With California having cut the amount that PG&E has to pay for third-party home-generated solar energy by 75% this year, the price of solar panels has crashed. That’s why SunPower (SPWR) shares have just cratered from $50 to $3.

As a result, deals of the century are being offered almost everywhere in the US. This is fortuitous as the price of public utility-generated electricity is rocketing everywhere by up to 15% a year.

It’s just a question of how long it takes Moore’s law-type efficiencies to reach exponential growth in the solar industry.

Solar electricity accounts for 4.75% of total US power generation, up from 3.96% in 2022, and compared to 27.3% in California. That means we are only five doublings away from 100% when energy essentially becomes free.

The next question beyond the immediate trading implications is, “What’s in it for you?”

I should caution you that after listening to more than 20 pitches, almost all of the information you get from fly-by-night solar installation salesmen is inaccurate. Most don’t know the difference when it comes to a watt, an ohm, or a volt.

I think they were mostly psychology or philosophy majors if they went to college at all.

The promised 25-year guarantees are only as good as long as the firms stay in business, which for many poorly run operations will not be long.

Talking to these guys reminded me of the aluminum siding salesman of yore. It was all high pressure, exaggerated benefits, and relentless emailing.

I come to this issue with some qualifications of my own, as I have been designing and building my own solar systems for the past 60 years.

During the early 1960s, when solar cells first became available to the public through Radio Shack (RIP), I used to create my own simple sun-powered devices from scratch. But when I measured the output, I would cry, finding barely enough power to illuminate a flashlight bulb.

We have come a long way since then. For years, I watched my organic bean-sprout-eating, Birkenstock-wearing neighbors install expensive, inefficient arrays because it was good for the environment, politically correct, and saved the whales.

However, when I worked out the breakeven point compared to conventional power sources, it stretched out into decades. So, I held off.

It wasn’t until 2015 when solar price/performance hit the breakeven sweet spot acceptable for me, about six years. I actually earned my money back in only four years, thanks to PG&E’s rapid price increases. Thanks to global warming my solar system is also becoming more efficient, not less. Why, I can’t imagine although higher heat might be bringing greater output.

Then I launched into overdrive, attempting to get the best value for money and game the many financing alternatives.

The numbers are now so compelling, that even a number-crunching, blue state-hating Texas oilman should be installing silicon on his roof.

A lot are.

My effort was the father of the many solar research pieces and profitable Trade Alerts you have received since.

Here are my conclusions up front: Learn about “tier shaving” from your local utility, and buy, don’t lease. All electrical utility plans are local.

First, about the former.

Every utility has a tiered system of charging customers on a prorated basis. A minimal amount of power for a low-income family of four living in a home with less than 1,500 square feet, about 20% of the U.S. population, costs about 10 cents a kilowatt hour.

This is a function of the high level of public power utility regulation in the U.S., where companies are granted local monopolies. There are a lot of trade-offs, local politics, and quid pro quos that are involved in setting electric power rates.

My local supplier, PG&E (PGE) has five graduated billing tiers, with the top rate at 55 cents a kWh for mansion-dwelling energy hogs like me (one Tesla in the garage and a Cybertruck on the way).

In order to minimize your up-front capital cost, you want to buy all the power you can at the poor person rate, and then eliminate the top four tiers entirely. Do this, and you can cut the cost of your new solar system by half.

Your solar provider will ask for your recent power bills and will help you design a system of the right size.

Warning! They will try to sell you more than you need. After all, they are in the solar panel-selling business, not the customer-value-for-money delivery business.

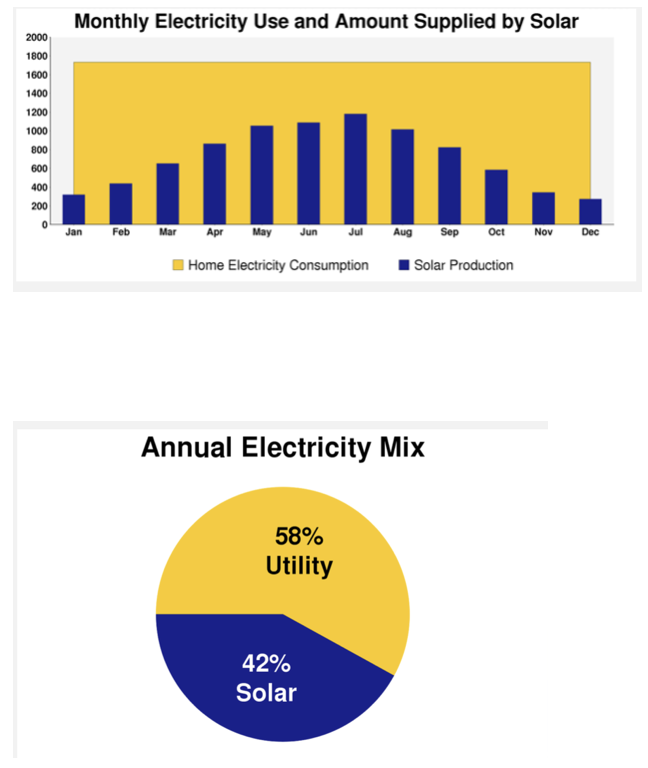

On the other hand, if you are a scientist or engineer, you can simply calculate these figures yourself. In my case, I use 18,000 kWh a year, but by installing only a 9,000 kWh/year system, my monthly power bill dropped from $500 to $50 a month.

This system cost me $32,000, or $22,400 net of the 30% alternative energy investment tax credit, giving me a breakeven point of four years and eight months.

Don’t focus too much on the panels themselves, as they are only 25% of a system’s costs. The big installers constantly play a myriad of panel manufacturers off against each other to get the cheapest bulk supplies.

The majority of the expense is for labor, the inverter needed to convert DC solar power to AC wall plug power, and permitting.

As for me, Mr. First Class All the Way, I specified only 19 of the best American-made, most efficient 335 kWh SunPower (SPWR) panels.

If I had settled for lower-cost 250 kWh imported panels and just bought more of them, I would have saved a few thousand bucks. That’s fine if you have the roof space.

One other frill I ordered was a top-of-the-line SunPower SPR-6000m inverter, which includes two 110-volt AC outlets. Many solar systems won’t work without access to the grid to run the inverter and software.

This will enable me to operate independently of the grid in case it is knocked out by an earthquake or storm, and power a few select appliances, such as my refrigerator, cell phones, laptop, and, of course, my car.

Once you get your connection notice from your utility, you enter electricity Nirvana, selling power at a premium during the day, and buying it back at a discount at night.

You are, in effect, using the grid as a giant storage device, or battery.

You can then log into your account online and measure how much your solar panels are generating in San Francisco, even from places as remote as Africa, as I did last summer.

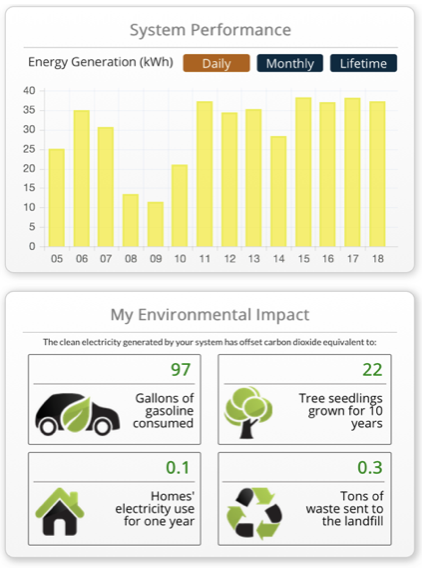

My statement is posted below, showing my roof is happily generating about 38 kW a day, or one full Tesla 100kW battery recharge every 2 1/2 days.

Since my system is in California, it also expresses the solar energy produced in terms of gallons of gasoline equivalent, tree seedlings grown over 10 years, an average home’s power consumption for one year, or the number of tons of waste sent to a landfill.

Call this “feel good” with a turbocharger.

At the end of every 12 months, the utility will then perform a “true up” calculation. If you produce more power than you used, the utility owes you a check.

Buzzkill warning!

PG&E has to pay me only its lowest marginal cost of power, or 4 cents/kWh for the excess power I produce. That is why it pays to underbuild your system, which for me costs $2.49/kWh to install, net of the tax credit.

This was the quid pro quo that enabled PG&E to agree to the whole plan in the first place. So, you won’t get rich off your solar system.

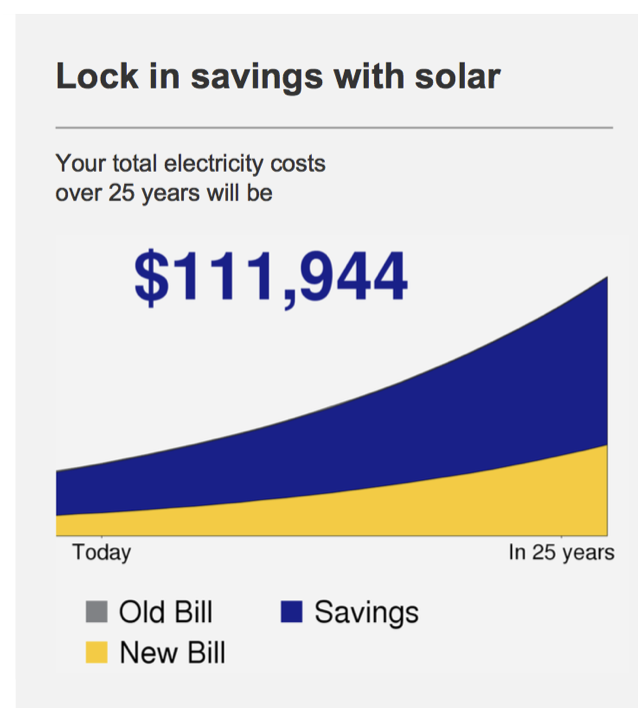

I am now protected against any price increase for electricity for the next 25 years!

PG&E has already notified me of back-to-back 7.5% annual rate increases for the next two years to pay for the replacement of their aging, dilapidated infrastructure, a problem that is occurring nationally.

Oh, and my $32,000 investment has increased the value of my home by $64,000, according to my real estate friend.

Now for the lease or buy question. If you don’t have $32,000 for a solar installation, (or $16,000 for a normal size house with no Tesla’s), or you want to preserve your capital for your trading account, you may want to lease from a company such as Solar City.

The company will design and install an entire system for you for no money down and lease it to you for 20 years. But after your monthly lease payment, Solar City will end up keeping half the benefit, and raise your cost of electricity annually.

In my case, my monthly power bill will have dropped from $450 to $250. And you don’t get any 30% investment tax credit. However, this is still cheaper than continuing to buy conventional power.

So if you can possibly afford it, buy, don’t rent.

This being Silicon Valley, niche custom financing firms have emerged to let you have your cake and eat it, too.

Dividend Solar (click here for their site) will lend you the money to buy your entire system yourself, thus qualifying you for the investment tax credit.

As long as you use the tax credit to repay 30% of your loan principal within 15 months, the interest rate stays at 6.49% for the 20-year life of the loan. Otherwise, the interest rate then rises to a credit card like 9.99%. A FICO score of only 690 gets you in the door.

There are a few provisos to add.

You can’t install solar panels on clay or mission tile roofs popular in the U.S. Southwest (where the sun is), or tar and gravel roofs, as the breakage or fire risk is too great. The racks that hold the panels down in hurricane-force winds simply won’t fit.

If you want to maintain your aesthetics, you can take the mission tiles off, install a simple composite shingle roof, bolt your solar panels on top, and then put back the clay tiles back around the edges. That way it still looks like you have a mission tile roof.

Also, it is best to install your system in the run-up to the summer solstice, when the days are longest and the sunshine brightest. Solar systems produce 400% more power on the longest day of the year compared to the shortest, because of the lower angle of the sun’s rays hitting the Northern Hemisphere.

Tesla (TSLA) has added a whole new chapter to the solar story.

It offers the PowerWall, a 13.5 kW home storage battery that will cost up to $7,000 (click here for “The Solar Missing Link is Here!”)

The development is made possible by the enormous economies of scale for battery manufacturing made possible by the new Gigafactory near Reno, Nevada.

The Gigafactory will double world lithium-ion battery capacity in one shot. Plans for a second Gigafactory are already in the works.

This will permit homeowners to use their solar panels to charge batteries during the day, and then run off them at night, making them fully energy-independent.

Yes, a total American solar energy supply in 15 years sounds outrageous, insane, and even ludicrous (to use some of Elon Musk’s favorite words).

But, so did the idea of a 3-gigahertz laptop microprocessor for a mere $1,000 24 years ago, when Moore’s law first applied.

The graphics for my own solar power supply are below:

SunPower SPR-6000m