In the end, it proved to be a one-stock market.

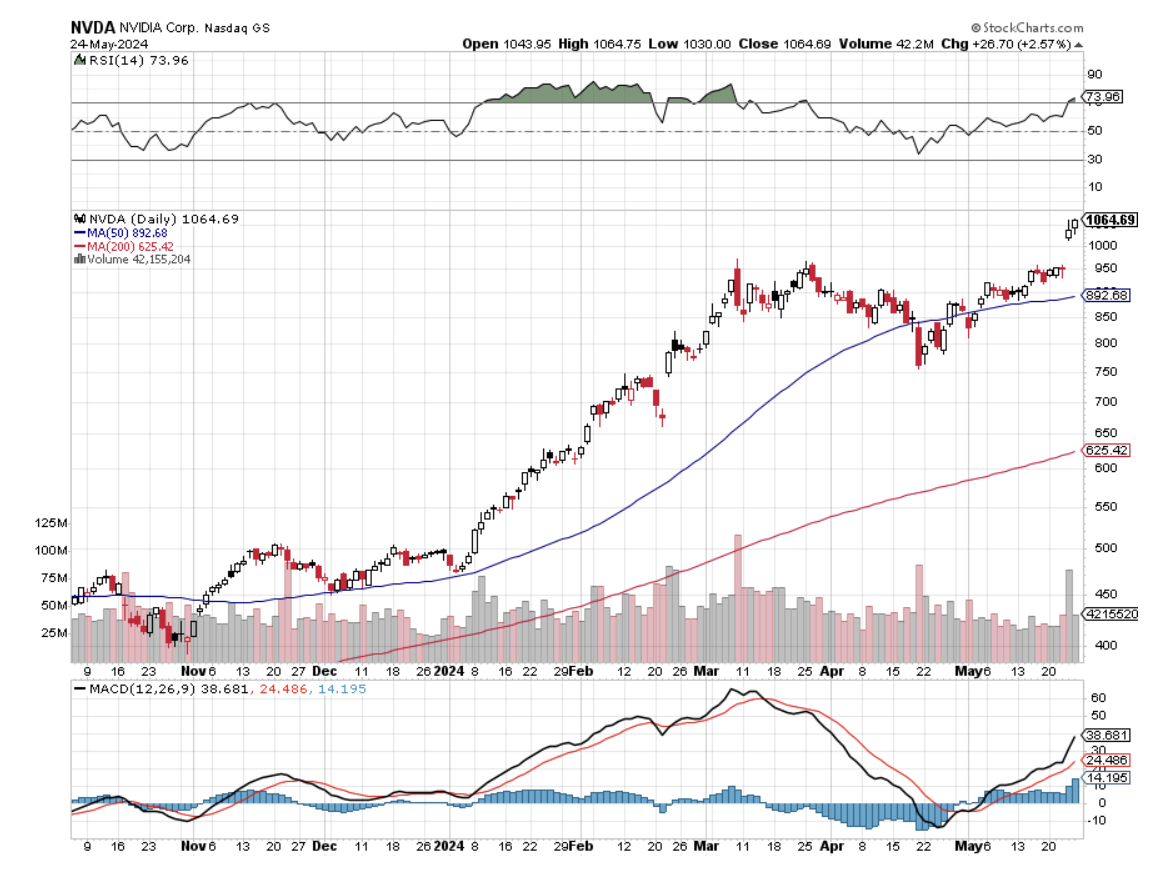

As I expected, once the NVIDIA earnings were out it proved to be not only the top for (NVDA), but also for every other stock and asset class.

It was “risk off” with a vengeance.

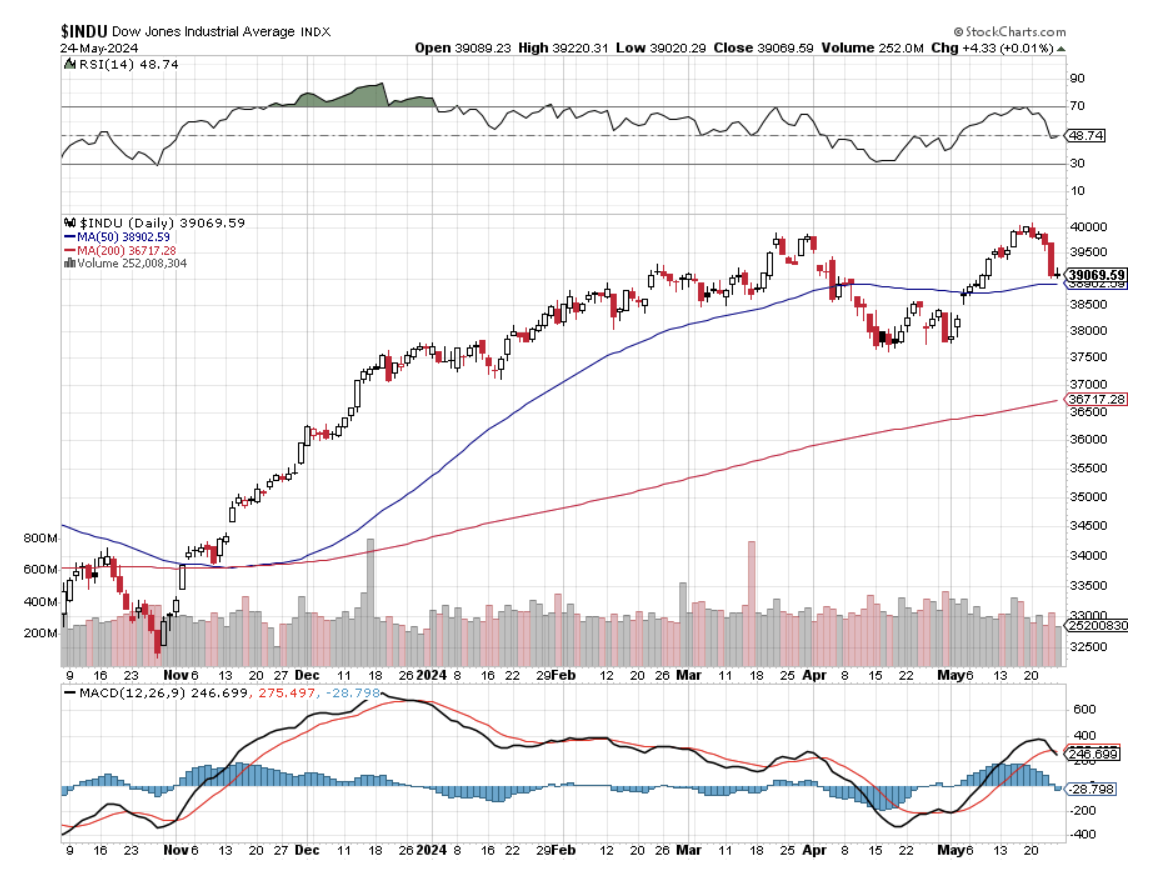

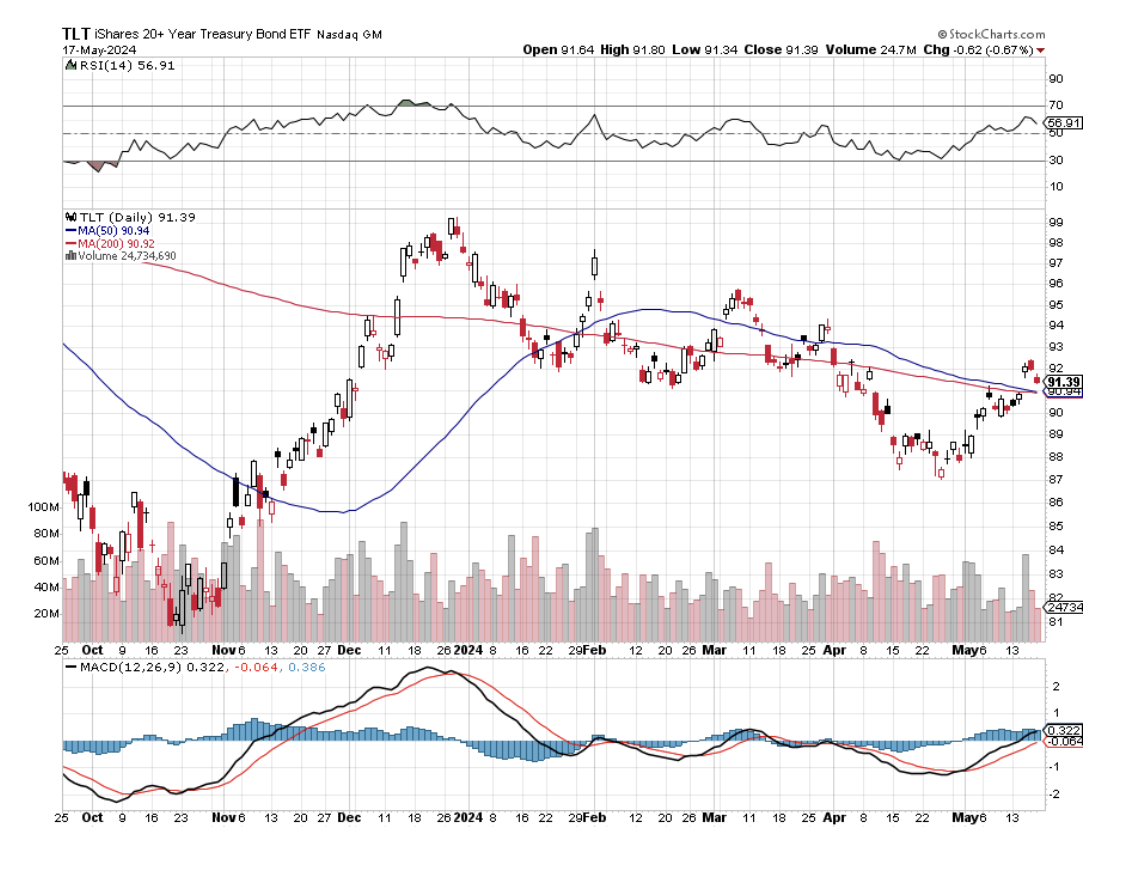

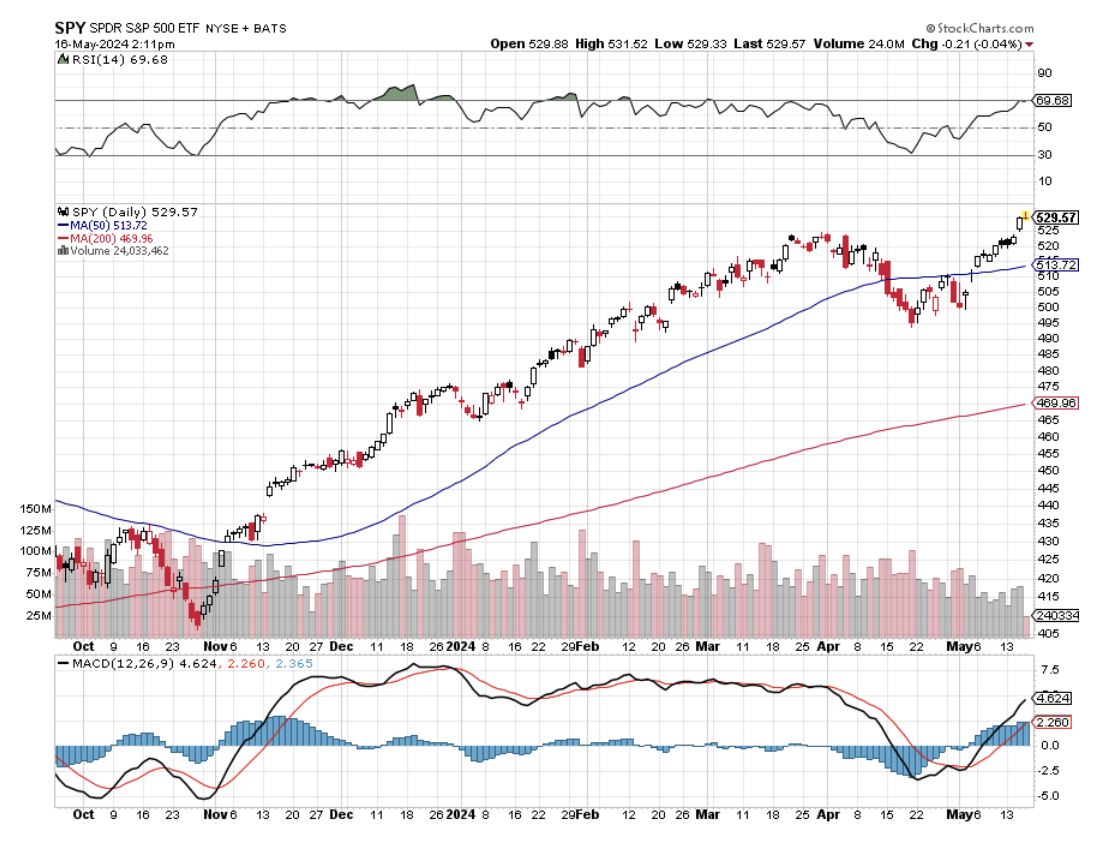

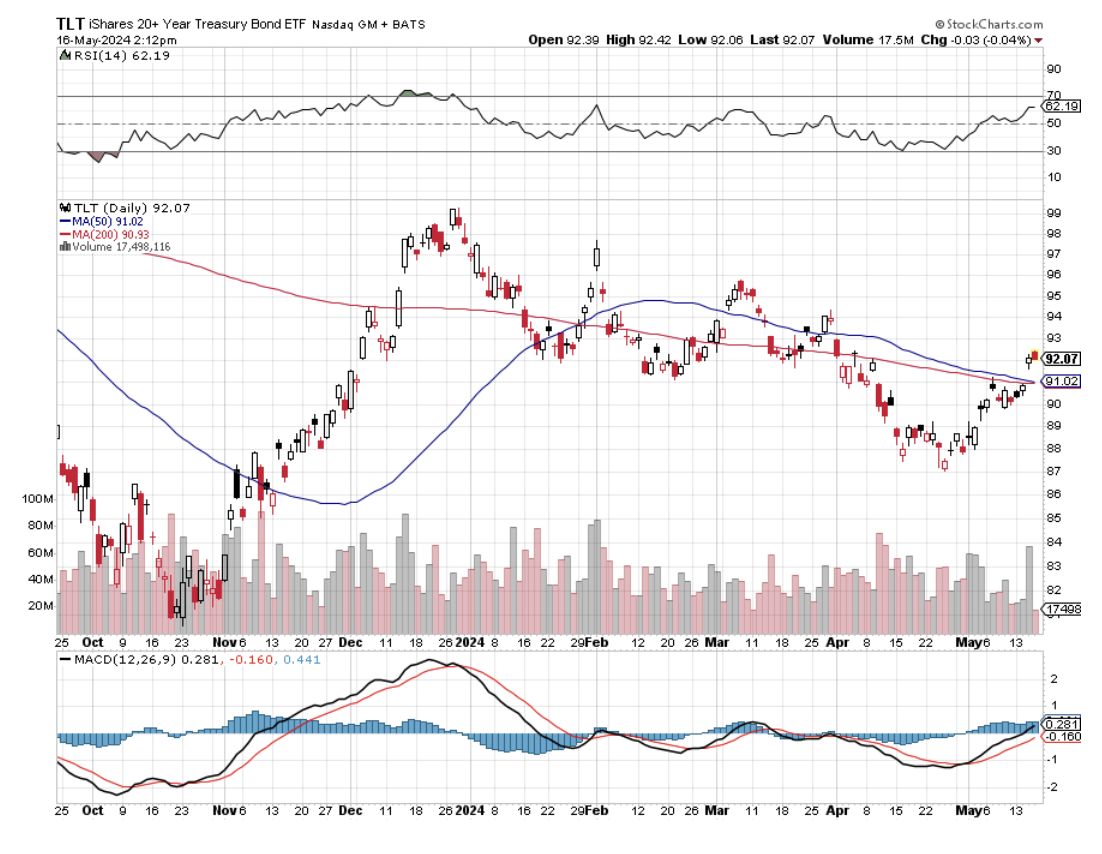

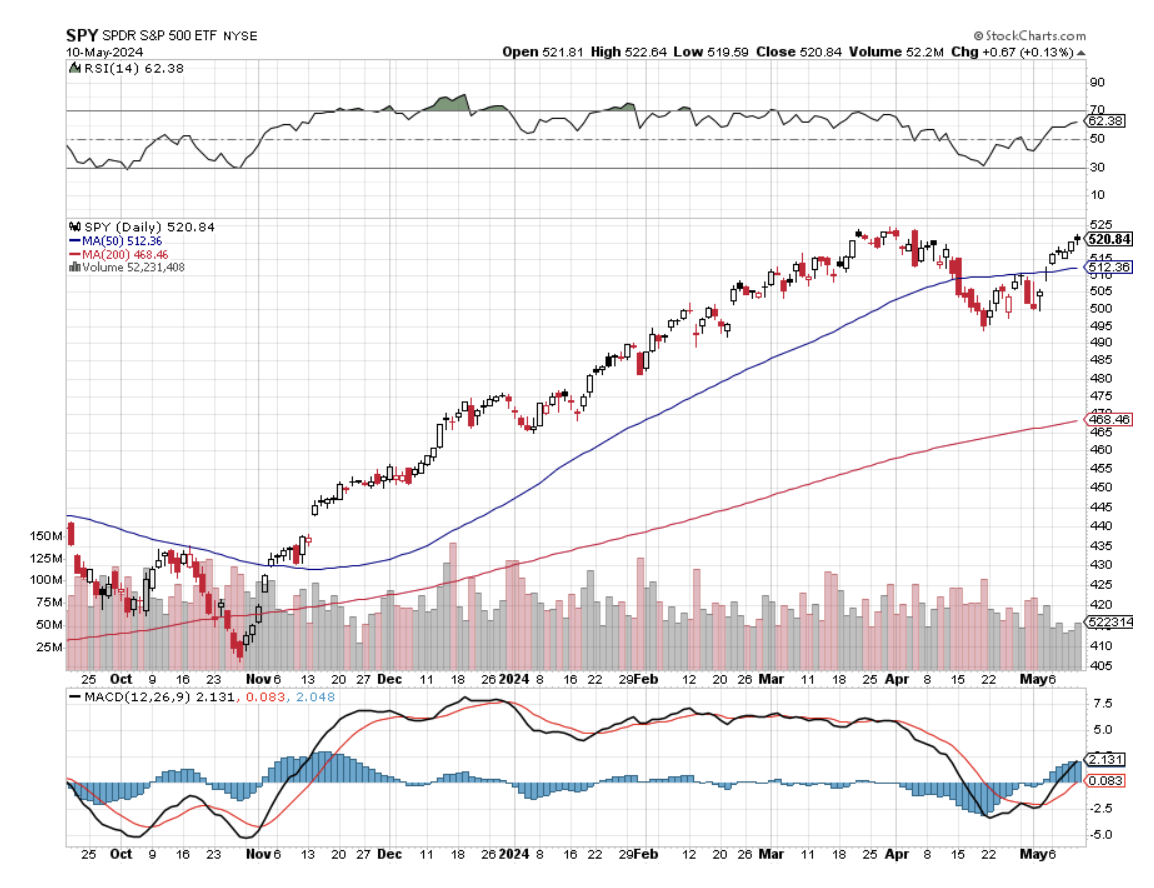

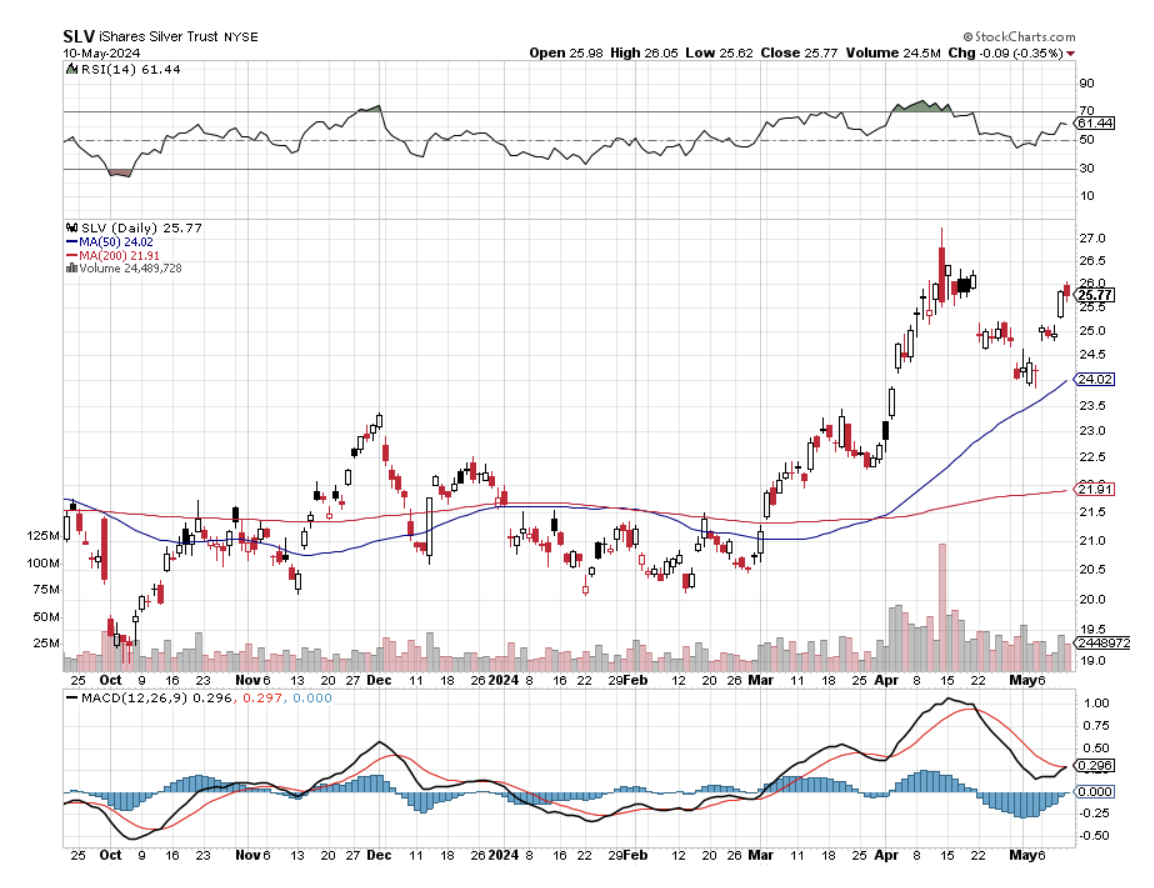

The Dow ($INDU) and S&P 500 (SPY) suffered their worst day in a year. Bonds (TLT) took it on the nose. Gold (GLD) and silver (SLV) gave up their recent 5% and 10% gains, the worst action in eight months. Even the real estate data was awful, even though it lags by a month.

It gets worse.

Look at the chart for the Dow Average below and you’ll see that a very clear double top is in place. And now we have commercial real estate REIT’s (SREIT) suspending redemptions and gating investors lest they trigger a run on the bank and force distress liquidations.

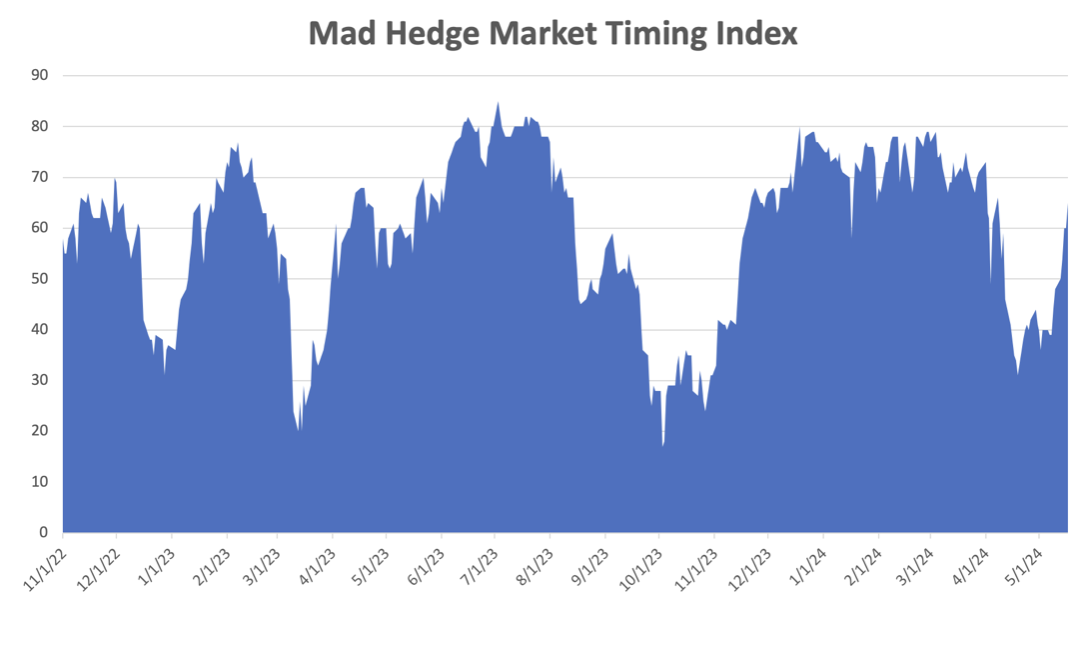

I’m not turning bearish. But all this means we have some tough rows to hoe before we reach substantial new highs again. I’m still sticking to my 2024 year-end target of $6,000 for the (SPY). But it might be a good summer to take a long Alaskan cruise, climb a high mountain like the Matterhorn, or catch the latest shows in London’s West End (Kiss Me Kate, Les Misérables, or Moulin Rouge?).

I’m doing all three.

Don’t get me wrong. All this travel does not mean that I have become lazy, indolent, or a skiver. I actually get more work done when I am on the road as I don’t have so many local distractions, like unplugging the toilet (I have two daughters), trapping rats under the house, or getting someone to weed the garden.

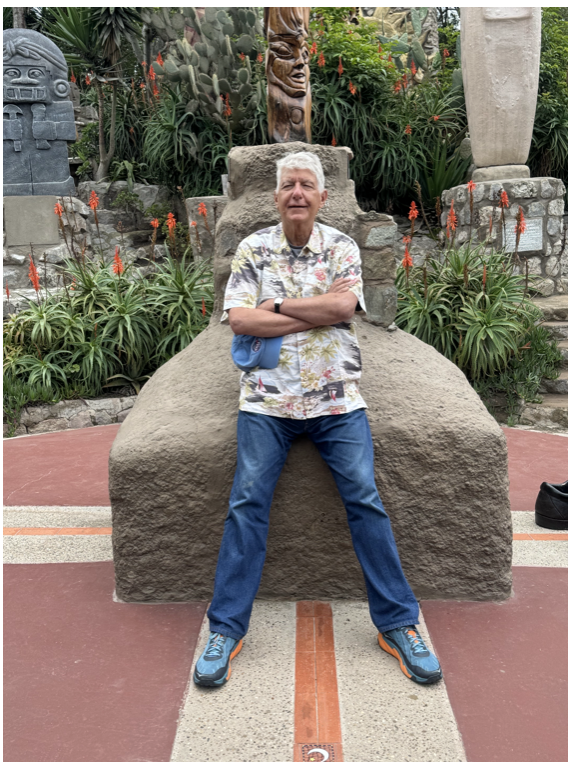

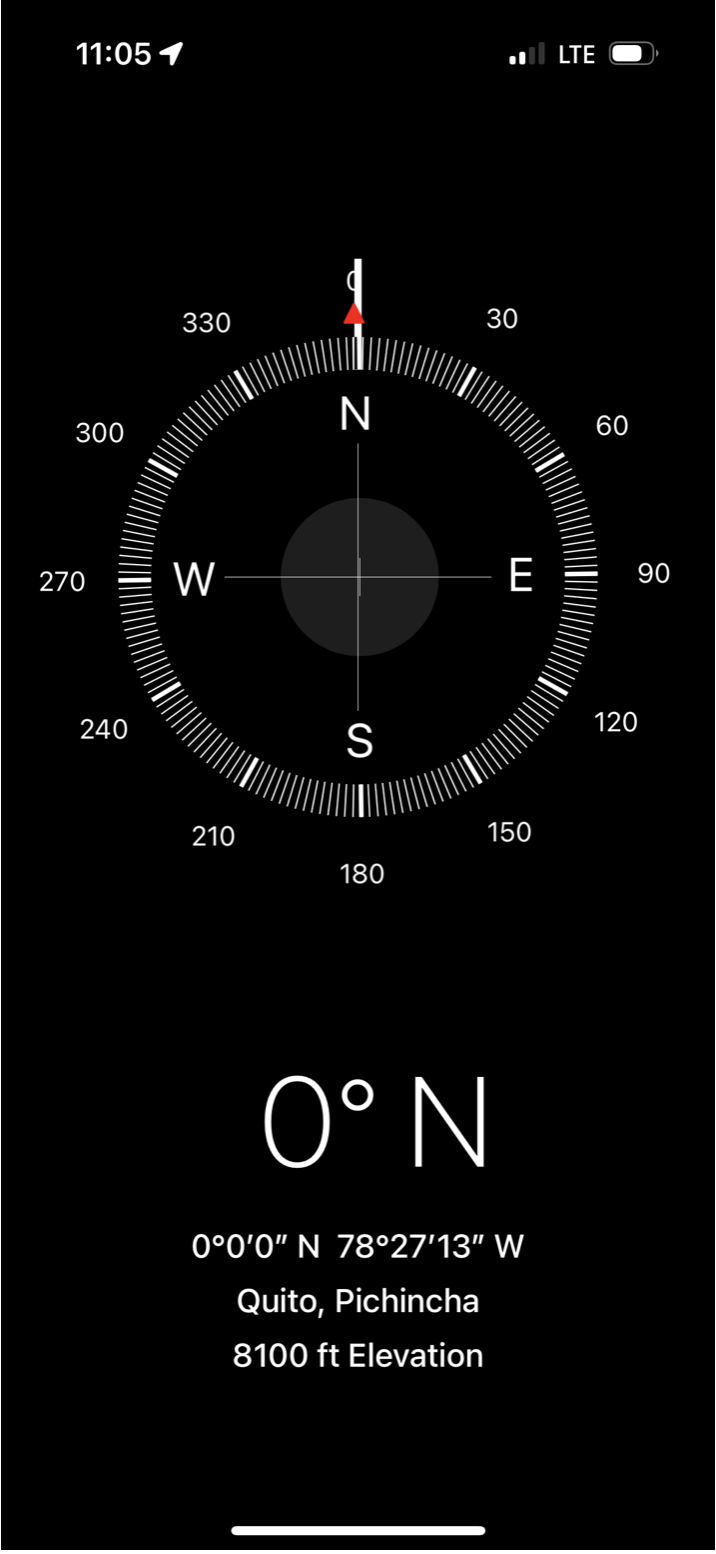

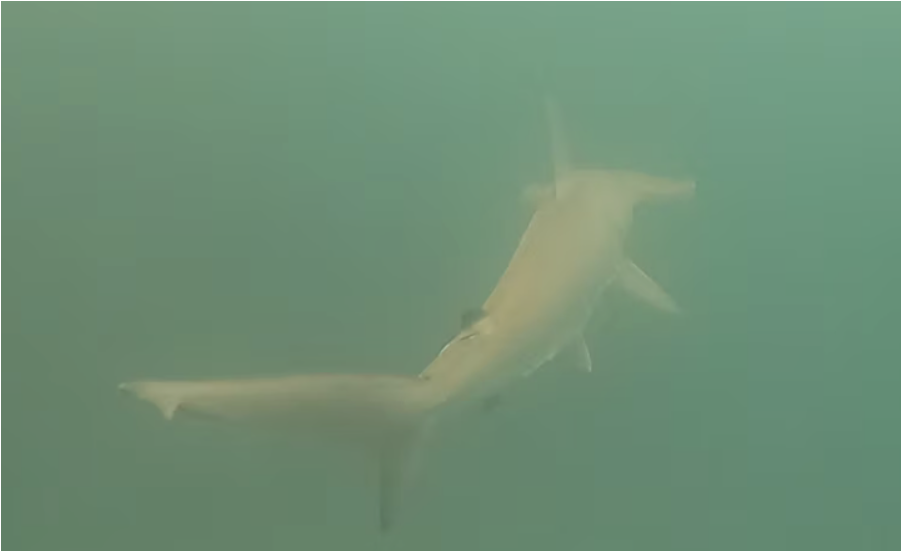

In the Galapagos Islands I actually achieved ten hours a day of work because, dead on the equator, you have to meter your sun exposure carefully. Notice that my trade alerts went up in volume and were all good and my original content increased. I actually had the time to write what I really wanted to write.

With Elon Musk’s global Starlink Internet service promising 200 mb/sec and actually delivering 50, the world is my oyster.

And how about those NVIDIA earnings!

They were Blockbuster for sure, and for good measure they announced a 10:1 stock split, Taking the shares over $1,000 for the first time. Talk about a one: two punch for the shorts!

Revenues came in at an astounding $26.04 billion vs. $24.65 billion expected. CEO Jenson Huang called it a new Industrial Revelation. It sounds a lot like my New American Golden Age and Pax Americana. I reiterate by yearend $1,400 target. It’s as if Microsoft (MSFT), Intel (INTC), Dell (DELL), and Netscape all combined into a single company in 1995.

If by some miracle we do get a 20% correction like we had in April, double the position I know you all already have. Oh, and Mad Hedge hit a new all-time high, up 18.01% YTD and 695% since inception.

What’s more important here is not how spectacular a bet on (NVDA) a decade ago at $15 a share a decade ago was, back when it was considered a lowly video game stock. The implications for the global economy are immense. In means the massive $200 billion in capital spending for this year is too low. It also means the future is happening faster than anyone realizes, even me.

You know those popup 15-second advertising videos that have suddenly started appearing on your phone? They eat up immense processing power and drain your battery at an epic rate (more power demands). But they can be entertaining. Think of them as a metaphor for the entire economy.

Let me assure you that I’m called “Mad” for a reason. When (NVDA) suffered its last correction, I doubled up my own personal LEAPS position. That was when the bears were arguing for a selloff in (NVDA) prompted by an air pocket in orders headed into the Blackwell superchip release.

It turns out there’s no air pocket. Customers are buying the old (NVDA) chips as fast as they can at premium prices.

Dow 120,000 here we come!

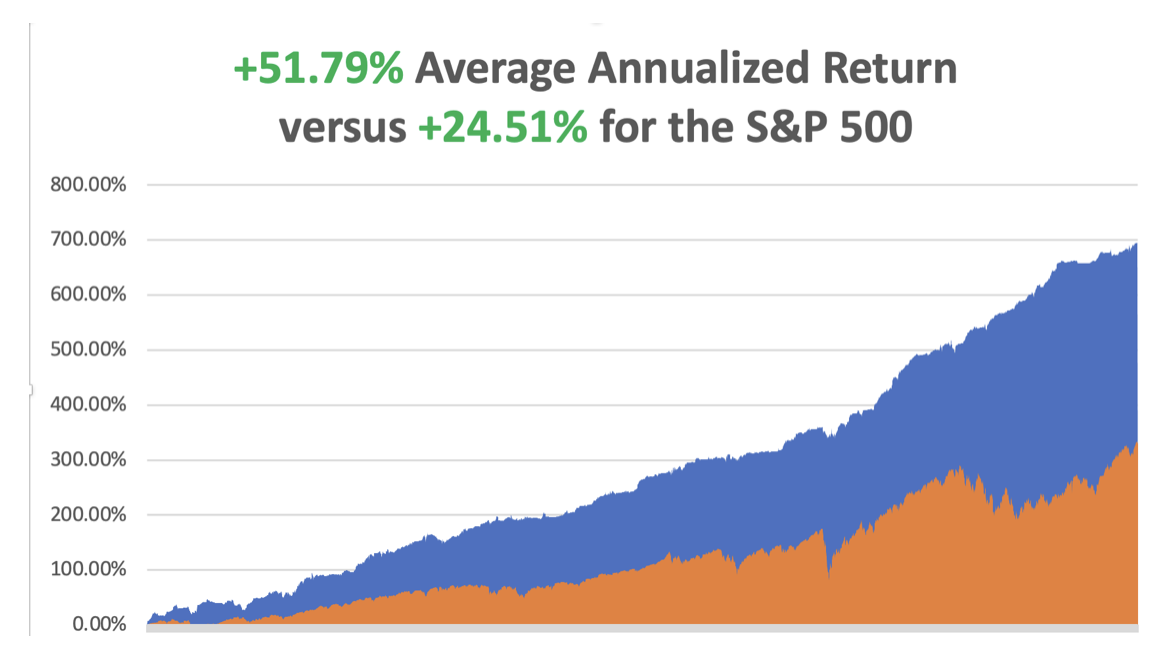

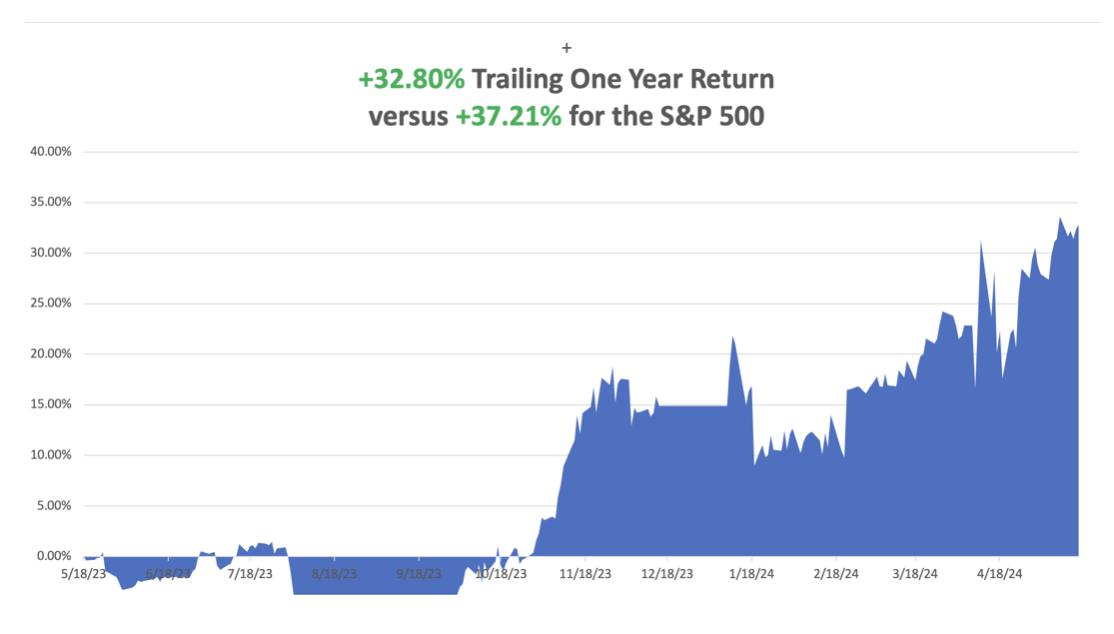

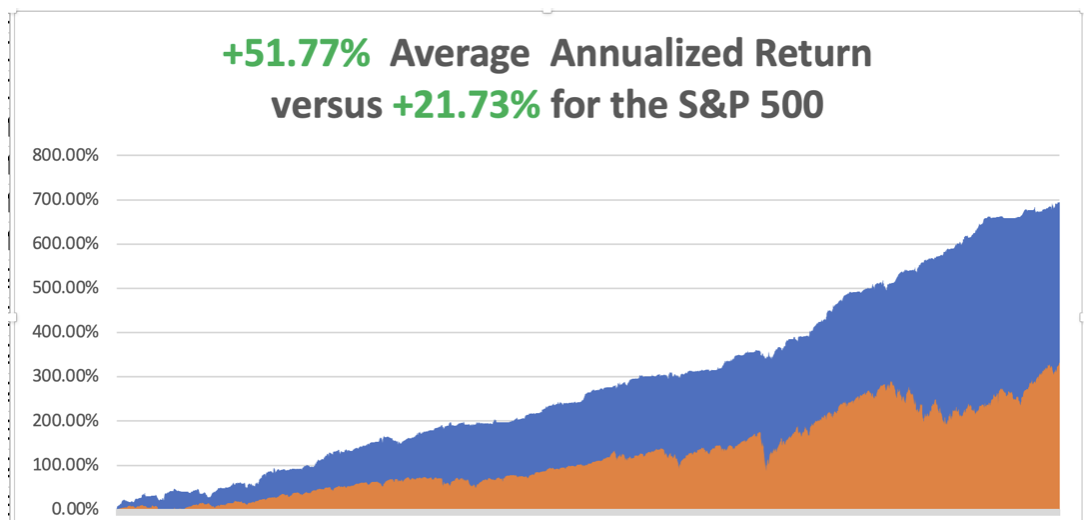

So far in May, we are up +3.38%. My 2024 year-to-date performance is at +18.01%. The S&P 500 (SPY) is up +10.90% so far in 2024. My trailing one-year return reached +33.25%.

That brings my 16-year total return to +694.62%. My average annualized return has recovered to +51.79.

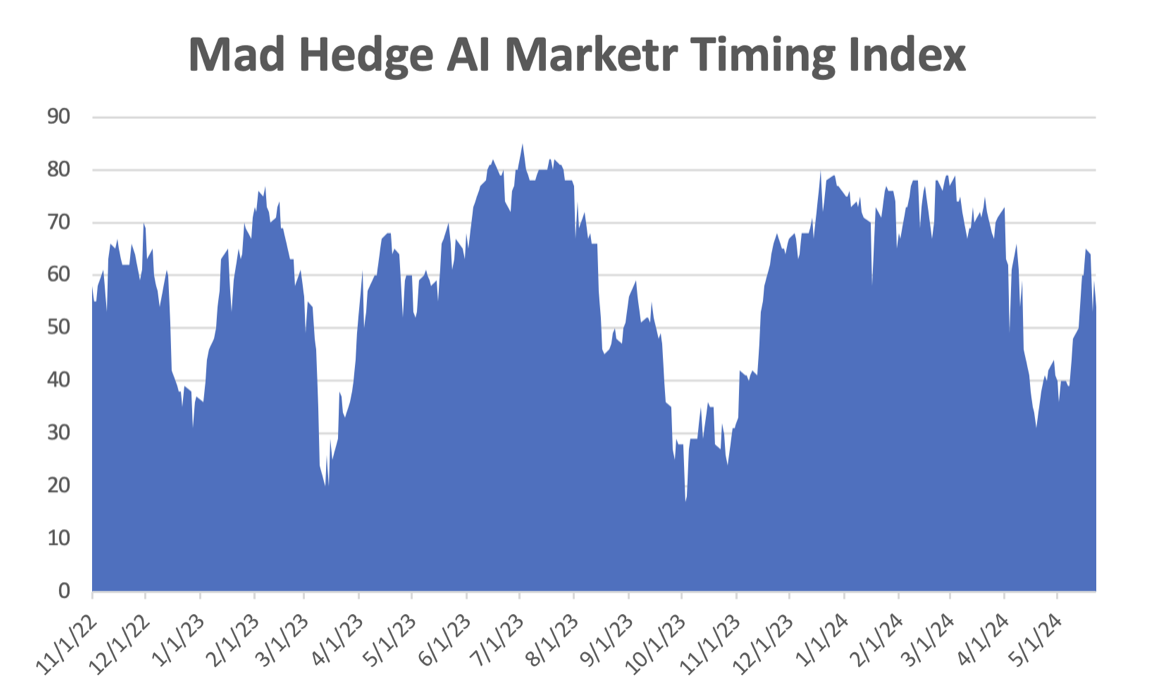

As the market reaches higher and higher, I continue to pare back risk in my portfolio. I took profits on my long in (SLV) right at a multiyear high and just before a 10% plunge. That left me 90% in cash and with a single short in (AAPL) going into the worst selloff in a year.

The harder I work, the luckier I get.

Some 63 of my 70 round trips were profitable in 2023. Some 27 of 37 trades have been profitable so far in 2024.

Copper Slide Continues, down 7% in three days, as the extent of Chinese speculation becomes clear. The route has spread to gold, silver, iron ore, and platinum. Once the Chinese enter a market, the volatility always goes up. Speculators have fled a collapsing Chinese real estate market into commodities of every sort. Buy the big dip. They’ll be back.

S&P Global Flash PMI Jumps, 50.9 for services and 54.8 for manufacturing, a one-year high. Stocks and bonds took it on the nose, taking ten-year US Treasury yields up to 4.49%. Commodities were already taking a bath thanks to speculative Chinese dumping. Inflation wasn’t gone, it was just taking a nap.

Existing Home Sales Fall, down for the second month in a row at -1.9% to 4.14 million rates in April. The Median selling price rose to $407,600, a new record. The residential real estate boom is back! The nascent recovery in demand from a 13-year low in October is being hindered by limited inventory that’s keeping asking prices elevated

New Home Sales Tank in April, down 4.4%, and 7.7% in March.

The median price of a new home was $433,500, 4% higher than it was in April 2023. Builders say they cannot lower prices due to high costs for land, labor, and materials. The big production builders have been buying down mortgage rates to help boost sales, but they are able to do that because of their size.

Weekly Jobless Claims Fall, down 215,000, down 8,000, the steepest decline since September. Federal Reserve officials are looking for further weakening in demand as they try to tame inflation without triggering a surge in unemployment.

30-Year Fixed Rate Mortgage Drops Below 7.0%. The housing market taking a step back in April after a strong performance in the first quarter.

To Monetize or Not? Most of us are still using AI for free. Providers are now facing a dilemma, “Growth at or cost”, or “Take the money and run” for systems that are, with the new $40,000 Blackwell chips, still incredibly expensive to build. Microsoft’s GPT 4.0, Goggle’s AI Overview, and Gemini AI are essentially beta tests that are still free (the black George Washington’s, etc). But Amazon is looking to start charging for the AI elements of its Alexa service. Your biggest monthly bill may soon be for AI.

Thousands of Young Traders are Getting Wiped Out, following the trading advice of London-based IM Academy. The guru, Chris Terry, calls itself the “Yale of forex, the Harvard of trading,” despite his own criminal conviction for theft. Since 2014 IM Academy has grown to 500,000 members taking in $1 billion in revenues. Terry had no formal education and until the late nineties worked as a construction worker in New York. IM is now under investigation by the FTC. Be careful who you listen to, as most investment newsletters out there are fakes.

US to Drop One Million Barrels of Gasoline on the Market, ahead of the annual July 4 price spike. The fuel will come from closing down the Northeast Emergency Fuel Reserve. With the decarbonization of America, who needs it? It takes 2 gallons of oil to produce 1 gallon of gasoline. Hey, what’s the point of being a politician if you can’t engage in pre-election ploys? Another dig at the oil companies.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, May 27 is Memorial Day. As the senior officer, I will be leading the annual parade in Incline Village, this time wearing my Ukrainian Army major’s hat.

On Tuesday, May 28 at 1:30 PM EST, the Dallas Fed Manufacturing Index is released.

On Wednesday, May 29 at 11:00 PM EST, the Fed Beige Book is published

On Thursday, May 30 at 8:30 AM EST, the Weekly Jobless Claims are announced. We also get the second read of the US Q1 GDP Growth Rate.

On Friday, May 31 at 8:30 AM the Core PCE Price Index is announced, an important inflation read.

At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, It was with a heavy heart that I boarded a plane for Los Angeles to attend a funeral for Bob, the former scoutmaster of Boy Scout Troop 108.

The event brought a convocation of ex-scouts from up and down the West Coast and said much about our age.

Bob, 85, called me two weeks ago to tell me his CAT scan had just revealed advanced metastatic lung cancer. I said, “Congratulations Bob, you just made your life span.”

It was our last conversation.

He spent only a week in bed and then was gone. As a samurai warrior might have said, it was a good death. Some thought it was the smoking he quit 20 years ago.

Others speculated that it was his close work with uranium during WWII. I chalked it up to a half-century of breathing the air in Los Angeles.

Bob originally hailed from Bloomfield, New Jersey. After WWII, every East Coast college was jammed with returning vets on the GI bill. So he enrolled in a small, well-regarded engineering school in New Mexico in a remote place called Alamogordo.

His first job after graduation was testing V2 rockets newly captured from the Germans at the White Sands Missile Test Range. He graduated to design ignition systems for atomic bombs. A boom in defense spending during the fifties swept him up to the Greater Los Angeles area.

Scouts I last saw at age 13 or 14 were now 60, while the surviving dads were well into their 80’s. Everyone was in great shape, those endless miles lugging heavy packs over High Sierra passes obviously yielding lifetime benefits.

Hybrid cars lined both sides of the street. A tag-along guest called out for a cigarette and a hush came over a crowd numbering over 100.

Apparently, some things stuck. It was a real cycle of life weekend. While the elders spoke about blood pressure and golf handicaps, the next generation of scouts played in the backyard or picked lemons off a ripening tree.

Bob was the guy who taught me how to ski, cast for rainbow trout in mountain lakes, transmit Morse code, and survive in the wilderness. He used to scrawl schematic diagrams for simple radios and binary computers on a piece of paper, usually built around a single tube or transistor.

I would run off to Radio Shack to buy WWII surplus parts for pennies on the pound and spend long nights attempting to decode impossibly fast Navy ship-to-ship transmissions. He was also the man who pinned an Eagle Scout badge on my uniform in front of beaming parents when I turned 15.

While in the neighborhood, I thought I would drive by the house in which I grew up, once a modest 1,800 square-foot ranch-style home to a happy family of nine. I was horrified to find that it had been torn down, and the majestic maple tree that I planted 40 years ago had been removed.

In its place was a giant, 6,000 square foot marble and granite monstrosity under construction for a wealthy family from China.

Profits from the enormous China-America trade have been pouring into my hometown from the Middle Kingdom for the last decade, and mine was one of the last houses to go.

When I was class president of the high school here, there were 3,000 white kids and one Chinese. Today those numbers are reversed. Such is the price of globalization.

I guess you really can’t go home again.

At the request of the family, I assisted in the liquidation of his investment portfolio. Bob had been an avid reader of the Diary of a Mad Hedge Fund Trader since its inception, and he had attended my Los Angeles lunches.

It seems he listened well. There was Apple (AAPL) in all its glory at a cost of $21. I laughed to myself. The master had become the student and the student had become the master.

Like I said, it was a real circle of life weekend.

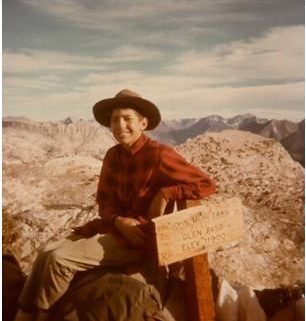

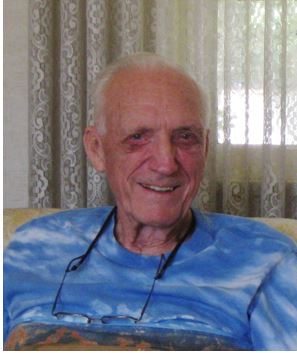

Scoutmaster Bob

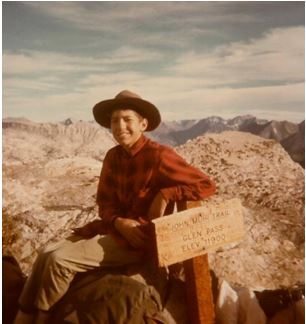

1965 Scout John Thomas

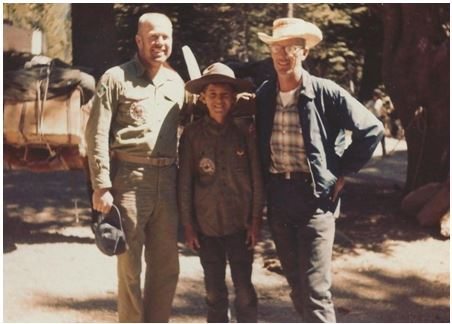

The Mad Hedge Fund Trader at Age 11 in 1963

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader