Global Market Comments

February 17, 2023

Fiat Lux

Featured Trade:

(SOME BASIC TRICKS FOR TRADING OPTIONS)

CLICK HERE to download today's position sheet.

Global Market Comments

February 17, 2023

Fiat Lux

Featured Trade:

(SOME BASIC TRICKS FOR TRADING OPTIONS)

CLICK HERE to download today's position sheet.

Global Market Comments

February 16, 2023

Fiat Lux

Featured Trade:

(IS AIRBNB YOUR NEXT TEN BAGGER?),

(ABNB), (WYNN), (H), (GOOG), (PYPL)

CLICK HERE to download today's position sheet.

Last summer, I stayed at an Airbnb in Long Beach, CA in order to pick up my kids from the Boy Scout Camp on Catalina Island. It was billed as a vintage 1920s residence with all the period finishes, was two blocks from the beach, and was a short drive to the Cataline ferry, so it seemed like the ideal place.

But the second I walked into the place I was overcome by a ghostly Twilight Zone type feeling. Everything seemed strangely familiar. What really freaked me out was that the grill on the electric wall heater exactly matched the scar on my sister’s hand. Even though the place was 100 years old, I had been here before.

When I returned home, I headed straight for a voluminous genealogy file that I maintained. After an hour of going through all the family records, I hit paydirt. The address of the Airbnb was listed as the home address of my grandmother when she was married in 1925.

When the pandemic hit in February 2020, I figured Airbnb (ABNB) was toast. Global travel had ground to a halt, and competitors like Wynn Resorts (WYNN) and Hyatt Hotels (H) saw their share prices plunge to near zero.

Instead, the opposite happened.

While the big hotels continue to roast in purgatory, Airbnb catapulted to a new golden age, and how they did it was amazing.

They turned all travel local. Instead of recommending that I visit Cairo, Tokyo, or Rio de Janeiro, they suggested Carmel, Monterey, or Mendocino, all destinations within driving distance.

It worked spectacularly well, and the company is now moving from strength to strength. Since the pandemic bottom, the shares have rocketed from $69 to $210.

My neighborhood in Incline Village, NV was almost always deserted outside of holidays. Now it is packed with Airbnber’s awkwardly moving in every Friday only to flee on Sunday.

How would you like to get an 80% discount on all of your luxury hotel accommodations?

During my recent trip to Dubrovnik in Croatia, I rented an 800-square-foot, two-bedroom, two-bath home inside the city walls for $300 a night.

A single, cramped 150-square-foot room in the nearest five-star hotel was $600 night.

All that was missing was room service, a handout for a big tip, and a surly attitude at the front desk.

Sounds like a massive, game-changing disruption to me.

Thank you, Airbnb!

The big question for you and me is: Will the valuation soar tenfold from the current $106 billion to $1 trillion?

Is (ABNB) your next ten bagger?

To answer that question, I spent six weeks traveling around the world as an Airbnb customer. This enabled me to understand their business model, their strengths and weaknesses, and analyze their long-term potential.

As a customer, the value you receive is nothing less than amazing.

I have been a five-star hotel guest for most of my life, with someone else picking up the tab much of the time (thank you Morgan Stanley!), so I have a pretty good idea on the true value of accommodations.

What you get from Airbnb is nothing less than spectacular. You get three or four times the floor space for one-third the price. That’s a disruption factor of 7:1.

The standards are often five-star and at the top end, depending on how much you spend. I found I could often get an entire three-bedroom house for the price of a single hotel room, with a better location.

Or, I could get an excellent abode in rural settings, where none other was to be had, whatsoever.

That’s a big deal for someone like me who spends so much of the year on the road.

You also get a new best friend in every city you visit.

On most occasions, the host greeted me on the doorsteps with the keys, and then introduced me to the mysteries of European kitchen appliances, heating, and air conditioning.

Pre-stocking the refrigerator with fresh milk, coffee, tea, and jam seems to be a tradition the hosts pick up in their Airbnb orientation course.

One in Waterford, Ireland even left me a bottle of wine, plenty of beer, and a frozen pizza. She read my mind. She then took me on a one-hour tour of their city, divulging secrets about their favorite restaurants, city sights, and nightspots. Everyone proved golden. Thanks, Mary!

After you check out, Airbnb asks you to review the accommodation. These can be incredibly valuable in deciding your next pick.

I had one near miss with what I thought was a great deal in London, until I read, “The entire place reeks of Indian cooking.” Having caught amoebic dysentery in India once Indian cooking does not exactly bring back fond memories.

Similarly, the hosts rate you as a guest.

One hostess in Dingle, Ireland shared a story about picking up her clients from town after they got drunk and lost in the middle of the night. Then they threw up in the back of the car on the way home.

Guests forgetting to return keys is another common complaint.

Needless to say, I received top ratings from my hosts, as fixing their WIFI to boost performance became a regular and very popular habit of mine.

After my initial fabulous experience in London, I thought it might be a one-off, limited to only the largest cities. So, I started researching accommodations for my upcoming trips.

I couldn’t have been more wrong.

Just the Kona Coast on the big island of Hawaii had an incredible 300 offerings, including several bargain beachfront properties.

The center of Tokyo had over 300 listings. The historic district in Florence, Italy had a mind-blowing 351 properties. When I stayed there, six of seven floors of the building I stayed in were devoted to (ABNB) accommodations. The one full time resident was pissed and often slammed his door.

Fancy a retreat on the island of Bali in Indonesia and tune up your surfing? There are over 197 places to stay!

Airbnb has truly gone global.

Airbnb’s business model is almost too simple to be true, involving no more than a couple of popular applications. Call it an artful melding of Google Earth (GOOG), email, text, and PayPal (PYPL).

While no one was looking, it became the world’s largest hotel at a tiny fraction of the capital cost.

The company has 6 million hosts in 100,000 cities worldwide in 220 countries who so far have earned $150 billion, and 150 million users. The all-time number of guests is 1 billion. The company recently shut down all of its Russia listings.

That supply/demand imbalance shifts the burden of the cost to the renters, who usually have to fork out a 12% fee, plus the cost of the cleaning service.

Hosts only pay 3% to process the credit card fees for the payment.

To say that Airbnb has created controversy would be a huge understatement.

For a start, it has emerged as a major challenge to the hotel industry, which is still stuck with a 20th century business model. There’s no way hotels can compete on price.

One Airbnb “super host” in Manhattan managed 200 apartments, essentially, creating out of scratch, a medium-sized virtual “hotel” until the city caught on to them.

Taxes are another matter.

Some municipalities require hosts to pay levies of up to 20%, while others demand quarterly tax filings and withholding taxes. That is, if tax collectors can find them.

Airbnb may be the largest new source of tax evasion today.

In cities where housing is in short supply, Airbnb is seen as crowding out local residents. After all, an owner can make far more money subletting their residence nightly than with a long-term lease.

Several owners told me that Airbnb covered their entire mortgage and housing cost for the year while paying off the mortgage at the same time.

Owners in the primmest of areas, like mid-town Manhattan off of Central Park, or the old city center in Dubrovnik rent, their homes out as much as 180 days a year.

It is doing nothing less than changing lives.

That has forced local governments to clamp down.

San Francisco has severe, iron-clad planning and zoning restrictions that only allow 2,000 new residences a year to come on the market.

It is cracking down on Airbnb, as well as other home-sharing apps like FlipKey, VRBO, and HomeAway, by forcing hosts to register with the city or face brutal $1,000 a day fine.

Ratting out your neighbor as an off-the-grid Airbnb member has become a new cottage industry in the City of the Bay.

Airbnb is fighting back with multiple lawsuits, citing the federal Communications Decency Act, the Stored Communications Act, and the First Amendment covering the freedom of speech.

It is a safe bet that a $91 billion company can spend more on legal fees than a city the size of San Francisco.

The company has also become the largest contributor in San Francisco’s local elections. In 2015, it fought a successful campaign against Proposition “F”, meant to place severe restrictions on their services.

An Airbnb stayover is not without its problems.

The burden of truth in advertising is on the host, not the company, and inaccurate listings are withdrawn only after complaints.

A twenty-something-year-old guy’s idea of cleanliness may be a little lower than your own.

Long-time users learn the unspoken “code”.

“Cozy” can mean tiny, “as is” can be a dump, and “lively” can bring the drunken screaming of four-letter words all night long, especially if you are staying upstairs from a pub.

And that spectacular seaside view might come with relentlessly whining Vespa’s on the highway out front as I was once confronted with in coastal Italy. Always brings earplugs and blindfolds as backups.

Researching complaints, it seems that the worst of the abuses occur in shared accommodations. Learning new foreign cultures can be fascinating. But your new roommate may want to get to know you better than you want, especially if you are female.

In one notorious incident, a Madrid guest was raped and had to call customer service in San Francisco to get the local police to rescue her. The best way to guard against such unpleasantries is to rent the entire residence for your use only, as I do.

Another problem arises when properties are rented out for illegal purposes, such as prostitution or drug dealing. Near my San Francisco home five people were shot and killed in an illegal block party nearby in a Airbnb weekend rental that was supposed let out to a “quiet couple.”

More than once, an unsuspecting resident woke up one morning to discover they were living next door to a new bordello.

Coming out of the pandemic, my conclusion is that the travel industry is entering a hyper-growth phase. Blame the emerging middle-class Chinese, who are going to be everywhere.

The real shock came when I left Airbnb and stayed in a regular hotel. Include the fees and the cleaning charges, and the service is no longer competitive for a single-night stay. Total costs now regularly run double the posted one-night price posted on websites.

In any case, most hosts have two or three-night minimums to minimize hassle.

When I checked in at a Basel, Switzerland Five Star hotel, all I got was a set of keys and a blank stare. No great restaurant tips, no local secrets, no new best friend.

I spent that night surfing www.airbnb.com, planning my next adventure.

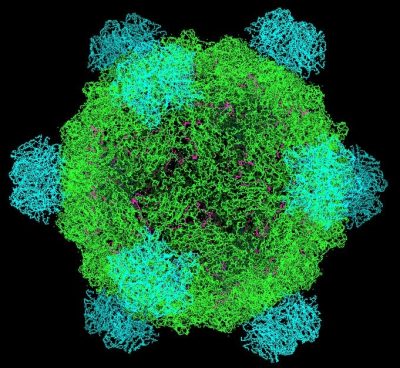

Grandparents at Future Airbnb in 1925

Global Market Comments

January 20, 2023

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

CLICK HERE to download today's position sheet.

Some 50 years ago, when I was a biotechnology student at UCLA, a handful of graduate students speculated about how dangerous our work really was.

It only took us an hour to figure out how to synthesize a microbe that had a 99% fatality rate, was immune to antibiotics and was so simple it could be produced in your home kitchen.

Basically, a bunch of bored students discovered a way to destroy the world.

We voiced our concerns to our professors, who immediately convened a national conference of leaders in the field. Science had outpaced regulation, as it always does. They adopted standards and implemented safeguards to keep this genie from getting out of the bottle.

Four decades later scientists have been successful at preventing a “doomsday” bug from accidentally escaping a lab and wiping out the world’s population.

That is, until now.

In 2010, Dr. Craig Venter created the first completely synthetic life form able to reproduce on its own. Named “Phi X174,” the simple virus was produced from a string of DNA composed entirely on a computer. Thus was invented the field of synthetic biology, better known as “Synbio.”

Venter’s homemade creature was your basic entry-level organism. Its DNA was composed of only 1 million base pairs of nucleic acids (adenine, thymine, cytosine, guanine, and uracil), compared to the 3 billion pairs in a human genome. Shortly thereafter, Venter one-upped himself by manufacturing the world’s first synthetic bacteria.

The work was hailed as the beginning of a brave new world that will enable biology to make the same dramatic advances in technology that computer science did in the 20th century. Dr. Drew Endy of Stanford University says that Synbio already accounts for 2% of US GDP and is growing at a breakneck 12% a year. He predicts that Synbio will eventually do more for the economy than the Internet and social media combined.

You may recall Craig Venter as the man who first decoded the human genome in 2003. The effort demanded the labor of thousands of scientists and cost $3 billion. We later learned that the DNA that was decoded was Craig’s own. Some five years later, the late Steve Jobs spent $1 million to decode his own genes in a vain attempt to find a cure for pancreatic cancer.

Today, you can get the job done for $1,000 in less than 24 hours. That’s what movie star Angelina Jolie did, who endured a voluntary double mastectomy when she learned her genes guaranteed a future case of terminal breast cancer.

The decoding industry is now moving to low-cost China, where giant warehouses have been built to decode the DNA of a substantial part of humanity. That should soon drop the price to $100. It’s all about full automation and economies of scale.

This technology is already spreading far faster than most realize. In 2004, MIT started the International Genetically Engineered Machine Contest where college students competed to construct new life forms. Recently, a high school division was opened, attracting 194 entries from kids in 34 countries. Gee, when I went to wood shop in high school, it was a big deal when I finished my table lamp.

This will make possible “big data” approaches to medical research that will lead to cures of every major human disease, such as cancer, heart disease, diabetes, and more within our lifetimes. This is why the healthcare (XLV), biotechnology (XBI), and pharmaceutical (XPH) sectors have been top performers in the stock market for the past two years. It’s not just about Obamacare.

The implications spread far beyond healthcare. IBM (IBM) is experimenting with using DNA-based computer code to replace the present simple but hugely inefficient binary system of 0’s and 1’s. “DNA-based computation” is prompting computer scientists to become biochemists and biochemists to evolve into computer scientists to create “living circuit boards.” Google (GOOG), Apple (AAPL), and Cisco (CSCO) have all taken notice.

We are probably only a couple of years away from enterprising hobbyists downloading DNA sequences from the Internet and building new bugs at home with a 3D printer. Simple organisms, like viruses, would need a file size no larger than one needed for a high-definition photo taken with your iPhone. They can then download other genes from the net, creating their own customized microbes at will.

This is all great news for investors of every stripe, and will no doubt accelerate America’s economic growth. But it is also causing governments and scientists around the world to wring their hands, seeing the opening of a potential Pandora’s box. What if other scientists lack Venter’s ethics, who went straight to President Obama for security clearance before he made his findings public?

If we can’t trust our kids to drink, drive, or vote, then how responsibly will they behave when they get their hands on potential bioterror weapons? How many are familiar with Bio Safety Level 4 (BSL) standards? None, I hope.

In fact, the race is already on to weaponize synbio. In 2002, scientists at SUNY Stonybrook synthesized a poliovirus for the first time. In 2005, another group managed to recreate the notorious H1N1 virus that caused the 1918 Spanish Flu epidemic. Some 50-100 million died in that pandemic within 2 years.

Then in 2011, Ron Fouchier of the Erasmus Medical Center in Holland announced that he had found a way to convert the H5N1 bird flu virus, which in nature is only transmitted from birds to people, into a human to human virus. Of the 565 who have come down with bird flu so far, which originates in China, 59% have died.

It didn’t take long for the Chinese to get involved. They have taken Fouchier’s work several steps further, creating over 127 H5N1 flu varieties, five of which can be transmitted through the air, such as from a sneeze. The attributes of one of these just showed up in the latest natural strain of bird flu, the H7N9.

The World Health Organization (WHO) and the Center for Disease Control (CDC) in Atlanta, Georgia are charged with protecting us from outbreaks like this. But getting the WHO, a giant global bureaucracy, to agree on anything is almost impossible unless there is already a major outbreak underway. The CDC has seen its budget cut by 25% since 2010 and has lost another 5% due to the US government sequester.

The problem is that the international organizations charged with monitoring all of this are still stuck in the Stone Age. Current regulations revolve around known pathogens, like smallpox and the Ebola virus, that date back to the 1960s when the concern was about moving lethal pathogens across borders via test tubes.

That is, oh so 20th century. Thanks to the Internet, controlling information flow is impossible. Just ask Muammar Gaddafi and Bashar Al Assad. Al Qaida has used messages embedded in online porn to send orders to terrorists.

Getting international cooperation isn’t that easy. Only 35 countries are currently complying with the safety, surveillance, and research standards laid out by the WHO. Indonesia refused to part with H5N1 virus samples spreading there because it did want to make rich the western pharmaceutical companies that would develop a vaccine. African countries say they are too poor to participate, even they are the most likely victims of future epidemics.

Scientists have proposed a number of safeguards to keep these new superbugs under control. One would be a dedicated sequence of nucleic acid base pairs inserted into the genes that would identify its origin, much like a bar code at the supermarket. This is already being used by Monsanto (MON) with its genetically modified seeds. Another would be a “suicide sequence” that would cause the germ to self-destruct if it ever got out of a lab.

One can expect the National Security Agency to get involved, if they haven’t done so already. If they can screen our phone calls for metadata, why not high-risk DNA sequences sent by email?

But this assumes that the creators want to be found. The bioweapon labs of some countries are thought to be creating new pathogens so they can stockpile vaccines and antigens in advance of any future conflict.

There are also the real terrorists to consider. When the Mubarak regime in Egypt was overthrown in 2011, demonstrators sacked the country’s public health labs that had been storing H5N1 virus. Egypt has one of the world’s worst bird flu problems, due to the population’s widespread contact with chickens.

It is hoped that the looters were only in search of valuable electronics they could resell, and tossed the problem test tubes. But that is only just a hope.

I have done a lot of research on this area over the decades. I even chased down the infamous Unit 731 of the Japanese Imperial Army that parachuted plagued infected rats into China during WWII, after first experimenting on American POWs.

The answer to the probability of biowarfare always comes back the same. Countries never use this last resort for fear of it coming back on their own population. It really is an Armageddon weapon. Only a nut case would want to try it.

Back in 1976, I was one of the fortunate few to see in person the last living cases of smallpox. As I walked through a 15th century village high in the Himalayas in Nepal, two dozen smiling children leaned out of second-story windows to wave at me. The face of everyone was covered with bleeding sores. And these were the survivors. Believe me, you don’t want to catch it yourself.

Sure, I know this doesn’t directly relate to what the stock market is going to do today. But if a virus escaped from a rogue lab and killed everyone on the planet, it would be bad for prices, wouldn’t it?

I really hope one of the kids competing in the MIT contest doesn’t suffer from the same sort of mental problems as the boy in Newton, Connecticut did.

Global Market Comments

December 9, 2022

Fiat Lux

Featured Trade:

(WHY TECHNICAL ANALYSIS NEVER WORKS)

(FB), (AAPL), (AMZN), (GOOG), (MSFT), (VIX)

Welcome to the year from hell.

We have now collapsed 16% from the January high. Buyers are few and far between, with one day, 5% crashes becoming common.

By comparison, the Mad Hedge Fund Trader is up a nosebleed 88.48% during the same period.

The Harder I work, the luckier I get.

Go figure.

It makes you want to throw up your hands in despair and throw your empty beer can at the TV set.

Let me point out a few harsh lessons learned from this most recent meltdown and the rip-your-face-off rally that followed.

Remember all those market gurus claiming stocks would rise every day for the rest of the 2022?

They were wrong.

This is why almost every Trade Alert I shot out this year have been from the “RISK OFF” side.

“Quantitative Tightening”, or “QT” is definitely not a stock market-friendly environment.

We went into this with big tech leaders, including Apple (AAPL), Amazon (AMZN), Google (GOOG), and Microsoft (MSFT), all at or close to all-time highs.

The other lesson learned this year was the utter uselessness of technical analyses. Usually, these guys are right only 50% of the time. This year, they missed the boat entirely. After perfectly buying the last top, they begged you to dump shares at the bottom.

In 2020, when the S&P 500 (SPY) was meandering in a narrow nine-point range, and the Volatility Index (VIX) hugged the $11-$15 neighborhood, they said this would continue for the rest of the year.

It didn’t.

When the market finally broke down in January, cutting through imaginary support levels like a hot knife through butter ($35,000?, $34,000? $33,000?), they said the market would plunge to $30,000, and possibly as low as $20,000.

It didn’t do that either.

If you believed their hogwash, you lost your shirt.

This is why technical analysis is utterly useless as an investment strategy. How many hedge funds use a pure technical strategy? Absolutely none, as it doesn’t make any money on a stand-alone basis.

At best, it is just one of 100 tools you need to trade the market effectively. The shorter the time frame, the more accurate it becomes.

On an intraday basis, technical analysis is actually quite useful. But I doubt few of you engage in this hopeless persuasion.

This is why I advise portfolio managers and financial advisors to use technical analysis as a means of timing order executions, and nothing more.

Most professionals agree with me.

Technical analysis derives from humans’ preference for looking at pictures instead of engaging in abstract mental processes. A picture is worth 1,000 words, and probably a lot more.

This is why technical analysis appeals to so many young people entering the market for the first time. Buy a book for $5 on Amazon and you can become a Master of the Universe.

Who can resist that?

The problem is that high-frequency traders also bought that same book from Amazon a long time ago and have designed algorithms to frustrate every move of the technical analyst.

Sorry to be the buzzkill, but that is my take on technical analysis.

Hope you enjoyed your cruise.

Global Market Comments

November 4, 2022

Fiat Lux

Featured Trade:

(NOVEMBER 2 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (LLY), (TSLA), (GOOG), (GOOGL), (JPM), (BAC), (C), (BRK), (V), (TQQQ), (CCJ), (BLK), (PHO), (GLD), (SLV), (UUP)

Below please find subscribers’ Q&A for the November 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: The country is running out of diesel fuel this month. Should I be stocking up on food?

A: No, any shortages of any fuel type are all deliberately engineered by the refiners to get higher fuel prices and will go away soon. I think there was a major effort to get energy prices up before the election. If that's the case, then look for a major decline after the election. The US has an energy glut. We are a net energy exporter. We’re supplying enormous amounts of natural gas to Europe right now, and natural gas is close to a one-year low. Shortages are not the problem, intentions are. And this is the problem with the whole energy industry, and the reason I'm not investing in it. Any moves up are short-term. And the industry's goal is to keep prices as high as possible for the next few years while demand goes to zero for their biggest selling products, like gasoline. I would be very wary about doing anything in the energy industry here, as you could get gigantic moves one way or the other with no warning.

Q Is the SPDR S&P 500 ETF (SPY) put spread, correct?

A: Yes, we had the November $400-$410 vertical bear put spread, which we just sold for a nice profit.

Q: I missed the LEAPS on J.P. Morgan (JPM) which has already doubled in value since last month, will we get another shot to buy?

A: Well you will get another shot to buy especially if another major selloff develops, but we’re not going down to the old October lows in the financial sector. I believe that a major long-term bull move has started in financials and other sectors, like healthcare. You won’t get the October lows, but you might get close to them.

Q: I’m waiting for a dip to get into Eli Lilly (LLY), but there are no dips.

A: Buy a little bit every day and you’ll get a nice average in a rising market. By the way, I just added Eli Lilly to my Mad Hedge long-term model portfolio, which you received on Thursday.

Q: Any thoughts about the conclusion of the Twitter deal and how it will affect tech and social media?

A: So far all of the indications are terrible. Advertisers have been canceling left and right, hate speech is up 500%, and Elon Musk personally responded to the Pelosi assassination attempt by trotting out a bunch of conspiracy theories for the sole purpose of raising traffic and not bringing light to the issue. All indications are bad, but I've been with Elon Musk on several startups in the last 25 years and they always look like they’re going bust in the beginning. It’s not even a public stock anymore and it shouldn’t be affecting Tesla (TSLA) prices either, which is still growing 50% a year, but it is.

Q: In terms of food commodities for 2023, where are prices headed?

A: Up. Not only do you have the war in Ukraine boosting wheat, soybean, and sunflower prices, but every year, global warming is going to take an increasing toll on the food supply. I know last summer when it hit 121 degrees in the Central Valley, huge amounts of crops were lost due to heat. They were literally cooked on the vine. We now have a tomato shortage and people can’t make pasta sauce because the tomatoes were all destroyed by the heat. That’s going to become an increasingly common issue in the future as temperatures rise as fast as they have been.

Q: Do I trade options in Alphabet (GOOG) or Alphabet (GOOGL)?

A: The one with the L is the holding company, the one without the L is the advertising company and the stock movements are really identical over the long term, so there really isn’t much differentiation there.

Q: Why can’t inflation be brought down by increasing the supply of all goods?

A: Because the companies won’t make them. The companies these days very carefully manage output to keep prices as high as possible. It’s not only the energy industry that does that but also all industries. So those in the manufacturing sector don’t have an interest in lowering their prices—they want high prices. If they see the prices fall, they will cut back supply.

Q: What do you think about growth plays?

A: As long as interest rates are rising, growth will lag and value will lead, and that has been clear as day for the last month. This is why we have an overwhelming value tilt to our model portfolio and our recent trade alerts. They’ve all been banks—JP Morgan (JPM), Bank of America (BAC), Citigroup (C), plus Berkshire Hathaway (BRK) and Visa (V) and virtually nothing in tech.

Q: I don’t know how to execute spread trades in options so how do I take advantage of your service?

A: Every trade alert we send out has a link to a video that shows you exactly how to do the trade. I have to admit, I’m not as young as I was when I made the videos, but they’re still valid.

Q: Is the US housing market about to crash?

A: There is a shortage of 10 million houses in the US, with the Millennials trying to buy them. If you sell your house now, you may not be able to buy another one without your mortgage going from 2.75% to 7.75%—that tends to dissuade a lot of potential selling. We also have this massive demographic wave of 85 million millennials trying to buy homes from 65 million gen x-ers. That creates a shortage of 20 million right there. That's why rents are going up at a tremendous rate, and that's why house prices have barely fallen despite the highest interest rates in 20 years.

Q: If we get good news from the Fed, should we invest in 3X ETFs such as the ProShares UltraPro QQQ (TQQQ)?

A: No, I never invest in 3X ETFs, because they are structured to screw the investor for the benefit of the issuer. These reset at the close every day, so do 2 Xs and not more. If you're not making enough money on the 2Xs, maybe you should consider another line of business.

Q: Do you think BlackRock Corporate High Yield Fund (HYT) will show the pain of slights because of their green positioning?

A: No I don’t, if anything green investing is going to accelerate as the entire economy goes green. And you’ll notice even the oil companies in their advertising are trying to paint themselves as green. They are really wolves in sheep’s clothing. They’ll never be green, but they’ll pretend to be green to cover up the fact that they just doubled the cost of gasoline.

Q: Where do you find the yield on Blackrock?

A: Just go to Yahoo Finance, type in (BLK), and it will show the yield right there under the product description. That’s recalculated by algorithms constantly, depending on the price.

Q: Do you like Cameco (CCJ)?

A: Yes, for the long term. Nuclear reactors have been given an extra five years of life worldwide thanks to the Russian invasion of Ukraine. Even Japan is opening theirs.

Q: Should I short the US dollar (UUP) here?

A: The answer is definitely maybe. I would look for the dollar to try to take one more run at the highs. If that fails, we could be beginning a 10-year bear market in the dollar, and bull market in the Japanese yen, Australian dollar, British pound, and euro. This could be the next big trade.

Q: What is your outlook on Real Estate Investment Trusts (REITs) now?

A: I think it looks great. REITs are now commonly yielding 10%. The worst-case scenario on interest rates has been priced in—buying a REIT is essentially the same thing as buying a treasury bond, but with twice the leverage, because they have commercial credits and not government credits. We’ll be doing a lot more work on REITS. We also have tons of research on REITS from 12 years ago, the last time interest rates spiked. I'll go in and see who’s still around, and I'll be putting out some research on it.

Q: How do you see the price development of gold (GLD)?

A: Lower—the charts are saying overwhelmingly lower. Gold has no place in a rising interest rate world. At least silver (SLV) has solar panel demand.

Q: Do you have any fear of Korea going into IT?

A: Yes, they will always occupy the low end of mass manufacturing, and you can see that in the cellphone area; Samsung actually sells more phones than Apple, but they’re cheaper phones with lower-end lagging technology, and that’s the way it’s always going to be. They make practically no money on these.

Q: When can we get some more trade alerts?

A: We are dead in the middle of my market timing index, so it says do nothing. I’m looking for either a big move down or big move up to get back into the market. This is a terrible environment to chase trades when you're trading, so I'm going to wait for the market to come to me.

Q: What about water as an investment? The Invesco Water Resources ETF (PHO)?

A: Long term I like it. There’s a chronic shortage of fresh water developing all over the world, and we, by the way, need major upgrades of a lot of water systems in the US, as we saw in Jackson, MS, and Flint, MI.

Q: Will REITs perform as well as buying rental properties over the next 10 to 20 years?

A: Yes, rental properties should do very well, as long as you’re not buying any city that has rent control. I have some rental properties in SF and dealing with rent control is a total nightmare, you’re basically waiting for your tenants to die before you raise the rent. I don’t think they have that in Nevada. But in Las Vegas, you have the other issue that is water. I think the shortage of water will start to drag on real estate prices in Las Vegas.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log on to www.madhedgefundtrader.com go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

It’s Been a Tough Market

Global Market Comments

September 9, 2022

Fiat Lux

Featured Trade:

(SEPTEMBER 7 BIWEEKLY STRATEGY WEBINAR Q&A),

(MSFT), (NVDA), (RIVN), (AMZN), (POAHY), (SPWR), (FSLR), (CLSK), (FCX), (CCJ), (GOOG), (TLT), (TSLA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.