Global Market Comments

November 9, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(THE DEATH OF PASSIVE INVESTING),

(SPY), (SPX), (QQQ), (META), (UUP), (GLD), (INDU)

Global Market Comments

November 9, 2022

Fiat Lux

Featured Trade:

(TESTIMONIAL),

(THE DEATH OF PASSIVE INVESTING),

(SPY), (SPX), (QQQ), (META), (UUP), (GLD), (INDU)

Global Market Comments

November 7, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE FED GIVETH AND THE FED TAKETH AWAY)

(SPY), (TLT), (JNK), (AAPL), (MSFT), (AMZN), (GOOGL), (META)

Now you see it, now you don’t.

The rip-roaring rally that started in October, with which we made so much money on, vaporized in a heartbeat. Traders lulled into a false sense of security with happy talk among themselves were suddenly throwing up on their shoes.

Fed governor Powell clearly indicated that interest rates will remain higher for longer, and therefore, stock prices lower. Powell promised us pain last summer and is delivering big time. Powell’s job is NOT to defend the stock market.

Personally, I’m looking for another 75 basis points on December 14, followed by 50 basis points on February 1 and another 25 basis points on March 22. This will bring us 4.75%-5.00% range for overnight Fed funds. After that, rates will fall for years as the Fed rushes to repair the damage it inflicted on the economy. Stocks will deliver the 800% return I have been promising.

I went into the Fed meeting short and used the ensuing meltdown to take profits.

As a result, my November month-to-date performance went off to the races, already achieving a hot +2.20%.

That leaves me with a very rare 100% cash position. With midterm election results out on Wednesday and the next report on the Consumer Price Index on Thursday, that sounds like a prudent place to be.

My 2022 year-to-date performance ballooned to +77.57%, a new high. The Dow Average is down -11.85% so far in 2022.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +49.51%.

That brings my 14-year total return to +590.13%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +49.51%, easily the highest in the industry.

There is no doubt that the greatest buying opportunity of the century is setting up. Those who bought the Dotcom Crash bottom in 2003 snapped up Apple (AAPL) at 20 cents on its way to $186, split adjusted. During the 2009 Financial Crisis bottom, the savvy snapped up Microsoft (MSFT) at $11. Its top tick last year was $23.

A similar golden opportunity is setting up in the next year and will create immense wealth. Just remember that things always go down more than you think, and then rise far more than you believe possible.

However, one of the greatest questions of all time has finally been resolved. Can stock markets rise without big tech? The answer has been an overwhelming “YES.” Financial, where we have been very heavily involved, rose up to 25% while tech was falling 20%. Healthcare has been on fire as well. It all gives us a place to earn our crust of bread until the long-term trend up in tech resumes, however long that may take.

The turn will be called by the prospect of Fed interest rate CUTS sometime in 2023, and good luck calling that.

Further complicating matters near term is that this could be the greatest tax loss selling year of all time, with some stocks down up to 80% sold to offset gains elsewhere, such as in energy. But the mutual funds are already done, their tax year already ended. Whatever is left must be wound up by December 31.

Nonfarm Payroll Comes in at a Hot 261,000 in October, higher than hoped. The Headline Unemployment Rate crawled up to 3.7%, the highest since February. Average hourly earnings are up 4.7% YOY, far below the inflation rate. The U-6 “Discourage worker” rate rose from 6.7% to 6.8%. Anyone who thinks these numbers will lead to an earlier end to the Fed interest rate rises has a hole in their head.

JOLTS Beats Bigtime, with 10.7 million jobs opening, a million more than expected. No cooling of labor demand here.

ADP Rises 239,000, more than expected, nailing the coffin shut on the 75-basis point rate hike. The strong industries, like Airlines and Leisure & Hospitality, are still hiring like crazy.

Is Big Tech Dead Money? It may be for months, or even years, but Big Tech always comes back. It’s just a matter of how long it takes big double-digit earnings to return with the onset of the next robust economic recovery. Until then, expect a lot of differentiation. Apple (AAPL) will hold up best, followed by Amazon (AMZN) and Google (GOOGL). As for Meta (META), the old Facebook, it may never come back.

Tech Austerity Accelerates, with Apple (AAPL) announcing an unheard-of hiring freeze. The rest of big tech is following suit. The knees are about to be cut from under the market’s safest stock.

Fed Raises Interest Rates by 75 Basis Points but changed their language to be slightly more accommodative. Stocks rallied 500 points on the news. If this is bullish, it’s a stretch. They are still targeting a 2% inflation rate and will take into account cumulative tightening to date. Acknowledging they have already raised rates a lot is something. That is more dovish than expected.

Chicago PMI is Still Falling, from 47 estimated to 45.2 in October. Under 50 indicates a recessionary economy.

Morgan Stanley Says Rising Rates to End Soon, according to strategist Mike Wilson. The big pivot will happen sooner than later. I agree.

Twitter Hate Speech Spikes 500%, since Elon Musk took over the company, as racists and conspiracy theorists test his looser limits. The entire senior staff has been fired as they are still subject to fraud accusations from Musk. Musk thinks he can resell the company for a big premium in five years. Is this the end of democracy, or just Twitter (TWTR) whose stock no longer trades? More advertisers will bail after Musk paraded conspiracy theories in the wake of the Pelosi assassination attempt.

US Treasury to Borrow $550 Billion in Q4. It means the bond short (TLT) and (TBT) may have one more gasp to go.

Japan Spends $42 Billion to Support the Yen in October to no avail, as it threatens new lows. The yen will remain weak as long as interest rates remain near zero.

First Starship to Launch in December, the largest rock ever launched. The super heavy booster will return to earth while the capsule will land off the coast of Hawaii. Space X has a $3 billion contract from NASA to return to the moon by 2025.

US Banks Processed $1.2 Billion in Ransomware Payments this Year, triple the previous year’s level. Russia is the source of many of the attacks. And you wonder why we are supporting Ukraine?

Russian Economy Shrinks by 5% YOY in September as the sanctions take their toll. Only 45% to go. The call-up of 300,000 reservists has yet to hit the economy.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With the economy decarbonizing and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, November 7 at 12:00 PM, the Consumer Credit for September is released.

On Tuesday, November 8, the US Midterm elections take place with 532 House and 34 Senate seats up for grabs.

On Wednesday, November 9 the entire day will be spent analyzing election results and tracking the ties.

On Thursday, November 10 at 8:30 AM, Weekly Jobless Claims are announced. We also get the US Core Inflation Rate for October.

On Friday, November 11 at 8:30 AM the University of Michigan Consumer Sentiment for November is printed. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, I was recently in Los Angeles visiting old friends, and I am reminded of one of the weirdest chapters of my life.

There were not a lot of jobs in the summer of 1971, but Thomas Noguchi, the LA County Coroner, was hiring. The famed USC student jobs board had delivered! Better yet, the job included hours at night and free housing at the coroner's department.

I got the graveyard shift, from midnight to 8:00 AM. All I had to do was buy a black suit from Robert Halls, for $25.

Noguchi was known as the “coroner to the stars” having famously done the autopsies on Marilyn Monroe and Jane Mansfield. He did not disappoint.

For three months, whenever there was a death from unnatural causes, I was there to pick up the bodies. If there was a suicide, gangland shooting, or horrific car accident, I was your man.

Charles Manson had recently been arrested and I was tasked with digging up the victims. One, cowboy stuntman Shorty Shay, had his head cut off and neatly placed in between his ankles.

The first time I ever saw a full set of women’s underclothing, a girdle, and pantyhose, was when I excavated a desert roadside grave that the coyotes had dug up. She was pretty far gone.

Once, I and another driver were sent to pick up a teenage boy who had committed suicide in Beverly Hills. The father came out and asked us to take the mattress as well. I regretted that we were not allowed to do favors on city time. He then said, “can you take it for $200”, then an astronomical sum.

A few minutes later found a hearse driving down the Santa Monica Freeway on the way to the dump with a double mattress expertly tied on the roof with Boy Scout knots with a giant blood spot in the middle.

Once, I was sent to a cheap motel where a drug deal gone wrong had produced several shootings. I found $10,000 in a brown paper bag under the bed. The other driver found another ten grand and a bag of drugs and kept them. He went to jail. I didn’t.

The worst pick-up of the summer was also the most disgusting and even made the old veterans sick. A 300-pound man had died of a heart attack and was not discovered for a month. We decided to each grab an arm or leg and all tug on the count of three. One, two, three, and all four limbs came off!

Eventually, I figured out that handling dead bodies could be hazardous to your health, so I asked for rubber gloves. I was fired.

Still, I ended up with some of the best summer job stories ever.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

October 24, 2022

Fiat Lux

Featured Trade:

(GET WITH THE TIMES)

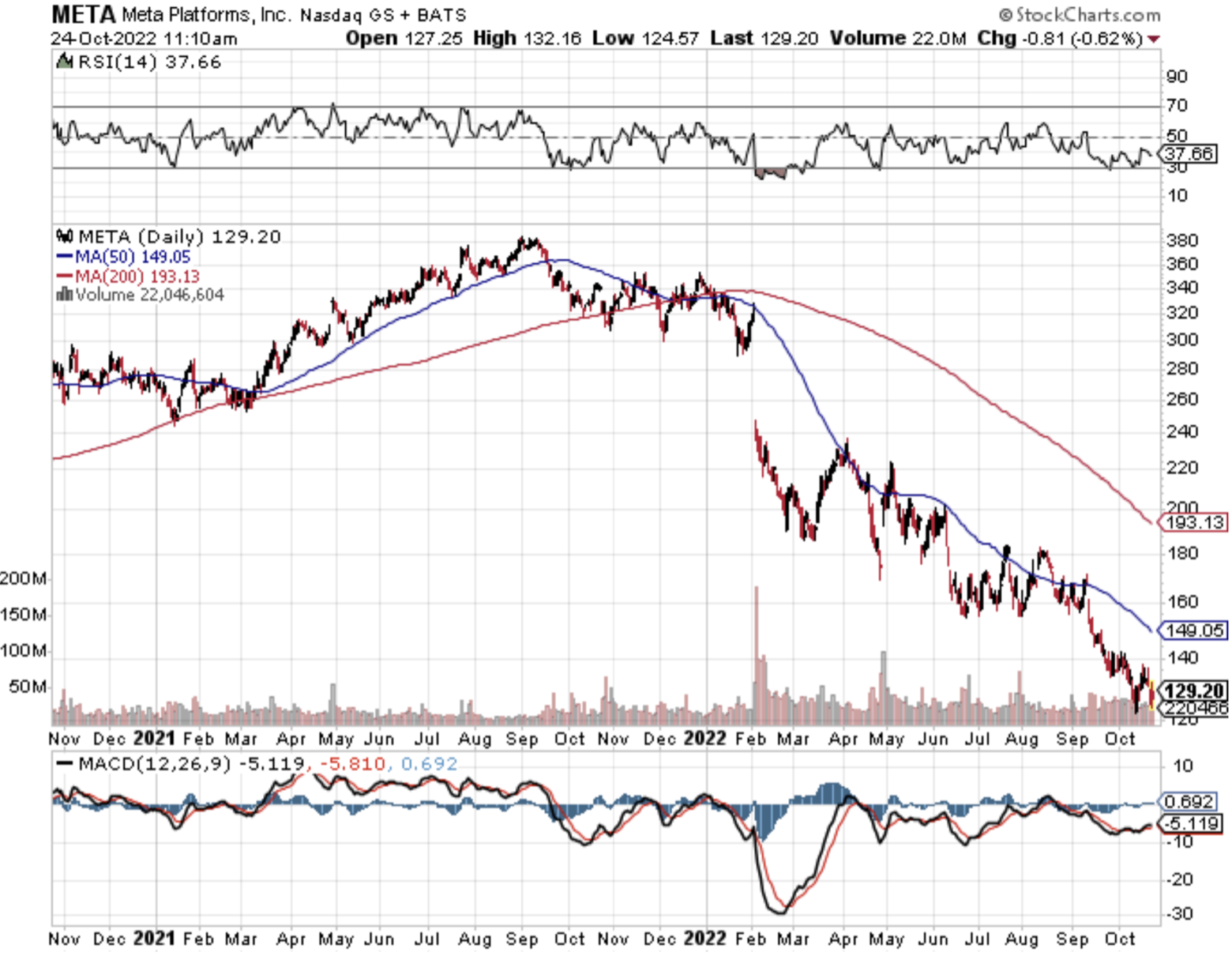

(META)

Brad Gerstner is the Founder and CEO of Altimeter Capital, a tech investment firm based in Silicon Valley and a big shareholder of Meta or Facebook.

On Monday morning, Gerstner wrote an “open letter” to the CEO of Meta Mark Zuckerberg essentially telling him that he has no idea what he’s doing and to get with the program.

Of course, the letter used a polite and courteous tone, but the content was damaging to say the least.

Some of his thoughts also back up exactly what I’ve been preaching.

Innovation in Silicon Valley has come to a screeching halt, and many of these incremental projects aren’t looking too attractive, like Metaverse.

Zuckerberg is also wildly out of step with the current times as bond yields have exploded, and tech stocks have been crushed. Yet the CEO has ramped up spending and getting very little bang for his buck.

He seems oblivious to all of it.

Gerstner wants juicing up of free cash flow through the existing platforms which focus mainly on digital ads, because they are still highly profitable.

He also criticized the amount of money used to develop the Metaverse and called for an imminent reduction in costs.

He later complains that META has increased its headcount from 25,000 to 75,000 heads in the past three years, but META is not squeezing out more productivity by this.

Gerstner recommends cutting the staff budget by 20% which would bring down staff costs to last year’s levels.

He didn’t say that the extra $40 billion in savings would go to shareholder returns, but one might conclude that he is lobbying for that decision that would benefit his wallet.

Essentially, “recommending” to invest $1-$2 billion is a direct show across the bow to Facebook management signaling not good enough at the top level.

Investors believe this technology is not only akin to a pet project, but also a failure of long-term strategic significance.

Remember that Zuckerberg is investing $30 billion in the metaverse in 2022 and wants to ramp up in 2023,.

My guess is that Zuckerberg adopts a defiant stance since he believes he’s the smartest guy in the room at all times.

He hates to be doubted and has an impulse to prove people wrong.

Even if the metaverse is the future, Zuckerberg is wildly early and investors want him to milk profits now from the ad business before he goes full steam into monetizing the metaverse.

Zuckerberg has super voting rights and is unable to get fired from the company he co-founded and investors gave him a pass for this situation for quite some time.

Now, moving forward, it appears as if Zuckerberg doesn’t care about Meta’s stock price anymore and will do anything to make this metaverse project work even if it doesn’t mesh with the balance sheet or the current cost of capital.

He doesn’t care because he views his legacy as intertwined with the prospects of the metaverse which is a dangerous path to choose.

It’s irresponsible for a CEO to crowbar a public company into a binary decision on a speculative technology when there’s no need for it.

Volunteering for high risk is a sign of bad leadership.

A CEO that cannot get fired is dangerous and it is coming back to haunt investors.

My guess is that Zuckerberg will double hiring, double investments and capital spending, double artificial intelligence engineers and triple down on this metaverse project because he views it as an existential proposition.

From an individual investor's point of view, reckless leadership means avoiding the stock.

I believe META’s stock is due for a terrible earnings report, poor forward guidance and I would sell any rally in META stock.

Mad Hedge Technology Letter

October 3, 2022

Fiat Lux

Featured Trade:

(ZUCK LOSING HIS MIDAS TOUCH)

(META), (RBLX)

It’s gotten so bad at Facebook’s Menlo Park headquarters that to attract high-level talent, they have to overpay by almost 5 times.

That’s how unattractive it is to work for Facebook now – almost a permanent stain on one’s resume.

It was just only a few years ago when Facebook or Meta (META) was the go-to growth story in upcoming technology, and its business model, which is still quite profitable, launched them into a trillion-dollar company.

Every Stanford MBA student was clamoring to get into the company at almost any cost. It was a blue chip tech company.

That was then and this is now.

Poor management has started to spiral out of control and that starts from the top down where co-founder and current CEO Mark Zuckerberg is notorious for being a difficult boss to work for.

He is also unfirable because he owns 51% of voting rights and rules with an iron fist like a Russian tsar.

Pouring sand on the fresh wound, Facebook has announced future job cuts for the first time in its history as a company. Might as well go out in style.

The trillion-dollar company that was once unstoppable is now shrinking its headcount to cut costs, an almost unimaginable situation just a few months ago.

This management move is essentially a mea culpa signaling that business decisions have been atrocious.

The flagship product Facebook is pretty much unusable now which is part of the multi-pronged problem.

It’s filled with so much chaos because every high-priced software engineer has attempted to put their stamp on the product by installing additional “improvements.”

The interface is now as convoluted as ever and things just get in the way.

Much like Microsoft word, it’s a software product that transcends time which is why I use Microsoft Word 2010. It also doesn’t force me to upload and save my Word document to Microsoft’s Cloud like the new iteration.

Facebook is the same, better as a slimmed-down simplified version, but that doesn’t boost short-term revenue.

Even if short-term capitalism gets in the way, it doesn’t deny the fact that competition has reared its ugly head and Zuckerberg and Facebook are flat-out losing.

The Chinese communist party-sponsored TikTok is the competitor and is hot with the young crowd with its short-form videos.

TikTok is securing market share from Facebook and Instagram while Zuckerberg pivots to virtual reality in the form of the metaverse.

Zuckerberg’s expensive shift to the metaverse also appears to be a failure which could turn out to be Zuckerberg digging his own Facebook grave.

The most successful metaverse platforms already exist in 2D, with Roblox Corp. (RBLX) and Epic Games Inc.’s Fortnight.

Success has been achieved in the form of regular users with incentives around building and sharing experiences.

Meta has instead focused on the immersive sensation of its virtual reality products, which isn’t all that appealing.

Overpaying software developers because the platform has fallen out of favor is a red flag.

Now, Meta has more red flags than a Chinese communist parade.

Meta now has a $360 billion valuation and the US economy, its biggest revenue driver, is facing a 2023 recession.

The upcoming recession is what first prompted the job cuts, but I believe this will trigger something more cynical in the form of gross underperformance of Meta’s business model and another leg down in its story.

We are inching to the point where Meta will need to perform backflips to turn around the titanic because nothing on the horizon suggests they have anything figured out.

The metaverse – not a solution.

Sell all rallies during the period of high-interest rates.

Meta clearly cannot solve the current challenges that are deteriorating by the day.

Mad Hedge Technology Letter

September 22, 2022

Fiat Lux

Featured Trade:

(POTENTIAL TECH REVERSAL PUSHED BACK)

(FED), (META), (AAPL)

Tech investors want nothing to do with an aggressive Federal Reserve, but that’s what we have.

I don’t choose this and neither do many others out there.

We have been spoilt in a world with low inflation, global peace, low energy, and high liquidity which was the perfect scenario for tech stocks.

The reverse has happened almost overnight and now it’s that much harder to earn your crust of bread in the tech world.

Gone are the days of buying Facebook for peanuts then going for a sauna and a nap. It’s not that easy right now.

Tech stocks don’t go up in a straight line anymore – there will be many zigs and zags along the way moving forward.

Tech stocks aren’t immune to these exogenous stocks and as anointed growth companies, they inherently need to borrow capital and grow more than the cost of it.

That endeavor is stretched to the limit as bond yield explodes to the upside with this latest rate rise.

Raising interest rates by 0.75% for the third consecutive time this afternoon was the consensus, but in fact, there was a 25% chance of a full 1% rate rise. We avoided that bullet.

Tech stock doves were hoping US Federal Reserve Governor Jerome Powell would save them, by initiating a pivot to save the stock market, but no do this time around.

It underscores that Powell is adamant about continuing this inflation battle even if I do believe it’s too little too late.

The central bank’s new benchmark borrowing rate is now between 3.0% to 3.25%, up from the current range of 2.25% to 2.5%. This would bring the fed funds rate to its highest level since 2008.

Tech stock reacts most sensitively to the change in Fed Funds rates which is why we have seen CEO and Founder of Meta (META) or Facebook Mark Zuckerberg lose $71 billion of his net wealth this year.

Not only is the macroenvironment squarely against him, but his flagship product Facebook is losing steam, and his new product the Metaverse has garnered tepid reviews from outsiders.

How long does the Fed intend to increase rates?

The updated consensus for the Fed Funds Rate shows it at 4-4.25% by the end of 2022, another hike to 4.25-4.5% at end of 2023, and one more cut in 2024 and two more in 2025.

The answer is quite a while longer.

In the meantime, this will initiate a “reverse wealth effect” and tech stocks are the biggest losers, and the US dollar is an unmitigated winner.

Delaying lower Fed Funds rates means delaying the reversal in tech stocks which need lower rates to explode higher and without it, they are quite ordinary.

Signaling higher rates for longer is designed to tame inflation, but there are so many unintended consequences for US tech stocks.

The most important themes to be concerned about are revenue and financing.

The .75% increase in rates will mean that tech stocks will produce lower annual revenue because financing costs will be higher.

This is already at a time when general costs have exploded higher such as an uncontrollable wage spiral, supply chain bottlenecks, health care costs, transportation costs, and energy costs.

It’s a great deal harder to keep the numbers down enough to profit which basically means gross margins will compress further from today.

Tech stocks will come back because they always do. They are the profit engine of corporate America, and that will never change.

I see great tech companies like Apple (AAPL) installing the framework so they can maximize on the next move up when the bull market reignites.

They are doing this by moving iPhone production to India and other tablet production to Vietnam to get out of lockdown China.

Now is the time to reset before tech bounces back and it’s painful to see tech get slaughtered, but this is a necessary evil after a wonderful bull run from 2012 to November 2021.

US FED GOVERNOR GIVES NO LOVE TO TECH STOCKS

Mad Hedge Technology Letter

September 19, 2022

Fiat Lux

Featured Trade:

(READING THE TECH TEA LEAVES)

(GOOGL), (FDX), (META), (SNAP)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.