We can flip through the thesaurus to look for superlatives that would describe how Apple (AAPL) is performing versus the rest of the market or tech sector, yet it really doesn’t matter who we compare them to, because no matter what we do, somebody would need to be clinically insane to bet against this well-oiled machine.

To give credit where credit is due, Apple CEO Tim Cook parlayed his friendship with co-founder Steve Jobs into the top job at Apple precisely because he was and still very much is an operational specialist.

In times of pandemic, climate change, supply chain problems, hyperinflation, and geopolitical volatility, this is the man you want at the helm to make those operational decisions that benefit shareholders.

Cook even pulled off China and is the only person in Silicon Valley that can claim that level of tech success in the Middle Kingdom.

Not many US tech companies can outdo the Chinese in China, but that is what Cook has managed to achieve and that sometimes gets overlooked.

I have undeniably been a major skeptic about China, but he has managed to penetrate so deeply into Chinese culture that the Chinese can’t root him and his products out without massive disruption and possible social unrest.

Cook, being the operations guy that he is, told the media that he expects supply bottlenecks to ease, which is a major bullish signal to the rest of tech and the semiconductor industry.

That comment alone will mean that the Nasdaq will finish the year at least 7-10% higher than if he didn’t make that comment and to nobody’s surprise, Apple is trending higher by over 6% today and rightly so.

The market trusts Tim Cook and what he says, and I can’t say the same for Tesla’s Elon Musk who loves to overpromise and underdeliver.

This is also good news for the EV sector such as Lucid (LCID) and Rivian (RIVN) which I highlight as two stocks with massive potential even if they can’t ramp up to Tesla levels right away.

Optimizing the supply chain has never been more important today because of the de-globalized elements that have filtered through to corporate America.

Part of streamlining the operations helps when you are Apple and you are Tim Cook and you can negotiate contracts down to the fractional cent.

Other companies simply don’t have that negotiating leverage.

They have curried together that type of goodwill that Apple has with their brand name and footprint.

Moving forward, the best way to decode the content of Apple’s earnings report is by viewing it as an equivalent to an implicit guarantee that margins and operations will be running smoothly for the rest of the year.

That in itself carries more weight than the Fed supplying capital for zombie companies.

I keep mentioning that this is the era in which the balance sheet matters; and wow, Apple has a crystal clean sheet that almost doesn’t need balancing.

Apple’s optionality is just mind-boggling from unlimited buybacks, to possibly raising their dividend from 22 cents, to hiring and expanding their workforce, adding more data centers, and so on.

They literally have any tool in the tool kit to respond to any possible headwind.

That is a luxury that most tech companies cannot claim to possess aside from a handful.

As Microsoft reported stellar earnings, this is just another feather in the cap for big tech.

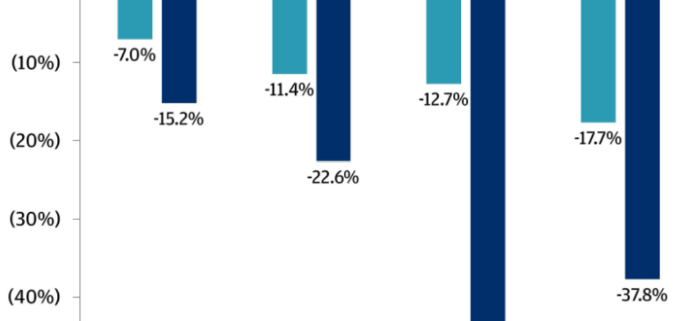

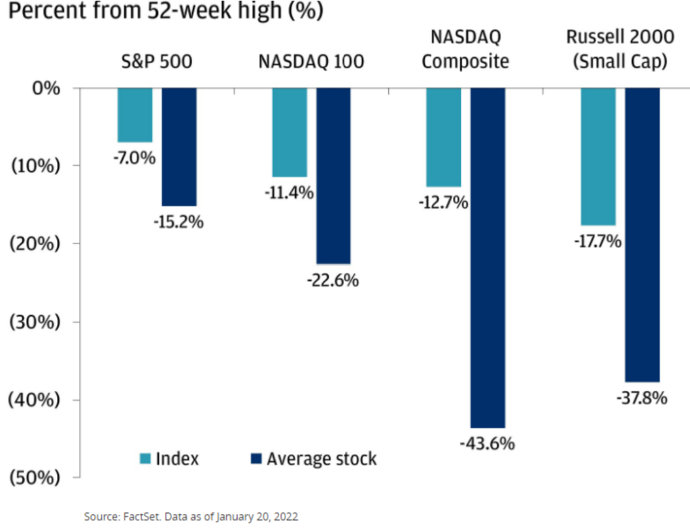

Big tech is protected from the carnage that smaller tech companies must face, and who have less options to remediate possible devastating internal or external threats.

Not only is Apple riding high on their horse at the vanguard, but they possess products and software that simply can’t be substituted out, which easily creates an overwhelming strong hand when it comes to pricing power.

Next in the queue with earnings is Alphabet (GOOGL), where I fully expect them to reveal record earnings. Facebook (FB) too should do well, but not as good as GOOGL.

Don’t bet against Goliath.