Below, please find subscribers’ Q&A for the December 11 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Lake Tahoe, Nevada.

Q: I was assigned options—called away on both my short-call positions in BlackRock (BLK) and Bank of America (BAC).

A: What you do there is call your broker and exercise your long to cover your short; that should get you 100% of the profit 10 days ahead of expiration, and that is the best way to get out of that position. If you get hit with the dividend, then you're at break-even on the total trade. The way to get around this is you have 10 positions, including several non-dividend paying positions, so you don't have a call-away risk. You really only have about a 1 in 100 chance to get called away, so it's worth doing. If the worst case is you break even, the best case is you make 15% or 20% on the position in a month. That is worth doing.

Q: What do you think of the situation in Syria?

A: We don't know. For us, it's a huge win because it eliminates the last Russian position in the Middle East. They have lost Egypt, Syria, Iraq, and at one point Algeria—so they have no more positions in the Middle East. They lose all their air bases, military bases, and naval bases in Syria, and they also lose their only warm water port in the Mediterranean. It happened because they couldn't afford to draw troops away from Ukraine to help support Syria. Given the choice between Syria and Ukraine, they'll pick Ukraine. It is another argument for the US to maintain support for Ukraine.

The trouble is in the Middle East, whenever you get a chance, you often end up getting somebody else that's worse. Did we just trade one terrorist for another one? We'll have to wait and see. Fortunately, this war didn't cost us any money. It cost Russia a lot. We had no troops in Syria and no weapons commitments, so we got off easily on this one. It’s probably the most important foreign policy achievement of the last four years.

In the meantime, we're destroying all their weapons stockpiles, just in case the new people coming in are bad guys. We'd rather not wait until after they identify themselves as bad guys—we might as well destroy all the weapons now while nobody is defending them. So, as I speak, we're destroying weapons stockpiles for its ships and rocket facilities. Also, this is a huge loss for Iran because they lose easy sea access to Gaza. They used to just truck weapons to the coast in Lebanon, put them on a boat, and send them to Gaza. Now, they have to go all the way around Africa to supply Gaza. So basically it's a huge win for us, and I'll write more about that in the Monday letter.

Q: Do the spread positions need to be actively closed out to achieve profits?

A: No, they don't. You don't have to touch them. That's the beauty of these positions. All ten I expect to expire in the money at maximum profit point, and on the following Monday morning opening, you will find that the margin is freed up, the cash profit is credited to your account, and you're in a 100% cash position. So don't do anything, even if your broker will tell you to individually buy and sell the individual legs and wipe out your profit. I sent out a research piece on this today about how to handle when calls are called away.

Q: I sold BlackRock (BLK) last week because Schwab called and warned me I could owe $6,000 due to the dividend. They did not suggest I close my long position.

A: Again, it goes back to how to handle option call-aways. The only reason they call you is to eliminate any liability for Charles Schwab because, in the past, people would get options called away, they'd say my broker never told me, and they sued the broker. So, the reason they emailed you and called you with warnings is to avoid liability for themselves. In actual fact, only 1 out of 100 different options actually get called away. It's done randomly by a computer, and you're far better off holding the position. And then, if you do get called away, use your long to exercise your short. It's a perfectly hedged position, so you have no actual outright risk. The only real risk is if you don't check your email every day and you don't know you've been called away, so you don't call your broker to exercise your long to cover your short.

Q: Do you envision other countries trending towards more tariffs? How would that affect global growth?

A: Any time we raise a tariff on another country, they're going to raise by an equal amount, and it becomes a perfect growth destruction machine. That's why every economic agency in the world is predicting lower growth for next year.

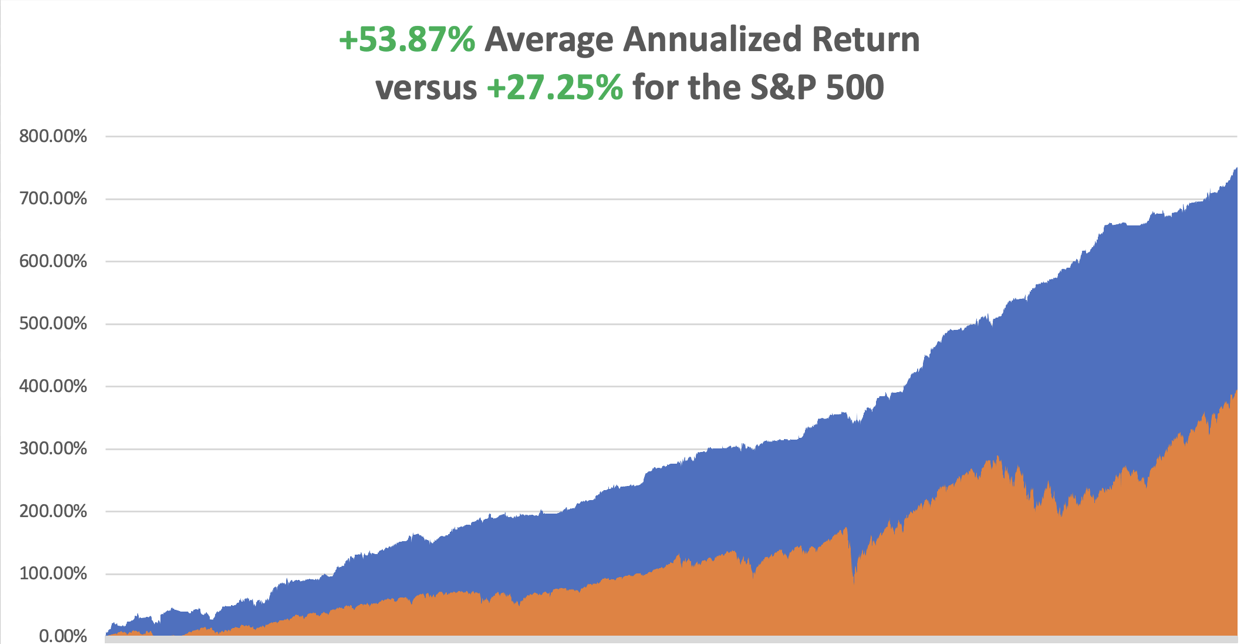

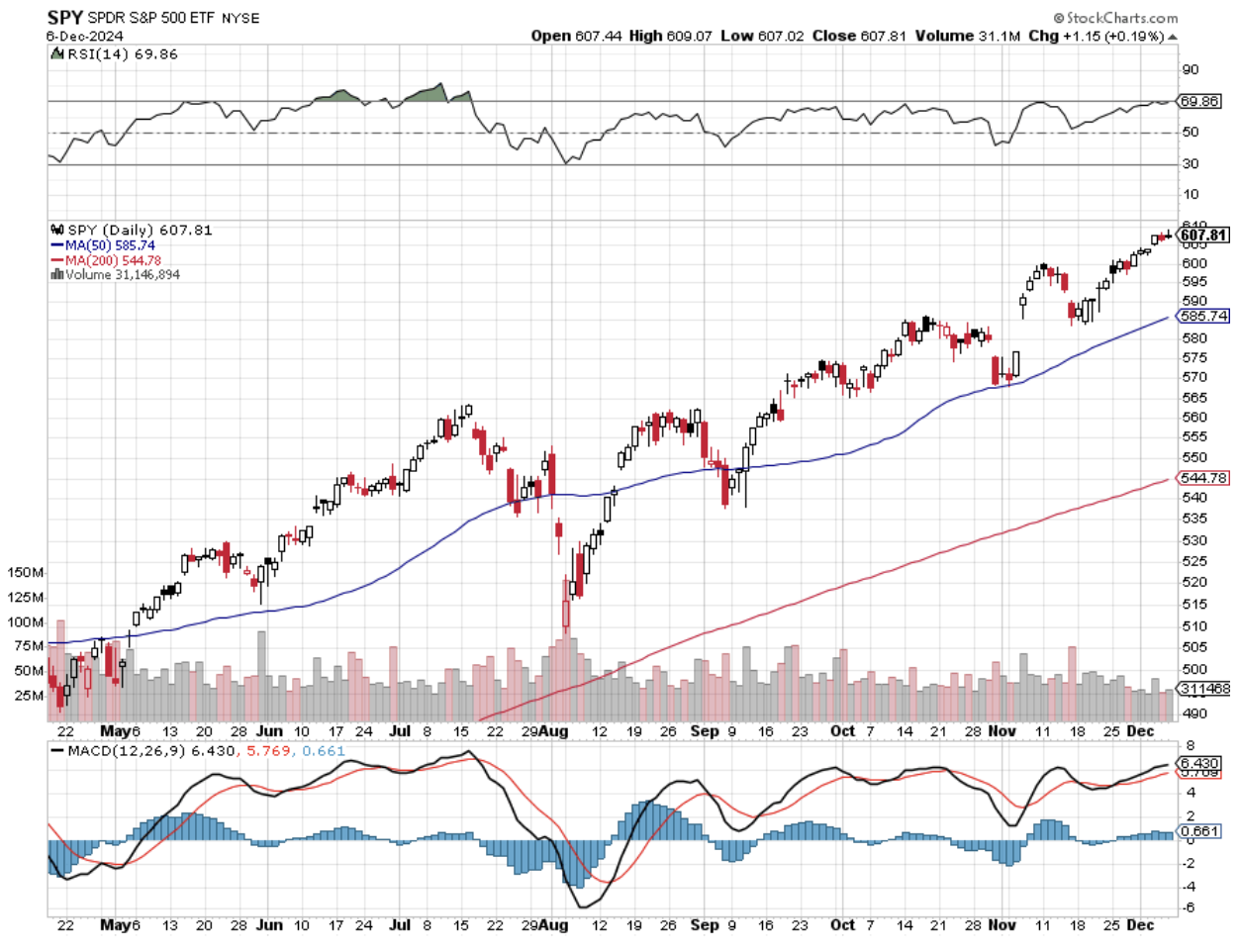

Q: Why are stocks so expensive? Can the high prices be an impediment for new investors to participate or not?

A: It's obviously not an impediment because we're at an all-time high, and we keep going to new all-time highs. Most investors, not just a few, are still underweight stocks, and they're chasing the market. I predicted this would happen all year basically, and now it's happening, and we're 100% invested in making a fortune. So that's what happens when you make big predictions far into the future, and they happen.

Q: What do you think about meme stocks like GameStop (GME)?

A: Don't bother with the meme stocks like GameStop when the good stuff like Tesla (TSLA), Meta (META), and Amazon (AMZN) are going up like a rocket. Why buy the garbage when the high-quality stuff is doing well? And, of course, most of the people buying that stuff, the meme stocks, are kids who don't know what the good stuff is, but they'll find out someday.

Q: If you like Japanese cars, what do you think of Korean cars and, therefore, those companies’ stocks?

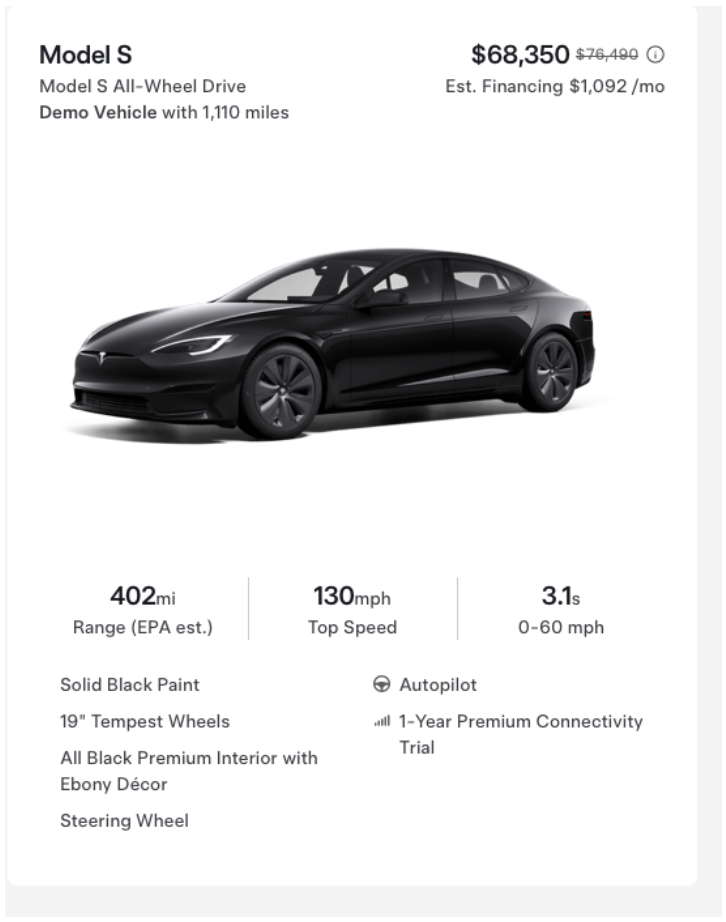

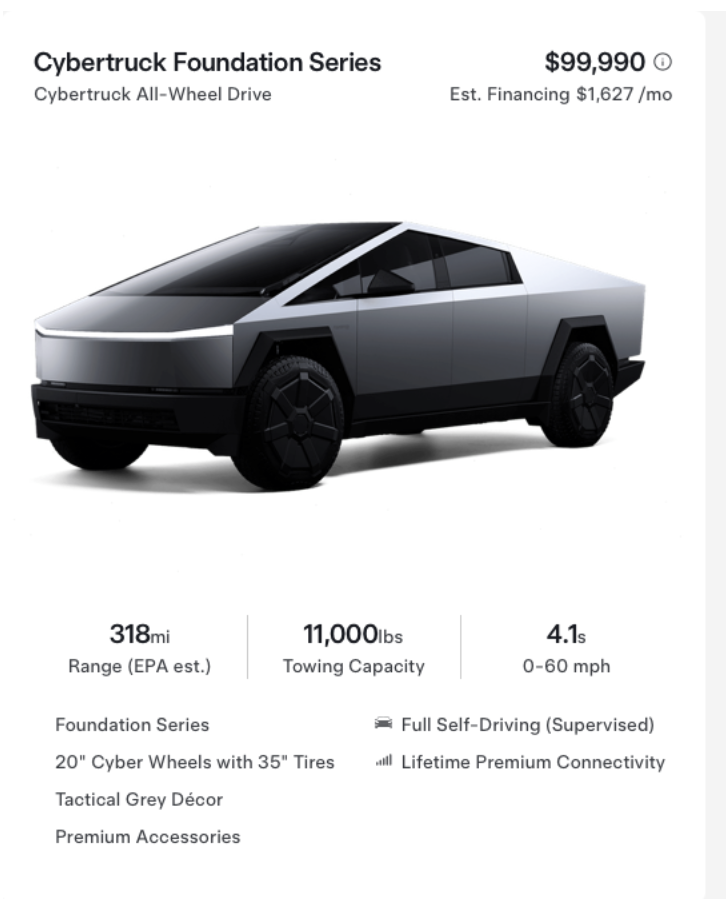

A: I don't like them. When you take your Tesla in for a service, sometimes you get a KIA in return. Ouch. You can literally hear every bolt rattle as you drive down the freeway, and you leave behind a trail of parts; the quality difference is enormous.

Q: How do you determine the limit price on spread trades?

A: I don't like making less than a 5% profit in a month. It's just not worth the risk. So let's say if I do a trade alert at $9.00, I'll create a spread of, say, $9.00, $9.10, $9.20, $9.30, $9.40, and that's it. We tell people to not pay more than $9.40. Before we told people not to do that, they used to buy at market, and they would end up paying $10.00 for a $10.00 spread, and it is absolutely not worth it. That is the reason we do that.

Q: I have trouble getting your recommended price.

A: When we put out a trade alert, and 6,000 people are trying to do it at once, you'll never get the recommended price. You may get it at the close because a lot of the high-frequency traders that pile into these positions and pay the maximum price have to be out of that position by the end of the day, so they often dump their positions at the close. And if you just leave your limit order in there, it'll get filled. If it doesn't get filled at the close, it will get filled at the opening the next morning. So that's why I'm telling people on every alert now to put in a spread, put in good-until-cancelled orders, and most of the time, you'll get some or all of those orders done. That is a good way to make money; if you don't believe me, just go to our testimonials page (click here), where hundreds of people have sent in recommendations on their experience.

Q: What do you think about crypto here (BITO)?

A: I wouldn't touch it with a 10-foot pole. The time to get involved in crypto was when it was at $6,000 two years ago, not at $100,000 now. And when the quality is trading and rising up almost every day, why bother with crypto? You'd never know if your custodian is going to steal your position. And by the way, if anyone knows an attorney expert at recovering stolen crypto, please send me their name because I have a few clients who took someone else's advice, invested in crypto, and had their accounts completely wiped out.

Q: Should I bet big on oil stocks (USO) because of the possible deregulation starting in 2025?

A: Absolutely not. “Drill, baby, drill” means oil glut—lower oil prices, which is terrible for oil companies, so you shouldn't touch them. The only plus for oil under the new administration is they'll probably refill the Strategic Petroleum Reserve in Texas and Louisiana from the current 425 million barrels to 700 million barrels by buying on the open market and enriching the oil companies.

Q: Would you sell long-term holds in pharma stocks?

A: No. If it's a long-term hold, your holding will survive the new administration. They'll probably go back up starting from a year going into the next election unless they find ways to deal with the current administration. But if you're in the vaccine business and the head of Health and Human Services is a lifetime anti-vaxxer, that is not going to be good for business, no matter how you cut it, sorry.

Q: Why is Walgreens (WBA) doing so poorly?

A: Terrible management and too late getting into online commerce. The service there is terrible. Every time I go to Walgreens to get a prescription filled, there's a line a mile long. It seems to be a dying company. Someone actually is making a takeover offer for the company today, so I would stand aside on that.

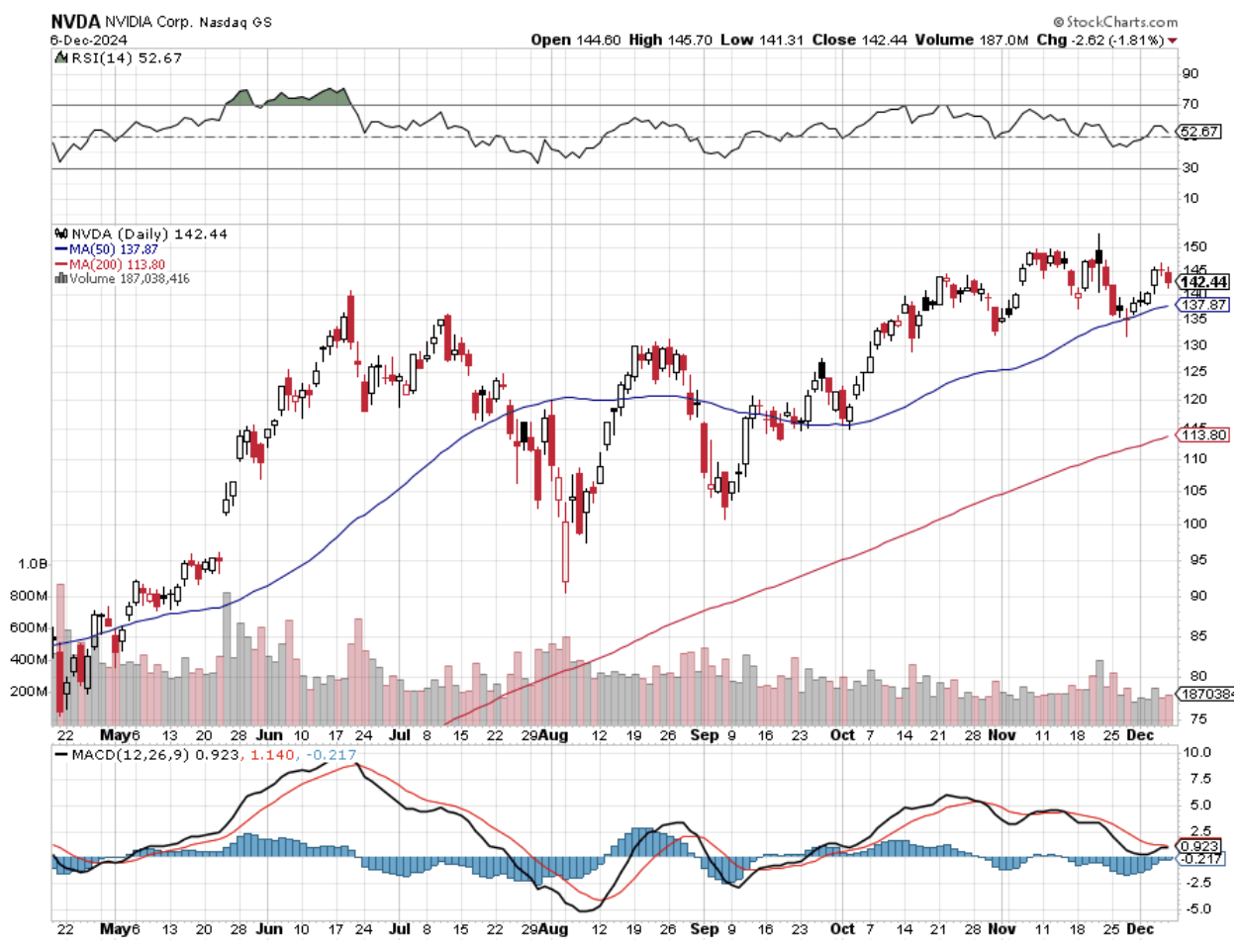

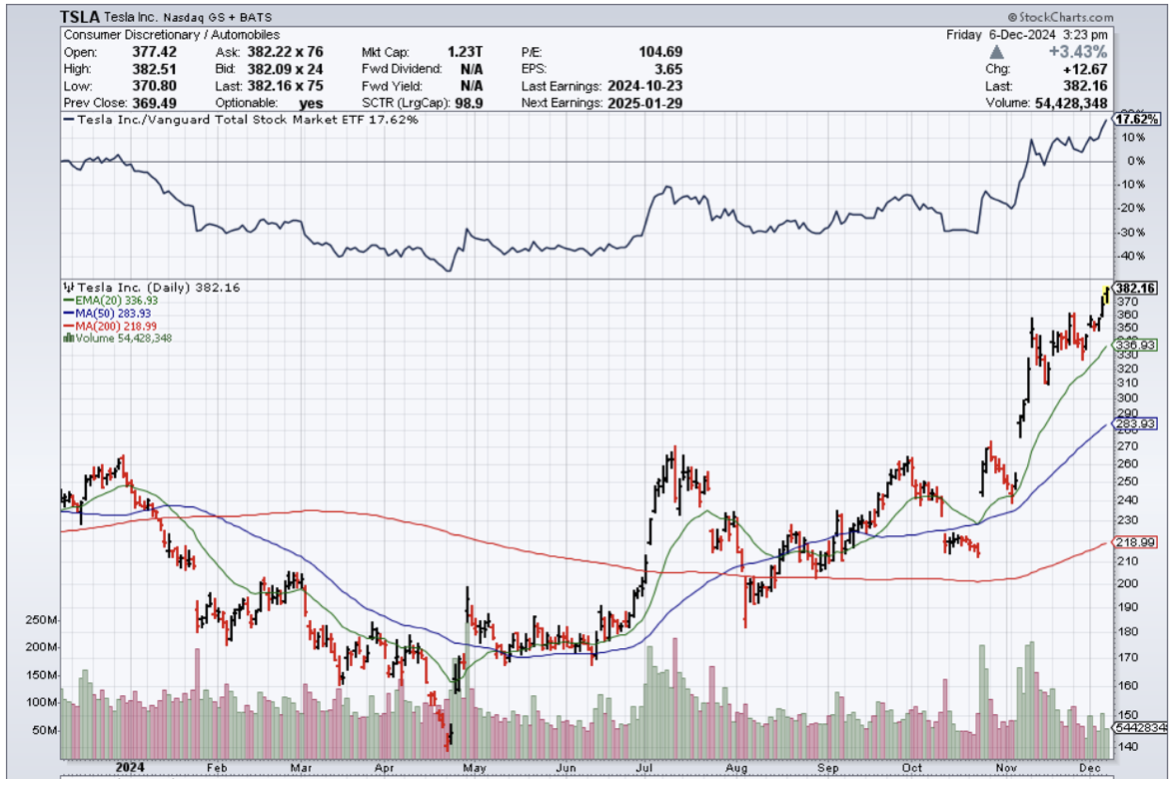

Q: Is Tesla (TSLA) risky?

A: Any stock that's tripled in four months is risky. But the rule of thumb with Tesla is that it always goes up more than you expect and then down more than you expect. Here is where high risk means high reward. My $1,000 target is now looking pretty good.

Q: If you're receiving Global Trading Dispatch, do you get the stock option service?

A: Yes, every trade alert we send out gives you the choice of a stock, an ETF, or an option to buy to take advantage of that alert.

Q: The EV stock Lucid (LCID) just got an analyst upgrade, but the chart looks terrible. Should I buy this cheap stock?

A: Absolutely not. Never confuse “gone down a lot" with “cheap.” Lucid only exists because it's supported by the Saudi royal family. They own about 75% of the company. They have no chance of ever competing with Tesla. Period. End of story.

Q: I have LEAPS on Google (GOOG), Amazon (AMZN), and Microsoft (MSFT). They expire in January, February, and March.

A: I would keep all of those—those are all good stocks. I expect them to keep rising at least until January 20th. After that, the Trump administration may announce antitrust actions against all three of these companies, but you'll probably have most of your profit by then. So from here on, if I had longs in all of these companies, I would definitely run them over the holidays because you'll probably get another pop sometime in January.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or JACQUIE'S POST, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader