Of course, WWII historians know well the man who never was, the popular name for Operation Mincemeat.

In 1943, British intelligence found a homeless man who died on the streets of London, dressed him up as a Royal Marine Major William Martin, and released his body from a submarine off the coast of Spain, a German ally.

Handcuffed to his wrist was a briefcase with highly detailed plans for the allied invasion of Greece and the Balkans. The Germans shifted ten divisions to defend the region.

When the allies invaded Sicily instead, it came completely out of the blue. The invading American and British forces found the island almost undefended and inadequately manned and supplied by Italian troops. The allies planned for three months to capture Sicily. Instead, they did it in a mere 38 days. Allied losses came in at a tenth of those expected, thanks to Royal Marine Major William Martin.

The analogy here is that last week, we witnessed the market that never was. Stocks went down, then up. Bonds went up, then down. Even Tesla was virtually unchanged. It all ended up as a big fat zero for traders.

What all of this means for us investors is a subject of heated discussion among strategists. Of course, the Cassandras are always out there arguing that this is all proof that markets are peaking and that the mother of all stock market crashes is just ahead of us.

I take a different tack.

I think we are well into a long-overdue “time” correction whereby stocks go sideways for weeks or months before resuming their heroic assault on new highs. The timing will be dictated by the frantic reversal of the bond market at a ten-year Treasury yield of 2.00%.

Investors will rotate from the newly expensive recovery plays like banks into the newly cheap, such as technology stocks. Notice the sudden recent interest in legacy companies like Oracle (ORCL), Intel (INTC), and Cisco Systems (CSCO), which completely missed the great 2020 tech rally.

All of this sets up perfectly for the barbell portfolio which I have been advocating all year.

If there is a selloff, it will be by things that normal people don’t own. Those include SPACS, anything the Reddit crowd chases, stay-at-home stocks, and very high-priced tech stocks with no earnings.

Much focus has been placed on the Taiwanese-owned Ever Given stuck in the Suez Canal. As a Middle Eastern war correspondent for many years, I spent endless hours debating with my compatriots over what closure of the canal would mean.

What hasn’t been mentioned was that the accident was not caused by a Chinese captain, but Egyptian pilot ships are required to take on to raise revenues, and bribes, for the impoverished country. This all happened in the middle of a sandstorm where visibility is near zero.

I can tell you right now that they won’t get the Ever Given off there until they start to unload containers and lift off some weight so the 200,000-ton ship can rise of its own accord. Good luck with that in the middle of the Sinai Desert. Why not just sell all the contents on Amazon and have them deliver it for free as part of their prime membership?

This is a debacle that will last weeks, if not months, and will cost $9 billion a day in international trade until it’s over. In the meantime, commercial shippers have asked for protection from pirates from the US Navy as they navigate the unfamiliar water around the tip of Africa.

The Mad Hedge Summit Videos are Up, from the March 9,10, and 11 confab. Listen to 27 speakers opine on the best strategies, tactics, and instruments to use in these volatile markets. The product discounts offered last week are still valid. Start, stop, and pause the videos at your leisure. Best of all, access to the videos is FREE. Access them all by clicking here, click on CURRENT SUMMIT REPLAYS in the upper right-hand corner, and then choose the speaker of your choice.

Weekly Jobless Claims dive by 100,000, to 684,000, a one-year low. The decline was led by Illinois and Ohio. Labor shortages are popping up around the country in skilled areas, but bars and restaurants are still lagging severely.

Huge Office Cuts are coming, with execs planning a permanent 20% cut. Better to give the money to shareholders. Downtowns across the country will change beyond all recognition. How do you turn an office into an apartment?

CP Rail buys Kansas City Southern, for $25 billion, further concentrating the north American rail industry. It’s a steal because an economy entering a decade-long boom moves lots of stuff. It’s also a great North/South international trade play, which is recovering strongly with the exit of our last president. I used to ride box cars on the old Canadian Pacific back in the sixties (you can’t hitch hike where there are no cars), and occasionally the engineers would let me drive. It suddenly makes Norfolk South (NSC) and Union Pacific (UNP) look very tempting.

Another Tesla $3,000 Target was issued by Ark’s Cathie Wood, an early investor. Cathie’s Ark Innovation Fund ETF was up 180% last year largely on the strength of a massive Tesla (TSLA) holding. Her bear case is a low of $1,500 by 2025, nearly triple the current price. She has only one more triple to go to get to my own $10,000 forecast.

Biden has $3 Trillion More to Spend on top of the just passed $1.9 trillion rescue package. It's all rocket fuel for the stock market, not so much for bonds. The money will be spent on a mix of old-line freeway and bridge repair along with new spending on decarbonizing the power grid and social measures. It will be financed by tax hikes on those earning over $400,000. Remember, Roosevelt hiked the maximum tax rate to 90% on the wealthy, where it stayed for 30 years, and Biden is old enough to remember.

Daily Air Travelers top 1.5 Million, for the first time in a year. The pandemic low was 200,000 a day. It’s an indication of how anxious Americans have become to travel, and how strong the imminent economic boom will be.

Intel to build two chip fabs for $20 billion in Arizona to address the current severe shortage. US construction is a positive as it helps reduce reliance on foreign supplies. Too bad it will still leave them five years behind (AMD), but it’s a major move in the right direction. It deals with everything investors wanted to hear and moves them solidly into the 10nm architecture market. Buy (INTC) on dips.

New Home Sales Dive, off 18.2% in February, now that the free money train has left the station. Weather was blamed as a factor, with giant snowstorms slamming much of the country. Shortage of supply is another big issue. Some big builders are basically out of inventory and are reduced to selling floor plans with extended completion dates.

US Dollar (UUP) hits a four-month high, with a major assist from rising US bond interest rates. Expect the rally to continue until ten-year yields hit 2.00%, then sell the daylights out of it. With the US money supply growing at a near exponential 30% annual rate, there’s no way the dollar strength can continue. When you increase the supply, you decrease the value, simple supply and demand. My first pick is to buy the Aussie (FXA) a call option on a global synchronized economic recovery.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000, here we come!

It’s amazing how well patience can help your performance. My Mad Hedge Global Trading Dispatch profit reached a super-hot 18.61% so far in March on the heels of a spectacular 13.28% profit in February.

It was a go-nowhere week in the market, so I limited myself to a single trade all week, a double short in the bond market (TLT) on top of a welcome $5 rally. The position turned immediately profitable.

I still have a deep in-the-money call spread Tesla (TSLA) that is profitable and expires in 14 trading days. That leaves me with 70% cash and a barrel full of dry powder.

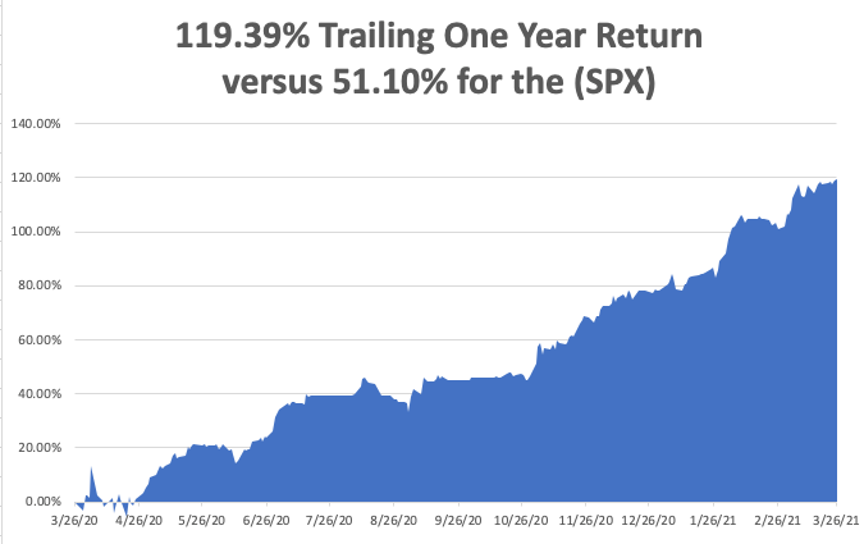

This is my fifth double-digit month in a row. My 2021 year-to-date performance soared to 42.10%. The Dow Average is up 9.9% so far in 2021.

That brings my 11-year total return to 464.65%, some 2.08 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 41.30%.

My trailing one-year return exploded to positively eye-popping 119.39%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Corona virus cases at 30.2 million and deaths topping 550,000, which you can find here.

Thankfully, death rates have slowed dramatically, but Obituaries are still the largest sector in the newspaper. At this point, some 47% of the US population has achieved immunity through vaccination or catching the disease. Herd immunity is near.

The coming week is a big one for jobs data.

On Monday, March 29, at 9:00 AM, the Dallas Fed Manufacturing Index for March is released.

On Tuesday, March 30, at 9:00 AM, the S&P Case Shiller National Home Price Index for January is published.

On Wednesday, March 31 at 8:15 AM, the ADP Challenger Private Employment Report for March is out. Pending Home Sales for February are indicated at 9:00 AM.

On Thursday, April 1 at 8:30 AM, the Weekly Jobless Claims are published.

On Friday, April 2 at 8:30 AM we get the Nonfarm Payroll Report for March. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, tax time is coming up and let me tell you, I have absolutely the best IRS story of all time.

It comes from my late, dear friend, Al Pinder, who I sat next to for ten years at the Foreign Correspondents of Japan in Tokyo, pounding away on antiquated Royal typewriters until our shoulders were as stiff as boards. Al then was the shipping correspondent for the New York Journal of Commerce newspaper.

Al was a colorful character, to say the least.

In the run up to WWII, Al took an extended vacation in Japan where he toured and photographed the country’s beaches, looking for the best landing sites for the US military in case war broke out.

To sneak the top-secret pictures out of the country, he bought a large steamer trunk and placed them a false bottom. Then he went to Tokyo’s red-light district in Yoshiwara, bought a dubious sex toy, an inflatable life-sized Japanese doll, and placed it on top.

When the trunk was searched, the customs officials found the doll, had a good laugh and passed him on. Al’s photos were the basis of Operation Olympic, the 1945 US invasion of Japan, made unnecessary by the dropping of the atomic bomb.

When the war broke out, Pinder parachuted into western China, where he acted as the liaison with Mao Zedong’s guerilla forces in Hunan province. In 1944, Al received a coded message from headquarters ordering him to intercept a top-secret airdrop from a DC3 in the middle of the night.

Knowing he would be mercilessly tortured by the Japanese if caught, he set up three signal fires in a triangle in a remote part of the desert and managed to find the parachute. Dodging enemy patrols all the way, he returned to his hideout in a mountain cave and opened the package.

In it was a letter from the IRS asking why he had not filed a tax return for the past three years.

I told this story at Al’s wake a few years ago and everyone had a good laugh. Al went on to run CIA operations in Japan during the fifties and sixties. When he passed away, there was a frantic search for a safe deposit box by American intelligence officials containing records of all CIA payoffs to Japan’s leading conservative party.

When the box was finally found, there was an enormous sigh of relief at the embassy. I still miss Al.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader