Mad Hedge Technology Letter

June 11, 2018

Fiat Lux

Featured Trade:

(HERE ARE SOME GREAT SECOND-TIER CLOUD PLAYS TO SALT AWAY),

(DOCU), (ZUO), (ZS), (MSFT), (AMZN)

Tag Archive for: (MSFT)

The year of the cloud has been one of the most successful themes for the Mad Hedge Technology Letter since inception and rightly so.

The heavy hitters are knocking it out of the park with the top gangbuster firms facing no impediment to success.

As these firms crack on, it seems there is not a day that passes by where Amazon (AMZN) or Microsoft (MSFT) do not close up 1% for the day.

If you are feeling nervous and believe the top cloud plays are getting too frothy for your taste, even though they are not, it is time to look at alternative parts of the cloud ecosphere that could tickle your fancy.

The second-tier cloud companies focusing on a particular niche of the market is the perfect place to identify companies that are growing at higher rates than the top cloud companies in terms of revenue expansion.

Amazon, because of its sheer size, will find it harder to double its revenue in the same amount of time as cloud companies with annual revenue of just a few hundred million dollars.

Zscaler (ZS) is a cloud security company that I advised readers to buy on April,16, at $29 and after a blowout quarterly report the stock touched the $42 handle intraday.

This company is a solid buy, especially in light of the General Data Protection Regulation (GDPR) and a newfound, broad-based emphasis on Internet security that will usher in a new injection of cloud security spending.

Zscaler CEO Jay Chaudhry delivered a glorious quarterly performance and the only direction this company is going is up.

All told, Zscaler processes in excess of 45 billion Internet requests per day during peak periods.

It detects and blocks more than 100 million daily threats while performing more than 120,000 unique daily security updates.

The end result is far superior security than traditional outlets. That's the whole point.

The cloud security company was able to inspire business to a 49% YOY pace of growth and calculated billings were up 73% YOY to $54.7 million.

The quarter's success didn't stop there with operating margins gaining 9% YOY helping Zscaler go cash free positive for the quarter.

The type of security products it offers is part of an annual $17.7 billion market and rapidly expanding.

Firms are incentivized to adopt these products because reduced cost on bandwidth and lower network equipment costs benefit the bottom line.

A mobile dominant world is fast approaching, and Zscaler has positioned itself perfectly to take advantage of the new pipeline of business coming its way.

The slew of new signed contracts reinforces this trend.

The most prominent deals were with a Fortune 500 medical equipment company that purchased a bundle including a Cloud Firewall, Sandbox and Data Loss Prevention for 40,000 users.

It followed that up with a deal with a European bank that added the business bundle with SSL inspection and data loss prevention (DLP) for more than 70,000 users driven by the business moving to Office 365.

Zscaler kept going strong with another Fortune 500 tech company joining its lineup, integrating the transformation bundle for 20,000 employees and contractors just six months ago,

They were thrilled with the products, leading them to buy an additional 25,000 seats and now have all 45,000 employees served by Zscaler.

A global 500 IT services and products company in Asia went for the entry level professional bundle covering10,000 users in Q2.

It expanded the next quarter with the same bundle for more than 130,000 users domestically.

Forecasted revenue is expected to be in the range of $184 million to $185 million, substantially larger than the $126 million of revenue in 2017.

Once annual revenues start eclipsing the several billion-dollar mark, growth becomes tougher to grind out.

Zscaler is headed by an old hand and understands the market in detail.

The firm will be in a growth sweet spot for the foreseeable future. Subscribers who do not mind taking on the added risk could expect these investments to pay off many times over.

Another niche cloud company Zuora (ZUO) is performing briskly.

I recommended this stock the same day as Zscaler when it was trading at $20.50. The stock is up big, rocketing to $28.50 at the time of this writing.

Zuora is a company focused on software that helps companies manage their subscriptions business, which has been all the rage for tech companies.

The software as a service (SaaS) model has become the de-facto standard to bill for tech services, and Zuora helps automate and execute.

First quarter revenue surged 60% to $51.7 million.

Zuora's retention rate of 110% increased to 112%, demonstrating that existing customers buy premium add-ons and stick around in its ecosystem.

Zuora increased the numbers of clients with an active contract value greater than $100,000 by 6% to 441, resulting in a net add of 26.

Zscaler and Zuora are around the same size and could experience similar bullish price trajectories in the stock going forward.

DocuSign (DOCU), a digital signature software company, is another niche player whose services have been valuable in the business environment.

Instead of scrawling out your name with a quill and ink, clicking to sign makes the process faster than ever.

The stickiness of its services led Forbes to anoint DocuSign as the fourth best cloud company on the Forbes Cloud 100 list in 2017.

Last year saw DocuSign blow past the half a billion-number bringing in revenue of $518 million, up 36% YOY.

The lion's share of its business comes from its subscription business carving out $484 million in 2017, passing the $348 million in 2016.

DocuSign set an IPO price range between $24 to $26 in April 2018, and the stock has more than doubled to $58 today.

Do not fight against the cloud; embrace it like your lovable pet dog. There is no reason to short these stocks because chances are likely you will get badly burned on these ultimate buy on the dip stocks.

However, DocuSign has seldom even dipped, even in the face of a trade war, crushing dip buyers' dreams.

It has gone up in a straight line.

Only once since its late April IPO has there been a pullback of more than $1.50, and that happened in mid-May when the stock went from $45.50 to $43.

Remember, the trend is your friend.

Zscaler's 37% bump to its share prices after the earnings beat is why you want to get into this stock.

The moves up are legendary.

Zuora's earnings beat earned them a not-too-shabby 20% one-day return as well.

No matter how well Amazon does, there is no 37% up move in one day unless it finds the cure for cancer in a single pill form.

As Amazon and Microsoft grow stronger, so does the appetite for these niche cloud services.

The tide will lift all boats and choosing either a dinghy or a luxury yacht will stand you in good stead.

_________________________________________________________________________________________________

Quote of the Day

"I don't care about revenues," - said Cofounder and Executive Chairman of Alibaba Jack Ma.

Mad Hedge Technology Letter

June 6, 2018

Fiat Lux

Featured Trade:

(SHOULD MICROSOFT BE A FANG?),

(MSFT), (AAPL), (AMZN), (MU), (GOOGL)

Microsoft's (MSFT) code grab of GitHub was another virtuoso bit of business by Microsoft CEO Satya Nadella.

Bill Gates' old stomping ground has been identified as a top 3 tech stock by the Mad Hedge Technology Letter since the early days of the letter.

A company with Amazon-esque growth and Apple-like profits is hard to beat.

There is little doubt that Microsoft will be leading the economy for the foreseeable future and its purchase of GitHub for $7.5 billion, a source code library and platform for developers to collaborate together, is testimony that Microsoft is developer friendly and raises its attractiveness level to the best developers on the market.

Universally, this underlines the strength of large-cap tech that keeps strengthening in an attempt to eclipse the competition.

Large-cap tech outperformance is one of the main overarching narratives in equity markets this year.

Investors have been handed more and more bullish evidence that has made Morgan Stanley's downgrade of Micron (MU) absurd.

The ultra-competitive environment tech industry is fighting tooth and nail to find the best technology talent around the world.

GitHub is the largest host of source code the world has ever seen and earns revenue by charging corporate customers who run projects on its platform.

This is definitely not a revenue grab as GitHub's marginal revenue is beside the point.

Upon the announcement, Microsoft shares traded higher confirming the stance of investors treating Microsoft as a super growth stock and not a legacy company of yore that focuses on extracting profits while keeping overhead low.

Growth is about spending and spending some more.

This San Francisco-based company plays host to 24 million developers and has become a critical platform for developers working on collaborative projects for Apple (AAPL), Alphabet (GOOGL), and Amazon developers around the world.

Microsoft is its biggest contributor and the purchase makes sense long term and short term.

GitHub has a de-facto monopoly of open source coding repositories. There is only one game in town for developers to collaborate on, boding well for Microsoft.

Not only will Microsoft have the biggest library of code in the world, but the monetization pathway of GitHub squarely falls on the shoulders of Microsoft Azure - Microsoft's sensational cloud business.

GitHub is just another tool that will be incorporated into its cloud and is part of the strategy to surpass Amazon as the No. 1 cloud provider.

Microsoft envisages developers and businessmen working in concert on Microsoft's cloud using its proprietary software and services that will happily feed through to the bottom line in a material way.

Look for Microsoft to keep adding premium selective parts to its software and services lineup.

As for individual developers, GitHub has been the platform to display their talents.

It is commonplace during interviews for developers to point out contributions to projects through GitHub, giving them an edge in the hiring process.

Any reputable developer should have repositories on GitHub chronicling their every move.

Every major tech company deeply respects the functionality of GitHub and what it brings to the industry.

This is not just a flash in the pan.

Crucially, the plethora of new data access about coders streaming into the Redmond, Washington, offices is a dream come true.

This will also allow Microsoft to identify and recruit the best of the best in an algorithmic method to the dismay of other tech companies.

Theoretically, the company could create an in-house ranking system of developers using the data and automate its HR department while topping it off with some artificial intelligence sauce.

There is certain to be untold, untapped talent hidden away in the layers of GitHub repositories. Once Microsoft combs through the nitty-gritty, surely a slew of contract offers will head the way for the dark horses roaming around GitHub.

In a sellers' market, the buyers find you and pay you more than the market price and not the other way around.

GitHub flirted with the possibility of going public before meeting with Nadella.

The meeting blew away GitHub leaving management impressed.

That smoothed the way for the decision to accept Nadella's offer of $7.5 billion paid in Microsoft stock.

The inflated price was a head turner.

Just three years ago, the last private round of valuation estimated GitHub at $2 billion in 2015.

Microsoft even floated the idea of buying GitHub for $5 billion in informal talks at one point.

Therefore, the $7.5 billion in stock paid to GitHub is considered a healthy premium to the market price.

Even with the inflated price, this move was a no-brainer.

The deal will see Microsoft's Vice President Nat Friedman take the reins at GitHub as CEO. He will be instructed by Nadella how to exactly realize the perfect fusion between Microsoft Azure and GitHub's code treasure trove.

Naturally, there is no guarantee all 28 million GitHub users will be coding on the Azure platform. However, if just a few million convert and adopt the Azure platform, then a GitHub purchase will seem like a massive bargain.

It's entirely possible that in the near-term future, Microsoft will be crowned as the best place in the world to work as a developer.

If this does not come to fruition, Microsoft will be in the ballpark of the top echelon.

The ability to recruit the best developers in the world is reinforced by its other big-name purchase of LinkedIn, a job networking site purchased for $26.2 billion in 2016.

LinkedIn and the data that came with it, is another salient tool helping Microsoft identify inefficiencies in the job market.

The historical progression of employees' careers is digitized, and trends can be manipulated from the data.

Microsoft will be able to understand more about the state of the job market than any other company in the world.

Ownership of the biggest coding platform, largest job networking site, and massive amounts of prized data resulting from these platforms are precious gems inside of Microsoft's portfolio.

All of these new functions will derive synergies from each other helping evolve Microsoft into a stronger company.

No doubt there will be GitHub links showing up in LinkedIn profiles.

The applications are unlimited.

In the future it might be difficult to entirely avoid the Microsoft ecosystem. The conscious decision to become even more developer friendly is poised to pay dividends in the quality of its tech staff.

Microsoft will have to extend an olive branch to the portion of developers who disagree with this purchase.

A small minority is skeptical.

The integrity of the platform will have the potential to be compromised favoring Microsoft's narrow interests.

Nadella will need to do some smoothing over with the maverick developers to get them on board with everybody else.

Even though some developers are worried the platform will be undermined, certainly the existing developers at Microsoft are jumping with joy about this development.

The GitHub buy will aid Microsoft developers to build more unique cloud products to sell as add-ons.

Venture capital company Andreessen Horowitz will be rewarded with a $1 billion pay packet from its $100 million investment into GitHub.

A cool 10-fold return.

These were the precise deals that Microsoft used to lose out to the vaunted FANGs.

It shows how far Microsoft has come in such a short amount of time.

Smartly, Nadella has used the cash pile to draw in businesses that have synergies with the existing Microsoft ecosystem.

GitHub is another example of round pegs fitting into round holes.

Microsoft is a darling of the Mad Hedge Technology Letter, and now that it has crossed the $100 threshold, this price level will act as ironclad support.

If the stock somehow gets caught up in macro-headwinds and drops to $95, consider it a gift from God.

_________________________________________________________________________________________________

Quote of the Day

"School districts in the U.S. don't adopt technology very quickly," - said co-founder and CEO of Netflix Reed Hastings.

Global Market Comments

June 4, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 13, 2018, PHILADELPHIA, PA, GLOBAL STRATEGY LUNCHEON)

(THE MARKET OUTLOOK FOR THE WEEK AHEAD, or NEW ALL-TIME HIGHS AND NEW ALL-TIME HIGHS),

(AAPL), (FB), (AMZN), (MSFT), (TLT)

Mad Hedge Technology Letter

June 4, 2018

Fiat Lux

Featured Trade:

(THE INNOVATOR'S DILEMMA),

(UBER), (WMT), (SNAP), (MSFT), (GOOGL), (AAPL), (GM), (IBM)

We knew the May Nonfarm Payroll Report was coming in hot when the president leaked the numbers ahead of time. He tweeted that he "Was looking forward to" the numbers hours before the official release.

Last month, when the report was weak, we heard nary a word from Twitter. Just add that to the ever-growing list of unpredictables we traders have to deal with on a daily basis.

As for myself, I was looking for robust numbers last Tuesday when I piled on an aggressive, highly leveraged short position in the bond market, right at the four months highs. When bonds collapsed my reward was a 62.50% profit in only three trading days.

In the blink of an eye, we have made back half of the drop in interest rates prompted by the Italian political crisis. Ten-year U.S. Treasury yields plunged from 3.12% all the way down to 2.75% and are now back up to 2.92%. Bonds have almost fallen three points in three days.

This trade instructs you on the merits of going outright long options instead of more conservative spreads when you expect a very sharp, rapid move in the immediate term.

The result was to take the performance of the Mad Hedge Trade Alert Service to yet another all-time high. Those who signed up at any time in the past 12 months have to be extremely happy.

After one trading day, my June return is +2.94%, my year-to-date return stands at a robust 23.31%, my trailing one-year return has risen to 59.20%, and my eight-year profit sits at a 299.78% apex.

The payroll report suggests that the nine-year economic expansion will easily growth to 10. Never mind that we are putting it all on an American Express card and that our kids are going to have to pick up the tab. For now, it's happy days.

That means my 2018 year-end forecast is alive and well for a (SPY) of 3,000. If earnings continue to grow at a 25% annual rate and you assume a modest 17.5 X, getting there is a chip shot. Next year is another story, when year-on-year growth rates fall to zero.

The jobs report came in at 223,000 versus the three-month average of 175,000, and the Headline Unemployment Rate dropped to 3.8%, a new decade low. Average Hourly Earnings rose to an inflationary 0.3%.

Retail gained 31,0000 jobs, Health Care 29,000, and Construction 25,000. Only Temporary Workers lost 7,800.

The broader U-6 "discouraged worker" unemployment rate fell to 7.6%, a 17-year low.

The major hallmark of the week was an upside breakout of technology. Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), and Facebook (FB) all hit historic highs.

I don't know why tech is breaking out here. Maybe the market is discounting another round of blockbuster quarterly earnings that starts in two months. Possibly the tech growth rate is accelerating at the granular level.

Perhaps there is nothing else to buy. But for whatever reason, tech is going up and I want in. Tech is the secular growth story of our generation and will remain so for the foreseeable future.

The smartest that I have done this year is to start my Mad Hedge Technology Letter in February as it added 60 hours of research into tech companies into our research mix. As a result, the readers are swimming in profits.

This coming week is nearly clueless in terms of hard data releases.

On Monday, June 4, at 10:00 AM, we get May Factory Orders.

On Tuesday, June 5, May PMI Services is announced.

On Wednesday, June 6, at 7:00 AM, the MBA Mortgage Applications come out.

Thursday, June 7, leads with the Weekly Jobless Claims at 8:30 AM EST, which saw a fall of 11,000 last week from a 43-year low.

On Friday, June 8, at 8:30 AM EST, we get the Baker Hughes Rig Count at 1:00 PM EST, which rose by only 1 last week.

As for me, I will be glued to my TV watching the local Golden State Warriors trounce the Cleveland Cavaliers. That's providing they can overcome LeBron James, who seems to be a force of nature.

Good Luck and Good Trading.

New Highs!

I must confess, innovation can't be taught.

You are innovative, or you aren't. Don't pretend otherwise.

Innovation drives companies to outperform.

The economic environment becomes more cutthroat by the day rendering complacent companies obsolete.

Top-quality innovation leading to outstanding entrepreneurship is a well-traversed theme transcending industries across the American economic landscape.

The reservoir of innovation in 2018 is primarily flowing from one narrow source - the tech sector.

This is the primary motive for many adjacent industries to incorporate tech expertise into existing and commonly ancient legacy systems.

Tech promises laggards a ride atop the gravy chain.

In many instances, these companies are grappling with existential threats from all directions.

The best example is Walmart (WMT), which effectively mutated into the next FANG with its majority stake in Indian e-commerce juggernaut Flipkart. This deal followed its purchase of Jet.com in 2016, which was its first foothold in the e-commerce world.

Traditional companies are becoming tech companies because of the ability to innovate all leads through the fingertips of talented coders.

When all roads lead to Rome, you will have to go through Rome.

The hunger for innovation has had major implications to the financial side of technology.

The story picks up from a recent report disclosing the 2017 remuneration of co-founder and CEO of Instagram competitor Snapchat (SNAP) Evan Spiegel.

The $637.8 million he received in 2017 was the third-highest annual compensation ever to be collected by a CEO.

Snapchat has tanked following its 2017 IPO and the main reason is Facebook is stealing its lunch and leaving Snap the crumbs on which to nibble.

Instagram, using a cunning strategy of cloning Snap's best features, single-handedly bludgeoned Snap's share price cutting it by half after the successfully launched IPO.

Snap has been an unequivocal sell on the rallies stock since the inception of the Mad Hedge Technology Letter and the disastrous redesign did no favors either.

My first risk off recommendation was Snapchat and at the time it was trading at $19. To revisit the story, please click here.

Microsoft (MSFT) is a great stock because it posts accelerated revenue and earnings, while Snapchat is a terrible company because it produces accelerated losses and lousy user growth.

A company almost 100 times smaller than Microsoft should not be struggling to grow.

It's a failure of epic proportions.

Small companies expand briskly because the law of numbers is leveraged in their favor and the tiniest bump of additional business has a larger effect on the bottom line.

As it stands, Snapchat lost $373 million in 2015, and followed that up with a disastrous $514 million loss in 2016, and a gigantic $3.45 billion loss in 2017.

Losses accelerated by 800% but annual revenue only doubled last year.

It was no shocker that the poor relative performance resulted in the sacking of 100 Snapchat developers.

Smart people would assume an annual salary of this magnitude (Spiegel's) would be the result of excellent performance.

Why else would a CEO get a lavish payout?

I'll explain.

The demand for tech knows no bounds.

In this environment, venture capitalists will pay up for brilliant ideas.

The problem is that brilliant ideas don't grow on trees.

The few cutting-edge ideas have stacks of money thrown at them.

In this sellers' market, founders can cherry-pick the best financing deal that will enrich them the quickest and empower them the most.

Multiple offers have become the norm just as with the Silicon Valley housing market.

The consequences are the premium for these brilliant ideas keeps rising and investors keep paying higher prices without a second thought.

Therefore, founders and CEOs are opting for the financial packages that offer them bulletproof voting shares, allowing the innovators to control operations to the very last detail.

The founders are responsible for leading innovation, and investors are offering glorious pay terms for this innovation because it can't be substituted. Low-quality tech has less of a premium because the technology can easily be rebranded and substituted.

Technology from the ground up is slowly being automated away leaving runaway valuations the norm.

Giving the keys to the Ferrari makes sense as tech companies formulate long-term strategies based on scale. And securing job security without the threat of an activist takeover offers peace of mind for CEOs who are focused on the daily grind.

Knowing their baby won't get stolen from the carriage goes a long way in tech land.

Venture capitalists are reticent about following through with proper governance because they do not want to alienate the innovators who could choose to stop innovating.

These investors also know that tech is the least regulated industry in the world, so it's better to turn a blind eye to cunning growth strategies that push the border of regulation.

The competition to fund these emerging tech companies is borderline criminal.

Uber declined a $3 billion investment by no other than the Oracle of Omaha Warren Buffett.

Buffett described himself as a "great admirer" of Uber CEO Dara Khosrowshahi.

Uber is one of the most unlikely Warren Buffett investments because it doesn't create anything and burns cash faster than a Kardashian.

Buffett's faith in Uber underscores the reliance on tech to fuel the stock market to new heights.

Buffett also admitted mistakes on missing out on Alphabet (GOOGL) and Apple (AAPL).

Rightly so.

Then add in the mix of SoftBank's $100 billion vision fund that just announced an upcoming sequel with another $100 billion vision fund.

Where is all this money flowing into?

Of the tech companies that went through an IPO last year backed by venture capitalist money, 67% relinquished superior voting rights to key founders, a rise of 54% since 2010.

Compare that to non-tech companies that only allow 10% to 15% of CEOs to institute a voting structure that will put them in charge indefinitely.

In many instances, the persona of these ultra-famous tech CEOs has taken on a life of its own.

Elon Musk, CEO of Tesla, is the most prominent example of a celebrity tech innovator milking every possible penny from his shareholders and is not shy about flaunting it.

News has it that Musk needs to go back to the well for another stage of financing later this year.

Don't worry, the money will be there in this climate.

Buffett's rejection was due to losing out to SoftBank, which beat out Buffett to invest in Uber.

SoftBank just announced a $3.35 billion investment into GM's (GM) autonomous driving unit called Cruise enhancing the best big data portfolio in the world.

At this pace, CEO of SoftBank Masayoshi Son will have a piece of every major big data company in the world.

This all bodes well for tech equities as the insatiable hunt for emerging, innovative tech spills over into daily equity market driving up the prices for all the top innovating public companies such as Salesforce, Amazon, Microsoft and Netflix.

Buffett, down on his luck after being shafted by Uber, picked up more Apple shares.

He sold all his IBM (IBM) shares after reading the Mad Hedge Technology Letter advising him to stay away from legacy companies.

Smart move, Warren. You can pick up the tab for our next lunch date.

If you have a few billion to throw around, expect multiple offers over the asking price for any high-grade tech innovation.

The going rate is shooting through the roof and you might NEVER be able to sack the founder.

Caveat emptor.

_________________________________________________________________________________________________

Quote of the Day

"We knew that Lyft was going to raise a ton of money. And we went (to their investors): 'Just so you know, we're going to be fund-raising after this, so before you decide whether you want to invest in them, just make sure you know that we are going to be fund-raising immediately after.' " - said former CEO and founder of Uber Travis Kalanick when asked how he copes with competition.

Mad Hedge Technology Letter

May 31, 2018

Fiat Lux

Featured Trade:

(HOW SALESFORCE RAN OVER ORACLE),

(CRM), (ORCL), (MU), (RHT), (MSFT), (INTC), (AMZN), (GOOGL)

Modern tech has an unseen dark side to it.

Coders relish the opaqueness surrounding the industry infatuated with developing the next big thing to take Silicon Valley by storm.

There is nothing opaque about the Mad Hedge Technology Letter.

I grind out recommendations and you follow them. Period. End of story.

To put it mildly, the letter has gotten off to a flying start since its inception in February 2018, and there is no looking back, only looking forward.

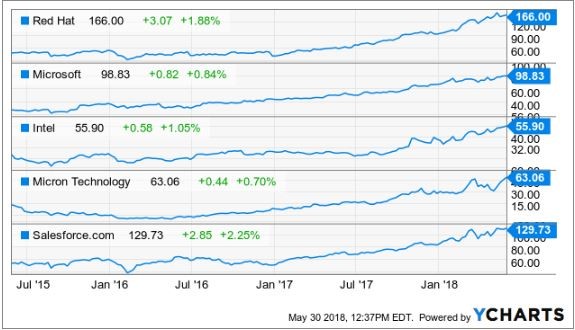

Micron (MU), Red Hat (RHT), Microsoft (MSFT), and Intel (INTC), just to name a few, have been solid recommendations standing up to all the nonsense and mayhem permeating throughout the periodically irrational markets.

Have you noticed lately when you open up the morning paper while sipping on a steaming mug of Blue Bottle Coffee, that almost every story is about technology?

It's not a mistake. I swear.

Technology is permeating into the nooks and crannies of our society and the leaders of this movement are laughing all the way to the bank.

One of those aforementioned pioneers is no other than local lad, Salesforce CEO and perennial Facebook basher Marc Benioff.

I recommended Salesforce at $110 and it was one of the first positions in the Mad Hedge Technology portfolio.

You can't blame me.

I saw this stock pick from a million miles away and I will explain why.

Salesforce set ambitious targets that nobody thought were realistic at the time.

How high in the sky does Benioff want to build his castles?

By 2022, Marc Benioff set out sales targets of a colossal $20 billion per year.

Then Benioff gushed that Salesforce would pass the $40 billion mark, done and dusted by 2028 and $60 billion by 2034.

Remember that tech CEOs are incentivized to forecast ludicrous sales targets because it lures in the unknowledgeable investor.

Unknowledgeable or pure genius, it does not matter, Salesforce is an emphatic buy.

Salesforce is the ultimate growth stock.

In 2016, annual revenue came in at $6.67 billion, which is about the same size as a middle level semiconductor company.

They followed that up with $8.38 billion in 2017, demonstrating the parabolic shaped trajectory of the company.

At the end of fiscal year 2017, Salesforce announced that it expects revenue of around $12.60 billion in 2019.

The latest earnings report, Benioff disclosed full year guidance of $13.13 billion.

This puts Salesforce in the running to achieve its lofty aspirations.

Apparently, the castles Benioff is building aren't in the sky after all.

Theoretically, if Benioff expands the business into a $16 billion to $16.5 billion business by 2019, Salesforce will have a more than likely chance to pass the $20 billion mark by the end of 2020, a full two years than initially thought.

Salesforce will have ample wiggle room on the way to $20 billion if it is 2022 for which it aims.

Why am I rambling on about revenue?

It's the only metric that Salesforce investors value.

The company registered two straight years of less than $200 million in profits then followed it up with a less than stellar 2016 where it lost almost $50 million.

Don't expect any dividends from this neck of the woods anytime soon especially after acquiring MuleSoft, an integration software company, for $6.5 billion last quarter.

This purchase will add another $315 million of annual revenue to Salesforce's quest of eclipsing its future sales targets. This was after MuleSoft made $296.5 million in 2017 before it became a part of Marc Benioff's stable.

Benioff has proved a shrewd dealmaker, taking advantage of cheap capital to add suitable parts to his business.

Since 2016, Benioff has snapped more than 50 niche software companies that he rebrands as Salesforce products and sells them as add-on products.

This is further evidence that any funds available will be allocated toward reinvestment into products and services deeming any future dividend inconceivable, especially with the elevated revenue targets to surpass.

As for the business. Do we still need to talk about it?

Rip-roaring growth was seen across the board with total revenue increasing 25%.

Investors should stay away from any cloud company that is growing less than 20%.

Market intelligence firm International Data Corporation (IDC) voted Salesforce as the No. 1 client relationship management (CRM) platform for the fifth consecutive year.

It is the industry leader in sales, marketing, service, and increased market share in 2017, more than its closest competitors.

Larry Ellison must be tearing his hair out as Oracle's (ORCL) share price has been excommunicated to purgatory indefinitely.

Oracle is a company that I have been pounding on the tables to stay away from.

The Mad Hedge Technology Letter seldom recommends legacy companies that are still legacy companies.

Driving past his former estate, emanating from a sparkling perch in Incline Village overlooking Lake Tahoe, my neighbor gives me the goose bumps.

The property was later sold for $20.35 million. All told, Larry has around $100 million invested in real estate dotted around Incline Village. I sarcastically mentioned to him last time we bumped into each other to call me immediately when his $90 million estate in Kyoto, Japan, hits the market.

Oracle's position in the pecking order is a telltale sign of the inability to land the creme de la creme government contracts that ostensibly fall into Amazon (AMZN), Alphabet (GOOGL), and Microsoft's lap.

And it's not surprising that Larry is spending more time tending to his vast array of glittering luxury properties around the world rather than running Oracle.

Oracle is like a deer caught in the headlights and Marc Benioff is at the wheel.

On the Forbes 500 rankings, Salesforce has moved up almost 200 spots.

This position will rise as Salesforce is under contract booking a further $20.4 billion of commitments driven by its subscription services offering cloud products.

On the domestic contract front, it was much of the same for Salesforce, which inked premium deals with the U.S. Department of Agriculture, Kering, and sports apparel giant Adidas.

International companies such as Philips and Santander UK are expanding their relationships with Salesforce. A firm nod of approval.

Salesforce has been voted in the top three of most innovative companies for the past eight years by reputable Forbes magazine. The list was started in 2011, and it has never dropped out of the top three.

The gobs of innovation are the main logic behind the top five financial institutions expanding their relationship with Salesforce by an extra 70%.

Once companies start using the CRM platform, they become mesmerized with the premium add-ons that help companies run more efficiently.

Benioff has been a huge proponent of artificial intelligence (A.I.) and is an outsized catalyst to product enhancement gains.

Salesforce has taken Einstein, it's A.I. platform, and allowed all the applications to run through it.

The integration of Einstein has resulted in more than 2 billion correct predictions per day paying homage to the quality of A.I. engineering on display.

Instead of hiring a whole team of in-house data scientists, Salesforce is A.I. functionality by the bucket full and it is easy to use on its platform.

In some cases, incorporating Salesforce's A.I. into the business has bolstered other companies' top line by 15%.

Often, Salesforce's A.I. tools are declarative meaning the technology can identify solutions without a fixed formula.

Benioff has choreographed his strategy perfectly.

He is betting the ranch on unlocking data from legacy companies that migrate to his platform.

MuleSoft will help in this process of extracting value, then A.I. will supercharge the data, which is being unlocked.

What does this mean for Salesforce?

Higher revenue and more clients leading to accelerated growth. The share price has powered on north of $130, and after I recommended it at $110, I am convinced this stock will surge higher.

Salesforce is an absolute no-brainer buy on the dip.

Growth Means Shiny New Office Buildings

_________________________________________________________________________________________________

Quote of the Day

"If we become leaders in Artificial Intelligence, we will share this know-how with the entire world, the same way we share our nuclear technologies today." - said current President of Russia, Vladimir Vladimirovich Putin.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.