Buy fear, sell greed.

That is what has been my magic formula for making money over the past 50 years.

But what happens if you get nothing?

What happens if you are stuck in a big fat middle of a range? That seems to be the case now that the market is nailed to the (SPY) 4,000 level, which it turns out is exactly the middle of a four-month trading range.

The market fought the Fed for two months from June and won. It has lost since Jackson Hole. The market has only seen that degree of whipsaw four times since 1950.

It now appears that it is front running a very weak number for the Consumer Price Index on September 13. After that, we get a 75-basis point rate rise on September 20. Good cop first, then bad cop.

That leaves me twiddling my thumbs along with everyone else, waiting for the market to throw up on its shoes. We were almost getting there last week when the Volatility Index (VIX) clawed its way back to $27. Then it gave it all up, falling back to $22. Some $5 is just not enough spread with which to make a living, or worth executing a trade.

And here is the key to the market right now.

You’re not buying stocks for headlines you are seeing today, which are universally dire, cataclysmic, and predicting Armageddon.

You are buying for the headlines that will appear in a year. This will include:

Russia loses the Ukraine War

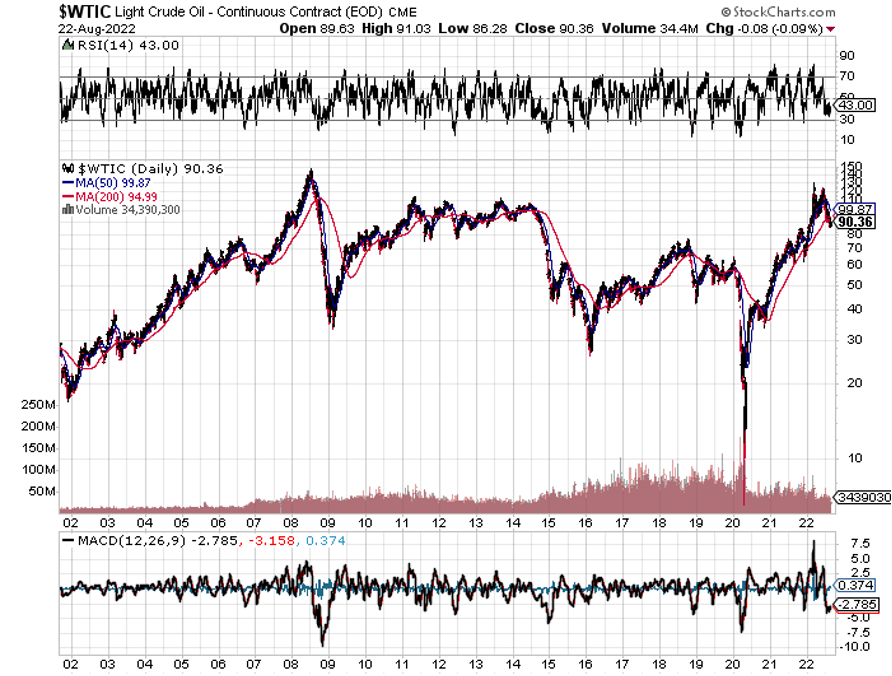

The price of oil (USO) collapses below $50 a barrel

The European energy crisis ends

Gasoline prices fall below $2.00 a gallon

Inflation falls below 4%

Interest rates stabilize around 3.50%-4.00%

Corporate earnings reaccelerate

We get another $1 trillion in corporate share buybacks

That sounds like one heck of a market to buy into. Why not buy now when everything is on sale, rather than in a year when it is expensive once again?

You don’t have to bet the ranch today. Just scale in, buying 10% of a position a day in your favorite names until you are fully invested. That way, you’ll get an average close to a bottom. You’ll at least get a seat on the train and won’t be left behind waving goodbye from the platform.

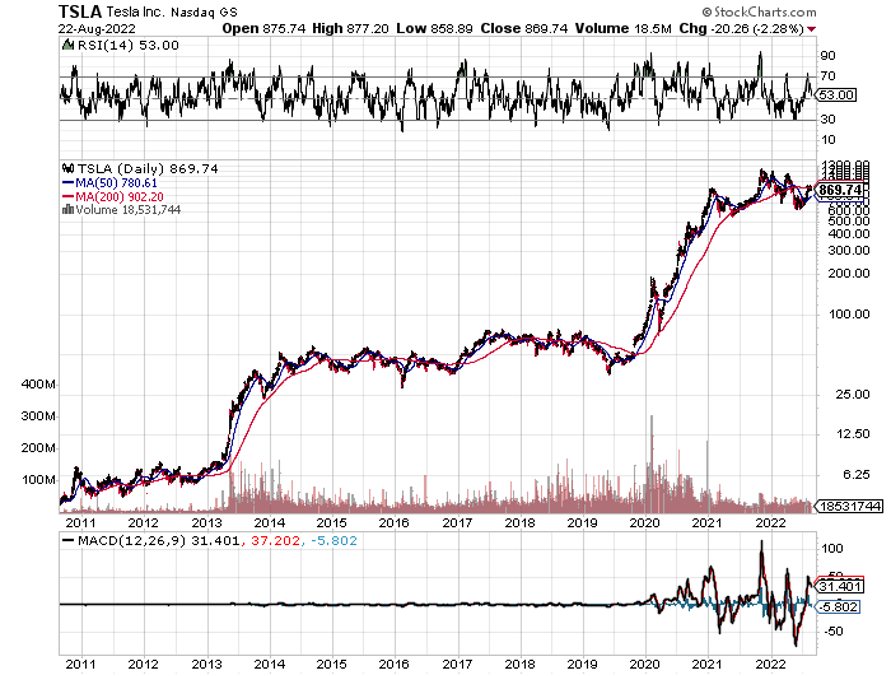

That means adding technology stocks to your portfolio, which will be the top-performing sector for the rest of this century.

The other thing you can do is to start getting rid of your defensive names. If you think oil is going below $50 in a year as I do, you don’t want to have a single oil name in your portfolio.

You want to own boring stocks in falling markets and exciting ones in rising markets.

You can’t get THE bottom. I can’t do it, so how are you going to?

There is one other factor that I guarantee you no one is looking at. Do you know anyone who bought a spec home for a quick flip lately? I bet not.

That means there is a lot of speculative capital looking for a new home and I bet that a lot of it is going into the stock market. The same is true with bitcoin.

I just thought you’d like to know.

Apple Rolls Out Next-Gen iPhone. The focus will be on larger phones with faster processors and a better camera. There may also be an inflationary $100 price increase. A new watch and Airpods are also expected. Buzz kill: every two years, this event usually marks a six-month high in the stock. Apple may no longer be the safest stock in the market.

Russia Cuts Gas Supplies to Europe until Ukraine sanctions are lifted. That took the Euro to a 20-year low of under 99 cents. You get into bed with the devil, and you pay the consequences. Russia must desperately need that trade with Europe.

Germany Fights Russia with Coal. Coal is enjoying a renaissance in Germany where it is being used to replace the total cut-off in Russian natural gas. In 2022, coal has jumped from 27% to 33% of electricity production, while gas has plunged from 18% to 11.7%. It goes against the country’s strong environmental principles and will only be used as a bridge towards greatly accelerated alternative energy efforts. Importing all the natural gas they can from the US also helps. It will greatly help Europe hold together this winter to face down the Russian energy war.

Home Equity is Shrinking, down $500 billion from the $11.5 trillion peak. It means less money is available to go into stocks. But we are nowhere near a crash, like we saw in 2008, when home equity nearly went to zero. No liar loans, exaggerated appraisals, or financial crisis this time. This housing recession will be about ice, not fire. There won’t be much of a housing crash when we’re still short 10 million homes. If you sell, your new mortgage will have double the interest rate. Ergo, don’t sell.

Weekly Jobless Claims Hit 3-Month Low, down 6,000 to 222,000. This number is not even close to an economic slowdown. In the wake of the decent nonfarm payroll report last week, it shows that employment is anything but slowing.

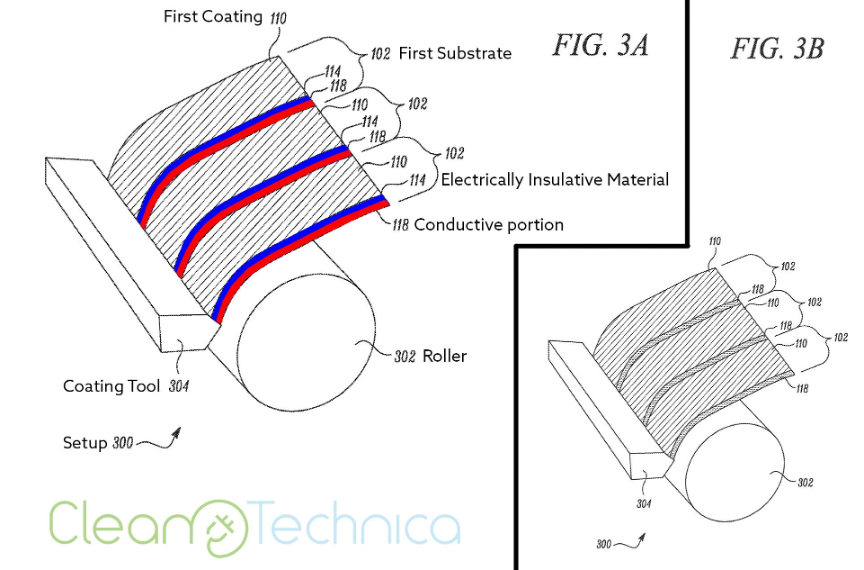

Tesla (TSLA) Triples China Deliveries after expanding the Shanghai factory. Elon Musk seems able to accomplish what others can’t, increasing production and sales in the face of rolling Covid lockdowns, heat waves, and materials shortages. Buy (TSLA) on dips.

California Sets a $22 Minimum Wage for fast food workers starting from 2023. It’s a catch-up with minimum wages that haven’t changed for 20 years and represents a broader issue for the rest of the country. Think this may be inflationary? Count on all of this going straight into product price rises. It may become cheaper to make your cheeseburgers at home.

The Bond Market Crashes, with ten-year US Treasury bond soaring 20 basis points to a 3.35% yield. The (TLT) hit a new 2022 low at $107.49. Bonds are reading the writing on the wall from Jackson Hole, even if stocks aren’t. Avoid (TLT).

Oil Crashes $4 on recession fears. Most Russian sales are now taking place 20% below the market to China and India. We may be approaching an interim low as winter approaches unless the Ukraine war ends.

A US Rail Strike Threatens as wage talks stall. A recession could be the result. Negotiators have until September 16 to reach a deal for 115,000 workers. A strike would also spike inflation. This could be our next black swan.

My Ten-Year View

When we come out the other side of pandemic and the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With oil in a sharp decline, inflation falling, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

With markets now a snore, my September month-to-date performance ground up to +1.02%. I took profits in my last long in Microsoft (MSFT) going into a rare 100% cash position awaiting the next market entry point.

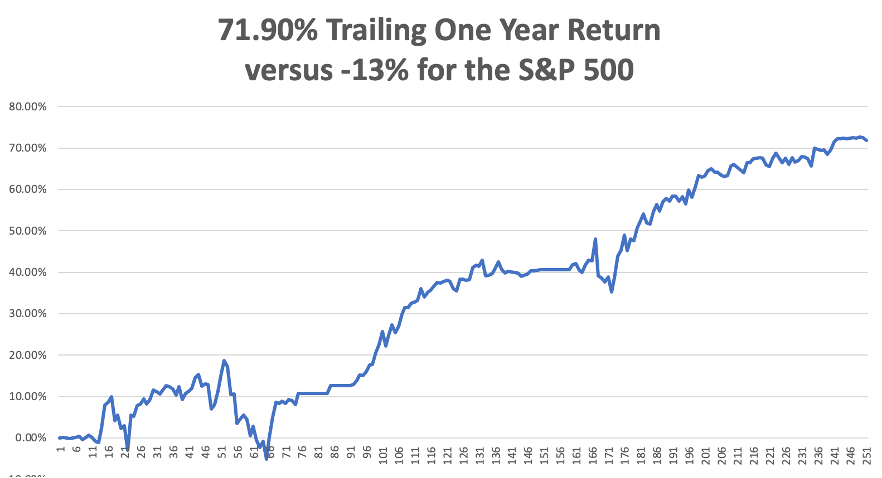

My 2022 year-to-date performance improved to +60.98%, a new high. The Dow Average is down -12% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +73.65%.

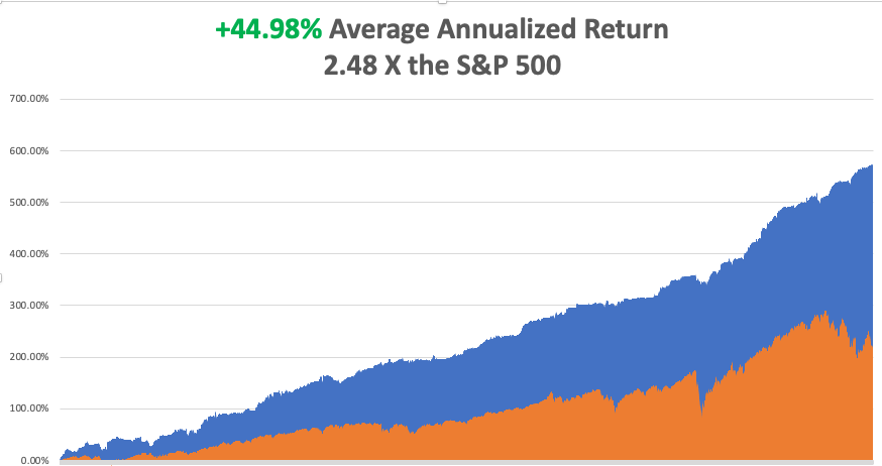

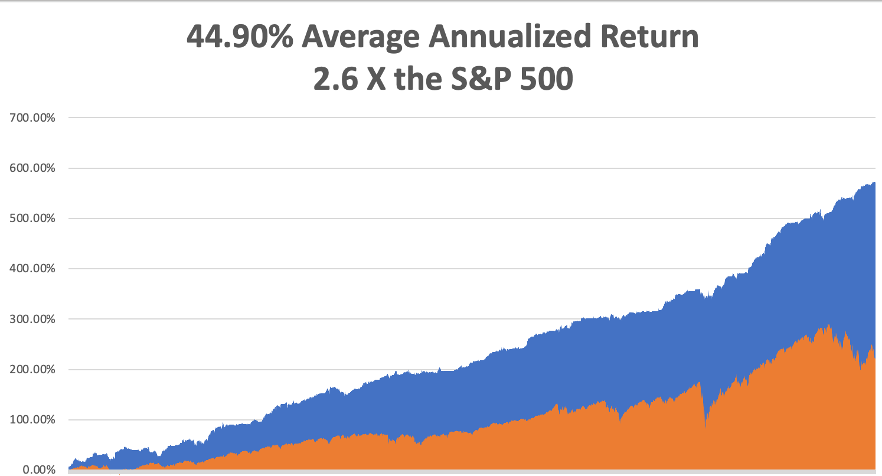

That brings my 14-year total return to +573.54%, some 2.48 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +44.98%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 95.2 million, up 300,000 in a week and deaths topping 1,050,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, September 12 at 8:30 AM, US Consumer Inflation Expectations for August is released.

On Tuesday, September 13 at 8:30 AM, the US Core Inflation Rate for August is out.

On Wednesday, September 14 at 7:00 AM, the Producer Price Index for August is published.

On Thursday, September 15 at 8:30 AM, Weekly Jobless Claims are announced. We also get Retail Sales for August.

On Friday, September 16 at 7:00 AM, the University of Michigan Consumer Sentiment is disclosed. At 2:00 the Baker Hughes Oil Rig Count are out.

As for me, when you’re 6’4” and 180 pounds, there is not a lot of things that can seriously toss you around. One is a horse, and another is a wave.

It was the latter that took me down to Newport Beach, CA to a beachfront house for my annual foray into body surfing. Newport Beach has some of the best waves in California.

This is the beach that made John Wayne a movie star.

John, whose real name was Marion Morrison, grew up in a Los Angeles suburb and won a football scholarship to the University of Southern California. While still a freshman in 1925, he went bodysurfing at Newport Beach with a carload of buddies. A big wave picked him up and smashed him down on the sand, breaking his right shoulder.

At football practice, there was no way a big lineman could block and tackle with a broken shoulder, so he was kicked off the team and lost his scholarship.

He still had to eat, so he resorted to the famed student USC jobs bulletin board, which I have taken advantage of myself (it’s where I got my LA coroner’s job).

The 6’4” Wayne was hired as a stagehand by up-and-coming movie director John Ford, himself also a former college football star. In 14 years, Wayne worked himself up from gopher, to extra, to a leading man in 1930, and then his breakout 1939 film Stagecoach.

During WWII, Wayne, too old, was confined to entertainment for the USO shows and making propaganda films while the rest of his generation was at the front. He never recovered from that humiliation and spent the rest of his life as a super patriot.

I saw John Wayne twice. My uncle Charles, who was the CFO of the Penn Central Railroad in the 1960s, made a fortune selling short the stock right before it went bankrupt (maybe that was legal then?). He bought a big beach house on California Balboa’s Island right next door to John Wayne’s.

One day, the family was cruising by Wayne’s house, and he was sitting on his front patio in a beach chair. Then one of our younger kids shouted out “he’s bald” which he was. Wayne laughed and waved.

The second time was in the early 1970s. I was walking across the lobby of the Beverly Hills Hotel with the movie star and Miss America runner-up Cybil Shephard on my arm. He walked right up to us and with a big smile said, “hello gorgeous”. He wasn’t talking to me.

I learned a lot about Wayne from my uncle, Medal of Honor winner Mitchell Paige, who was hired as the technical consultant for the 1949 film Sands of Iwo Jima and spent several months working closely with him. The lead character, Marine Sargent John Striker, was based on Mitch.

Film critics complained that Wayne couldn’t act, that he was just himself all the time. But I knew my uncle Mitch well, a humble, modest, self-effacing man, and Wayne absolutely nailed him to a tee.

The Searchers, made in 1958, and directed by John Ford, is considered one of the finest movies ever made. I show it to my kids every Christmas to remind them where they came from because we have an ancestor who was kidnapped in Texas by the Comanches and survived.

John Wayne was a relentless chain smoker, common for the day, and lung cancer finally caught up with him. His first bout was in 1965 when he was making In Harm’s Way, the worst war movie he ever made. His last film, The Shootist, made in 1978, was ironically about an old gunslinger dying of prostate cancer.

John Wayne hosted the 1979 Academy Awards rail thin, racked by chemotherapy and radiation treatments. He died a few months later after making an incredible 169 movies in 50 years.

John Wayne was one of those people you’re lucky to run into in life. He was a nice guy when he didn’t have to be.

As for those waves at Newport Beach, I can vouch they are just as tough as they were 100 years ago.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader