Below please find subscribers’ Q&A for the June 16 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Lake Tahoe, NV.

Q: Does Copper (FCX) look like a buy now or wait for it to drop?

A: I would buy ⅓ now, ⅓ lower down, ⅓ lower down still. Worst case we get down to $30 in Freeport McMoRan (FCX) from $37 today. A new internal combustion engine requires 40 lbs. of copper for wiring, but new EVs require 200 lbs. per car, and the number of EV cars is about to go from 700,000 last year to 25 million in 10 years. So, you can do the math here. It's basically 24.3 million times 200 lbs., or 1.215 billion tons, and that's the annual increase in demand for copper over the next 10 years. There aren’t enough mines in the world to accommodate that, so the price has to go up. However, (FCX) has gone up 12 times from its 2020 low and was overdue for a major rest. So short term it's a sell, long term it's a double. That's why I put the LEAPS out on it.

Q: Lumber prices are dropping fast, should I bet the ranch that it’ll drop big?

A: No, I think the big drop has happened; we’re down 40% from the highs, the next move is probably up. And that is a commodity that will remain more or less permanently in short supply due to the structural impediments put into the lumber market by the Trump administration. They greatly increased import duties from Canada and all those Canadian mills shut down as a result. It’s going to take a long time to bring those back up to speed and get us the wood we need to build houses. Another interesting thing you’re seeing in the bay area for housing is people switching over to aluminum and steel for framing because it’s cheaper, and of course in an earthquake-prone fire zone, you’d much rather have steel or aluminum for framing than wood.

Q: I didn’t catch the (FCX) LEAP, can you reiterate?

A: With prices at today's level, you can buy the 35 calls in (FCX), sell short the 40 calls, and get nearly a 177% return by January 2022. That's an absolute screamer of a LEAPS.

Q: How do you see the working from home environment in the near future after Morgan Stanley (MS) asked everyone to return?

A: Well that’s just Morgan Stanley and that’s in New York. They have their own unique reasons to be in New York, mostly so they can meet and shake down all their customers in Manhattan—no offense to Morgan Stanley, but I used to work there. For the rest of the country, those in remote places already, a lot of companies prefer that people keep working from home because they are happier, more productive, and it’s cheaper. Who can beat that? That’s why a lot of these productivity gains from the pandemic are permanent.

Q: Is there a recording of the previous webinar?

A: Yes, all of the webinars for the last 13 years are on the website and can be accessed through your account.

Q: What makes Microsoft (MSFT) a perfect-looking chart?

A: Constant higher lows and higher highs. They also have a fabulous business which is trading relatively cheaply to the rest of tech and the rest of the main market. Of course, they were a huge pandemic winner with all the people rushing out to buy PCs and using Microsoft operating software. I expect those gains to improve. The new game now is the “wide moat” strategy, which is buying companies that have near monopolies and can’t be assailed by other companies trying to break into their businesses. The wide moat businesses are of course Microsoft (MSFT), Amazon (AMZN), Facebook (FB) and Alphabet (GOOGL). That's the new investment philosophy; that's why money has been pouring back into the FANGs for a month now.

Q: Do you have any concerns about Facebook’s (FB) advertising ability, given the recent reduction of tracking capabilities of IOS 4.5 users?

A: Well first of all, IOS 4.5 users, the Apple operating system, are only 15% of the market in desktops and 24% of mobile phones. Second, every time one of these roadblocks appears, Facebook finds a way around it, and they end up taking in even more advertising revenue. That’s been the 15-year trend and I'm sticking to it.

Q: Is Caterpillar (CAT) a LEAP candidate right now?

A: Not yet, but we’re getting there. Like many of these domestic recovery plays, it is up 200% from the March lows where we recommended it. The best time to do LEAPS is after these big capitulation selloffs, and all we’ve really seen in most sectors this year is a slow grind down because there's just too much money sitting under the market trying to get into these stocks. Let’s see if (CAT) drops to the 50-day moving average at $185 and then ask me again.

Q: If you have the (FCX) LEAPS, should you keep them?

A: I would keep them since I'm looking for the stock to double from here over the next year. If you have the existing $45-$50 LEAPS, I would expect that to expire at its max profit point in January. But you may need to take a little pain in the interim until it turns.

Q: Should I bet the ranch on meme stocks like (AMC) and GameStop GME)?

A: Absolutely not, I’m amazed you haven't lost everything already.

Q: Do you think Exxon-Mobile (XOM) could rise 30% from here?

A: Yes, if we get a 30% rise in oil. We are in a medium-term countertrend rally in oil which will eventually burn out and take us to new lows. Trade against the trend at your own peril.

Q: Disneyland (DIS) in Paris is set to open. Is Disneyland a buy here?

A: Yes, we’re getting simultaneous openings of Disneyland’s worldwide. I’ve been to all of them. So yes, that will be a huge shot in the arm. Their streaming business is also going from strength to strength.

Q: How long will the China (FXI) slowdown last?

A: Not long, the slowdown now is a reaction to the superheated growth they had last year once their epidemic ended. We should get normalized growth in China at around 6% a year, and I expect China to rally once that happens.

Q: Have you changed your outlook on inflation, real or imagined?

A: I don’t think we’re going to have inflation; I buy the Fed's argument that any hot inflation numbers are temporary because we’re coming off of a one-on-one comparisons from when the economy was closed and the prices of many things went to zero. If you look at that inflation number, it had trouble written all over it. Some one third of the increase was from rental cars. One of the hottest components was used cars. You’re not going to get 100% year on year increases next year in rental or used cars.

Q: When you issue a trade alert, it’s always in the form of a call spread like the Microsoft (MSFT) $340-$370 vertical bull call spread. What are the pros and cons of doing this trade on the put side, like shorting a vertical bear put spread?

A: It’s six of one, half a dozen of the other. There are algorithms that arbitrage between the two positions that make sure that they’re never out of line by more than a few cents. I put out call spreads because they’re easier for beginners to understand. People get buying something and watching it go up. They don’t get borrowing something, selling it short, and buying it back cheaper.

Q: Will gold (GLD) prices go up?

A: Yes, when inflation goes up for real.

Q: What is the future of the gig economy? How will that affect Uber (UBER) and Lyft (LYFT)?

A: I like both, because they just got a big exemption from California on part time workers, and that is very positive for their business models.

Q: Do you think the government doesn’t want to cancel student debt because it will unleash inflation?

A: It’s the exact opposite. The government wants to forgive student debt because it will unleash inflation. If you add 10 million new consumers to the economy, that is very positive. As long as former students have tons of debt, horrible credit ratings, and are unable to buy homes or get credit cards, they are shut out of the economy. They can’t participate in the main economy by buying homes, shopping, or getting credit. The fact that the US has so many college grads is why businesses succeed here and fail in every other country. That should be encouraged.

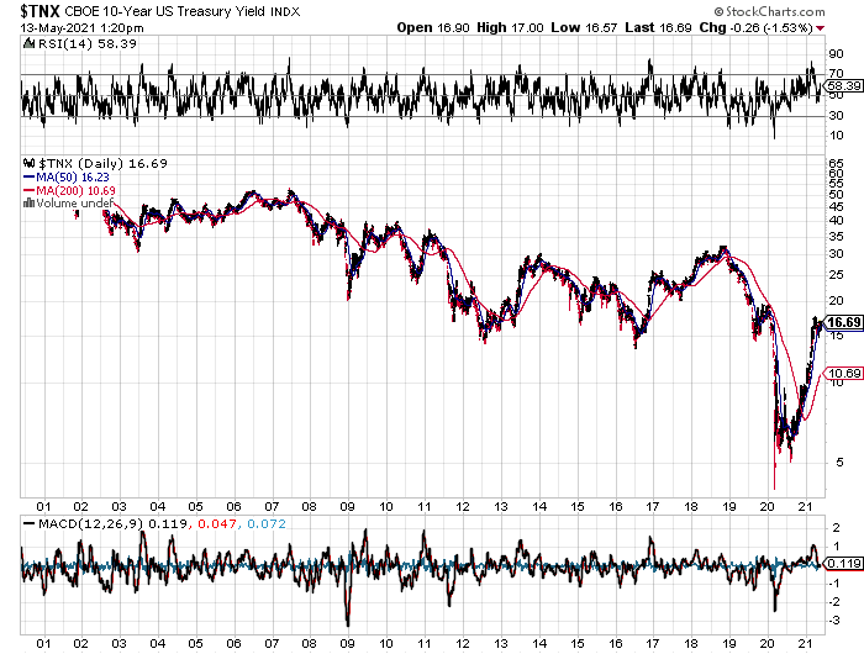

Q: Where is the United States US Treasury Bond Fund (TLT) headed?

A: Short term up, long term down.

Q: Options premiums are not melting away much today; I hope they start decaying after the Fed announcement.

A: In these elevated volatility periods—believe it or not, the (VIX) is still elevated compared to its historic levels—they hang on all the way to the very last day, before expiration, before they really melt the time value on options. It really does pay to run these into expiration now. When the VIX was down at like $9-$10, that was not the case.

Q: I bought a short term expiration going long the (TLT) to hedge my position; was this smart?

A: Yes, but only if you are a professional short-term trader. If you are in front of your screen all day and are able to catch these short term moves in (TLT), that is smart. My experience is that most individual investors don’t have the experience to do that, don’t want to sit in front of a screen all day, and would rather be playing golf. Such hedging strategies end up costing them money. Also, remember that half of the moves these days are at the opening; they’re overnight gap openings and you can’t catch that intraday trading—it’s not possible. So over time, the people who take the most risk make the most money. And that means the people who don’t hedge make the most money. But you have to be able to take the pain to do that. So that’s my philosophy talk on risk taking.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trade