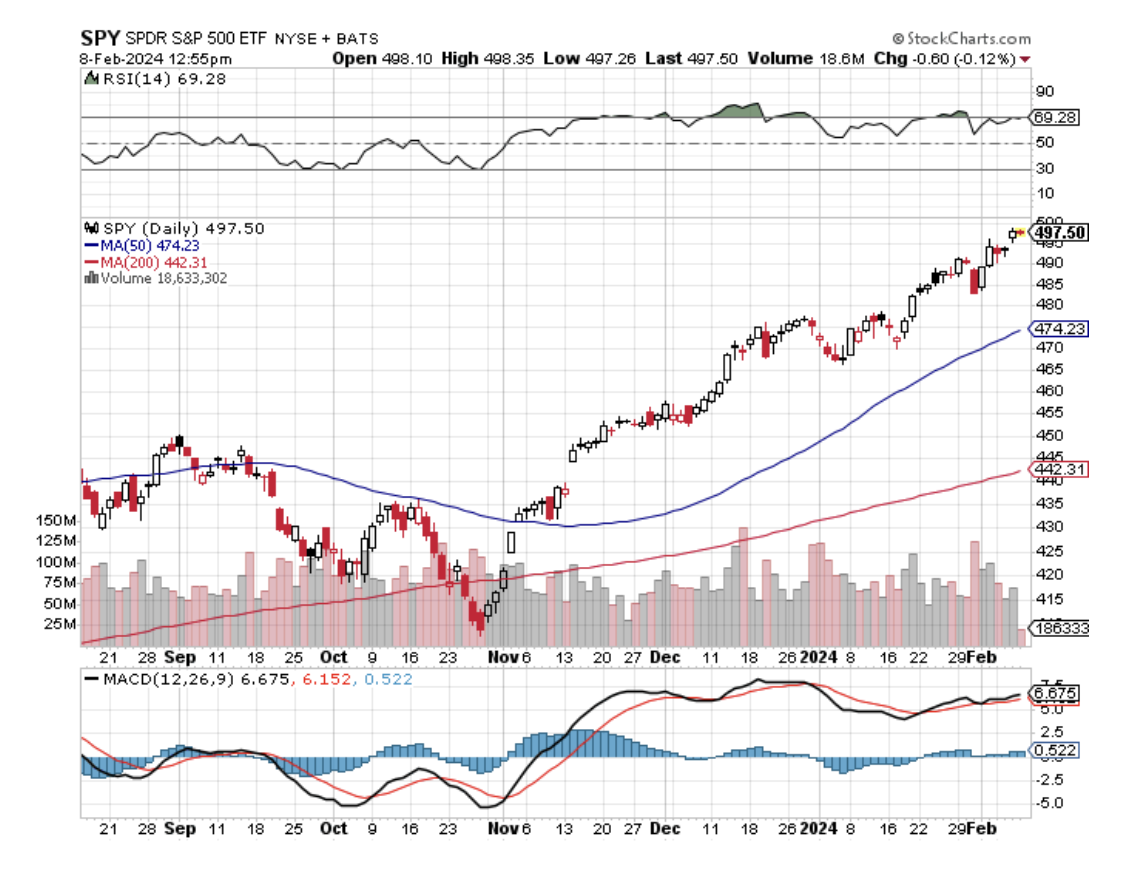

When I announced my year-end target for the S&P 500 on the first of January, I knew it was cautious. That provided for only a 15% gain for 2024. Yet here we are a mere six weeks into the New Year, and we only have 10.4% to go.

That is with the six lead stocks, which account for 30% of the entire stock market capitalization, seeing earnings grow up to 300% annually. With that kind of growth, even $6,000 is looking overly conservative, even allowing for no multiple expansion whatsoever.

The top six stocks are over 11% YTD, while half of all S&P 500 stocks are down. A few friends of mine who are still alive and have been in the market for as long as I have never seen a market this concentrated. They are amazed, befuddled, and aghast, as am I.

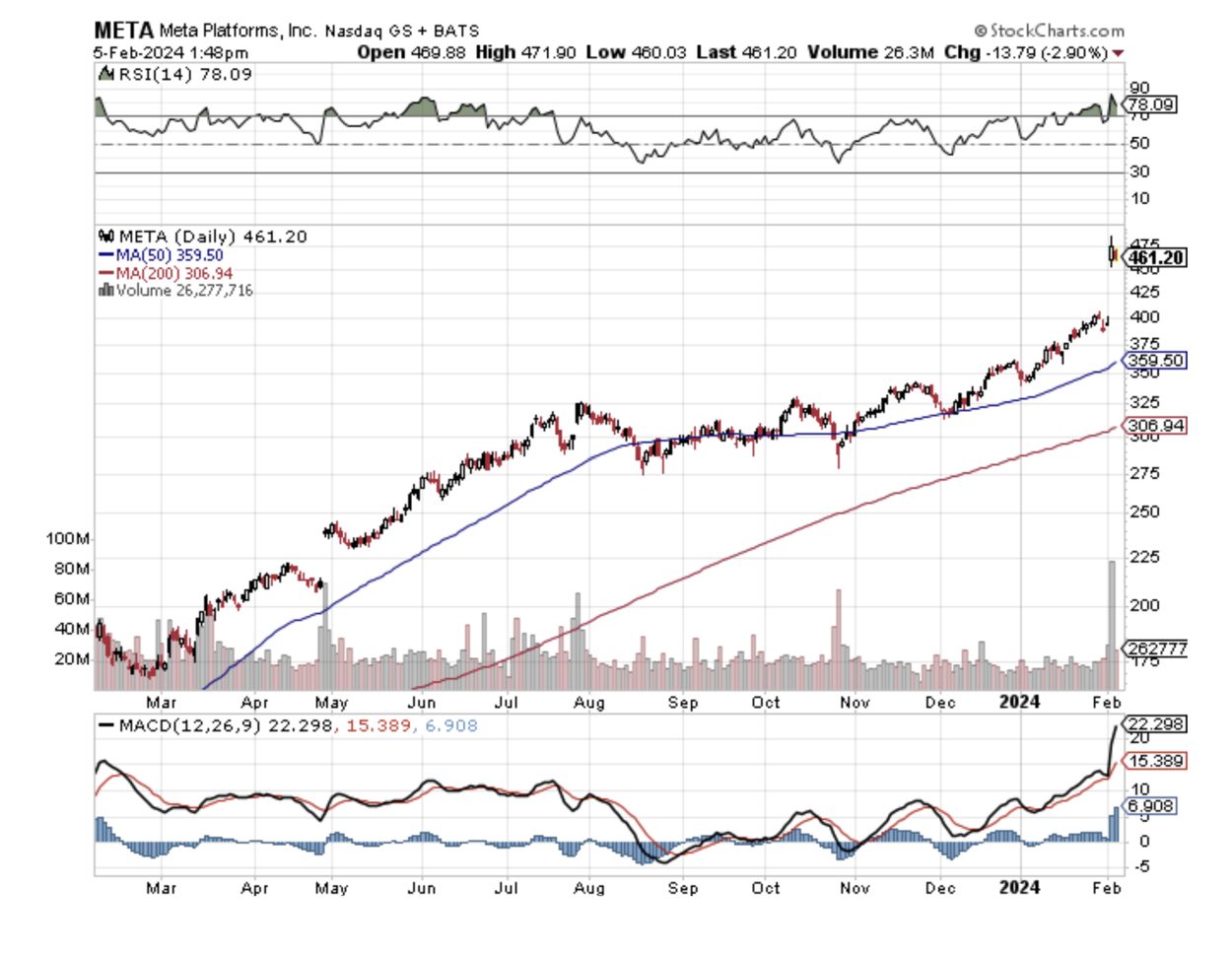

And if you do want to buy big tech, you’re going to have to compete with the big tech companies themselves to do so. The buyback machine continues full speed ahead, with Apple (AAPL) Hoovering up $20.5 billion of its own shares, Alphabet (GOOGL) $16.1 billion, Meta (META) 6.3 billion, and Microsoft (MSFT) $4 billion.

I am a firm believer that markets will do whatever they have to do to screw the most people. So far this year it has done an admirable job doing just that, going up in a straight line with everyone underinvested and with $8 trillion on the sideline.

This is how markets will continue screwing most people. It keeps going up a little bit more. The NVIDIA earnings announcement due out on February 21 could be the ideal turning point.

Then the market suffers a ferocious correction, maybe 10% in a short period. Traders panic and dump all their positions. Then the (SPX) turns around at about $4,800 on a dime and then rockets all the way up to $6,000, frustrating investors once again.

I just thought you’d like to know.

I am usually cautious about ultra bears, but I picked up an interesting view last week about how long it may take the Chinese economy to recover.

During the US house bust from 2007 to 2012, the United States had 3 million excess unwanted homes weighing on the market like a dead weight, or about a seven-month oversupply. That was enough excess to cause the Great Recession, a 52% crash in the S&P 500, and the demise of thousands of American companies, including Lehman Brothers and Bear Stearns.

Today, China has a staggering 50 million excess homes in a population only four times larger than ours. That is a 15-year oversupply for the market. That means China could suffer a decade and a half of subpar growth and lagging stock markets. Don’t touch Chinese stocks even though they offer attractive single-digit multiples.

Why do you care? Because China is the world’s largest consumer and importer of most commodities, food, and energy. The stocks that specialize in these areas could be facing a long-term drag from the Middle Kingdom unless it is offset somewhere else.

The Chinese are only now discovering that the principal driver of their economic growth for the past 30 years has been US investment. President Xi has managed to scare that away with a hostile attitude towards America and saber-rattling over Taiwan. Last year for the first time the US imported more from Mexico than from China, where many companies have re-shored.

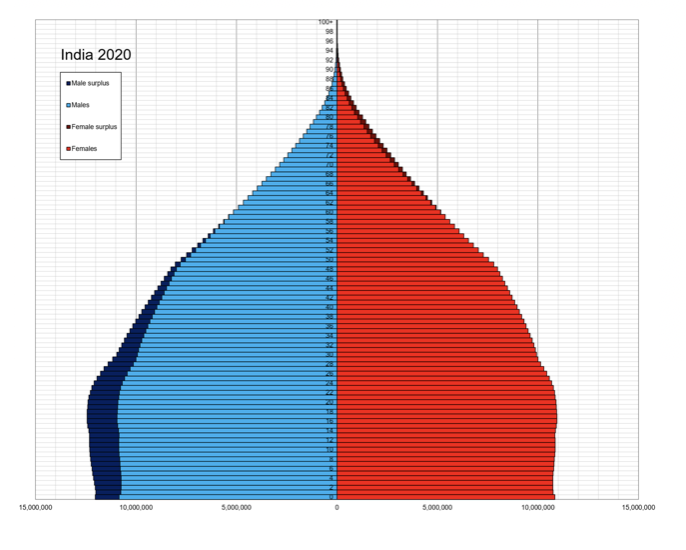

Wonder why crude oil (USO), (XOM), (OXY) is at $68 a barrel when the US economy is growing at a 3.1% rate? This is the reason. It is also a strong argument in favor of investing in India, which I discussed last week. Buy the (INDA) and the (INDY), not the (FXI) or (BABA).

In the meantime, you’ve got to love ARM Holdings PLC, whose earnings announcement triggered a heroic 56% one-day move up in the stock. They execute sub-designs for almost every AI chip out there. That’s what a 3% float in the stock gets you. Anyone who has any doubts about the durability of the AI story should take a look at what happened to (ARM) last week.

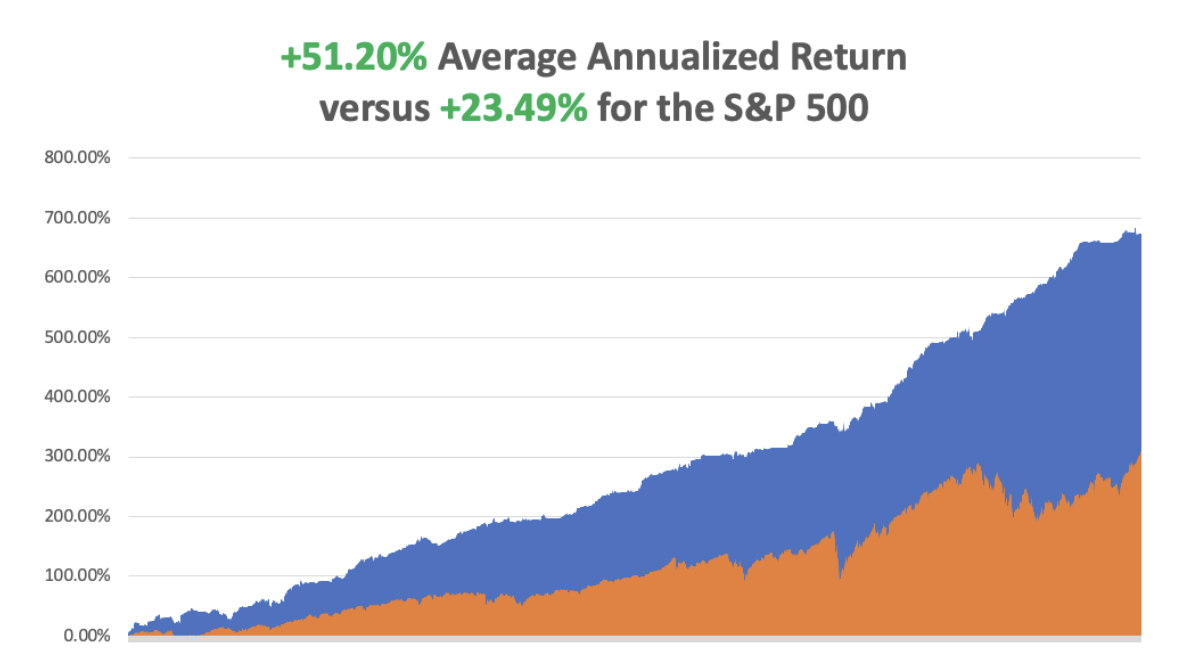

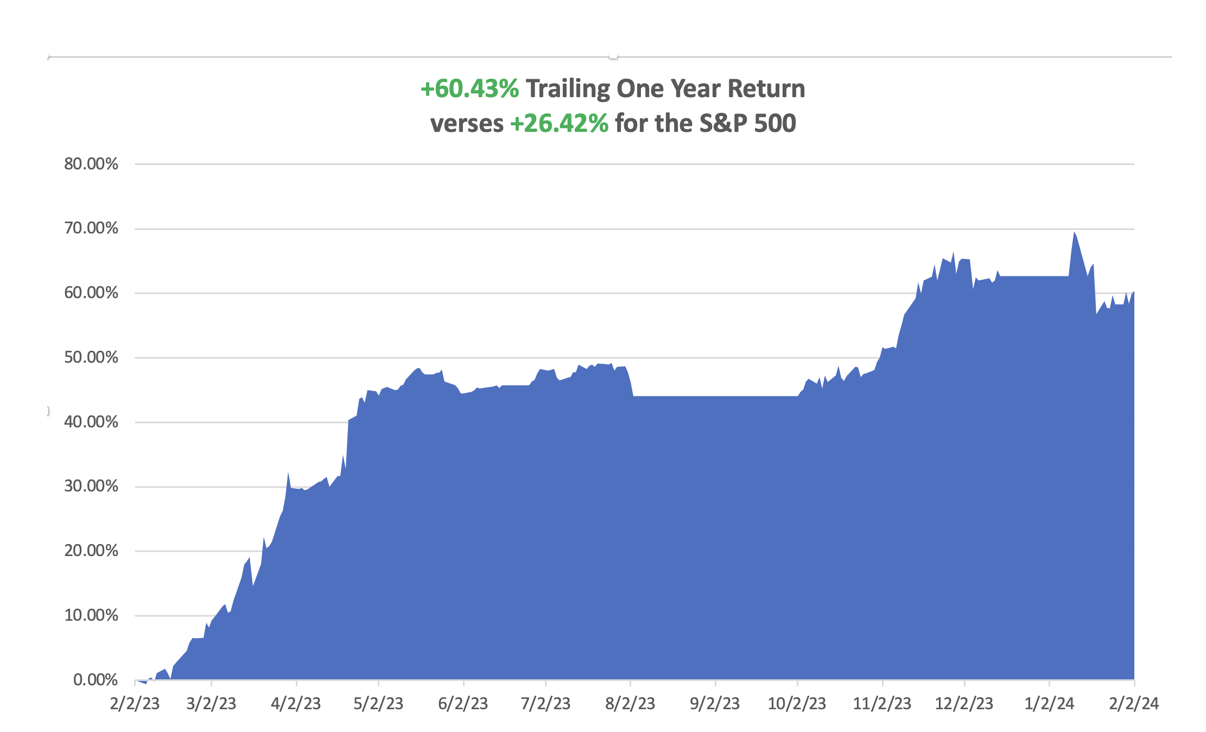

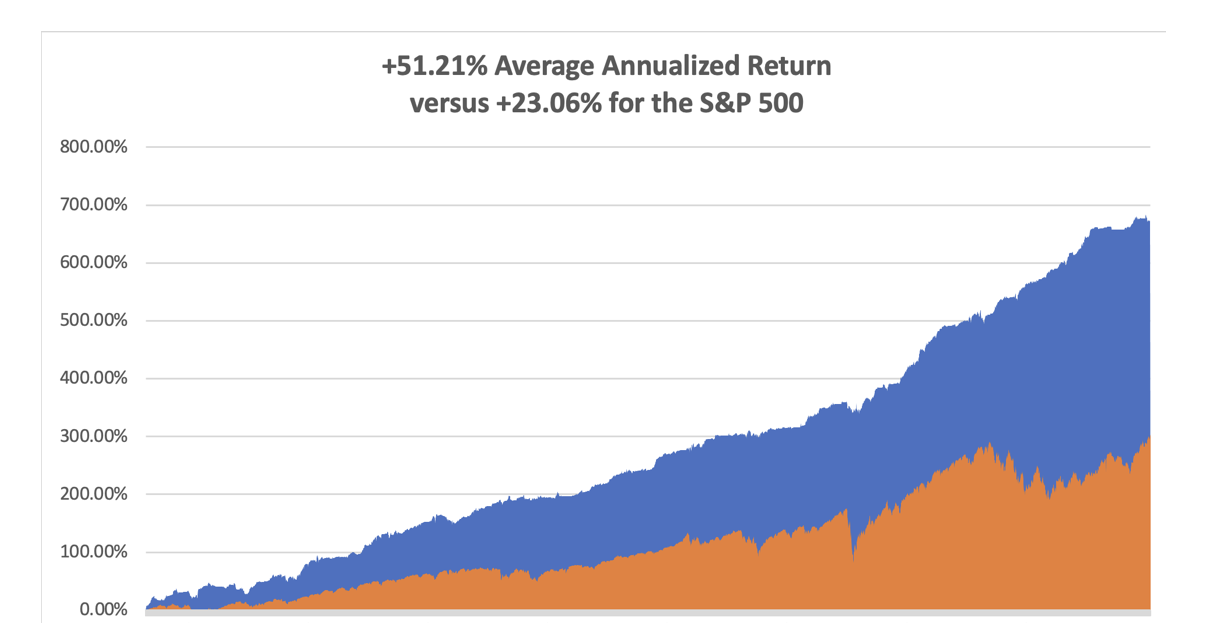

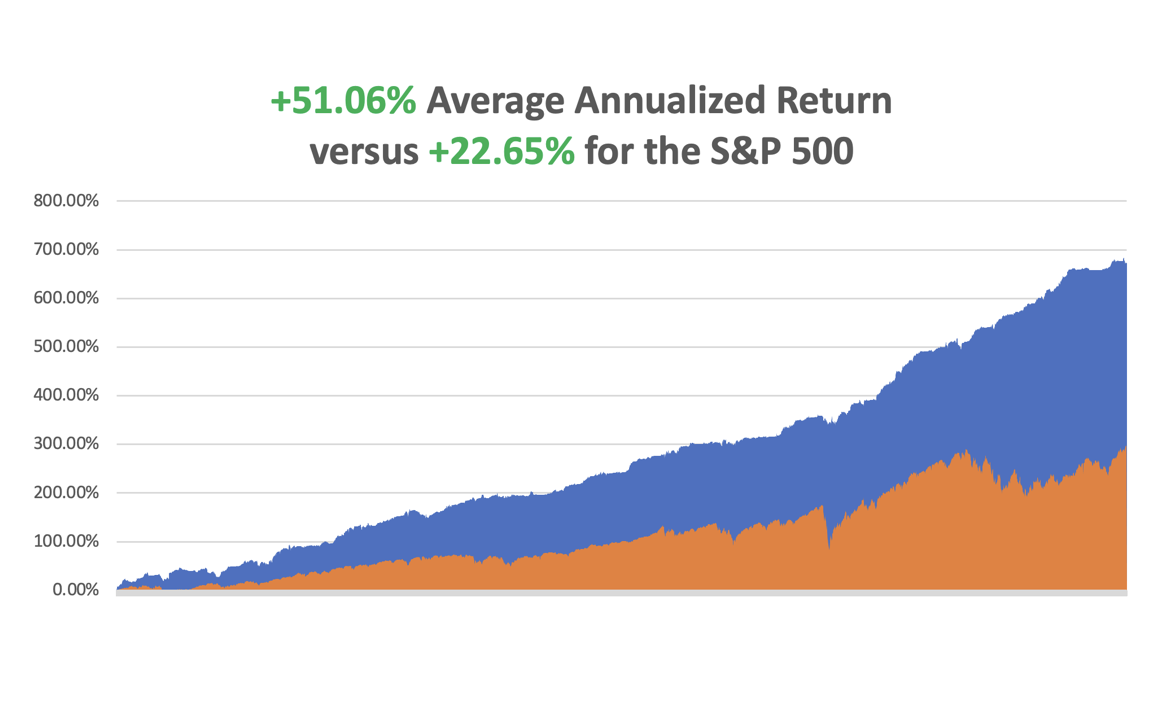

So far in February, we are up +1.78%. My 2024 year-to-date performance is also at -2.50%. The S&P 500 (SPY) is up +5.03% so far in 2024. My trailing one-year return reached +60.44% versus +33.13% for the S&P 500.

That brings my 16-year total return to +674.13%. My average annualized return has retreated to +51.20%.

Some 63 of my 70 trades last year were profitable in 2023.

I am maintaining longs in (MSFT), (AMZN), (V), (PANW), and (CCJ).

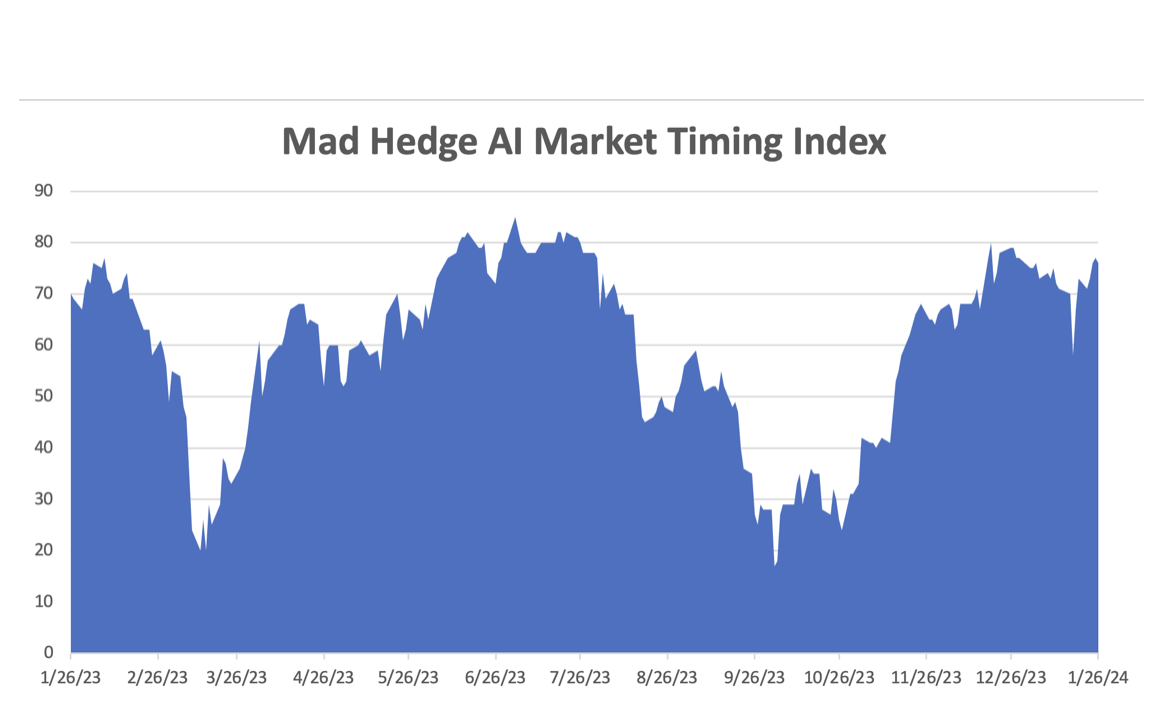

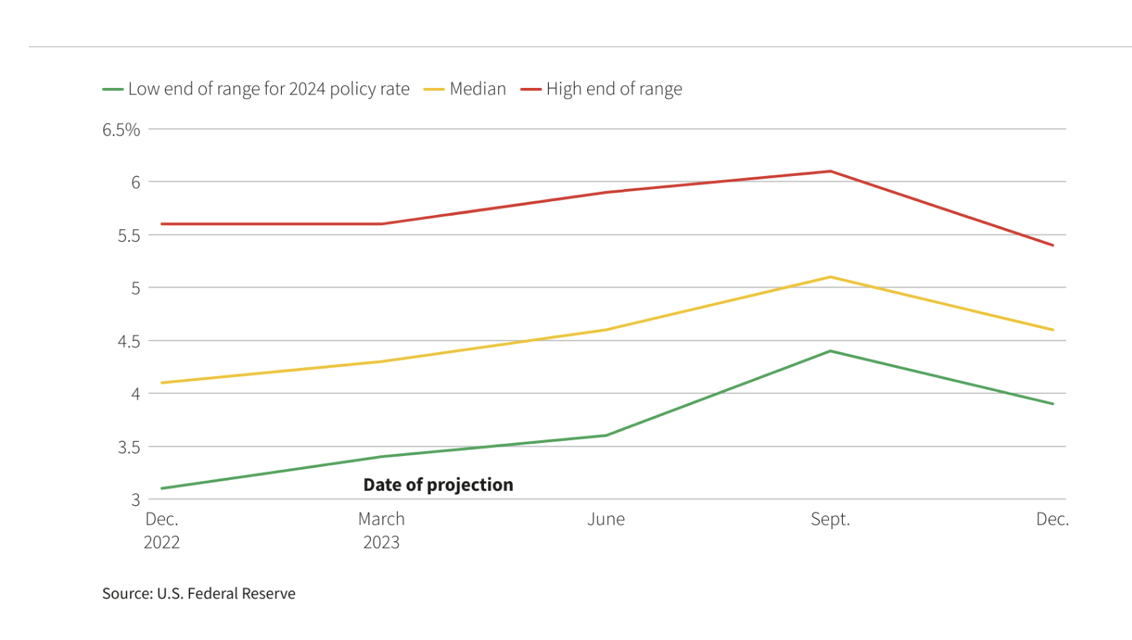

Reheating is Becoming an Issue, with a strong US economy and record-low unemployment rate possibly prompting the Fed to delay interest rate cuts. The stock market has been running on steroids on the expectation of imminent cuts. This is a new market risk and could unleash a thunderstorm on our parade.

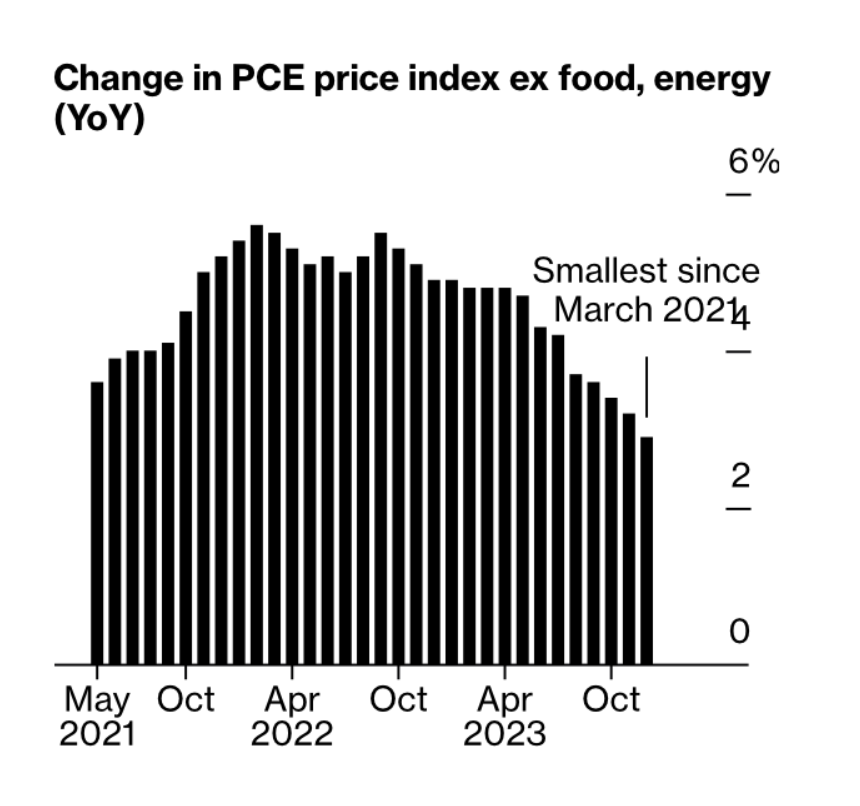

CPI Revised Down, in December, from 0.3% to 0.2%. The deflationary economy is back! Stocks loved it, with the S&P 500 catapulting to $5,000. That’s why I revised my yearend target up to $6,000.

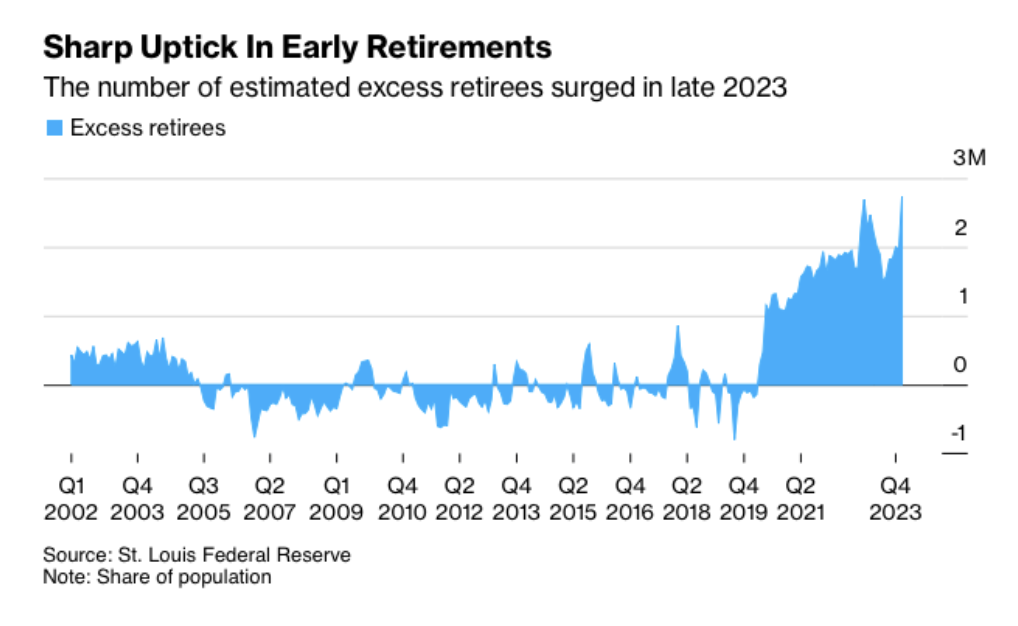

Early Retirements are Soaring, thanks to a stock market at new all-time highs. Baby boomers can now afford to “take this job and shove it.”

NVIDIA Enters New Custom Chip Market, potentially adding another $30 billion in revenues. The dominant global designer and supplier of AI chips aim to capture a portion of an exploding market for custom AI chips and to protect itself from the growing number of companies interested in finding alternatives to its products. Buy (NVDA) on dips.

Morgan Stanley Upgrades NVIDIA to an $800 Target. An exceptional supply-demand imbalance in the artificial intelligence-chip sector, as well as a massive shift in spending toward emerging technology, is likely to persist over the near term. Buy (NVDA) on dips.

ARM Holdings (ARM) Soars by 41%, off a spectacular forecast-based demand for designed-up AI chips. UK-based Arm makes money through royalties, when companies pay for access to build Arm-compatible chips, usually amounting to a small percentage of the final chip price. Arm said its customers shipped 7.7 billion Arm chips during the September quarter.

Tesla (TSLA) Looking to Cut Jobs, and reduce costs, as is the rest of Silicon Valley. The move could mark the bottom of the stock. Elon Musk is the master job cutter, axing 80% of the Twitter staff on takeover.

Meta (META) Gains $196 Billion in Market Cap in One Day, off the back of record sales, tripled earnings, and reduced costs.

Construction Spending Gains, up 0.9% in December, the best since October. Watch the industry reaccelerate as interest rates fall.

Royal Caribbean Beats, with record bookings in an industry I have recently become intensely interested in. (RCL) is grabbing market share from land-based vacations, as Millennials are finally discovering cheap cruise vacations, where it is often cheaper than to stay in a motel with all you can eat. Only a few cruises were lost to the Red Sea War. (RCL) just launched Icon of the Seas, the world’s largest cruise ship.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, February 12, the US Consumer Inflation Expectations are announced.

On Tuesday, February 13 at 8:30 AM EST, the Core Inflation Rate will be released.

On Wednesday, February 14 at 2:00 PM, the Producer Price Index is published. The Federal Reserve announces its interest rate decision.

On Thursday, February 15 at 8:30 AM, the Weekly Jobless Claims are announced. We also get Retail Sales.

On Friday, February 16 at 2:30 PM, the January Building Permits are published, along with the University of Michigan Consumer Sentiment. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, it was in 1986 when the call went out at the London office of Morgan Stanley for someone to undertake an unusual task. They needed someone who knew the Middle East well, spoke some Arabic, was comfortable in the desert, and was a good rider.

The higher-ups had obtained an impossible-to-get invitation from the Kuwaiti Royal family to take part in a camel caravan into the Dibdibah Desert. It was the social event of the year.

More importantly, the event was to be attended by the head of the Kuwait Investment Authority, who ran over $100 billion in assets. Kuwait had immense oil revenues, but almost no people, so the bulk of their oil revenues were invested in western stock markets. An investment of goodwill here could pay off big time down the road.

The problem was that the US had just launched air strikes against Libya, destroying the dictator, Muammar Gaddafi’s royal palace, our response to the bombing of a disco in West Berlin frequented by US soldiers. Terrorist attacks were imminently expected throughout Europe.

Of course, I was the only one who volunteered.

My managing director didn’t want me to go, as they couldn’t afford to lose me. I explained that in reviewing the range of risks I had taken in my life, this one didn’t even register. The following week found myself in a first-class seat on Kuwait Airways headed for a Middle East in turmoil.

A limo picked me up at the Kuwait Hilton, just across the street from the US embassy, where I occupied the presidential suite. We headed west into the desert.

In an hour, I came across the most amazing sight - a collection of large tents accompanied by about 100 camels. Everyone was wearing traditional Arab dress with a ceremonial dagger. I had been riding horses all my life, camels not so much. So, I asked for the gentlest camel they had.

The camel wranglers gave me a tall female, which was more docile and obedient than the males. Imagine that! Getting on a camel is weird, as you mount them while they are sitting down. My camel had no problem lifting my 180 pounds.

They were beautiful animals, highly groomed, and in the pink of health. Some were worth millions of dollars. A handler asked me if I had ever drunk fresh camel milk, and I answered no. They didn’t offer it at Safeway. He picked up a metal bowl, cleaned it out with his hand, and milked a nearby camel.

He then handed me the bowl with a big smile across his face. There were definitely green flecks of manure floating on the top, but I drank it anyway. I had to, lest my host would lose face. At least it was white. It was body temperature warm and much richer than cow’s milk.

The motion of a camel is completely different from a horse. You ride back and forth in a rocking motion. I hoped the trip was short, as this ride had repetitive motion injuries written all over it. I was using muscles I had never used before. Hit your camel with a stick and they take off at 40 miles per hour.

I learned that a camel is a super animal ideally suited for the desert. It can ride 100 miles a day, and 150 miles in emergencies, according to TE Lawrence, who made the epic 600-mile trek to Aquaba in only four weeks in the height of summer. It can live 15 days without water, converting the fat in its hump.

In ten miles, we reached our destination. The tents went up, clouds of dust rose, the camels were corralled, and the cooking began for an epic feast that night.

It was a sight to behold. Elaborately decorated huge three-by-five wide bronze platers were brought overflowing with rice and vegetables, and every part of a sheep you can imagine, none of which was wasted. In the center was a cooked sheep’s head with the top of the skull removed so the brains were easily accessible. We all ate with our right hands.

I learned that I was the first foreigner ever invited to such an event, and the Arabs delighted in feeding me every part of the sheep, the eyes, the brains, the intestines, and the gristle. I pretended to love everything and laid back and thought of England. When they asked how it tasted I said it was great. I lied.

As the evening progressed, the Johnny Walker Red came out of hiding. Alcohol is illegal in Kuwait, and formal events are marked by copious amounts of elaborate fruit juices. I was told that someone with a royal connection had smuggled in an entire container of whiskey and I could drink all I wanted.

The next morning I was awoken by a bellowing camel and the worst headache in the world. I threw a rock at him to get him to shut up and he sauntered over and peed all over me.

The things I did for Morgan Stanley!

Four years later, Iraq invaded Kuwait. Some of my friends were kidnapped and held for ransom, while others were never heard from again.

The Kuwaiti government said they would pay for the war if we provided the troops, tanks, and planes. So they sold their entire $100 million investment portfolio and gave the money to the US.

Morgan Stanley got the mandate to handle the liquidation, earning the biggest commission in the firm’s history. No doubt, the salesman who got the order was considered a genius, earned a promotion, and was paid a huge bonus.

I spent the year as a Marine Corps captain, flying around assorted American generals and doing the odd special opp. I got shot down and still set off airport metal detectors. No bonus here. But at least I gained an insight and an experience into a medieval Bedouin lifestyle that is long gone.

They say success has many fathers. This is a classic example.

You can’t just ride out into the Kuwait desert anymore. It is still filled with mines planted by the Iraqis. There are almost no camels left in the Middle East, long ago replaced by trucks. When I was in Egypt in 2019, I rode a few mangy, pitiful animals held over for the tourists.

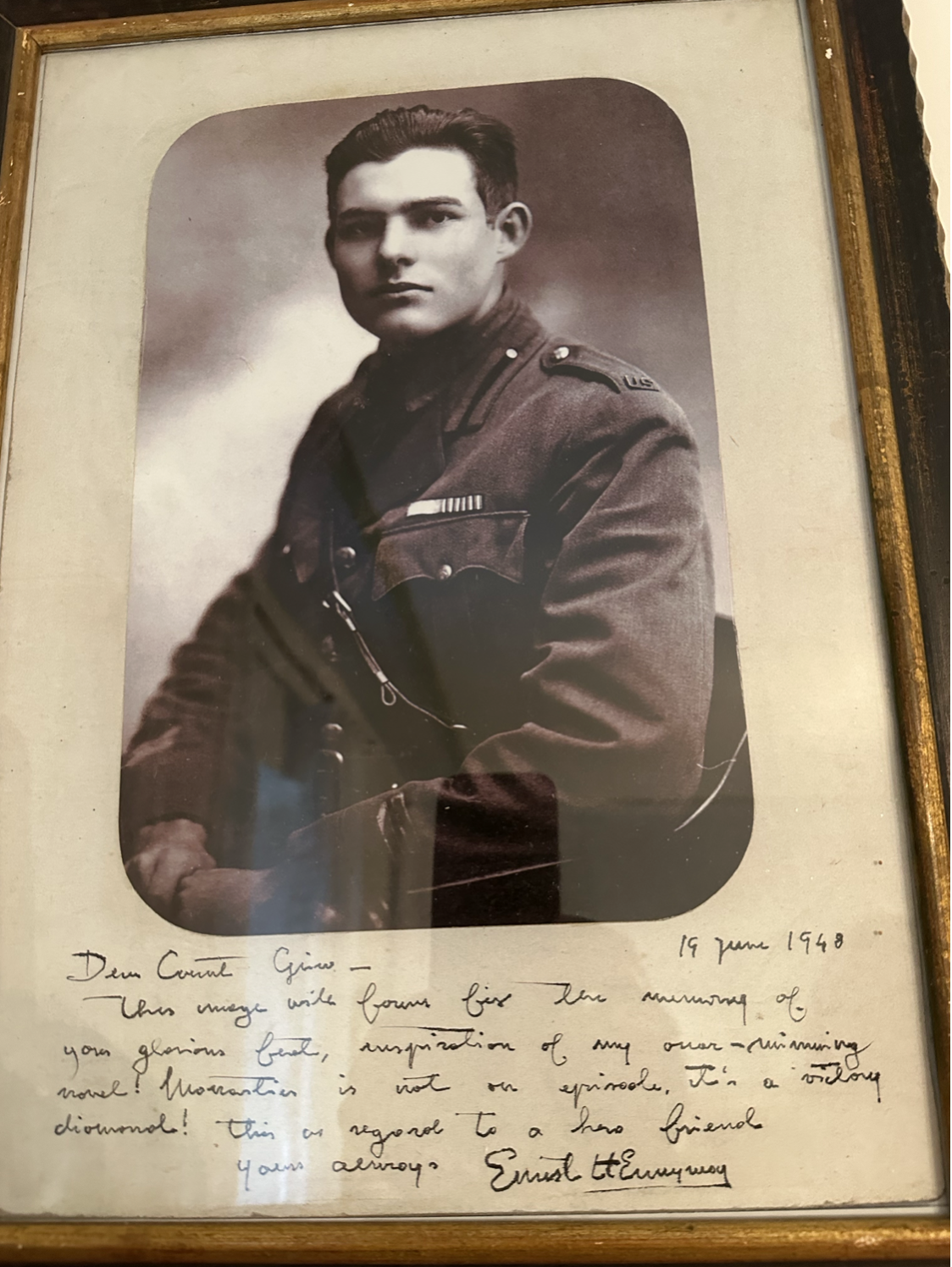

When I passed through my London Club last summer, the Naval and Military Club on St. James Square, whose portrait was right at the front entrance? None other than that of Lawrence of Arabia.

It turns out we were members of the same club in more ways than one.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

John Thomas of Arabia

Checking Out the Local Camel Milk

This One Will Do

Traffic in Arabia