When I first joined Morgan Stanley in 1983, a number of my clients were old enough to have experienced the 1929 stock market crash and the Great Depression that followed.

One was Sir John Templeton, who confided in me over lunch at his antebellum-style mansion at Lyford Cay in the Bahamas, that his long career started with a lot of excitement, and then became incredibly boring for a decade.

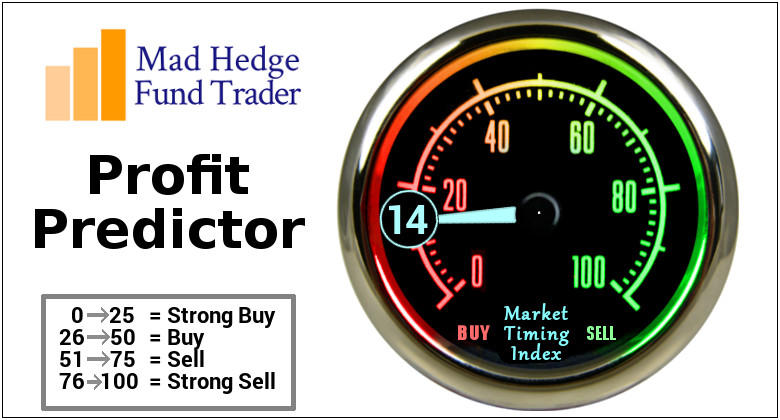

It looks like we entered the incredibly boring phase on January 4, when the stock market began its current downtrend. Last week brought the longest weekly losing streak since 1923, some eight weeks so far.

The market is actually down a lot more than it looks, meaning that we are a lot closer to the bottom than you think. Some 87% of the S&P 500 is down more than 10% and 61% is down 20%. The damage is far worse with the NASDAQ, with some 93% of shares down 10%, and a gut-punching 73% down 20% or more.

While tech has already gone down a lot, some 32% so far this year, it is still trading at an 18% premium to the main market. Remember, in this business, timing is everything. If you invested in tech at the Dotcom peak in 1999, it took you 14 years to break even. Latecomers in this cycle could suffer a similar duration of pain and suffering.

And while these are the kind of moves that usually precede a recession, there is still an overwhelming amount of data that says it won’t happen. We here at Mad Hedge Fund Trader analyze, dissect, and examine data all day long.

I will once again repeat what my UCLA math professor told me a half-century ago. “Statistics are like a bikini bathing suit; what they reveal is fascinating, but what they conceal is essential.”

For a start, 3.6% unemployment rates are not what recessions are made of. Double-digit ones are. The next jobless rate print in June is likely to be down, not up. The country in fact is suffering its worst worker shortage in 80 years. There are currently 6 million more jobs than workers. And wages are rising, putting more money in the pockets of consumers.

Last month, airline ticket prices rose by 25%. Good luck trying to get a plane anywhere as all are full. Last winter, I bought a first-class round-trip ticket from San Francisco to London for $6,000. Today, the same ticket is $10,000. During recessions, planes fly empty, routes get cancelled, and staff laid off. Airlines also go bust and are not subject to the takeover wars we are seeing now.

Recessions also bring dramatic credit crises. Rising default rates force banks to retreat from lending, FICO scores tank, and debt markets dry up. It’s all quiet on the western front now, with all fixed income and liquidity indicators are solidly in the green. And while interest rates are higher, they are nowhere near the peaks seen during past recessions.

All this may explain that after the horrific market moves we have already seen but we may be only 4% from the final bottom in this bear move to an S&P 500 at $3,600, or 7% from an (SPX) of $3,500. That means it is time to start scaling into long-term positions now in the best quality names.

That’s why I have been aggressively piling on call spreads in technology that are 10%-20% in the money with only 19 days to expiration, making money hand over fist.

An interesting headline caught my attention last week. The Russians were stealing farm equipment from Ukraine on an epic scale. When they couldn’t steal it, such as when the electronics were disabled, they were destroying it.

That means the Russians didn’t invade Ukraine to get more beachfront territory on the Black Sea, although that is definitely a plus. They want to destroy a competitor’s agricultural production in order to raise the value of their own output.

Yes, this is the beginning of the Resource Wars that could continue for the rest of this century. Resource producers like the US, Russia, Canada, Australia, and Ukraine will be the big winners. Resource consumers like China, India, and the Middle East will be the big losers.

JP Morgan cuts US GDP Forecasts, with the second half marked down from 3% to 2.4% and 2023 from 2.1% to 1.5%. This means no recession, which requires two back-to-back negative quarters.

China’s Industrial Production collapses by 2.9%, and Retail Sales fell by a shocking 11.1%. The Shanghai shutdown is to blame. It means longer supply chain disruptions for longer and another drag on our own economy. If Tesla has a bad quarter, it will be because of a shortage of vehicles in China. So, will the end of Covid in China bring the bull market back in the US?

The US Budget Deficit is in free fall, putting our hefty bond shorts at risk. While Trump was president the national debt exploded by $4 trillion, a dream come true for bond shorts. Since Biden became president, the annual budget deficit has plunged from $3.1 trillion to $360 billion for the first seven months of fiscal 2022, and we could approach zero by yearend. An exploding economy has sent tax revenues soaring, and taxpayers still have to pay a gigantic bill for last year’s monster capital gains in the stock market. Biden has also been unable to get many spending bills through the Senate, where he lacks a clear majority.

India Bans Food Exports. Climate change is destroying its output with heat waves, while the Ukraine War has eliminated 13% of the world’s calories. This is a problem when you have 1.2 billion to feed. Expect food inflation to worsen.

Consumer Sentiment hits an 11-year low according to the University of Michigan, dipping from 64 to 59.1. Record gas prices and soaring inflation are the reasons, but spending remains strong off the super strong jobs market.

Homebuilder Sentiment hits a two-year low, down from 77 to 69 in May, according to the National Association of Homebuilders. Recession fears and soaring interest rates are the big reasons.

Building Permits dive in April by 3.2%, and single family permits were down 4.6%. The onslaught of bad news for housing continues. Avoid.

Target implodes on terrible earnings, taking the stock down 25%, the worst in 40 years. They finally got the inventory they wanted. Too bad consumers are too poor to buy it with $6.00 a gallon.

Commodities send Battery Costs soaring by 22%. Who knew you were going long copper, lithium, and chromium when you bought your Tesla? It’s a good thing you did. Now you can give the middle finger salute when you drive past gas stations.

Average Household now spending $5,000 a year on gasoline, which is $5,000 they’re not spending on anything else. Just ask Target (TGT) and Walmart (WMT).

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility seen since 1987, my May month-to-date performance recovered to +4.79%.

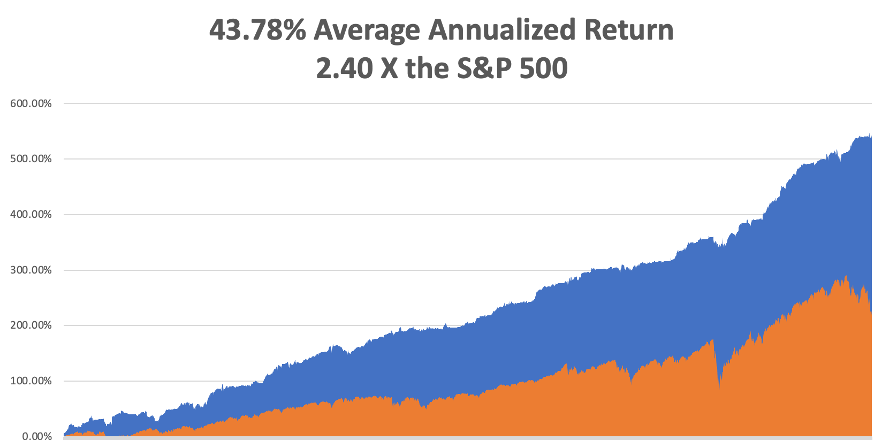

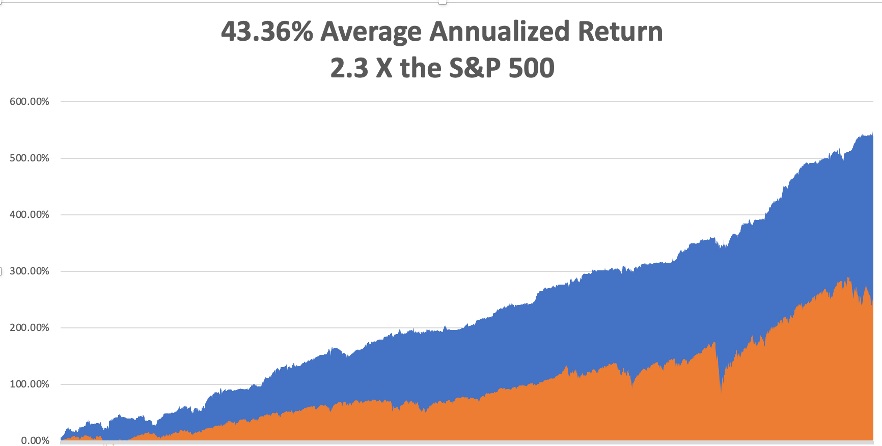

My 2022 year-to-date performance exploded to 34.97%, a new high. The Dow Average is down -16.4% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 62.99%.

This week, I added new long positions in Visa (V) and Microsoft (MSFT) when the Volatility Index (VIX) was in the mid $30s. I also did a nice round trip on an Apple (AAPL) short which brought in $1,740. I also took profits on two longs in the (SPY) and two shorts in the (TLT). Overall, it was a great week!

That brings my 14-year total return to 547.53%, some 2.40 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.78%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 82.5 million, up 300,000 in a week and deaths topping 1,000,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, May 23 at 8:30 AM EST, the Chicago Fed National Activity Index for April is out.

On Tuesday, May 24 at 8:30 AM, New Home Sales for April are released.

On Wednesday, May 25 at 8:30 AM, Durable Goods for April are published.

On Thursday, May 26 at 8:30 AM, Weekly Jobless Claims are disclosed. The first look at Q2 GDP is printed.

On Friday, May 27 at 8:30 AM, Personal Income & Spending is out. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, one of my fondest memories takes me back to England in 1984 for the 40th anniversary of the D-Day invasion of France. On June 6, 160,000 Americans stormed Utah and Omaha beaches, paving the way for the end of WWII.

My own Uncle Al was a participant and used to thrill me with his hair-raising D-Day experiences. When he passed away, I inherited the P-38 Walther he captured from a German officer that day.

The British government wanted to go all out to make this celebration a big one as this was expected to be the last when most veterans, now in their late fifties and sixties, were in reasonable health. President Ronald Reagan and prime minister Margaret Thatcher were to be the keynote speakers.

The Royal Air Force was planning a fly past of their entire fleet that started over Buckingham Palace, went on the to the debarkation ports at Southampton and Portsmouth, and then over the invasion beaches. It was to be led by a WWII Lancaster bomber, two Supermarine Spitfire, and two Hawker Hurricane fighters.

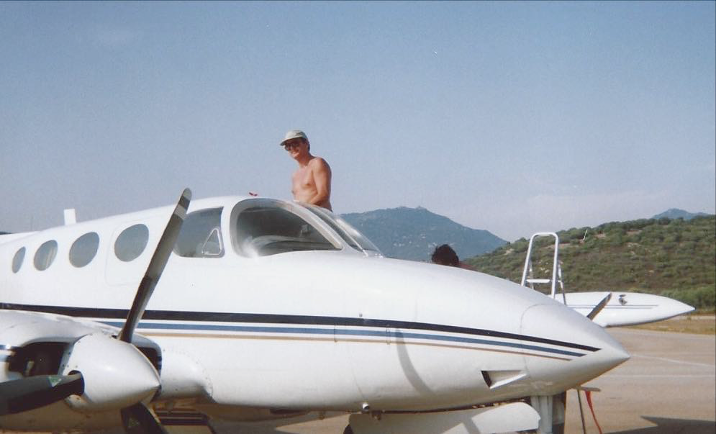

The only thing missing was American aircraft. The Naval and Military Club in London, where I am still a member, wondered if I would be willing to participate with my own US-registered twin-engine plane?

“Hell yes,” was my response.

Of course, the big concern was the weather, as it was in 1944. Our prayers were answered with a crystal clear day and a gentle westerly wind. The entire RAF was in the air, and I found myself the tail end Charlie following 175 planes. I was joined by my uncle, Medal of Honor winner Colonel Mitchell Paige.

We flew 500 feet right over the Palace. I could clearly see the Queen, a WWII veteran herself, Prince Philip, Lady Diana, and her family waving from the front balcony. Massive shoulder-to-shoulder crowds packed St. James Park in front.

As I passed over the coast, much of the Royal Navy were out letting their horns go full blast. Then it was southeast to the beaches. I flew over Pont du Hoc, which after 40 years still looked like a green moonscape, after a very heavy bombardment.

In one of the most courageous acts in American history, a company of Army Rangers battled their way up 100-foot sheer cliffs. After losing a third of their men, they discovered that the heavy guns they were supposed to disable turned out to be telephone poles. The real guns had been moved inland 400 yards.

We peeled off from the air armada and landed at Caen Aerodrome. Taxiing to my parking space, I drove over the rails for a German V2 launching pad. I took a car to the Normandy American Cemetery at Colleville-sur-Mer where Reagan and Thatcher were making their speeches in front of 9,400 neatly manicured graves.

There were thousands of veterans present from all the participating countries, some wearing period uniforms, most wearing ribbons. At one point, men from the 101st Airborne Division parachuted overhead from vintage DC-3’s and landed near the cemetery.

Even though some men were in their sixties and seventies, they still made successful jumps, landing with big grins on their faces. The task was made far easier without the 100 pounds of gear they carried in 1944.

The 78th anniversary of the D-Day invasion is coming up shortly. I won’t be attending this time but will remember my own fine day there so many years ago.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Pont du Hoc