Mad Hedge Technology Letter

May 31, 2018

Fiat Lux

Featured Trade:

(HOW SALESFORCE RAN OVER ORACLE),

(CRM), (ORCL), (MU), (RHT), (MSFT), (INTC), (AMZN), (GOOGL)

Mad Hedge Technology Letter

May 31, 2018

Fiat Lux

Featured Trade:

(HOW SALESFORCE RAN OVER ORACLE),

(CRM), (ORCL), (MU), (RHT), (MSFT), (INTC), (AMZN), (GOOGL)

Modern tech has an unseen dark side to it.

Coders relish the opaqueness surrounding the industry infatuated with developing the next big thing to take Silicon Valley by storm.

There is nothing opaque about the Mad Hedge Technology Letter.

I grind out recommendations and you follow them. Period. End of story.

To put it mildly, the letter has gotten off to a flying start since its inception in February 2018, and there is no looking back, only looking forward.

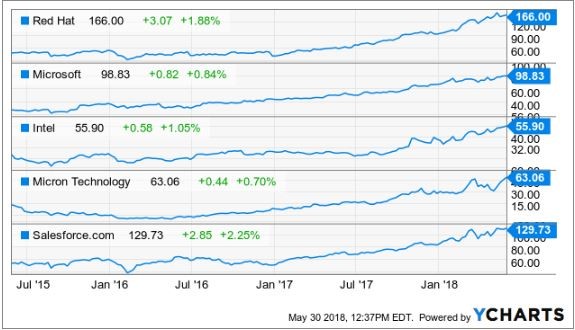

Micron (MU), Red Hat (RHT), Microsoft (MSFT), and Intel (INTC), just to name a few, have been solid recommendations standing up to all the nonsense and mayhem permeating throughout the periodically irrational markets.

Have you noticed lately when you open up the morning paper while sipping on a steaming mug of Blue Bottle Coffee, that almost every story is about technology?

It's not a mistake. I swear.

Technology is permeating into the nooks and crannies of our society and the leaders of this movement are laughing all the way to the bank.

One of those aforementioned pioneers is no other than local lad, Salesforce CEO and perennial Facebook basher Marc Benioff.

I recommended Salesforce at $110 and it was one of the first positions in the Mad Hedge Technology portfolio.

You can't blame me.

I saw this stock pick from a million miles away and I will explain why.

Salesforce set ambitious targets that nobody thought were realistic at the time.

How high in the sky does Benioff want to build his castles?

By 2022, Marc Benioff set out sales targets of a colossal $20 billion per year.

Then Benioff gushed that Salesforce would pass the $40 billion mark, done and dusted by 2028 and $60 billion by 2034.

Remember that tech CEOs are incentivized to forecast ludicrous sales targets because it lures in the unknowledgeable investor.

Unknowledgeable or pure genius, it does not matter, Salesforce is an emphatic buy.

Salesforce is the ultimate growth stock.

In 2016, annual revenue came in at $6.67 billion, which is about the same size as a middle level semiconductor company.

They followed that up with $8.38 billion in 2017, demonstrating the parabolic shaped trajectory of the company.

At the end of fiscal year 2017, Salesforce announced that it expects revenue of around $12.60 billion in 2019.

The latest earnings report, Benioff disclosed full year guidance of $13.13 billion.

This puts Salesforce in the running to achieve its lofty aspirations.

Apparently, the castles Benioff is building aren't in the sky after all.

Theoretically, if Benioff expands the business into a $16 billion to $16.5 billion business by 2019, Salesforce will have a more than likely chance to pass the $20 billion mark by the end of 2020, a full two years than initially thought.

Salesforce will have ample wiggle room on the way to $20 billion if it is 2022 for which it aims.

Why am I rambling on about revenue?

It's the only metric that Salesforce investors value.

The company registered two straight years of less than $200 million in profits then followed it up with a less than stellar 2016 where it lost almost $50 million.

Don't expect any dividends from this neck of the woods anytime soon especially after acquiring MuleSoft, an integration software company, for $6.5 billion last quarter.

This purchase will add another $315 million of annual revenue to Salesforce's quest of eclipsing its future sales targets. This was after MuleSoft made $296.5 million in 2017 before it became a part of Marc Benioff's stable.

Benioff has proved a shrewd dealmaker, taking advantage of cheap capital to add suitable parts to his business.

Since 2016, Benioff has snapped more than 50 niche software companies that he rebrands as Salesforce products and sells them as add-on products.

This is further evidence that any funds available will be allocated toward reinvestment into products and services deeming any future dividend inconceivable, especially with the elevated revenue targets to surpass.

As for the business. Do we still need to talk about it?

Rip-roaring growth was seen across the board with total revenue increasing 25%.

Investors should stay away from any cloud company that is growing less than 20%.

Market intelligence firm International Data Corporation (IDC) voted Salesforce as the No. 1 client relationship management (CRM) platform for the fifth consecutive year.

It is the industry leader in sales, marketing, service, and increased market share in 2017, more than its closest competitors.

Larry Ellison must be tearing his hair out as Oracle's (ORCL) share price has been excommunicated to purgatory indefinitely.

Oracle is a company that I have been pounding on the tables to stay away from.

The Mad Hedge Technology Letter seldom recommends legacy companies that are still legacy companies.

Driving past his former estate, emanating from a sparkling perch in Incline Village overlooking Lake Tahoe, my neighbor gives me the goose bumps.

The property was later sold for $20.35 million. All told, Larry has around $100 million invested in real estate dotted around Incline Village. I sarcastically mentioned to him last time we bumped into each other to call me immediately when his $90 million estate in Kyoto, Japan, hits the market.

Oracle's position in the pecking order is a telltale sign of the inability to land the creme de la creme government contracts that ostensibly fall into Amazon (AMZN), Alphabet (GOOGL), and Microsoft's lap.

And it's not surprising that Larry is spending more time tending to his vast array of glittering luxury properties around the world rather than running Oracle.

Oracle is like a deer caught in the headlights and Marc Benioff is at the wheel.

On the Forbes 500 rankings, Salesforce has moved up almost 200 spots.

This position will rise as Salesforce is under contract booking a further $20.4 billion of commitments driven by its subscription services offering cloud products.

On the domestic contract front, it was much of the same for Salesforce, which inked premium deals with the U.S. Department of Agriculture, Kering, and sports apparel giant Adidas.

International companies such as Philips and Santander UK are expanding their relationships with Salesforce. A firm nod of approval.

Salesforce has been voted in the top three of most innovative companies for the past eight years by reputable Forbes magazine. The list was started in 2011, and it has never dropped out of the top three.

The gobs of innovation are the main logic behind the top five financial institutions expanding their relationship with Salesforce by an extra 70%.

Once companies start using the CRM platform, they become mesmerized with the premium add-ons that help companies run more efficiently.

Benioff has been a huge proponent of artificial intelligence (A.I.) and is an outsized catalyst to product enhancement gains.

Salesforce has taken Einstein, it's A.I. platform, and allowed all the applications to run through it.

The integration of Einstein has resulted in more than 2 billion correct predictions per day paying homage to the quality of A.I. engineering on display.

Instead of hiring a whole team of in-house data scientists, Salesforce is A.I. functionality by the bucket full and it is easy to use on its platform.

In some cases, incorporating Salesforce's A.I. into the business has bolstered other companies' top line by 15%.

Often, Salesforce's A.I. tools are declarative meaning the technology can identify solutions without a fixed formula.

Benioff has choreographed his strategy perfectly.

He is betting the ranch on unlocking data from legacy companies that migrate to his platform.

MuleSoft will help in this process of extracting value, then A.I. will supercharge the data, which is being unlocked.

What does this mean for Salesforce?

Higher revenue and more clients leading to accelerated growth. The share price has powered on north of $130, and after I recommended it at $110, I am convinced this stock will surge higher.

Salesforce is an absolute no-brainer buy on the dip.

Growth Means Shiny New Office Buildings

_________________________________________________________________________________________________

Quote of the Day

"If we become leaders in Artificial Intelligence, we will share this know-how with the entire world, the same way we share our nuclear technologies today." - said current President of Russia, Vladimir Vladimirovich Putin.

Mad Hedge Technology Letter

May 29, 2018

Fiat Lux

Featured Trade:

(HERE ARE SOME EARLY 5G WIRELESS PLAYS),

(T), (VZ), (INTC), (MSFT), (QCOM), (MU), (LRCX), (CVX), (AMD), (NVDA), (AMAT)

How would you like to be part of the biggest business development in the history of mankind?

This revolution will increase business functionality up to 10 times while flattening costs by up to 90%.

Still interested?

Enter the Internet of Things (IoT).

The Internet of Things (IoT) can be boiled down to Internet connectivity with things.

Your luxury juice maker, hair removal kit, and multi-colored Post-its will soon be online.

No, you won't be able to have Tinder chats with the new connectivity, but embedded sensors, tracking technology, and data mining software will aggregate a digital dossier on how products are performing.

The data will be fed back to the manufacturing company offering a comprehensive and accurate review without ever asking a human.

The magic glue making IoT ubiquitous and stickier than a hornet's nest is the emergence and application of 5G.

4G is simply not fast enough to facilitate the astronomical surge in data these devices must process.

5G is the lubricant that makes IoT products a reality.

Verizon Communications (VZ) and AT&T (T) have been assiduously rolling out tests to select American cities as they lay the groundwork for the 5G revolution.

The aim is for these companies to deliver customers a velocious 1 Gbps (gigabits per second) wireless connection speed.

Delivering more than 10 times the average speed today will be a game changer.

America isn't the only one with skin in the game and some would say we are not even leading the pack.

China Mobile (CHL) is carrying out a bigger test in select Chinese cities, and Chinese telecom company Huawei can lay claim to 10% of the 5G patents.

Americans should start to notice broad-based adoption of 5G networks around 2020.

Once widespread usage materializes, watch out!

It will go down in history books as a transformational headline.

The IoT revolution will follow right after.

Until the 5G rollout is done and dusted, tech companies are licking their chops and preparing for one of the biggest shifts in the tech ecosphere affecting every product, service, and industry.

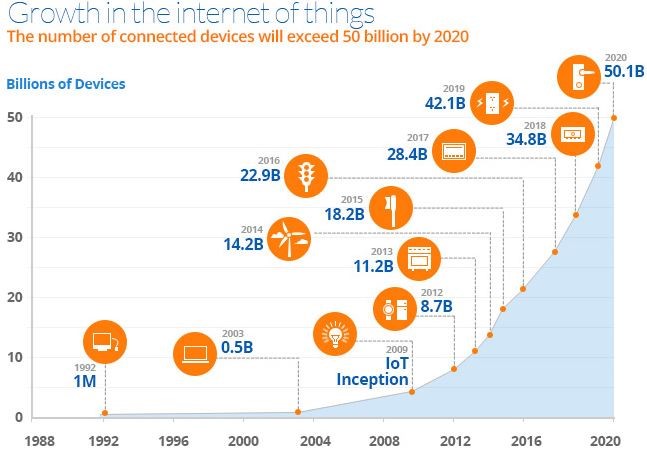

The worldwide IoT market is poised to mushroom into a $934 billion market by 2025 on the back of cloud computing, big data, autonomous transport technology, and a host of other rapidly emerging technology.

The arrival of 5G will have an astronomical network effect. Companies will be able to enhance product specs faster than before because of the feedback of data accumulated by the tracking technology and sensors.

The appearance of this flashy new technology will spawn yet another immeasurable migration to technological devices by 2020.

In just two years, the world will play host to more than 50 billion connected devices all pumping out data as well as consuming data.

What a frightful thought!

IoT's synergies with new 5G technology will have an unassailable influence on the business environment.

For instance, industrial products in the form of robots and equipment will be a huge winner with 5G and IoT technology.

The industrial IoT market is expected to sprout to $233 billion by 2023.

Robots will pervade deeply into economic provenance acting as the mule for brute strength heavy labor plus more advanced tasks as they become more sophisticated.

Total global spending related to IoT products will surpass 1.4 trillion dollars by 2021, according to the International Data Corporation (IDC).

IoT growth will become most robust in the thriving Asian markets fueled by a bonus tailwind of the fastest growing region in the world.

The advanced automation abilities of Germany and the U.K. will also give them a seat at the table.

Micron CEO Sanjay Mehrotra gushed about the future at Micron's investor day celebrating IoT and data as the way forward. Mehrotra explained that the explosion of IoT products will create a new tidal wave of "growing demand for storage and memory."

Chips are a great investment to grab exposure to the 5G, IoT, and big data movement.

Up until today, the last generation of technological innovation brought consumers computers and smartphones.

That world has moved on.

Open up your eyes and you will notice that literally everything will become a "data center on wheels or on feet."

To arrive at this stage, products will need chips.

As many high-grade chips as they can find.

Data centers are one segment in dire need of chips. This market will more than double from $29 billion in 2017 to $62 billion in 2021.

The general-purpose chip market for servers is cornered by Intel.

Industry insiders estimate Intel's market share at 98% to 99% of data center chips. Clientele are heavy hitters such as Amazon Web Services, Google, and Microsoft Azure along with other industry peers.

The only other players with data server chips out there are Qualcomm (QCOM) and Advanced Micro Devices Inc. (AMD).

However, there have been whispers of Qualcomm shutting down the 48-core Centriq 2400 chip for data centers that was launched only last November after head of Qualcomm's data center division, Anand Chandrasekher, was demoted via reassignment.

AMD's new data center chip, Epyc, has already claimed a few scalps with Baidu (BIDU) and Microsoft Azure promising to deploy the new design.

IoT integration is the path the world will take to adopting full-scale digitization.

Microsoft just announced at its own Build 2018 conference its plans to invest $5 billion into IoT in the next four years.

The Redmond, Washington-based company noted operational savings and productivity gains as two positive momentum drivers that will benefit IoT production.

Consulting firm A.T. Kearny identified IoT as the catalyst fueling a $1.9 trillion in productivity increases while shaving $177 billion off of expenses by 2020.

These cloud platforms give tech companies the optimal stage to win over the hearts and dollars of non-tech and tech companies that want to digitize services.

Many of these companies will have IoT products percolating in their portfolio.

Examples are rampant.

Schneider Electric in collaboration with Microsoft's IoT Azure platform brought solar energy to Nigeria by the bucket full.

The company successfully installed solar panels harnessing its performance using IoT technology through the Microsoft cloud.

Kohler rolled out a new lineup of smart kitchen appliances and bathroom fixtures coined "Kohler Konnect" with the help of Microsoft's Azure IoT platform.

Consumers will be able to remotely fill up the bathtub to a personalized temperature.

Real-time data analytics will be available to the consumer by using the bathroom mirror as a visual interface with touch screen functionality giving users the option to adjust settings to optimal levels on the fly.

Kohler's tie-up with Microsoft IoT technology has proved fruitful with product development time slashed in half.

To watch a video of Kohler's new budding relationship with Microsoft's Azure IoT platform, please click here.

It is safe to say operations will cut out the wastefulness using these new tools.

Look no further than legacy American stocks such as oil and gas producer Chevron (CVX), which wants a piece of the IoT pie.

Chevron announced a lengthy seven-year partnership with Microsoft's Azure platform.

The fiber optic cables inside oil production facilities generate more than 1 terabyte of data per day.

In the Houston, Texas, offices, sensors installed six miles below the surface shoot back data to engineers who monitor human safety and system operations on four continents from the Lone Star State.

The newest facility in Kazakhstan, using state-of-the-art technology, will produce more data than all the refineries in North America combined.

Using the aid of artificial intelligence (A.I.), computers will analyze seismic surveys. This pre-emptive technology customizes solutions before problems can germinate.

The new smart-work environment will multiply worker productivity that has been at best stagnant for the past generation.

To get in on the IoT action, buy shares of companies with solid IoT cloud platforms such as Microsoft and Amazon.

Buy best-of-breed chip companies such as Nvidia (NVDA), Intel (INTC), Advanced Micro Devices (AMD) and Micron (MU).

And buy tech companies that produce wafer fab equipment such as Applied Materials (AMAT) and Lam Research (LRCX).

_________________________________________________________________________________________________

Quote of the Day

"Don't be afraid to change the model." - said cofounder and CEO of Netflix Reed Hastings.

Mad Hedge Technology Letter

May 21, 2018

Fiat Lux

Featured Trade:

(HERE'S THE BIGGEST TECHNOLOGY CONTRACT IN HISTORY)

(AMZN), (MSFT), (ORCL), (IBM), (GOOGL)

The return of the Jedi is coming.

Luke Skywalker and Obi-Wan Kenobi will enter the cloud and use the force.

Not the Jedi of the famous George Lucas films, but JEDI - Joint Enterprise Defense Infrastructure commissioned by the Department of Defense.

This large contract is up for grabs.

Rumor has it that Amazon is in the driver's seat to become the government's right-hand man.

The purpose of this broad-based upgrade is to enhance communication channels among military branches by loading up operations into the cloud.

Artificial Intelligence (A.I.) and machine learning will be integrated as well.

One task slated for modernization includes the heaps of documents waiting to be translated from Arabic, Farsi, Chinese and other foreign languages into English.

A.I. will organize which documents have priority over others as well as aiding in raw translation. This will save the Department of Defense's overworked linguists thousands of hours in brute translation work.

As it stands, the government is grappling with an overlapping fractious system with legacy software up to 20 years old.

These legacy systems of yore are poor at keeping out the cyber criminals looking for a smash-and-data grab.

One instance where massive inefficiencies rear its ugly head is in the Department of Agriculture.

This department has 22 chief information officers that require seven more personal assistants inflating the IT budget.

The government could become the best turnaround story in the tech industry in years.

This turnaround could eventually become bigger than Microsoft and Cisco, which are the poster children for extreme cosmetic surgery in Silicon Valley.

The government burns $90 billion per year servicing IT operations, and JEDI is slated to offer an attractive sum of $100 billion over 10 years to a private company.

Not only will the Department of Defense modernize, but every part of the government will adopt new technologies.

Security is a priority for this administration after its legitimacy was questioned due to alleged nefarious Russian involvement.

The Committee on Foreign Investment in the United States (CFIUS) has buckled down rejecting a myriad of attempted foreign takeovers of cutting-edge tech companies stressing the need to properly harness local tech companies' ingenuity to the benefit of the country.

These new opportunities do not affect the already $1 billion per quarter that Alphabet (GOOGL) takes in from government servicing.

The $1 billion contract was given to Alphabet to develop the Algorithmic Warfare Cross-Functional Team industrially working on Project Maven.

Project Maven is the Department of Defense's attempt to integrate A.I. and machine learning into motion detector technology applied to surveillance drones using the Google cloud.

Project Maven received an additional boost to its objectives with an additional $100 million cash injection recently underlining the government's efforts to make warfare more efficient and less expensive.

Amazon Web Services (AWS) has also carved out a nice $5 billion per quarter business thanks to the power brokers in Washington.

Another side deal consummated recently has thrust Microsoft into the frame as well.

Microsoft (MSFT) agreed with the Office of the Director of National Intelligence to service 17 intelligence agencies with the Microsoft Azure cloud platform.

The deal was reported to be valued at "hundreds of million" of dollars.

Another separate deal agreed by both parties has Microsoft migrating another 3.4 million users and 4 million devices from the Department of Defense into the cloud.

All told, Microsoft has pulled in more than $1.3 billion of orders from the government in the past five years.

Bill Gates's old company was rewarded certification to supply the government with computers, operating systems, Microsoft Office, and the cloud services bolstering their credentials to potentially extract more government business.

The administration has adopted a winner takes all approach to the JEDI contract preferring one cloud provider to maintain the infrastructure.

Companies are scratching and clawing to get within a shout of winning this valuable revenue stream that could extrapolate down the road.

JEDI accounts for just 20% of the cloud possibilities for the tech companies in the government system.

The further 80% of digitization will happen down the road.

Firms are up in arms about the single platform solution and believe branching out to multiple platforms will come in use if part of the operation goes down.

Hybrid solutions are the norm for 80% of Fortune 500 companies.

As it is, International Business Machines Corp. (IBM), Oracle (ORCL), Alphabet, Amazon (AMZN), and Microsoft have been adamant that they are the best candidates for the job.

Amazon has been on a one-man mission mobilizing its all-star team of lobbyists to gain an edge.

Amazon has been part of the government's purse strings for quite some time.

It was awarded a $600 million contract in 2013.

Secretary of Defense James Mattis spoke about the relationship with Amazon in glowing terms characterizing Amazon's performance as "impressive" in terms of securing data and functionality.

The positive Amazon feedback has given AWS a head start. It hopes to capitalize on the biggest transfer of data to the cloud in modern history.

Once completed, departments will at last be able to access files from different branches on the same platform. This process is currently done manually.

Quickening the pace of modernization is a prerogative for the new administration.

President Donald Trump signed an executive order to spur on the process of getting rid of the decaying system.

Son-in-law Jared Kushner has also been an advocate of the agonizing overhaul.

This bold initiative ties in well with enhancing cybersecurity inside Washington at a time when hackers have penetrated legacy systems with ease.

Getting the White House up and running will improve the operation of the government. From an investor's point of view, it will add materially to the bottom line of companies that start to win more contracts.

This underscores the reliance of our government and economy on the large cap tech companies that are single-handedly propping up the current bull market.

The White House will wake up one day and understand that technology innovation is more powerful than ever, and even the mayhem inside the White House can't stop the digitization of politics.

Going forward Amazon and Microsoft should get a healthy boost to their overflowing coffers. Legacy companies such as IBM and Oracle could be punished by the government as well as investors for being legacy companies, which could lead the government to pass over IBM and Oracle.

Yes Mr. President ... An Upgrade Is Needed

_________________________________________________________________________________________________

Quote of the Day

"What would I do? I'd shut it down and give the money back to the shareholders." - said Michael Dell in 1997, the founder of Dell Technologies, when asked what he would do if he was in charge of Apple.

Global Market Comments

May 11, 2018

Fiat Lux

Featured Trade:

(WEDNESDAY, JUNE 13, 2018, PHILADELPHIA, PA, GLOBAL STRATEGY LUNCHEON),

(MAY 9 BIWEEKLY STRATEGY WEBINAR Q&A),

(FB), (MU), (NVDA), (AMZN), (GOOGL),

(TLT), (SPX), (MSFT), (DAL),

(MAD HEDGE DINNER WITH BEN BERNANKE)

Below please find subscribers' Q&A for the Mad Hedge Fund Trader May 9 Global Strategy Webinar with my guest co-host Bill Davis of the Mad Day Trader.

As usual, every asset class long and short was covered. You are certainly an inquisitive lot, and keep those questions coming!

Q: Would you still short Facebook (FB)?

A: Right now, no. I thought the dynamics changed off the last earnings report, so the answer is no. We have made a ton of money trading Facebook this year, and all of it has been from the long side.

Q: How will the election affect the market?

A: It will go down into the election, but you'll then get a strong rally as the uncertainty fades away. It really makes no difference who wins. It is the elimination of uncertainty that is the big issue.

Q: Do you have a price to buy Micron Technology (MU) or NVIDIA (NVDA), or do you want to wait for a crash day?

A: I want to wait for a crash day, because even though these are great companies, on the down days, they fall twice as fast as any other stock. Your entry point is very important in that situation.

Q: Do you see opportunities to sell short the U.S. Treasury bond market (TLT) again?

A: Yes. But wait for the four-point rally not the two-point rally.

Q: Rising interest rates should benefit banks - why are they such horrible performers?

A: The double in bank stocks in 2017 fully discounted this year's interest rate move. For banks to really perform interest rates have to move higher still, which they will eventually.

Q: When will the yield curve invert and what will be the implications?

A: You can take the Fed's current rate of interest rate rises (which is 25 basis points every three months) and essentially calculate that the yield curve inverts at the end of 2018 or the beginning of 2019. Recessions and bear markets always follow six months after that inversion takes place. That's when interest rates start to rise very sharply as bond investors panic and unwind all their leveraged long positions.

Q: Why are you not involved with Amazon (AMZN) and Google (GOOGL)?

A: I've already taken big profits in both of these and I'm just waiting for another serious dip before I get back in again.

Q: What happens to stock buybacks?

A: While other investors are pulling out of the market, stock buybacks are doubling. But, that is only happening, essentially, in the tech stocks - they're the buyback kings. If you don't have a serious buyback program this year, your stock is falling. Companies are the sole net buyers of the market this year, and they are only buying their own stocks.

Q: What do you see the upper and lower end of the S&P 500 (SPY) range to November?

A: I think we've already got it: 2,550 on the low side, 2,800 on the high side - that a 10% range and you can expect it to get narrower and narrower going into November. After that, we get an upside breakout to new all-time highs.

Q: When will rates be negative next?

A: In the next recession, the bottom of which will be in 2 to 2.5 years; that's when interest rates in the U.S. could go negative, as they did in Japan and Europe for several years.

Q: What is your No. 1 pick in the market today?

A: We love Microsoft (MSFT) long term. However, right now the background macro picture is more important than stock selection than any single name, so we're keeping a position in Microsoft in the Mad Hedge Technology Letter, but not in Global Trading Dispatch. We're sort of hanging back, waiting for another sell-off before we touch anything on the long side in GTD. Remember, the money is made on a buy in the new position, not on the sell going out.

Q: Was the semiconductor chip sell-off overdone?

A: Absolutely - the negative report was put out by a new analyst to the industry who doesn't know what he's talking about. If you ask all the end users of the chips, all they talk about is A.I., and that means exponential growth of chip demand.

Q: Is it a good time to buy airline stocks (DAL)?

A: No, until we get a definitive peak in oil, and a speed up again in the economy, you don't want to touch economically sensitive sectors like the airlines.

Mad Hedge Technology Letter

May 9, 2018

Fiat Lux

Featured Trade:

(HERE'S THE TOP STOCK IN THE MARKET TO BUY TODAY),

(MSFT), (AMZN), (AAPL), (APTV), (QCOM), (FB)

When the CEO of Microsoft, Satya Nadella, sits down for a candid interview, I move mountains then cross heaven and hell to listen to him, and you should, too.

Microsoft is at the top of my list as a conviction buy.

Nadella is one of the great CEOs of our time and was able to complete Microsoft's makeover after Steve Ballmer's insipid tenure at the helm.

Microsoft's Build conference is the perfect platform for Nadella to share his wisdom about the company, industry, and changes going forward.

In an age where tech CEOs thrive off of smoke and mirrors, Nadella was succinct conveying the concept of trust as the secret sauce that will help tech's digital footprint expand into new territories.

Trust infused products through the cloud and A.I. will be the perfect archetype of future tech that will encourage accelerated adoption rates.

A.I. was the message of the day at the Build conference. Nadella used the term A.I. 14 times and the word cloud four times when interviewed.

It was fitting that Microsoft wowed the audience with a sparkly, new-fangled demo.

The demo put on by Microsoft in conjunction with Amazon's (AMZN) Alexa showed smart-assistants working in collaboration.

Microsoft showed how it is possible to use a PC Windows desktop to order an Uber car through Amazon's Alexa.

This technology is very powerful and is a work-around for the "walled garden" problem where big companies are closing off their systems only to proprietary software and products limiting upside potential.

The ability to collaborate with multiple A.I. smart systems will generate a whole new layer of business catering toward the communication and business developments among A.I. systems.

Nadella also offered extended examples of A.I. applications, for instance, the capability of detecting cracks in an oil pipeline and running recognition software through a drone using a Qualcomm (QCOM) manufactured camera to monitor the state of containers.

Trusting A.I. will expedite the usage of A.I. business applications, and the companies diverting capital into A.I. enhancement will reap from what they sow.

The knock-on effect is that university A.I. staff members are being poached faster than a breakfast egg. There is a bidding war going on as we speak from both sides of the Pacific.

Facebook is opening new A.I. research centers in Seattle and Pittsburgh.

Previously, A.I. was a buzzword and companies would trot out a visually stimulating display with pizzazz. But that is all changing with A.I. swiftly moving into the backbone of all business operations.

Ottomatika, a company that develops software for autonomous cars acquired by Aptiv (APTV), was entirely a Carnegie Mellon University (CMU) in-house project that was picked up by Aptiv for commercial applications.

In one fell swoop, (CMU) lost a whole team of leading A.I. researchers.

Microsoft is a premium stock because it straddles both sides of the fence.

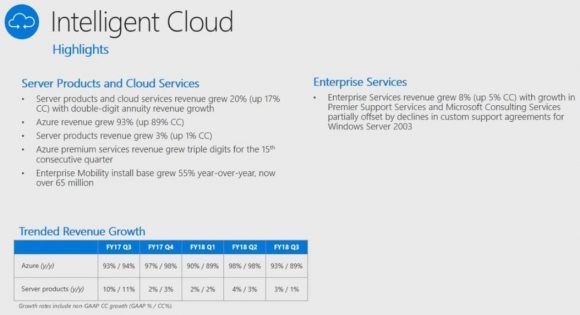

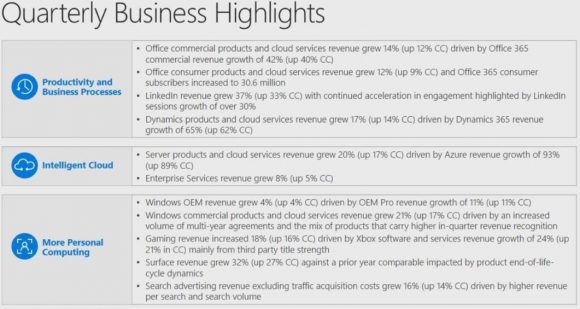

On one side, it's an uber growth company with Microsoft Azure growing 93% YOY satisfying investors requirement for insatiable growth.

On the other hand, Microsoft is robustly lucrative profiting $21.20 billion in 2017, and would be a Warren Buffett-type of cash flow reliant stock even though he has smothered any inkling of buying Microsoft shares because of his close relationship with co-founder Bill Gates.

Even Microsoft's legacy product Microsoft Office 365 is a gangbuster segment swelling 42% YOY.

This contrasts with other legacy companies that are attempting to wean themselves from their own outdated products.

Office 365 products are still embedded in daily life, and I am using it now to type this story.

On the technical side of it, Microsoft is beefing up its developer tools.

Microsoft will integrate Kubernetes, an open-source system for automating deployment, into the Azure as well as upping its Azure Bot Service adding 100 new features.

There are more than 300,000 developers who operate the Azure Bot Service alone.

The slew of upgrades for developers will enhance the power of Microsoft's software and ecosystem.

The overarching theme to the Build conference is the integration of A.I. into real life business applications and the importance of the cloud.

Now the Cloud.

Nadella reaffirmed Microsoft's position in the cloud wars characterizing the current environment as a duo of Amazon and Microsoft with Google trailing behind.

Microsoft has the potential to nick Amazon's position as the industry's cloud leader because of the unique set of products it can combine with the cloud.

Most of the world utilizes a mix of PC-based hardware, using Microsoft's software and operating system, supplemented by an Android-based smartphone.

As expected, Microsoft, Alphabet (GOOGL), and Amazon are spending a pretty penny advancing their cloud business.

Microsoft spends more than $1 billion per month on Azure cloud data centers.

This number now surpasses the entire annual Microsoft R&D budget.

In the interview, Nadella cited that Microsoft now has 50 domestic data centers.

Amazon habitually holds between 50,000 to 80,000 servers at each data center. Extrapolate the lower range of the number with 50 data centers and Microsoft could have at least 2.5 million servers working for its data needs.

The barriers of entry have never been higher in the cloud industry because the costs are spiraling out of control.

Few people have billions upon billions to make this business work at the appropriate scale.

Tom Keane, head of Global Infrastructure at Microsoft Azure, recently said that Azure meets 58 compliance requirements set forth by the federal government, industry, and local players.

Azure is the first cloud that satisfies the Defense Federal Acquisition Regulation Supplement criteria for contractors to handle Department of Defense work.

Regulation has emerged as one of the controversial issues of 2018, and this did not get lost in the shuffle.

The trust comment was clearly a thinly veiled swipe against Facebook's (FB) much frowned upon business model, making it commonplace these days for prominent CEOs to distance themselves from Mark Zuckerberg's creation.

Protecting a company's image and reputation is paramount in the new rigid era of big data.

Nadella's anti-Facebook rhetoric continued by noting the auction-based pricing standards are "funky," explaining the model is counterintuitive. His reason was that as demand increases, the price should drop and not rise.

Apple (AAPL) CEO Tim Cook has largely been negative about Facebook's tactics. The fury is justified when you consider Apple and Microsoft hustle industriously to develop software and hardware products while Facebook manipulates user data to profit from collected data. A nice shortcut if there ever was one.

It's clear that Apple and Microsoft have no interest in giving third parties access to personal data because the leadership understands it is a slippery slope to go down and unsustainable.

Nadella's emphasis on tech ethics is a breath of fresh air and the data Microsoft accumulates is used to improve the cloud and software products rather than pedal to mercenaries.

The companies that have staying power create proprietary products that cannot be replicated.

Microsoft's assortment of software products acts as the perfect gateway into the cloud and is a moat widening tool.

A.I. and the cloud are all you need to know, and Microsoft is at the heart of this revolutionary movement.

Any weakness of Microsoft's shares into the low-90s is a screaming buy.

_________________________________________________________________________________________________

Quote of the Day

"Innovation has nothing to do with how many R&D dollars you have. When Apple came up with the Mac, IBM was spending at least 100 times more on R&D. It's not about money. It's about the people you have, how you're led, and how much you get it." - said Apple cofounder Steve Jobs.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.