It’s looking like the trade war between the US and China is going to heat up some more, no matter who wins the presidential election. It is no longer a question of “if”, but “how much” and “when.”

Please forgive me, but I am new at this. I have only been covering China for 50 years now since the Cultural Revolution was sweeping an impoverished, starving third-world communist country.

With a massive US trade deficit with China in 2023, the Middle Kingdom has become a top administration target.

A real trade war would cause thousands of businesses in the US to go bankrupt and leave millions unemployed. Transpacific transportation would ground to a halt, filling up harbors with hundreds of redundant ships.

Trillions of dollars of direct investment in the two countries would be held hostage.

In other words, a trade war would be like cutting off our noses to spite our faces.

Just as America has its Tea Party and right-wing conspiracy theorists, so does China.

Their entire worldview revolves around the merciless exploitation of China by the Western powers that took place during the 19th century.

British trading companies, like Jardine Matheson, imported cheap opium from India and sold it to the Chinese at the point of a gun, triggering three wars. With only primitive weapons at hand, the Chinese were powerless to resist.

By the time of the fall of the Qing Dynasty in 1912, the entire country had been carved up into spheres of influence dominated by the West and Japan.

Then the Japanese invaded in 1937, and 29 million Chinese died. As recently as 1938, my Marine Corps uncle, Colonel Mitchell Paige, was charged with protecting American gunboats cruising the Yangtze River.

To us, this is all ancient history inhabiting dusty textbooks in libraries never visited. Patriotic Chinese feel like this happened yesterday.

You could dismiss all this as academic musings.

But national pride and sovereignty are really big deals in China today.

During China’s last trade war with Japan only five years ago, several Japanese facilities were burned down by angry, uncontrollable mobs, and visiting businessmen were assaulted on the street. Trade ground to a halt.

So it behooves us to analyze which companies will suffer the most from any deterioration in the US-Chinese relationship before markets figure this out. The Chinese are not interested in any “America First” policy in any way, shape, or form.

Here is my hit list:

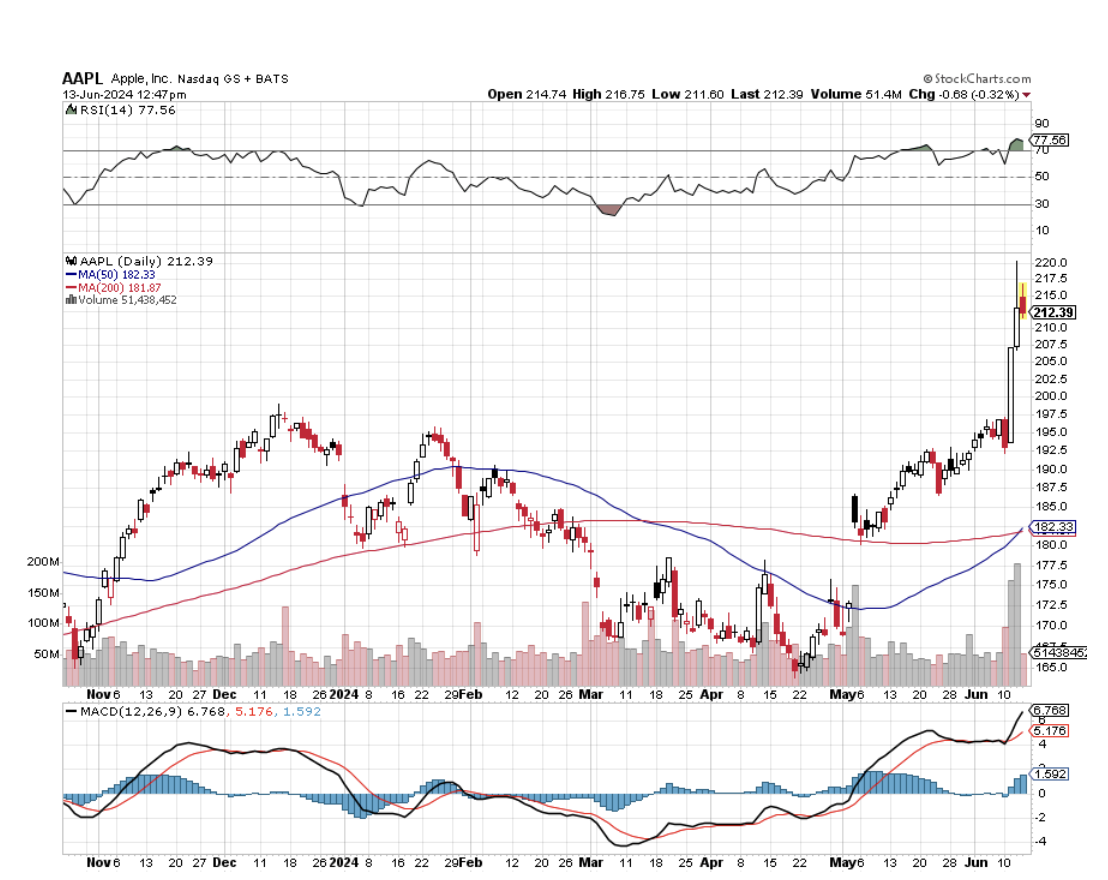

1) Apple (AAPL) – Yes, Cupertino, CA-based Apple has a big fat bull’s-eye on its back. The company is a vast, finely tuned machine that needs everything to work perfectly to deliver hundreds of millions of iPhones around the world.

The number of things that can go wrong here can’t be counted. What if the one million workers at its Foxconn subcontractor fail to show up for work someday? What if they are not allowed to go to work? What if they burn THAT factory down?

Another problem is that Chinese growth is a key part of Apple’s long-term sales strategy. A Chinese boycott would put a huge dent in those plans.

Remember, Apple is getting it from both sides, with Trump promising a 35% import duty on all Apple products. That would certainly hurt sales.

I’m sure Apple management is on tenterhooks as to how all this will play out in the coming months.

There is no backup plan here. Apple is just too big and too sophisticated to change any part of its incredibly complex supply chain in less than a decade.

2) General Motors (GM) – Is one of the most globalized US companies of all. (GM) can’t build a car in Detroit without 40% of its parts coming from Japan, Mexico, South Korea, or dozens of other countries.

General Motors is also hugely dependent on Chinese sales. It sells more Buicks in China than it does in the US. That is one-third of GM’s total worldwide sales.

Next, the company plans to sell Chinese-made Buicks in America.

While we weren’t looking, General Motors has become a Chinese company, and many others are falling suit.

3) Wal-Mart (WMT) – Imagine walking into your local Walmart one day and finding out that all of the prices have been marked up by 35%.

This is the reason why the company is called the “Chinese Embassy.” I dare you to find anything there that is NOT made in China, except for the food and the flowers (a dozen long stem red roses are only $10!).

Like Apple, the company is so big that any change in its supply chain would take years. You can add Target (TGT) to this hit list for the same reasons.

On top of that, Wal-Mart has 432 stores operating in China. Imagine the effect that a boycott would have there.

4) Boeing (BA) - The local flight school that maintains my plane has been totally taken over by Chinese students. That is because China needs to buy $1 trillion worth of aircraft over the next 20 years, some 6,800 jetliners in all.

Boeing expects to provide the lion’s share of these. The company has already entered the planning phases for the construction of a giant new aircraft assembly plant in China.

It would be really easy for China to switch a major part of these orders over to Europe’s Airbus Industries, which has been aggressively competing to accomplish exactly that.

Boeing didn’t get the business because of the advanced technology seen in the 787 Dreamliner. Chinese were simply attempting to even out the trade balance.

5) Starbucks (STBX) – Starbucks founder Howard Schultz made no secret of his dislike for Donald Trump before the election. With 2,500 stores in China, and plans to double that figure, he had little other choice.

With relations between the US and China turning colder than the firm’s overpriced ice espresso, sales, growth plans, and share prices could take a big hit. Chinese may have to postpone their caffeine addiction until the next Democratic administration.

6) Caterpillar (CAT) – You can’t have an infrastructure boom anywhere in the world without Caterpillar, whose heavy machinery is the gold standard for large public works projects. I have been covering the company for 40 years.

7) Tesla (TSLA) – Tesla’s factory in China is the company’s biggest seller. If the Chinese expropriate or impede in any way such as through strikes, Tesla’s share price would drop by half instantly. I know the Chinese promised to play nice when Tesla made this groundbreaking, technology-transferring investment. But guess what Elon? The Chinese can change their minds.

As a result of the upcoming US round of massive deficit spending, (CAT)’s share has been one of the best performers since the presidential election.

Unfortunately, this time the company is so heavily invested in China that it has also built a large assembly plant there. China accounts for 20% of the firm’s worldwide sales.

Time for a short?

The net effect on the impairment of business at all of these companies will be lower profits, high volatility of profits, and continued uncertainty. The shares will be forced to trade at a discount.

When you are running a mammoth global business, the last thing in the world you want is unpredictability.

It will also bring a rapid rise in inflation, as prices are raised to offset higher costs and a strong dollar.

Who will be the biggest victims?

Working-class Trump voters in Rust Belt states, least able to afford price hikes, especially those who already have jobs in Midwest manufacturing.