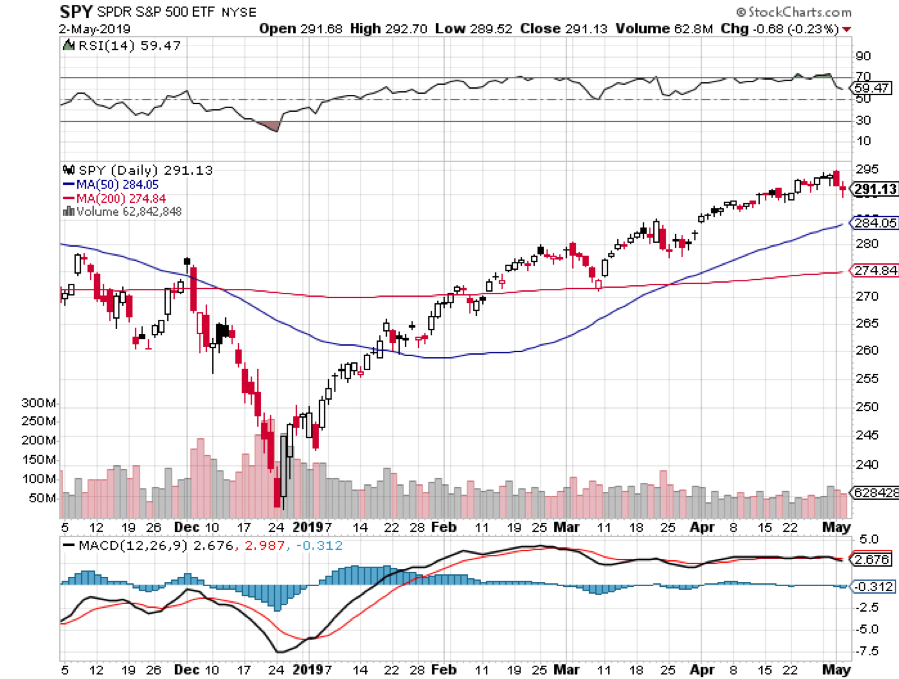

I was all ready to write this week that massive monetary stimulus created by the Federal Reserve will cause the stock market to continue its slow-motion melt up.

The president had other ideas.

As of this writing, the US will impose without warning a surprise 25% increase in tariffs on $200 billion worth of Chinese imports, effective Friday, or in four days.

Clearly, the trade negotiations are not going as well as advertised by the administration. My bet is that the stock market won’t like this. All I can say is that I’m glad I’m 90% in cash and 10% in a Walt Disney vertical bull call spread that expires in nine trading days.

The bigger and unanswerable question is whether this is just a negotiating strategy already well known by the Bronx Housing Authority that sets up a nice dip to buy? Or is it this the beginning of a long overdue summer correction?

Nobody knows.

Certainly, the rally was getting long in the tooth, rising almost every day in 2019, with NASDAQ reaching new all-time highs. Those who kept their big-cap technology stock through the sturm und drang of the December meltdown have been rewarded handsomely. Index players reigned supreme.

However, we live in unprecedented times. Never before has a stock market received this much artificial stimulus at an all-time high unless you hark back to the Tokyo 1989 top. Japanese shares are now trading at 43% lower than that high….30 years later. We all know that our own decade-old bull market will eventually end in tears, but will it be in days, weeks, months, or years?

I had plenty of great wisdom, wonderful sector selections, colorful witticisms, and killer stock picks to serve up to you this week, but they have all be outrun by events. There’s nothing to do now but wait and see how the market responds to this tariff bombshell at the Monday morning opening.

After three months of decidedly mixed data, the information flow on the economy suddenly swung decidedly to the positive. The jobs data could have been more positive.

Of course, the April Nonfarm Payroll Report was a sight to behold. It came in at 263,000, about 80,000 more than expected, and more than makes up for last month’s dismal showing. It was a bull’s dream come true. This is what overheating looks like fueled by massive borrowing. Play now, pay later.

The headline Unemployment Rate fell a hefty 0.2% to 3.6%, the most since 1969 when the Vietnam War was raging, and the economy was booming. I remember then that Levi Strauss (LEVI) was suffering from a denim shortage then because so much was being sent to Southeast Asia to use as waterproof tarps. Wages rose 3.2% YOY.

Professional and Business Services led at a massive 76,000 jobs, Construction by 33,000 jobs, and Health Care by 27,000 jobs. Retail lost 12,000 jobs.

The ADP came in at a hot 275,000 as the private hiring binge continues. Then the April Nonfarm Payroll Report blew it away at 263,000. The headline unemployment rate plunged to a new 49-year low at 3.6%.

Consumer Spending hit a decade high, up 0.9% in March while inflation barely moved. Is Goldilocks about to become a senior citizen?

Apple (AAPL) blew it away with a major earnings upside surprise. The services play is finally feeding into profits. Stock buybacks were bumped up from $100 billion to $150 billion. Don’t touch (AAPL) up here with the stock just short of an all-time high. How high will the shares be when Apple’s revenue split between hardware and software revenues is 50/50?

Pending Home Sales jumped 3.8% on a signed contract basis. No doubt the market is responding to the biggest drop on mortgage rates in a decade. At one point, the 30-year fixed rate loan fell as low as 4.03%. Avoid housing for now, it’s still in a recession.

Topping it all off, the Fed made no move on interest rates. Like this was going to be a surprise? This may be the mantra for the rest of 2019. The big revelation that the Fed will start ending quantitative tightening now and not wait until September, as indicated earlier. More rocket fuel for the stock market. Let the bubble continue.

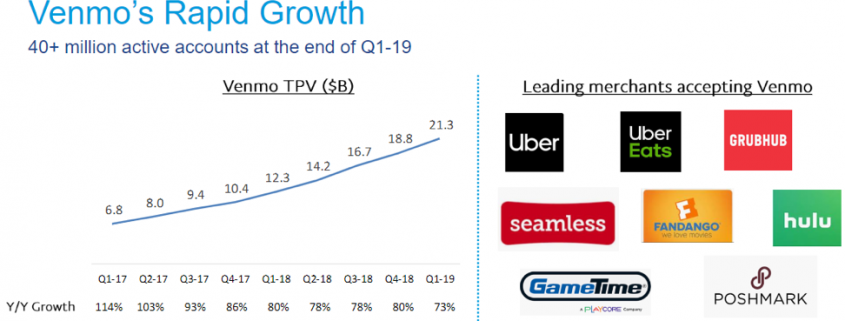

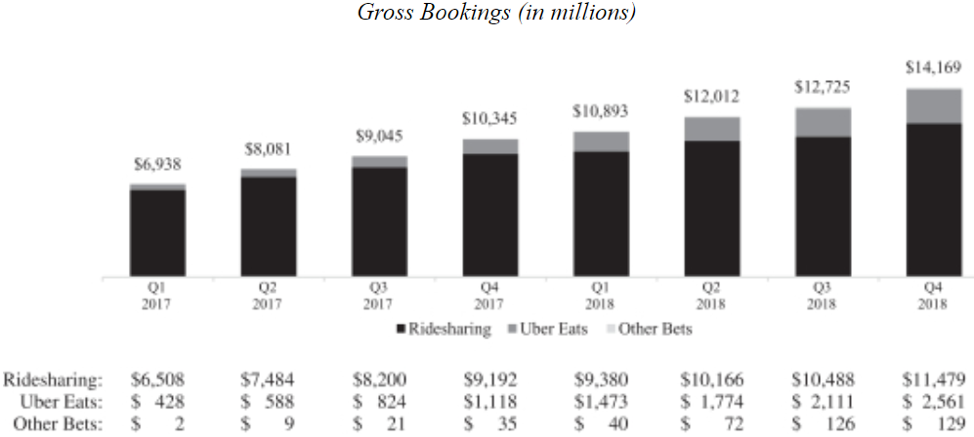

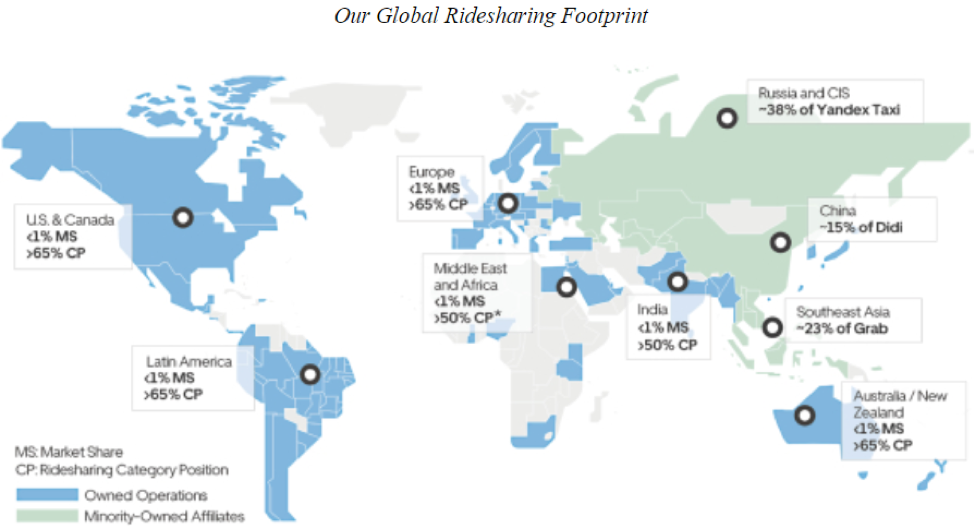

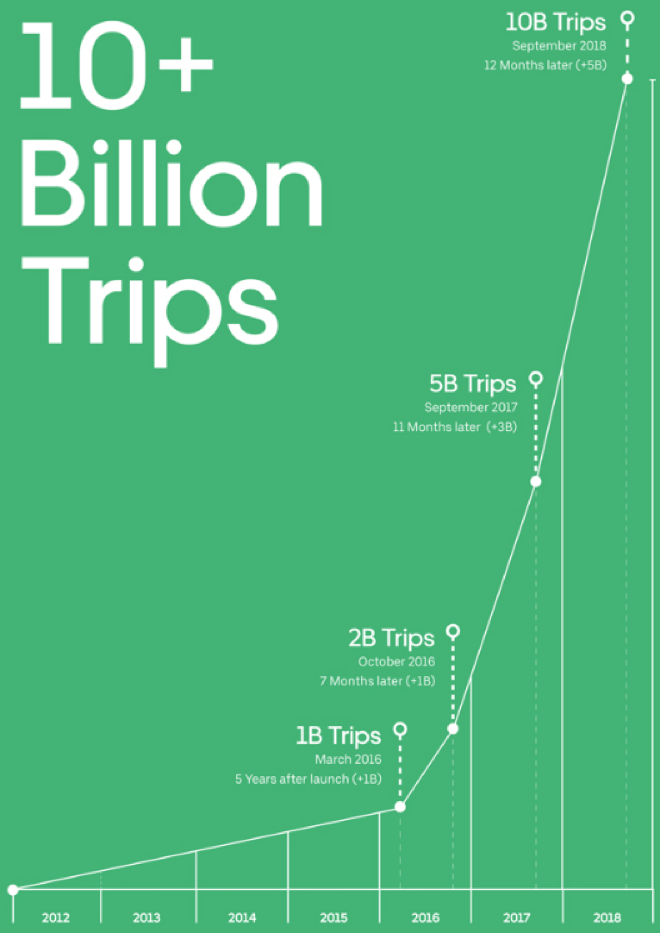

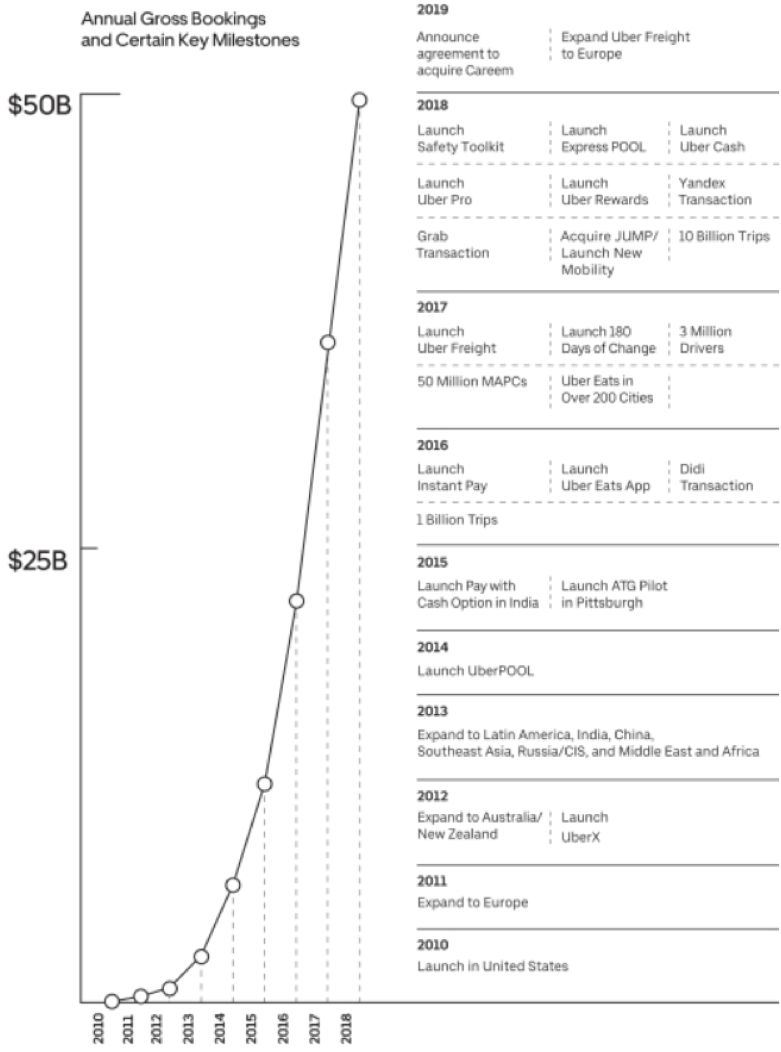

Uber (UBER) hit the Road for its IPO with valuations being cut daily, from a high of $120 billion to a recent low of $90 billion. The issue goes public on Friday morning. Rival Lyft (LYFT) definitely peed on their parade with their ill-fated IPO plunging 33%.

It wasn’t all Champaign and roses. San Francisco home prices fell for the first time in seven years. The median price is now only $830,000, down 0.1% YOY. Back up the truck! Clearly a victim of the Trump tax bill, this market won’t recover until deductions for taxes are restored. That may take place in two years….or never!

The Mad Hedge Fund Trader suffered a modest setback with the sudden collapse of copper prices last week, thus giving up all its profit in Freeport McMoRan (FCX). Global Trading Dispatch closed the week up 14.48% year to date and is down -1.48% so far in May. My trailing one-year retreated to +18.85%.

Reflecting the huge sector divergence in the market, the Mad Hedge Technology Letter leaped to another new all-time high on the back of two new very short-term positions in Intuit (INTU) and Google (GOOG), which we picked up after the earnings debacle there. Some 11 out of 13 Mad Hedge Technology Letter round trips have been profitable this year.

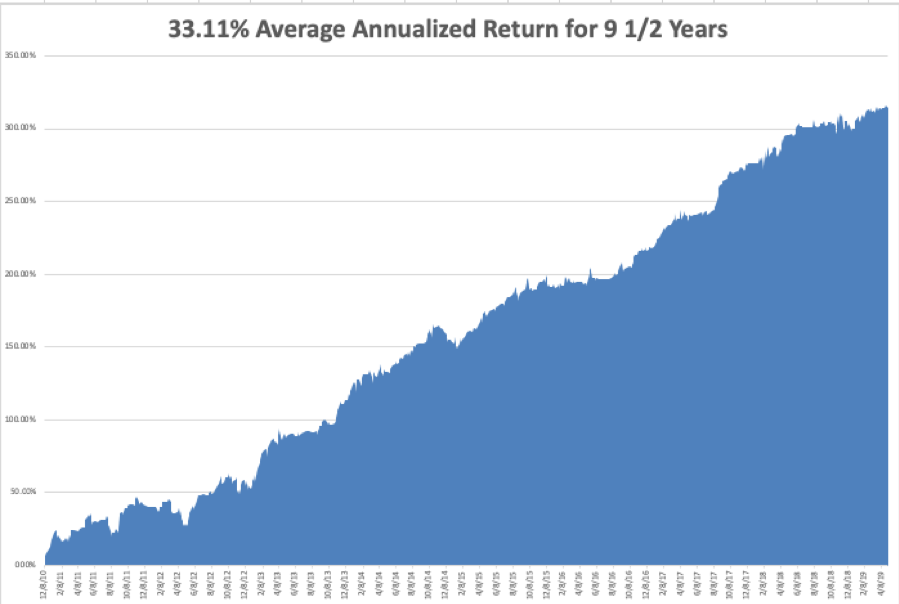

My nine and a half year profit shrank to +314.62%. The average annualized return backed off to +33.11%. With the markets at all-time highs and my Mad Hedge Market Timing Index forming a 2 ½ month high, I am now 90% in cash with Global Trading Dispatch and 80% cash in the Mad Hedge Tech Letter.

The coming week will be pretty boring after last week’s excitement, at least on the hard data front.

On Monday, May 6, Occidental Petroleum (OXY), now engaged in a ferocious takeover battle for Anadarko, reports. So does (AIG).

On Tuesday, May 7, 3:00 PM EST, we obtain March Consumer Credit. (LYFT), one of the worst performing IPOs this year, gives its first ever earnings report.

On Wednesday, May 8 at 2:00 PM, we get the most important earnings report of the week with Walt Disney (DIS), along with (ROKU).

On Thursday, May 9 at 8:30 the Weekly Jobless Claims are produced. At the same time, we get the March Producer Price Index. Dropbox (DBX) reports.

On Friday, May 10 at 8:30 AM, we get the Consumer Price Index. The Baker-Hughes Rig Count follows at 1:00 PM. (UBER)’s IPO will be priced at the opening. Viacom (VIA) Reports.

As for me, I’ll be watching the Kentucky Derby on Saturday. The field is wide open, now that the favorite, Omaha Beach, has been scratched.

As I will be attending the Las Vegas SALT conference during the coming week, the Woodstock of hedge fund managers, I will take the opportunity to rerun some of my oldies but goodies. We also have recently enjoyed a large number of new subscribers so I will be publishing several basic training pieces.

Maybe it was something I said?

For more on the SALT conference, please click here (you must be logged in to your account to access this piece).

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader