Be nice to investors on the way up, because you always meet them again on the way down. This is the harsh reality of those who have placed their money in the fracking space this year.

The hottest sector in the market for the first half of the year, investors have recently fallen on hard times, with the price of oil collapsing from a $107 high in June to under $77 this morning, a haircut of some 28% in just five months.

Prices just seem to be immune to all the good news that is thrown at them, be it ISIL, the Ukraine, or Syria.

It wasn?t supposed to be like that. Using this revolutionary new technology, drillers are in the process of ramping up US domestic oil production from 6 million to 10 million barrels a day.

The implications for the American economy have been extraordinarily positive. It has created a hiring boom in the oil patch states, which has substantially reduced blue-collar unemployment. It has added several points to US GDP growth.

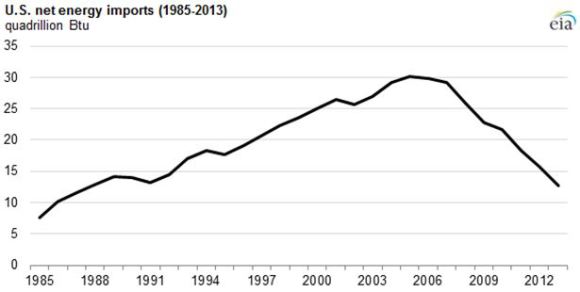

It has also reduced our dependence on energy imports, from a peak of 30 quadrillion Btu?s in 2005 to only 13 quadrillion Btu?s at the end of last year. We are probably shipping in under 10 quadrillion Btu?s right now, a plunge of 66% from the top in only 9 years.

The foreign exchange markets have taken note. Falling imports means sending hundreds of billions of dollars less to hostile sellers abroad. Am I the only one who has noticed that we are funding both sides of all the Middle Eastern conflicts? The upshot has been the igniting of a huge bull market in the US dollar that will continue for decades.

That has justified the withdrawal of US military forces in this volatile part of the world, creating enormous savings in defense spending, rapidly bringing the US Federal budget into balance.

The oil boom has also provided ample fodder for the stock market, with the major indexes tripling off the 2009 bottom. Energy plays, especially those revolving around fracking infrastructure, took the lead.

Readers lapped up my recommendations in the area. Cheniere Energy (LNG) soared from $6 to $85. Linn Energy (LINE) ratcheted up from $7 to $36. Occidental Petroleum moved by leaps and bounds, from $35 to $110.

Is the party now over? Are we to dump our energy holdings in the wake of the recent calamitous falls in prices?

I think not.

One of the purposes of this letter is to assist readers in separating out the wheat from the chaff on the information front, both the kind that bombards us from the media, and the more mundane variety emailed to us by brokers.

When I see the quality of this data, I want to throw up my hands and cry. Pundits speculate that the troubles stem from Saudi Arabia?s desire to put Russia, Iran, the US fracking industry, and all alternative energy projects out of business by pummeling prices.

The only problem is that these experts have never been to Saudi Arabia, Iran, the Barnett Shale, and wouldn?t know which end of a solar panel to face towards the sun. Best case, they are guessing, worst case, they are making it up to fill up airtime. And you want to invest your life savings based on what they are telling you?

I call this bullpuckey.

I have traveled in the Middle East for 46 years. I covered the neighborhood wars for The Economist magazine during the 1970?s.

When representing Morgan Stanley in the firm?s dealings with the Saudi royal family in the 1980?s, I paused to stick my finger in the crack in the Riyadh city gate left by a spear thrown by King Abdul Aziz al Saud when he captured the city in the 1920?s, creating modern Saudi Arabia.

They only mistake I made in my Texas fracking investments is that I sold out too soon in 2005, when natural gas traded at $5 and missed the spike to $17.

So let me tell you about the price of oil.

There are a few tried and true rules about this industry. It is far bigger than you realize. It has taken 150 years to build. Nothing ever happens in a hurry. Any changes here take decades and billions of dollars to implement.

Nobody has ever controlled the market, just chipped away at the margins. Oh, and occasionally the stuff blows up and kills you.

As one time Vladimir Lenin advisor and Occidental Petroleum founder, the late Dr. Armand Hammer, once told me, ?Follow the oil. Everything springs from there.?

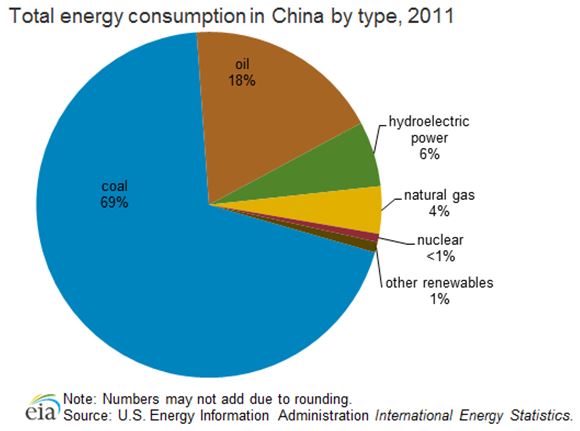

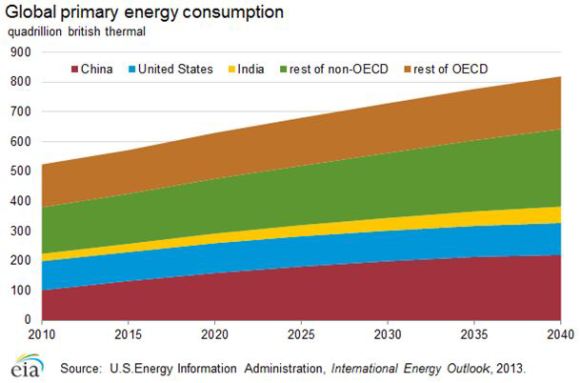

China is the big factor that most people are missing. Media coverage has been unremittingly negative. But their energy imports have never stopped rising, whether the economy is up, down, or going nowhere, which in any case are rigged, guessed, or manufactured. The major cities still suffer brownouts in the summer, and the government has ordered offices to limit air conditioning to a sweltering 82 degrees.

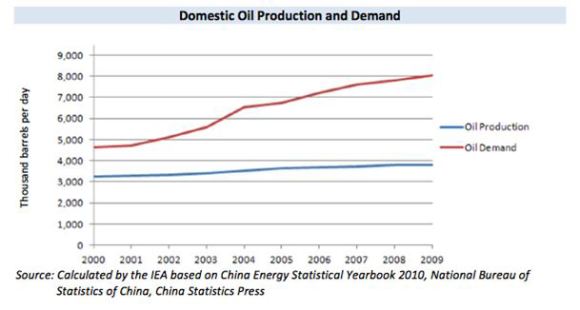

Chinese oil demand doubled to 8 million barrels a day from 2000-2010, and will double again in the current decade. This assumes that Chinese standards of living reach only a fraction of our own. Lack of critical infrastructure and storage prevents it from rising faster.

Any fall in American purchases of Middle Eastern oil are immediately offset by new sales to Asia. Some 80% of Persian Gulf oil now goes to Asia, and soon it will be 100%. This is why the Middle Kingdom has suddenly started investing in aircraft carriers.

So, we are not entering a prolonged, never ending collapse in oil prices. Run that theory past senior management at Exxon Mobil (XOM) and Occidental (OXY), as I have done, and you?ll summon a great guffaw.

It will reorganize, restructure, and move into new technologies and markets, as they have already done with fracking. My theory is that they will buy the entire alternative energy industry the second it become sustainably profitable. It certainly has the cash and the management and engineering expertise to do so.

What we are really seeing is the growing up of the fracking industry, from rambunctious teenage years to a more mature young adulthood. This is its first real recession.

For years I have heard complaints of rocketing costs and endless shortages of key supplies and equipment. This setback will shake out over-leveraged marginal players and allow costs to settle back to earth.

Roustabouts who recently made a stratospheric $200,000 a year will go back to earning $70,000. This will all be great for industry profitability.

What all of this means is that we are entering a generational opportunity to get into energy investments of every description. After all, it is the only sector in the market that is now cheap which, unlike coal, has a reasonable opportunity to recover.

Oil will probably hit a low sometime next year. Where is anybody?s guess, so don?t bother asking me. It is unknowable.

When it does, I?ll be shooting out the Trade Alerts as fast as I can write them.

Where to focus? I?ll unfurl the roll call of the usual suspects. They include Occidental Petroleum (OXY), Exxon Mobil (XOM), Devon Energy (DVN), Anadarko Petroleum (APC) Cabot Oil & Gas (COG), and the ProShares 2X Ultra Oil & Gas ETF (DIG).

Fracking investments should be especially immune to the downturn, because their primary product is natural gas, which has not fallen anywhere as much as Texas tea. Oil was always just a byproduct and a bonus.

CH4 was the main show, which has rocketed by an eye popping 29% to $4.57 in the past two weeks, thanks to the return of the polar vortex this winter. We are now close to the highs for the year in natural gas.

The cost of production of domestic US oil runs everywhere from $28 a barrel for older legacy fields, to $100 for recent deep offshore. Many recent developments were brought on-stream around the $70-$80 area. So $76 a barrel is not the end of the world.

On the other hand, natural gas uniformly cost just under $2/Btu, and that number is falling. Producers are currently getting more than double that in the market.

And while on the subject of this simple molecule, don?t let ground water pollution ever both you. It does happen, but it?s an easy fix.

Of the 50 cases of pollution investigated by MIT, most were found to be the result of subcontractor incompetence, natural causes, or pollution that occurred 50 or more years ago. Properly regulated, it shouldn?t be happening at all.

When I fracked in the Barnett Shale 15 years ago, we used greywater, or runoff from irrigation, to accelerate our underground expositions. The industry has since gotten fancy, bringing in highly toxic chemicals like Guar Gum, Petroleum Distillates, Triethanolamine Zirconate, and Potassium Metaborate.

However, the marginal production gains of using these new additives are not worth the environmental risk. Scale back on the most toxic chemicals and go back to groundwater, and the environmental, as well as the political opposition melts away.

By the way, can any readers tell me if my favorite restaurant in Kuwait, the ship Al Boom, is still in business? The lamb kabob there was to die for.