Global Market Comments

March 10, 2020

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES IN TODAY’S MARKET),

(SPY), (VIX), (VXX), (AAPL), (CCL), (UAL), (WYNN)

Global Market Comments

March 10, 2020

Fiat Lux

Featured Trade:

(RISK CONTROL FOR DUMMIES IN TODAY’S MARKET),

(SPY), (VIX), (VXX), (AAPL), (CCL), (UAL), (WYNN)

Today, we saw the largest point loss in market history, the first use of modern circuit breakers, and individual stocks down up to 40%. Ten-year US Treasury bond yields cratered to 0.39%. Virtually the entire energy and banking sectors vaporized.

What did I do? I did what I always do during major stock market crashes.

I took my Tesla out to get detailed. When I got home, I washed the dishes and did some laundry. And for good measure, I mowed the lawn, even though it is early March and it didn’t need it.

That’s because I was totally relaxed about how my portfolio would perform.

There is a method to my madness, although I understand that some new subscribers may need some convincing.

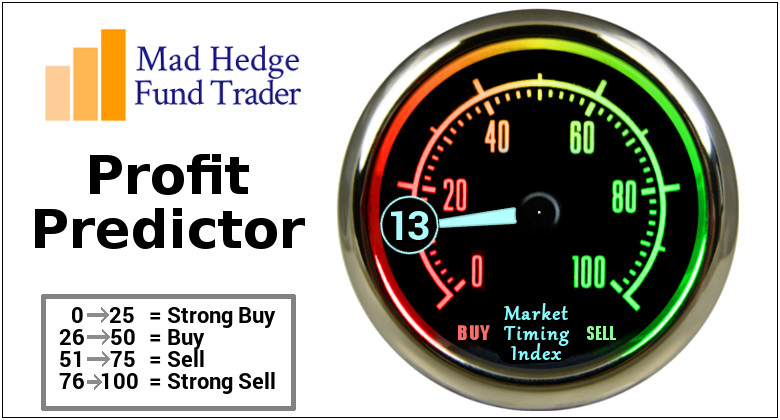

I always run hedged portfolio, with hedges within hedges within hedges, although many of you may not realize it. I run long calls and puts against short calls and puts, balance off “RISK ON” positions with “RISK OFF” ones, and always keep a sharp eye on multi-asset class exposures, options implied volatilities, and my own Mad Hedge Market Timing Index.

While all of this costs me some profits in rising markets, it provides a ton of protection in falling ones, especially the kind we are seeing now. So, while many hedge funds are blowing up and newsletters wiping out their readers, I am so relaxed that I could fall asleep at any minute.

Whenever I change my positions, the market makes a major move or reaches a key crossroads, I look to stress test my portfolio by inflicting various extreme scenarios upon it and analyzing the outcome.

This is second nature for most hedge fund managers. In fact, the larger ones will use top of the line mainframes powered by $100 million worth of in-house custom programming to produce a real-time snapshot of their thousands of positions in all imaginable scenarios at all times.

If you want to invest with these guys feel free to do so. They require a $10-$25 million initial slug of capital, a one-year lock-up, charge a fixed management fee of 2% and a performance bonus of 20% or more.

You have to show minimum liquid assets of $2 million and sign 50 pages of disclosure documents. If you have ever sued a previous manager, forget it. The door slams shut. And, oh yes, the best performing funds are closed and have a ten-year waiting list to get in. Unless you are a major pension fund, they don’t want to hear from you.

Individual investors are not so sophisticated, and it clearly shows in their performance, which usually mirrors the indexes less a large haircut. So, I am going to let you in on my own, vastly simplified, dumbed-down, seat of the pants, down and dirty style of risk management, scenario analysis, and stress testing that replicates 95% of the results of my vastly more expensive competitors.

There is no management fee, performance bonus, disclosure document, lock up, or upfront cash requirement. There’s just my token $3,000 a year subscription fee and that’s it. And I’m not choosy. I’ll take anyone whose credit card doesn’t get declined.

To make this even easier, you can perform your own analysis in the excel spreadsheet I post every day in the paid-up members section of Global Trading Dispatch. You can just download it and play around with it whenever you want, constructing your own best-case and worst-case scenarios. To make this easy, I have posted this spreadsheet on my website for you to download by clicking here. You have to be logged in to access and download the spreadsheet.

Since this is a “for dummies” explanation, I’ll keep this as simple as possible. No offense, we all started out as dummies, even me.

I’ll take Mad Hedge Model Trading Portfolio at the close of March 9, 2020, the date of a horrific 2,000 down day in the Dow Average. This was the day when margin clerks were running rampant, brokers were jumping out of windows, and talking heads were predicting the end of the world.

I projected my portfolio returns in three possible scenarios: (1) The market collapses an additional 5.3% by the March 20 option expiration, some 8 trading days away, (2) the S&P 500 (SPX) rises 10% by March 20, and (3) the S&P 500 trades in a narrow range and remains around the then-current level of $2,746.

Scenario 1 – The S&P 500 Falls Another 5.3% to the 2018 Low

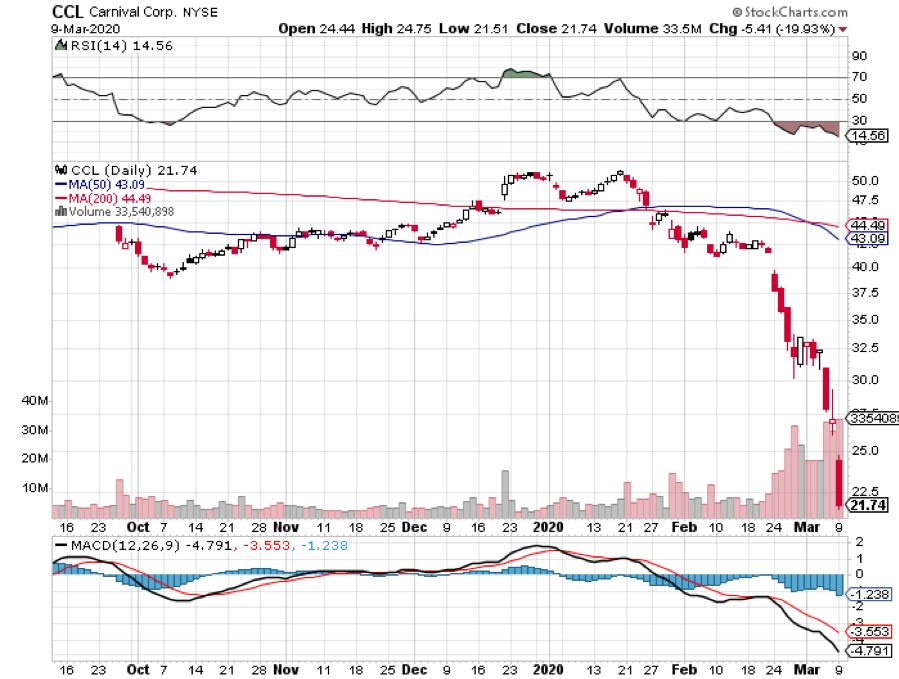

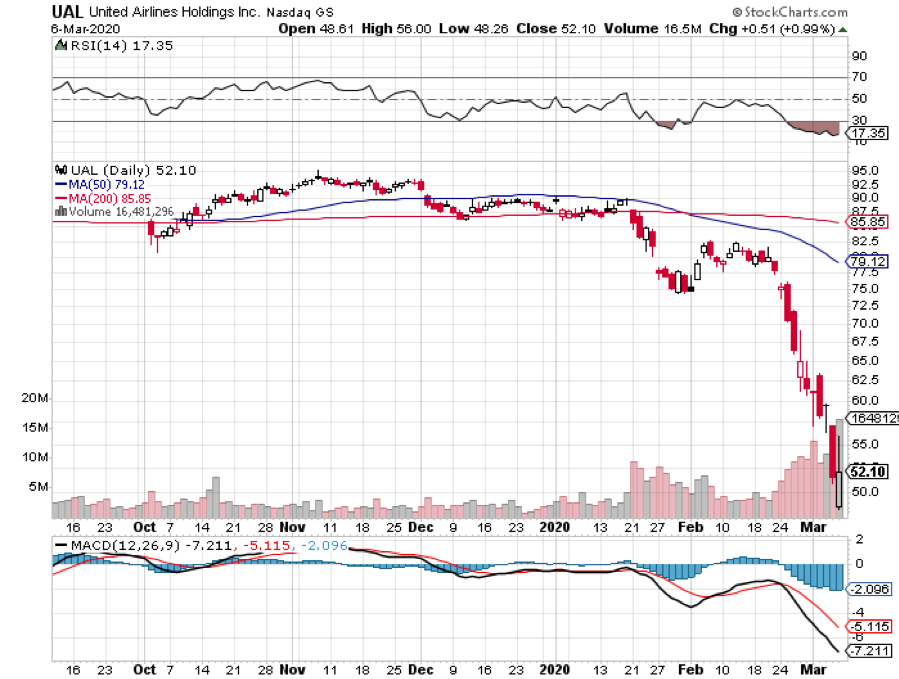

A 5.3% loss would take the (SPX) down to $2,600, to the 2018 low, and off an astonishing 800 points, or 23.5% down from the recent peak in a mere three weeks. In that situation the Volatility Index (VIX) would rise maybe to $60, the (VXX) would add another point, but all of our four short positions (AAPL), (UAL), (CCL), and (WYNN) would expire at maximum profit points.

In that case, March will end up down -3.58%, and my 2020 year-to-date performance would decline to -6.60%, a pittance really compared to a 23.5% plunge in the Dow Average. Most people would take that all day long. We live to buy another day. Better yet, we live to buy long term LEAPs at a three-year market low with my Mad Hedge Market Timing Index at only 3, a historic low.

Also, when the market eventually settles down, volatility will collapse, and the value of my (VXX) positions double.

Scenario 2 – S&P 500 rises 10%

The impact of a 10% rise in the market is easy to calculate. All my short positions expire at their maximum profit point because they are all so far in the money, some 20%-40%. It would be a monster home run. I would go back in the green on the (VXX) because of time decay. That would recover my March performance to +1.50% and my year-to-date to only -1.42%

Scenario 3 – S&P 500 Remains Unchanged

Again, we do great, given the circumstances. All the shorts expire at max profits and we see a smaller increase in the value of the (VXX). I’ll take that all day long, even though it cost me money. When running hedge funds, you are judged on how you manage your losses, not your gains, which are easy.

Keep in mind that these are only estimates, not guarantees, nor are they set in stone. Future levels of securities, like index ETFs, are easy to estimate. For other positions, it is more of an educated guess. This analysis is only as good as its assumptions. As we used to say in the computer world, garbage in equals garbage out.

Professionals who may want to take this out a few iterations can make further assumptions about market volatility, options implied volatility or the future course of interest rates. And let’s face it, politics is a major influence this year. Thanks Joe Biden for that one day 1,000 point rally to sell into, when I established most of my shorts and dumped a few longs.

Keep the number of positions small to keep your workload under control. Imagine being Goldman Sachs and doing this for several thousand positions a day across all asset classes.

Once you get the hang of this, you can start projecting the effect on your portfolio of all kinds of outlying events. What if a major world leader is assassinated? Piece of cake. How about another 9/11? No problem. Oil at $10 a barrel? That’s a gimme.

What if there is an American attack on Iranian nuclear facilities to distract us from the Coronavirus and stock market carnage? That might take you all two minutes to figure out. The Federal Reserve launches a surprise QE5 out of the blue? I think you already know the answer.

Now that you know how to make money in the options market, thanks to my Trade Alert service, I am going to teach you how to hang on to it.

There is no point in being clever and executing profitable trades only to lose your profits through some simple, careless mistakes.

The first goal of risk control is to preserve whatever capital you have. I tell people that I am too old to lose all my money and start over again as a junior trader at Morgan Stanley. Therefore, I am pretty careful when it comes to risk control.

The other goal of risk control is the art of managing your portfolio to make sure it is profitable no matter what happens in the marketplace. Ideally, you want to be a winner whether the market moves up, down, or sideways. I do this on a regular basis.

Remember, we are not trying to beat an index here. Our goal is to make absolute returns, or real dollars, at all times, no matter what the market does. You can’t eat relative performance, nor can you use it to pay your bills.

So the second goal of every portfolio manager is to make it bomb-proof. You never know when a flock of black swans is going to come out of nowhere or another geopolitical shock occurs causing the market crash.

Global Market Comments

March 9, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SEARCHING FOR A BOTTOM),

(SPX), (VIX), (VXX), (CCL), (UAL), (WYNN)

OK, I’ll give it to you straight.

If the American Coronavirus epidemic stabilizes at current levels of infection, the double bottom in the S&P 500 (SPX) at 2,850 will hold, down 16% from the all-time high two weeks ago.

If it gets worse, it won’t, possibly taking the index down another 8.8% to 2,600, the 2018 low. Not only have we lost the 2019 stock market performance, we may be about to lose 2018 as well.

Of course, the problem is testing kits, which the government has utterly failed to provide in adequate numbers. The president is relying on disease figures provided by Fox News and ignoring those of his own experts at the CDC. And the president told us that the governor of Washington state, the site of the first US Corona hot spot, is a “snake,” and that the outbreak on the Diamond Princess is not his fault.

It’s not the kind of leadership the stock market is looking for at the moment. It amounts to an economic and biological “Pearl Harbor” where the government slept while the disease ran rampant. Until we get the true figures, markets will assume the worst. The real number of untested cases could be in the hundreds of thousands or millions, not the 350 reported. And stock prices will react accordingly.

There is an interesting experiment going on at the Grand Princess 100 miles off the coast of San Francisco right now which will certainly affect your health. Of the 39 showing Corona symptoms, 21 were found to have the disease and 19 of these were crew.

That means ALL of the passengers who took the last ten cruises were exposed, about 30,000 people, 90% of whom are back ashore. The Grand Princess may turn out to be the “Typhoid Mary” of our age.

You can see these fears expressed in the volatility index, which hit a decade high on Friday at $55, although it closed at $42. We live in a world now were all economic data is useless, earnings forecasts are wildly out of date, and technical analysis is ephemeral at best. Airlines, restaurants, and public events are emptying out everywhere and the deleterious effects on the economy will be extreme.

That is kind of hard to trade.

The good news is that this won’t last more than a couple of months. By June, the epidemic will be fading, or we’ll all be dead. All of the buying you see now is of the “look through” kind where investors are picking up once in a decade bargains in the highest quality companies in expectation of ballistic moves upward out the other side of the epidemic.

Enormous fortunes will be made, but at the cost of a few sleepless nights over the next few weeks. The bear market will end when everyone who needs tests get them and we obtain the results.

The Fed cut interest rates by 50 basis points taking the overnight rate down to 1.25%. They may cut again in two weeks. Traders were looking for some kind of global stimulus to head off a global recession. Markets are in “show me” mode and were down 300 prior to the announcement.

Quantitative Easing has become the cure for all problems. So, if it doesn’t work, try, try again? The Fed has now used up all its dry powder levitating the stocks, with the market already at a 1.00% yield for ten-year money. We need a vaccine, not a rate cut. New York schools close on virus fears.

The Beige Book says Corona is a worry, in their minutes from the last Fed meeting six weeks ago, mentioning it 48 times in yesterday’s report. No kidding? Travel and leisure are the hardest hit, and international trade is in free fall. The presidential election is also arising as a risk to the economy. Worst of all, the new James Bond movie has been postponed until November. The report only applies to data collected before February 24.

The next recession just got longer and deeper, as the Fed gives away the last of its dry powder. It’s the first time the central bank was used to fight a virus. It only creates more short selling and volatility opportunities for me down the line. Thanks Jay!

Gold ETF assets hit all-time high, both through capital appreciation and massive customer inflows. Fund values have exceeded the 2012 high, when gold futures reached $1,927. They saw 84 metric tonnes added to inventory in February. The barbarous relic is a great place to hide out for the virus. I expect a new all-time high this year and a possible run to $3,000.

Biotech & healthcare are back! Bernie’s thrashing last week in ten states takes nationalization of health care off the table for good. Biden should sweep most of the remaining states. There’s nothing left for Bernie but Michigan and Florida. Buy Health Care and Biotech on the dip!

The Nonfarm Payroll was up 273,000 in February, much higher than expectations. At least we HAD a good economy. The headline unemployment rate was 3.5%%. As if anyone cares. The only number right now that counts is new Corona infections. This may be the last good report for a while, possibly for years.

Private Payrolls were up 183,000, says the February ADP Report. No Corona virus here. Do you think companies believe this is a short-term ephemeral thing? What if they gave a pandemic and nobody came?

Mortgage Applications were up 26%, week on week, as free money keeps the housing market on fire. Don’t expect too much from the banks though. Mine offered a jumbo loan at 3.6%. Banks are not lining up to sell at the bottom.

The OPEC Meeting was desperate to stabilize prices and they failed utterly. But if they fail to deliver at least 1 million barrels a day in production slowdowns at their Friday Vienna meeting, Texas tea could reach the $30 a barrel handle in days.

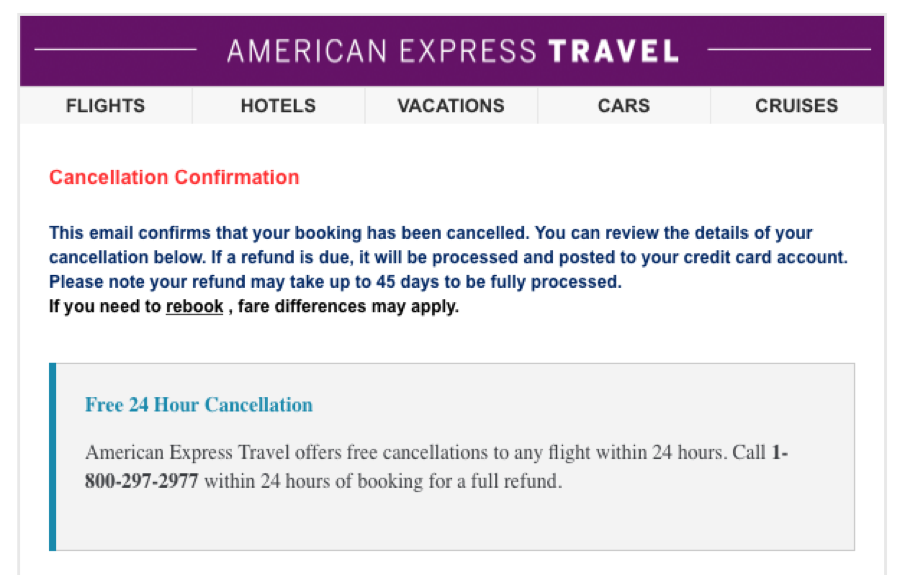

The airline industry will lose $113 billion from the virus, says IATA, the International Air Transport Association. All events everywhere have been cancelled, even my Boy Scout awards dinner for Sunday night and my flight to a wedding in April. Lufthansa just cancelled half of all it flights worldwide. Who knows where the bottom is for this industry? I bet you didn’t know that airline ticket sales account for 8% of all credit card purchases. Keeping my short in United Airlines (UAL).

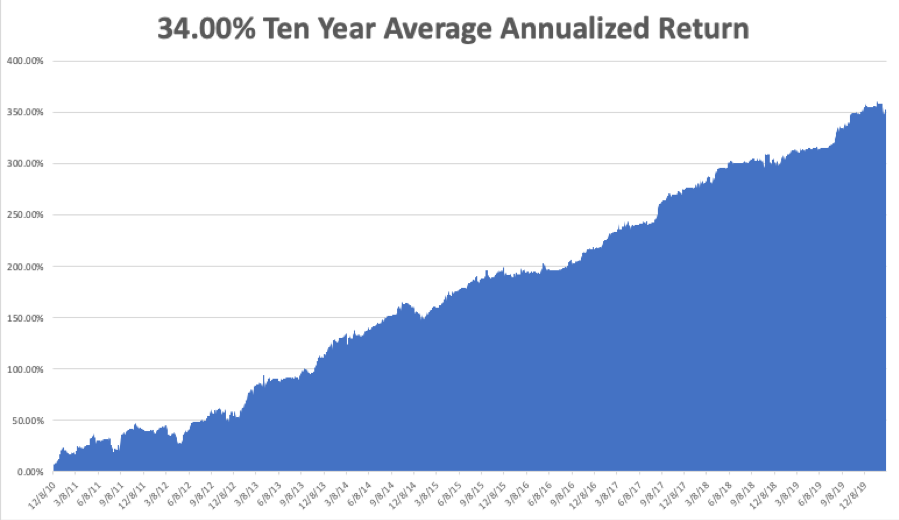

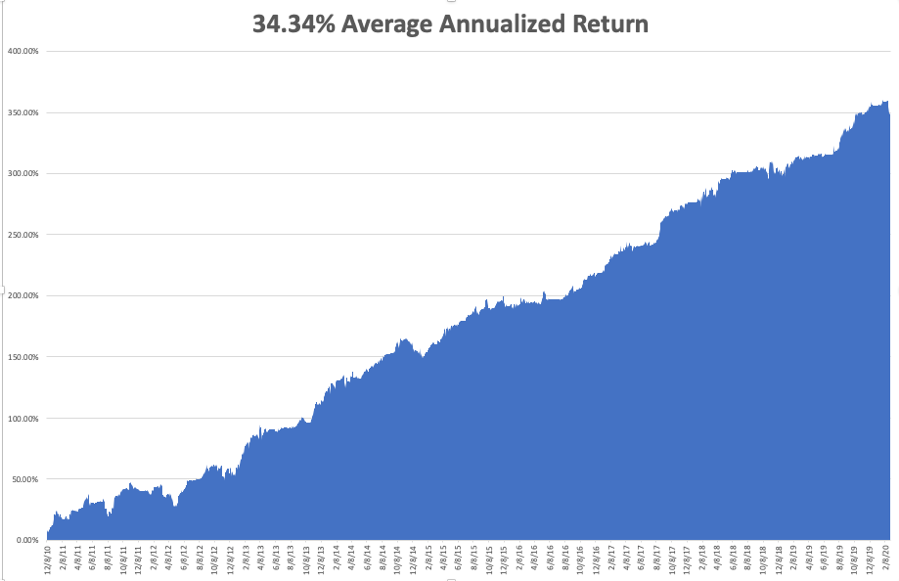

My Global Trading Dispatch performance took a shellacking, pulling back by -4.41% in March, taking my 2020 YTD return down to -7.33%. That compares to a return for the Dow Average of -16% at the Friday low. My trailing one-year return is stable at 48.44%. My ten-year average annualized profit ground back up to +34.00%.

I took my hit of the year on Friday, losing 4.4% on my bond short. A 9-point gap move has never happened in the long history of the bond market. Fortunately, my losses were mitigated by a five-point dip I was able to use to get out, a hedge within my bond position, and three short positions in Corona related-stocks, (CCL), (WYNN), and (UAL), which cratered.

All eyes will be focused on the Coronavirus still, with deaths over 3,000. The weekly economic data are virtually irrelevant now. This is usually the weakest week of the month on the data front.

On Monday, March 9 at 10:00 AM, the Consumer Inflation Expectations is out.

On Tuesday, March 10 at 5:00 AM, the NFIB Business Optimism Index is released.

On Wednesday, March 11, at 7:30 AM, the Core Inflation Rate for February is printed.

On Thursday, March 12 at 8:30 AM, Initial Jobless Claims are announced. Core Producer Price Index for February is also out.

On Friday, March 13 at 9:00 AM, the University of Michigan Consumer Sentiment Index is published. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, I’ll be shopping for a cruise this summer. I am getting offered incredible deals on cruises all over the world. Suddenly, every cruise line in the world is having sales of the century.

Shall it be a Panama Canal cruise for $99, a trip around the Persian Gulf for $199, or a voyage retracing the route of the HMS Bounty across the Pacific for $299. Of course, the downside is that I may be subject to a two-week quarantine on a plague ship on my return.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 2, 2020

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or TRADING THE CORONA MARKET),

(SPX), (INDU), (AAPL), (VIX), (VXX), (AAPL), (MSFT), (AMZN)

It’s time to stockpile food, load up on ammo, and get ready to isolate yourself from the coming Corona Armageddon. If you rely on prescriptions to keep breathing, better lay in a three-month supply. Six months might be better.

At least, that’s what the stock market thinks. That was some week!

Thank goodness it wasn’t as bad as the 1987 crash, when we cratered 20% in a single day, thanks to an obscure risk control strategy called “portfolio insurance” that maximized selling at market bottoms.

In fact, we may have already hit bottom on Friday at Dow 24,681 and S&P 500 (SPX) 2,865.

There are a whole bunch of interesting numbers that converge at the 24,000 Dow Average handle. That is the level where we started the second week of 2019, so we have virtually given up that entire year. If you missed 2019, you get a second chance at the brass ring.

As for the (SPX), as the week’s lows have pulled back exactly to the peaks of twin failed rallies of 2018, right where you would expect major technical support on the long term charts.

And here is something else that is really interesting. If you use the (SPX) price earnings multiple of 16X that prevailed when Trump became president and then add in the 38.62% earnings growth that has occurred since then, you come up with a Dow average of 24,000.

Yes, the market has plunged from a 20X multiple to 16X in a week.

Want more?

If you drop every stock in the market to its 200-day moving average, you get close to a Dow Average of 24,000. I’m talking Apple (AAPL) down to $240, Microsoft (MSFT) cratering to $145. Amazon (AMZN) hit the 200-day on Friday at $1,849.

This means we are well overdue for a countertrend short-covering rally of one-third to two-thirds of the recent loss, or 1,500 to 3,000. That could take the (VIX) back to $20 in a heartbeat. I’ll take any bounce I can get, even the dead cat variety.

What the market has done in a week is backed out the entire multiple expansion that has occurred over the last three years caused by artificially low interest rates and the presidential browbeating of the Federal Reserve.

The fluff is gone.

I have been warning for months that torrid stock market growth against falling corporate earnings growth could only end in tears. And so it did.

Whether the bottom is at 24,000, 23,000, or 22,000, you are now being offered a chance to get off your rear end and pick up at bargain prices the cream of the crop of corporate America, many of which have seen shares drop 20-30% in six trading days.

Stock prices here are discounting a recession that probably won’t happen. That’s what it always does at market bottoms. It’s not a bad time to dollar cost average. Put in a third of your excess cash now, a third in a week, and the last bit in two weeks.

You also want to be selling short the Volatility Index (VIX) big time. With a rare (VIX) level of $50, you can consider this a “free money” trade. Over the last decade, (VIX) has spent only a couple of days close to this level.

Even during the darkest days of the 2008 crash, (VIX) spent only quarter trading between $20 and $50, and one day at $90. That makes one-year short positions incredibly attractive. Get the (VXX) back to last week’s levels and you are looking at 100% to 200% gains on put options very quickly. That’s why I went to a rare double position on Friday.

And then there is the Coronavirus, which I believe is presenting a threat that is wildly exaggerated. If you assume that the Chinese are understating the number of deaths, the true figure is not 3,000 but 30,000. In a population of 1.2 billion that works out to 0.0025%.

Apply that percentage to the US and the potential number of deaths here is a mere 7,500, compared to 50,000 flu deaths a year. And most of those are old and infirm with existing major diseases, like cancer, pneumonia, or extreme obesity.

Thank goodness I’m not old.

Fear, on the other hand, is another issue. Virtually all conferences have been cancelled. A school is closed in Oregon. Most large corporations banned non-essential travel on Friday. Major entertainment areas in San Francisco have become ghost towns. If this continues, we really could scare ourselves into an actual recession, which is what the stock market seemed to be screaming at us last week.

You can forget about the vaccine. It would take a year to find one and another year to mass produce it. They may never find a Corona vaccine. They have been looking for an AIDS vaccine for 40 years without success. So, we are left with no choice but to let nature run its course, which should be 2-3 months. The stock market may fully discount this by the end of this week.

What's disgraceful is the failure of the US government to prepare for a pandemic we knew was coming. I just returned from a two-week trip around Asia and Australia and at every stop my temperature was taken, I was asked to fill out an extensive health questionnaire and was screened for quarantine. When I got back to the US there was nothing. I just glided through the eerily empty immigration.

Most American communities have no Corona tests and have to mail samples to the CDC in Atlanta to get a result. We probably already have thousands of cases here already but don’t know it because there has been no testing. When the stock market learns this, expect more down 1,000-point days.

Where is the bottom? That is the question being asked today by individuals, institutions, and hedge funds around the world. That’s because there are hundreds of billions of dollars waiting on the sidelines left behind by the 2019 melt-up in financial assets. It’s been the worst week since 2008. All eyes are on (SPX) 2,850, the October low and the launching pad for the Fed’s QE4, which ignited stocks on their prolific 16% run. Suddenly, we

have gone from a market you can’t get into to a market you can’t get out of.

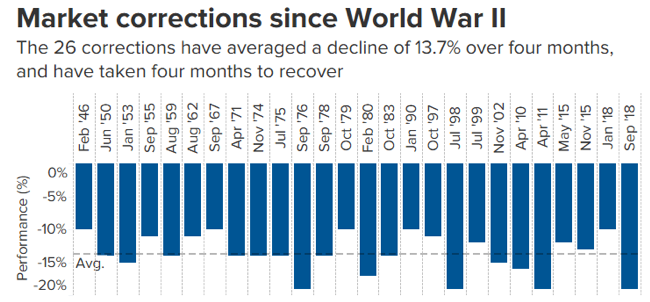

How long is this correction? The post-WWII average is four months, but we have covered so much ground so fast that this one may be quicker. We haven’t seen one since Q4 2018, which was one of the worst.

Corona does have a silver lining. Air pollution in China is the lowest in decades, with coal consumption down 42% from peak levels. It’s already starting to return as Chinese workers go back on the job. Call it the “Looking out the Window” Index.

Consumer Confidence was weak in February, coming in at 130.7, less than expected. Corona is starting to sneak into the numbers. Yes, imminent death never inspired much confidence in me.

International Trade is down 0.4% year on year for the first time since the financial crisis. It’s the bitter fruit of the trade war. The coasts were worst hit where trade happens. Trade is clearly in free fall now, thanks to the virus.

The helicopters are revving their engines, with global central banks launching unprecedented levels of QE to head off a Corona recession. Futures market is now pricing in three more interest rate cuts this year, up from zero two weeks ago. Hong Kong is giving every individual $1,256 to spend to stimulate the local economy. The plunge protection team is here! At the very least, markets are due for a dead cat bounce.

Bob Iger Retired from Walt Disney as CEO and will restrict himself to the fun stuff. The stock is a screaming “BUY” down here, with theme parks closing down from the Corona epidemic. Oops, they’re also in the cruise business!

Will the virus delay the next iPhone, and 5G as well? Like everything else these delays, it depends. Missing market could become the big problem. Missing customers too. I still want to buy (AAPL) down here in the dumps down $90 from its high.

The IEA says the energy outlook is the worst in a decade. Structural oversupply and the largest marginal customers mean that we will be drowning in oil basically forever. Avoid all energy plays like the plague. Don’t get sucked in by high yielding master limited partnerships. Don’t confuse “gone down a lot” with “cheap”.

Why is the market is really going down? It’s not the Coronavirus. It’s the Fed ending of its repo program in April, announced in the Fed minutes on February 19. No QE, no bull market. The virus is just the turbocharger. The Fed just dumped the punch bowl and no one noticed. This may all reverse when we get the next update on the Coronavirus.

A surprise Fed rate cut may be imminent, with a 25-basis point easing coming as early as tomorrow. There is no doubt that the virus is demolishing the global economy.

Investment Spending is Falling off a Cliff, with the Q4 GDP Report showing a 2.3% decline. Consumer spending, the main driver for the US economy, is also weakening as if economic data made any difference right now.

I could see the meltdown coming the previous weekend and was poised to hit the market with short sales and hedges. But when the index opened down 1,000, it was pointless. The best thing I could do was to liquidate my portfolio for modest losses. Two days later, that was looking a stroke of genius. This was the first 1,000 dip in my lifetime that I didn’t buy.

I then piled on what will almost certainly be my most aggressive position of 2020, a double weighting in selling short the Volatility Index at $50. Within 30 minutes of adding my second leg, the (VIX) had plunged to $40, earning back nearly half my losses from the week.

The British SAS motto comes to mind: “Who Dares Wins”.

My Global Trading Dispatch performance pulled back by -6.19% in February, taking my 2020 YTD return down to -3.11%. My trailing one-year return is stable at 40.95%. My ten-year average annualized profit ground back up to +34.34%.

With many traders going broke last week or running huge double-digit losses, I’ll take that all day long in the wake of a horrific 4,500 point crash in the Dow Average.

All eyes will be focused on the Coronavirus still, with deaths over 3,000. The weekly economic data are virtually irrelevant now. However, some important housing numbers will be released.

On Monday, March 2 at 10:00 AM, the US Manufacturing PMI for February is out.

On Tuesday, March 3 at 4:00 PM, US Auto Sales for February are released.

On Wednesday, March 4, at 8:15 PM, the ADP Report for private sector employment is announced.

On Thursday, March 5 at 8:30 AM, Weekly Jobless Claims are published.

On Friday, March 6 at 8:30 AM, the February Nonfarm Payroll Report is printed. The Baker Hughes Rig Count follows at 2:00 PM.

As for me, we have just suffered the driest February on record here in California, so I’ll be reorganizing my spring travel plans. Out goes the skiing, in come the beach trips.

Such is life in a warming world.

That’s it after I stop at Costco and load the car with canned food.

John Thomas

CEO & Publisher

Global Market Comments

February 28, 2020

Fiat Lux

Featured Trade:

(FEBRUARY 26 BIWEEKLY STRATEGY WEBINAR Q&A),

(VIX), (VXX), (SPY), (TLT), (UAL), (DIS), (AAPL), (AMZN), (USO), (XLE), (KOL), (NVDA), (MU), (AMD), (QQQ), (MSFT), (INDU)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 26 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: There’s been a moderation of new coronavirus cases in China. Is this what the market needs to find a bottom?

A: Absolutely it is; of course, the next risk is that cases keep increasing overseas. The final bottom will come when overseas cases start to disappear, and that could be a month or two off.

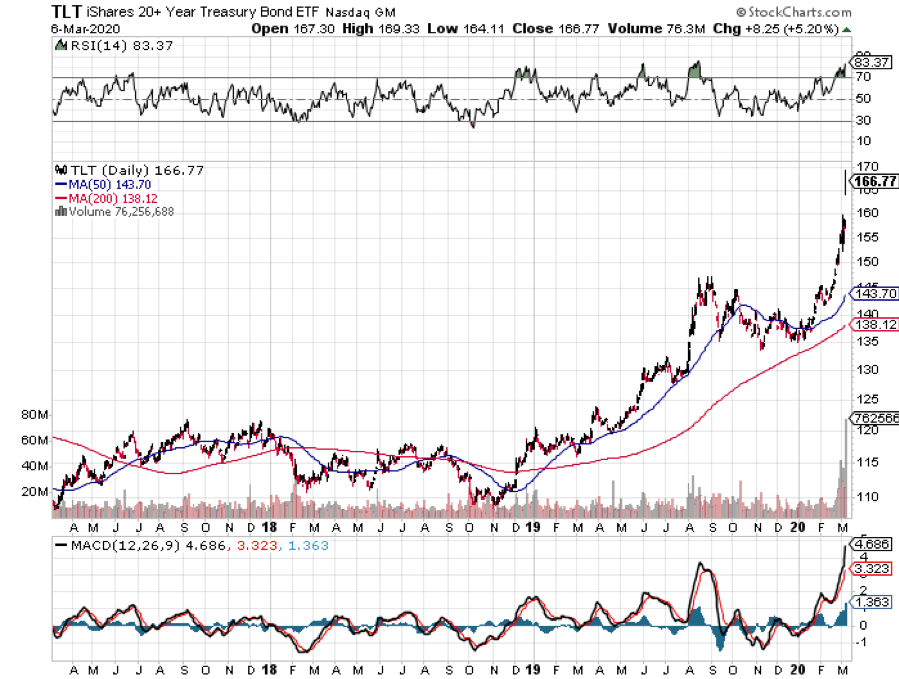

Q: How low will interest rates go after the coronavirus?

A: Well, interest rates already hit new all-time lows before the virus became a stock market problem. The virus is just giving it a turbocharger. Our initial target of 1.32% for the ten-year US Treasury bond was surpassed yesterday, and we think it could eventually hit 1.00% this year.

Q: What is the best way to know when to buy the dip?

A: When the Volatility Index (VIX) starts to drop. If you can get the volatility index down to the mid-teens and stay there, then the market will stabilize and start to rise fairly sharply. A lot of the really high-quality stocks in the market, like United Airlines (UAL), Walt Disney (DIS), Apple (AAPL) and Amazon (AMZN), have really been crushed by this selloff. So those are the names people are going to look at for quality at a discount. That’s going to be your new investment theme, buying quality at a discount.

Q: Do recent events mean that Boeing (BA) is headed down to 200?

A: I wouldn't say $200, but $280 is certainly doable. And if you get to $280, then the $240/$250 call spread all of a sudden looks incredibly attractive.

Q: What does a Bernie Sanders presidency mean for the market?

A: Well, if he became president, we could be looking at like a 50-80% selloff—at least a repeat of the ‘09 crash. However, I doubt he will get elected, or if elected, he won’t have control of congress, so nothing substantial will get done.

Q: Is this the beginning of Chinese (FXI) bank failures that will cause an economic crisis in mainland China?

A: It could be, but the actual fact is that the Chinese government is doing everything they can to rescue troubled banks and companies of all types with short term emergency loans. It’s part of their QE emergency rescue package.

Q: Can you explain what lower energy prices mean for the global economy?

A: Well, if you’re an oil consumer (USO), it’s fantastic news because the price of gas is going down. If you’re an oil producer (XLE), like for people in the Middle East, Texas, Louisiana, Oklahoma, and North Dakota, it’s terrible news. And if you’re involved anywhere in the oil industry, or own energy stocks or MLPs, you’re looking at something like another great recession. I have been hugely negative on energy for years. I’ve seen telling people to sell short coal (KOL). It’s having a “going out of business” sale.

Q: Should I aggressively short Tesla (TSLA) here? Surely, they couldn’t go up anymore.

A: Actually, they could go up a lot more. I would just stay away from Tesla and watch in amazement—there’s no play here, long or short. It suffices to say that Tesla stock has generated the biggest short-selling losses in market history. I think we’re up to about $15 billion now in short losses. Much smarter people than us have lost fortunes trying in that game.

Q: Was that an Amazon trade or a Google trade?

A: I sent out both Amazon and an Apple trade alert this morning. You should have separate trade alerts for each one.

Q: Are chips a long term buy at today’s level?

A: Yes, but companies like NVIDIA (NVDA), Micron Technology (MU), and Advanced Micro Devices (AMD) may be better long-term buys if you wait a couple of weeks and we test the new lows that we’ve been talking about. Chips are the canary in the coal mine for the global economy, and we have not gotten an all-clear on the sector yet. If you’re really anxious to get into the sector, buy a half of a position here and another half 10% down, which might be later this week.

Q: When will Foxconn reopen, the big iPhone factory in China?

A: Probably in the next week or so. Workers are steadily moving back; some factories are saying they have anywhere from 60-80% of workers returning, so that’s positive news.

Q: Are bank stocks a sell because of lower interest rates?

A: Yes, absolutely. If you think the 10-year treasury is running to a 1.00% yield as I do, the banks will get absolutely slaughtered, and we hate the sector anyway on a long-term basis.

Q: What about future Fed rate cuts?

A: Futures markets are now pricing in possibly three more rate cuts this year after discounting no more rate cuts only a few weeks ago. So yes, we could get more interest rates. I think the government is going to pull all the stops out here to head off a corona-induced recession.

Q: Once your options expire, is it still affected by after-hours trading?

A: If you read the fine print on an options contract, they don’t actually expire until midnight on a Saturday night after options expiration day, even though the stock market stops trading on a Friday. I’ve never heard of a Saturday exercise, but you may have to get a batch of lawyers involved if you ever try that.

Q: What’s the worst-case scenario for this correction?

A: Everything goes down to their 200-day moving averages, including Indexes and individual stocks. You’re talking about Apple dropping to $243 and Microsoft (MSFT) to $144, and NASDAQ (QQQ) to 8,387. That could tale the Dow Average (INDU) to maybe 24,000, giving up all the 2019 gains.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

February 14, 2020

Fiat Lux

Featured Trade:

(FEBRUARY 12 BIWEEKLY STRATEGY WEBINAR Q&A)

(SQ), (TSLA), (FB), (GILD), (BA), (CRSP), (CSCO), (GLD)

(FEYE), (VIX), (VXX), (USO), (LYFT), (UBER)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader February 12 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: What do you think about Facebook (FB) here? We’ve just had a big dip.

A: We got the dip because of a double downgrade in the stock from a couple of brokers, and people are kind of nervous that some sort of antitrust action may be taken against Facebook as we go into the election. I still like the stock long term. You can’t beat the FANGs!

Q: If Bernie Sanders gets the nomination, will that be negative for the market?

A: Absolutely, yes. It seems like after 3 years of a radical president, voters want a radical response. That said, I don't think Bernie will get the nomination. He is not as popular in California, where we have a primary in a couple of weeks and account for 20% of total delegates. I think more of the moderate candidates will come through in California. That's where we see if any of the new billionaire outliers like Michael Bloom or Tom Steyer have any traction. My attitude in all of this is to wait for the last guy to get voted off the island—then ask me what's going to happen in October.

Q: When should we come back in on Tesla (TSLA)?

A: It’s tough with Tesla because although my long-term target is $2,500, watching it go up 500% in seven months on just a small increase in earnings is pretty scary. It’s really more of a cult stock than anything else and I want to wait for a bigger pullback, maybe down to $500, before I get in again. That said, the volatility on the stock is now so high that—with the short interest going from 36% down to 20%—if we get the last of the bears to really give up, then we lose that whole 20% because it all turns into buying; and that could get us easily over $1,000. The announcement of a new $2 billion share offering is a huge positive because it means they can pay off debt and operate with free capital as they don’t pay a dividend.

Q: Is Square (SQ) a good buy on the next 5% drop?

A: I would really wait 10%—you don't want to chase trades with the market at an all-time high. I would wait for a bigger drop in the main market before I go aggressive on anything.

Q: What about CRISPR Technology (CRSP) after the 120% move?

A: We’ve had a modest pullback—really more of a sideways move— since it peaked a couple of months ago; and again, I think the stock either goes much higher or gets taken over by somebody. That makes it a no-lose trade. The long sideways move we’re having is actually a very bullish indication for the stock.

Q: If Bernie is the candidate and gets elected, would that be negative for the market?

A: It would be extremely negative for the market. Worth at least a 20% downturn. That said, according to all the polling I have seen, Bernie Sanders is the only candidate that could not win against Donald Trump—the other 15 candidates would all beat Trump in a 1 to 1 contest. He's also had one heart attack and might not even be alive in 6 months, so who knows?

Q: I just closed the Boeing (BA) trade to avoid the dividend hit tomorrow. What do you think?

A: I’m probably going to do the same, that way you can avoid the random assignments that will stick you with the dividend and eat up your entire profit on the trade.

Q: When do you update the long-term portfolio?

A: Every six months; and the reason for that is to show you how to rebalance your portfolio. Rebalancing is one of the best free lunches out there. Everyone should be doing it after big moves like we’ve seen. It’s just a question of whether you rebalance every six months or every year. With stocks up so much a big rebalancing is due.

Q: I have held onto Gilead Sciences (GILD) for a long time and am hoping they’ll spend their big cash hoard. What do you think?

A: It’s true, they haven’t been spending their cash hoard. The trouble with these biotech stocks, and why it's so hard to send out trade alerts on them, is that you’ll get essentially no movement on them for years and then they rise 30% in one day. Gilead actually does have some drugs that may work on the coronavirus but until they make another acquisition, don’t expect much movement in the stock. It’s a question of how long you are willing to wait until that movement.

Q: Is it time to get back into the iPath Series B S&P 500 VIX Short Term Futures ETN (VXX)?

A: No, you need to maintain discipline here, not chase the last trade that worked. It’s crucial to only buy the bottoms and sell the tops when trading volatility. Otherwise, time decay and contango will kill you. We’re actually close to the middle of the range in the (VXX) so if we see another revisit to the lows, which we could get in the next week, then you want to buy it. No middle-of-range trades in this kind of market, you’re either trading at one extreme or the other.

Q: Could you please explain how the Fed involvement in the overnight repo market affects the general market?

A: The overnight repo market intervention was a form of backdoor quantitative easing, and as we all know quantitative easing makes stocks go up hugely. So even though the Fed said this wasn't quantitative easing, they were in fact expanding their balance sheet to facilitate liquidity in the bond market because government borrowing has gotten so extreme that the public markets weren’t big enough to handle all the debt; that's why they stepped into the repo market. But the market said this is simply more QE and took stocks up 10% since they said it wasn't QE.

Q: What about Cisco Systems (CSCO)?

A: It’s probably a decent buy down here, very tempting. And it hasn't participated in the FANG rally, so yes, I would give that one a really hard look. The current dip on earnings is probably a good entry point.

Q: Should we buy the Volatility Index (VIX) on dips?

A: Yes. At bottoms would be better, like the $12 handle.

Q: When is the best time to exit Boeing?

A: In the next 15 minutes. They go ex-dividend tomorrow and if you get assigned on those short calls then you are liable for the dividend—that will eat up your whole profit on the trade.

Q: Do you like Fire Eye (FEYE)?

A: Yes. Hacking is one of the few permanent growth industries out there and there are only a half dozen listed companies that are cutting edge on security software.

Q: What are your thoughts on the timing of the next recession?

A: Clearly the recession has been pushed back a year by the 2019 round of QE, and stock prices are getting so high now that even the Fed has to be concerned. Moreover, economic growth is slowing. In fact, the economy has been growing at a substantially slower rate since Trump became president, and 100% of all the economic growth we have now is borrowed. If the government were running a balanced budget now, our growth would be zero. So, certainly QE has pushed off the recession—whether it's a one-year event or a 2-year event, we’ll see. The answer, however, is that it will come out of nowhere and hit you when you least expect it, as recessions tend to do.

Q: Would you buy gold (GLD) rather than staying in cash?

A: I would buy some gold here, and I would do deep in the money call spreads like I have been doing. I’ve been running the numbers every day waiting for a good entry point. We’re now at a sort of in between point here on call spreads because it’s 7 days to the next February expiration and about 27 days to the March one after that, so it's not a good entry point this week. Next week will look more interesting because you’ll start getting accelerated time decay for March working for you.

Q: When are you going to have lunch in Texas or Oklahoma?

A: Nothing planned currently. Because of my long-term energy views (USO), I have to bring a bodyguard whenever I visit these states. Or I hold the events at a Marine Corps Club, which is the same thing.

Q: Would you use the dip here to buy Lyft (LYFT)? It’s down 10%.

A: No, it’s a horrible business. It’s one of those companies masquerading as a tech stock but it isn’t. They’re dependent on ultra-low wages for the drivers who are essentially netting $5 an hour driving after they cover all their car costs. Moreover, treating them as part-time temporary workers has just been made illegal in California, so it’s very bad news for the stocks—stay away from (LYFT) and (UBER) too.

Q: Is the Fed going to cut interest rates based on the coronavirus?

A: No, interest rates are low enough—too low given the rising levels of the stock market. Even at the current rate, low-interest rates are creating a bubble which will come back to bite us one day.

Q: Household debt exceeded $14 trillion for the first time—is this a warning sign?

A: It is absolutely a warning sign because it means the consumer is closer to running out of money. Consumers make up 70% of the economy, so when 70% of the economy runs out of money, it leads to a certain recession. We saw it happen in ‘08 and we’ll see it happen again.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.