Below please find subscribers’ Q&A for the March 17 Mad Hedge Fund Trader Global Strategy Webinar broadcast from frozen Incline Village, NV.

Q: I’ve heard that the COVID-19 cases are being understated by 16 million. Do you think this is true?

A: Yeah, I've always argued that the previous government's numbers were vastly underestimating the true number of cases out there for political purposes, but we are on the downslide regardless, so that’s good.

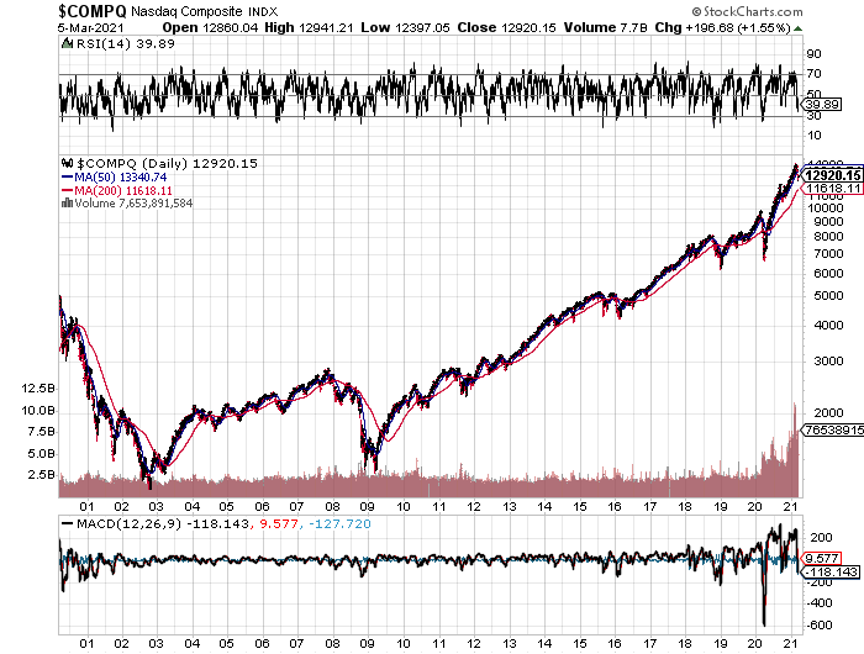

Q: When are tech stocks going to bottom out and when can I buy them?

A: I knew I would get this question. This is the question of the day. Picking bottoms is always tough because these are momentum plays and not valuation plays. I’ll give you a couple of levels though. The tech (QQQ) multiple is now at 25X earnings and the S&P 500 (SPY) is at 22X, so your first bottom will be down about 10% from here, or a 22X multiple. And I don’t think we will get much lower than that because tech stocks are growing at 20-25% a year, versus the (SPY) growing at maybe 10%, and I don’t think tech goes to much of a discount in that situation. So, you’re just waiting for interest rates to top out and start to go down, which will be the other indicator of a tech bottom. We had a slowdown in the rise of rates for just a couple of days this week, and tech stocks took off like a rocket. Those are your two big signals.

Q: With the Fed announcement, are you still in the Invesco QQQ Trust NASDAQ ETF (QQQ) bear put spread?

A: Yes, one of them expires in two days so that’s a piece of cake. The other one expires in a month, but it is way out-of-the-money—the April $240-$245 bear put spread, so I’ll keep that for a real meltdown day. But if it looks like we’re getting a breakout, I will come out of that short position so fast it will make your head spin.

Q: Do you like Palantir (PLTR)?

A: Absolutely yes—screaming LEAP candidate. It traded all the way down to $20 two weeks ago and is trading around $25 now. It’s a huge data firm, lots of CIA and defense work, huge government contracts extending out for years, cutting edge technology, and run by a nut job, so yes screaming buy at this level.

Q: Freeport McMoRan (FCX) is taking some pain here, is this still a buy and hold?

A: Yes, it’s taking the pain along with all the other domestic stocks, which is natural. In their case though, it’s up almost 10x from its bottom a year ago where we recommended it, so yeah I'd say time for a rest. So I’m still a buyer of the metals and (FCX) on dips, but like all other metals, it did get overextended. EV manufacturing is doubling this year, which uses a ton of copper. The same is true with solar panels and Chinese industrial recovery. When all your major markets are doubling in size, it’s usually good for the stock. I peaked at $50 in the last cycle and could touch $100 in this one.

Q: What are your thoughts about the Lucid EV SPAC, Churchill Capital IV (CCIV)?

A: Don’t touch it with a ten-foot pole. They only have 1 or 2 concept vehicles for high-end investors to test drive. The rumor is that their main factory will be in Saudi Arabia where the bulk of the seed capital came from. They’ll never catch up with Tesla (TSLA) on the technology. There's always going to be a few niche $250,000 cars out there, and they have no proof they can actually make these things. When they get to a million vehicles a year, then I might be interested. But they haven't done the hard part yet, which is mass-producing battery packs for a million cars. They've only done the easy part which is designing one sexy prototype to raise money. So, stay away from Lucid, I don’t think they’re going to make it.

Q: What about oil?

A: I am avoiding oil plays like the plague.

Q: When do you anticipate your luncheons to be back?

A: Maybe in 2023. I don’t want to scare off my customers by inviting them to a lunch where they all get COVID-19. If I did have a lunch, I’d have a vaccine requirement and a temperature gun to hit them at the door like everywhere else. I really miss meeting subscribers in person.

Q: Should I buy banks like JP Morgan (JPM) at this level?

A: I would say no. That ship has sailed. Wait for a steeper selloff or just let it run. We’ve already had an enormous move and you don’t want to chase it with a low discipline trade, which is what that would be.

Q: What do you think of silver (SLV)?

A: It’s a buy long term, short term it’s in the grim spiral of death along with the other precious metals, which absolutely hate rising interest rates. A silver long here is the equivalent of a bond (TLT) long. When you do go into silver, buy Wheaton Precious Metals (WPM) for the leveraged long play.

Q: Is 3M (MMM) going to extend the upside?

A: Probably yes, that's a classic American industrial play and a great company. I have friends who work there. How could we live without Post-it notes, Scotch Tape, and Covid-19 N-95 masks?

Q: What about Square (SQ)?

A: I love it in the long term, buy on the dips and buy it through LEAPS (long term equity anticipation securities).

Q: Should I unwind my leveraged financial ETF?

A: I’d say take a piece off, yeah; you never get fired for taking a profit. And they have had a tremendous move. Plus of course, the flip side of taking profits on domestic recovery stocks is to buy tech with that money. And eventually, that's what the entire market will do, it just may still be a little bit early.

Q: What’s a good target for LEAPS for CRISPR (CRSP) and Palantir (PLTR)?

A: Put your first strike 30% higher than today’s stock price and go 2 years out in maturity. I noticed on some names, the June 2023’s are starting to trade, but they’re highly illiquid. But if you put a bid in there and you get a market meltdown, you will get hit.

Q: If the long-term future for oil (USO) is so bad, why is it $65?

A: A few reasons. #1, huge short covering action. #2, economy recovery faster than people expected because of the stimulus. #3, a lot of people, mostly in Texas, Oklahoma, and Louisiana, don’t believe that there will be an all-electric grid in 20 years and think that oil will be in demand forever, including the entire oil industry, so they’re in there buying. And #4, the Saudis have held back with production increases to push the price up, so they’re letting it run so they can sell at a higher price. When they do sell, oil crashes again.

Q: Can we re-watch this presentation?

A: Yes, we post it about 2 hours later on the website so all our people in about 135 countries can access it whenever they like. Just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Q: How often do you have these webinars?

A: Every two weeks, and if you need help accessing it on your account page, email customer support at support@madhedgefundtrader.com.

Q: Is it time to initiate short positions on oil companies?

A: Not yet but keep it in the back of your mind. When some of the super-hot economic data come out after Q2, that may be your short in oil—then we may get into the $70’s a barrel. But not yet, there’s still too much upward momentum.

Q: Do you think we will see the 30-year fix below a 3.00% yield again?

A: Yes, in the next recession, which may be 5 or 10 years off because we’re starting at such a low base.

Q: Regarding copper, EV motors require a ton of copper. Doesn’t that make the metals a BUY?

A: That is true, and why we recommended Freeport McMoRan at $4 a year ago and recommended buying every dip. Each one of these rotor motors on each wheel of a Tesla weighs about 100 lbs—I’ve lifted them. Remember I tore apart a Tesla once just to see what made it tick, and they’re really heavy, and they use a lot of copper, and silver as well. So that has always been the bull market case for copper, as well as the fact that China re-emerged as a major buyer for their industrial buildout. That’s why we had a long in the SPDR S&P Metals and Mining ETF (XME).

Q: Do you foresee a good opportunity to go heavy into margin again?

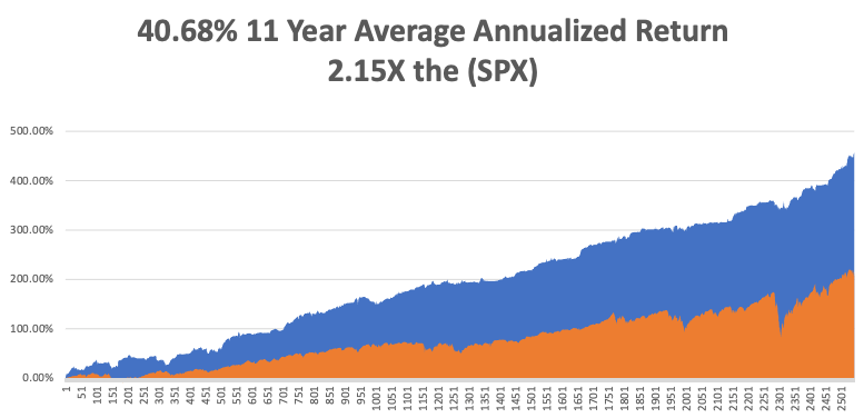

A: Maybe if we get a decent selloff this summer, but you’ll never get the opportunity we had a year ago when you really wanted to put 100% of your portfolio into 2-year LEAPS. The people who did that made many tens of millions of dollars, which is why I get a free bottle of Bourbon every month. That was a once in 20 years event.

Q: What is your 2021 target for the S&P 500 (SPX)?

A: $4,860. It’s in my strategy letter which I sent out on January 6th, and that is all still posted on the website, click here for it.

Q: How do I renew my subscription with your company, and how do I figure out what I bought?

A: Email customer support at support@madhedgefundtrader.com and they will answer you immediately.

Q: Do you follow the iShares IBoxx High Yield Corporate Bond ETF (HYG)?

A: Yes, that is the high yield junk bond fund, but I have been avoiding long bond plays, as you may have noticed with my screaming short of the past year. We list (HYG) in these slides in the Bonds section.

To watch a replay of this webinar, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or TECHNOLOGY LETTER (as the case may be), then WEBINARS, and all the webinars from the last ten years are there in all their glory.

Good Luck and Stay Healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader