This is no Potemkin village!

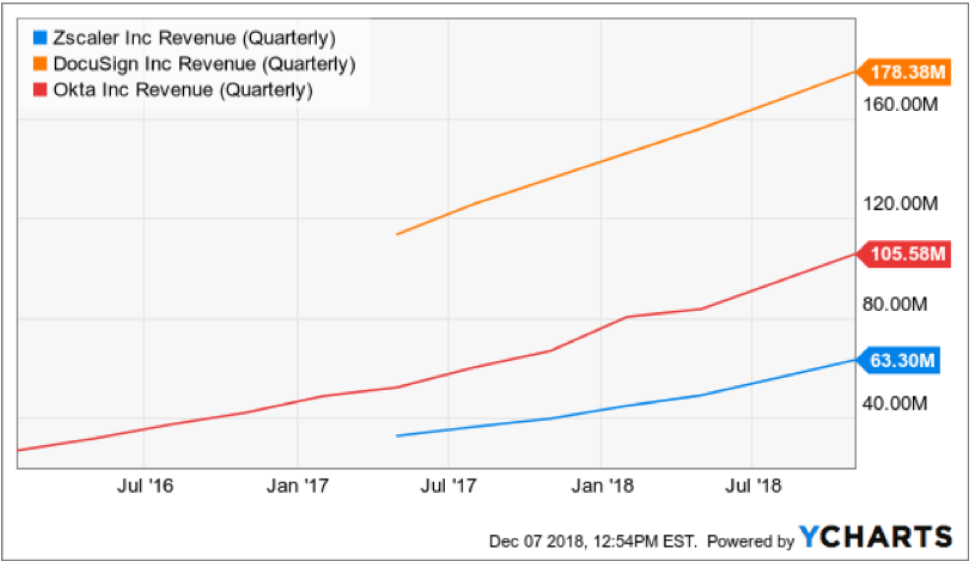

That was my reaction when I examined the earnings reports from second-tier cloud companies Okta (OKTA), Zscaler (ZS), and DocuSign (DOCU).

Cloud companies aren’t going away anytime soon, please singe that into your memory.

Even during a winter Nasdaq (QQQ) swoon, software companies are delivering great earnings.

Ironically enough, the three aforementioned security-based cloud companies come at a time when global tech security is the laser-like focus of contentious geopolitics.

There isn’t a hotter topic circulating the gossip networks these days.

Okta is the best in show for identity management – a snazzy term for managing employees’ passwords.

Okta’s products are built on top of the Amazon Web Services cloud.

Coincidentally, Okta was erected in 2009 by a team of former Salesforce (CRM) executives. Salesforce is one of my favorite cloud-based software companies, offering a blueprint for success to other up-and-coming software companies.

Current Okta CEO and founder Todd McKinnon previously served as the Senior Vice President of Engineering at Salesforce.

Other founders include Okta COO Freddy Kerrest who also walked the corridors of Salesforce.

I can tell you that you could do much worse than starting a new software company with a collection of Salesforce upper echelon talent.

This all-star team is behind the insatiable growth of Okta whose revenue has grown over 600% since establishing itself.

Somewhere along the way at Salesforce, this veteran team became acutely aware of a lack of password security and the dire need for it.

This gang of brothers took it upon themselves to spin out of their former lives and develop this specialized cloud product.

Comparing with Intuit (INTU), the finance and accounting software company, readers can lucidly comprehend the superior growth trajectory of Okta.

I am not tarring Intuit as a bad tech company, it rather does justice to the growth model at Okta.

Okta was forecasted to grow between 43%-45% YOY in the previous quarter and shredded any remnant of doubt by posting 58% YOY of revenue growth.

Last quarter was also Okta’s first profitable quarter as a public company.

Customer expansion was another bright highlight with Okta adding 42% YOY.

Specific relationships that drove the bottom line was America’s second-largest traditional supermarket chain and parent of Safeway, Albertsons, Okta became responsible for their passwords on Albertsons’ e-commerce and loyalty programs.

Other relationships that gained traction were other blockbuster names such as the Transportation Security Administration, Sonoco, LendingClub, and Hertz.

The record third quarter also saw gross margin expansion from 68.4% to 71.9%.

CEO of Okta Todd McKinnon briefly summed up the firm’s outlook by gushing that Okta is “well positioned to further benefit from tailwinds as organizations continue their move to the cloud while digitally transforming and securing their businesses.”

McKinnon stole the words right out of my mouth.

Cloud-based software companies will be outsized winners in 2019 as investors start nitpicking more of which tech to own and which tech to dispose of.

This year spawned a massive divergence between tech who has legs and tech who will be dragged down to the depths of the ocean floor by the heavy weight of regulation, overwhelming competition, or just flat out poor management or inferior product development.

In mid-2018, the FANG shared up moves in unison, Facebook zigged and so did Amazon and friends, then they gleefully zagged together.

That trade unceremoniously fell apart swiftly when macro headwinds applied extreme pressure to each unique model.

Suddenly, the FANGs weren’t best pals anymore and the weaknesses became painfully exposed glaringly to the outside world.

Look for the FANG stocks to experience additional divergence as we moved forward because the low-hanging fruit has been picked and only the strong will excel 2019.

Before the recent turbulence, big tech stocks were assumed as one trade and that is done and dusted.

An exciting new chapter to the tech world and the fierce competition it breeds await with the much-praised unicorns of Uber, Lyft, Airbnb, and Slack going public next year.

As for Okta, analysts expected the company to guide to around a 45% YOY growth rate next year, but management took the liberty to forecast a more audacious revenue growth rate of 53% YOY to a tad below $400 million.

Okta’s management has gone out on a limb predicting revenue to surpass $500 million and maintain an annual growth rate of over 30% for the next five years.

Future revenue has a one-way ticket to $1 billion – quite impressive when you consider 2015 revenue came in at $41 million.

Another growth stock performing amid a tempestuous broader market is digital signature cloud company DocuSign.

The company expansion withstood any supposed softness to its business model outperforming expectations.

DocuSign improved on their 2nd quarter growth rate of 33% and sequentially accelerated to 37% last quarter.

Management jacked up revenue expectations to just under $700 million next year, almost three times the annual revenue of 2015.

The disappointing price action neglecting DocuSign’s bright performances is a sign of the current times.

Catching a horrid downdraft from its 2018 peak of $65 is a swift kick in the groin, but it sadly epitomizes the broader malaise whipsawing market volatility like a bull at a rodeo.

The price action is rare for a company displaying accelerating revenue growth with exciting revenue prospects.

Zscaler echoed the same positive sentiment recording a quarter to remember nudging up sales by a robust 59% easily beating forecasts.

Management geared towards premium-priced bundles spiking gross margin massaging the bottom line.

Next year’s annual guidance was nothing short of spectacular with management believing the company will crack $270 million of total revenue compared to analysts conservatively modeling $259 million in 2019.

Zscaler is still labeled a minnow in the larger landscape of the cyber security market and is the smallest of the three firms written about today, but that is gradually moving up the totem pole as the firm’s hyper-growth model is kicking into gear.

Gartner research estimates that the global information security market will eclipse $124 billion in 2019 offering many players an enlarging piece of the pie.

It is justifiable to bake in that Zscaler's prospects will outrun any broader weakness that tries to crimp the stock’s unfettered momentum.

With a current market capitalization slightly north of $5 billion, the growth potential may justify a premium valuation.

Investors fervently applauded the quarterly results elevating the stock 12% on the positive news.

Zscaler is now convinced it can spearhead consistent profitability and positive cash flow by 2020.

It’s hard not to see them decimate their own in-house projections.

These three shining stars of the cloud revolution are not papering over cracks of a dying model, they are front and center of a cohort leading the digital economy and the underlying outperformance backs up this premise.

Unfortunately, even if a company goes gangbusters, they could still be vulnerable to outside forces which are lamentably unavoidable.

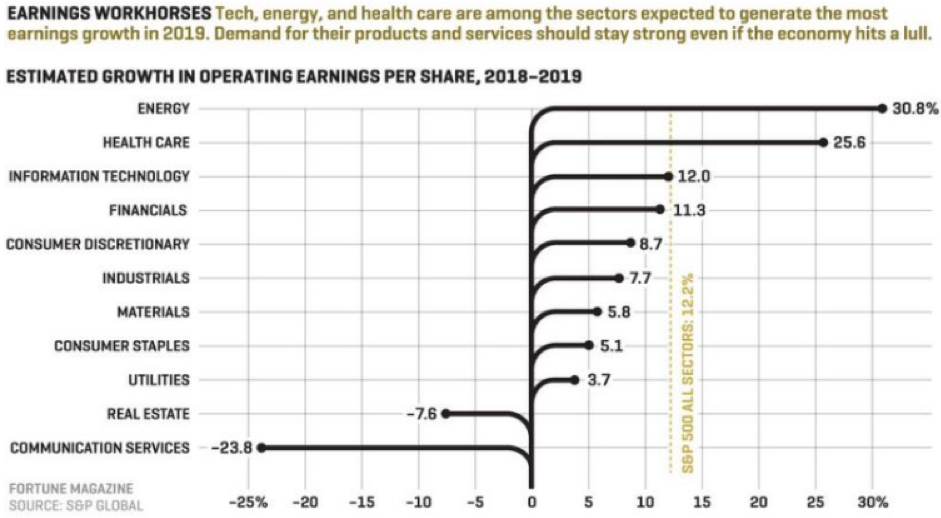

A report published by S&P Global shows the tech industry growing earnings by 12% in 2019, only trailing health care and energy.

This is a great sign of things to come next year.

The demand for quality cloud products of this ilk is one theme that will perpetuate.

The American economy is on the verge of a whole slew of analog companies from other sectors traversing single file into the sweet spot of the data-dependent tech taxonomy clamoring for hybrid specialized offerings.

It is safe to say burgeoning cloud-based software companies with annual revenue of less than half a billion dollars are not only primed to take advantage of the digital migration phenomenon irrespective of the machinations in Washington or the fluctuations of treasury yields, but will post attractive financials numbers because of the law of large numbers that makes small companies’ results look better than they are on a percentage basis.