After a half-century in the markets, I have noticed that it is the investors with the correct long-term views who make the biggest money. My favorite example is my friend, Warren Buffet, who doesn’t care if an investment turns good in five minutes or five years.

Buffet’s Berkshire Hathaway (BRKB) is the largest outside investor in Apple (AAPL). And guess what his cost has been? By the time you add up the compounded dividends he has collected since he started buying the stock in 2011, it's zero. The value today? $15.5 billion.

Buffet didn’t buy Apple for its hardware, iPhone, or iTunes. He bought it for the brand, which has improved astronomically. Look at Berkshire’s portfolio and it is packed with brands, like American Express (AXP), Coca-Cola (KO), and Exxon (XOM).

When did Buffet last buy Apple? In May when it hit $130.

That’s why Warren Buffet is Warren Buffet and you are you.

While the inflation news last week has been great and it is likely to get better, I believe that investors are missing the bigger, more important long-term picture.

The fact is that markets are now discounting an earlier than expected end to the Ukraine War, much earlier.

I get constant updates on the war from the Joint Chiefs of Staff, Britain’s Defense Committee, and NATO headquarters and I can tell you that the war has taken a dramatic turn in Ukraine’s favor just in the last two weeks.

Russian casualties have topped 80,000, nearly half the standing army. They have lost 2,200 of their 2,800 operational tanks. Some 120 front line aircraft have been destroyed. This week, Ukraine attacked the principal Russian air base in Crimea, leaving the smoking ruins of seven more aircraft there.

Russia is in effect fighting a modern digitized war with 50-year-old Cold War weapons and it isn’t working. Its generals have no experience fighting wars against determined opposition. Putin would do better listening to the retired generals on CNN for military advice.

America’s High HIMARS (the M142 High Mobility Artillery Rocket System) has become the Stinger missile of this war. The Lockheed Martin (LMT) factory in Camden, Arkansas that makes these missiles is running 24/7 on doubled orders.

The sanctions against Russia have been wildly successful. The Russian economy is utterly collapsing. What oil they are selling now is at half price. Aircraft are being cannibalized for parts to keep others flying. Much of the educated middle class has fled the country. Draft dodging is rampant.

What does all this mean for you and me?

The commodity price spike the war prompted has ended and most are now in steep downtrends. Gold (GLD), where the Russians were major buyers, has been flat as a pancake. This has put our inflation numbers into freefall. Interest rate fears peaked in June and are now in the rear-view mirror.

As is always the case, markets have seen these developments and correctly ascertained their consequences far before we humans did (except for maybe me). It has been no surprise that they have been tracking the Russian defeat day by day and have been on an absolute tear since June 15.

Even small techs suffering 18-month bear markets have now begun major recoveries, with companies like Snowflake (SNOW), up 50%, Netflix (NFLX), up 39%, and Cathie Wood’s Innovation Fund (ARKK) up 57%. Even crypto has returned from the grave, with Ethereum (ETHE) up an eye-popping 105%.

But don’t go gaga over stocks just yet.

The Fed ramps up quantitative tightening in September to $95 billion a month and will deliver another interest rate hike. That's why I am running a double short in the bond market (TLT), (TBT) once again.

We also have the midterms to worry about which, with recent developments, promise to be more contentious than ever. Look for another round of tiring new election fraud claims.

That’s great because these events will give us good entry points lower down for trade alerts, not the short-term top we are looking at right now.

It helps that with ten-year US Treasury yields at 2.80%, it has an effective price earning multiple of 37, while stocks growing earnings at 10% a year boast a price earnings multiple of only 16. That sets up a massive, long stock/short bond trade which Mad Hedge will be pushing well on into 2023.

And you know what?

The smart guys I know in the hedge fund community are starting to model for the next Fed interest rate CUT. Markets will love it and discount this far in advance.

If you want to get on the train with me before it leaves the station, just keep reading this newsletter.

Yes, markets are now being driven by rate cuts and peace prospects, not rate rises and war!

Your retirement fund will love it.

I just thought you’d like to know.

CPI Dives to 8.5%, down 0.6% in July. The peak is in, and stocks rallied 500. Look for another drop in August, with gasoline prices falling daily. The 800-pound gorilla in the room has exited.

The Producer Price Index Dives 0.5%, confirming last week’s weak CPI number. And many core prices are indicating that we will get another drop when the August numbers are reported in September. It was worth another 300-point rally in the Dow Average, which is getting seriously overbought.

Consumer Inflation Expectations dive to 6.2% for the coming year and only 3.2% for three years. according to a New York Fed Survey. Expectations for food costs saw the largest decline. The CPI is out on Wednesday. No doubt a media onslaught over a coming recession has a lot to do with it.

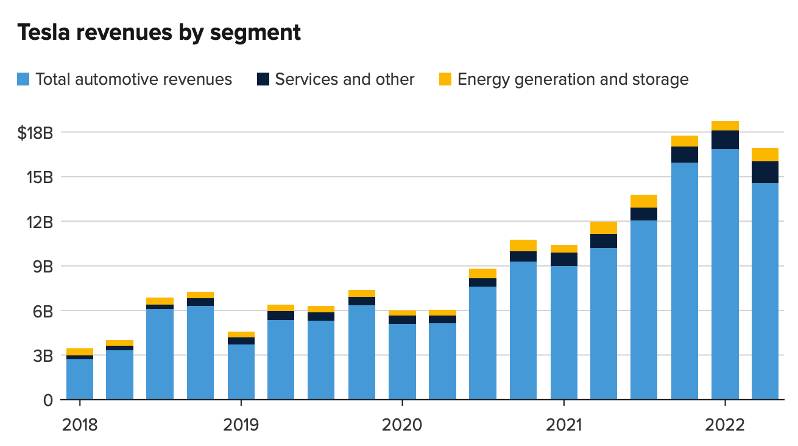

Elon Musk Sells $6.9 billion worth of Tesla (TSLA) Stock, explaining the $100 drop in the shares last week. Ostensibly, this is to pay for Twitter if he loses his court case. Musk clearing took advantage of a 60% rise in (TSLA) to head off distress sales in the future. Musk also opened the door to share buy backs in the future. Buy (TSLA) on dips.

85,000 IRS Agents are Headed Your Way, but only if the government can hire them and only if you are a billionaire or a profitable large oil company. The rest of us will be ignored by this unpublicized portion of the Biden inflation bill.

US Dollar (UUP) Takes a Hit on CPI Report, which effectively showed that the US saw deflation in July. The greenback is pulling back the 20-year highs which gave you the cheapest European vacation in your lives. The prospect of interest rates rising at a slower pace is dollar negative. Buy (FXA) and (FXC) on dips.

Boeing (BA) Delivered its First 787 Dreamliner in a year, after long-awaited regulatory approval. The monster 30% rise in the shares off the June low predicted as much. A global aircraft shortage helps. Airbus is going to have to start earnings its money again. Keep buying (BA) on dips.

Weekly Jobless Claims Pop 12,000 to 262,000, a new high for the year. It’s not at concerning levels yet but is definitely headed in the wrong direction. Maybe it’s just a summer slowdown? Maybe not.

Shipping Container Charges are Plunging Everywhere, except in the US, which currently has the world’s strongest economy. It’s a sign that global supply chain problems are easing. But the US leads the world in demurrage, or delays, with New York the worst, followed by Long Beach.

Import Prices are Plunging, thanks to a super strong dollar, taking more pressure off of inflation. They fell 1.4% in July according to the Department of Labor. Easing supply chain problems are helping. Biden has had the run of the table for months now

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil prices now rapidly declining, and technology hyper accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

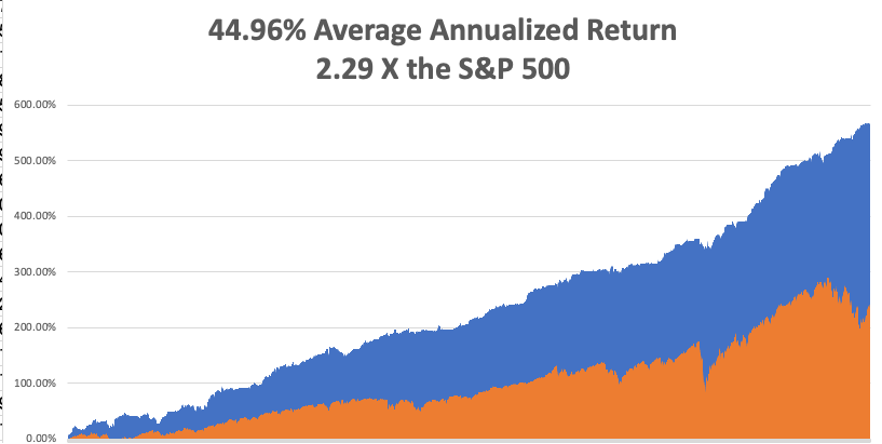

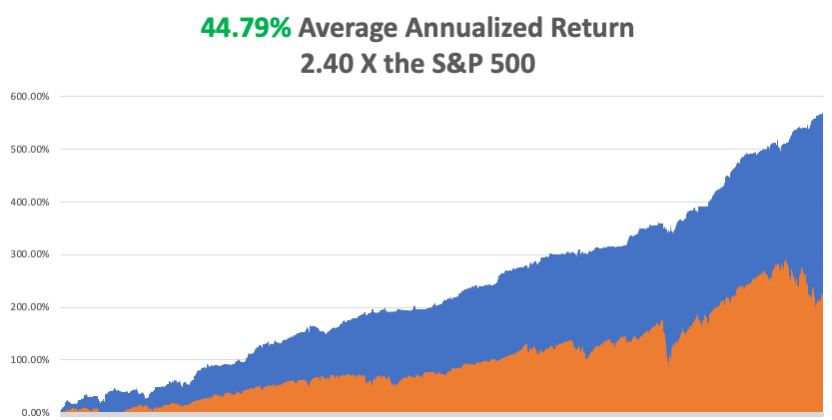

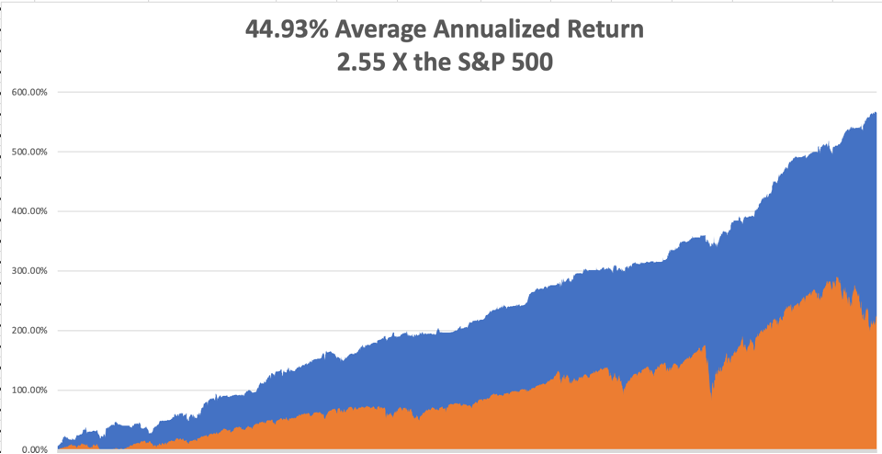

My August performance climbed to +2.14%. My 2022 year-to-date performance ballooned to +56.97%, a new high. The Dow Average is down -7.0% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 74.76%.

That brings my 14-year total return to 569.53%, some 2.56 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 44.96%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 93 million, up 300,000 in a week and deaths topping 1,037,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, August 15 at 8:30 AM EDT, the New York Empire State Manufacturing Index for August is released.

On Tuesday, August 16 at 8:30 AM, the Housing Starts for July are out.

On Wednesday, August 17 at 8:30 AM, Retail Sales for July are published. At 11:00 AM the Fed Minutes from the last meeting are printed.

On Thursday, August 18 at 8:30 AM, Weekly Jobless Claims are announced. Existing Home Sales for July are announced.

On Friday, August 19 at 2:00 the Baker Hughes Oil Rig Count is out.

As for me, while we’re all waiting for the dog days of August to end, it is time to reminisce about my old friend George Schultz who passed away last year at the age of 101.

My friend was having a hard time finding someone to attend a reception who was knowledgeable about financial markets, White House intrigue, international politics, and nuclear weapons.

I asked who was coming. She said Reagan’s Treasury Secretary George Shultz. I said I’d be there wearing my darkest suit, cleanest shirt, and would be on my best behavior, to boot.

It was a rare opportunity to grill a high-level official on a range of top-secret issues that I would have killed for during my days as a journalist for The Economist magazine. I guess arms control is not exactly a hot button issue these days.

I moved in for the kill.

I have known George Shultz for decades, back when he was the CEO of the San Francisco-based heavy engineering company, Bechtel Corp in the 1970s.

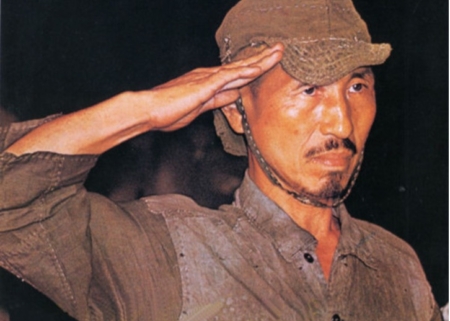

I saluted him as “Captain Schultz”, his WWII Marine Corp rank, which has been our inside joke for years. Now that I am a major, I guess I outrank him.

Since the Marine Corps didn’t know what to do with a PhD in economics from MIT, they put him in charge of an anti-aircraft unit in the South Pacific, as he was already familiar with ballistics, trajectories, and apogees.

I asked him why Reagan was so obsessed with Nicaragua, and if he really believed that if we didn’t fight them there, would we be fighting them in the streets of Los Angeles as the then-president claimed.

He replied that the socialist regime had granted the Soviets bases for listening posts that would be used to monitor US West Coast military movements in exchange for free arms supplies. Closing those bases was the true motivation for the entire Nicaragua policy.

To his credit, George was the only senior official to threaten resignation when he learned of the Iran-contra scandal.

I asked his reaction when he met Soviet premier Mikhail Gorbachev in Reykjavik in 1986 when he proposed total nuclear disarmament.

Shultz said he knew the breakthrough was coming because the KGB analyzed a Reagan speech in which he had made just such a proposal.

Reagan had in fact pursued this as a lifetime goal, wanting to return the world to the pre nuclear age he knew in the 1930s, although he never mentioned this in any election campaign. Reagan didn’t mention a lot of things.

As a result of the Reykjavik Treaty, the number of nuclear warheads in the world has dropped from 70,000 to under 10,000. The Soviets then sold their excess plutonium to the US, which has generated 20% of the total US electric power generation for two decades.

Shultz argued that nuclear weapons were not all they were cracked up to be. Despite the US being armed to the teeth, they did nothing to stop the invasions of Korea, Hungary, Vietnam, Afghanistan, and Kuwait.

Schultz told me that the world has been far closer to an accidental Armageddon than people realize.

Twice during his term as Secretary of State, he was awoken in the middle of the night by officers at the NORAD early warning system in Colorado to be told that there were 200 nuclear missiles inbound from the Soviet Union.

He was given five minutes to recommend to the president to launch a counterstrike. Four minutes later, they called back to tell him that there were no missiles, that it was just a computer glitch projecting ghost images on a screen.

When the US bombed Belgrade in 1989, Russian president Boris Yeltsin, in a drunken rage, ordered a full-scale nuclear alert, which would have triggered an immediate American counter-response. Fortunately, his generals ignored him.

I told Schultz that I doubted Iran had the depth of engineering talent needed to run a full-scale nuclear program of any substance.

He said that aid from North Korea and past contributions from the AQ Khan network in Pakistan had helped them address this shortfall.

Ever in search of the profitable trade, I asked Schultz if there was an opportunity in nuclear plays, like the Market Vectors Uranium and Nuclear Energy ETF (NLR) and Cameco Corp. (CCR), that have been severely beaten down by the Fukushima nuclear disaster.

He said there definitely was. In fact, he was personally going to lead efforts to restart the moribund US nuclear industry. The key here is to promote 5th generation technology that uses small, modular designs, and alternative low-risk fuels like thorium.

Schultz believed that the most likely nuclear war will occur between India and Pakistan. Islamic terrorists are planning another attack on Mumbai. This time, India will retaliate by invading Pakistan. The Pakistanis plan on wiping out this army by dropping an atomic bomb on their own territory, not expecting retaliation in kind.

But India will escalate and go nuclear too. Over 100 million would die from the initial exchange. But when you add in unforeseen factors, like the broader environmental effects and crop failures (CORN), (WEAT), (SOYB), (DBA), that number could rise to 1-2 billion. This could happen as early as 2023.

Schultz argued that further arms control talks with the Russians could be tough. They value these weapons more than we do because that’s all they have left.

Schultz delivered a stunner in telling me that Warren Buffet had contributed $50 million of his own money to enhance security at nuclear power plants in emerging markets.

I hadn’t heard that.

As the event ended, I returned to Secretary Shultz to grill him some more about the details of the Reykjavik conference held some 36 years ago.

He responded with incredible detail about names, numbers, and negotiating postures. I then asked him how old he was. He said he was 100.

I responded, “I want to be like you when I grow up”.

He answered that I was “a promising young man.” I took that as encouragement in the extreme.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

We’re Getting Pretty High