Global Market Comments

May 2, 2025

Fiat Lux

Featured Trade:

(APRIL 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (AGQ), (NVDA), (SH), (UNG), (USO),

(TSLA), (SPX), (CCJ), (USO), (GLD), (SLV)

Global Market Comments

May 2, 2025

Fiat Lux

Featured Trade:

(APRIL 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (AGQ), (NVDA), (SH), (UNG), (USO),

(TSLA), (SPX), (CCJ), (USO), (GLD), (SLV)

Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies?

A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When the Chinese economy slows, Australia slows. Australia is basically a call option on the Chinese economy. So they're not getting the ballistic moves that we've seen in, say, the Euro and the British pound, which are up about 20%. Live by the sword, die by the sword. If you rely on China as your largest customer for your export commodities, you have to take the good and the bad.

Q: I see we had a terrible GDP print on the economy this morning, down 0.3%. When are we officially in a recession?

A: Well, the classical definition of a recession is two back-to-back quarters of negative GDP growth. We now have one in the bank. One to go. And this quarter is almost certain to be much worse than the last quarter, because the tariffs basically brought all international trade to a complete halt. On top of that, you have all of the damage to the economy done by the DOGE cuts in government spending. Approximately 80% of the US states, mostly in the Midwest and South, are very highly dependent on Washington spending for a healthy economy, and they are going to really get hit hard. So the question now is not “do we get a recession?”, but “how long and how deep will it be?” Two quarters, three quarters, four quarters? We have no idea. Even if trade deals do get negotiated, those usually take years to complete and even longer to implement. It just leaves a giant question mark over the economy in the meantime.

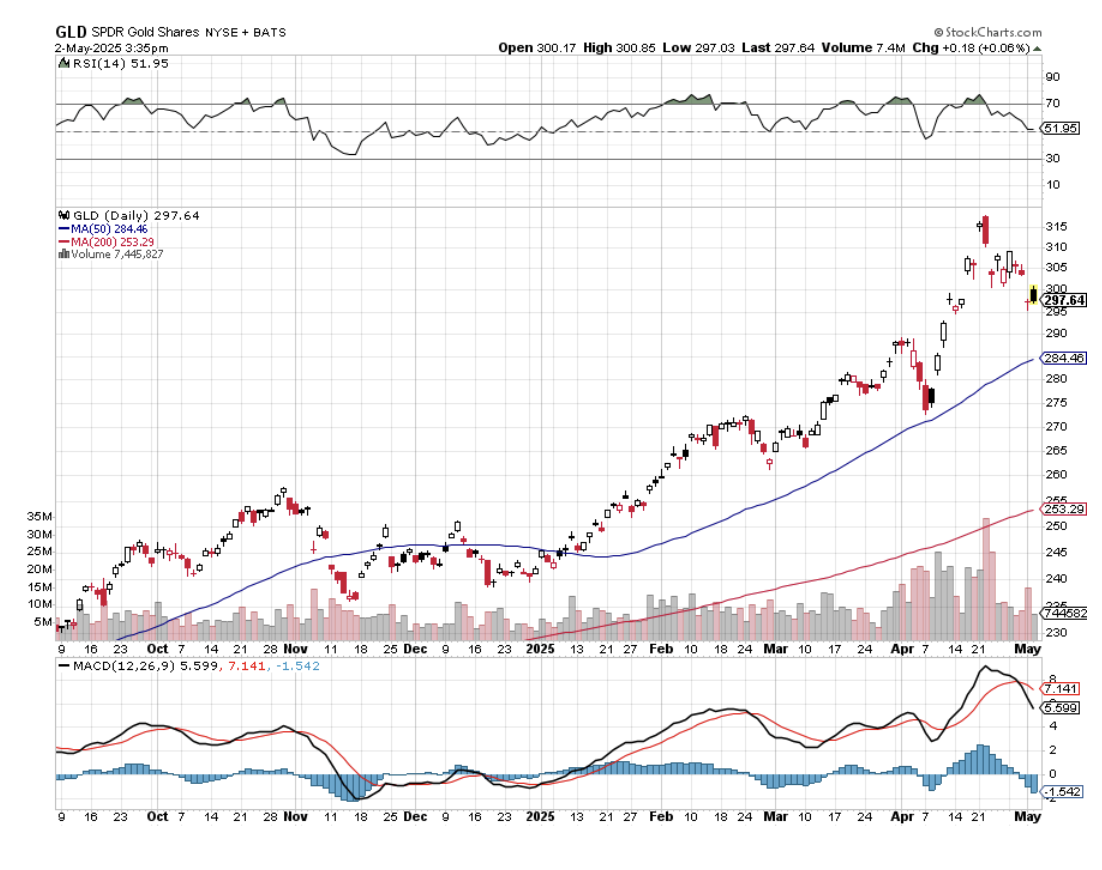

Q: Is SPDR Gold Trust (GLD) the best way to play gold, or is physical better?

A: I always go for the (GLD) because you get 24-hour settlement and free custody. With physical gold, you have to take delivery, shipping is expensive, and insurance is more expensive. Plus, then you have to put it in a vault. Private vaults have a bad habit of going bankrupt and disappearing with your gold. You keep it in the house, and then if the house burns down, all your gold is gone there. Plus, it can get stolen. There's also a very wide dealing spread between bid and offer on physical gold coins or bars; usually it's at least 10%, often more. So I often prefer the ease of trading with the GLD, which owns futures on physical gold, which is held in London, England. So that is my call on that.

Q: Is ProShares Ultra Silver (AGQ) the leveraged silver play?

A: It absolutely is, but beware: (AGQ) is only good for short, sharp rises because the contango and the storage operating costs of any 2x are very, very high—like 10% a year. So, good if you're doing a day trade, not good for a one-year hold. Then you're just better off buying silver (SLV).

Q: What is more important with the Fed's mandate—unemployment or fear of inflation?

A: That's an easy one. Historically, the number one priority at the Fed has been inflation. That is their job to maintain the full faith and credit of the U.S. Dollar, and inflation erodes the value, or at least the purchasing power of the US dollar, so that has always historically been the priority. Until we see inflation figures fall, I think the chance of them cutting interest rates is zero, and we may not see actual falls until the end of the year, because the next influence on prices is up because of the trade war. The trade war is raising prices everywhere, all at the same time. So that will at least add 1 or 2% to inflation first before it starts to fall. You can imagine how if we get a 6% inflation rate, there's no way in the world the Fed can cut rates, at least for a year, until we get a new Fed governor. So that has always historically been the priority.

Q: Do you think the 10-year yield is going down to 5%?

A: You know, we're really in a no-man's-land here. Recession fears will drive rates down as they did yesterday. I haven't even had a chance to see where the bond market is this morning because. So, rates are rising on a recessionary GDP, which is the worst possible outcome. Rates should be falling on a recessionary GDP print. Of course, Washington’s efforts to undermine the U.S. dollar aren't helping. Threatening to withhold taxes on interest payments to foreign owners is what caused the 10% down move in bonds in one week—the worst move in the bond market in 25 years. So, the mere fact that they're even thinking about doing something like that scares foreign investors, not only from the bond market, but all US investments period. And certainly, we've seen some absolutely massive stock selling from them.

Q: Why won't the market go down to 4,000 in the S&P 500?

A: Absolutely, it could; that is definitely within range. That would put us down 30% from the February highs, it just depends on how long the recession lasts. If you just get a two-quarter shallow recession, we could bounce off 4800 for the (SPX) until we come out. If the recession continues for several quarters, and it's looking like it will, then 4,000 is definitely within range. So, it's all about the economy. And remember, stocks are expensive. They don't get cheap until we get a PE multiple of 16, and even then, that alone, just a multiple shrinkage would take us down to 4,000.

Q: Would it be a good idea to buy the S&P 500 (SPY) as it falls?

A: I'm getting emails from readers asking if it's time to buy Nvidia (NVDA) or time to buy Tesla (TSLA). What I've noticed is that investors are constantly fighting the last battle. They're always looking for what worked last time, and that does not succeed as an investment strategy. As long as I'm selling rallies, I'm not even thinking about what to buy on the bottom. The world could look completely different on the other side. The MAG-7 may not be the leadership in the future, especially with the Trump administration trying to dismantle four out of seven companies through antitrust, and the rest are tied up in the trade wars. So, tech is still expensive relative to the main market, and we're going to need to look for new leaders. My picks are going to be mining shares, gold, and banking. Those are the ones I'm looking to buy on dips, but right now, cash is king unless you want to play on the short side. Being paid 4.3% to stay away sounds pretty good to me, especially when your neighbors have 30% losses. You know, I've heard of people having all of their retirement funds in just two stocks: Nvidia and Tesla, and they're getting wiped out. So, you don't want to become one of them.

Q: After a tremendous run in Gold, is Silver a better risk-reward right now?

A: I would say yes, it is. Silver has been lagging gold all year because central banks, the most consistent buyers for the past decade, buy gold—they don't buy silver. But what we may be in store for here now is a prolonged sideways move in gold while the technicals catch up with it. And in the meantime, the money goes elsewhere into silver and Bitcoin. That's my bet.

Q: Is Apple (APPL) a no-touch now?

A: I’d say yes. The trade war is changing by the day, and Apple probably does more international trade than any other company in the world. Also, Apple gets hit with recessions like everybody else. There was a big front run to buy Apple products ahead of tariffs—my company bought all its computer and telephone needs for the whole year ahead of the tariffs. We're not buying anything else this year. And I would imagine millions more are planning to do the same, so you could get some really big hits in Apple earnings going forward.

Q: Should I sell my August Proshares Short S&P 500 (SH) LEAPS?

A: No, I would keep them. If the (SPX) IS trading between 5,000 to 5,800, your $4-$42 SH LEAPS should expire at max profit in August, so I'm hanging on to mine. Next time we take a run at 5,000, you should be able to get out of your SH LEAPS at 80% to 90% of the max profit.

Q: What car company stock will do the best in a high-tariff global economy?

A: Tesla (TSLA), because 100% of their cars are made in the US with 90% US parts (the screens come from Panasonic in Japan). Their foreign components are only about 10%, so they can eat that. For General Motors (GM), it's more like 30% of all components are made abroad, and they can't eat that; their profit margins are too low. (GM) expects to lose $5 billion because of tariffs. By the way, the profit margins on Tesla have fallen dramatically from 30% down to 10% in two years, so it's not like they're in great shape either. Also, Tesla hasn’t had a CEO for ten months, which is why the board is looking for a replacement.

Q: Is it a good time to buy the dip in oil (USO)?

A: Absolutely not. Oil is the most sensitive sector to recessions, because if you can't sell oil, you have to store it, very expensively. It costs 30 to 40% a year to store oil—that's the contango; and once all the storage is full, then you have to cap wells, which then damages the long-term production of the wells. I think at some point you will expect an announcement from Washington to refill the Strategic Petroleum Reserve, which was basically sold by Biden at $100 a barrel. You can now get it back for $60. That may not be a bad idea if you're going to have a strategic petroleum reserve. What's better is just to quit using oil completely, which we were on trend to do.

Q: Will interest rates drop by year-end?

A: They may drop by year-end once unemployment runs up to 5% or 6% —which is likely to happen in a recession—and inflation starts to decline, even if it declines from a higher level. Even if they don't cut by year end, they'll still cut in a year when the president can appoint a new Fed governor. What the Trump really needs to do is appoint Janet Yellen as the Fed governor. She kept interest rates near zero for practically all of her term. We need another Yellen monetary policy.

Q: The job market here seems to be slowing quite fast. Is there any way this will rebound and stave off recession?

A: No, there is not. Companies are going to be looking to cut costs as fast as they can to offset the shrinkage in sales, but also to help cope with tariffs. So no, the job market is actually surprisingly strong now. That means future data releases are probably going to get a lot worse. In April, we saw job gains in Health care, adding 51,000 jobs. Other sectors posting gains included transportation and warehousing (29,000), financial activities (14,000), and social assistance. I highly doubt any of these sectors will show gains next month.

Q: What about nuclear energy plays?

A: I like them, partly because people are buying stocks like Cameco Corp (CCJ) as a flight to safety commodity play, like they're buying gold, silver, and copper. But also, this administration is supposed to be deregulation-friendly, and the only thing holding back nuclear (at least new modular reactors) is regulation. That and the fact that no one wants to live next door to a nuclear power plant, for some strange reason.

Q: What do I think about natural gas (UNG)?

A: Don't touch. Don't buy the dip. All energy plays look terrible right here, going into recession.

Q: What are your thoughts on manufacturing returning to the U.S? And how will that affect the stock market?

A: I think there's zero chance that any manufacturing returns to the U.S. Companies would rather just shut down than operate money-losing businesses. You know, if your labor cost goes from $5 to $75 an hour, there's no chance anyone can make money doing that, and no shareholders are going to want to touch that stock. That is the basic flaw in having a government where no one is actually running a manufacturing business anywhere in the government. They don't know how things are actually made. They're all real estate or financial people.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

April 30, 2025

Fiat Lux

Featured Trade:

(HUMANOIDS TO THE RESCUE OR NOT)

(TSLA)

Dr. Doom Nouriel Roubini needs to lay off the fear porn – I’m not taking the bait this time. Sorry Roubs!

Roubini is sounding the alarm bells on humanoid robots, but I think it is more of a case of fear-mongering than anything else.

After all, like most economists, Roubini isn’t a trader, he is an academic who sits behind the scenes and goes after those juicy sound bites that the media need to publish stories.

He wasn’t taking profits in great tech trades like when I captured profits on Netflix just the other day.

His idea goes like this…

He thinks the big breakthrough right now is the evolution of humanoid robots that essentially follow individual workers on the factory floor, on a construction site, even a chef in a restaurant, or a housekeeper. It's terrifying, but it's happening in the next literally year or two.

For this level of transformation in one year, I believe the percentage chance of this coming to fruition is less than 2%.

My understanding of the humanoids is that the software will take 10 years to figure out the nuances.

Roubini — known as Dr. Doom for his bleak economic forecasts — said human jobs will be lost to humanoids.

Instead, an LLM (large language model) learns about everything in the world, the entire internet follows your job or my job or anybody else's job in a few months, then learns everything that a construction worker, factory worker, or any other service worker can do, and then can replace them. And I think that it's going to be a revolution — it's going to affect blue-collar jobs like we've never, ever seen before.

The humanoid robot market could reach $7 trillion by 2050, Citi research recently found. Those robots — such as Tesla's (TSLA) Optimus — may be able to do everything from clean your home to fold your laundry. The robots could create job loss as routine tasks get automated.

There is a higher likelihood that this humanoid from Tesla will be used as staging to convince investors to buy more tech stocks.

Tech companies have a huge problem on their hands and there hasn’t been a lot of great brain activity to find a real solution.

Venture capitalists have been lamenting the lack of real innovation in tech products like Mark Andreesen and Peter Thiel.

The humanoid is here to get investors to buy more tech stocks in companies that aren’t innovating.

Tech companies are cutting staff to beat earnings and that isn’t a sign for top notch growth.

Investors need to separate the fluff from reality.

The reality is that big tech companies still make enormous amounts of profit, but have failed miserably in finding something new.

Apple CEO Tim Cook is still figuring out what to do next after selling iPhones to Chinese people.

The humanoid operating on AI software might give tech stocks an extra 6-month cushion before investors pull the rug.

Enjoy the bull market while it lasts. I executed a bullish trade in Dell which is part of the AI story.

AI stocks will go higher and humanoid stocks will too – not because they will make money, but because investors still buy the hype.

Global Market Comments

April 28, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or HERE’S THE BEST-CASE SCENARIO)

(SPY), (TLT), (NFLX), (COST), (NVDA), (TSLA), (MSTR)

Last week, a concierge customer asked me an excellent question. Having correctly called the top in this market to the hour, what would it take for me to go all in on the long side and get maximum bullish?

With everyone now laser-focused on downside risks, which was really a last February game, I thought I’d take the opportunity this morning to examine the upside possibilities, if there are any at all.

Let’s say that the trade war ends before the ninety-day deadline is up on July 9, and the Chinese tariffs are reduced from a trade embargo of 145% to, say, only 20%. Markets will instantly rally 10%, with possibly half of that move happening at a market opening, so you can’t participate.

That is in effect, as what happened last week, with investors willing to look through the trade war to a less onerous business environment sometime in the future. A 20% tariff still takes the US growth rate down to zero, but it at least takes a recession off the table. Problem number one: Zero-growth economies don’t command high earnings multiples.

The problem with that scenario is that we hit a wall of selling above 5,800, where the late entrants came in but are now trying to get out, at close to cost. To get above that level, we need a really powerful fundamental bull case, which is now nowhere on the horizon. That’s why it’s unlikely that the stock market will see any positive returns for 2025.

The reality is that the trade war is not the only place where the economy has been driven off the rails. Even a 20% tariff brings substantially higher prices. International trade is falling off a cliff. Massive cuts in government spending are highly deflationary. Deporting large numbers of immigrants reduces demand and shrinks the labor supply. Unless Congress can pass a budget bill soon, we are on track to see an automatic $5 trillion tax increase by yearend. The budget deficit will hit a new record for this year.

Needless to say, companies will continue to sit on their hands with this amount of uncertainty and wait for the many unknowns to play out. None of these commands higher multiples for equities, let alone the near record S&P 500 multiple at 20X that prevails now.

To really get maximum bullish like I was for most of the last 15 years, the economy would have to return to the conditions that took stocks to record highs like we had until three months ago. That would be a globalized free-trading economy with the US playing a dominant role. That’s an economy that deserves high earnings multiples.

We won’t see that for at least four more years, but markets may start to discount it in only three years as we run up to the next presidential election in 2028. Imagine a future presidential candidate who campaigns on a zero-tariff regime and a return to globalization.

To get a sustainable multi-year bull market in stocks, it would help a lot if we started from a much lower base first. New bull markets don’t start at 20X multiples. A 16X multiple is much more likely, or 20% lower than we are now. We may get that.

The government is currently trying to break up three of the Magnificent Seven with antitrust actions, which led the march to higher stock markets for years. Corporate earnings are now rapidly shrinking, but we won’t see the hard numbers until August. Until then, we only get forecasts. Lower earnings command much lower multiples. That leaves on the table my 4,500 forecast low for the (SPX).

We could well be stuck in a trading range for years. Stocks could continue to bump their heads up against a (SPX) 5,800 ceiling but also get talked up by the administration whenever it collapses towards 4,800. Some 1,000 (SPX) points is quite a wide trading range to play with and plenty enough to make money on.

I did it only last week. You have to ignore the news flow and use the volatility index ($VIX) for your market timing. When the ($VIX) hit $54 last week, I piled on longs in (NFLX), (NVDA), (MSTR), and (JPM). By Friday, I gained 8.12% in new performance, my best weekly return in the 17-year history of Mad Hedge Fund Trader.

What if you just want to take a long-term view and not have to check the ($VIX) in between every putt on the golf course?

Gold (GLD) is looking pretty darn good right now. With the collapse of the US dollar ongoing, flight to safety assets is in short supply. American economic conditions will get worse before they get better. Central bank accumulation has continued at its torrid decade-long pace. And gold seems to have broken the link with interest rates that held it back for so long, eliminating opportunity cost as an issue. Even ultra-cautious JP Morgan expects the barbarous relic to reach $4,000 an ounce this quarter.

The great mystery in the sector has been the lagging performance of the gold miners. While gold doubled, the shares of Barrack Gold (GOLD) went nowhere.

Gold miners have yet to be taken seriously by mainstream institutional investors, as they are often the subject of excessive promotion, scams, and outright fraud. Token or non-existent dividends are another impediment. Millennials have clearly gravitated towards crypto instead. Miners also got a bad rap from the ESG investment trend as they are considered a “dirty” industry. Anything US dollar-denominated is being dragged down by the weak greenback. That’s why gold only accounts for 0.54% of global portfolios today, versus 2.48% in 1998.

That may all be about to change.

Last week, Barrack Gold, which mines gold at a cost of $1,600 an ounce and sells it at the recent $3,500, completed a monster 23% move in the shares. Newmont Mining (NEM) completed an incredible 32% move. Gold attractiveness is such that only a 5% decline was enough to pull me back in on the long side last week.

High prices atone for a lot of sins.

April is now up by a spectacular +10.31%. That takes us to a year-to-date profit of +24.14% so far in 2025. My trailing one-year return stands at a spectacular +84.47%. That takes my average annualized return to +50.61% and my performance since inception to +776.03%, a new all-time high.

It has been another wild week in the market. I used the 1,200-point meltdown in the Dow Average on Monday to add longs in (NFLX), (JPM), and (MSTR). I also quickly covered a short in (MSTR). After the market rallied 2,000 points, I added shorts in (TSLA), (SPY), and a new long in (GLD). That leaves me 40% long, 30% short, and 30% cash. If everything goes our way on the May 16 options expiration day, we will be up 30% on the year.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Stock Market Suffers the Worst Start to a Year in History. April was the worst since 1932, and lower lows beckon. The Real “Trump Trade” was a “Sell America” trade, with stocks, bonds, energy, and the US dollar all collapsing.

Fed Beige Books Point to Stagflation. Prices are rising and economic activity has begun to slow across parts of the nation as businesses and households try to adapt to Trump’s erratic rollout of sweeping tariffs aimed at reshaping global trade, a report Wednesday from the Federal Reserve showed. Uncertainty around international trade policy was pervasive across reports, the U.S. central bank said.

Leading Economic Indicators Plunge, published Monday by research group The Conference Board, fell 0.7%, to 100.5, in March, following an upwardly revised 0.2% decline in February. Economists polled by The Wall Street Journal had expected a 0.5% decline for March. The recession is here, you just don’t know it yet.

Europe Lowers Interest Rates, down 0.25% to 2.25%, to head off a recession caused by Trump tariffs. The bank’s rate-setting council decided at a meeting in Frankfurt to lower its benchmark rate by a quarter percentage point to 2.25%. The bank has been steadily cutting rates after raising them sharply to combat an outbreak of inflation from 2022 to 2023.

Netflix Earnings rocket, setting the stock on fire, as an indication that the stock may be recession-proof. Netflix reported first-quarter adjusted earnings of $6.61 a share on revenue of $10.54 billion. Analysts surveyed by FactSet expected earnings of $5.67 a share on revenue of $10.5 billion. The stock climbed 3.4% in after-hours trading. As of the market close Thursday, it has risen 9.2% this year. Buy (NFLX) on dips.

IMF Cuts US GDP forecast for 2025 from 2.8% to 1.8%, and they are a deep lagging indicator. The prediction is part of a wide-ranging reduction in global growth. Tariffs are to blame.

US Dollar Hits Three-Year Low, as the flight from American trade accelerates. No trade with the US means no need to buy the greenback.

Gold Tops $3,424, the 1980 inflation-adjusted all-time high. A shortage of “Sell America” trades is driving everyone into gold all at once. The (GDX) gold miners ETF hit a 13-year high. Gold imports are now a major contributor to the US trade deficit.

JP Morgan Targets Gold at $4,000 in Q2, as the “Sell America” trade gathers steam. Central banks are the big winners here, which have been hoovering up the barbarous relic for years.

Tesla Bombs, with Q1 earnings down a gob-smacking 71%, a four-year low. Sales are in free fall globally. Tesla’s cost of making and selling vehicles dropped over 17% year over year, driven by lower raw material prices and reduced expenses of ramping up Cybertrucks production. Automotive gross margin for the period, excluding regulatory credits, was 12.5%, down from 30% a year ago, compared with expectations of 11.8%. Tesla short sellers have earned $11.5 billion so far this year, including myself, with the stock down 55%. The shares rose $10 on news that Elon Musk will spend significantly less time with DOGE. Buy only the biggest dips in (TSLA).

Record Funds are Pouring into Japan. Overseas investors have bought a net ¥9.64 trillion ($67.5 billion) of the Asian nation’s debt and equities so far in April, according to preliminary weekly figures released by the Ministry of Finance on Thursday. That level is already the most for any month on record, based on balance-of-payments data going back to 1996. What was the only thing Warren Buffett was buying last year? Japanese trading companies.

Existing Homes Sales Hit 16-Year Low. Sales of previously owned US homes fell 5.9% in March to an annualized rate of 4.02 million, the weakest March since 2009. The median sales price increased 2.7% from a year ago to $403,700, a record for the month of March and extending a run of year-over-year price gains dating back to mid-2023.

Apple to Move All iPhone Production to India. It is a move that has been underway for some time due to China’s soaring labor costs. Since I began covering China in the early 1970s, China's average annualized income has risen from $300 a year to $16,000, up 5,300%.

Alphabet (GOOG) Beats, after the company topped Wall Street estimates and showed growth in its advertising and search business. The company suggested that it’s too soon to tally the impact of Trump’s tariffs, but the ending of the de minimis loophole could create a “slight headwind” to its advertising business. The really interesting number was Alphabet’s estimate of a potential market size of 4 billion rides a year for its Waymo autonomous driving taxi service.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, April 28, at 8:30 AM EST, the Dallas Fed Manufacturing Index is announced.

On Tuesday, April 29, at 3:30 AM, the S&P Case Shiller National Home Price Index is released. We also get the JOLTS job openings report.

On Wednesday, April 30, at 8:30 PM, the Q1 GDP growth rate is published, as is the CPI for April.

On Thursday, May 1, at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, May 2, at 8:30 AM, we get the Nonfarm Payroll Report for April.

As for me, when I was shopping for a Norwegian Fjord cruise a few years ago, each stop at a port was familiar to me because a close friend had blown up bridges in every one of them during WWII.

During the 1970s at the height of the Cold War, my late wife Kyoko flew a monthly round trip from Tokyo to Moscow as a British Airways stewardess. As she was checking out of her Moscow hotel, someone rushed up to her and threw a bundled typed manuscript that hit her in the chest.

Seconds later, a half dozen KGB agents dog piled on top of Kyoko. It turned out that a dissident was trying to get her to smuggle a banned book to the West. She was arrested as a co-conspirator and bundled away to the notorious Lubyanka Prison.

I learned of this when the senior KGB agent for Japan contacted me, who had attended my wedding the year before and filmed it. He said he could get her released, but only if I turned over a top-secret CIA analysis of the Russian oil industry.

At a loss for what to do, I went to the US Embassy to meet with Ambassador Mike Mansfield, whom, as The Economist correspondent in Tokyo, I knew well. He said he couldn’t help me as Kyoko was a Japanese national, but he knew someone who could.

Then in walked William Colby, head of the CIA.

Colby was a legend in intelligence circles. After leading the French resistance with the OSS, he was parachuted into Norway with orders to disable the railway system. Hiding in the mountains during the day, he led a team of Norwegian freedom fighters who laid waste to the entire rail system from Tromso all the way down to Oslo. He thus bottled up 300,000 German troops, preventing them from retreating home to defend from an allied invasion.

During Vietnam, Colby became known for running the Phoenix assassination program. It was wildly successful.

I asked Colby what to do about the Soviet request. He replied, “Give it to them.” Taken aback, I asked how. He replied, “I’ll give you a copy.” Mansfield was my witness, so I could never be arrested for being a turncoat.

Copy in hand, I turned it over to my KGB friend, and Kyoko was released the next day and put on a flight out of the country. She never took a Moscow flight again.

I learned that the report predicted that the Russian oil industry, its largest source of foreign exchange, was on the verge of collapse. Only a massive investment in modern Western drilling technology could save it. This prompted Russia to sign deals with American oil service companies worth hundreds of millions of dollars.

Ten years later, I ran into Colby at a Washington event, and I reminded him of the incident. He confided in me, “You know that report was completely fake, don’t you?” I was stunned. The goal was to drive the Soviet Union to the bargaining table to dial down the Cold War. I was the unwitting middleman. It worked.

That was Bill, always playing the long game.

After Colby retired, he campaigned for nuclear disarmament and gun control. He died in a canoe accident on the lake in front of his Maryland home in 1996.

Nobody believed it for a second.

William Colby

Kyoko

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Technology Letter

April 23, 2025

Fiat Lux

Featured Trade:

(TESLA HITS AN AIR POCKET)

(TSLA)

Global Market Comments

April 21, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or IN SEARCH OF THE LOST MARKET BOTTOM),

(SPY), (TLT), (NFLX), (COST), (NVDA), (TSLA), (MSTR)

Back in 1977, I met Chinese Premier Deng Xiaoping for the first time at the Foreign Correspondents Club of Japan. He was a cherubic 4’10” and I was a lanky 6’4” and when we shook hands, he craned his neck and laughed. When he asked me my name, I answered “Shorty” and we laughed again.

I know for a fact that Deng had survived the 1934 Long March. That was when the forces of Chiang Kai-shek chased the communists 5,000 miles across China in an attempt to wipe them out. The communists blew up bridges to stay ahead, starved, and gave away children to peasant families because they couldn’t feed them. The communist forces shrank from 100,000 to only 8,000 before they reached the safety of distant Yunnan province.

The lesson here? The Chinese can be tough, really tough.

Like everyone else, we here at Mad Hedge Fund Trader have no idea what is going to happen in the markets moment to moment. With trade policy changing by the hour, markets are basically untradable. The goal here is preservation of capital until better days arrive, no matter how long that may take, even if it's four years.

However, I DO know what a 3,000-point move in the Dow Average looks like. For the time being, I will be selling 3,000-point rallies and buying 3,000-point dips until Mr. Market tells me otherwise.

We have seen the biggest collapse in confidence in my lifetime, on par with the two oil shocks in the 1970s, the 1987 stock market crash, 9/11, the Great Recession, and the Pandemic. It’s not a great risk-taking environment.

As hard as it may be to believe, even after the carnage of the last two months, stocks are still historically expensive. The S&P 500 multiple is back up to 20X against a long-term average of 14X. In fact, earnings multiples are rising again because corporate earnings forecasts are being slashed.

At this point, the best-case scenario is that the government negotiates China tariffs down from 145% to only 50%. That still cuts 1% off of US GDP growth, which brings an automatic 4% corporate earnings growth.

Last year, the S&P 500 earned $240 a share, and analysts are chopping the 2025 forecast like an Alaskan lumberjack on steroids. Zero earnings growth this year at the current historically high multiple of 20X gets you a (SPX) of $4,800, where are lot of downside targets are bunching up right now. We almost got there on April 9.

But just as strategists like to competitively raise targets in bull markets, they also competitively lower them in bear markets. Zero earnings growth at an 18X multiple gets you to $4,320, and 16X gets you to $3,840. At 14X, $240 a share gets you to $3,360, where a lot of worst-case scenarios are congregating now.

If I started shouting a $3,360 target from the rooftops now, readers will assume that I‘ve become a permabear on the order of a Joe Granville, who in 1982 expected the S&P 500 Average to fall to 40.

And then what happens if earnings actually go negative this year? You can ratchet all these forecasts downward. What if China chooses not to negotiate, but waits out the trade war until a new president comes along, as most American companies are doing? Then we have four years of the Great Depression. In fact, these days, worst-case scenarios are a dime a dozen. While Republicans are swearing bullets over the mid-term elections in 18 months, the Chinese are as relaxed as ever. They don’t have elections, and if you disagree, you get shot.

The bottom line here is that the Chinese can take far more pain than we can.

The trade war is not the only thing dragging stock prices down right now. When most of the world is willing to buy unlimited amounts of your debt, a $37 trillion national debt is no problem. If they aren’t, it is a big problem. Suddenly, interest rates rise as government borrowing crowds out the private sector, as does the cost of debt service. The US Treasury has to refinance $9.2 trillion in maturing debt this year, as last week’s bond market crash may only be the opening chapter in THIS crisis.

If you’re not confused enough already, the Fed’s dual mandate is now diametrically opposed to each other. Inflation is going up, pushing it to raise interest rates. But there is no doubt that the economy is slowing and unemployment is rising, encouraging a cut. Let me know how this works out. As the Fed has always been a 100% backward-looking organization, the end of the year is the earliest the Fed can cut interest rates. Serious inflation hasn’t even started yet, and the Fed doesn’t anticipate things.

Speaking to several CEO’s this week, it’s clear that companies plan to spread out tariff-driven price increases over three years. Unfortunately for the Fed, that means prices will start rising now and continue indefinitely.

A collapsing economy, soaring interest rates, a trade war, inflation about to take off, and a crisis in confidence in the US do not argue for higher stock prices or multiples to me. If the US Treasury bill market is offering to pay you 4.3% to stay away, I would take it.

A concierge client asked me what would cause me to change my mind and turn 100% bullish. A declaration that all tariffs worldwide will be taken down to zero, ending the trade war. We may actually get several of these declarations, even if no real action is taken.

Once confidence is lost, it takes a really long time to get it back. Trump may have permanently broken America’s ability to borrow abroad.

As for me, I’m not holding my breath.

April is now up by +2.19% with our entire remaining portfolio expiring at max profit with the April 17 options expiration. That takes us to a year-to-date profit of +17.35% so far in 2025. My trailing one-year return stands at a spectacular +87.32%. That takes my average annualized return to +50.44% and my performance since inception to +769.24%, a new all-time high.

It has been another wild week in the market. I had the good fortune to have five options positions expire at Max profit in (NFLX), (COST), (NVDA), (TSLA), (MSTR). I added both longs and shorts in the leveraged long Bitcoin play (MSTR), betting that it will not rise or fall more than $100 in the next 19 days. I also use the collapse in the Volatility Index ($VIX) from $54 to $30 to take profits in the Proshares Short Vix Short Term Futures ETN (SVXY). Unusual times call for unusual trades.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

Jay Powell Hints at No Rate Cuts This Year, due to the inflationary impact of the biggest tariff increases in history, sending markets crashing. Gold is through the roof. The Fed is also turning bearish on the economy.

US Inflation Expectations Hits 44-Year High. Sharply rising interest rates are now a new factor pushing prices up, with the bond market suffering its worst week in 25 years. The University of Michigan on Friday showed that Inflation Expectations had soared to 6.7% in the wake of Trump's April 2 reciprocal tariffs announcement.

Antitrust Case Proceeds Against Meta, with the FTC attempting to force the company to divest WhatsApp and Instagram. Other antitrust cases are proceeding against Alphabet (GOOGL) and Amazon (AMZN). Not only is Trump wrecking the US economy, but he is also dismantling the largest West Coast profit earners.

Nvidia Suffers a Perfect Storm, with a ban on selling its no.2 chip in China, the H20, and a national security investigation by Congress. The shares suffered an 11% selloff. Semiconductors are definitely the chief whipping boy in this trade war. These H20 chips are dumbed down solely for export to China so they can be sold anywhere else.

China Imposes Rare Earth Ban for US, essential elements for all electronic manufacturing. The US has plenty of rare earths, but 90% of the processing is done in China. You can’t make semiconductors without rare earths.

Foreign Central Banks Selling US Treasury Bonds, and buying Treasury bills. Fewer dollars are needed to recycle smaller trade surpluses. It’s also a good time to de-risk. Taken together, that signals foreign governments could be pessimistic on the long-term prospects of the U.S. while trying to increase their access to cash in the near term. In February, foreign central banks unloaded a net $19.6 billion in longer-term U.S. bonds and notes. They sold $24.1 billion in January, 2025, and $42.3 billion in December, 2025. A little over a billion was sold in November 2025.

China Cancels Boeing Order, as part of the tit-for-tat trade war that’s seen Trump levy tariffs of as high as 145% on Chinese goods. Beijing has also requested that Chinese carriers halt any purchases of aircraft-related equipment and parts from US companies, the people said, asking not to be identified discussing matters that are private.

Morgan Stanley Marks Down (SPX) Earnings, from $270 to $257 per share. Citigroup said the Goldilocks sentiment in place entering this year has given way to abject uncertainty. Expect an avalanche of coming downgrades of US stocks.

MicroStrategy Loads the Boat with Bitcoin. The company, which does business as Strategy, revealed in a Form 8-K that it had acquired 3,459 Bitcoins for roughly $285.8 million, or around $82,618 per Bitcoin, between April 7 and Monday, April 14. The latest purchase brought MicroStrategy’s total holdings to 531,664 units of the digital currency, with an aggregate purchase price of $35.92 billion. Sell (MSTR) rallies. This is not a RISK OFF” asset, which trades like a leveraged long tech stock.

Unemployment Fears Hit Five-Year High. Consumer worries grew over inflation, unemployment, and the stock market as the global trade war heated up in March, according to a New York Fed survey. The probability that the unemployment rate would be higher a year from now surged to 44%, up 4.6 percentage points, and the highest level going back to the early Covid pandemic days of April 2020. The expectation that the market will be higher a year from now slid to 33.8%, a decline of 3.2 percentage points to the lowest reading going back to June 2022.

Apple Flew $2 Billion Worth of iPhones from India to beat the trump tariffs. (AAPL) It is probably the worst-affected company by the trade wars. Front-running tariffs have been going on throughout the economy.

US Temporarily Exempts Import Duties on Smart Phones and Chips, lifting a huge burden off Apple’s shoulders. The administration finally realized that moving iPhone production from China to the US is impossible. Like coffee beans, they can’t be grown here, except in Hawaii. Looks like Tim Cook’s million-dollar donation to Trump paid off. Buy Apple on dips.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, April 21, at 8:30 AM EST, the Conference Board Leading Economic Indicators are announced.

On Tuesday, April 22, at 3:30 AM, the Crude Oil Stocks are released.

On Wednesday, April 23, at 1:00 PM, New Home Sales are published.

On Thursday, April 24, at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get Existing Home Sales.

On Friday, April 25, at 8:30 AM, we get the University of Michigan Consumer Sentiment.

As for me, not a lot of people get a chance to board a WWII battleship these days. So when I got the chance, I jumped at it.

As part of my grand tour of the South Pacific for Continental Airlines in 1981, I stopped at the US missile test site at Kwajalein Atoll in the Marshall Islands, a mere 2,000 miles west southwest of Hawaii and just north of the equator.

Of course, TOP SECRET clearance was required, which I’ve had since I was 20, and no civilians were allowed.

No problem there, as clearance from my days at the Nuclear Test Site in Nevada was still valid. Still, the FBI visited my parents in California just to be sure that I hadn’t adopted any inconvenient ideologies in the intervening years.

I met with the admiral in charge to get an update on the current strategic state of the Pacific. China was nowhere back then, so there wasn’t much to talk about in the wake of the Vietnam War.

As our meeting wound down, the admiral asked me if I had been on a German battleship. “It’s a bit before my time,” I replied. “How would you like to board the Prinz Eugen he responded.

The Prinz Eugen was a heavy cruiser, otherwise known as a pocket battleship built by Nazi Germany. It launched in 1938 at 16,000 tons and with eight 8-inch guns. Its sister ship was the Admiral Graf Spee, which was scuttled in the famous Battle of the River Plate in South America in 1939.

Early in the war, it helped sink the British battleship HMS Hood and damaged the HMS Prince of Wales. The Prinz Eugen spent much of the war holed up in a Norwegian fjord and later provided artillery support for the retreating German Army on the eastern front. At the end of the war, the ship was handed over to the US Navy as a war prize.

The US postwar atomic testing was just beginning, so the Prinz Eugen was towed through the Panama Canal to be used as a target. Some 200 ships were assembled, including those from Germany, Japan, Britain, and even some American ships deemed no longer seaworthy, like the USS Saratoga. One of the first hydrogen bombs was dropped in the middle of the fleet.

The Prinz Eugen was the only ship to remain afloat. In the Navy film of the explosion, you can see the Prinz Eugen jump 200 feet into the air and come down upright. The ship was then towed back to Kwajalein Atoll and put at anchor. A typhoon came later in 1946, capsizing and sinking it.

It was a bright and sunny day when I pulled up to the Prinz Eugen in a small boat with some Navy divers. There was no way the Navy was going to let me visit the ship alone.

The ship was upside-down, with the stern beached, the bow in 300 feet of pristine turquoise water. The propellers had recently been sent off to a war memorial in Germany. The ship’s eight cannons lay scattered on the bottom, falling out of their turrets when the ship tipped over.

The small part of the Prinz Eugen above water had already started to rust through. But once underwater, it was like entering a live aquarium.

A lot of coral, seaweed, starfish, and sea urchins can accumulate in 36 years, and every inch of the ship was covered. Brightly tropical fish swam in schools. A six-foot mako shark with a hungry look warily swam by.

My diver friends knew the ship well and showed me the highlights to a depth of 50 feet. The controls in the engine room were labeled in German Fraktur, the preferred prewar script. Broken dishes displayed the Nazi swastika. Anti-aircraft guns frozen in time pointed towards the bottom. No one had been allowed to remove anything from the ship since the war, and in the Navy, most men follow orders.

It was amazing what was still intact on a ship that had been blown up by a hydrogen bomb. You can’t beat “Made in Germany.” Our time on the ship was limited as the hull was still radioactive, and in any case, I was running low on oxygen.

A few years later, the Navy banned all diving on the Prinz Eugen. Three divers had gotten lost in the dark, tangled in cables, and drowned. I was one of the last to visit the historic ship.

I checked with my friends in the Navy, and the Prinz Eugen is still there, but in deteriorating condition. When the ship started leaking oil in 2018 and staining the immaculate beaches nearby, the Navy launched a major effort to drain what was left from the 80-year-old tanks. No doubt a future typhoon will claim what is left.

So if someone asks if you know anybody who’s been on a German battleship, you can say, “Yes,” you know me. And yes, my German is still pretty good these days.

Vielen dank!

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Prinz Eugen in 1940

On Pelelui Island

Global Market Comments

April 8, 2025

Fiat Lux

Featured Trade:

(A REFRESHER COURSE AT SHORT SELLING SCHOOL),

(SH), (SDS), (PSQ), (DOG), (RWM), (SPXU), (AAPL), (TSLA),

(VIX), (VXX), (IPO), (MTUM), (SPHB), (HDGE)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.