I am sitting here holed up in my office in San Francisco.

Lake Tahoe is being evacuated as the Caldor fire is only ten miles away and the winds are blowing towards it. The visibility there is no more than 500 yards. The ski resorts are pointing their snow cannons towards their buildings to ward off flames.

Conditions are not much better here in Fog City. We are under a “stay at home” order due to intense smoke and heat. Even here, the fire engines are patrolling by once an hour.

The Boy Scout trip got cancelled this weekend, so the girls are having a cooking competition, chocolate chip waffles versus a German chocolate cake.

To make matters worse, I have been typing with only one finger all week, thanks to the elbow surgery I had on Tuesday. Next time, I’ll think twice before taking down a 300-pound steer. When I told the doctor how I incurred this injury, he laughed. “At your age?”

Which leaves me to contemplate this squirrelly stock market of ours. I have always been a numbers guy. But the higher the indexes rise, the cheaper stocks get. That’s not supposed to happen, but that is the fact.

We started out 2021 with an S&P 500 price earnings multiple of 25X. Now, we are down to a lowly 21X and the (SPY) is 20% higher, rising from $360 to $450.25.

The analyst community, ever the lagging indicator that they are, had S&P forward earnings for 2022 all the way down to $175. They have been steadily climbing ever since and are now touching $200 a share.

This is what 20/20 hindsight gets you. That and $5 will get you a cup of coffee at Starbucks. It takes a madman like me to go out on a limb with high numbers and then be right.

So what follows an ever-cheaper market? A more expensive one. That means stocks will continue to my set-in-stone target of $475 for the (SPY) for yearend, and (SPY) earnings of over $200 per share.

It gets better.

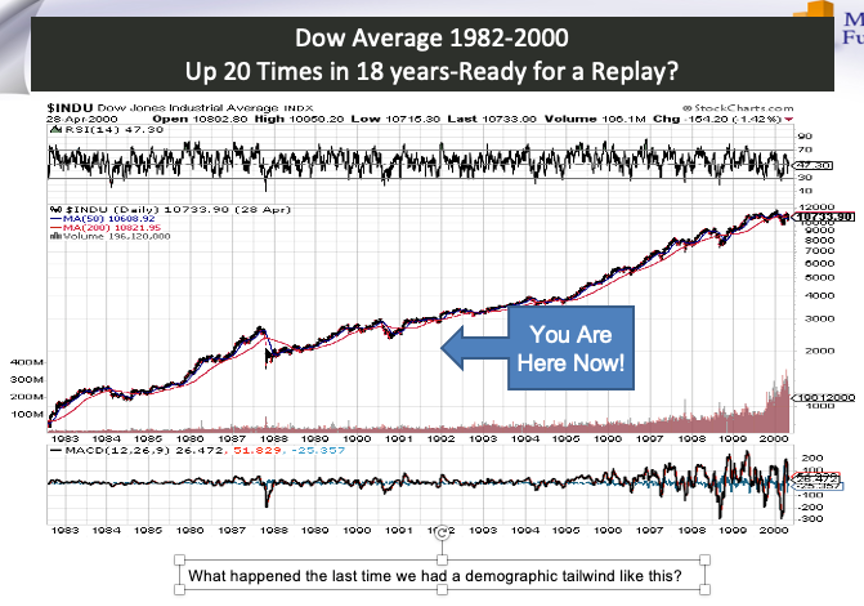

(SPY) earnings should hit $300 a share by 2025 and $1,400 a share by 2030. That makes possible my (SPY) target of $1,800 and my Dow Average target of 240,000 in a decade.

What are markets getting right that analysts and bears are getting wrong?

The future has arrived.

The pandemic brought forward business models and profitability by a decade. Technology is hyper-accelerating on all fronts.

Cycles are temporary but adoption is permanent. We are never going back to the old pre-pandemic economy. As a result, stocks are now worth a lot more than they were only two years ago.

So what do we buy now? There is a second reopening trade at hand, the post-delta kind. That means buying banks (JPM), (BAC), (C), brokers (GS), (MS), money managers (BLK), commodities (FCX), (X), hotels (WYNN), (MGM), airlines (ALK), (LUV), and energy (HAL), (SLB).

And what do we avoid like the plague? Bonds (TLT), which offer only confiscatory yields in the face of rising inflation with gigantic negative interest rates.

As for technology stocks, they will go sideways to up small in the aftermath of their ballistic moves of the past three months.

You all know that I am a history buff and there are particular periods of history that are starting to disturb me.

In August, we saw ten new intraday highs for the S&P 500 (SPY). That has not happened since 1987. Remember what happened in 1987?

We have not seen 11 new highs in August since 1929. The only negative three months seen since 1929 are August, September, and October. Remember what happened in 1929?

If that doesn’t scare the living daylights out of you, then nothing will. So, it seems we are in for some kind of correction, even if it’s just the 5% kind.

As for me, I’m looking forward to 2030.

The “Everything” Rally is on, according to my friend, Strategas founder Tom Lee. You can see it in the recent strength of epicenter stocks like energy, hotels, airlines, and casinos. It could run into 2022.

The Taper is this year and interest rate rises are later, said Jay Powell at Jackson Hole last week. Markets will be jumpy, especially bonds. Fed governor Jay Powell’s every word was parsed for meaning. Dove all the way. The larger focus will be on the August Nonfarm Payroll report out this week.

Pfizer Covid vaccination gets full FDA approval, requiring millions more to get shots and bringing forward the end of the pandemic. All 5 million government employees will now get vaccinated, including the entire military. It’s the fastest drug approval in history. Some 37,000 new cases in one day. The stock market likes it. Take profits on (PFE)

Bitcoin tops $50,000 after breaking several key technical levels to the upside. Next stop is a double top at $66,000. It helps that Coinbase is buying $500 million worth of crypto for its own portfolio. Buy (COIN) on dips.

The US Dollar will crash in coming years, says Jeffry Gundlach and I think he is right. Emerging markets will become the next big play but not quite yet. Gold (GLD) will be a great hideout once it comes out of hibernation. China will soon return to outperforming the US. The dollars reserve currency status is at risk.

The lumber crash is saving $40,000 per home, says Toll Brothers (TOL) CEO, Doug Yearly. Last year, lumber prices surged from $300 per board foot to an insane $1,700, thanks to a Trump trade war with Canada and soaring demand. It all flows straight through the bottom line of the homebuilders which should rally from here. Buy (TOL) on dips.

China’s crackdown creates investment opportunities, says emerging investing legend Mark Mobius. He sees corporate governance improving over the long term. The gems are to be found among smaller companies not affected by Beijing’s hard-line. Mobius loves India too.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

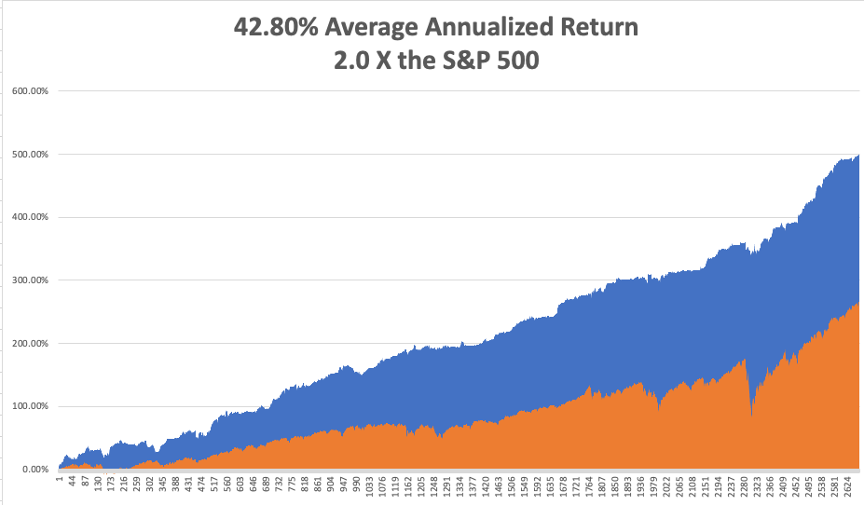

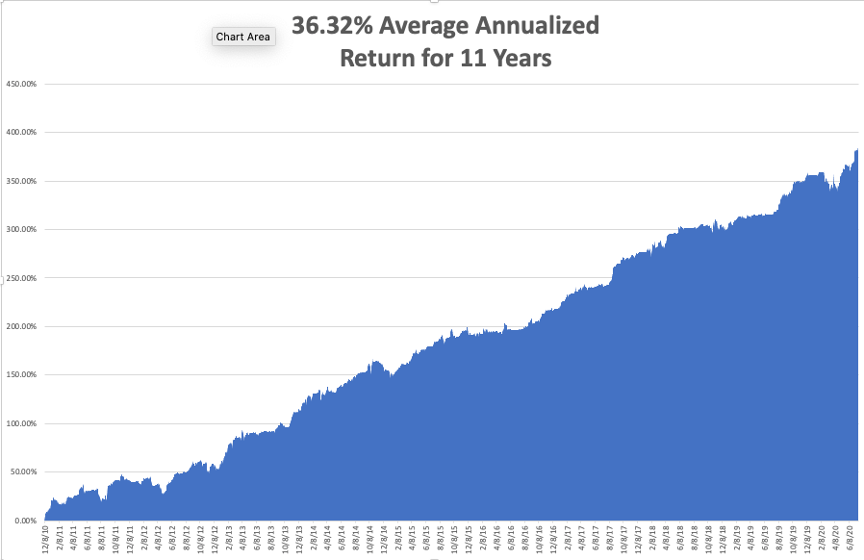

My Mad Hedge Global Trading Dispatch saw a healthy +7.62% gain in August. My 2021 year-to-date performance appreciated to 76.83%. The Dow Average was up 15.87% so far in 2021.

That leaves me 80% in cash at 20% in short (TLT) and long (SPY). I’m keeping positions small as long as we are at extreme overbought conditions.

That brings my 12-year total return to 499.38%, some 2.00 times the S&P 500 (SPX) over the same period. My 12-year average annualized return now stands at an unbelievable 42.80%, easily the highest in the industry.

My trailing one-year return popped back to positively eye-popping 116.67%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 39 million and rising quickly and deaths topping 638,000, which you can find here.

The coming week will bring our monthly blockbuster jobs reports on the data front.

On Monday, August 30 at 11:00 AM, Pending Home Sales are published. Zoom (ZM) reports.

On Tuesday, August 31, at 10:00 AM, S&P Case Shiller National Home Price Index for June is released. CrowdStrike (CRWD) reports.

On Wednesday, September 1 at 10:45 AM, the ADP Private Employment report is disclosed.

On Thursday, September 2 at 8:30 AM, Weekly Jobless Claims are announced. DocuSign (DOCU) reports.

On Friday, September 3 at 8:30 AM, the all-important August Nonfarm Payroll report is printed. At 2:00 PM, the Baker Hughes Oil Rig Count is disclosed.

Oh and the German chocolate cake won, but please don’t tell anyone.

As for me, given the losses in Afghanistan this week, I am reminded of my several attempts to get into this troubled country.

During the 1970s, Afghanistan was the place to go for hippies, adventurers, and world travelers, so of course, I made a beeline for straight for it.

It was the poorest country in the world, their only exports being heroin and the blue semiprecious stone lapis lazuli, and illegal export of lapis carried a death penalty.

Towns like Herat and Kandahar had colonies of westerners who spent their days high on hash and living life in the 14th century. The one cultural goal was to visit the giant 6th century stone Buddhas of Bamiyan 80 miles northwest of Kabul.

I made it as far as New Delhi in 1976 and was booked on the bus for Islamabad and Kabul ($25 one-way). Before I could leave, I was hit with amoebic dysentery.

Instead of Afghanistan, I flew to Sydney, Australia where I had friends and knew Medicare would take care of me for free. I spent two months in the Royal North Shore Hospital where I dropped 50 pounds, ending up at 125 pounds.

I tried to go to Afghanistan again in 2010 when I had a large number of followers of the Mad Hedge Fund Trader stationed there, thanks to the generous military high-speed broadband. The CIA waved me off, saying I wouldn’t last a day as I was such an obvious target.

So, alas, given the recent regime change, it looks like I’ll never make it to Afghanistan. I won’t live long enough to make it to the next regime change. It’s just one more concession I’ll have to make to my age. I’ll just have to content myself reading A One Thousand and One Nights at home instead. The Taliban blew up the stone Buddhas of Bamiyan in 2001.

In the meantime, I am on call for grief counseling for the Marine Corps for widows and survivors. Business has been thankfully slow for the last several years. But I’ll be staying close to the phone this weekend just in case.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

India in 1976