After 54 years of trading, and 60 if you count my paper boy days, I have never seen the conventional wisdom be so wrong about the markets.

There was near universal sentiment that we would crash come January. Instead, with have only seen four down days this year. The shorts got slaughtered.

So it’s clear that something brand new is going on here in the markets. I call it “My New Theory of Equities.”

I always have a new theory of equities. That’s the only way to stay ahead of the unwashed masses and live on the cutting edge. After all, I don’t have to run faster than the bear, just faster than the competition to keep you making money.

So here is my new theory.

Many strategists are bemoaning the loss of the free money that zero interest rates made available for the last decade. They are convinced that we will never see zero interest rates again.

But guess what? Markets are acting like free money is about to return, and a lot faster than you think. Free money isn’t gone forever, it is just taking a much-needed vacation.

What if free money comes from somewhere else? You can forget about free money from the government. Fear of inflation has ended that source, unless we get another pandemic, which is at least a decade off.

No, I found another source of free money, and that would be exponentially growing technology profits. Those who don’t live in Silicon Valley are ignorant of the fact that technology here is hyper accelerating and tech companies are becoming much more profitable.

You know those 80,000 tech workers who just got laid off? They all averaged two job offers each from the thousands of startup companies operating from garages and extra bedrooms all around the Bay Area. As a result, the Silicon Valley unemployment rate is well under 2%, nearly half the national average.

I bet you didn’t know that there are over 100 industrial agricultural startups here growing food in indoor ultraviolet lit lowers. It turns out that these use one tenth of the inputs of a conventional input, like water and fertilizer in half the time.

There are hundreds of solar startups in play, many venture capital financed by Saudi Arabia. While the kingdom has a lot of oil, they have even more sunshine. And what are they going to do with all that oil? Use solar generated electricity to convert it to hydrogen to sell to us as “green” energy.

Solar itself will just be a bridge technology to fusion, which you may have heard about lately. What happens when energy becomes free? It boggles the mind. This appears to be a distant goal now. But remember that we went from atomic bombs to nuclear power plants in only 12 years, the first commercially viable one supplying electricity to Pittsburgh in 1957 (click here for the link).

The future happens fast, far faster than we realize. Always.

Here is another anomaly for you. While these massive tech layoffs have been occurring, Weekly Jobless Claims have plunged to a two-year low from 240,000 to only 186,000.

That is because tech workers aren’t like you and me. When they get laid off the first thing, they do is cheer, then take a trip to Europe. They are too wealthy to qualify for unemployment benefits, so they never apply. When they get home, they immediately get new jobs that pay more money with extra stock options.

I know because I have three kids working in Silicon Valley and enjoy a never-ending stream of inside dope.

This means that you need to be loading the boat with tech stocks on every major dip for the rest of your life, or at least my life. The profit opportunities are exponential.

This creates a new dilemma.

You can pick up the easy doubles and triples now just though buying listed companies. But many of the hundred and thousand baggers haven’t even been created yet. That’s where newly unemployed tech workers are flocking to. That’s where you’ll find the next Tesla (TSLA) at $2 trade.

How will you find those? Don’t worry, that’s my job. After all, I found the last Tesla at $2, minting many new millionaires along the way.

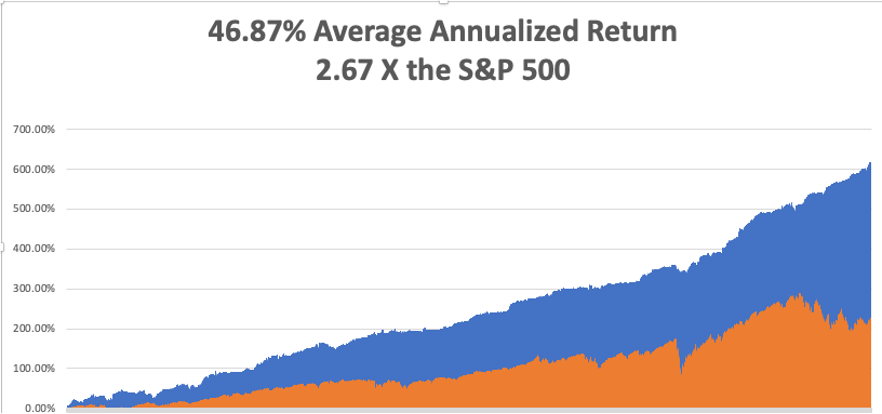

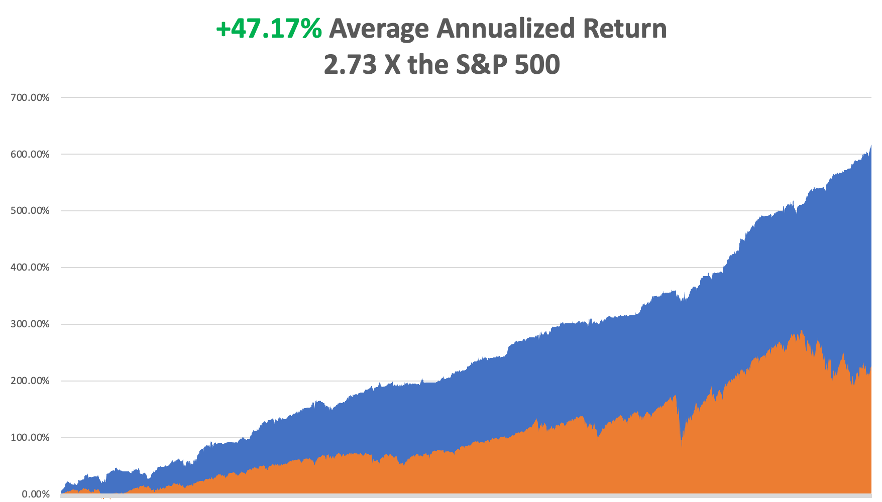

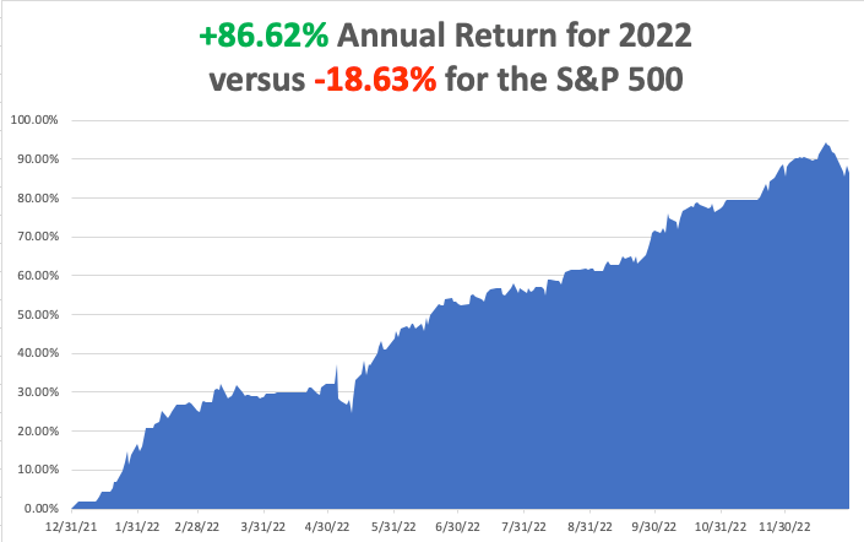

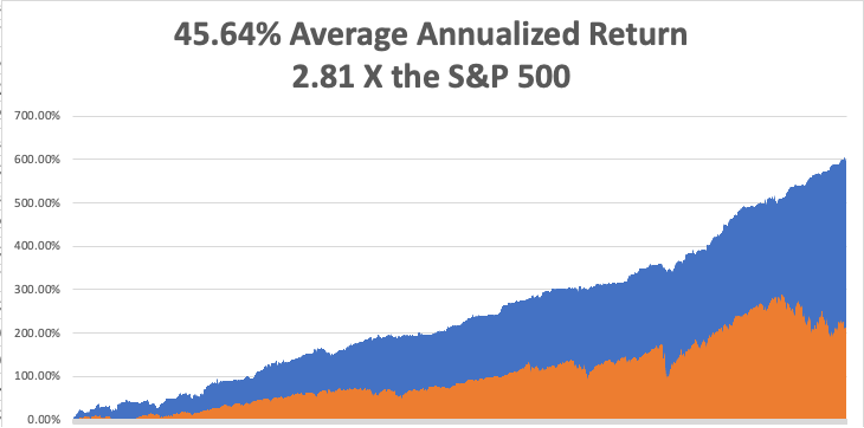

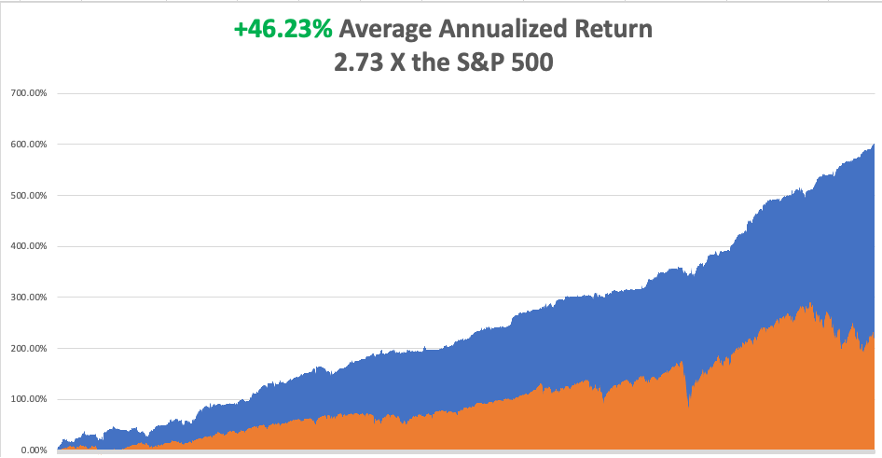

My trading performance certainly shows the possibilities of this My New Theory of Equities, which so far in January has tacked on a robust +19.94%. My 2023 year-to-date performance is the same at +19.94%, a spectacular new high. The S&P 500 (SPY) is up +7.32% so far in 2023.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 15 years ago. My trailing one-year return maintains a sky-high +95.09%.

That brings my 15-year total return to +617.13%, some 2.66 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +46.87%, easily the highest in the industry.

Last week, I took profits on my longs in Tesla (TSLA) and Occidental Petroleum (OXY). That leaves me 90% in cash, with one lonely 10% short in the (QQQ). Markets are wildly overextended here; the Volatility Index ($VIX) is at a two-year low at $18, and my own Mad Hedge Market Timing Index is well into “SELL” territory at 70.

My invitation on the long side is wearing thin.

And while I’m at it, let me introduce one of my favorite secret economic indicators.

I call it the “Flat Tire Indicator”.

It goes something like this. The stronger the economy, the more trucks you have driving to new construction sites to build factories and homes. That means more trucks wearing out the roads, creating more potholes, and bouncing more nails out the back.

Tadah! You get more flat tires.

I am not citing this as some Ivory Tower, pie-in-the-sky academic theory. I spent the morning getting a flat tire on my Tesla Model X fixed. This wasn’t just any old tire I could pick up on sale at Big O Tires. It was a Pirelli Scorpion Zero 265/35 R22 All Season staggered racing tire.

Still, Tesla did well. From the time I typed in my request on the Tesla app on my smartphone to the time the repair was completed at my home, only 45 minutes had elapsed.

Still, $500 for a tire Elon? Really?

Elon Musk Ambushed the shorts, with a Massive Short Squeeze Hitting Tesla, up 80% in three weeks and far and away the top-performing major stock of 2023. Tesla now accounts for an incredible 7% of the entire options market. Bearish hedge funds are panicking. It’s dragging the rest of big tech with it. I think we are due for a rest around the Fed interest rates decision in three days. I warned you about an onslaught of good news coming out about Tesla. It has arrived!

Will This Week See the Last Interest Rate Hike, in this cycle on February 1? That’s what stocks seem to be discounting now, with the major indexes up almost every day this year. And even next week may only deliver a 25-basis point hike.

The Fed’s Favorite Inflation Indicator Fell in December, Core PCE up only 4.4% YOY. It’s fanned the tech flames for a few more days. The University of Michigan is calling for only 3.9%.

Q4 GDP is Up 2.9%, far higher than expected. This is becoming the recession that may not show. New car sales went ballistic and there were huge orders for Boeing. Bonds sold off on the news.

Recession Risk Falls, from a 98% probability to only 73% according to an advanced model from JP Morgan Bank. Other models say it’s dropped to only 50%. A soft landing is now becoming the conventional view. The view is most clearly seen in high-yield bonds which have recently seen interest rates plunge. This may become the recession that never happens.

Tech Layoffs Top 75,000, or 2% of the tech workforce. Most get two job offers on hitting the street from the thousands of garage startups percolating in San Francisco Bay Area garages, taking the Silicon Valley unemployment rate below 2%. All tech is losing is the froth it picked up during the pandemic. As I tell my kids, you want to work in the industry where 2% of the US population spin off 35% of America’s profits. Buy big tech on the coming dips.

Tesla Price Cuts Crush the EV Industry, in a clear grab by Elon for market share, already at 65% globally. Teslas are now the cheapest EVs in the world on a per mile basis, and with the new federal subsidies they now qualify for the discount rises to 35%. (GM), (F), and Volkswagen can’t match the cuts because they are already hemorrhaging money on EVs and lack the parts to appreciably boost production. Keep buying (TSLA) on dips, which is up $8 this morning.

Tesla Beats, on both earnings and guidance. It’s looking for 1.8 million vehicles sold in 2023 versus 2022 sales of 1.31 million. Elon is still planning on 50% annual growth over the foreseeable future. The shares jumped an incredible 12% on the news. The Cybertruck will roll out at the end of this year, and I am on the list. The recent price cuts were hugely successful, killing the EV competition, and could take 2023 production to 2 million. It all makes (TSLA) a strong buy and long-term hold on the next $20 dip.

China is Taking Over the Auto World and is the only country that outsold the US in EVs. The Middle Kingdom exported more than 2.5 million cars last year, taking it just behind Germany. The country is targeting 8 million exports by 2030, double Japan’s. What is not said is that most of these will go to low waged emerging countries without auto regulations, safety standards, or even laws. No Chinese cars were sold in the US, far and away the world’s largest market at 15 million units last year in a global market of 67.6 million.

Pending Home Sales Jump in December, up 2.5%, providing more green shoots for the real estate market. This is on a signed contracts-only basis, the best in 14 months. The January numbers will get a huge boost from dramatically lower mortgage rates.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, January 30 a6 7:30 AM EST, the Dallas Fed Manufacturing Index is announced. NXP Semiconductor (NXPI) reports.

On Tuesday, January 31 at 6:00 AM, the S&P Case Shiller National Home Price Index is updated. Caterpillar (CAT) reports.

On Wednesday, February 1 at 7:00 AM EST, the JOLTS Private Sector Job Openings are released. The Fed Interest Rate Decision is disclosed. Meta (META) reports.

On Thursday, February 2 at 8:30 AM EST, the Weekly Jobless Claims are announced. Apple (AAPL), Amazon (AMZN), and Alphabet (GOOGL) report.

On Friday, February 3 at 8:30 AM EST, the January Nonfarm Payroll Report is printed. Regeneron (REGN) reports.

At 2:00 the Baker Hughes Oil Rig Count is out.

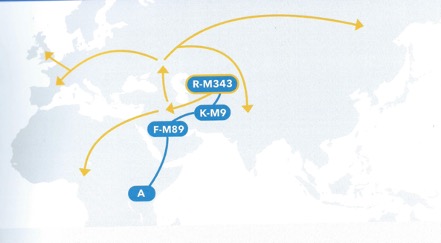

As for me, when Anne Wijcicki founded 23andMe in 2007, I was not surprised. As a DNA sequencing pioneer at UCLA, I had been expecting it for 35 years. It just came 70 years sooner than I expected.

For a mere $99 back then they could analyze your DNA, learn your family history, and be apprised of your genetic medical risks. But there were also risks. Some early customers learned that their father wasn’t their real father, learned of unknown brothers and sisters, that they had over 100 brothers and sisters (gotta love that Berkeley water polo team!) and other dark family secrets.

So, when someone finally gave me a kit as a birthday present, I proceeded with some foreboding. My mother spent 40 years tracing our family back 1,000 years all the way back to the 1086 English Domesday Book (click here).

I thought it would be interesting to learn how much was actually fact and how much fiction. Suffice it to say that while many questions were answered, alarming new ones were raised.

It turns out that I am descended from a man who lived in Africa 275,000 years ago. I have 311 genes that came from a Neanderthal. I am descended from a woman who lived in the Caucuses 30,000 year ago, which became the foundation of the European race.

I am 13.7% French and German, 13.4% British and Irish, and 1.4% North African (the Moors occupied Sicily for 200 years). Oh, and I am 50% less likely to be a vegetarian (I grew up on a cattle ranch).

I am related to King Louis XVI of France, who was beheaded during the French Revolution, thus explaining my love of Bordeaux wines, Chanel dresses, and pate foie gras.

Although both my grandparents were Italian, making me 50% Italian, I learned there is no such thing as a pure Italian. I come it at only 40.7% Italian. That’s because a DNA test captures not only my Italian roots, plus everyone who has invaded Italy over the past 250,000 years, which is pretty much everyone.

The real question arose over my native American roots. I am one sixteenth Cherokee Indian according to family lore, so my DNA reading should have come in at 6.25%. Instead. It showed only 3.25% and that launched a prolonged and determined search.

I discovered that my French ancestors in Carondelet, MO, now a suburb of Saint Louis, learned of rich farmland and easy pickings of gold in California and joined a wagon train headed there in 1866. The train was massacred in Kansas. The adults were massacred, and all the young children adopted into the tribe, including my great X 5 Grandfather Alf Carlat and his brother, then aged four and five.

When the Indian Wars ended in the 1870s, all captives were returned. Alf was taken in by a missionary and sent to an eastern seminary to become a minister. He then returned to the Cherokees to convert them to Christianity. By then Alf was in his late twenties so he married a Cherokee woman, baptized her, and gave her the name of Minto, as was the practice of the day.

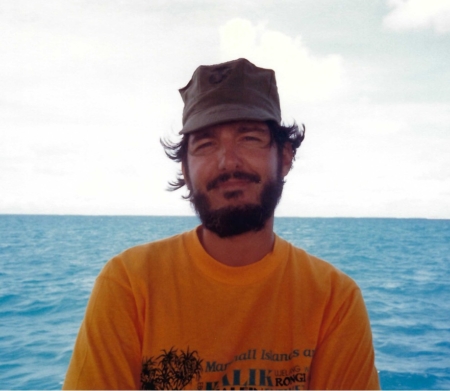

After a great effort, my mother found a picture of Alf & Minto Carlat taken shortly after. You can see that Alf is wearing a tie pin with the letter “C” for his last name of Carlat. We puzzled over the picture for decades. Was Minto French or Cherokee? You can decide yourself.

Then 23andMe delivered the answer. Aha! She was both French and Cherokee, descended from a mountain man who roamed the western wilderness in the 1840s. That is what diluted my own Cherokee DNA from 6.50% to 3.25%. And thus, the mystery was solved.

The story has a happy ending. During the 1904 World’s Fair in St. Louis (of Meet me in St. Louis fame), Alf, then 46 placed an ad in the newspaper looking for anyone missing a brother from the 1866 Kansas massacre. He ran the ad for three months and on the very last day his brother answered and the two were reunited, both families in tow.

Today, it costs $169 to get you DNA analyzed, but with a much larger data base it is far more thorough. To do so click here at https://www.23andme.com

My DNA has Gotten Around

It All Started in East Africa

1880 Alf & Minto Carlat, Great X 5 Grandparents

My New Coincident Economic Indicator