Remember Y2K?

The world was supposed to end at midnight on December 31, 1999 because computers would be unable to cope with the turnover of the new millennium. I remember making presentations to big hedge funds, predicting that Y2K was a big nothing burger and, worst case, somebody’s toaster wouldn’t work.

I spent that New Year’s Eve with my kids at Disneyland in Orlando, watching one heck of a fireworks display. What happened the next morning? Even the toasters worked.

I think we are setting up for another Y2K outcome, except that this time, it’s the presidential election that has everyone in a tizzy.

The polls are tied at 48%-48% with a margin of error of 4%. In fact, for the last 50 years, the opinion polls have been wrong by an average of 3.4%. One side already has that 3.4% and probably more, plus all seven battleground states, but we won’t know for sure until November 6.

As an investment manager, it is not my job to pick a side or impose my view upon you but to deliver the best possible investment returns for my clients.

And let me tell you how.

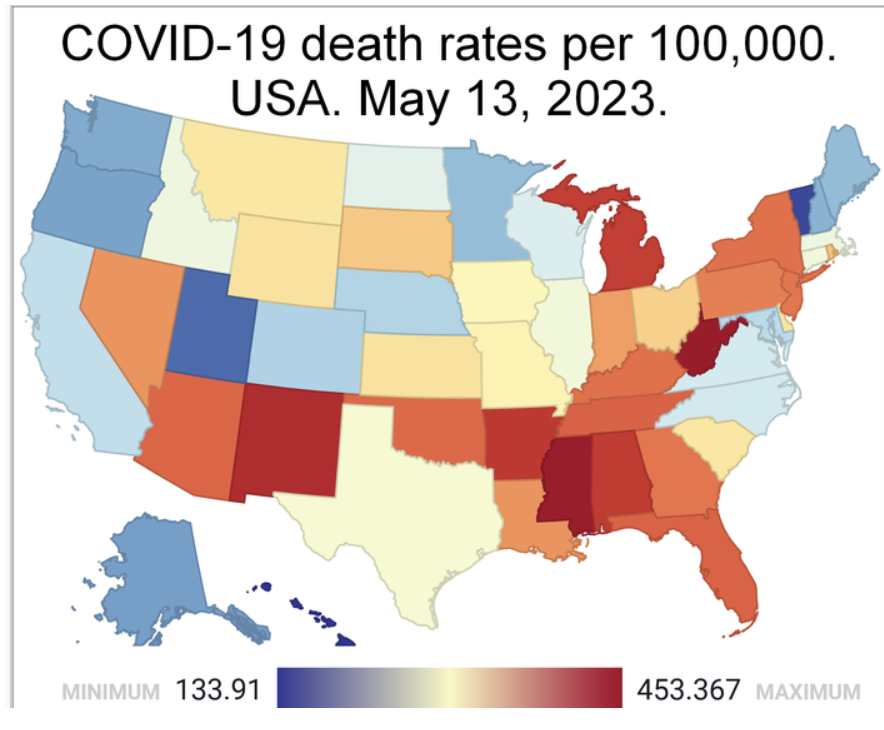

Remember the Pandemic? Four years after the event, we now have the luxury of copious hard data. Out of 103,436,829 cases, some 1,203,648 Americans died, or 1.3%. But, the death rate in red states was much higher than in blue states.

For example, California suffered only 101,159 deaths out of a population of 39,128,162 for a death rate of 0.26%. Florida saw 86,850 deaths out of a population of 22,634,867 for a death rate of 0.38%. Deaths in Florida were 68% higher in the Sunshine State than in the Golden State.

Florida, in effect, traded lives for business profits. Florida also had a Typhoid Mary effect in that by staying open for spring breaks and vacations; it increased the death rates in surrounding red states.

Assume that half of those who died were voters and apply this math to the entire country, and Republicans lost 393,059 votes to the pandemic compared to only 268,935 for Democrats. Some 124,125 more Republican voters died than Democrats. Is 124,125 votes enough to decide this election?

Absolutely!

In the 2020 presidential election, Biden won the three battleground states of Georgia by the famous 11,779 votes, Arizona by 10,457 votes, and Nevada by 33,596 votes. That’s 33 electoral college votes right there out of 270 needed.

The opinion polls have missed these numbers by a mile because their algorithms don’t take the pandemic into consideration. They are counting dead voters, while the actual election polls only count live ones. I predict that the opinion polls will be spectacularly wrong….again.

Of course, these are back-of-the-matchbook ballpark calculations. I’ll leave it to some future aspiring PhD candidate to research his thesis with more precise figures. I have better things to do.

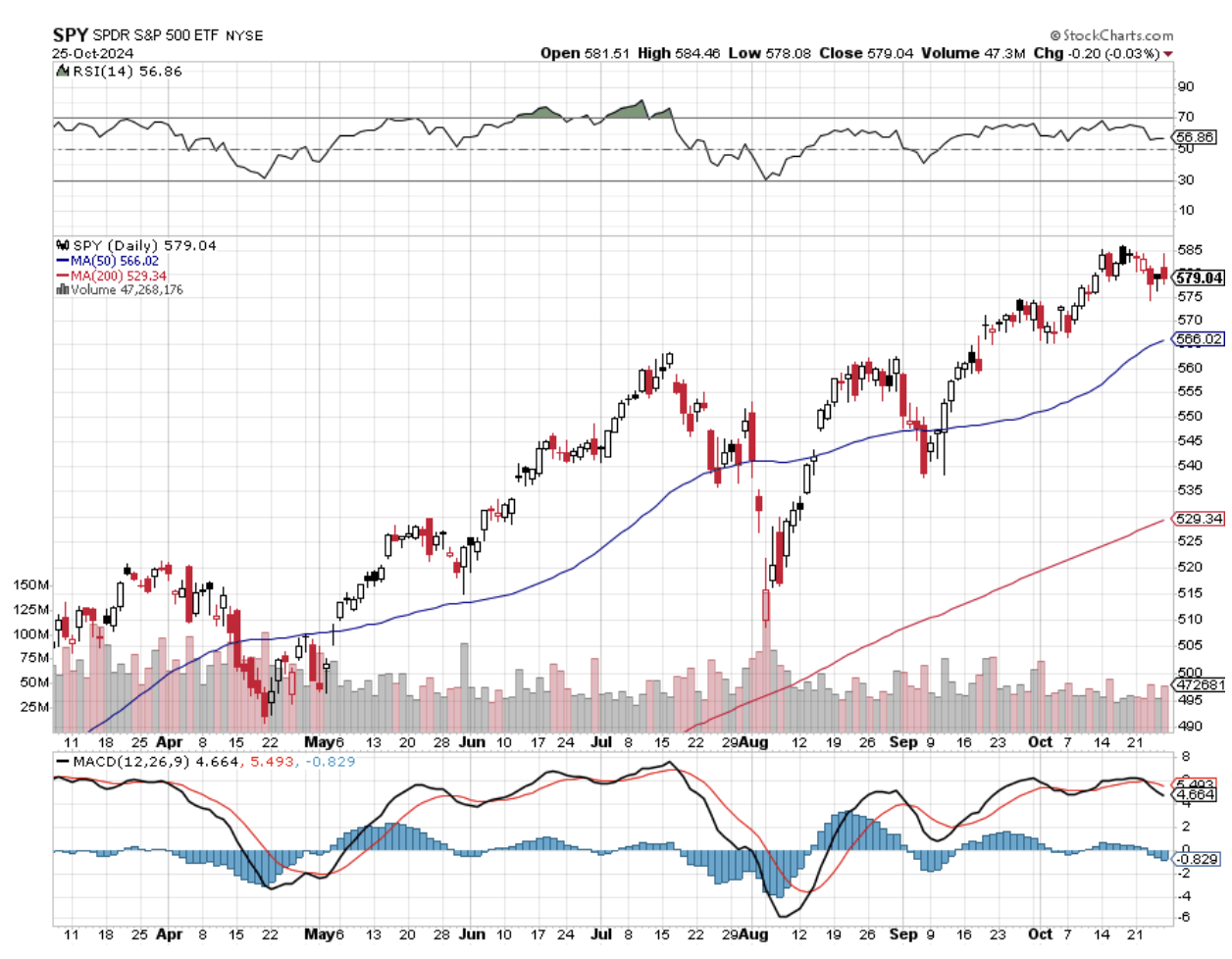

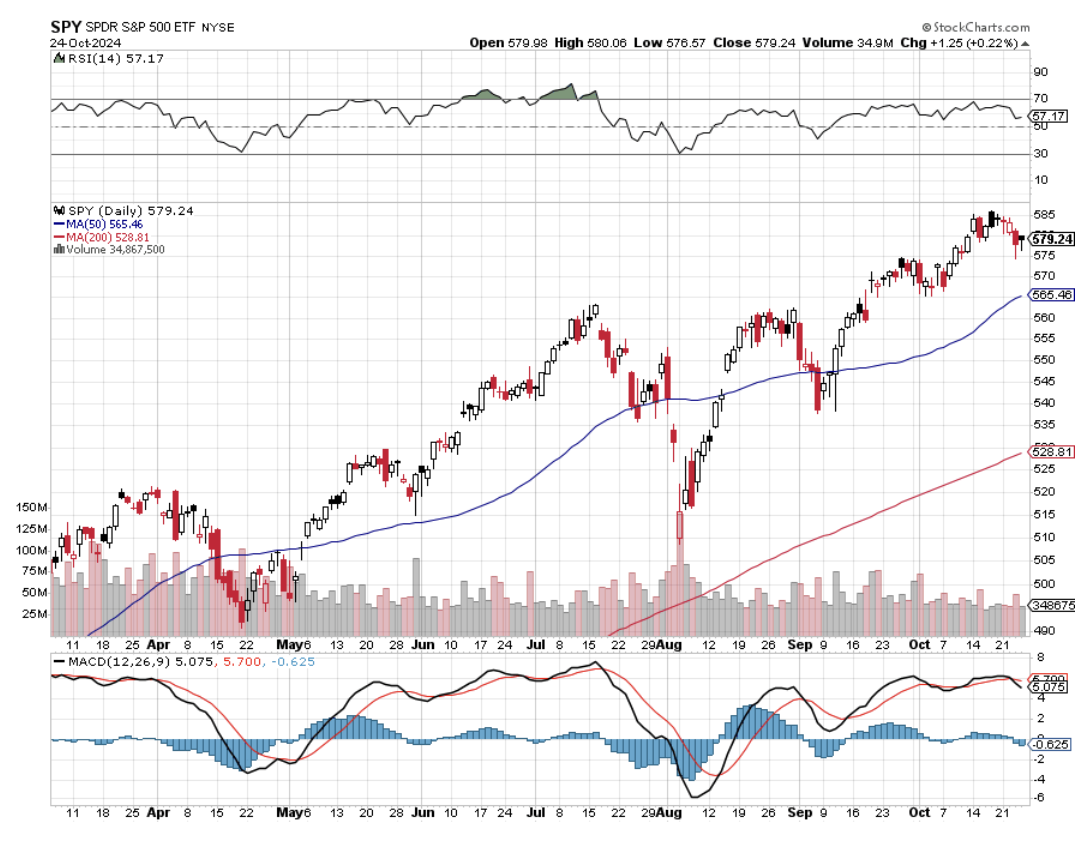

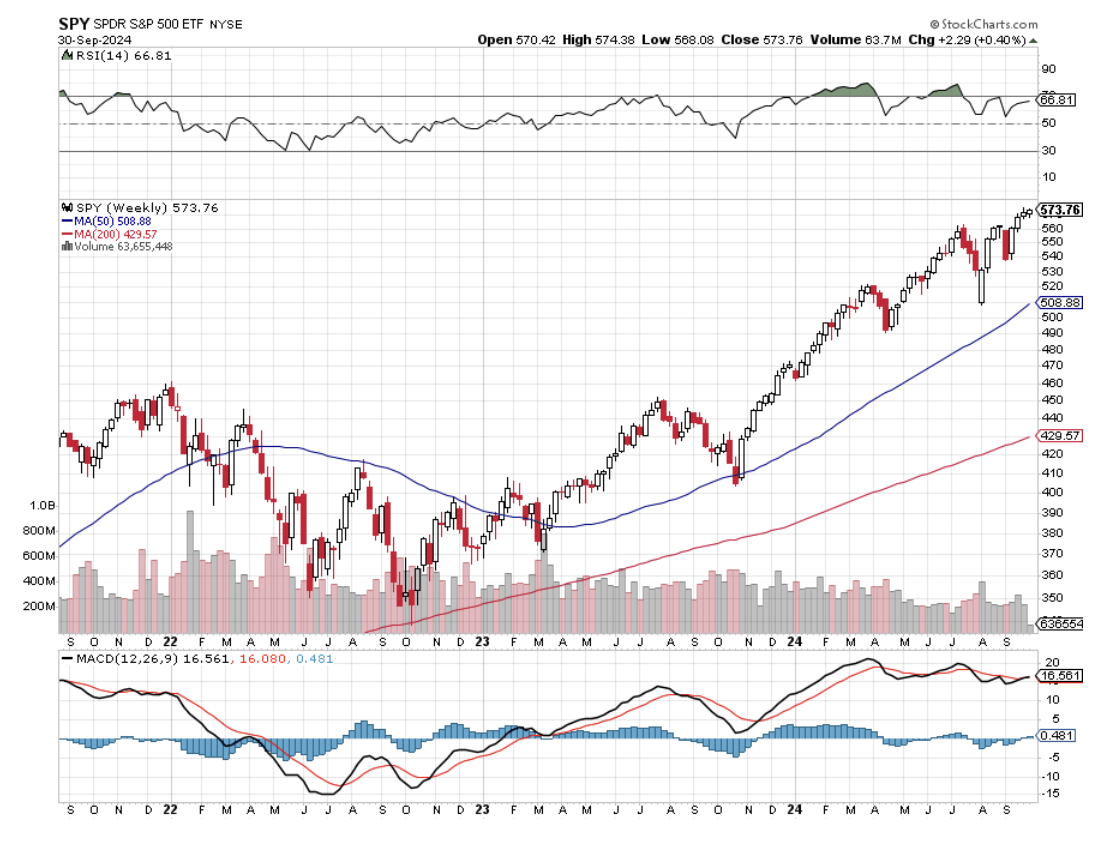

So, how do we make money off of all this? I have never seen investors so underweight and cautious going into a major risk event like this election. They have been scared out of the market by the media. Therefore, I expect the stock market to rise by 10% after the election, taking the S&P 500 as high as 6,400.

Let the great chase begin!

Here is your model portfolio for the rest of 2024.

(NVDA), (META), (CRM) – Underweight fund managers will chase this year’s best performers so they can look good at yearend. Similarly, they will dump their worst performers in the energy sector. So will individual investors for tax loss harvesting.

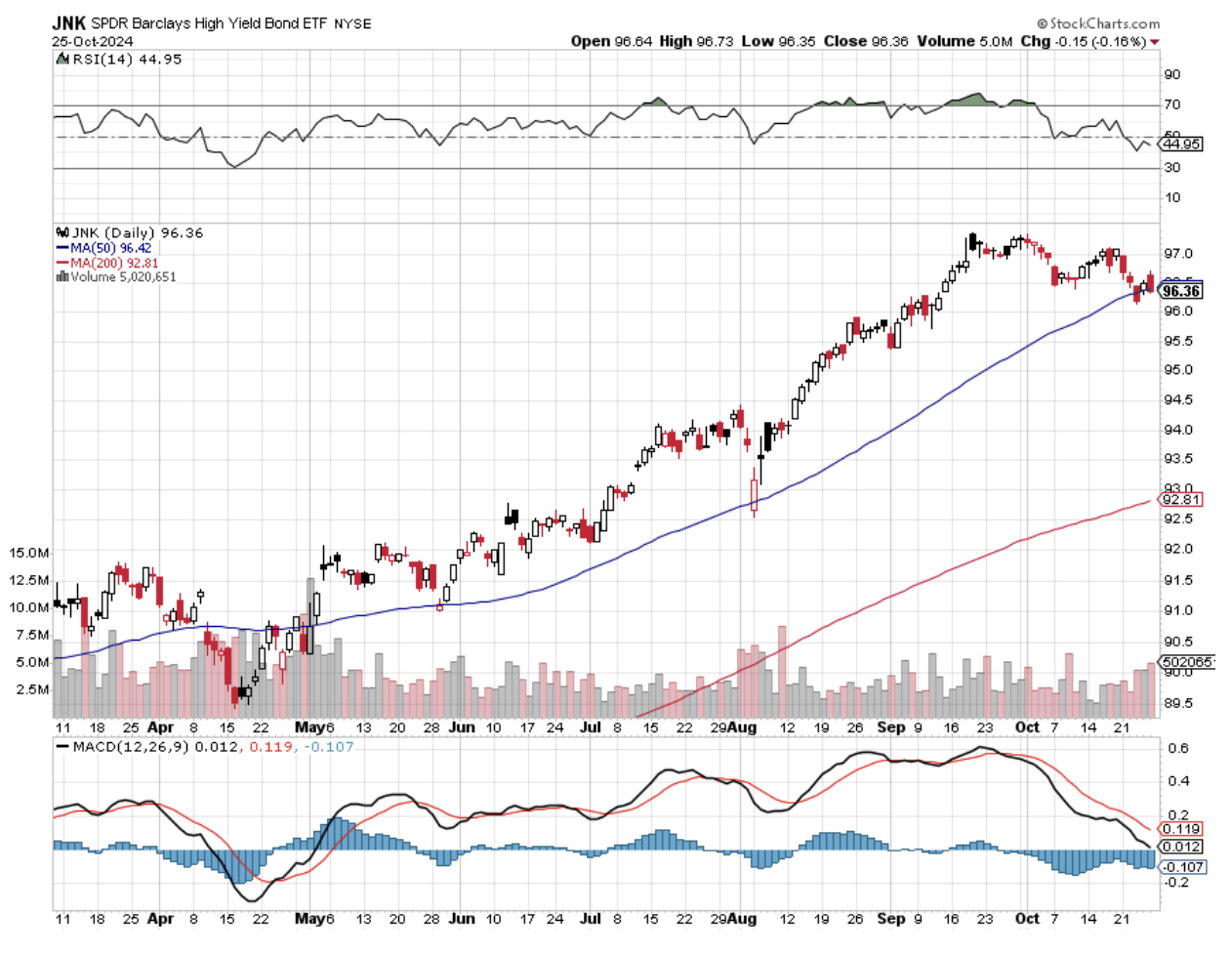

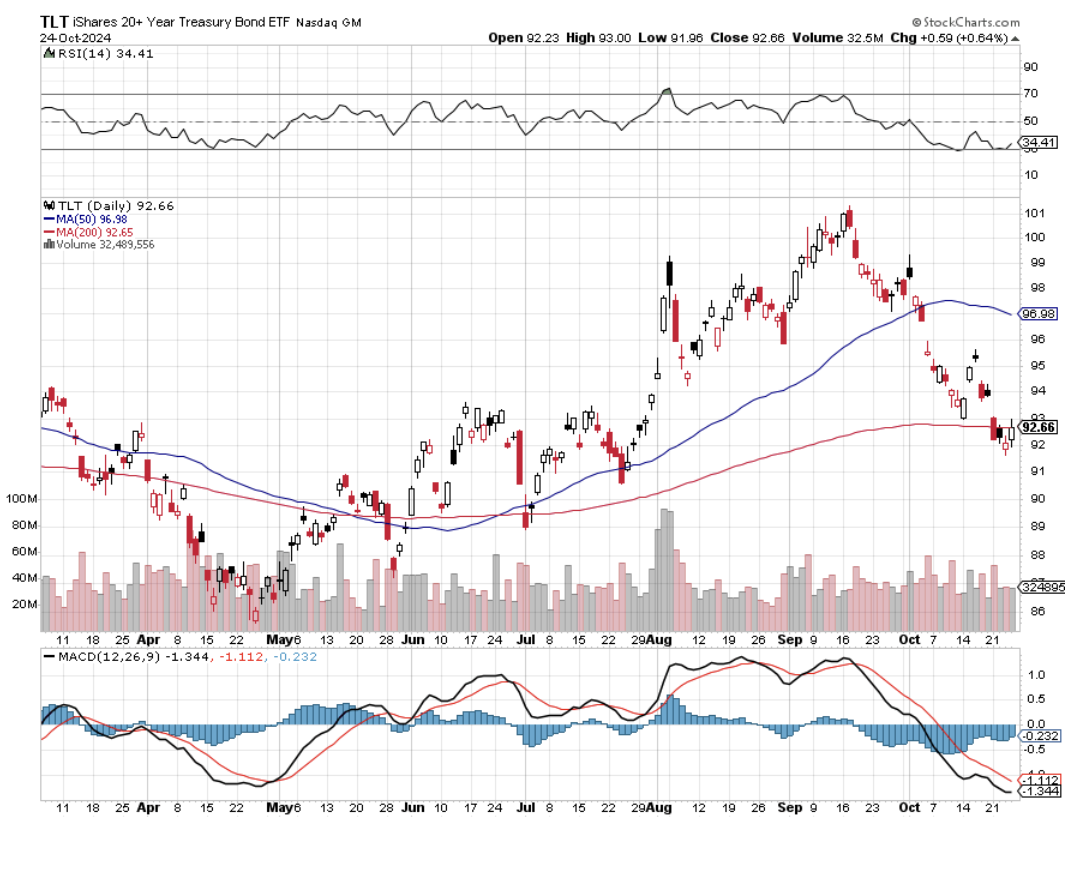

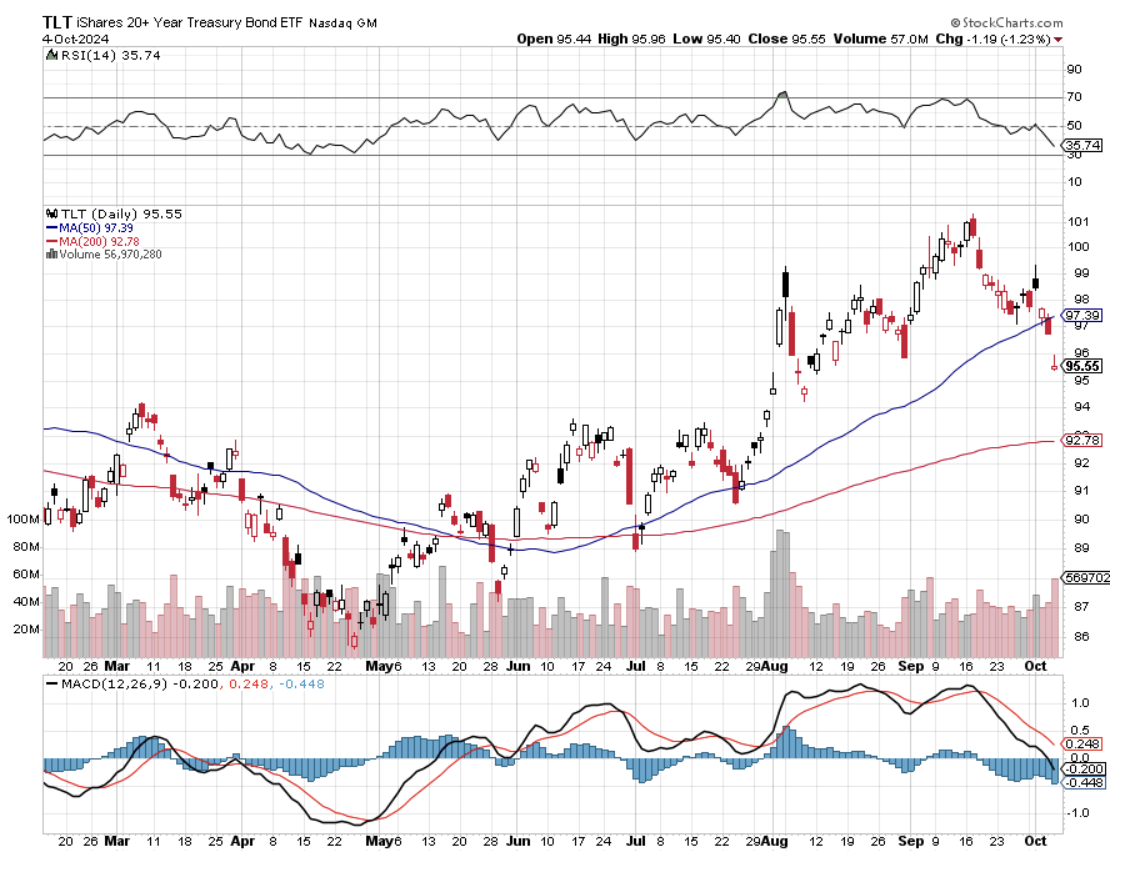

(TLT), (JNK), (CCI) – All interest rate plays make back recent losses as the threat of $10-$15 trillion in new borrowing by a future president, Trump, disappears.

(DHI), (LEN), (PHM) – There is no better interest rate play than new homebuilding. It’s tough to beat a structure shortage of 10 million homes.

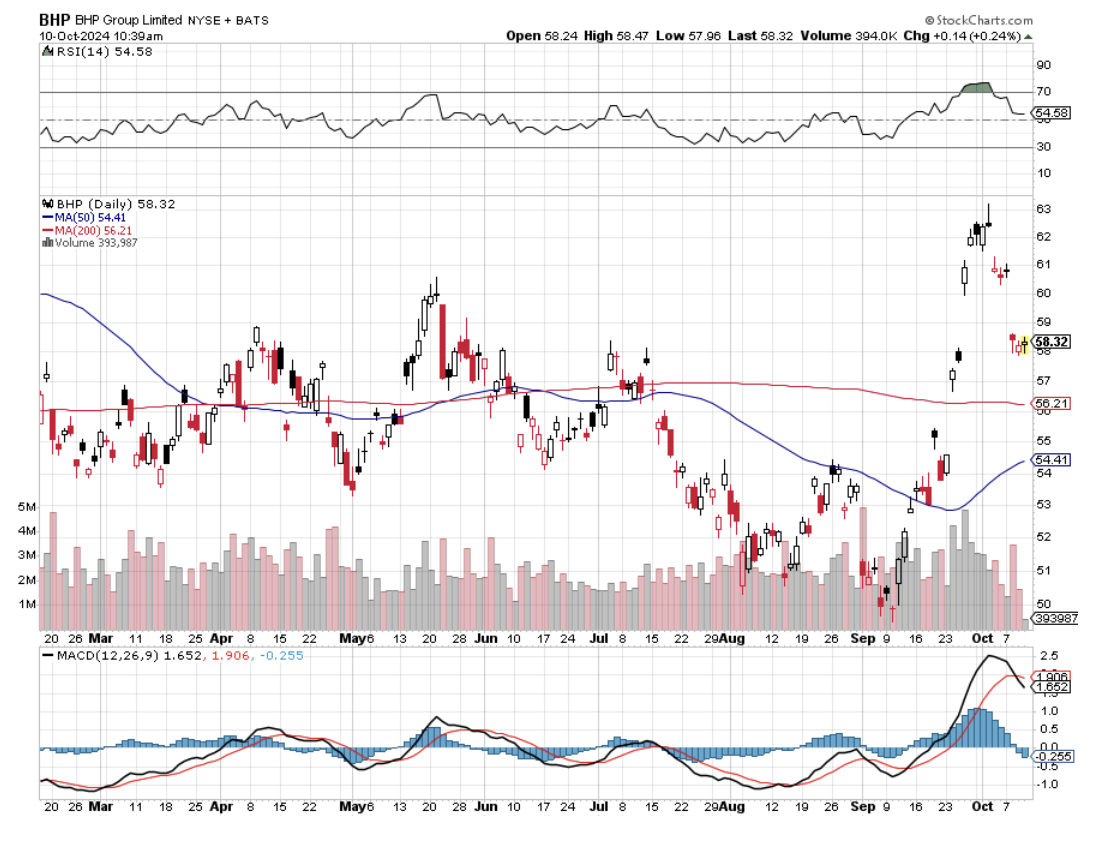

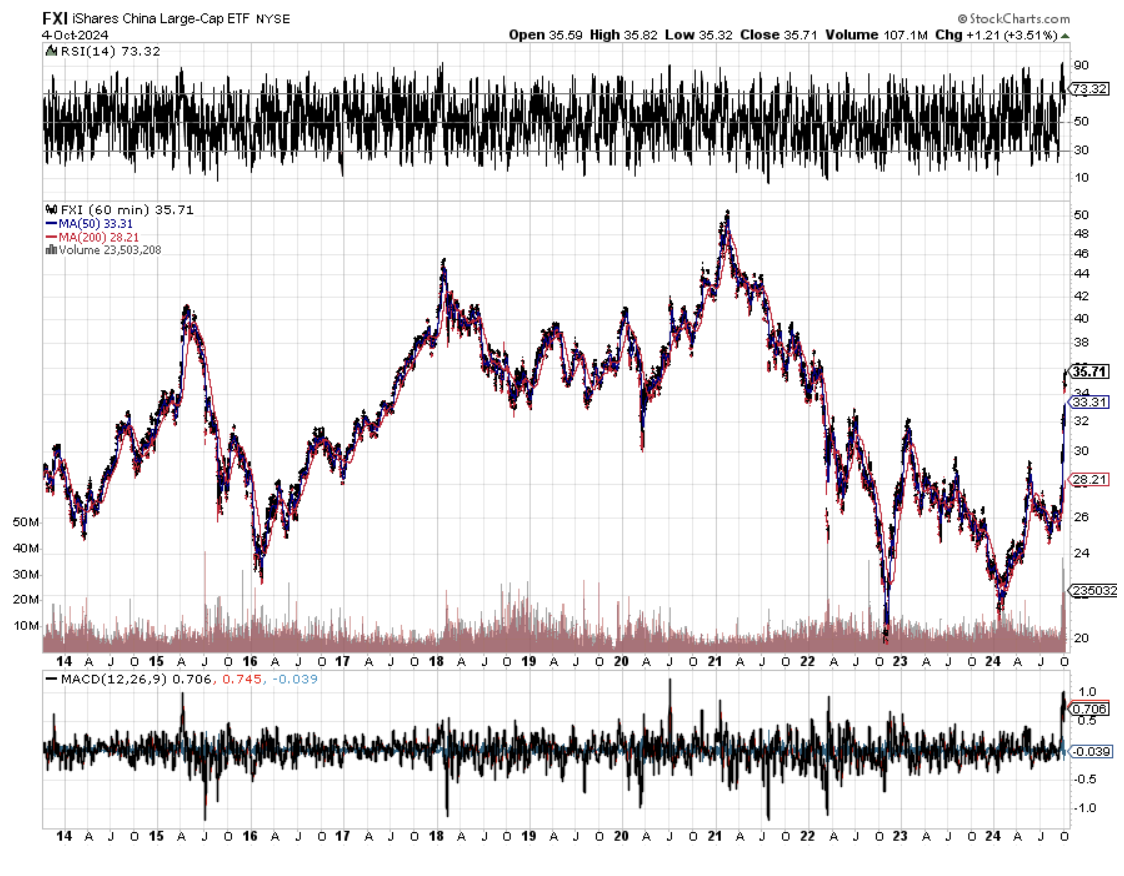

(GLD), (SLV), (NEM) – Precious metals also do very well as they have less yield competition from other interest rate plays. These have become the principal savings vehicle for Chinese individuals.

(FXE), (FXB), (FXA) – A falling interest rate advantage for the US dollar means you want to buy all the currencies.

(JPM), (BAC), (GS) – Banks also do exceedingly well in a falling interest rate environment, and brokers and money managers will cash in on exploding stock market volume.

Also, on November 6, your toaster will probably still work. And I will never understand why the Center for Disease Control never accepted my application out of college. So, I went to Vietnam instead.

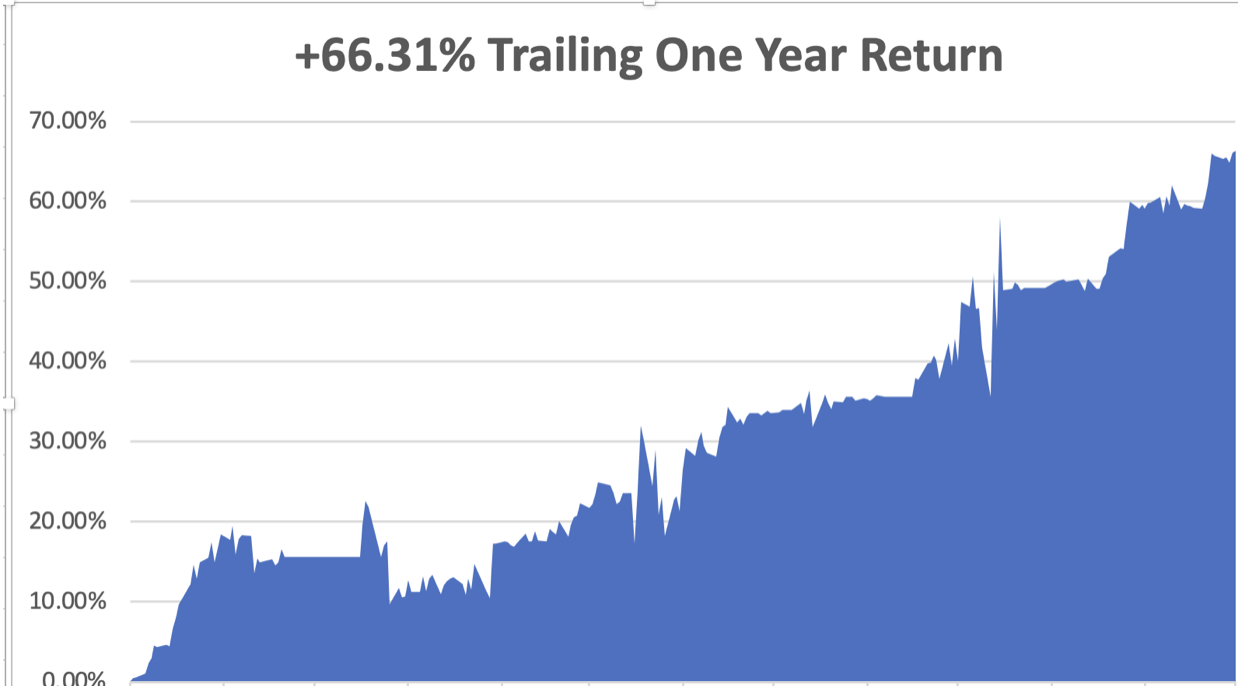

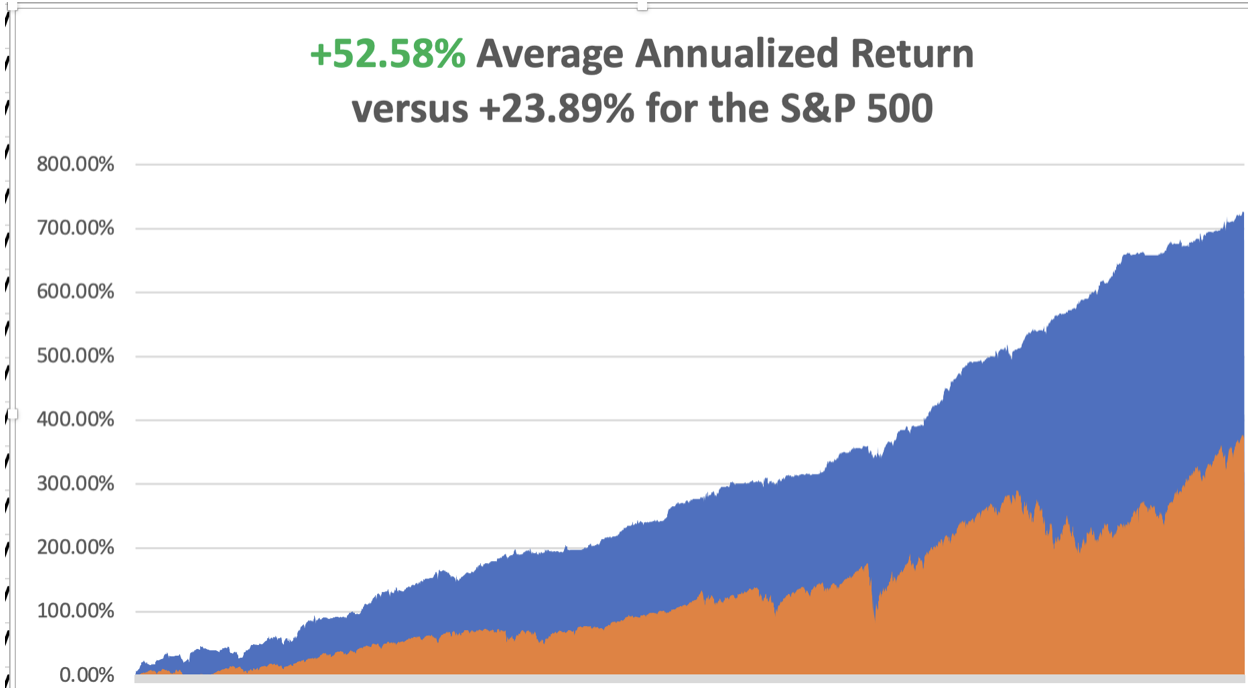

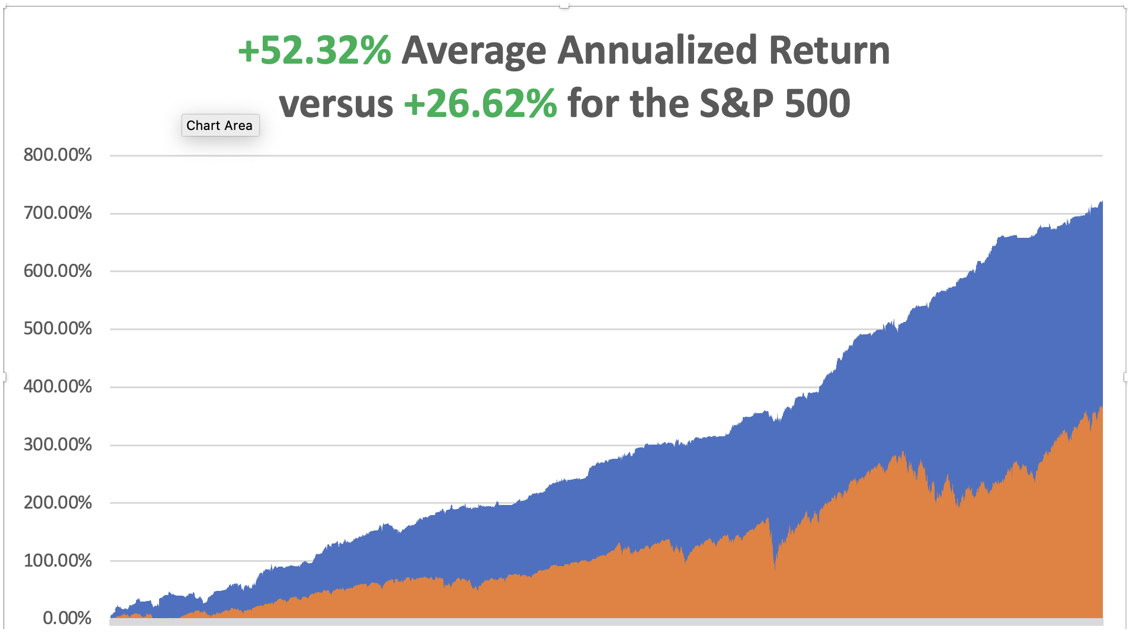

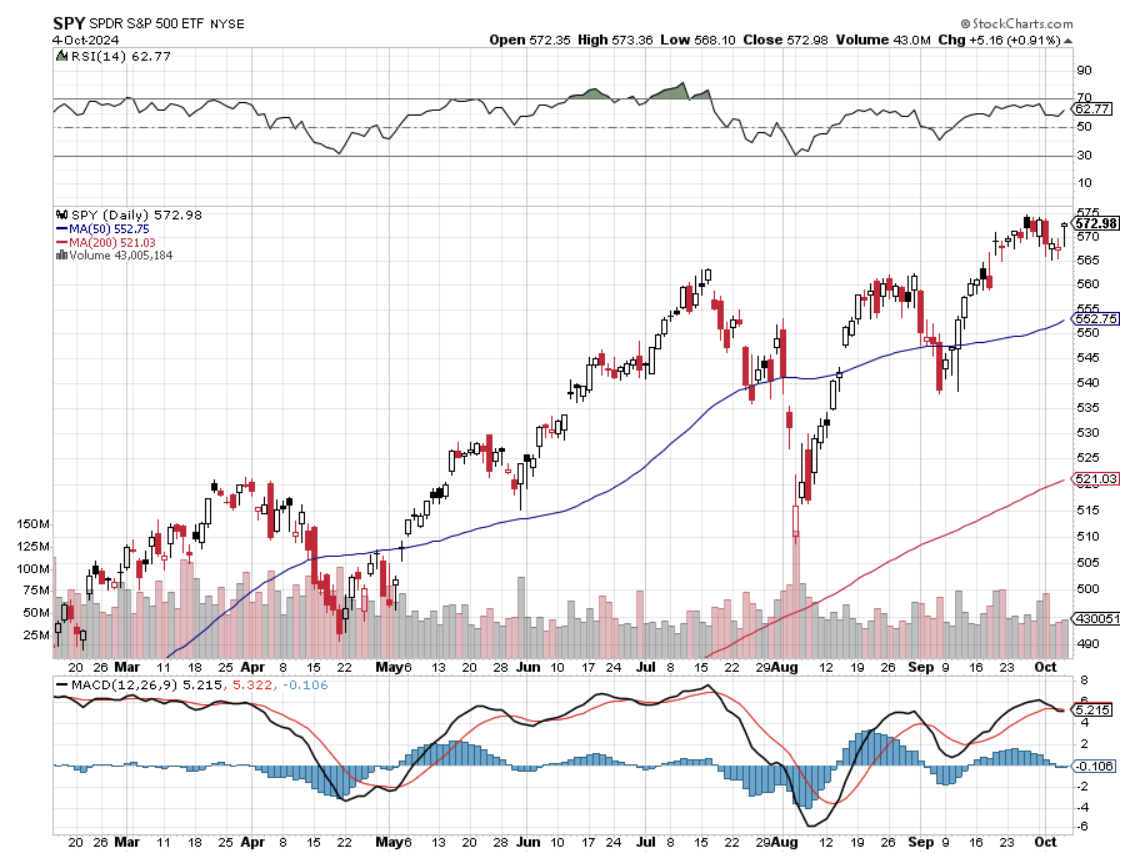

So far in October, we have gained a breathtaking +5.46%. My 2024 year-to-date performance is at an amazing+50.70%. The S&P 500 (SPY) is up +21.38% so far in 2024. My trailing one-year return reached a nosebleed +66.31. That brings my 16-year total return to +727.33%. My average annualized return has recovered to +52.58%.

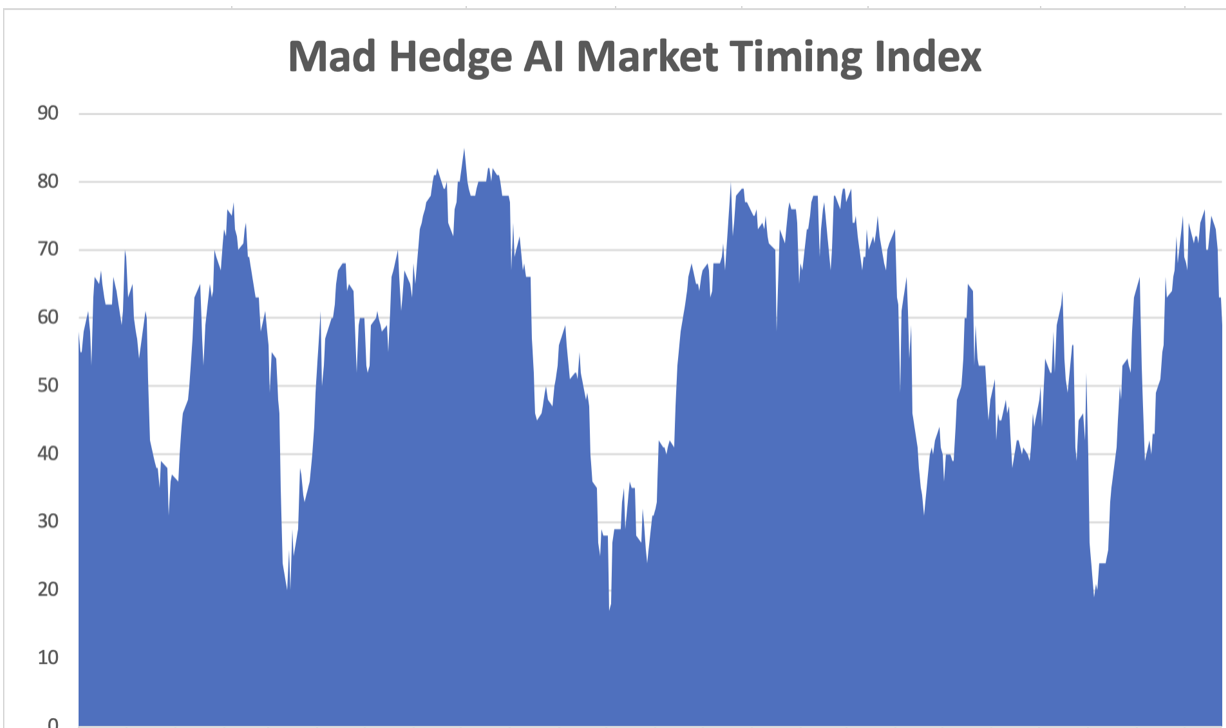

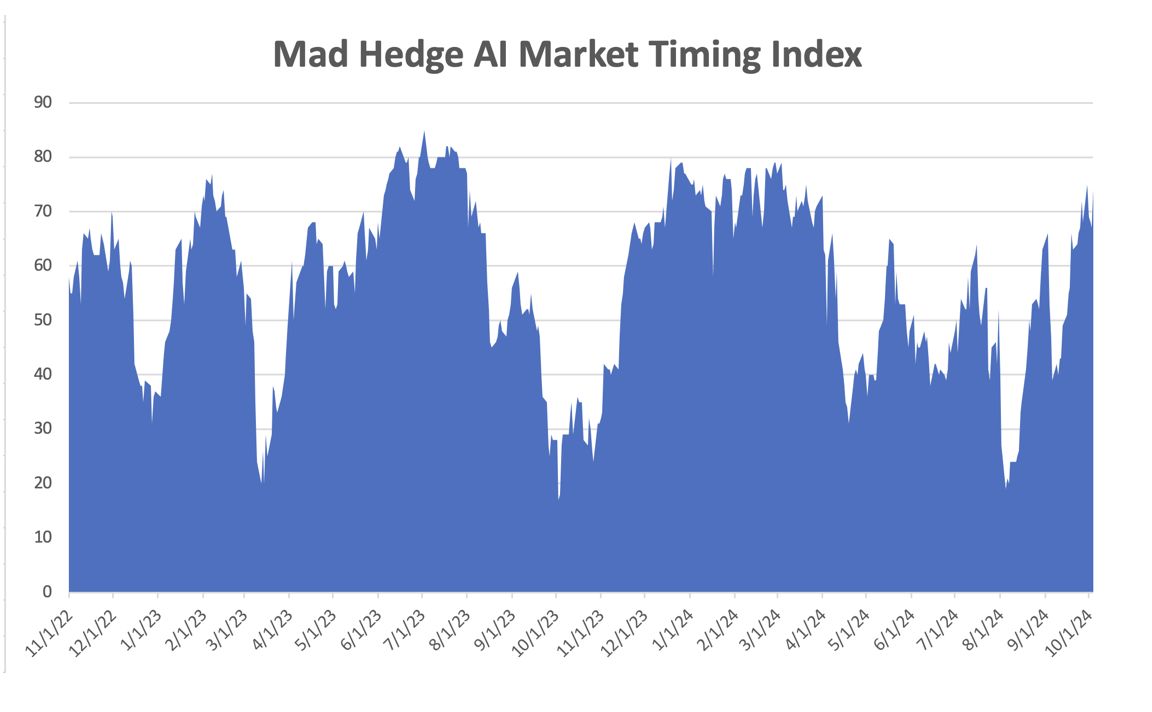

I am remaining cautious with a 70% cash, a 20% long, and a 10% short. I maintained two longs in (GLD) and (JPM) that are well in the money. I sold short (TSLA) to take advantage of a massive 29% gain in two days off the back of blockbuster earnings.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 61 of 81 trades have been profitable so far in 2024, and several of those losses were really break evens. Some 16 out of the last 19 trade alerts were profitable. That is a success rate of +75.30%.

Try beating that anywhere.

New Home Sales Jumped 4.1% in September at 738,000 seasonally adjusted units on a signed contract basis. The median home price rose to 426,300. This despite a roller coaster month on interest rates, falling to 6.0% for the 30-year, then jumping back up to 7.0%.

Fusion is going Commercial in San Francisco, with a German company, Focused Energy, making a $65 million investment. The firm will draw heavily from staff from nearby Lawrence Livermore National Labs, which achieved a net energy gain for the first time in 2022. Focused Energy is one of eight companies given grants to accommodate a doubling of power demand by 2050. Commercial fusion will be the next big thing, where three soda cans of heavy hydrogen can power San Francisco for a day.

Money Market Funds See Massive Pre-Election Inflows, as investors see to avoid promised post-election violence. According to LSEG data, investors acquired a net $29.98 billion worth of money market funds during the week, posting their fourth weekly net purchase in five weeks. Personally, I think it is another Y2K moment.

Tesla Earnings Shock to the Upside, with both third-quarter profits and margins topping estimates. Elon Musk said that he expects 20% to 30% vehicle growth next year, sending the company's shares up 11% in post-market trading. The company still sees 2025 production of a cheaper model, maybe the Model 2. The Cybertruck has reached profitability for the first time and is reaching mass production. Tesla will see “slight growth” in deliveries this year. I am using the spike in the share price to take profits on my long to avoid election risk.

Apple iPhone Sales are Lagging, according to a leading analyst, with a drop in 10 million orders expected, down to 84 million units. The stock dropped 4% from an all-time high.

Boeing Reports $6 Billion Loss, a disastrous report from a dying company with awful management. This is going to be a very long-term workout. A strike resolution may market the bottom. Avoid (BAC) like a stalling airplane.

Newmont Mining Dives 7% after missing Wall Street expectations for third-quarter profit on Wednesday. Higher costs and lower production in Nevada took the shine away from a rise in total output. Newmont said that its costs rose due to planned maintenance at the Lihir project in Papua New Guinea — which it acquired following a $17 billion buyout of Newcrest — and higher expenditure for contract services across its portfolio. Buy (NEM) on dips.

McDonald's Kills Two in E.Coli Outbreak, linked to quarter pounders sold in Colorado and Nebraska. The stock dropped 10%. It’s clearly a supply chain problem. Given their vast size, with 45,000 stands in 100 countries, it’s amazing that this doesn’t happen more often. Avoid (MCD).

Bonds Plunge Anticipating a Trump Win, with the (TLT) down $10 from the recent high. If he does win, expect another $10 decline to $82. If Harris wins, expect a $10 rally. This is the best election trade out there.

Nvidia Tops $3.5 Trillion, as the shares hit a new all-time high at $144.45. It looks like it’s on a run to $150, then $160. Earnings are about to double when reported on November 20. Before then, investors will get some insight into demand for Nvidia’s newest Blackwell chips with earnings reports from big technology companies, including Microsoft (MSFT) coming at the end of this month. Buy (NVDA) on dips.

Hedge Funds Pour into Technology Stocks, such as semiconductors and hardware, at the fastest in five months amid the start of the third-quarter earnings season, according to Goldman Sachs on Friday. Outside the U.S., diverging reports from chipmaker Taiwan Semiconductor Manufacturing (TSM) and chipmaking equipment supplier ASML Holding (ASML) in opposite directions while investors await semiconductor companies such as Advanced Micro Devices (AMD) and Nvidia (NVDA) to unveil their earnings as they seek a trend. They are betting on a big post-election move-up.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age or the next Roaring Twenties. The economy is decarbonizing, and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000, here we come!

On Monday, October 28 at 8:30 AM EST, the Dallas Fed Manufacturing Index is published.

On Tuesday, October 29 at 6:00 AM, the S&P Case Shiller National Home Price Index is out. We also get the US JOLTS Job Openings Report. Alphabet (GOOGL) and (AMD) report.

On Wednesday, October 30 at 11:00 AM, the ADP Employment Change Report is printed. (META) and (MSFT) report.

On Thursday, October 31 at 8:30 AM, the Weekly Jobless Claims are announced. We also get the US Core PCE Price Index. (AMZN) reports.

On Friday, November 1 at 8:30 AM, the October Nonfarm Payroll Report is announced. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, with silver on fire once again and at 12-year highs, I thought I’d recall the last time a bubble popped for the white metal. I picked up this story from my late friend Mike Robertson, who ran the Dallas-based Robertson Wealth Management, one of the largest and most successful registered investment advisors in the country.

Mike is the last surviving silver broker to the Hunt Brothers, who in 1979-80 were major players in the run-up in the “poor man’s gold” from $11 to a staggering $50 an ounce in a very short time. At the peak, their aggregate position was thought to exceed 100 million ounces.

Nelson Bunker Hunt and William Herbert Hunt were the sons of the legendary HL Hunt, one of the original East Texas wildcatters and heirs to one of the largest Texas fortunes of the day. Shortly after President Richard Nixon took the US off the gold standard in 1971, the two brothers became deeply concerned about financial viability of the United States government. To protect their assets, they began accumulating silver through coins, bars, the silver refiner, Asarco, and even tea sets, and when it opened, silver contracts on the futures markets.

The brother’s interest in silver was well-known for years, and prices gradually rose. But when inflation soared into double digits, a giant spotlight was thrown upon them, and the race was on. Mike was then a junior broker at the Houston office of Bache & Co., in which the Hunts held a minority stake and handled a large part of their business. The turnover in silver contracts exploded. Mike confesses to waking up some mornings, turning on the radio to hear silver limit up, and then not bothering to go to work because they knew there would be no trades.

The price of silver ran up so high that it became a political problem. Several officials at the CFTC were rumored to be getting killed in their personal silver shorts. Eastman Kodak (EK), whose black and white film made them one of the largest silver consumers in the country, was thought to be borrowing silver from the Treasury to stay in business.

The Carter administration took a dim view of the Hunt Brothers’ activities, especially considering their funding of the ultra-conservative John Birch Society. The Feds viewed it as an attempt to undermine the US government. The proverbial sushi hit the fan.

The CFTC raised margin rates to 100%. The Hunts were accused of market manipulation and ordered to unwind their position. They were subpoenaed by Congress to testify about their motives. After a decade of litigation, Bunker received a lifetime ban from the commodities markets, a $10 million fine, and was forced into a Chapter 11 bankruptcy.

Mike saw commissions worth $14 million in today’s money go unpaid. In the end, he was only left with a Rolex watch, his broker’s license, and a silver Mercedes. He still ardently believes today that the Hunts got a raw deal and that their only crime was to be right about the long-term attractiveness of silver as an inflation hedge. Nelson made one of the greatest asset allocation calls of all time and was punished severely for it. There never was any intention to manipulate markets. As far as he knew, the Hunts never paid more than the $20 handle for silver and that all of the buying that took it up to $50 was nothing more than retail froth.

Through the lens of 20/20 hindsight, Mike views the entire experience as a morality tale, a warning of what happens when you step on the toes of the wrong people.

The white metal’s inflation-fighting qualities are still as true as ever, and it is only a matter of time before prices once again take another run to the upside.

Unfortunately, Mike won’t be participating in the next silver bubble. Suffering from morbid obesity, he died from a heart attack a decade ago.

Silver is Still a Great Inflation Hedge

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader