The balkanization of the internet is exploding in the short-term, knocking off the aggregated value of U.S. Fortune 500 companies in one fell swoop.

In technology terms, this is frequently referred to as “splinternet.”

A quick explanation for the novices can be summed up by saying the splinternet is the fragmenting of the Internet, causing it to divide due to powerful forces such as technology, commerce, politics, nationalism, religion, and interests.

What investors are seeing now is a hard fork of the global tech game into a multi-pronged world of conflicting tech assets sparring for their own digital territory.

The epicenter of balkanization is the division between China and the U.S. tech economy with India as the wild card.

This is fast becoming a winner-take-all affair.

Silicon Valley is winning in India due to border conflicts along the Himalayan Corridor.

India took count of 20 dead Indian soldiers felled by the Chinese Army stoking a wave of national outcry against regional rival China.

The backlash was swift with the Indian government banning 59 premium apps developed by China citing “national security and defense.”

The ban included the short-form video platform TikTok, which counts India as its biggest overseas market.

TikTok was projected to easily breeze past 500 million Indian users by the end of 2021 and was clearly hardest hit out of all the apps.

India is the second biggest base of global internet users with nearly half of its 1.3 billion population online.

The government rolled out the typical national security playbook saying that the stockpiling of local Indian data in Chinese servers undermines national security.

China’s inroads in the Indian tech market are set to wane with recent rulings already impacting roughly one in three smartphone users in India. TikTok, Club Factory, and UC Browser among other apps in aggregate tally more than 500 million monthly active users in May 2020.

Highlighting the magnitude of this purge - 27 of these 59 apps were among the top 1,000 Android apps in India.

China dove headfirst into the Indian market with their smartphones, apps, and an array of hardware equipment. Now, that is all on hold and looks like a terrible mistake.

Chinese smartphone makers command more than 80% of the smartphone market in India, which is the world’s second largest.

One of the reasons Apple (AAPL) could never make any headway in China is because they were constantly undercut by predatory Chinese phone makers with stolen technology.

It’s also not smooth saying for domestic Chinese tech as Chinese Chairman Xi reign in the private sector with Alibaba’s founder Jack Ma’s whereabouts unknown as we start the new year.

This is happening on the heels of the Chinese Communist Party thwarting the Alipay IPO in Shenzhen which was posed to become the biggest IPO ever.

TikTok is also being eyed-up for bans in Europe and the United States recently as it constantly curries to Beijing’s every whim by banning content unfavorable to the Chinese communist party and rerouting data back to servers in China.

Chinese tech is clearly the main loser for their government’s “distract its own people at all costs” campaign to shield themselves from the epic contagion of the lingering pandemic.

What does this mean for American tech?

For one, India is strengthening ties with the U.S., being the biggest democracy in Asia, and will be a massive foreign policy loss and loss of face for the Chinese communist regime.

The resulting losses for Chinese tech will usher in a new generation of local Indian tech with Silicon Valley mopping up the leftovers.

Even though the U.S. avoided the carnage from this round of balkanization, the situation in Europe is tenuous, to say the least.

Fault lines will compound the problem of a multinational tech revenue machine and the relationship with France is on the verge of becoming fractious.

The relationship is worsening with the Europeans by a trade deal consummated between the EU and China along with Western European powers such as France, Germany, and Britain looking to add to their tax coffers by taxing big tech companies like Facebook (FB), Twitter (TWTR), Google (GOOGL) in 2021.

This would be a massive blow to not only revenue streams but also global prestige for American tech.

Not only do Silicon Valley leaders see a murky future outside its borders, but digital territories are also getting carved out as we speak domestically.

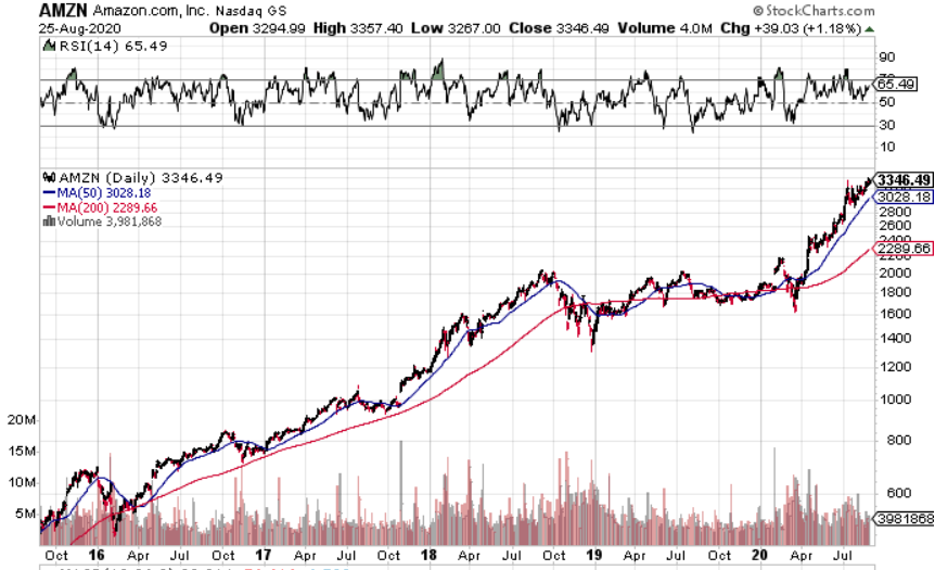

Amazon (AMZN)-owned Twitch and Twitter have clamped down on U.S. President Donald Trump’s account.

This could quickly spiral into a left-versus-right war in which there are competing apps for different political beliefs and for every subgenre of apps.

This would effectively mean a balkanization of tech assets within U.S. borders and division in 2021 is set to extend itself.

Silicon Valley wants products sold to the largest addressable market possible and that simply won’t happen in 2021.

The balkanization of the internet is now turning into an equally high risk as the antitrust and regulatory issues.

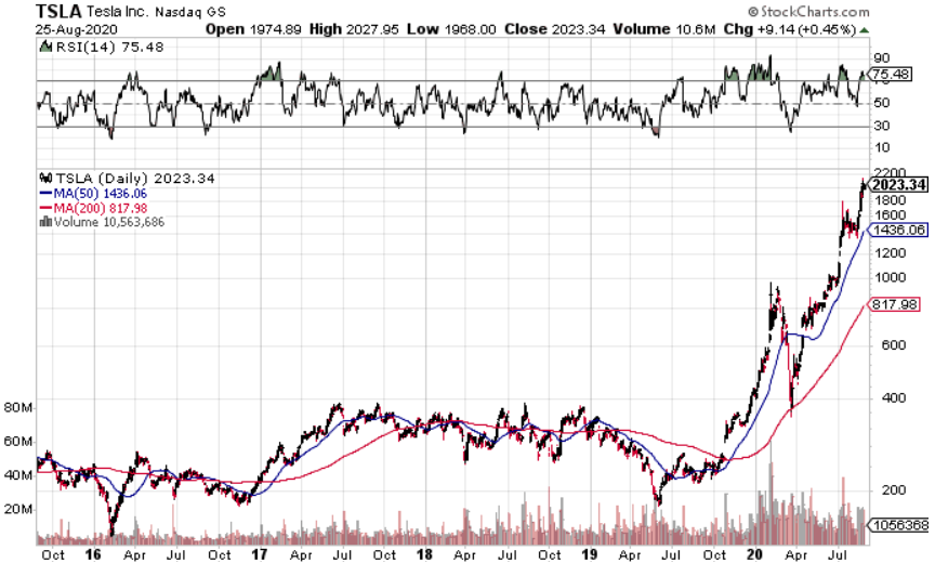

The issues keep piling up, but nothing has been able to topple big tech yet as they lead the broader market out of the pandemic.

Silicon Valley is still subsidized by ultra-low interest rates and quantitative easing by the Fed. If this changes, look for tech to roll over.

Let’s hope that never happens.