Boy, did I make the right move going into the election?

I always have a propensity to reduce risk going into a major event. Let the newbies stick their necks out. I’ll collect the low-hanging fruit afterward while trampling over their bodies. As they used to say at Morgan Stanley, “It’s the pioneers who get the arrows in their backs.”

So I went into the November 5 election with 70% cash and long JP Morgan (JPM), Nvidia (NVDA), and gold (GLD). On November 6, I quickly stopped out of gold at cost and let the other two run, which launched on major rallies driven by a new deregulation trend. I then converted the remaining cash into a deregulation portfolio.

The bottom line? Since the election, I have been able to run up a monster 18.05% profit in only 14 trading days. That works out to 1.29% a day, the most earned in the nearly 17-year history of the Mad Hedge Fund Trader.

Notice that no specific deregulation measures have been proposed. No action has been taken. What we are seeing in unrestrained buying is driven by beliefs, animal spirits, and unbounded optimism, which markets all love. Call it euphoria. The problem with euphoria is that it fades as easily as it starts. After the 2016 election, the euphoria lasted for four months, then the market died for three months.

We’ve heard a lot about deficit reduction in the coming years, and let me tell you that the bond market isn’t buying it for a second. Since September, Fed Funds futures markets have plunged from 350 basis points in interest rate cuts by June to only 150 basis points, and half of that has already been done. Even the December 25 basis point rate cut has shrunk to only a 50% probability.

And this is what the bond market has been sniffing out. Tax cuts, spending increases, mass deportation of minimum wage workers, and a trade war are all highly inflationary. The voters may buy it, but not bond investors, and the bond market is always right. All it sees is the National Debt rocketing from $35 trillion to $45 trillion in four years.

“Bond market vigilantes” is soon a term you will hear every day.

It's just a matter of time before we get a shocking, out-of-the-blue move-up in a monthly inflation report. That is when the stock market will crash, and bonds get taken out to the woodshed. Next to happen will be a US Treasury auction that fails, spiking interest rates across the board, which recently caused the British government to fall. Then, hello, recession. We will spend the next many months trading against that day. The new administration’s most important appointment will be the guy in charge of borrowing.

And let me tell you about the National Debt, which I learned all about in my years in the White House Press Corp. The Social Security budget now runs at $1.4 trillion a year in payments, while defense is at $825 billion, for a total spend of $2.225 trillion a year. On top of that, you have to add $1 trillion a year in existing interest payments on the outstanding debt.

Even if spending on these two items goes to ZERO, it would take 16 years to pay off the current National Debt. If the debt rises to $45 trillion in four years plus interest, it would take 22.5 years to pay off. And this is with the number of new retirees exploding thanks to the Baby Boomer generation and defense demands in all parts of the world rising by the day.

Cutting the deficit boils down to cutting Social Security, cutting defense, or cutting the tax subsidies for your largest donors (billionaires, the oil industry), which is why it is never going to happen. Any other spending is too small to move the needle.

One of my favorite tests for someone’s knowledge of the federal budget is to ask them how much the US gives away in foreign aid to poor countries every year, a number that gets wildly exaggerated by political parties. The guesses come in at anywhere from 1% to 10% of the total budget. The correct figure? $63.1 billion, or 0.94% of the total $6.7 trillion in US budget expenditures, or less than one-tenth of one percent. You have been warned. I’m going to give you a test the next time I run into you.

The current deficit is, in fact, a product of five successive tax CUTS (Kennedy, Reagan, Bush II, Trump 1, and soon to be Trump II), which now has far and away the lowest income tax rates in the industrialized world. Remember, before Kennedy, the Great Depression maximum marginal tax rate of 90% prevailed.

But you have to get around to know this. I know because I moved an entire hedge fund from London to San Francisco in 1994 to take advantage of lower tax rates and the emerging Internet boom. I saved millions.

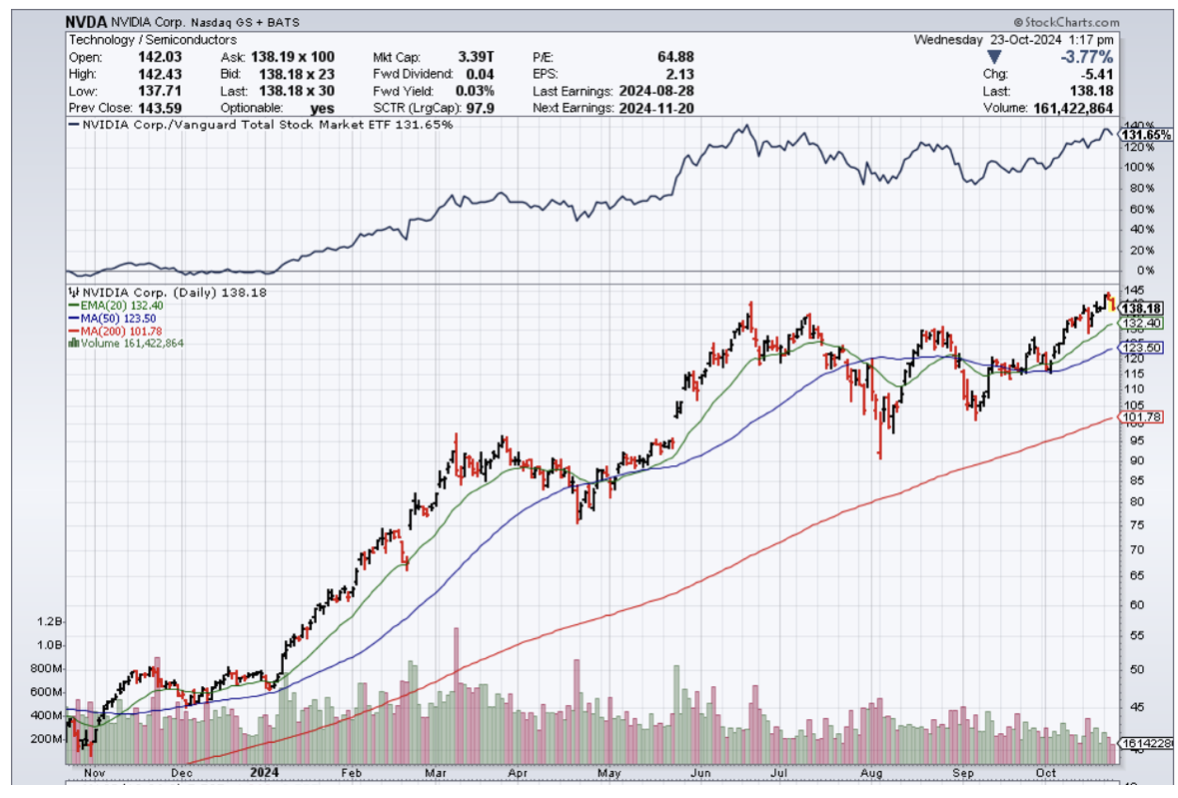

Which leads us to the most important question of the day: what to do about Nvidia (NVDA), almost certainly the largest holding of everyone who reads this letter. The company delivered spectacular earnings as promised, but the shares sold off $12. In fact, (NVDA) has only risen by $13 since June, with a drawdown of 37%. Rising volatility with incremental gains is a sign that a stock is topping out. At a $3.6 trillion market capitalization, the spectacular share price gains of the past are no longer attainable. The Law of Large Numbers is kicking in.

I still believe that (NVDA) will rise next year, but not by 200%. Some 20% is more likely. Fortunately, there is something you can do about it. With an options implied volatility of 40%, you can sell short the December 20, 2024, $156 call options against your existing position for $2.20. If Nvidia rises above $156 and your stock gets called away, your net proceeds will be $158.20, and you will think you died and went to Heaven.

If it doesn’t rise above $156, sell the January call options, and you take in another $2.20. After several months, this starts to add up to a lot of money. Eventually, the implied volatility will fade, and this trade won’t be there anymore.

But it works now.

That’s what I would do.

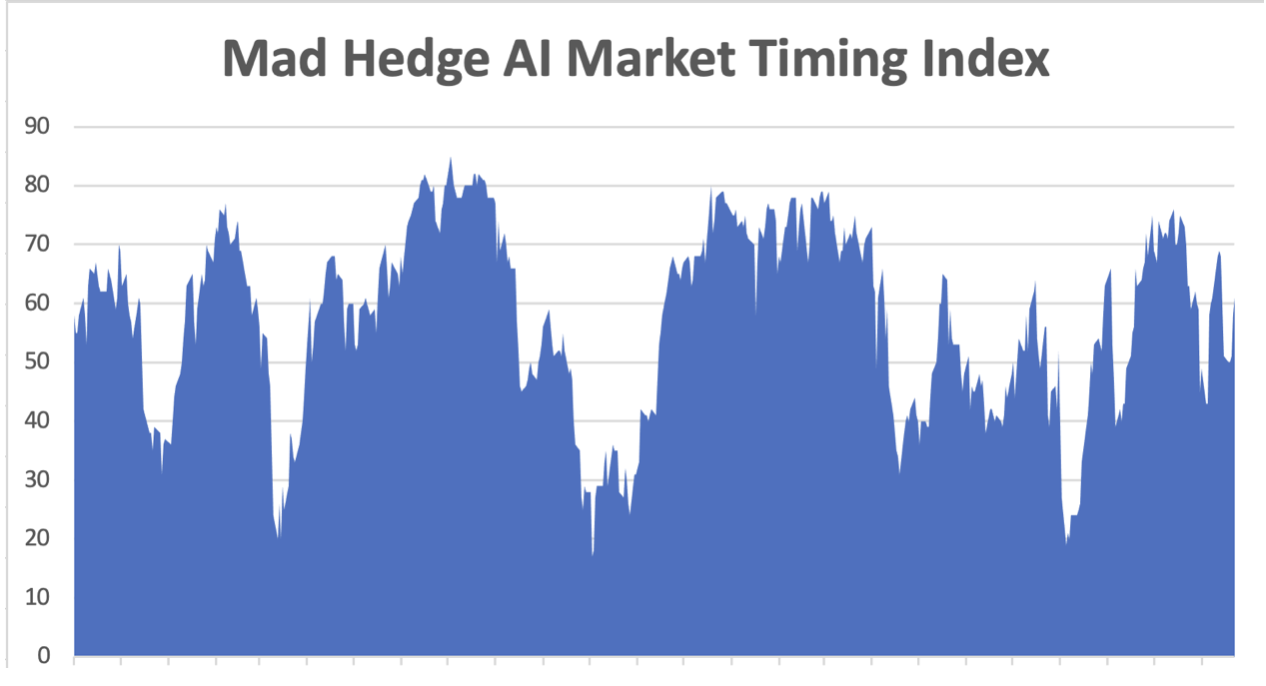

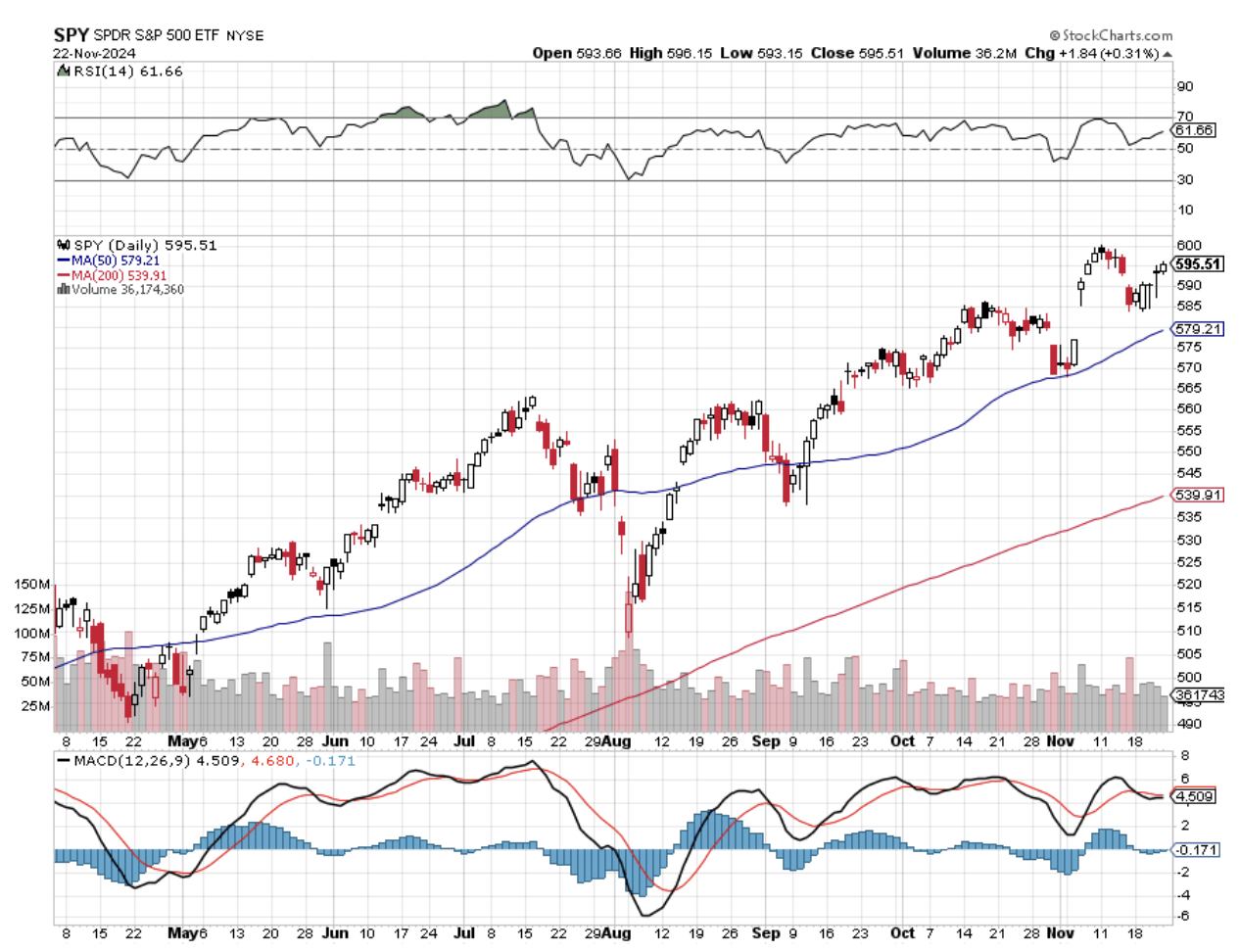

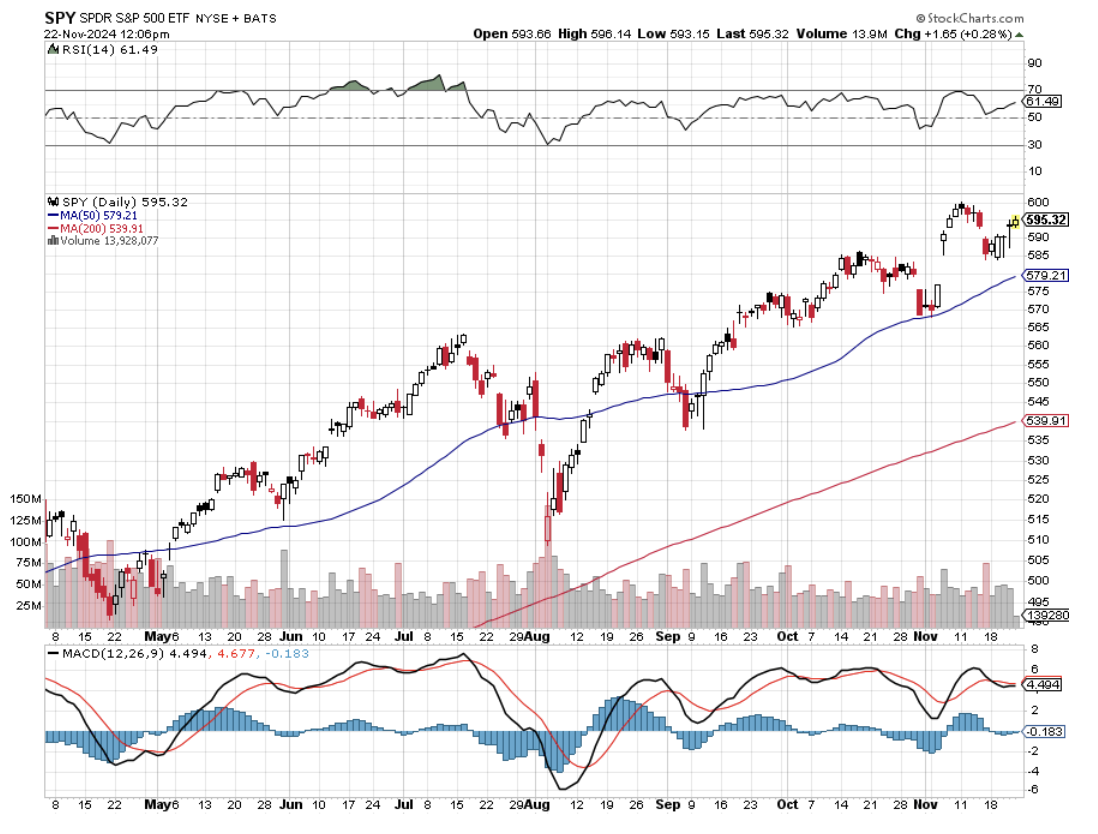

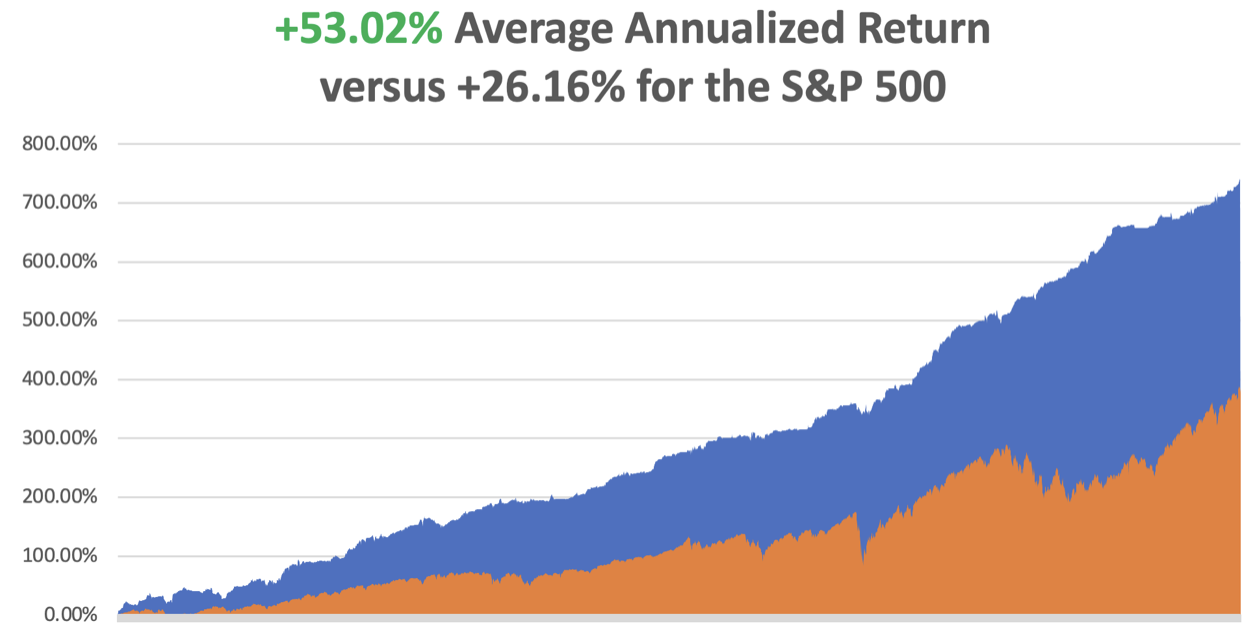

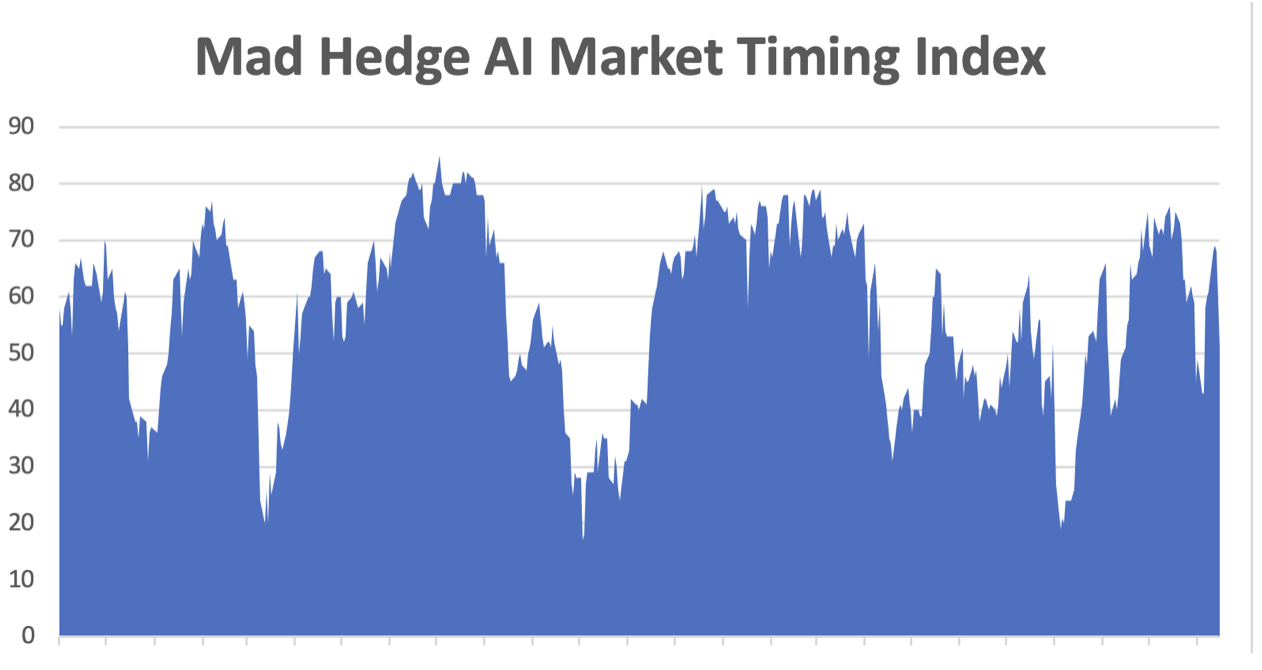

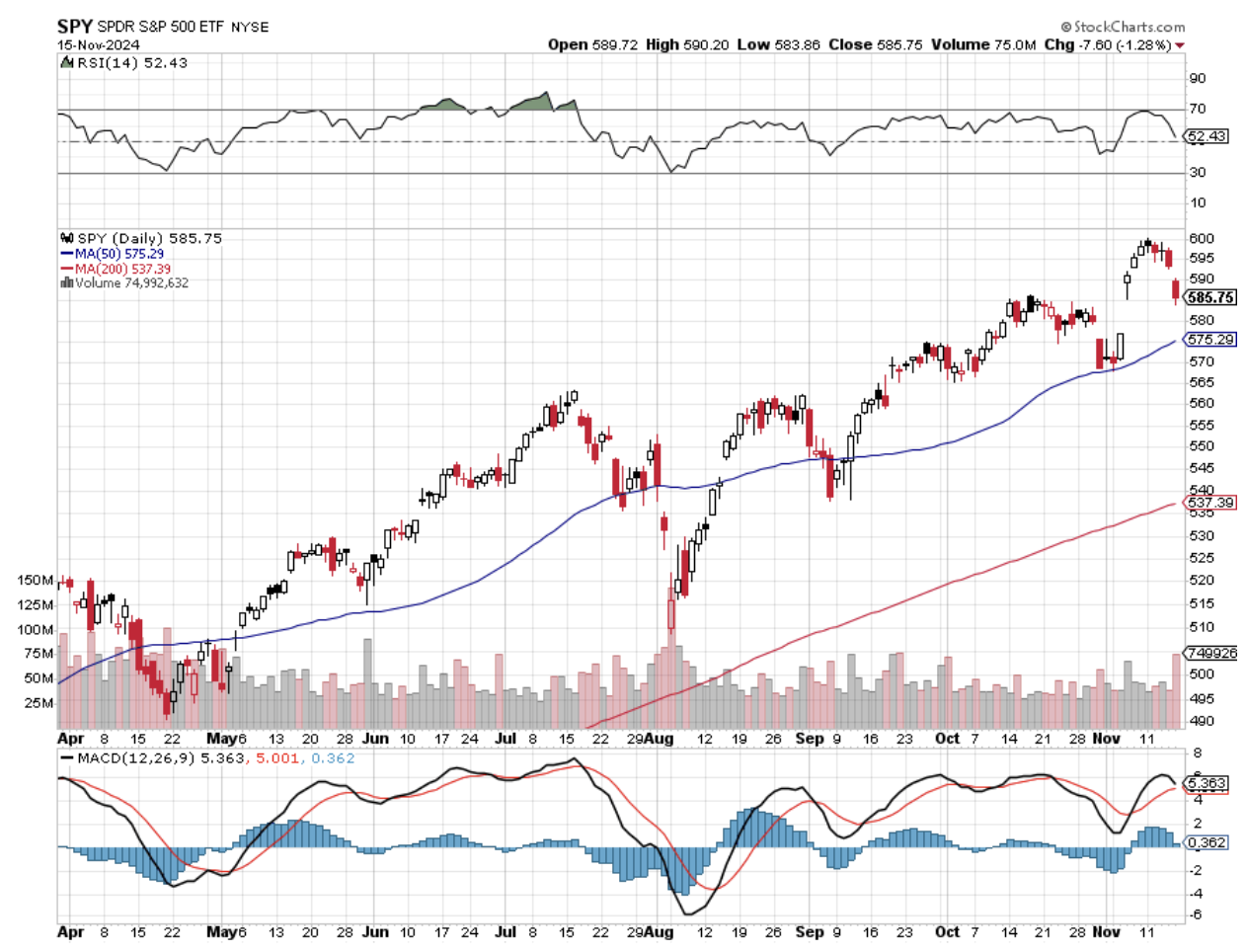

In November, we have gained a breathtaking +17.38%, November is proving to be our largest month of the year. My 2024 year-to-date performance is at an amazing +70.42%. The S&P 500 (SPY) is up +24.73% so far in 2024. My trailing one-year return reached a nosebleed +71.07%, up an incredible $10 on the week. That brings my 16-year total return to +747.05%. My average annualized return has recovered to an incredible +53.68%.

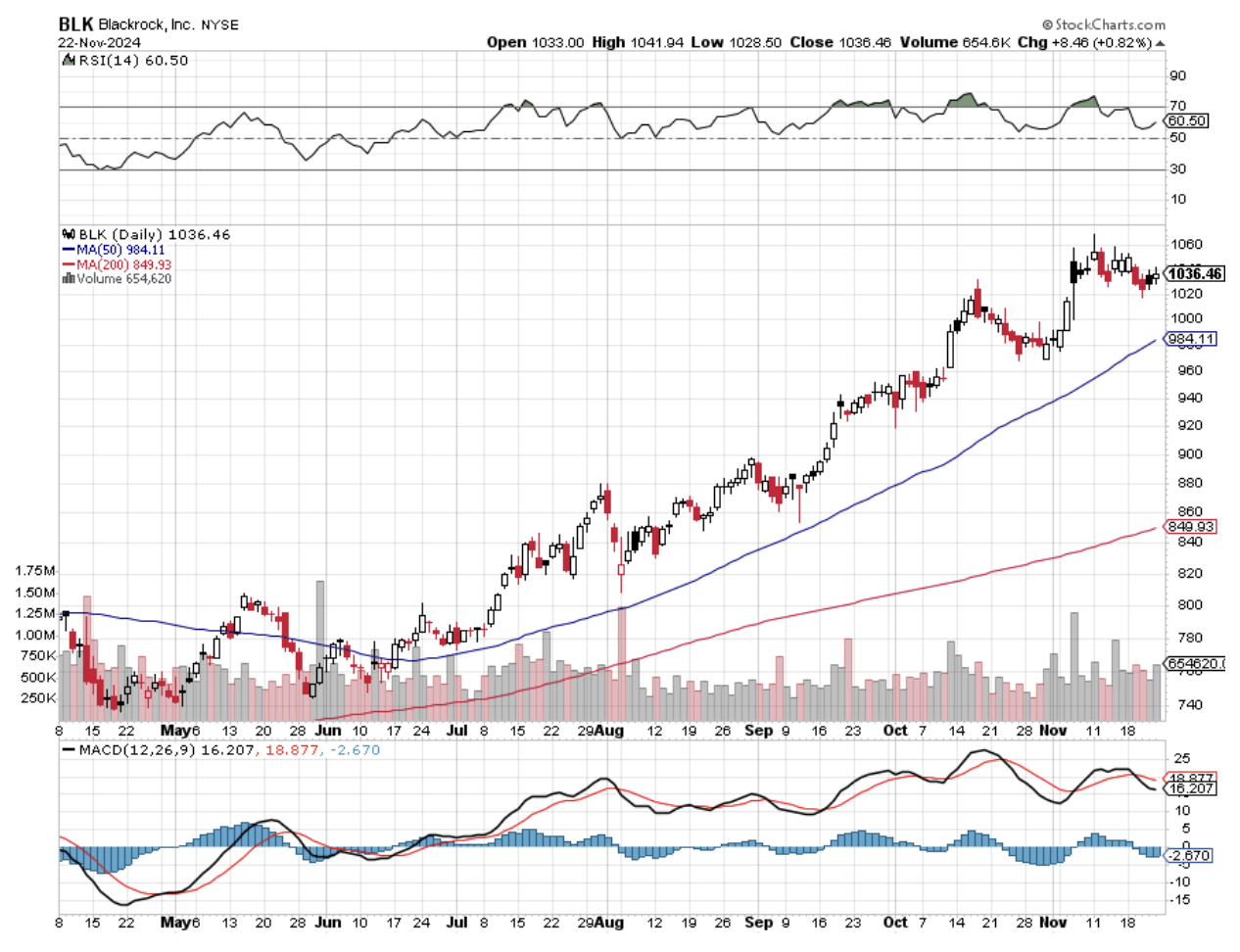

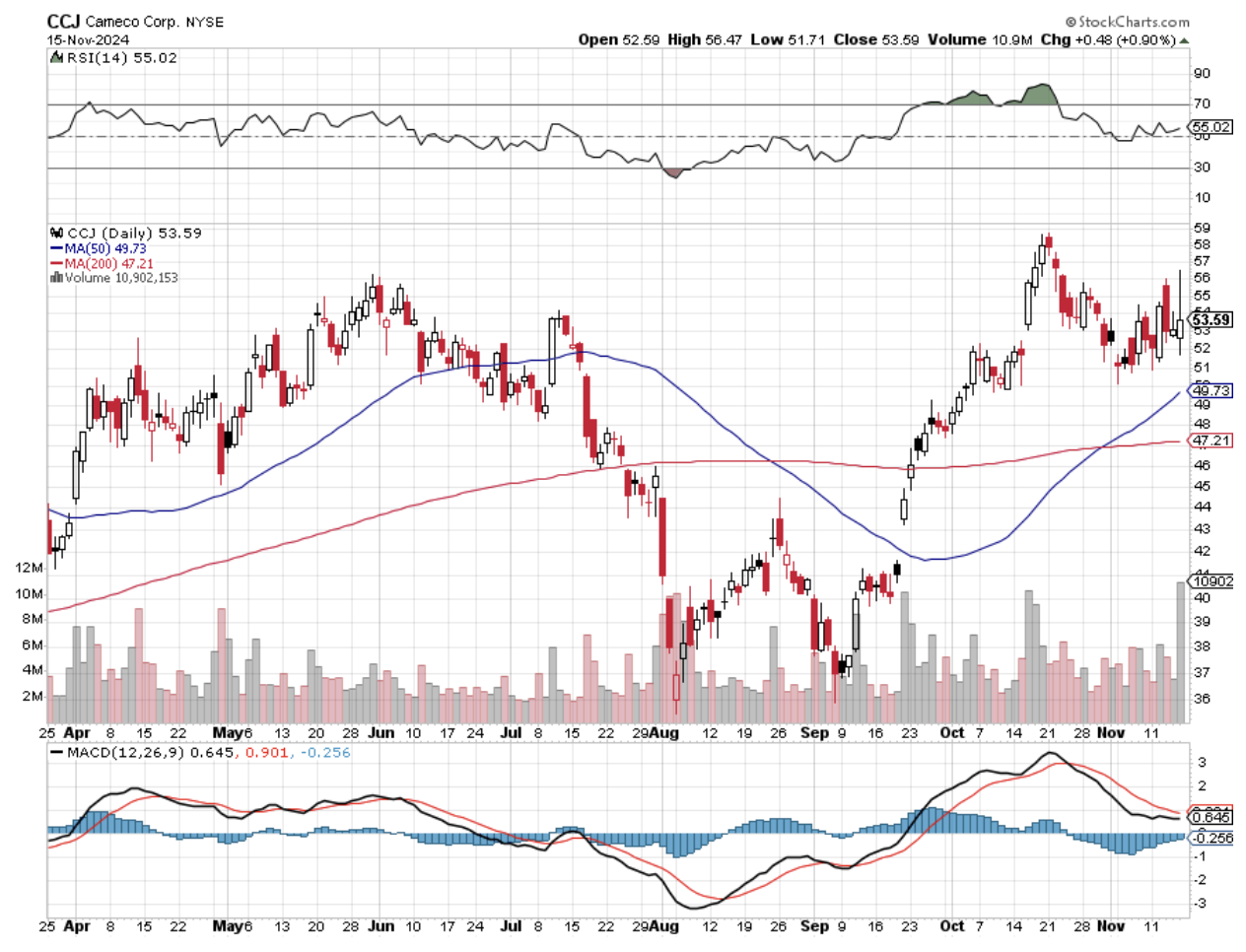

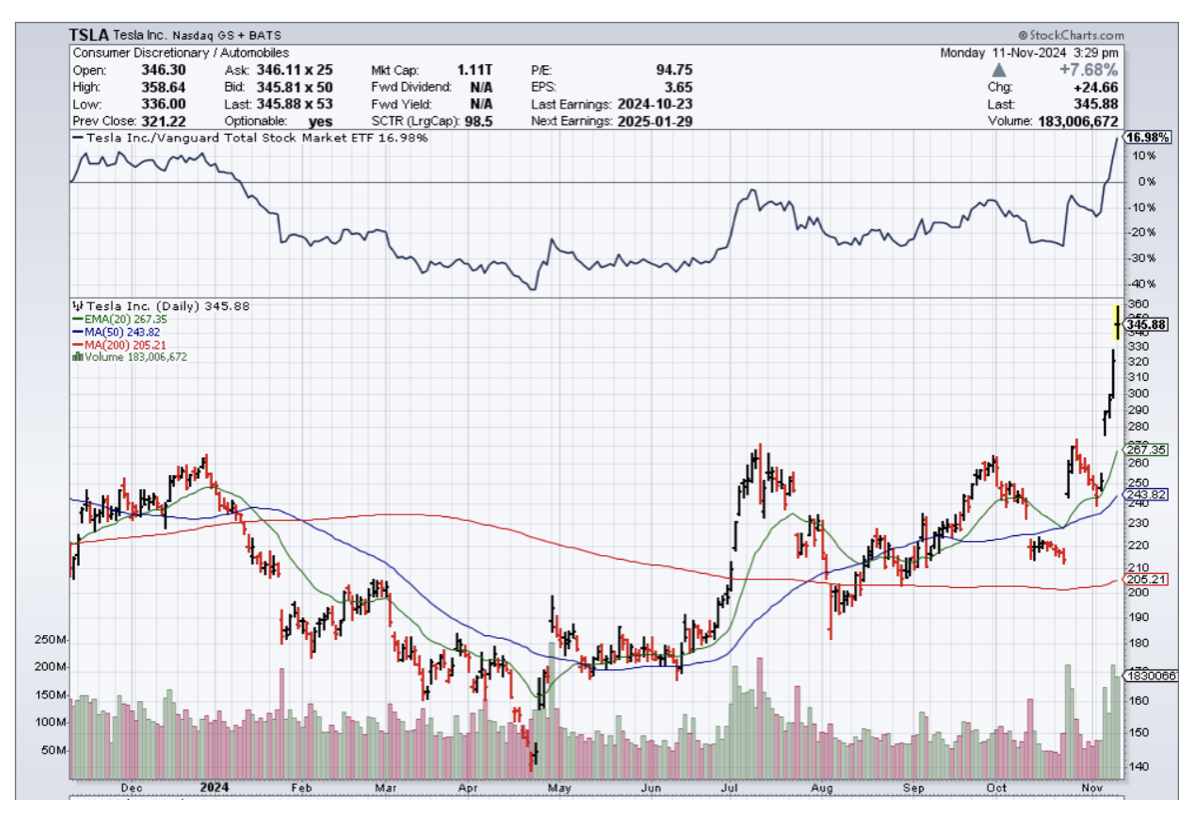

I maintained a 100% long-invested portfolio, betting that the market doesn’t drop below pre-election levels. That includes (JPM), (NVDA), (BAC), (C), (CCJ), (MS), (BLK) and a triple long in (TSLA). My November position in (JPM) expired at max profit. We are now so far in the money with all of our positions we should make 27 basis points a day until the December 20 option expiration in 18 trading days, thanks to time decay and falling volatility.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable so far in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, November 25 at 8:30 AM EST, the Dallas Fed Manufacturing Index is out.

On Tuesday, November 26 at 8:30 AM, the S&P Case Shiller National Home Price Index is published. At 11:00 AM, the Minutes from the last Fed Meeting are announced.

On Wednesday, November 27, at 8:30 AM, the Core PCE Price Index is 11:00 AM EST. It is a half day for the stock market, which closes at 1:00 PM EST.

On Thursday, November 28, is a National holiday in the US for Thanksgiving.

On Friday, November 29, is Black Friday, and it is a half day for the stock market, which closes at 1:00 PM. At 2:00 PM, the Baker Hughes Rig Count is printed.

Today, I thought I’d recall The World’s Worst Investor, who so happened to be my grandfather on my father’s side.

He was an immigrant from Sicily who joined the army during WWI to attain US citizenship lost an eye when he was mustard gassed on the Western Front in France. I recently obtained his military records from the Department of Defense and learned he was court-martialed for refusing to wash pots and pans at the front while blind!

After the war, the sight came back in one of Grandpa’s eyes, so he

bought a three-bedroom brick home on 76th Street in the Bay Ridge section of Brooklyn street for $3,000, eventually raising four kids. Back then, there was a dairy farm across the street, and horse-drawn wagons delivered ice blocks door to door.

During the roaring twenties, an assortment of relatives chided him for avoiding the stock boom where easy fortunes were made trading on ten to one margin. When the 1929 crash came, all of them lost their homes. Grandpa finished off the basement, creating space for two entire families to move in. He had never bought a stock in his entire life.

Because Dad contracted malaria with the Marines on Guadalcanal during WWII, the old man moved the family to Los Angeles in 1947 for the dry, sunny weather. Unfortunately, my grandmother heard there were no lobsters on the west coast, so she packed two big Maine ones in a suitcase. By the time they got to Las Vegas, the smell was so bad they got kicked off the train. In the booming postwar economy, they had to wait a week to get new seats to LA.

That was enough time for a flimflam man to sell Grandpa five acres of worthless land for $500. Ten years later, my dad drove out to check out the investment. It was a tumbleweed-blown, jackrabbit and rattlesnake-ridden piece of land so far out of town that it had to be worthless. You couldn’t see downtown, even if you stood on the rusted-out model “T” Ford that occupied the site. After that, the parcel became the family joke, and Grandpa was ridiculed as the world’s worst investor.

Grandpa died of cancer in 1977 at the age of 78. What German shrapnel and gas failed to accomplish, 60 years of smoking two packs a day of non-filter Lucky Strikes did. The army gave him cigarettes for free during the war, and he never shook the addiction. Even at the end, he insisted that there was no “proof” that cigarettes caused cancer, which soldiers referred to as “coffin nails.”

His estate executor put the long-despised plot out of Sin City up for sale, and a bidding war ensued. Although the final price was never disclosed, it was thought to be well into eight figures. In the intervening 30 years, the city of Las Vegas had marched steadily westward towards Los Angeles, sending its value through the roof. The deal triggered a big fight among the heirs, those claiming he was the stupidest demanding the greatest share of the proceeds, the bad blood generated continuing to this day. It turns out the world’s worst investor was actually the best, we just didn’t know it.

What was the address of this fabled piece of real estate? Why, it is 3325 Las Vegas Blvd. South, the site today of the Venetian and Palazzo Hotels, home to the Dal Toro restaurant, the venue for the last Mad Hedge Fund Trader’s Las Vegas strategy luncheon.

I’m sure Grandpa is laughing in his grave, in between smoles.

Bought for $500 in 1947

Postscript. One day in New York a few years ago, I had a few hours to spare waiting to board Cunard’s QEII to sail for Southampton, England.

So, I decided to check out the Bay Ridge address that I had heard so much about during my childhood. I took a limo over to Brooklyn and knocked on the front door. I was told the owner was expecting a plumber, so he let me straight in, not noticing my Brioni blue blazer nor the Cadillac stretch limo out front.

I told him about my family history with the property, but I could see from the expression on his face that he didn’t believe a single word.

Then, I told him about the relatives moving into the basement during the Great Depression. He immediately let me in and gave me a tour of the house. He told me that he had just purchased the home and had extensively refurbished it. When they tore out the walls in the basement, he discovered that the insulation was composed of crumpled-up newspapers from the 1930s, so he knew I was telling the truth.

I told him that Grandpa would be glad that the house was still in Italian hands. Could I enquire what he had paid for the house that sold in 1923 for $3,000? He said he bought it as a broken-down fixer-upper for a mere $775,000. And this was after the housing crash in 2011.

My Grandparents 1926

The Fabled Bay Ridge House Bought for $3,000

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader