It has been the worst New Year stock market opening in history.

After a two-day fake-out to the upside, stocks rolled over like the Bismarck and never looked up. NASDAQ did its best interpretation of flunking parachute school without a parachute, posting the worst month since 2008.

Markets can’t hold on to any rally longer than nanoseconds, and the last hour of the day has turned into one from hell.

What is even more confusing is that stocks are now trading like commodities, with massive one-way moves, while commodities, like oil (USO), copper( FCX), and iron ore (VALE) have resumed a steady grind up.

We had a lovefest going on here at Incline Village, Nevada for Technology and Bitcoin researcher Arthur Henry has been staying with me for the week to plot market strategy.

Once the market showed its hand, I sold short Microsoft (MSFT), which elicited torrents of complaints from readers. Then Arthur sold short Netflix (NFLX), inviting refund demands. Then I sold short Apple (AAPL), prompting accusations of high treason. Then Arthur sold short Teledoc (TDOC). There wasn’t a lot of talking, but frenetic writing and emailing instead.

Followers cried all the way to the bank.

In a mere two weeks, the price earnings multiple for the S&P 500 plunged from 22X to 20X. A lot of traders were only buying stock because they were going up. Take out the “up” and Houston we have a problem.

The entire streaming industry seems to have gone up in smoke and ex-growth practically overnight. Netflix (NFLX) delivered a gob smacking 29.5% swan dive in the wake of disappointing subscriber growth forecasts. Walt Disney (DIS), which ate the Netflix lunch, was dragged down 10% through guilt by association.

It is often said that the stock market has discounted 12 of the last six recessions. It is currently pricing in one of those non-recessions. What we are seeing is a sudden growth scare of the first order.

Despite last week’s carnage, stocks are still the most attractive asset class in the world, offering a potential 10% return in 2022. The problem is that they may make that 10% profit starting from 10% lower than here.

Despite all the red ink, big tech stocks are still on track to see a 30% earnings growth this year, and they account for a hefty 28% of the market.

Let’s look at Apple’s past declines for guidance on this meltdown.

Steve Jobs’ creation gave back 60% in the 2008 Great Recession, 34% during the 2015 growth scare, 48% during the great 2018 Christmas collapse, and 28% in the 2020 pandemic crash. So, the good news is that you won’t get killed by this selloff, you’ll just lose an arm and a leg. But they’ll grow back.

Remember, it’s always darkest just before it goes completely black. This correction is survivable, although it may not seem so at the moment.

It does vindicate my 2022 view that the first half will be about survival and that big money can be had in the second half.

So far, so good.

The Market is De-Grossing Big Time. That means cutting total market exposure and selling everything, regardless of stock or sector. The market is discounting a recession and bear market that isn’t going to happen, which occurs often. When it ends in a few weeks, interest rate sensitives, especially the banks, will bounce back hard, but tech won’t. Buy (JPM), (WFC), and (BAC) on bigger dips.

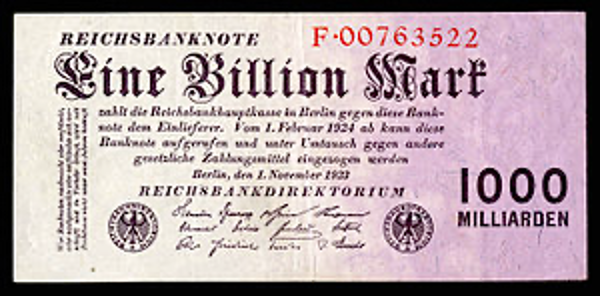

The Bond Collapse Goes Global, with German 10-year bunds going positive for the first time in three years, up 40 basis points in a month. Yes, inflation is finally hitting the Fatherland, home of post-WWI billion percent inflation. Eurozone inflation just topped 5%, well above its 2% target. British inflation hit a 30-year high. The move has lit a fire under all Euro currencies. Methinks the down move in (TLT) has more to go.

Fed to Raise Rates Eight Times, says Marathon Asset Management. That’s what will be needed to curb the current runaway inflation now at 7.0% and still rising. Personally, I think it will be 12 quarter-point increments to peak out at a 3 ¼% overnight rate. Any more and Powell might bring on a recession.

NASDAQ is Officially in Correction, down 10%, in the wake of poor performance this month. It’s the fourth one since the pandemic began two years ago. Tesla (TSLA), Amazon (AMZN), and NVIDIA (NVDA) have been leading the swan dive, all felled by rapidly rising interest rates. This could go on for months.

Weekly Jobless Claims Hit 286,000, a four-month high, as omicron sends workers fleeing home.

Goldman Sachs (GS) Gets Crushed, down 8%, on disappointing earnings. Tough market conditions are fading trading volumes while 2021 bonuses were through the roof. The move is particularly harsh in that buyers were flooding in right at support at the 200-day moving average.

China GDP (FXI) Grows 8.1% YOY but is rapidly slowing now, thanks to Omicron. China was first in and first out with the pandemic but is getting hit much harder in this round. That has prompted new mass lockdowns which will make out own supply chain problems worse for longer. In Chinese, “lockdown” means they weld your door shut, unlike here. Harsh, but it works.

Oil (USO) Hits Seven-Year High, as inventories hit a 21-year low. No new capital is entering the industry, crimping supplies as old fields play out. The threat of a Russian invasion of the Ukraine is prompting advance stockpiling. Russia is the world’s second-largest oil exporter.

Existing Homes Sales Hit a 15-Year High, at 6.12 million, the best since 2006. December fell 4.6%. Extreme inventory shortage is the issue, with only 910,000 homes for sale at the end of the year, an incredibly low 1.8-month supply. You can’t find anything on the market now, to buy or rent. The median price of a home sold in December was $358,000, a 15.8% gain YOY.

Bitcoin (BITO) Crashes, decisively breaking key support at $40,000. Non-yielding assets of every description are getting wiped. Bail on all crypto options plays asap.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With the pandemic-driven meltdown on Friday, my January month-to-date performance bounced back hard to 5.05%. My 2022 year-to-date performance also ended at 5.05%. The Dow Average is down -6.12% so far in 2022.

Once stocks went into free fall, I piled on the short positions as fast as I could write the trade alerts, including in Microsoft (MSFT), Apple (AAPL), and a double short in the S&P 500 (SPY). I also increased my shorts in the bond market (TLT) to a triple position. When prices became the most extreme, when the Volatility Index (VIX) hit $30, I bought both (SPY) and (TLT).

If everything goes our way, we should be up 14.26% by the February 18 options expiration.

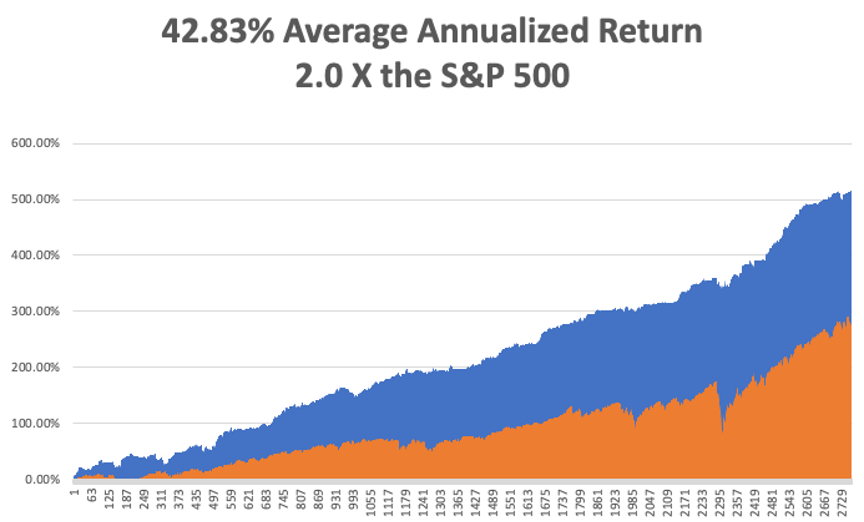

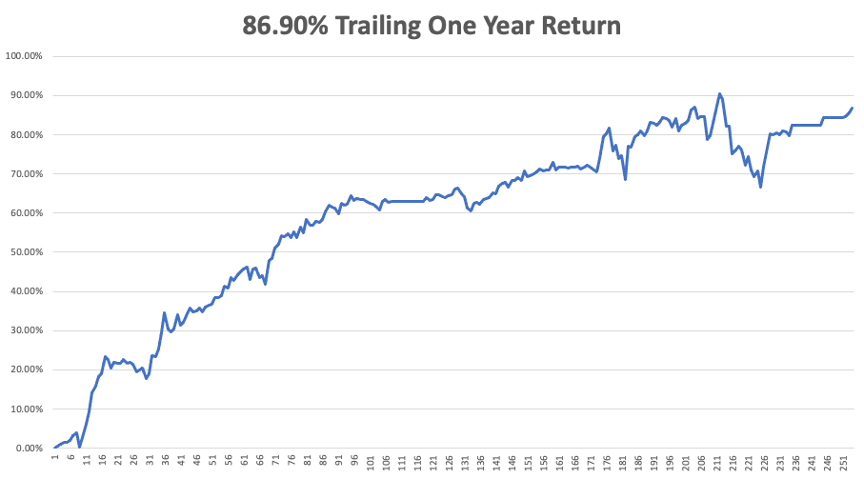

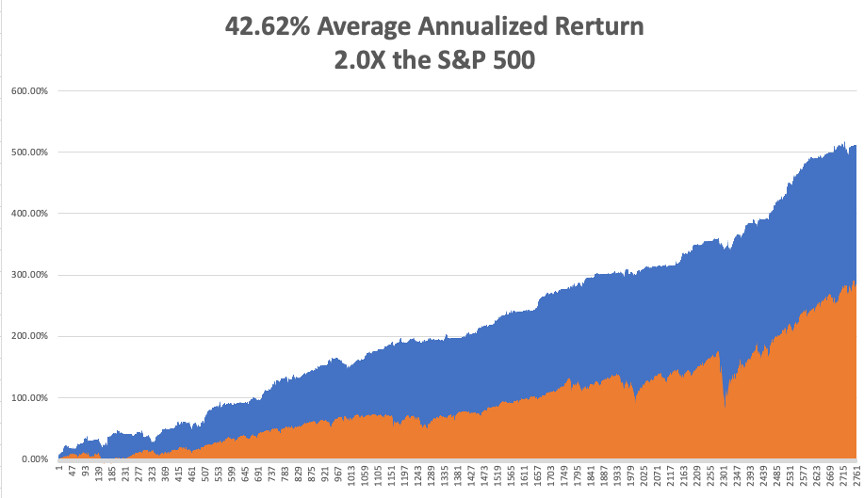

That brings my 12-year total return to 517.61%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return has ratcheted up to 42.82% easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 71 million and rising quickly and deaths topping 866,000, which you can find here.

On Monday, January 24 at 6:45 AM, The Market Composite Flash PMI for January is out. Haliburton (HAL) reports.

On Tuesday, January 25 at 6:00 AM, the S&P Case Shiller National Home Price Index for November is released. American Express (AXP) reports.

On Wednesday, January 26 at 7:00 AM, the New Home Sales for December are published. At 11:00 AM The Federal Reserve interest rate decision is announced. Tesla (TSLA), Boeing (BA), and Freeport McMoRan (FCX) report.

On Thursday, January 27 at 8:30 AM the Weekly Jobless Claims are disclosed. We also get the first look at US Q4 GDP. Alaska Air (ALK) and US Steel (X) report.

On Friday, January 28 at 5:30 AM EST US Personal Income & Spending is printed. Caterpillar (CAT) reports. At 2:00 PM, the Baker Hughes Oil Rig Count is out.

As for me, when I drove up to visit my pharmacist in Incline Village, Nevada, I warned him in advance that I had a question he never heard before: How good is 80-year-old morphine?

He stood back and eyed me suspiciously. Then I explained in detail.

Two years ago, I led an expedition to the South Pacific Solomon Island of Guadalcanal for the US Marine Corps Historical Division (click here for the link). My mission was to recover physical remains and dog tags from the missing-in-action there from the epic 1942 battle.

Between 1942 and 1944, nearly four hundred Marines vanished in the jungles, seas, and skies of Guadalcanal. They were the victims of enemy ambushes and friendly fire, hard fighting, malaria, dysentery, and poor planning.

They were buried in field graves, in cemeteries as unknowns, if not at all left out in the open where they fell. They were classified as “missing,” as “not recovered,” as “presumed dead.”

I managed to accomplish this by hiring an army of kids who knew where the most productive battlefields were, offering a reward of $10 a dog tag, a king's ransom in one of the poorest countries in the world. I recovered about 30 rusted, barely legible oval steel tags.

They also brought me unexploded Japanese hand grenades (please don’t drop), live mortar shells, lots of US 50 caliber and Japanese 7.7 mm Arisaka ammo, and the odd human jawbone, nationality undetermined.

I also chased down a lot of rumors.

There was said to be a fully intact Japanese zero fighter in flying condition hidden in a container at the port for sale to the highest bidder. No luck there.

There was also a just discovered intact B-17 Flying Fortress bomber that crash-landed on a mountain peak with a crew of 11. But that required a four-hour mosquito-infested jungle climb and I figured it wasn’t worth the malaria.

Then, one kid said he knows the location of a Japanese hospital. He led me down a steep, crumbling coral ravine, up a canyon and into a dark cave. And there it was, a Japanese field hospital untouched since the day it was abandoned in 1943.

The skeletons of Japanese soldiers in decayed but full uniform laid in cots where they died. There was a pile of skeletons in the back of the cave. Rusted bottles of Japanese drugs were strewn about, and yellowed glass sachets of morphine were scattered everywhere. I slowly backed out, fearing a cave-in.

It was creepy.

I sent my finds to the Marine Corps at Quantico, Virginia, who traced and returned them to the families. Often the survivors were the children or even grandchildren of the MIAs. What came back were stories of pain and loss that had finally reached closure after eight decades.

Wandering about the island, I often ran into Japanese groups with the same goals as mine. My Japanese is still fluent enough to carry on a decent friendly conversation with the grandchildren of their veterans. It turned out I knew far more about their loved ones than they. After all, it was our side that wrote the history. They were very grateful.

How many MIAs were they looking for? 30,000! Every year, they found hundreds of skeletons, cremated in a ceremony, one of which I was invited to. The ashes were returned to giant bronze urns at Yasakuni Ginja in Tokyo, the final resting place of hundreds of thousands of their own.

My pharmacist friend thought the morphine I discovered had lost half of its potency. Would he take it himself? No way!

As for me, I was a lucky one. My dad made it back from Guadalcanal, although the malaria and post-traumatic stress bothered him for years. And you never wanted to get in a fight with him….ever.

I can work here and make money in the stock market all day long. But my efforts on Guadalcanal were infinitely more rewarding. I’ll be going back as soon as the pandemic ends, now that I know where to look.

Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

True MIAs, the Ultimate Sacrifice

My Collection of Dog Tags and Morphine

My Army of Scavengers

Dad on Guadalcanal (lower right)