Below please find subscribers’ Q&A for the May 1 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Silicon Valley.

Q: I see the Bank of Japan bought $35 billion in the foreign exchange on the market. What's going on?

A: First of all, they didn’t buy dollars, they sold dollars and bought yen. Well, It's really very easy. Interest rates are the primary driver of foreign exchange rates. Japan has had the lowest interest rates in the world for 40 years, and the US has had the highest for the last two years. So it’s an easy hedge fund trade—short the Yen, and use the proceeds there to buy US dollar assets—you pick up an automatic spread of 4.7%. You then multiply that 10 times, that becomes 47%, and goes into the trillions of dollars in size. And of course, every hedge fund in the world is doing this trade. So that is a massive amount of Yen selling. They sold some of of their massive dollar reserves in an attempt to head off the collapse of the Japanese yen which hit some Y160, a 40-year low. So that's what's going on there.

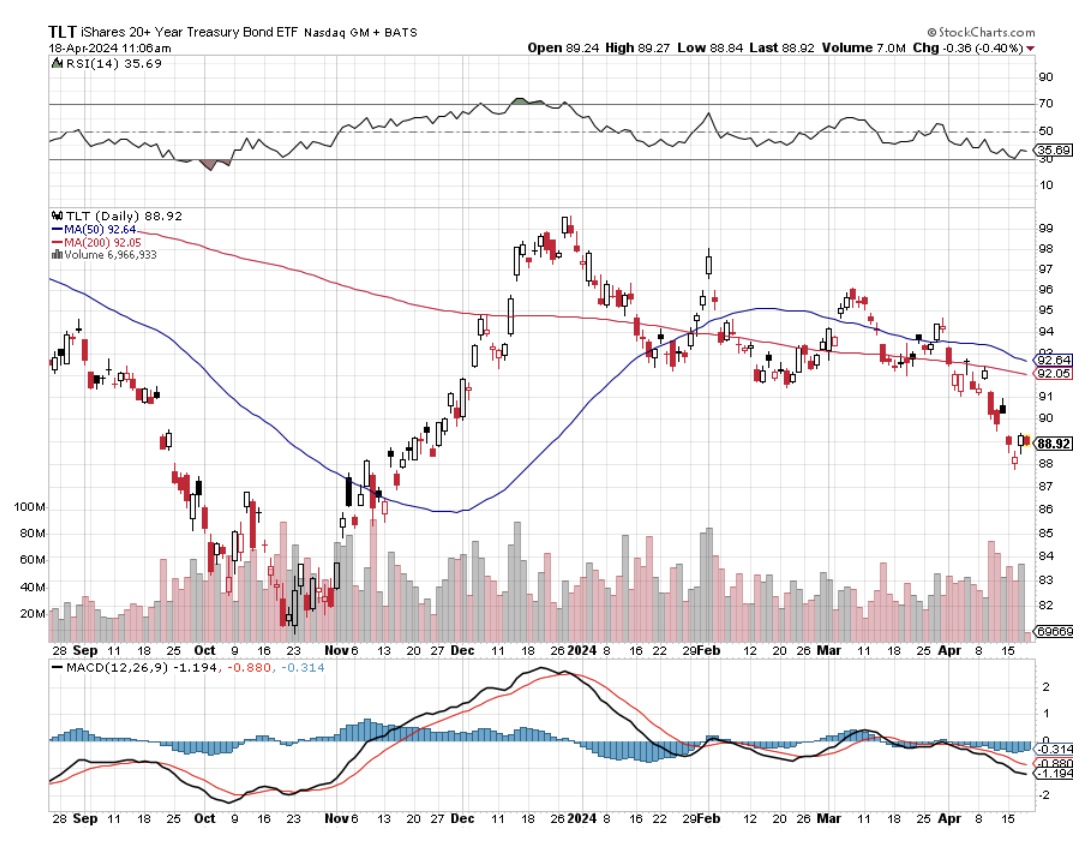

Q: What's your updated view on TLT, and what's your yearend view?

A: I think we kind of chop sideways as long as there's indecision on interest rates, and then maybe 3 points of downside max; and then after that, we start another twenty-point rally. So we're all waiting for the bottom of this move on the (TLT), and then we're going to go pedal to the metal, so that's an easy one.

Q: Would you stay away from DJT?

A: Absolutely. This is the most manipulated stock in the market and the largest short interest in the market. More people would short it if they could get the stock, which now costs 550% a year to borrow and has a SPAC set up. I never touch SPACs because 95% of those turn out to be failures. So go express your support for the former president in other ways would be my advice.

Q: My son-in-law works in AI and says Apple (APPL) will be a better player than Tesla (TSLA).

A: No it won't. First of all, Tesla is 15 years ahead of everybody on AI; they actually started a major AI effort in 2014, and they have the data of all the miles driven by 6 million cars all over the world, and nobody can replicate it; so that gives them a huge head start. Tesla also has Elon Musk running it, who would beat the pants on aggressiveness and competitiveness off Tim Cook all day long, so I would vote for Elon Musk on this one. But the next big AI surprise is probably going to come from Apple. That's going to happen in June when they have their developer's conference. I've already had several kids and relatives invited to attend that conference, so I’ll have a really good read on what's happening.

Q: Where do you see inflation for the rest of the year?

A: Tiny up to sideways and then down more—we may hit the 2% target by the end of the year. The key here is you have to let AI kick in and start generating profits instead of promises, as employees start being replaced with AI.

Q: Would you return to Havana?

A: I would. I had a great time, and now I have the knowledge of experience of having gone there. I was actually looking at Airbnb condos on the beach in Havana which you can get for $70 a month. You can't beat the prices in Cuba; they're like a 10th of anywhere in the world. You can buy a two-bedroom condo in Havana for $30,000. Compare that to New York—it would probably cost you $3 million, and would certainly cost you that much in San Francisco.

Q: What is a substantial dip?

A: I always get this question. It's different for each stock. It could be 5% for a boring one like Apple (AAPL), or 20% for a really wild one like Nvidia (NVDA). You can see both of them are acting like that right now, so it's different according to the volatility of the individual stock. There's no fixed answer.

Q: Are there expatriates living in Cuba?

A: There are, incredibly; some of them are working in the tourist industry, some in the computer industry. Would you consider it safe? Probably, yes, as long as you don't engage in politics. That would be a really big mistake. It's even dangerous for Cubans to have a political opinion. Best to just shut up and do what the government says; that's what totalitarian regimes are like. I've been in a lot of them, and by the way, that may be what it's like in the United States in another year, so we'll have to wait and see. I felt relatively safe in Cuba. I wasn't followed by the secret police, which I always used to be. Maybe I'm just not as valuable as I used to be!

Q: Do you have a ballpark timeline for Freeport-McMoRan (FCX) to reach under?

A: Time is always difficult to call because there are just so many variables and black swans out there, but I easily could see a spike in (FCX) going up to $100 sometime in 2025 when the global economy starts to recover; and if you're doing LEAPs on any depth here, I would go out to end of 2025 just to be safe. If Chinese ever starts new home contraction again that becomes a chip shot.

Q: The Feds are moving marijuana stocks from a schedule 3 to a schedule 1. Are there any plays here?

A: Well, I've never been a big fan of pot stocks. The barriers to entry are very low from anybody to come in as a competitor. At the end of the day, it's a brand play, much like Coca-Cola (KO), and they still have huge competition from the black market, because the black market doesn't have to pay the 30-40% in sales taxes. And it's a fairly poorly managed business—guess why? Everybody is stoned all the time. So I'm going pass on marijuana, there's too many better fish to fry. Leave it to the potheads.

Q: Why has Nvidia (NVDA) gone flat?

A: Trees don't grow to the sky. Nvidia was up 140% in 6 months, and you have to give time for the earnings to catch up with the stock. The earnings are growing at 40% a year, so they'll catch up pretty quickly. I'm thinking we could have a shot at $1,400 in Nvidia by the end of the year.

Q: McDonald's (MCD) just had a big sell-off on weak earnings, is it a buy-down here?

A: No. McDonald's has the highest exposure to sub $50,000/year earners of any of the fast food companies; they're the ones most affected by McDonald's high prices. Their margins are being crushed, and automation can't happen fast enough. And then there's the Ozempic effect: weight loss drugs are killing appetites, and eventually we'll have a hundred million people on weight loss drugs. And my bet is a lot of those are McDonald's customers, so avoid Mickey D.

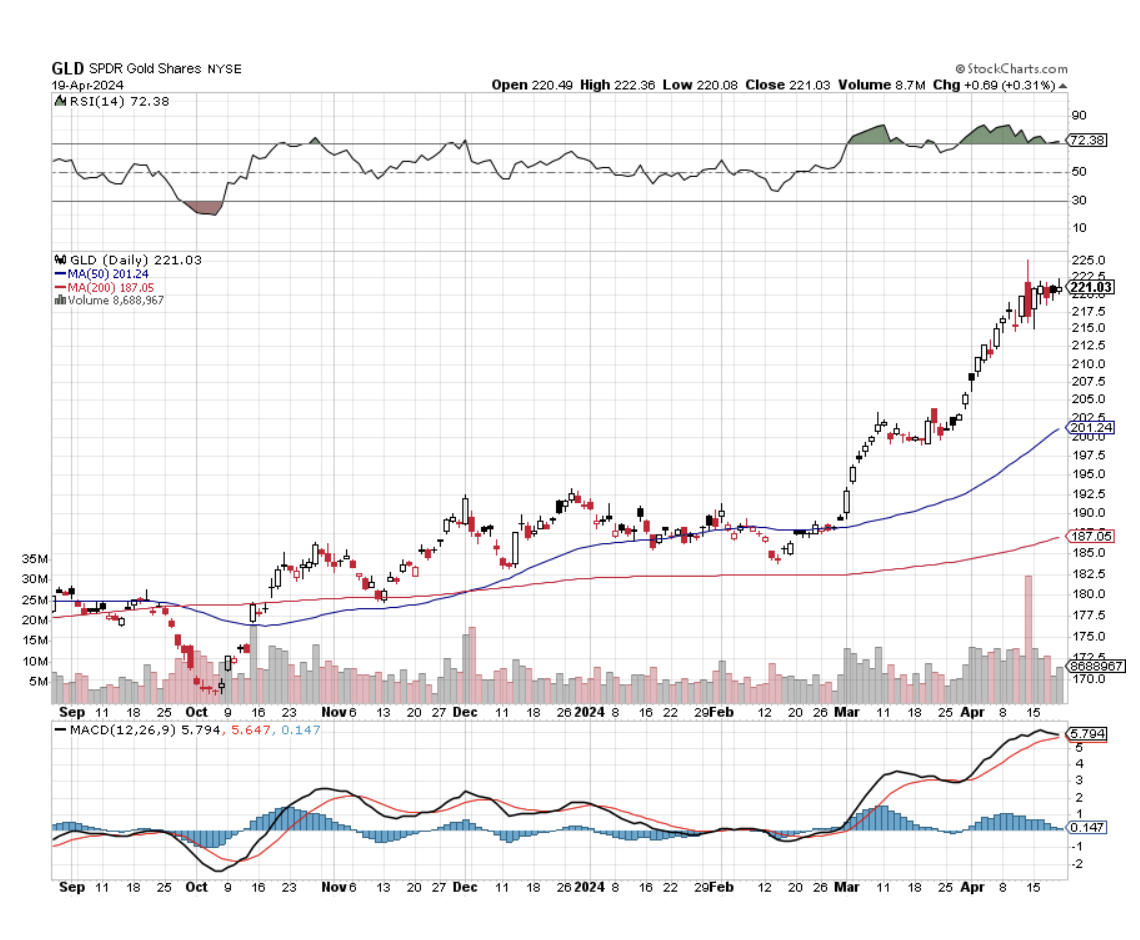

Q: What about the silver trade?

A: Silver is actually starting to outperform gold on the upside as it has historically done, so you might go along with a pair of trades owning both gold (GLD) and silver (SLV). Gold just sold off at 5% and silver sold off at 10%, so maybe the old volatility of silver is returning. I'd look to buy Wheaton Precious Metals (WPM) LEAPs down here.

Q: Do you think Starbucks (SBUX) is in the same boat as McDonald's (MCD)?

A: After the similar earnings sell off, I'd say yes. Starbucks doesn't do well in recessions or economic slowdowns. It’s an easy product to economize on. And they don't do well with the sub $50,000/year crowd either. Plus, I think Starbucks in particular is being weighed down by weak China sales.

Q: What's your outlook on energy?

A: Buy the dip. We're all looking for economic recoveries worldwide next year—oil does really well in that situation. We just have to work off the current overbought situation that was given to us by the Gaza War.

Q: Why are the miners not keeping up with gold and silver?

A: The answer is inflation. Inflation in the mining industry is double or triple what it is in a regular economy because you have so many companies chasing so few production resources. For example, those giant tires that go on these huge Caterpillar trucks—those are $200,000 a tire, and there's a two-year waiting list to get one. So as more people try to mine, the cost of mining goes up. That feeds into the earnings of the mining companies. Also, miners are subject to the whims of the stock market, which the metals aren't. So that's why I've been recommending the metals first and then miners second.

Q: With the new Amazon (AMZN) earnings, will they someday pay out a dividend?

A: They just delivered their first substantial profit in the company's history that I'm sure is by design, and if they're willing to increase benefits to shareholders, can dividends and stock buybacks be far behind? If that happens, you can expect Amazon stock to double from here. So absolutely, yes.

Q: Is housing about to crash because of high-interest rates?

A: Absolutely not. It's about to take off like a rocket as interest rates fall. You'll never get a crash in housing as long as we have a shortage of 10 million houses. Housing shortages don't get crashes. We had a housing oversupply in 2007 and 2008, and that's what caused that housing crash; but half of the home builders went under then and they never came back, creating the current shortage. In the meantime, people are using 5/1 ARM loans to get lower interest rates and praying that rates fall by the time the first adjustment comes along. Then they'll move into much lower 30-year rate mortgages right around the 5% level. That is the plan of a lot of home buyers these days.

Q: How are technology companies going to cope with the margin squeeze?

A: They will fire people. They have fired 300,000 people in the Bay Area in the last 2 years, and as a result, the stocks have skyrocketed. The prime example is META (META), which fired 20% of the staff and saw the stock double. Once that happened, everybody else jumped on the bandwagon and started laying off people like crazy. It was actually Elon Musk that started the whole cost-cutting trend in Silicon Valley, so you have to thank him for that.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, select your subscription (GLOBAL TRADING DISPATCH, TECHNOLOGY LETTER, or Jacquie's Post), then click on WEBINARS, and all the webinars from the last 12 years are there in all their glory

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader