is only capable of straight-line improvement. No contest.

Q: What about the Solid-State Batteries?

A: I actually wrote a piece about this earlier this week. Solid-State Batteries could allow a 20-fold increase in battery efficiency for cars and houses and that may only be 2 or 3 years off as there are several in development now. QuantumScape (KCAC) is the listed leader there. Bill Gates is a major investor (click here for the link).

Q: Can we play a short-term bounce in big oil like ExxonMobile (XOM)?

A: You can, but remember, this is a trading play only, not an investment play. The long-term future for these companies is to go to zero or to get into another line of business, like alternative energy.

Q: What will happen to the market after the Fed speaks today?

A: My guess is stocks will rally as long as Jerome doesn’t say anything horrendous like “this is your last freebie; I’m raising rates at the next meeting,” which he is not going to say at the last Fed meeting before the presidential election.

Q: I am trying to get through all the fluff of misinformation out there; I want your opinion on who is winning the US-China (FXI) trade war.

A: The simple answer is that China has been winning all along. The proof of that is that their economy is growing and ours is shrinking. That’s because China managed to cap their Corona deaths at 4,000 and ours are at 200,000. In the meantime, the technology improvements in China have been enormous over the last 4 years, so none of the trade war issues, which by the way, were all focused on the lowest margin businesses that China did, have had any effect. If anything, it’s forced China to offshore their low margin business to cheap countries like India, Vietnam, and Bangladesh so they disappear as China trade. I always thought the China trade war was a mistake—it’s always better to trade with someone than go to war with them. I’ve done both and prefer the former.

Q: Do you think Biden is bullish for stocks, considering all the regulations that will be put back?

A: I don’t think there will be many regulations put back except for the energy industry, which has essentially operated regulation-free for the last three years. All of those controls—on flaring, on pipelines, and so on—those will all get put back because they were implemented by executive order, which can be reversed with the stroke of a pen. I don’t see much regulation anywhere else in the economy coming back. And in fact, since Joe Biden pulled ahead in the polls in May, the stock market has gone up almost every day. So clearly, the market thinks Joe Biden will be positive for stocks, and the possibility that he might implement an extra $6 trillion dollars in fiscal spending once in office is the reason why. You have to look at what these people do, not what they say. And my bet is that since Trump set the precedent for record deficit spending, Biden will continue that. And we’ll only worry about things like deficits when the inflation rate tops 5%, when interest rates go back to 10% in five years—all the reasons that caused the massive rise in deficits during the late 70s and early 80s.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Sitting Pretty