To the dismay of tech shares, the tech industry doesn’t operate in a bubble.

The broader landscape is experiencing a dose of volatility triggered by the ratcheting up in interest rates.

There’s not much tech can do to change the narrative.

The back and forth political saber rattling isn’t helping either.

Tech is experiencing a swift rotation out of hyper-growth names such as Amazon (AMZN) and Netflix (NFLX) with investors taking profits on these names that have gone up in a straight line this year.

This does not mean you should fling these stocks into tech heaven yet.

The hardest hit names will be the marginal tech firms in the marginal tech spaces headed by dreadful management.

This narrow criterion conveniently perfectly fits one company I have written about extensively.

Enter Snapchat.

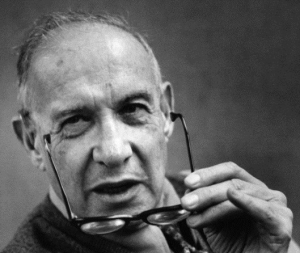

It’s been a year to forget or remember - depending on how you look at it for CEO of Snapchat Evan Spiegel.

Snapchat was one of my first recommendations of The Mad Hedge Technology Letter when I told readers to run for the hills.

To read my story on Snapchat, please click here.

At that time, the stock was trading at a luxurious $19.

Lionizing this shoddy company would be a stretch as shares have parachuted down to the $6.60 level.

The latest word is that Snapchat is burning money fast.

The cash crunch will quickly force them to raise some capital and this is just one of the many litanies of spectacular misfortunes that have beset this Venice, California social media starlet.

Maybe management is spending too much time ripping the bong on Venice Beach because the decisions being made are of that ilk.

The first catastrophic move out of many was the botched redesign alienating the core base who were dazed and confused by the new interface and functionality.

Social media works poorly when you can’t find your friends on it.

Spiegel admitted the redesign was “rushed” and it behooves me to let readers know that the redesign was the worst redesign I have ever seen in my life as I tested it out in my office.

Snapchat quickly restored the previous interface calming their shrinking core audience.

The self-inflicted wound was deep, and earnings reflected the quicksand Snapchat quickly found itself in.

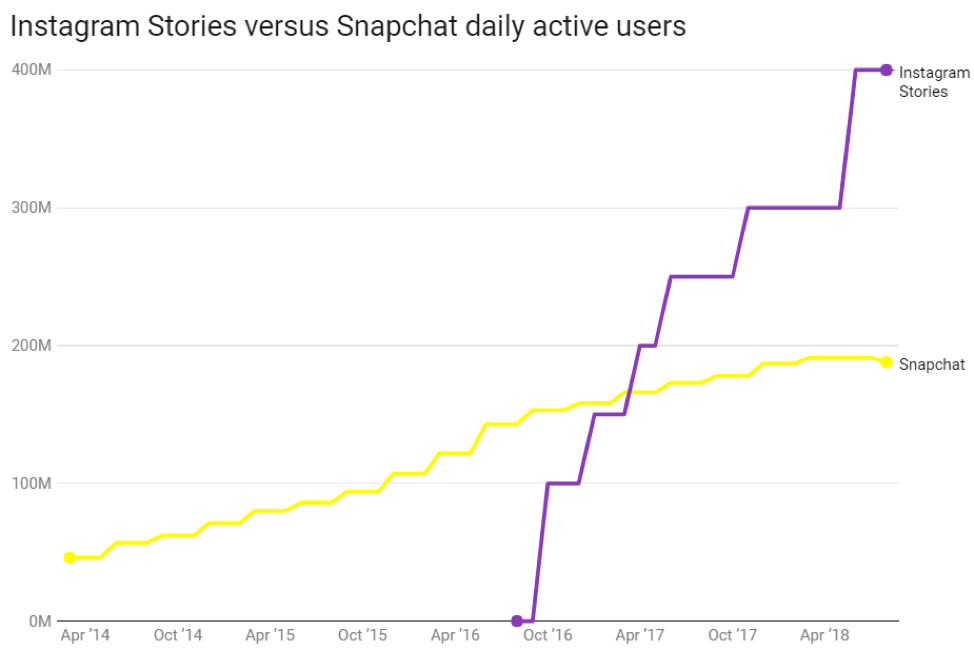

Snapchat announced that global daily active users (DAUs) shrank from 191 million to 188 million.

A company at this early stage in the growth cycle should be reeling in the users non-stop.

This is far from a mature company and if executed properly the company should have the ability to cast their net far and wide scooping up new users left and right.

Let’s remember that Instagram, the Facebook (FB) owned direct competitor, is growing their user base parabolically.

Simply put, Snapchat has had no answer to Instagram’s rapid rise to fame, and that was the center of my thesis to turn my back to this rapidly deteriorating company.

Snapchat has offered no meaningful innovation to combat the terrorizing force of Instagram.

The dearth of innovation has caused the average time spent on the platform to dip from 33 minutes to 31 minutes per session.

Instagram has stretched the lead on Snapchat. In fact, it was Instagram that cleverly borrowed Snapchat’s best features and integrated them into their platform.

Sentiment has turned rotten as the stock sold off when Spiegel announced that he wants the company to turn profitable in 2019.

Investors don’t believe this one iota.

Snapchat is expected to burn through $1.5 billion in 2019, and Spiegel’s pipedream of scratching out a profit is implausible.

Snapchat is not executing on the digital ad front.

It was a year and a half ago when consensus believed Snapchat was able to churn out revenue of $540 million this quarter, but it looks more likely that Snapchat is set for revenue of just a shade over $280 million.

The severe underperformance is due to a lack of advertisers causing the eventual price of digital ads to fetch a lower price in an auction-based model.

Stinging as it might be, the lower costs of ads is also caused by the average age group of Snapchat’s core base.

Snapchatters are usually teenagers and have low purchasing power.

Targeting an older user base would improve margins significantly.

However, the conundrum is that the core user base might jump ship like they did to Facebook and shifted over to Facebook-owned Instagram.

Snap doesn’t have a Facebook posing an acute problem that could likely backfire.

General Data Protection Regulation (GDPR) in the European Union made the issue of securing personal data a national issue.

Facebook poured fuel on the fire when they disclosed several breaches clobbering their share price.

Mark Zuckerberg’s company is still reeling from the series of mishaps.

Ironically, Facebook debuted a smart speaker with prime access to user’s home when trust is at its lowest ebb around Facebook’s data collection practices.

Investors really need to ask themselves if Facebook’s management has any common sense at all.

Any decent company would have halted this project and I expect it to be a complete disaster.

Part of Snapchat’s turnaround strategy involves releasing scripted shows as short as five minutes long.

Entering into the original content wars is a tough sell. The competition is becoming fiercer and this move hardly will differentiate itself from ad buyers who already avoid Snapchat. In fact, it smells of desperation.

Snapchat has seen a brutal brain drain with management leaving in droves.

They have voted with their feet.

Chief Strategy Officer Imran Khan was the latest to announce his upcoming departure.

Others to jettison are the VP of product, VP of sales, VP of engineering, and its general counsel.

The high turnover rate will make it more complicated to execute a drastic reversal of fortune.

The only silver lining is if Zuckerberg manages to screw up Instagram after forcing the creators out with his behind-the-scenes meddling, giving a glimmer of hope to Snapchat.

A stellar performance from the execution team along with a Facebook mess of Instagram could resuscitate the user base if users start to flee Instagram in droves.

There aren’t many alternatives unless a user is inclined to quit social media.

Snapchat badly needs to build up its user base or else digital ad buyers will stay away.

I am still bearish on this stock and it would take a small miracle to spruce up the share price again.