Below please find subscribers’ Q&A for the August 15 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from London, England

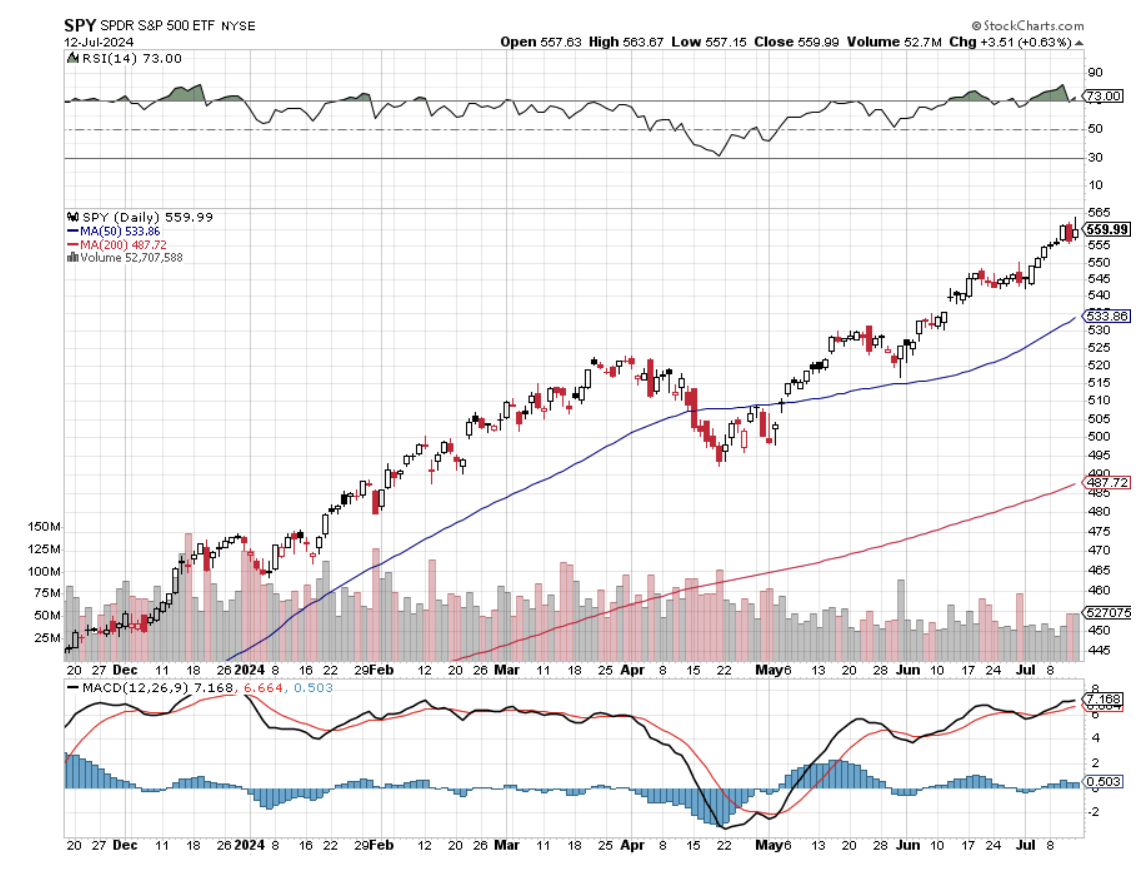

Q: Do you think we’ll still have another significant test of the lows for the year, or was that it last week? Stocks are rebounding huge this week.

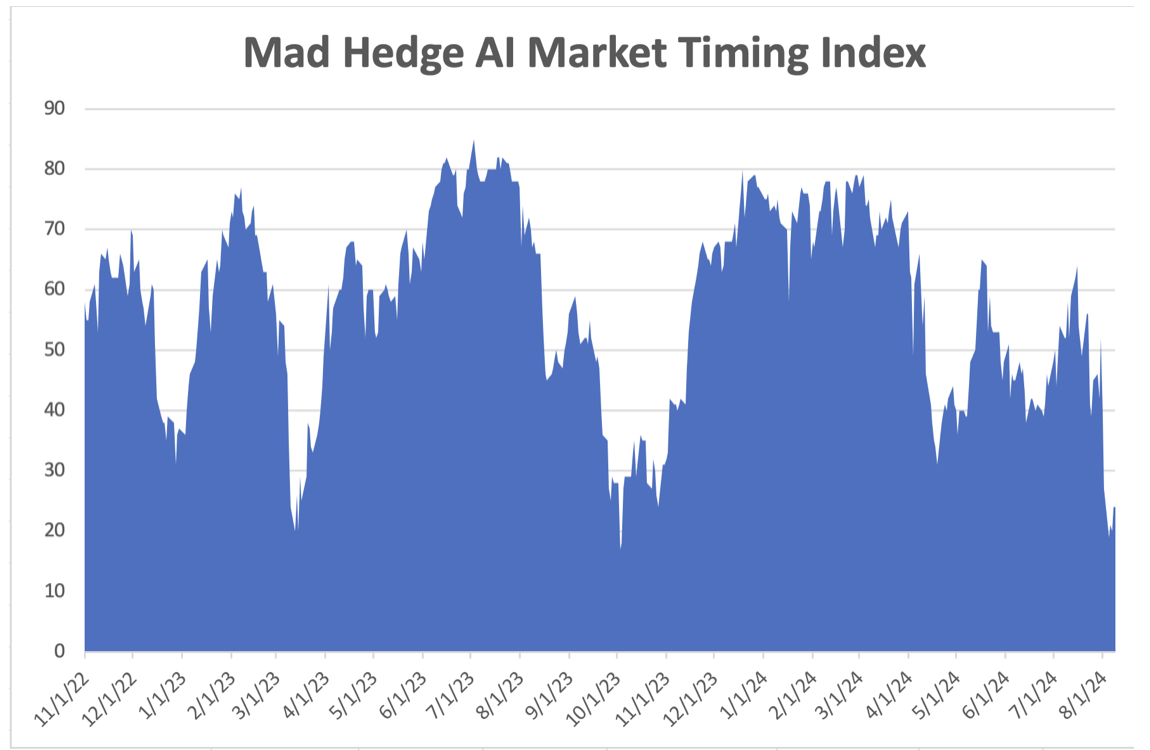

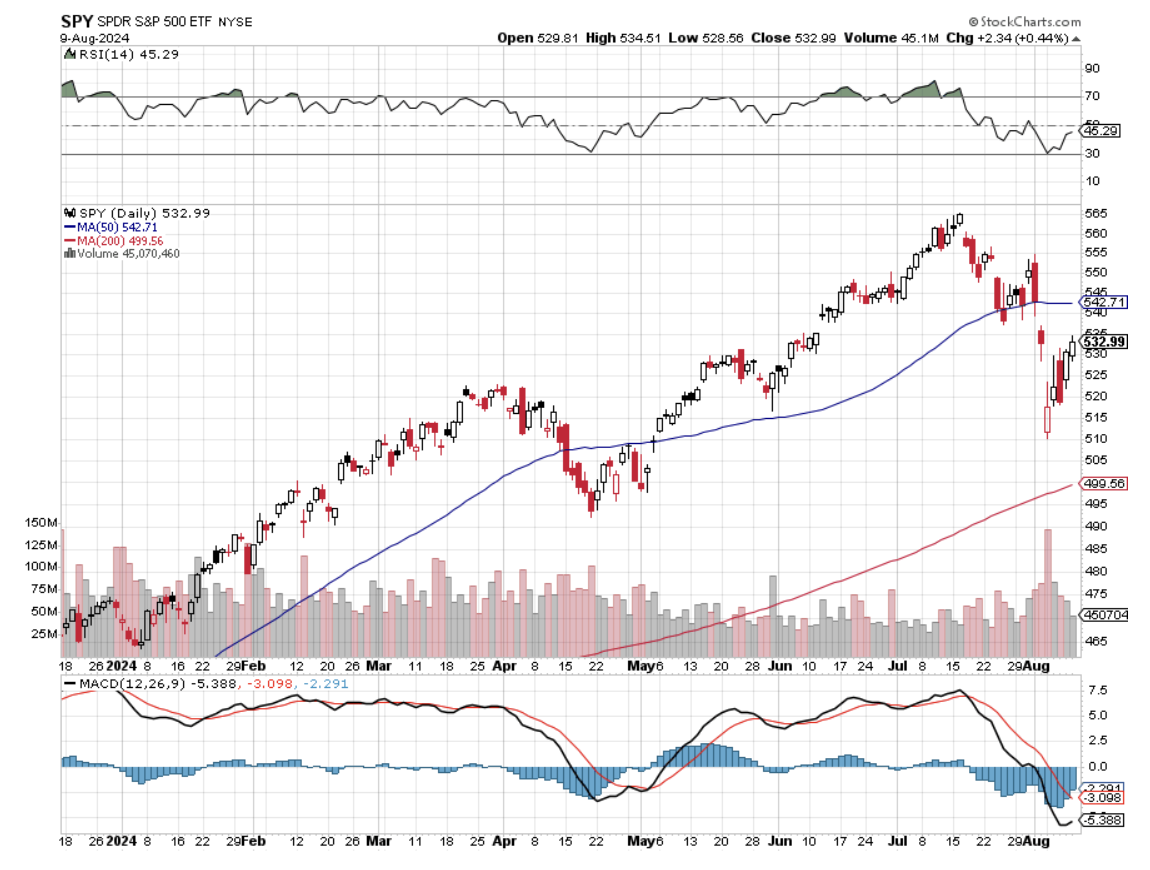

A: They never really went down very much. The average drawdown IN THE S&P 500 (SPY) in any given year is 15%. We only got a 10% drawdown this month because there is still $8 trillion dollars in cash sitting under the market, which never got into stocks. All of this year it's been waiting for a pullback, so I was kind of surprised we even got 10%. I was forecasting maybe 6%. So could we get a new low? You never discount the possibility, but we really have to have another shocking data point to get down to a 15% correction. That is exactly what triggered this sell-off with the Nonfarm Payroll we got in early July. So give me another rotten Nonfarm Payroll report, and we could be back at last week's lows. Which is why I'm 100% cash. I want to have tons of dry powder, if and when that happens.

Q: We've seen a big increase in refi’s for homes in the last week. Is this going to be positive for the economy?

A: Absolutely yes, and that's why we're not going to have a recession. You get housing back into the economy which has been dead meat for almost 3 years now, and suddenly one quarter to one-third of the economy recovers. So that's what takes us into probably 3% economic growth for another year in 2025.

Q: What do you think of the Chipotle CEO (CMG) moving to take over Starbucks (SBUX)?

A: I think it's a very positive move. Starbucks was dead in the water. Their stores are old and dirty and products need refreshing. So if anyone needs a fresh view it's Starbucks, and the guy from Chipotle has a spectacular track record. Chipotle is probably one of the more successful fast-food companies out there. I usually don't ever play fast food—the margins are too low, but I certainly like to watch the fireworks when they happen.

Q: Should I be shorting airline stocks here like Delta Airlines (DAL), now that a recession risk is on the table?

A: Absolutely not. If anything, airlines are a buy here. They've had a major sell-off over the last 3 months for many different reasons, not the least of which was the software crash that they had a month ago. This is not shorting territory. That was 3 months ago for the airlines. Just because it's gone down a lot doesn't mean you now sell, it's the opposite. You should be buying airlines. I usually avoid airlines because they never have any idea if they're going to make money or not, so it's a very high-risk industry, and the margins are shrinking. Let me tell you, the airlines in Europe are absolutely packed. The fares are rock bottom and the service is terrible. Anybody who thinks the consolidation of the airline industry brought you great service has got to be out of their mind.

Q: Do you have any rules on when you stop loss?

A: The answer is very simple. If I do call spreads, whenever we break the nearest strike price, I'm out of there. That’s where the leverage works exponentially against you. Usually, you get a 1 or 2% loss when that happens, and you want to roll it into another trade as fast as you can and make the money back. Sometimes you have to do three trades to make up one loss because when you issue stop losses, everybody else is trying to get out of there at the same time. It's not a happy situation to be in, so we try to keep them to a minimum—but that is the rule of thumb. Keep your discipline. Hoping that it can recover your costs is the worst possible investment strategy out there. Hoping is not a winning strategy.

Q: Why don't you wait for the bottom?

A: Because nobody knows where the bottoms are. All you can do is scale. When you think things are oversold, when you think things are cheap, then you start buying things one at a time unless you get these giant meltdown days like we got on August 5th. So that's what I probably will be doing, is scaling in on the weak days on stocks that have the best fundamentals. That’s the only way to manage a portfolio.

Q: Is it a good time to buy REITs for income?

A: Absolutely. REITs are looking at major drops in interest rates coming. That will greatly reduce their overheads as they refi, and of course, the recovering economy is good for filling buildings. So I've been a very strong advocate of REITs the entire year, and they really have only started to pay off big time in the last month, and Crown Castle Inc (CCI) is my favorite REIT out there.

Q: I own Freeport McMoRan (FCX). Do you think China’s problems will make FCX a sell?

A: Not a sell, but a wait. China (FXI) is delaying any recovery in a bull market. If we get another move in (FCX) down to the thirties I would double up, because eventually American demand offsets Chinese weakness, and we’ll be back in a bull market on the metals. It's American demand that is delivering the long-term bull case for copper, not the return of Chinese construction demand, which led to the last bull market. So we really are changing horses as the main driver of the demand for copper. It still takes 200 pounds of copper to make an EV whose sales are growing globally.

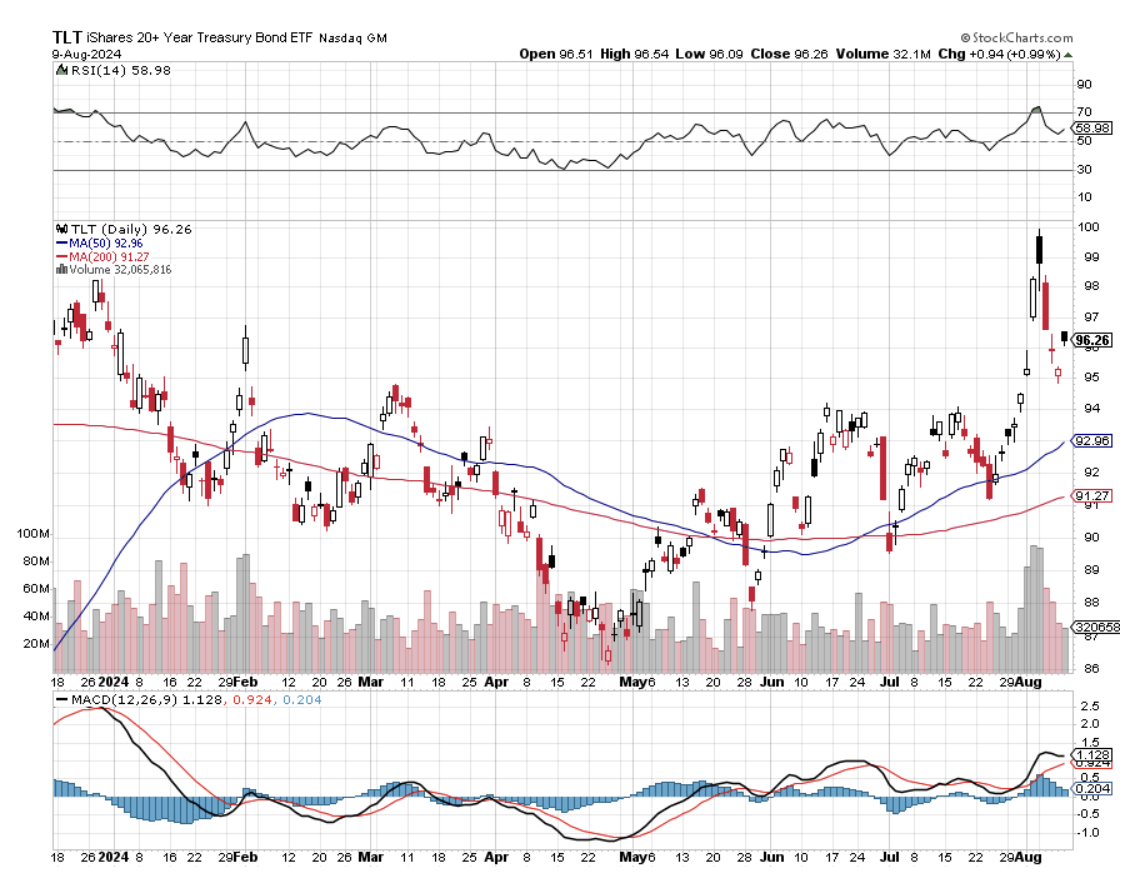

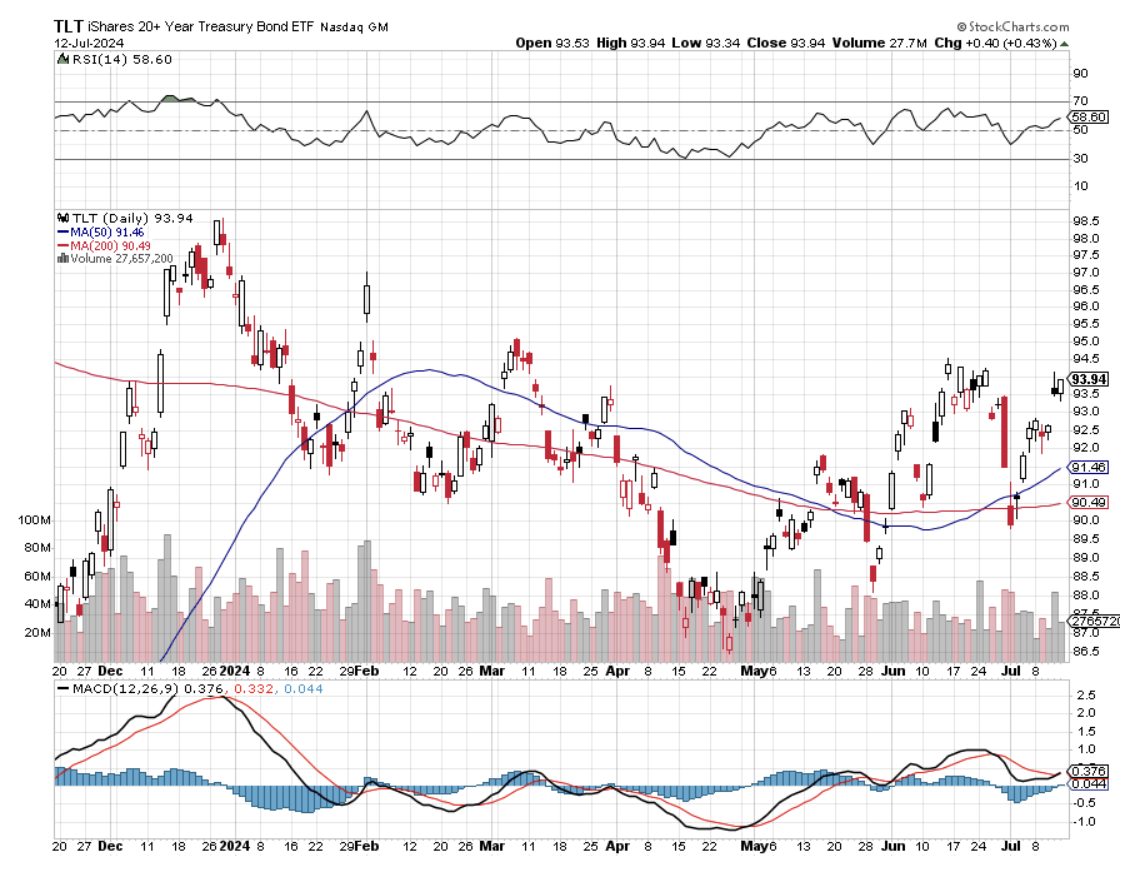

Q: Is it time to buy (TLT) now?

A: No, the time to buy (TLT) was at the beginning of the year, seven months ago, three months ago, a month ago. Now we've just had a really big $12 point rally, and really almost $18 points off the bottom. I would wait for at least a 5-point drop-in (TLT) before we dive back into that. If you noticed, I haven't been doing any (TLT) trades lately because the move has been so extended. And in fact, if they only cut a quarter of a point in September, then you could get a selloff in (TLT), and that'll be your entry point there. You have to ditch your buy high, sell low mentality, which most people have.

Q: What bond should I buy for a 6 to 10-year investment?

A: I’d buy junk bonds. Junk bonds have always been misnamed, or I would buy some of the high-yield plays like the BB loans (SLRN). With junk bonds, the actual default rate even in a recession, only gets to about 2%. So it certainly is worth having. I still think they're yielding 6 or 7% now, so that's where I would put my money. Or you can buy REITs which also have similarly high yields, like the (CCI), which is around 5% now. Risks in both these sectors are about to decline dramatically.

Q: Will there be an inflation spike next year?

A: No. Technology is accelerating so fast it's wiping out the prices of everything that's highly deflationary, and that pretty much has been the trend over the last 40 years. So don't expect that to change. The post-COVID inflationary spike was a one-time-only event, which then ended two years ago. We've gone from a 9% down to a 2.8% inflation rate; unless we get another COVID-induced inflation spike, there's no reason for inflation to return. Deflation is going to be the next game.

Q: What do you think of the UK economy now that you're in London?

A: Awful! Brexit was the worst thing that happened to England—that's why it was financed by the Russians. Brexit will have the effect of dropping both the economic growth rate and standards of living by half over the next 20 years. Expect England to beg their way back into Europe sometime in the future, although I may not live long enough to see it. There are no English people in London anymore. It's all foreigners. No one can afford it.

Q: Should I leap on Tesla (TSLA) where the current price is?

A: No. We’re waiting for the nuclear winter in EVs to end—no sign of it yet. And unfortunately, Elon Musk is scaring away buyers, especially in blue states, by palling around with Donald Trump, a well-known climate change denier. What's in that relationship? I have no idea. One of the first things Trump did was to dump subsidies for electric cars last time he was president. It's hard to tell who’s gone crazier, Trump or Musk.

Q: I have an empty portfolio, when should we expect your options trade to start coming in again?

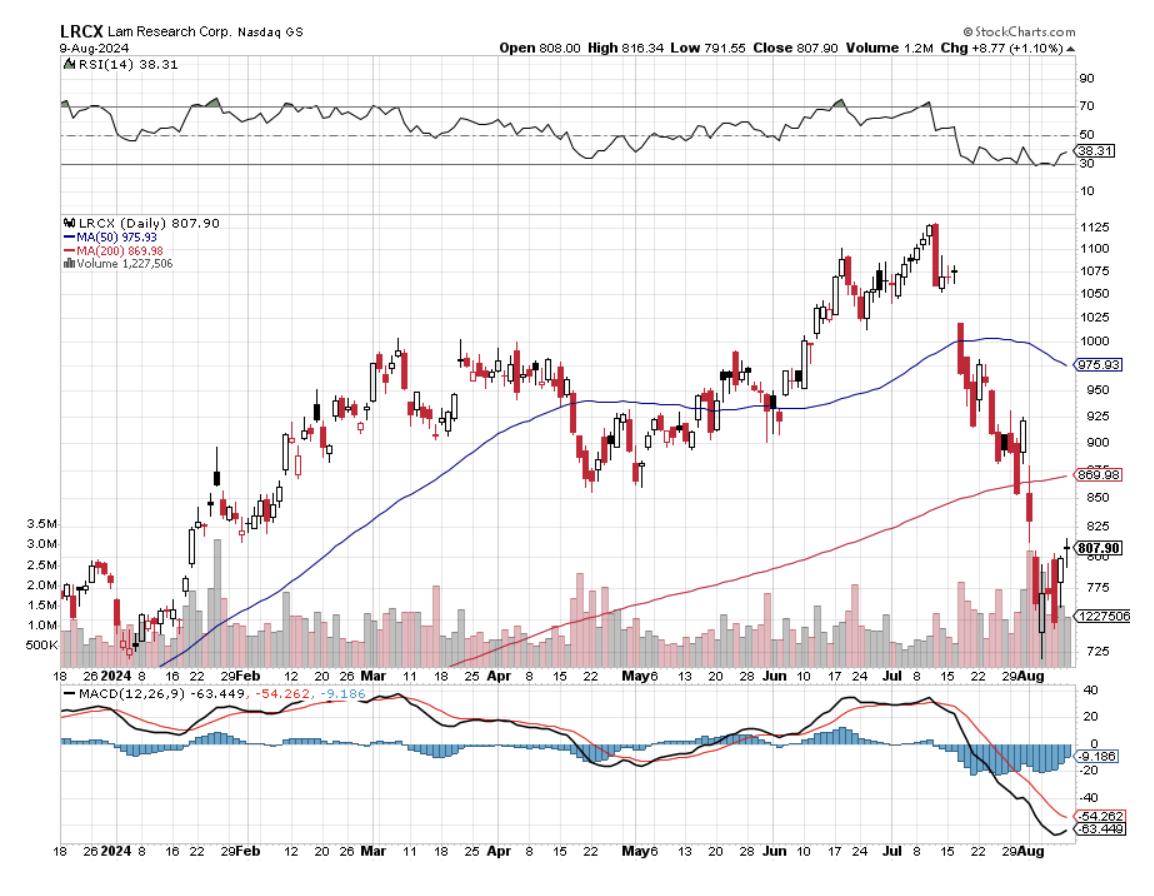

A: As soon as I see a great sell-off or a great individual situation like we got a couple days ago with the Mad Hedge Technology Letter in Lam Research (LRCX). That's what we look for all day, every day of the year. There's no point in trading for the sake of trading, that only makes your broker rich, not you. There's no law that says you have to have a trade every day, and actually having cash isn't so bad these days. They're still paying 5% for 90-day T Bills. If you don’t know what T Bills are, look up 90-day T bills on my website.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader