All good things must come to an end.

Mad Hedge has made fortunes for thousands of followers over the last 15 years with its aggressive options spread strategy, which profits mightily from falling market volatility ($VIX). That is what is happening in the market 95% of the time.

However, it doesn’t make sense when the ($VIX) drops below $20, and that may now continue to be the case for a prolonged period of time.

However, just as one window closes, another opens.

While low volatility makes options spreads no longer attractive, it makes two-year LEAPS the bargain of the century. With volatility this low, you essentially get the second year for free. That is more than adequate time to go into any recession that may or may not happen and then come back out the other side at max profit.

If the underlying stock suddenly rockets, which is often the case with my recommendations, you can collect 90% of the maximum potential profit in a two-year LEAPS within months, if not weeks.

Better yet, while we used to make 15%-20% on front month options spreads, which benefited from accelerated time decay, the profit on two-year LEAPS can run from 100% to 500%. One client bagged a 5,000%, or 50X profit on an NVIDIA (NVDA) LEAPS he strapped on last October.

He doesn’t work anymore.

The timing for this strategy adjustment is perfect. We have just entered a new bull market for stocks that could run for another decade. With the exception of the “Magnificent Seven,” most US stocks are now just above their bear market bottoms. What better time to increase your leverage tenfold.

I won’t be adding LEAPS to my daily position sheet or P&L. They will remain a front-month trading tool. So the millions you are about to make will just have to remain our little secret. Concierge members will get access to a dedicated website that will keep a running total of all Mad Hedge LEAPS issued.

All good strategies must come to an end. Market conditions change or the copycats and wannabees squeeze the life out of them. I have seen too many good traders go out of business clinging to strategies that worked yesterday, but not today. They were hauled away in straight jackets, kicking and screaming because they lost all their money.

The stock market is like working in a hurricane. If you don’t learn how to bend with the wind, you snap and end up in a pile of debris.

When the ($VIX) gets back above $20, or better yet $30, and the Mad Hedge Market Timing Index plunges down to the $20’s, I’ll be back fully loaded with front month options spreads by the dozens.

Good luck.

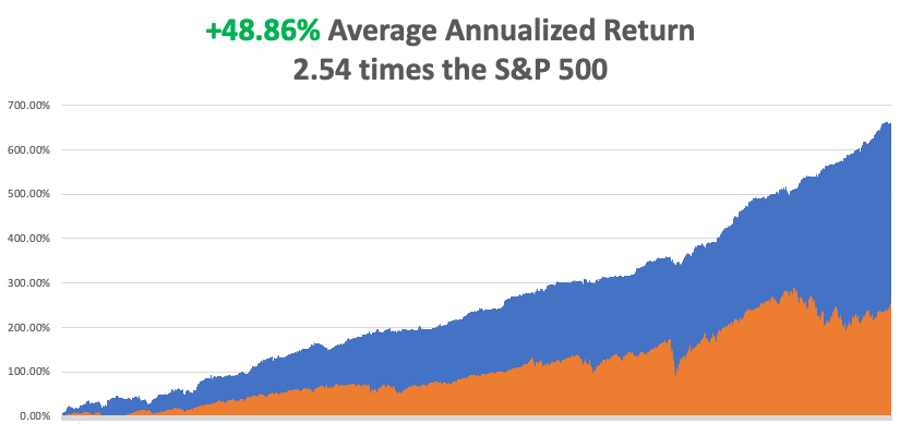

So far in June, we are up +0.47%. My 2023 year-to-date performance is still at an eye-popping +62.52%. The S&P 500 (SPY) is up only a miniscule +12.63% so far in 2023. My trailing one-year return reached +101.75% versus +24.19% for the S&P 500.

That brings my 15-year total return to +659.71%. My average annualized return has blasted up to +48.86%, another new high, some 2.54 times the S&P 500 over the same period.

Some 42 of my 46 trades this year have been profitable. Only 23 of my last 24 consecutive trade alerts have been profitable.

I executed no trades last week. Concierge members received a LEAPS trade alert on Crown Castle International (CCI), which regular subscribers should receive shortly. My longs in Tesla (TSLA) and Freeport McMoRan (FCX) expired at max profit, which I easily ran into the June 16 option expiration this week. I now have a very rare 100% cash position due to the lack of high-return, low-risk short-term trades.

A Mad Hedge Market Timing Index at 82 is not exactly encouraging me to bet the ranch. Don’t rush to buy the top.

On another matter, I am proud to say that every Mad Hedge service saw positions expire at their maximum profit at the June 16 quadruple witching options expiration.

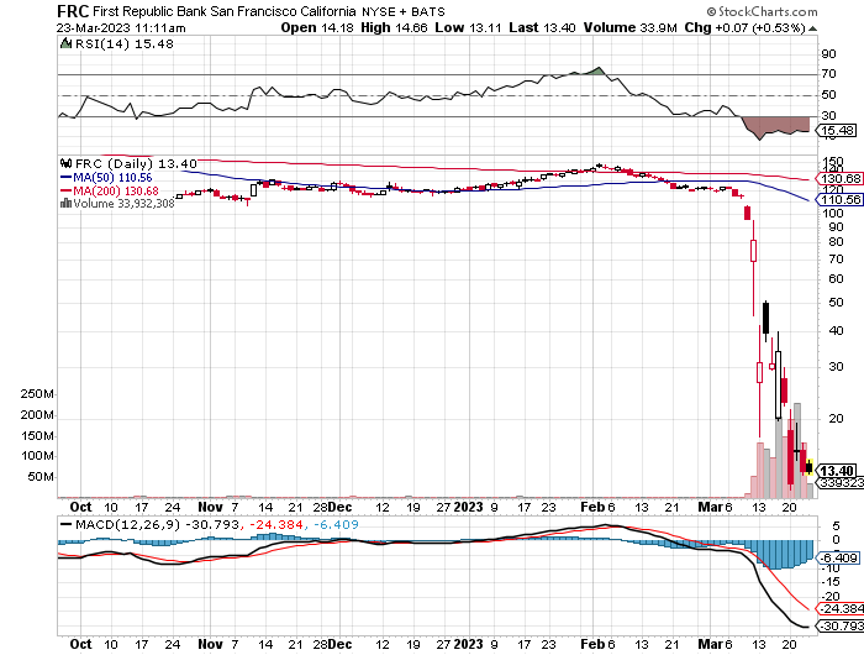

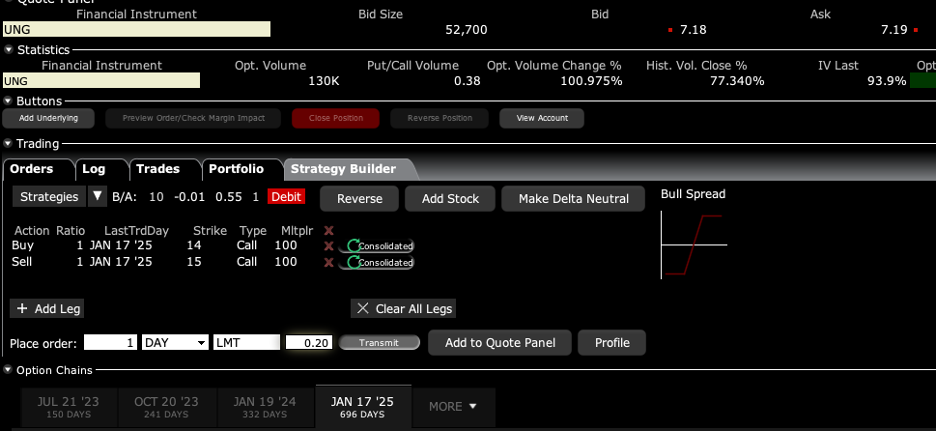

Global Trading Dispatch rang the cash register with Tesla (TSLA) and Freeport McMoRan (FCX). The Mad Hedge Technology Letter coined it with Apple (AAPL). The Mad Hedge Biotech & Health Care Letter printed money with Amgen (AMGN). Jacquie’s Post pleased followers with a profit in the (TLT). Finally, Mad Hedge AI, launched only on Monday, saw the shares for its initial trade alert for (UNG) jump a breathtaking 15% in four days.

I must be doing something right.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

Tesla Model Y Became World’s Top Selling Car in Q1, the first EV to do so. Some 267,200 Y’s were shifted, edging out Toyota’s Corolla by 10,800 units, which led the field for decades. Elon Musk’s price-cutting volume play is working to the competition’s chagrin. The Model Y is on track to top one million sales this year. Buy (TSLA) on dips

Tesla Drops Model 3 Price to $33,000, net of $7,500 federal EV tax credit. That helped it become the world’s top-selling car. Late to the market EV makers are getting killed, hemorrhaging cash. That took the shares up to a new 2023 high of $231. Keep buying (TSLA) on dips.

Apple Launches $3,497 Vision Pro Headset, in a run at Meta (META) in the virtual headset world. It’s the company’s first new product launch since the Apple Watch in 2014 coining yet another new revenue stream. Apple shares hit a new all-time high on the news. Buy (AAPL) on dips.

Weekly Jobless Claims Jump to 261,000, an increase of 28,000, as the deflationary effects of high-interest rates take hold.

Europe Enters a Recession, with a -0.1% GDP print in Q1. Sharp rises in Euro interest rates get the blame.

General Motors Adopts Tesla’s Charging System, essentially giving a near monopoly to Elon Musk. (GM) is joining Ford’s (F) capitulation from two weeks ago. This should grow into a $20 billion a year profit item for Tesla. All of my outrageous forecasts are coming true. Buy (TSLA) on dips.

US to Send Another $2 Billion Worth of Advanced Missiles to Ukraine. The package includes advanced Raytheon (RTX) Himars and Lockheed (LMT) Patriot 3 missiles. Buy both (RTX) and (LMT) on dips as both missiles now have order backlogs extending for years.

Coinbase Gets Crushed after the SEC throws the book at them. The government agency is intent on destroying the entire crypto infrastructure. Get your money out if you can. Avoid (COIN) on pain of death.

Volatility Index ($VIX) Hits 3 ½ Year Low, at $14.26. Complacency with the S&P 500 is running rampant, which always ends in tears. The level implies a maximum up-and-down range of only 8.2% for 30 days.

Airline Profits to Double in 2023, as service sharply deteriorates with revenge travel accelerating. Looks for this summer to be a perfect travel storm.

On Monday, June 19 is the first-ever Juneteenth National Holiday celebrating the freedom of the slaves in Texas, the last state to do so. Markets are closed.

On Tuesday, June 20 at 8:30 PM EST, US Building Permits for May are announced.

On Wednesday, June 21 at 10:00 AM, Fed Chairman Powell testifies in front of Congress.

On Thursday, June 22 at 8:30 AM, the Weekly Jobless Claims are announced.

On Friday, June 23 at 9:45 AM the S&P Global Flash PMI is printed.

At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, with the shocking re-emergence of Nazis on America's political scene, memories are flooding back to me of some of the most amazing experiences in my life. I thought we were done with these guys I have been warning my long-term readers for years now that this story was coming. The right time is now here to write it.

I know the Nazis well.

During the civil rights movement of the 1960s, I frequently hitchhiked through the Deep South to learn what was actually happening.

It was not usual for me to catch a nighttime ride with a neo-Nazi on his way to a cross burning at a nearby Ku Klux Klan meeting, always with an uneducated blue-collar worker who needed a haircut.

In fact, being a card-carrying white kid, I was often invited to come along.

I had a stock answer: "No thanks, I'm going to another Klan meeting further down the road."

That opened my driver up to expound at length on his movement's bizarre philosophy.

What I heard was chilling. Suffice it to say, I learned to talk the talk.

During 1968 and 1969, I worked in West Berlin at the Sarotti Chocolate factory in order to perfect my German. On the first day at work, they let you eat all you want for free.

After that, you got so sick that you never wanted to touch the stuff again. Some 50 years later and I still can’t eat their chocolate with sweetened alcohol on the inside.

My co-worker there was named Jendro, who had been captured by the Russians at Stalingrad and was one of the 5% of prisoners who made it home alive in 1955. His stories were incredible and my problems pale in comparison.

Answering an ad on a local bulletin board, I found myself living with a Nazi family near the company's Tempelhof factory.

There was one thing about Nazis you needed to know during the 1960s: They absolutely loved Americans.

After all, it was we who saved them from certain annihilation by the teeming Bolshevik hoards from the east.

The American postwar occupation, while unpopular, was gentle by comparison. It turned out that everyone loved Hershey bars. Americans became very good at looking the other way when Germain families were trying to buy food on the black market. That’s why Reichsmarks wasn’t devalued until 1948.

As a result, I got free room and board for two summers at the expense of having to listen to some very politically incorrect theories about race. I remember the hot homemade apple strudel like it was yesterday.

Let me tell you another thing about Nazis. Once a Nazi, always a Nazi. Just because they lost the war didn't mean they dropped their extreme beliefs.

Fast-forward 30 years, and I was a wealthy hedge fund manager with money to burn, looking for adventure with a history bent during the 1990s.

I was mountain climbing in the Bavarian Alps with a friend, not far from Garmisch-Partenkirchen, when I learned that Leni Riefenstahl lived nearby, then in her 90s.

Attending the USC film school decades earlier, I knew that Riefenstahl was a legend in the filmmaking community.

She produced such icons as Olympia, about the 1932 Berlin Olympics, and The Triumph of the Will, about the Nuremburg Nazi rallies. It is said that Donald Trump borrowed many of these techniques during his successful 2016 presidential run.

It was rumored that Riefenstahl was also the one-time girlfriend of Adolph Hitler.

I needed a ruse to meet her since surviving members of the Third Reich tend to be very private people, so I tracked down one of her black and white photos of Nubian warriors, which she took during her rehabilitation period in the 1960s.

It was my plan to get her to sign it.

Some well-placed intermediaries managed to pull off a meeting with the notoriously reclusive Riefenstahl, and I managed to score a half-hour tea.

I presented the African photograph, and she seemed grateful that I was interested in her work. She signed it quickly with a flourish.

I then gently grilled her on what it was like to live in Germany in the 1930s. What I learned was fascinating.

But when I asked about her relationship with The Fuhrer, she flashed, "That is nothing but Zionist propaganda."

Spoken like a true Nazi.

The interview ended abruptly.

I took my signed photograph home, framed it, and hung it on my office wall for a few years. Then I donated it to a silent auction at my kids' high school.

Nobody bid on it.

The photo ended up in storage at my home, and when it was time to make space, it went to Goodwill.

I obtained a nice high appraisal for the work of art and then took a generous tax deduction for the donation, of course.

It is now more than a half-century since my first contact with the Nazis, and all of the WWII veterans are gone. Talking about it to kids today, you might as well be discussing the Revolutionary War.

By the way, the torchlight parade we saw in Charlottesville, VA in 2017 was obviously lifted from The Triumph of the Will, except that they didn't use tiki poolside torches in Germany in the 1930s.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Leni Riefenstahl

Olympia