Global Market Comments

June 16, 2020

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

Global Market Comments

June 16, 2020

Fiat Lux

Featured Trade:

(THE IDIOT’S GUIDE TO INVESTING),

(TSLA), (BYND), (JPM)

(TESTIMONIAL)

Global Market Comments

June 1, 2020

Fiat Lux

Featured Trade:

(JOIN THE JUNE 4 TRADERS & INVESTORS SUMMIT),

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE COUNTRY THAT IS FALLING APART),

(SPX), (INDU), (TLT), (TBT), (GLD),

(AAPL), (FB), (JPM), (BAC)

Out of quarantine, into curfew.

Yes, we here at Incline Village, Nevada have received a “stay at home” order because we are in Washoe County, the same county as Reno, where police tear-gassed rioters assaulting a police station yesterday.

I now have the challenge of commuting between two cities that are curfewed, Oakland, CA and Incline Village, NV.

I wonder if this is turning into another 1968, but with a pandemic? That is when casualties peaked from the Vietnam War and there were national race riots and political assassinations.

I hope not.

I’m really getting into this pandemic thing. That’s because people tell me that I am better looking with a mask on. But then I’ve grown a long grey beard since I was locked up three months ago, so maybe less is better.

The great American talent for creativity, which I always knew was lurking under the surface, and exploded into the open.

High-end restaurants are now placing dressed up dummies at every other table to enforce social distancing rules. At one table, a man is on his knee proposing marriage to his girlfriend. At another, an older couple is arguing. Click here for a laugh.

An enterprising dad has captured 2 million YouTube views describing how to perform tasks only dads can do, like jump-starting a car and fixing toilets. If you need his help ask “Dad, How Do I” by clicking here.

Only in America.

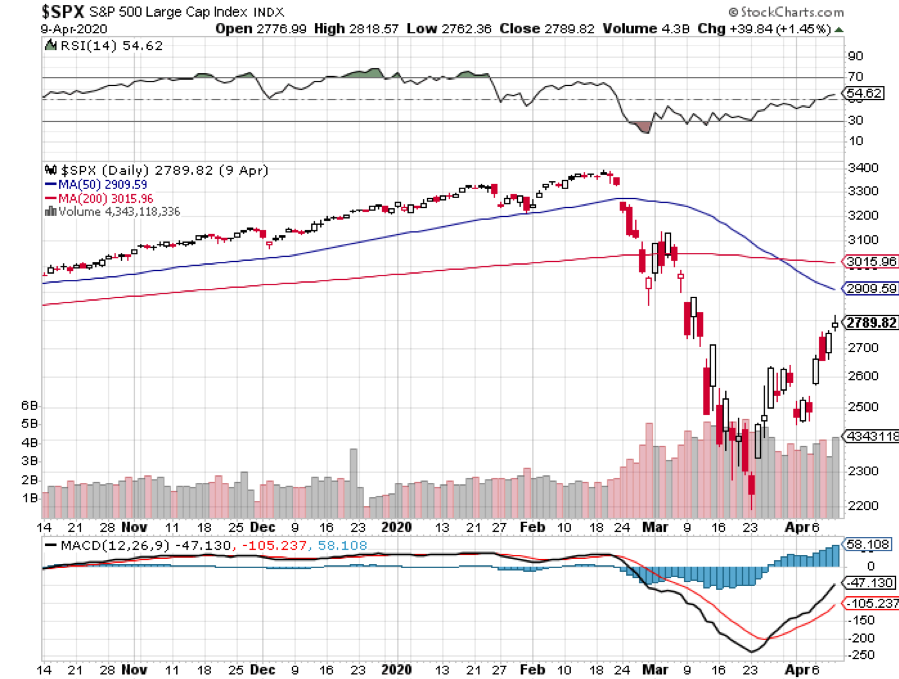

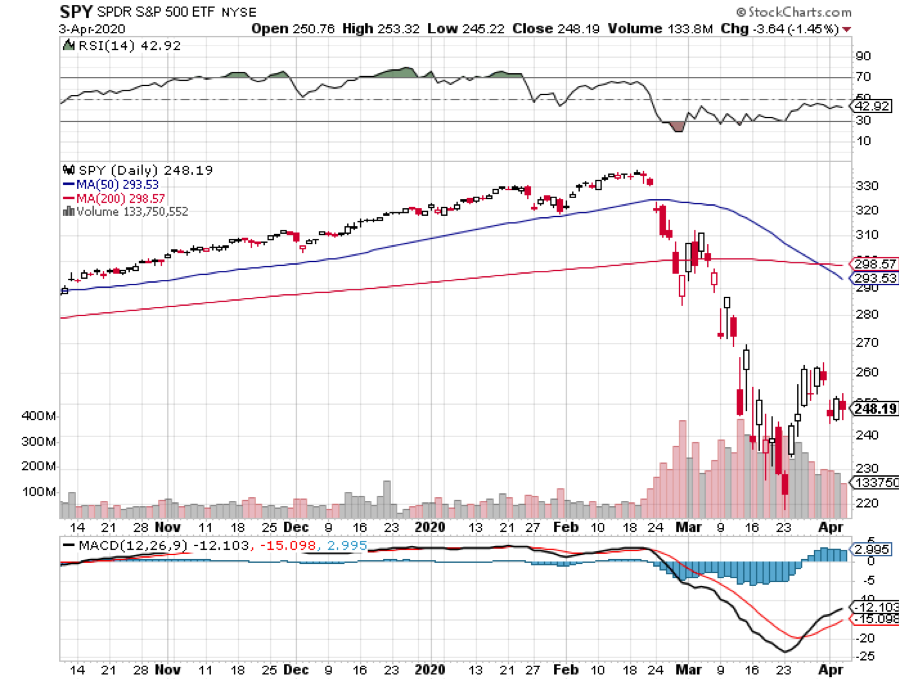

In the meantime, the stock market had one of the best weeks of the year in the face of the worst economic data in history. The (SPY) broke the 200-day moving average to the upside as the newly unemployed topped a staggering 41 million. Buyers rotated into recovery stocks as Covid-19 deaths exceeded 100,000.

All of the super smart traders I know who went into cash or strapped on short positions at the end of January are doing the same now. When markets detach from reality, I detach myself from risk. Almost all of my positions are now very low risk, have extremely small deltas, and expire in 14 trading days. The risk/reward for stocks now is terrible. The Mad Hedge Trade Alert Service delivered a stunning 27% profit off the March bottom.

By the way, in 1968 when the country was last falling apart, the Dow Average rose by 4.3% as part of one long 20-year sideways move. Brokers were forced to drive taxi cabs. I went to Tokyo for better fish to fry, and then Cambodia, Laos, and Burma. I came back 20 years later with an ample collection of lead stuck in various parts of my body.

Pending Home Sales fell down 21.8%, in April, and off 33.8% YOY on a signed contract basis. These are the worst numbers since the data series started. The West was hardest hit, down 50%. No wonder I’ve seen so many real estate agents at the beach. We already know that a sharp rebound is underway as Millennials move to the burbs and flee Corona-infested cities. Home prices will be up this year.

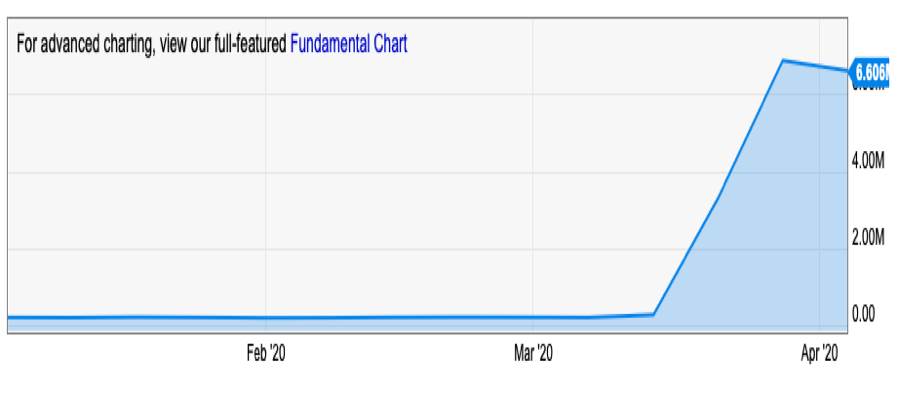

Easy In, Easy Out. The Fed pumped $3 trillion into the economy, and exactly $3 trillion has gone into stocks since the March bottom. There is a 90% correlation between stock prices and the direction of the Fed balance sheet. Stimulus checks went straight into day trading accounts as soaring online stock and option volumes show. In the meantime, Q2 GDP estimates have fallen to the -40%-50% range. What happens when the Fed stops buying? The M2 Money Supply (remember that?) is growing at an 80% annual rate. Buy gold (GLD).

Weekly Jobless Claims came in at 2.4 million, meaning that 41 million, or one out of four Americans out of work. That’s worse than seen during the Great Depression. Recent surveys show employers will hire back only 80% of those laid off, meaning that the Unemployment rate could stay above 10% for years. The future is being pulled forward fast and that means far fewer brick and mortar jobs. Only the large and the digital will survive.

The Market Has Flipped, from chasing big tech to chasing reopening stocks. It’s the only place where value is left. Out with (AAPL) and (FB) and in with (JPM) and (BAC). If it lasts, we’re going to new highs.

The China Trade War heats up, with 33 new companies banned from doing business with the US. You can cut global growth forecasts even more as international trade accelerates its decline. Where was Trump when tens of thousands demonstrated for democracy last fall? Wasn’t China’s President Xi Jinping his friend who did a great job controlling Covid-19?

Stocks are the most overbought in 20 years, since the top of the Dotcom bubble. Risk is extreme for new longs. Almost all S&P 500 stocks are trading above 50-day moving average.

Monster market short could force a short squeeze, with trend following commodity trading advisors boasting the biggest bearish bets in five years. The 200-day moving average at (SPX) $2,999.72 could be a real make or break, only 45 points away. The falling Volatility Index (VIX) is priming the pump for a downside collapse.

New Home Sales were up a stunning 0.6% in April versus an expected -21.9% loss, totaling 623,000 units on a signed contract basis only. The premium is now on new, clean, virus-free homes where you don’t die from a model home. Median home prices plunged from $339,000 to $309,000, down 8% YOY. It’s clear that a lot of speculative buying took place at the market bottom.

US Mortgage Applications up for 6th week, surging 54% since April. My forecast that your home will be your best performing asset of 2020 is coming true. I’m hearing stories of bidding wars again. It’s tough to beat a huge Millennial tailwind and record low-interest rates.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $0 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

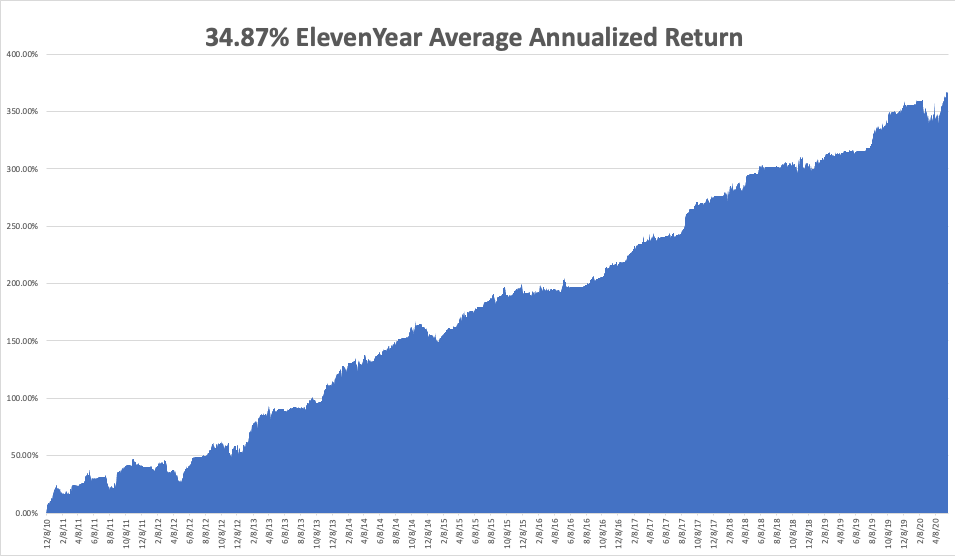

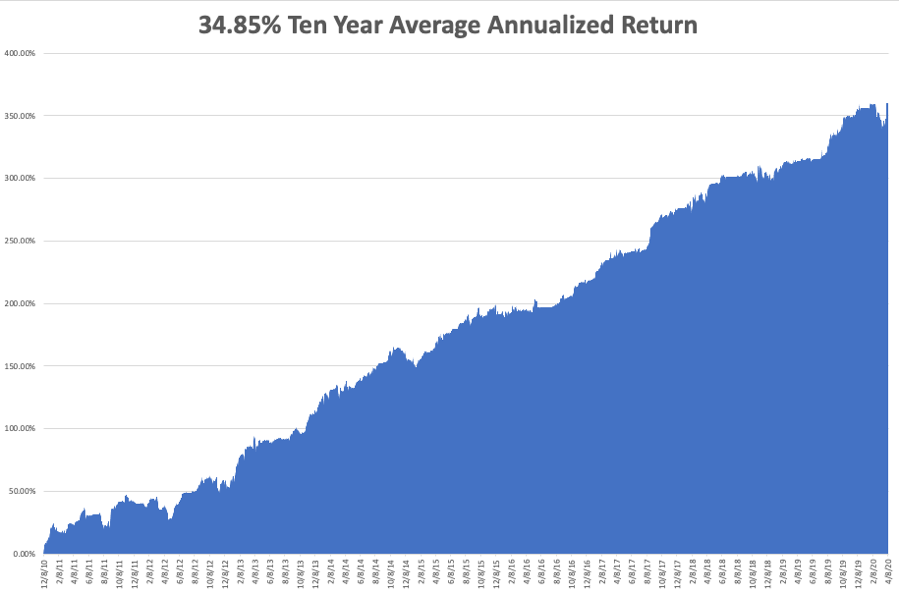

My Global Trading Dispatch performance was unchanged on the week, my downside hedges costing me money in a steadily rising, but wildly overbought market. We stand at an eleven year all-time high of 366.23%. It has been one of the most heroic performance comebacks of all time. We have gained an eye-popping 27.03% since the market bottom despite being hedged all the way up.

My aggressive short bond positions are still delivering some nice profits even though we only have 14 days to expiration, despite the fact the bond market went almost nowhere. That’s because time decay is really starting to kick in.

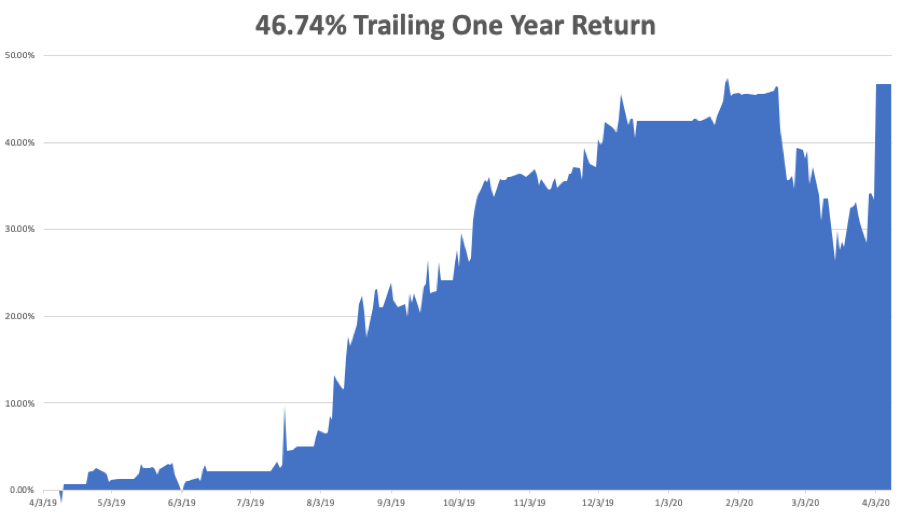

That takes my 2020 YTD return up to +10.32%. That compares to a loss for the Dow Average of -10.93%. My trailing one-year return exploded to 51.09%, nearly an all-time high. My eleven-year average annualized profit exploded to +34.87%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, June 1 at 10:00 AM EST, The US Manufacturing PMI for May is published.

On Tuesday, June 2 at 10:30 AM EST, weekly EIA Crude Oil Stocks are released.

On Wednesday, June 3, at 8:15 AM EST, The ADP Private Employment Report is announced.

On Thursday, June 4 at 8:30 AM EST, Weekly Jobless Claims are announced. I’ll be busy all day with the Mad Hedge Traders & Investors Summit.

On Friday, June 5, at 8:30 AM EST, the May Nonfarm Payroll Report is out. It may be the worst on record.

The Baker Hughes Rig Count follows at 2:00 PM EST.

As for me, my original plan this summer was to take a one-week cruise in Tahiti, lead an expedition to excavate more dog tags from Marines missing in action on Guadalcanal, perform a one-week roadshow for clients in New Zealand and Australia, Fly to South Africa for a one-week safari with my kids, and then cool my heels climbing the Matterhorn and thinking great thoughts at my summer home in Zermatt, Switzerland.

This will be the first time in eight years I have not climbed the great mountain. Don’t worry, I have already emailed the Zermatt Mountain Rescue Service and told them I won’t be able to help out this year because the town is closed.

Covid-19 had other ideas.

Instead, I will be commuting back and forth between San Francisco and Lake Tahoe by Tesla Model X, writing four newsletters a day, issuing uncountable trade alerts, and then taking a daily ten-mile hike to the Tahoe Rim Trail with a 40-pound backpack. Safer and much cheaper.

There’s no rest for the wicked. There’s always next year.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

With the May 15 options expiration only ten trading days away, there is a heightened probability that your short options position gets called away.

We have the good fortune of having a large number of deep in-the-money call and put options spreads about to expire at their maximum profit points, five to be precise.

If that happens, there is only one thing to do: fall down on your knees and thank your lucky stars. You have just made the maximum possible profit for your position with less risk. You just won the lottery, literally.

Most of you have short option positions, although you may not realize it. For when you buy an in-the-money put option spread, it contains two elements: a long put and a short put. The long put you own, but the short put can get assigned, or called away at any time and delivered to its rightful owner.

You have to be careful here because the inexperienced can blow their newfound windfall if they take the wrong action, so here’s how to handle it.

All you have to do was call your broker and instruct him to exercise your long position in your May puts to close out your short position in the May puts.

Puts are a right to sell shares at a fixed price before a fixed date, and one option contract is exercisable into 100 shares.

Sounds like a good trade to me.

Weird stuff like this happens in the run-up to options expirations.

A put owner may need to sell a long stock position right at the close, and exercising his long Put is the only way to execute it.

Ordinary shares may not be available in the market, or maybe a limit order didn’t get done by the stock market close.

There are thousands of algorithms out there which may arrive at some twisted logic that the puts need to be exercised.

Many require a rebalancing of hedges at the close every day which can be achieved through option exercises.

And yes, puts even get exercised by accident. There are still a few humans left in this market to blow it.

And here’s another possible outcome in this process.

Your broker will call you to notify you of an option called away, and then give you the wrong advice on what to do about it.

This generates tons of commissions for the broker but is a terrible thing for the trader to do from a risk point of view, such as generating a loss by the time everything is closed and netted out.

Avarice could have been an explanation here but I think stupidity and poor training and low wages are much more likely.

Brokers have so many ways to steal money legally that they don’t need to resort to the illegal kind.

This exercise process is now fully automated at most brokers but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

Some may also send you a link to a video of what to do about all this.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long and exercises become second nature, just another cost of doing business.

If you do this long enough, eventually you get hit. I bet you don’t.

Global Market Comments

April 14, 2020

Fiat Lux

Featured Trade:

(APRIL 8 BIWEEKLY STRATEGY WEBINAR Q&A),

(INDU), (SPY), (SDS), (BA), (VIX), (VXX), (GLD), (GDX),

(GOLD), (NEM), (QCOM), (HYG), (JNK)

(WHY SENIORS NEVER CHANGE THEIR PASSWORDS)

Global Market Comments

April 13, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD,

or THE BEAR MARKET RALLY IS OVER),

(INDU), (SPX), (TLT), (VIX, (VXX), (GLD), (JPM), (AMZN), (MSFT)

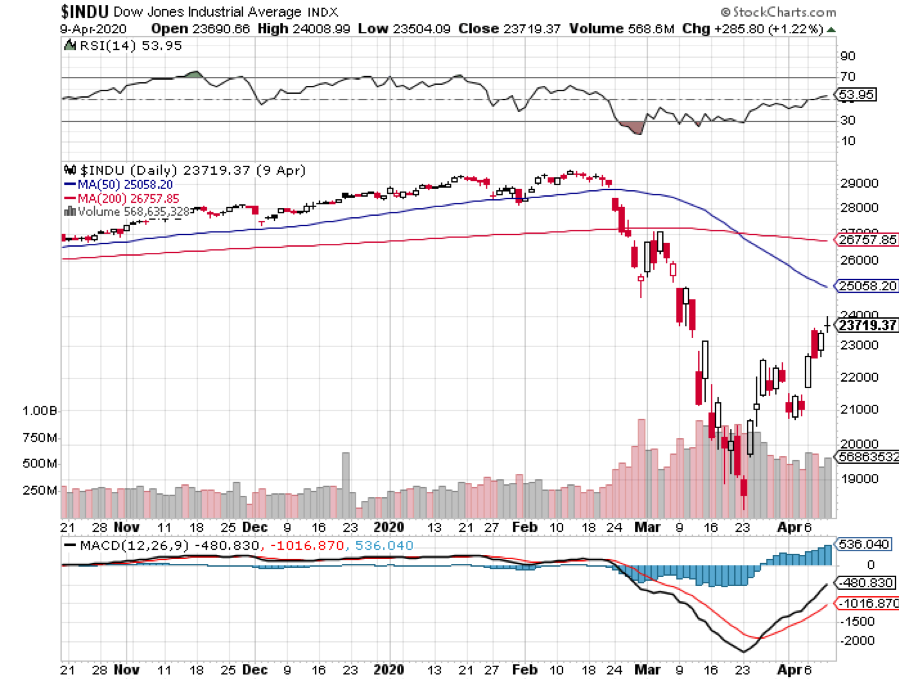

The Bear market rally is over, or at least that’s what Asian stock futures are screaming at us, and the shorts are piling back on….again.

For the first time in 16 years, I did not have to get up at 6:00 AM to hide Easter eggs. It’s not because my kids don’t believe in the Easter Bunny anymore. They’ll believe in anything that delivers them a free chocolate bunny. It’s because I couldn’t get any eggs. Much of the country’s egg production is being diverted into vaccine production for testing, of which, along with antivirals, there are more than 300 worldwide.

Enough of the happy talk.

It was a classic bear market rally we saw over the past two weeks in every way, retracing 50% of the loss this year. Junk stocks, like hotels, airlines, and cruise lines led, while quality big tech lagged. That’s the exact opposite of what you want to see for a new bull market.

At the Friday high, the Dow (IND) was down only 17% from the February all-time high at a two-decade 20X valuation high.

The US is now losing 2,000 citizens a day to the Coronavirus. That’s how many we lost at the peak of the Vietnam War in a month. We are suffering another 9/11 every day of the week.

More than 16.8 million have lost jobs in three weeks, more than all those gained in six years. Of all American companies with fewer than 500 employees, 54% have closed! JP Morgan (JPM) has just cut its forecast for Q2 GDP from a 25% loss to an end of world 40% decline on an annualized bases.

New York is losing 800 people a day and is burying many of them in mass graves. Bread lines have formed in countless major cities. And you think 17% is enough for a discount for stocks, given that a near-total shutdown will continue for another five weeks?

Are you out of your freaking mind?

Which leads me to believe that another retest in the lows is in the work, no matter how much government money is headed our way.

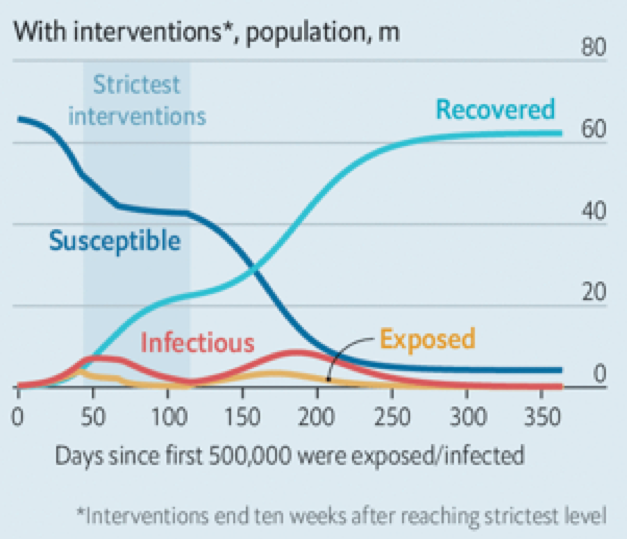

For a start, it will be three months before the Fed handouts show any meaningful impact on the economy. Second, we are due for a second wave of the virus in the fall, once the initial shelter-in-place ends. Markets will likely behave the same.

In the meantime, long term analysts of the global economic structure are going dizzy with possible permanent changes. I am in the process of writing a couple of pieces on this if I can only get away from the market long enough to do so.

It seems like half the country has lost their jobs, while the other half are now working double time without pay, like myself.

The market was stunned by 6.1 million in Weekly Jobless Claims, taking the implied Unemployment Rate to over 14%, more than seen during the 2008-2009 Great Recession. One out of four Americans will lose their jobs or suffer a serious pay cut in the next two months. At this rate, we will top the Great Depression peak of 25 million in two weeks.

The Fed launched a second $2.3 trillion rescue program, this time lending to states, local municipalities, and buying oil industry junk bonds. More money was made available to small businesses. Jay Powell is redefining what it means to be a central bank, but no one is complaining. It was worth one 500-point rally in the Dow Average, which we have already given back. At this point, almost the entire country is living on welfare.

Stocks soared firefly on falling death rates. Chinese cases are falling after the border closed, Italy and Madrid are going flat, and San Francisco is looking good. There is still a massive, but extremely nervous bid under the market. I’m selling into this rally. We will continue to chop in a (SPX) $2180-$2800 range for the foreseeable future.

Trump says there’s a light at the end of the tunnel, but he doesn’t tell you that the light is an oncoming express train. At the very least, the number of deaths will rise at least tenfold from here. That’s how many we lost in the Korean War. It hasn’t even hit the unsheltered states in the Midwest yet.

Gold (GLD) is making a run another all-time highs, topping $1,700. Expect everyone’s favorite hedge to go ballistic. QE infinity and zero interest rates will eventually bring hyperinflation and render the US dollar worthless. Gold production is falling due to the virus. Anything else you need to know?

Mortgage defaults are up 18-fold. People can’t even get through to their banks to tell them they are not going to pay. This is the next financial crisis. Fannie Mae and Freddie Mac are going to go broke….again.

Can the US government spend money fast enough, given that it has been shrinking for three years? I’m not getting my check until September. It’s not easy to spend $2 trillion in a hurry. I can’t even spend a billion in a hurry. It’s darn hard and I’ve tried. It suggests any recovery will be slower and lasts longer.

Here’s the bearish view on the economy, with Barclay’s Bank looking for an “L” shaped recovery, which means no recovery at all. I’m looking more for a square root type recovery, which means a sharp bounce back to a lower rate of growth. And there may be two “square roots” back to back.

Bond giant PIMCO predicts 30% GDP loss in Q2 on an annualized basis. Everyone staying home doing jigsaw puzzles isn’t doing much for our economic growth. This may end up becoming the most positive forecast out there.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $20 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance had a tough week, destroying my performance back to positive numbers for the year. That is thanks to my piling on the shorts in a steadily rising market. This brings short term pain, but medium-term ecstasy.

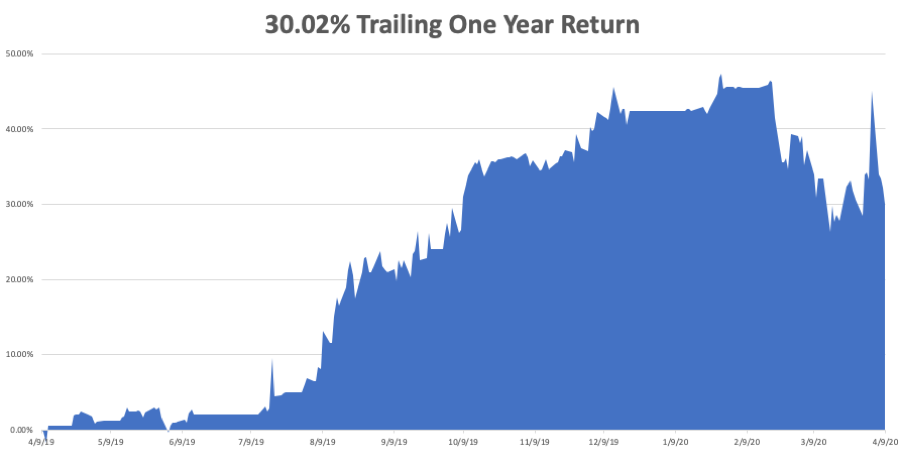

We are now down -3.99% in April, taking my 2020 YTD return down to -12.41%. That compares to an incredible loss for the Dow Average of -17% from the February top. My trailing one-year return sank to 30.02%. My ten-year average annualized profit was pared back to +33.51%.

My short volatility positions (VXX) were hammered even in a rising market, which means no one believes the rally, including me.

I took nice profits on two very deep in-the-money, very short dated call spreads in Amazon (AMZN) and Microsoft (MSFT), the two safest companies in the entire market, betting that we don’t go to new lows in the next nine trading days. As the market rose, I continued to add to my short position with the 2X ProShares Ultra Short S&P 500 (SDS).

This week, we get the first look at Q1 earnings. All economic data points will be out of date and utterly meaningless this week. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, April 13 Citigroup (C) and JP Morgan (JPM) report earnings.

On Tuesday, April 14 at 11:30 AM, the API Crude Oil Stocks are announced.

On Wednesday, April 15, at 2:00 PM, the New York State Manufacturing Index is released.

On Thursday, April 16 at 8:30 AM, Weekly Jobless Claims are announced. The number could top 6,000,000 again. At 7:30 AM, US Housing Starts for March are published.

On Friday, April 17 at 7:30 AM, the Baker Hughes Rig Count is released at 2:00 PM. Expect these figures to crash as well.

As for me, before the market carnage of the coming week ensues, I shall be sitting down with my kids and touring the National Gallery of Art in Washington DC. Many art museums have now opened up their collections online, for free. There is a special exhibition of “Degas at the Opera.” Please enjoy by clicking here.

Next to come will be the Louvre in Paris (click here), and the National Museum of the Marine Corps in Triangle, VA (click here). I have them tracing the dog tags I brought back from Guadalcanal. I bet some of my old weapons are in there.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

April 6, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MAD HEDGE GOES POSITIVE ON THE YEAR)

(INDU), (SPY), (VIX), (VXX), (AMZN), (MSFT), (BAC), (JPM)

There is no doubt that the Corona pandemic will be the WWII challenge of our generation. Since we are Americans, we will rise to the task. We all have our jobs to do, being it working as a front-line medical professional, or simply staying at home.

We will get through this.

I was standing in front of a Reno gun store yesterday waiting my turn to enter. Under Nevada’s strict shelter-in-place rules, only one person is allowed to enter a store at a time. I needed some ammo and black powder for my 1860 Army Colt revolver, which is hard to find in California.

I struck up a casual conversion about the pandemic with other waiting customers on a clear, brisk Nevada morning. A blue-collar worker with an AR-15 said he really wasn’t paying attention to it. A latino gang member with a heavily tattooed neck and fingers looking for a box of 9mm Glock shells confessed he hadn’t heard about it. A white nationalist with a heavily militarized SUV argued that the whole thing was a left-wing conspiracy meant to discredit Donald Trump.

Which can only mean one thing.

The worst days of the of the pandemic are ahead of us, as are the consequences for the stock market. Remember, 40% of the country don’t read newspapers or watch the news and are only barely aware of the seriousness of the disease.

The White House us currently forecasting 12 million cases and 250,000 deaths. That’s just an optimistic guess. Only one third of the country started their shutdowns early, one third were late, and the last third not at all. This means that the highest death rates will be in southern and midwestern states that are following the presidents advance and dismissing the pandemic out of hand, refusing to wear face masks.

So, we are really looking at a potential US 120 million cases and 2.4 million deaths. On that scale the food distribution system will start to break down for shear lack of workers. No one really knows how effective shelter-in-place will be, although the early data is encouraging. We are all living in one giant experimental petri dish right now.

And we will be the lucky country. Deaths in the Southern Hemisphere, which is just going into the winter, will be much higher.

Anytime I consider adding a long position, I first ask myself how it will stand up against a picture on the front page of the New York Times showing a pile of a thousand bodies outside a local hospital. I saw that sort of thing in Asia a half century ago. Markets will crash.

The game we are now in for the coming weeks is to trade an $18,000 to $22,000 range in the Dow Average. The sharp selloff in the Volatility Index (VIX) last week, which we caught with both hands, suggests that the next retest of the $18,000 low will be successful.

Further down the road, I’m not so sure. Any prediction beyond tomorrow in this environment is dubious at best. The world is moving on fast-forward now and the unbelievable is happening every day.

But here’s a shot. If the $18,000 to $22,000 range doesn’t hold, then we are moving to a $15,000 to $18,000 range. If that fails, then we are looking at $12,000 to $15,000 range. Then we will be looking at Great Depression levels of stock market sell-off, with a total corporate capitalization loss of an eye-popping $17 trillion.

The great challenge here is to buy your best stocks and LEAPs as low as possible before an unprecedented $6 trillion in federal stimulus that is coming our way. There will be the $2 trillion in jobs and corporate bailout money already passed, a $2 trillion infrastructure bill coming, and a second jobs and bailout bill that will be needed. On top of that, the Federal Reserve has committed to $8 trillion backstopping of the financial.

And here is the problem. Trump has spent the last three years shrinking the government. The pandemic is a very large government event. So, the Feds may simply not have enough bodies in place to spend, or to lend, all the money that has already been authorized.

That is your economic and market risk.

There is no doubt that the next month will be grim. The U-6 Unemployment Rate published on Friday was 8.9%, indicating the total number of jobless is already at 14.4 million. If the Fed is right and we soon hit 32%, total joblessness will soar to 52 million. During the Great Depression, that unemployment rate peaked at only 25%, throwing 20 million out of work. We could exceed those levels in the coming week!

Dr. Fauci predicts 200,000 US deaths. I think that’s a low number, given that 100 million Americans are still not sheltering-in-place. Corona is starting to take its toll on Wall Street, claiming the life of the Jeffries CFO, Peg Broadbent. Every state and city should prepare for a New York-style spike in cases.

The Fed is expecting 47 million unlucky individuals to lose jobs. This week, Macy’s (M) chopped 150,000, while Tillman Fertitta laid off 40,000 restaurant workers in place like Morton’s Steakhouse and the Bubba Gump Shrimp Company. Many more are to come. Weekly Jobless Claims have already exploded to 6.64 Million. That is three full recessions worth of job losses in two weeks.

The March Nonfarm Payroll Report was a disaster. Here is another number to put in your record book of awful numbers, the report showing 701,000 job losses in March. It’s the first negative number since 2010. Leisure & Hospitality fell by a staggering 459,000.

A second Corona wave might arrive in the fall, warns JP Morgan (JPM). We may not have visited the Volatility Index at $80 for the last time. I’m setting up more (VXX) shorts if we do revisit there. Sell all substantial stock market rallies.

It’s worse than you think. Brace yourself. Bank of America (BAC) has come out with the first GDP forecast I’ve seen that factors in a second wave of Coronavirus cases in the fall. It is not a pretty picture. They see every quarter of 2020 as coming in negative. These easily takes US GDP back to levels not seen since the Obama administration. The only consolation is that (BAC) has never been that great at forecasting the economy, basically leaving it to a bunch of kids. Here they are:

2020 Q1 -7%

2020 Q2 -30%

2020 Q3 -1%

2020 Q4 -30%

Oil rich countries will have to dump $225 billion in stocks, thanks to the collapse of oil to a once impossible $20 a barrel. An 80% plunge in national revenues is forcing asset sales at fire sale prices to avoid a brewing revolutions. They don’t retire former heads of states to golf clubs in the Middle East, they stand them up in front of a firing squads.

Oil Hit an 18-year low at $19.30 a barrel and it could get a lot worse. All of the world’s storage is full, so producers might have to PAY wholesalers to take Texas tea off their hands. Yes, negative oil prices are possible. Otherwise, producing wells will be permanently damaged with a total shutdown. Most of the industry has a negative net worth, save the majors. I told you to stay away!

China PMIs turn positive, coming in at 52 versus an expected 45 indicating a recovering economy. Watch the Middle Kingdom’s economic data more than usual. US PMIs are still in free fall. However, consumers still are staying at home. Their economy went first into the pandemic and will be the first out. There’s hope for us all the quarantine is working.

A $2 trillion infrastructure budget is in the works, and the Democrats will support it because the money won’t be spent until they get control of government in 2021. With most of the construction industry closed, the government’s cumbersome bidding process can’t even start until the summer.

You wonder how that last $2 trillion rescue package got done in five days? This will take us to Great Depression levels of bailout spending. The Fed balance sheet has exploded from $3.5 trillion to $5 trillion in weeks. I know 10,000 bridges that need to be fixed.

When we come out the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates at zero, oil at $20 a barrel, and many stocks down by three quarters, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

My Global Trading Dispatch performance had a spectacular week, blasting my performance back to positive numbers for the year. That is thanks to the ten-point collapse in the Volatility Index (VIX) on Thursday and Friday, which had a hugely positive effect on all our positions.

We are now up an amazing +11.02% for the first three days of April, taking my 2020 YTD return up to +2.60%. We are a mere 68 basis points short of an all-time high. That compares to an incredible loss for the Dow Average of -28.8%, with more to go. My trailing one-year return was recovered to 46.74%. My ten-year average annualized profit recovered to +34.85%.

My short volatility positions (VXX) are almost back to cost. I used every rally in the Dow Average to increase my short positions in the (SPY) to almost obscene levels. Now we have time decay working big time in our favor. These will all come good well before their ten-month expiration.

I bought two very deep in-the-money, very short-dated call spreads in Amazon (AMZN) and Microsoft (MSFT), the two safest companies in the entire market, betting that we don’t go to new lows in the next nine trading days.

At the slightest sign of a break in the pandemic, the economy and shares should come roaring back. Right now, I have a 30% cash position.

All economic data points will be out of date and utterly meaningless this week. The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here at https://coronavirus.jhu.edu

On Monday, April 6 at 6:00 AM, the Consumer Inflation Expectations for March are out.

On Tuesday, April 7 at 9:00 AM, the US JOLTS Job Openings Report is published.

On Wednesday, April 8, at 2:00 PM, the Fed Minutes for the previous meeting six weeks ago are released.

On Thursday, April 9 at 8:30 AM, Weekly Jobless Claims are announced. The number could top 3,000,000 again.

On Friday, April 10 at 7:30 AM, the US Core Inflation is released. The Baker Hughes Rig Count follows at 2:00 PM. Expect these figures to crash as well.

As for me, I have temporarily moved back to Oakland to retrieve my printer. As I left, my Tahoe neighbors told me I was nuts to go back to a big city. I then drove across an almost totally vacated Golden State, emptied by a pandemic.

With my free time, I have planted a victory garden. I managed to obtain tomatoes, eggplants, chili peppers, strawberries, lettuce, and bell peppers from the nearest Home Depot (HD) garden center. In two weeks, I should have something new to eat.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 13, 2020

Fiat Lux

Featured Trade:

(MARCH 11 BIWEEKLY STRATEGY WEBINAR Q&A),

(INDU), (SPX), (LVMH), (CCL), (WYNN), (AXP), (JPM), (MSFT), (AAPL), (NVDA)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.