This is not your father’s Western Union (WU).

Western Union (WU), the payment remittance service, is a legacy company that is going to harvest the most from a full migration to digital.

That is exactly what is currently happening.

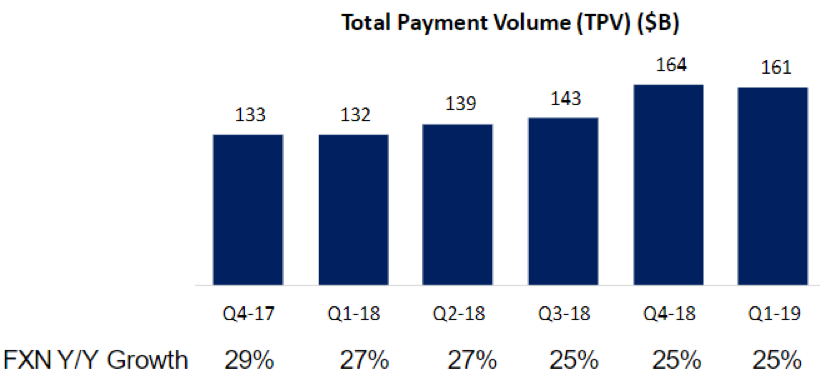

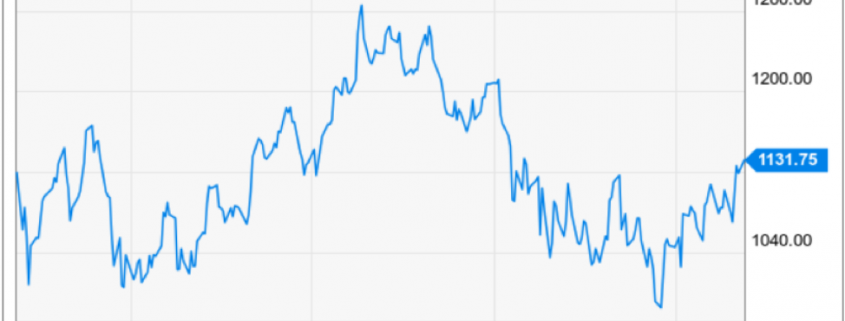

Part of the 25% gain in the stock this year is a nod of approval in the direction the company is heading to.

At its most recent investors’ day presentation, the firm boosted its positive earnings guidance, which was primarily driven by its growth strategy on different verticals.

Western Union’s revamped growth strategy is buttressed by its ability to meet increasing demand from global consumers and businesses for fast and reliable cross-border money transfer and payment solutions.

The company is shying away from the brick-and-mortar operations of yore and choosing a strategy that leverages Western Union’s continued investment in key capabilities such as digital, real-time account payout, compliance, and artificial intelligence.

These nice additions have positioned the company to show strength in one of the most holistic and versatile payment engines in the world.

Western Union has its eyes set on expanding its core consumer-to-consumer business as well as other payment segments where global organizations can utilize its cross-border solutions to expand into fresh markets or better serve existing customers.

Western Union predicts a 23% operating margin by 2022 and a low-double-digit EPS CAGR through 2022.

The operating margin and EPS targets presume a 2020-2022 revenue CAGR of 2% to 3%, compared with the 2019 revenue base excluding divestitures.

The revenue ramp up signals growth in consumer money transfer, driven by its website westernunion.com and other third-party digital services and mid-single-digit growth from Business Solutions.

Operating profit margin and EPS targets also reflect $150 million in total annual savings expected by 2022.

The company expects to succeed in operating efficiencies from initiatives aimed at optimizing commissions and reducing third-party spending.

These initiatives will boost the bottom line an extra $50 million in annual savings to operating profit by 2022.

From 2020 to 2022, Western Union expects to extract more than $3 billion of operating cash flow and return approximately $2.5 billion to $3 billion to shareholders through dividends and share repurchases.

The company is a cash cow and attractive for many traditional investors who value this type of cash flow.

Other pathways to higher revenue include partnerships that provide customized payments solutions to organizations such as e-Commerce businesses expanding into emerging markets, end-to-end cross-border solutions to third-party organizations to solve consumer money transfer needs, and cross-border services, such as foreign exchange and cash management.

Slagging off the brick-and-mortar payments model for the digital platform is the low-lying fruit here and Western Union has a phase of overperformance in them before they will be thwarted with substantial revenue resistance.

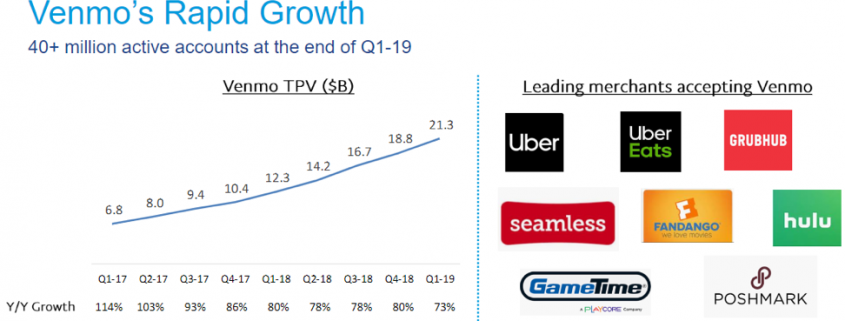

Could this one day turn into a legitimate and mature fintech payment platform such as PayPal Holdings (PYPL) and Square (SQ)?

Offering low cost and efficient services is the first step in the right direction and I can say I’ve seen weirder things happen in the world.

Western Union certainly is in a position of strength as it cruises into the first innings of its digital migration and I believe there is more room to run for the stock until $30.