War threatens in the Ukraine. Iraq is blowing up. Rebels are turning our own, highly advanced weapons against us. Israel invades Gaza. Ebola virus has hit the US. Oh, and two hurricanes are hitting Hawaii for the first time in 22 years.

Should I panic and sell everything I own? Is it time to stockpile canned food, water and ammo? Is the world about to end?

I think not.

In fact the opposite is coming true. The best entry point for risk assets in a year is setting up. If you missed 2014 so far, here is a chance to do it all over again.

It is an old trading nostrum that you should buy when there is blood in the streets. I had a friend who reliably bought every coup d? etat in Thailand during the seventies and eighties, and he made a fortune, retiring to one of the country?s idyllic islands off the coast of Phuket. In fact, I think he bought the whole island.

Now we have blood in multiple streets in multiple places, thankfully, this time, it is not ours.

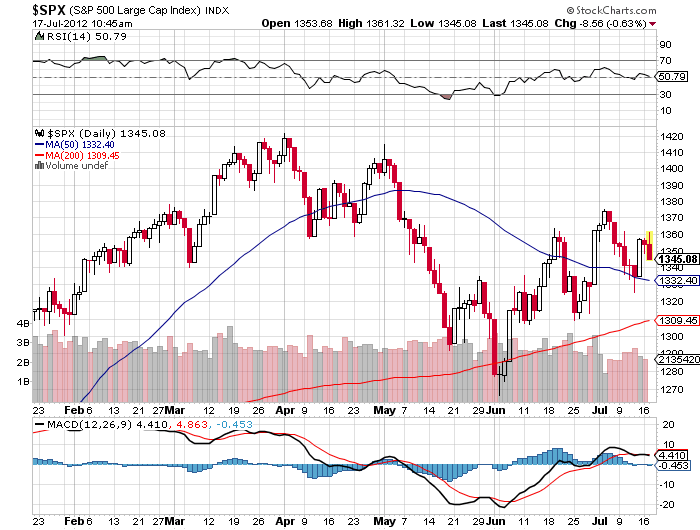

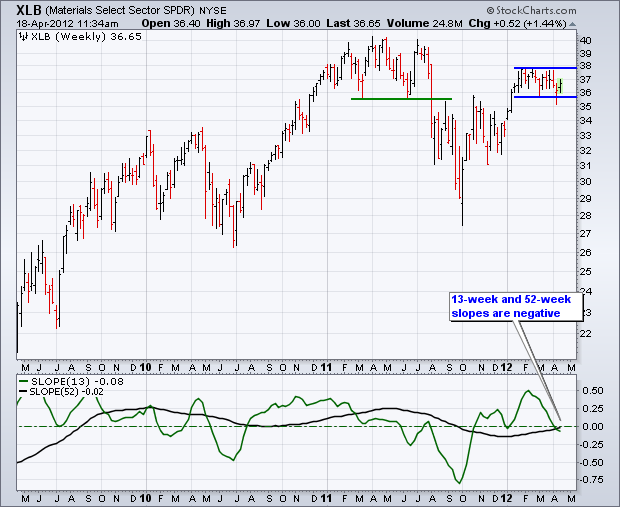

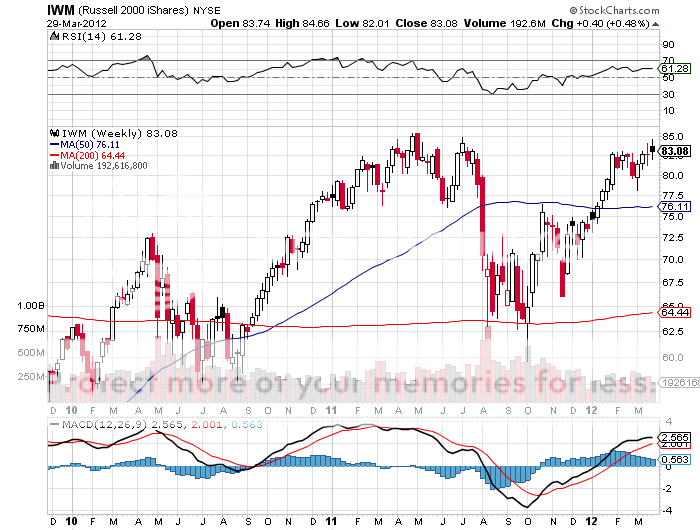

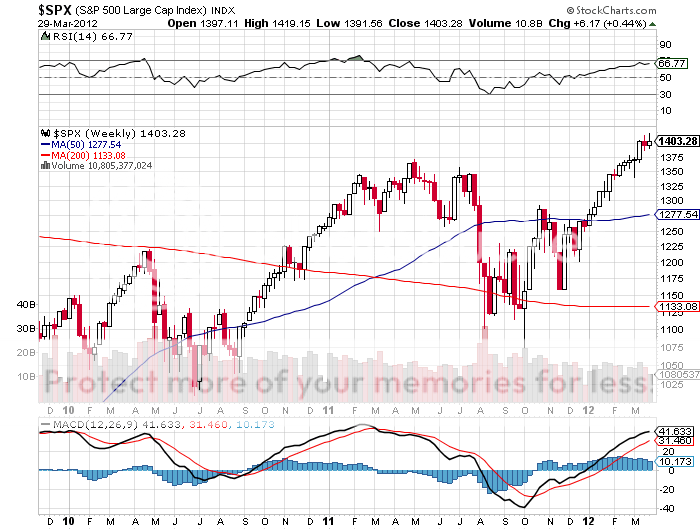

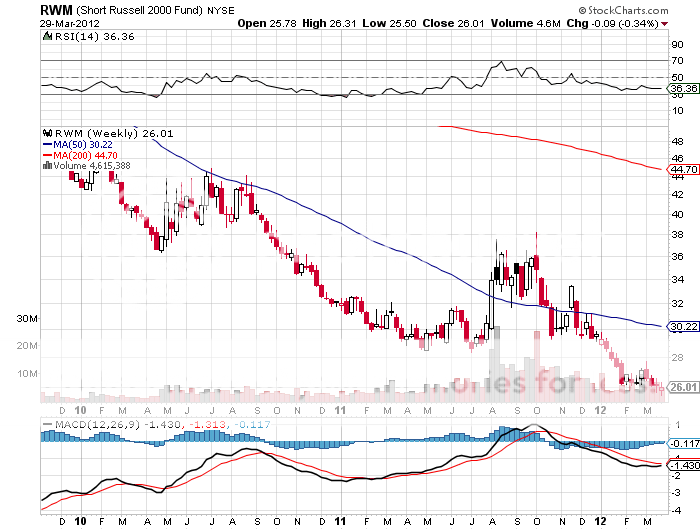

I had Mad Day Trader, Jim Parker, do some technical work for me. He tracked the S&P 500/30 year Treasury spread for the past 30 years and produced the charts below. This is an indicator of overboughtness of one market compared to another that reliably peaks every decade.

And guess what? It is peaking. This tells you that any mean reversion is about to unleash an onslaught of bond selling and stock buying.

There is a whole raft of other positive things going on. Several good stocks have double bottomed off of ?stupid cheap? levels, like IBM (IBM), Ebay (EBAY), General Motors (GM), Tupperware (TUP), and Yum Brands (YUM). Both the Russian ruble and stock market are bouncing hard today.

There is another fascinating thing happening in the oil markets. This is the first time in history where a new Middle Eastern war caused oil price to collapse instead of skyrocket. This is all a testament to the new American independence in energy.

Hint: this is great news for US stocks.

If you asked me a month ago what would be my dream scenario for the rest of the year, I would have said an 8% correction in August to load the boat for a big yearend rally. Heavens to Betsy and wholly moley, but that appears to be what we are getting.

It puts followers of my Trade Alert service in a particularly strong position. As of today, they are up 24% during 2014 in a market that is down -0.3%. Replay the year again, and that gets followers up 50% or more by the end of December.

Here is my own shopping list of what to buy when we hit the final bottom, which is probably only a few percent away:

Longs

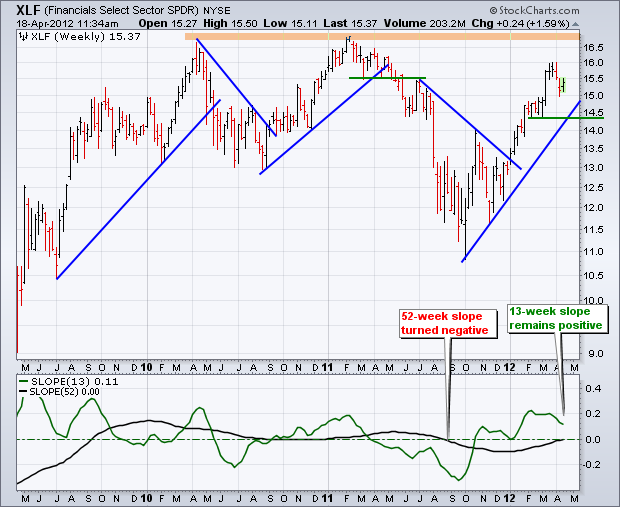

JP Morgan (JPM)

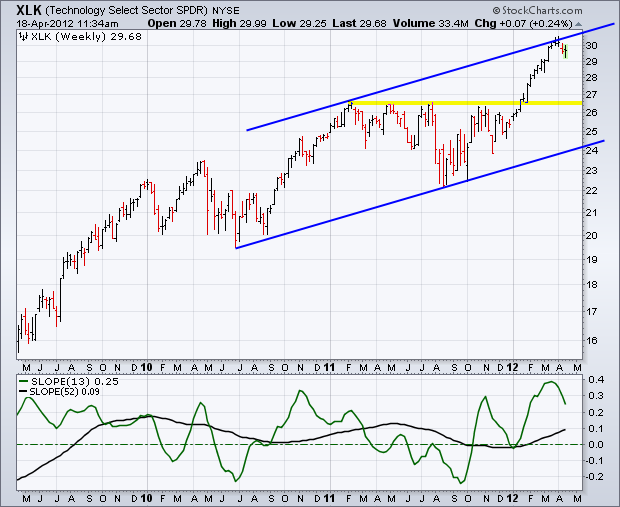

Apple (AAPL)

Google (GOOG)

General Motors (GM)

Freeport McMoRan (FCX)

Corn (CORN)

Russell 2000 (IWM)

S&P 500 (SPY)

Shorts

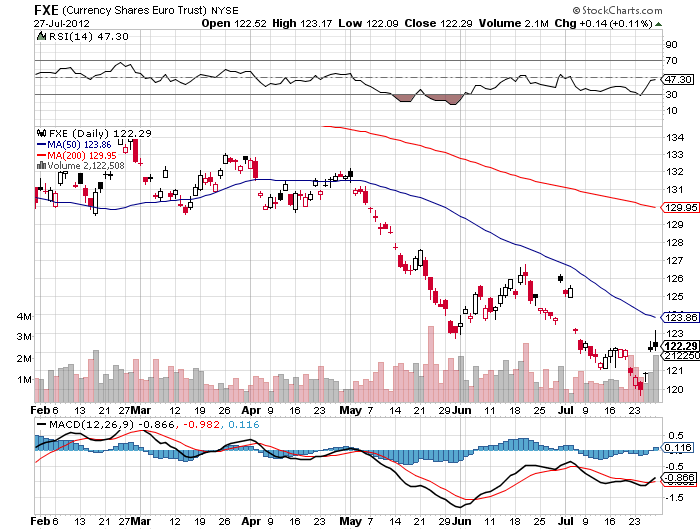

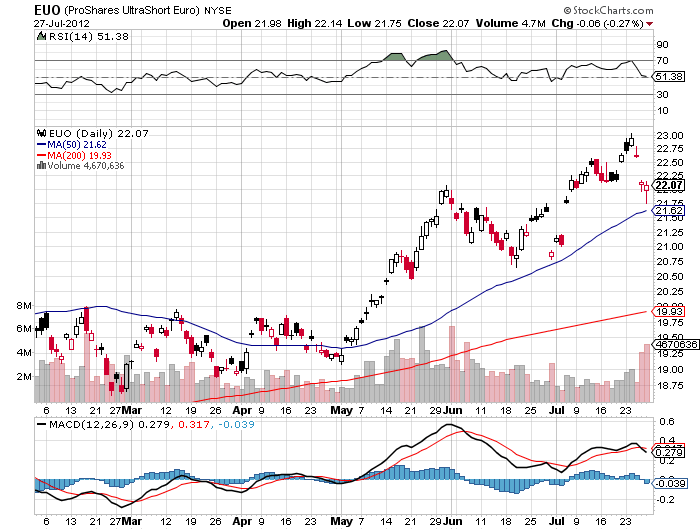

Euro (FXE), (EUO)

Yen (FXE), (YCS)