Below please find subscribers’ Q&A for the Mad Hedge Fund Trader March 11 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

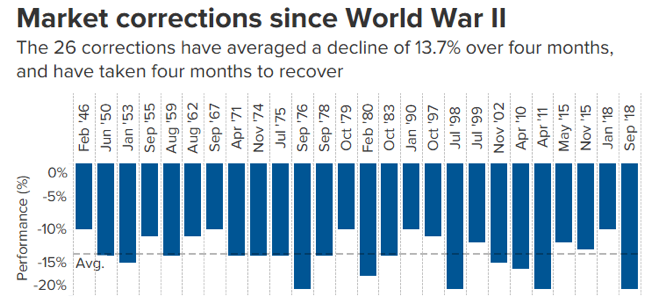

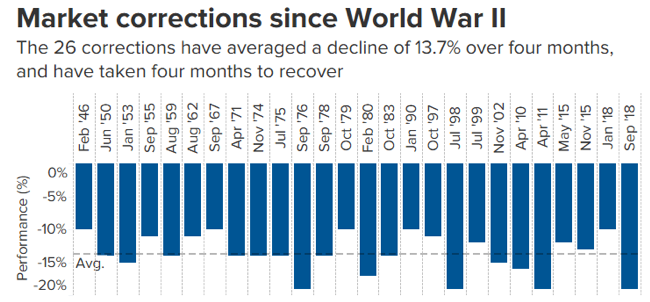

Q: What is the worst-case scenario for this bear market?

A: The average earnings loss for a recession is 13%. Last year, we earned $165 a share for the S&P 500. So, a recession would take us down to $143 a share. Multiply that by the 15.5X hundred-year average earnings multiple, where we are now, and that would take the (SPX) down to 2,200. However, if we get 100 million cases and 5 million deaths, as some scientists are predicting, we could get a 2008 repeat and a 50% crash in the (SPX) to 1,700. With the administration asleep at the switch, that is clearly a possibility. Nice knowing you all.

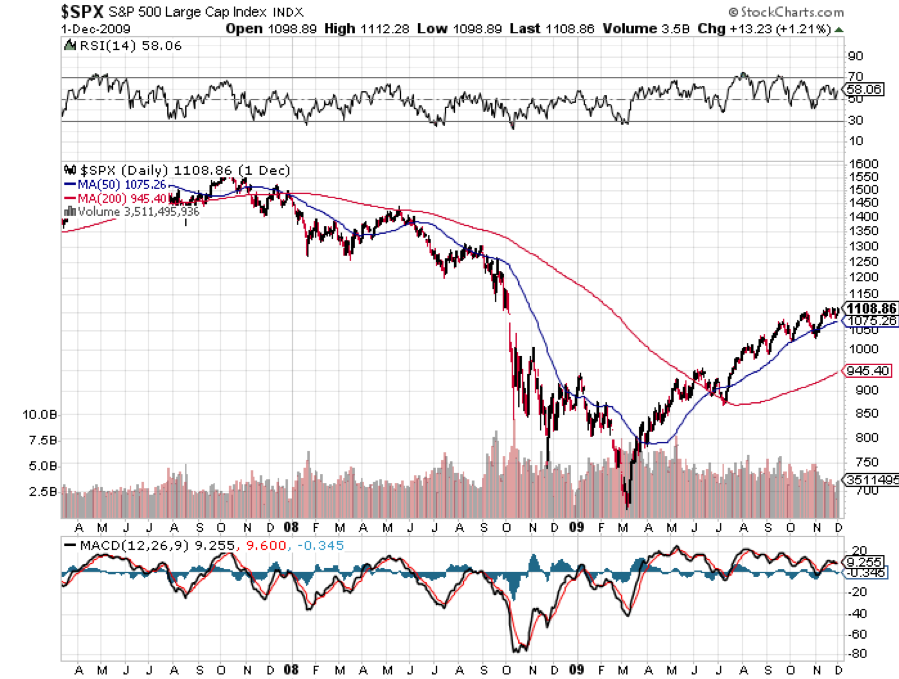

Q: Do you think we’re still setting up for another roaring 20s?

A: Yes, absolutely. We could not have a roaring 20s unless we got a major selloff and clearing out of old positions like we're getting now. That flushes out all the old capital and positions and paves the way for people to set up brand new positions at really bargain prices. If you missed the 2009 bottom, here's another chance.

Q: Will the fiscal stimulus help defeat the coronavirus?

A: No, viruses are immune to money. They don’t take PayPal or American Express (AXP). The president has been able to buy his way out of all his other problems until now; there’s no way to buy his way out of this one.

Q: Is JP Morgan’s (JPM) Jamie Dimon getting a heart attack related to the financial crisis?

A: Probably, yes. In a normal time, the pressure of a CEO in these big banks is enormous. All of a sudden half of your small customers are looking at bankruptcy—the pressure has to be immense. You've got customers screaming for short term loan facilities, you’ve got risk managers asking for margin extensions. And you certainly don't want to buy the banks here. I think this may be the final selloff with legacy banks, from which they never recover. The banks will disappear and come back online.

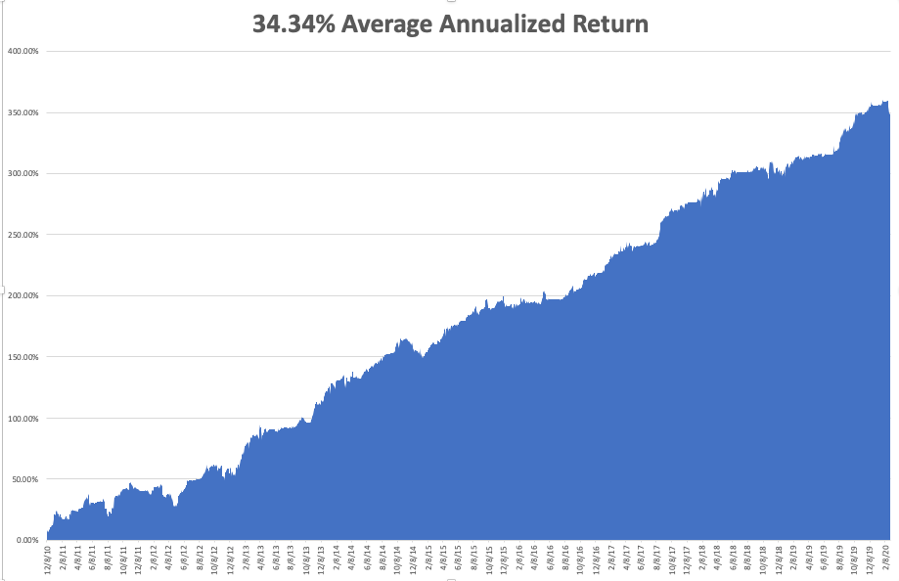

Q: What would you do with a $45,000-dollar portfolio right now? I don’t do options.

A: Look at my story on Ten Leaps to Buy at Market Bottom. Use those names—Microsoft (MSFT), Apple (AAPL), NVIDIA (NVDA), etc.—and just buy the stocks. Buy half now and a half in a month. This is a time to dollar cost average. And you’re looking at doubles at a minimum 3 years down the road—at the end of this year if you’re lucky. Once the virus burns out, it will only take a couple months to do that. Then it will be off to the races once again.

Q: Since the 2018 low was never tested, what do you think of 2400/2450?

A: I think that’s great. And you can get a half dozen different analyses that all come up with numbers around 2400, 2500, 2600. That’s where the final low will be—where you get a convergence of multiple support lines and opinions.

Q: Will buybacks come back or are they over for now?

A: They will come back once markets bottom. Companies aren’t stupid; they don’t like buying their own stocks at all-time highs, but they certainly will come in with major amounts of buying when they see their stocks down 20% or 30%. That's certainly what Apple is going to do.

Q: Will luxury retail shares get killed in the current market?

A: Yes, especially stocks like (LVMH), the old Louis Vuitton Moet Hennessey. They’re already down 37% this year. When it becomes clear that we are in an actual recession, these luxury names across the board will get completely abandoned. By the way, I worked with the son of the founder of this company when I was at Morgan Stanley. We called him “Bubbles.”

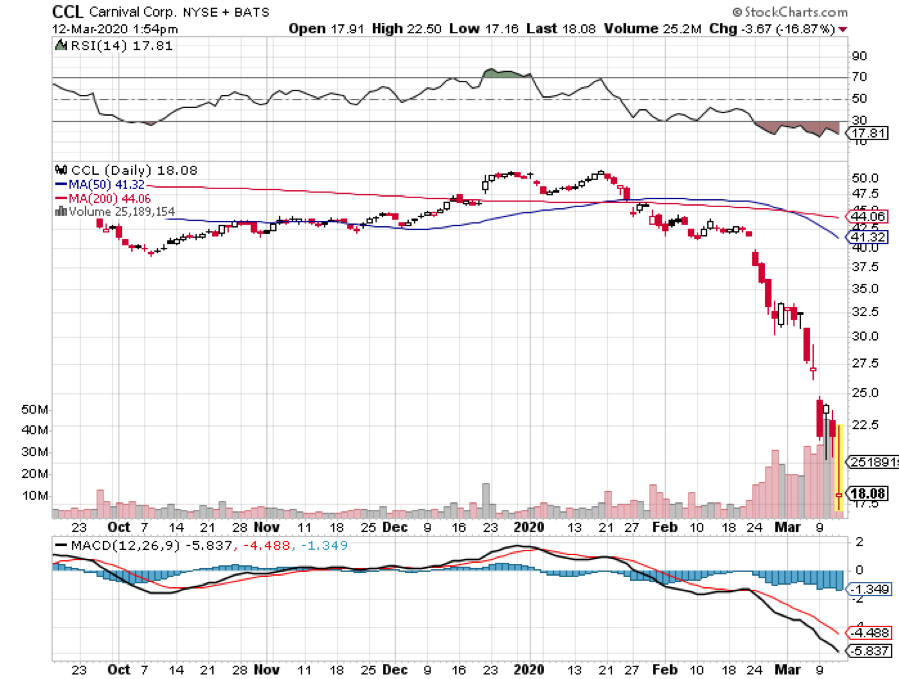

Q: Are there any similarities to 2008?

A: Yes; it’s worse because the market is dropping much faster than it ever has before. The 52% selloff in 2008 was spread out over the course of 18 months. Here, it’s taken only 14 trading days to see half of the damage done back then. It’s truly unbelievable.

Q: What do you think about gold (GLD)?

A: Even though gold is going up, gold miners (GDX) are doing terribly because they are stocks. They get tarred with the same brush blackening all other stocks. This is exactly what happened during the 2008-2009 crash. Fundamentals go out the window in these kinds of trading conditions, but they always come back.

Q: Is Europe in recession?

A: Absolutely, yes. I saw an interview with the Adidas CEO (ADDYY) this morning on TV and they said sales are off 90% on a month-on-month basis. Their stock is down 49% this year. You can bet that every other consumer company in Europe is suffering similar declines.

Q: What will real estate do in the next 3 months?

A: It's impossible to price real estate so finely because it's so illiquid. However, I expect it to hold up here because of super low interest rates, and then keep rising over the long term. We’re not going to get anything like the crashes we saw in 2008-2009 because all the excess leverage is not in the real estate market now, it’s in the stock market, where we are getting a much-deserved crash. If anything, I’d be buying rental properties here in low cost cities.

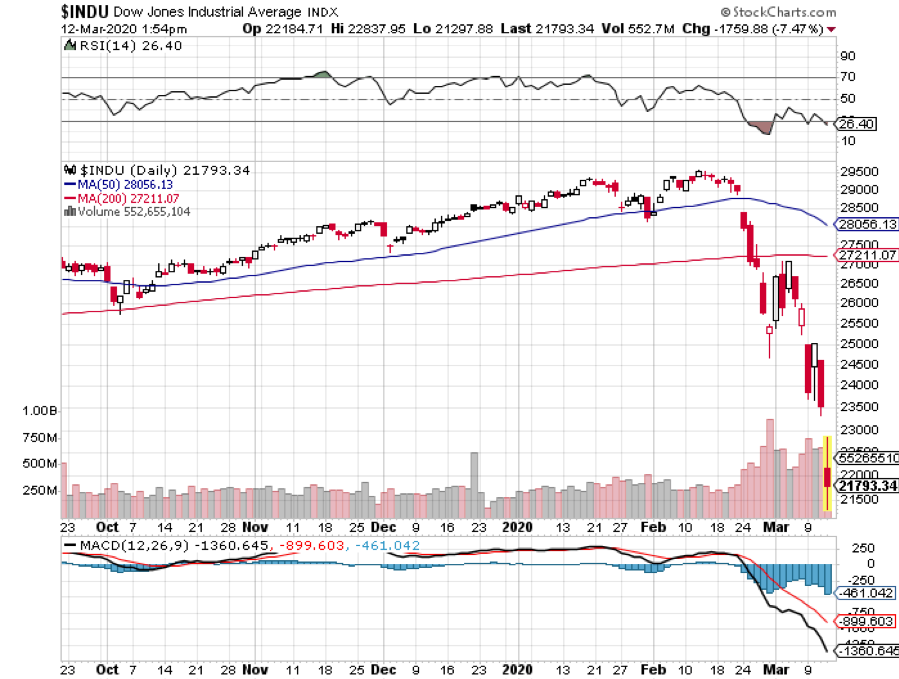

Q: What if the Dow Average (INDU) reaches the 300-day moving average?

A: It’s a nice theory, but technicals are meaningless in the face of panic selling. You don't want to get too fancy looking at these charts. When you have a billion shares to go at market, the 200 or 300 day moving average means nothing.

Good Luck and Good Trading. And stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader