Fintech is all the rage now, and it’s time for investors to grab a piece of the action.

The tech sectors’ stellar performance in 2018 is a little taste of things to come as every industry forcibly pushes toward software and artificial intelligence to enhance products and services.

Bull markets don’t die of old age and some of these tech stalwarts are truly defying gravity.

The fintech sector is no exception.

Square (SQ) led by tech visionary Jack Dorsey has been a favorite of the Mad Hedge Technology Letter practically from the newsletter’s inception.

But another company has caught my eye that most of you already know about – PayPal (PYPL).

PayPal, a digital payments company, has extraordinary core drivers and a splendid growth trajectory.

Its arsenal of services includes digital wallets, money transfers, P2P payments, and credit cards.

It also has Venmo.

Venmo, a digital payment app, is the strongest growth lever in PayPal’s umbrella of assets right now, and was the first meaningful digital payment app in America.

It was established by Andrew Kortina and Iqram Magdon-Ismail, who were roommates at the University of Pennsylvania, and the company was bought out by PayPal for $800 million in 2014, marking a new chapter in PayPal’s evolution.

Funny enough, Venmo’s original use was to buy mp3 formatted songs via email in 2009.

Venmo is wildly popular with tech savvy millennials. A brief survey conducted illustrates how fashionable Venmo is by recording higher user statistics than Apple Pay.

The app is commonly used for ordering pizza through Uber Eats or Grubhub (GRUB), or even shelling out for monthly rent.

If you want to stir up your imagination even more, Venmo has a prominent social feed where users can view other Venmo users’ purchases.

Financial models suggest Venmo could contribute $300 million to the PayPal top line in 2021. If Venmo executes perfectly, revenue could surpass the $1 billion mark in 2021, with much higher operating margins than PayPal’s core products.

Even though management declines to speak specifically about Venmo, the dialogue in the earnings call usually provides some color into what is going on underneath the hood.

Xoom, a digital remittance distributor app with offices in San Francisco and Guatemala City owned by PayPal, along with Venmo grew payment volume by 50% YOY, surging to $33 billion annually.

Of that $33 billion in volume, $19 billion was contributed by Venmo and Xoom chipped in with $14 billion.

More than 60,000 new merchants joined PayPal’s array of platforms, adding up to more than 19.5 million total merchants.

All in all, PayPal locked in $3.86 billion of sales last quarter, which was a 23% YOY jump in revenue, at a time where widespread acceptance of fintech platforms is brisk.

PayPal raised its end-of-year forecast and rewarded shareholders with authorization of a $10 billion buyback.

Upward margin expansion, expanding market share, multiple revenue stream, and untapped pricing power is the recipe to PayPal’s meteoric rise.

PayPal’s share price has climbed higher from a base of $73 at the beginning of the year to an all-time high of more than $90.

Offering more proof fintech is alive and kicking is Jack Dorsey’s Square’s dizzying rise of more than 200% YOY in its share price.

The company is exceeding all revenue growth expectations and is poised to ramp up subscription revenue.

As with the Venmo app, Square’s Cash app has unrealized potential and will be one of the outperforming profit drivers going forward.

Square hopes to be the one-stop-shop for all types of digital payment needs including consumer finance, equity purchases, possibly international transfers, and cryptocurrency.

All of this is happening amid a robust secular story that could have seen traditional banks swept into the dustbin of history.

Rewind a few years ago, perusing the data about the movement to digital payments must have frightened the living daylights out of the executives from major Wall Street mainstays.

Digital wallets assertive migration into mainstream money payment services could have detached traditional banks’ core businesses.

Slogging your way to a physical bank to put in a wire transfer was not appealing.

Archaic methods of business are painful to see, and traditional banks were still operating this way as of 2015.

Time is money and technology has crashed the traditional waiting time to almost zero.

The way these tech companies operate is simple.

They compete to hire a hoard of advanced computer developers or shortcut the process using the time-honored tradition of poaching the competition’s best talent.

Then snatch market share at all costs and grow like crazy.

Banks badly needed introducing some functions to their array of services such as linking with third-party payment APIs to facilitate online payments and enabling cross-platform digital payments.

Other functions such as establishing modern peer-to-peer payment systems or adopting QR code technology that are wildly popular in East Asia could enhance optionality as well.

These are several instruments they could have amalgamated into their arsenal of fintech technology that could have freshened up these dinosaur institutions.

Harmonizing banking tasks with mobile functionality was fast coming and would be the standard.

Anyone not on board would sink like the Titanic.

Ultimately, banking institutions needed to up their game and acquire one of these digital wallet processors or watch from the sidelines.

They chose the former when a consortium called Early Warning Services (EWS) jointly created by behemoth American banks, including JPMorgan Chase & Co. (JPM), Capital One (COF), Bank of America (BAC), and Wells Fargo (WFC) to “prevent fraud and reduce detection risk” made a game-changing decision.

(EWS) acquired digital payment app Zelle in 2016, and this was its aggressive response to Square Cash and PayPal’s Venmo.

Results have been nothing short of breathtaking.

Leveraging the embedded base of existing banking relationships, Zelle took off like a scalded chimp and never looked back.

In a blink of an eye, Zelle had already signed up more than 30 banks and over 100 financial institutions to its platform.

Banks couldn’t bear being left out of the fintech party.

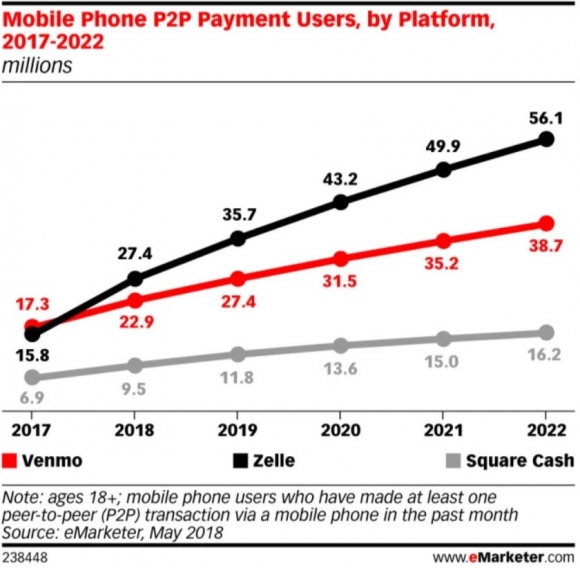

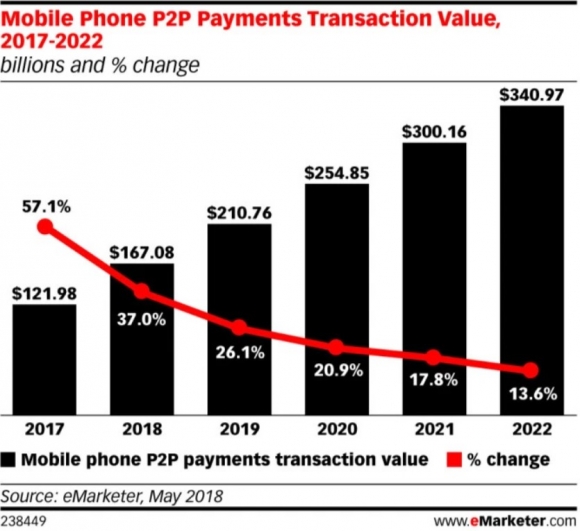

With hearty conviction, Zelle is signing up users at a pace of 100,000 per day, and the volume of payments in 2017 eclipsed $75 billion.

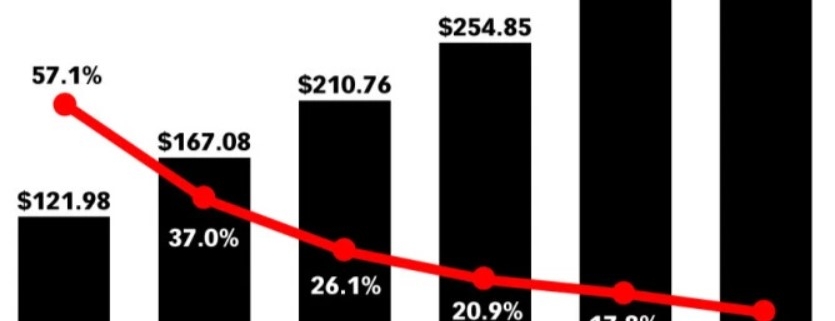

Zelle projects to expand more than 73% in 2018, integrating 27.4 million new accounts in the U.S., head and shoulders above Venmo’s 22.9 million and Square Cash due to add 9.5 million more users.

Make no bones about it, Zelle was in prime position to convert existing relationships into digital converts. The banks that do not have an interest in Zelle have an uphill climb to stay relevant.

The United States is rather late to this secular growth story. That being said, already 57% of Americans have used a mobile wallet at least once in their lives.

Innovative ideas bring supporters galore and even more adoptees.

That is why the strong pivot into technological enhanced ideas bear unlimited fruit.

Using a mobile platform to just open an app then send funds within a split second with minimal costs is appealing for the Netflix (NFLX) crazed generation that can hardly get off the couch.

Ironically, it’s those in the emerging parts of the world leading this fintech revolution by skipping the traditional banking experience completely and downloading digital wallet apps on their mobile devices.

It’s entirely realistic that some fresh-faced youth have never been present at a physical banking branch before in India or China.

Download an app and your fiscal life commences. Period.

The volume of funds passing through the arteries of Chinese digital wallet apps surpassed $15 trillion in 2017.

And by 2021, 79.3% of the Chinese population are projected to use digital wallets as their main source of splurging Chinese yuan.

America lags a country mile behind China, but the Chinese progress has offered American tech companies a crystal-clear blueprint to springboard digital payment initiatives.

Chinese state banks are already starting to become marginalized, and the Wall Street banks are not immune to the same fate.

Devoid of a digital strategy will be a death knell to certain banking institutions.

Compare the pace of adoption and some must question why American adoption is tardy to a fault.

Highlighting the lackadaisical pace of American fintech integration was Alibaba’s (BABA) smash-and-grab attempt at MoneyGram International Inc. (MGI), as it sought to gain a foothold into the American fintech market.

The attempt was rebuffed by the federal government.

The nascent state of the digital payment world in America must alarm Silicon Valley experts. And the run-up in Square and PayPal includes calculated bets that these two standouts will leapfrog into the future with guns blazing along with Zelle.

The parabolic nature of Square’s mystifying gap up means that a moderate pullback is warranted to put capital to work in this name.

Investors should wait for a timely entry point into PayPal as well.

These two stocks have overextended themselves.

As the fintech pie extrapolates, there will be multiple victors, and these victors are already taking shape in the form of Zelle, PayPal, and Square.

________________________________________________________________________________________________

Quote of the Day

“In the not-too-distant future, commerce is just going to be commerce. It won't be online commerce or offline commerce. It's just going to be commerce. And that will happen because of the phone,” – said CEO of PayPal Dan Schulman.