Global Market Comments

January 20, 2023

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

CLICK HERE to download today's position sheet.

Global Market Comments

January 20, 2023

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

CLICK HERE to download today's position sheet.

Some 50 years ago, when I was a biotechnology student at UCLA, a handful of graduate students speculated about how dangerous our work really was.

It only took us an hour to figure out how to synthesize a microbe that had a 99% fatality rate, was immune to antibiotics and was so simple it could be produced in your home kitchen.

Basically, a bunch of bored students discovered a way to destroy the world.

We voiced our concerns to our professors, who immediately convened a national conference of leaders in the field. Science had outpaced regulation, as it always does. They adopted standards and implemented safeguards to keep this genie from getting out of the bottle.

Four decades later scientists have been successful at preventing a “doomsday” bug from accidentally escaping a lab and wiping out the world’s population.

That is, until now.

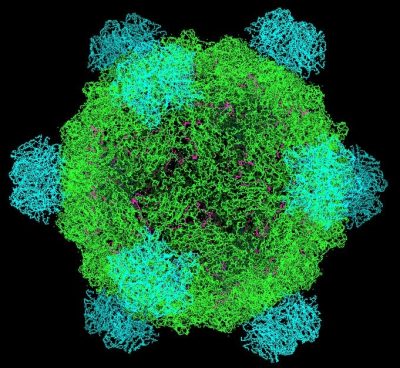

In 2010, Dr. Craig Venter created the first completely synthetic life form able to reproduce on its own. Named “Phi X174,” the simple virus was produced from a string of DNA composed entirely on a computer. Thus was invented the field of synthetic biology, better known as “Synbio.”

Venter’s homemade creature was your basic entry-level organism. Its DNA was composed of only 1 million base pairs of nucleic acids (adenine, thymine, cytosine, guanine, and uracil), compared to the 3 billion pairs in a human genome. Shortly thereafter, Venter one-upped himself by manufacturing the world’s first synthetic bacteria.

The work was hailed as the beginning of a brave new world that will enable biology to make the same dramatic advances in technology that computer science did in the 20th century. Dr. Drew Endy of Stanford University says that Synbio already accounts for 2% of US GDP and is growing at a breakneck 12% a year. He predicts that Synbio will eventually do more for the economy than the Internet and social media combined.

You may recall Craig Venter as the man who first decoded the human genome in 2003. The effort demanded the labor of thousands of scientists and cost $3 billion. We later learned that the DNA that was decoded was Craig’s own. Some five years later, the late Steve Jobs spent $1 million to decode his own genes in a vain attempt to find a cure for pancreatic cancer.

Today, you can get the job done for $1,000 in less than 24 hours. That’s what movie star Angelina Jolie did, who endured a voluntary double mastectomy when she learned her genes guaranteed a future case of terminal breast cancer.

The decoding industry is now moving to low-cost China, where giant warehouses have been built to decode the DNA of a substantial part of humanity. That should soon drop the price to $100. It’s all about full automation and economies of scale.

This technology is already spreading far faster than most realize. In 2004, MIT started the International Genetically Engineered Machine Contest where college students competed to construct new life forms. Recently, a high school division was opened, attracting 194 entries from kids in 34 countries. Gee, when I went to wood shop in high school, it was a big deal when I finished my table lamp.

This will make possible “big data” approaches to medical research that will lead to cures of every major human disease, such as cancer, heart disease, diabetes, and more within our lifetimes. This is why the healthcare (XLV), biotechnology (XBI), and pharmaceutical (XPH) sectors have been top performers in the stock market for the past two years. It’s not just about Obamacare.

The implications spread far beyond healthcare. IBM (IBM) is experimenting with using DNA-based computer code to replace the present simple but hugely inefficient binary system of 0’s and 1’s. “DNA-based computation” is prompting computer scientists to become biochemists and biochemists to evolve into computer scientists to create “living circuit boards.” Google (GOOG), Apple (AAPL), and Cisco (CSCO) have all taken notice.

We are probably only a couple of years away from enterprising hobbyists downloading DNA sequences from the Internet and building new bugs at home with a 3D printer. Simple organisms, like viruses, would need a file size no larger than one needed for a high-definition photo taken with your iPhone. They can then download other genes from the net, creating their own customized microbes at will.

This is all great news for investors of every stripe, and will no doubt accelerate America’s economic growth. But it is also causing governments and scientists around the world to wring their hands, seeing the opening of a potential Pandora’s box. What if other scientists lack Venter’s ethics, who went straight to President Obama for security clearance before he made his findings public?

If we can’t trust our kids to drink, drive, or vote, then how responsibly will they behave when they get their hands on potential bioterror weapons? How many are familiar with Bio Safety Level 4 (BSL) standards? None, I hope.

In fact, the race is already on to weaponize synbio. In 2002, scientists at SUNY Stonybrook synthesized a poliovirus for the first time. In 2005, another group managed to recreate the notorious H1N1 virus that caused the 1918 Spanish Flu epidemic. Some 50-100 million died in that pandemic within 2 years.

Then in 2011, Ron Fouchier of the Erasmus Medical Center in Holland announced that he had found a way to convert the H5N1 bird flu virus, which in nature is only transmitted from birds to people, into a human to human virus. Of the 565 who have come down with bird flu so far, which originates in China, 59% have died.

It didn’t take long for the Chinese to get involved. They have taken Fouchier’s work several steps further, creating over 127 H5N1 flu varieties, five of which can be transmitted through the air, such as from a sneeze. The attributes of one of these just showed up in the latest natural strain of bird flu, the H7N9.

The World Health Organization (WHO) and the Center for Disease Control (CDC) in Atlanta, Georgia are charged with protecting us from outbreaks like this. But getting the WHO, a giant global bureaucracy, to agree on anything is almost impossible unless there is already a major outbreak underway. The CDC has seen its budget cut by 25% since 2010 and has lost another 5% due to the US government sequester.

The problem is that the international organizations charged with monitoring all of this are still stuck in the Stone Age. Current regulations revolve around known pathogens, like smallpox and the Ebola virus, that date back to the 1960s when the concern was about moving lethal pathogens across borders via test tubes.

That is, oh so 20th century. Thanks to the Internet, controlling information flow is impossible. Just ask Muammar Gaddafi and Bashar Al Assad. Al Qaida has used messages embedded in online porn to send orders to terrorists.

Getting international cooperation isn’t that easy. Only 35 countries are currently complying with the safety, surveillance, and research standards laid out by the WHO. Indonesia refused to part with H5N1 virus samples spreading there because it did want to make rich the western pharmaceutical companies that would develop a vaccine. African countries say they are too poor to participate, even they are the most likely victims of future epidemics.

Scientists have proposed a number of safeguards to keep these new superbugs under control. One would be a dedicated sequence of nucleic acid base pairs inserted into the genes that would identify its origin, much like a bar code at the supermarket. This is already being used by Monsanto (MON) with its genetically modified seeds. Another would be a “suicide sequence” that would cause the germ to self-destruct if it ever got out of a lab.

One can expect the National Security Agency to get involved, if they haven’t done so already. If they can screen our phone calls for metadata, why not high-risk DNA sequences sent by email?

But this assumes that the creators want to be found. The bioweapon labs of some countries are thought to be creating new pathogens so they can stockpile vaccines and antigens in advance of any future conflict.

There are also the real terrorists to consider. When the Mubarak regime in Egypt was overthrown in 2011, demonstrators sacked the country’s public health labs that had been storing H5N1 virus. Egypt has one of the world’s worst bird flu problems, due to the population’s widespread contact with chickens.

It is hoped that the looters were only in search of valuable electronics they could resell, and tossed the problem test tubes. But that is only just a hope.

I have done a lot of research on this area over the decades. I even chased down the infamous Unit 731 of the Japanese Imperial Army that parachuted plagued infected rats into China during WWII, after first experimenting on American POWs.

The answer to the probability of biowarfare always comes back the same. Countries never use this last resort for fear of it coming back on their own population. It really is an Armageddon weapon. Only a nut case would want to try it.

Back in 1976, I was one of the fortunate few to see in person the last living cases of smallpox. As I walked through a 15th century village high in the Himalayas in Nepal, two dozen smiling children leaned out of second-story windows to wave at me. The face of everyone was covered with bleeding sores. And these were the survivors. Believe me, you don’t want to catch it yourself.

Sure, I know this doesn’t directly relate to what the stock market is going to do today. But if a virus escaped from a rogue lab and killed everyone on the planet, it would be bad for prices, wouldn’t it?

I really hope one of the kids competing in the MIT contest doesn’t suffer from the same sort of mental problems as the boy in Newton, Connecticut did.

Global Market Comments

December 30, 2020

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

Global Market Comments

December 30, 2019

Fiat Lux

Featured Trade:

(WILL SYNBIO SAVE OR DESTROY THE WORLD?),

(XLV), (XPH), (XBI), (IMB), (GOOG), (AAPL), (CSCO), (BIIB)

Global Market Comments

November 1, 2019

Fiat Lux

Featured Trade:

(OCTOBER 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(SQ), (CCI), (SPG), (PGE), (BA), (MSFT), (GOOGL), (FB), (AAPL), (IBB), (XLV), (USO), (GM), (VNQ)

Below please find subscribers’ Q&A for the Mad Hedge Fund Trader October 30 Global Strategy Webinar broadcast from Silicon Valley, CA with my guest and co-host Bill Davis of the Mad Day Trader. Keep those questions coming!

Q: Would you buy Square (SQ) around here?

A: I don’t want to buy anything around here—that’s why I’m 90% cash. Would I buy Square on a market selloff? Absolutely, it's one of our favorite fintech stocks for the long term. The fintech stocks are eating the lunch of the legacy banks at an accelerating rate.

Q: What's the best yield play currently, now that bonds have gone so high?

A: High-quality REITs—especially cell tower REITs. We’re going to get a significant increase in the number of cell towers, thanks to 5G, and there are REITs specifically dedicated to cell phone towers. An example is Crown Castle (CCI), which has a generous 3.45% dividend yield. The worst REITs are the mall-based like Simon Property Group (SPG).

Q: PG&E (PGE) has just had a huge selloff of 50%. Should I buy it now or is it a potential zero?

A: I wouldn’t touch PG&E at all—They’re already in bankruptcy, and they are now accepting responsibility for starting another eight fires this week, including the big Kincaid fires. You could have the state government take over the company and wipe out all the shareholders— the liabilities are just growing by the second, so I would turn my attention elsewhere. Don’t reach for new ways to get in trouble.

Q: Regarding Boeing (BA), it looks like you caught the bottom on the last dip—should I buy it here or wait for another dip?

A: Wait for another dip. The company seems to have an endless supply of bad news. That said, if we visit $325 a share one more time, I would buy it again. We caught about a $10 dollar move in Boeing to the upside. Keep buying the dips. The bad news story on this is almost over.

Q: Do you think the earnings season will be better than expected? If so, which sectors do you think will outperform?

A: It’s always better than expected because they always downgrade right before earnings, so everything is a surprise to the upside. Some 80% of all stocks surprise to the upside every quarter. And what would I be buying on dips? Big Tech. Especially things like Apple (AAPL), Facebook (FB), Alphabet (GOOGL), and Microsoft (MSFT) —that is where the only reliable longer-term growth is in the economy. If you want to buy cheap companies on dips, go for Biotech (IBB) and Health Care (XLV), which have gone up almost every day since we launched the Biotech letter a month ago. To subscribe to the Mad Hedge Biotech and Healthcare Letter, please click here.

Q: What does it mean that the Chile APEC summit is cancelled? What is Trump going to do now for signing on the trade deal?

A: There may not be a trade deal. It's another postponement and could be another trigger for a long-overdue selloff in the market. We've basically been going up nonstop now for 2½ months, and almost everyone's market timing indicators are saying extreme overbought territory here, including ours.

Q: Will there be a replay of this webinar posted?

A: Yes, we always post these on the website a couple of hours after it airs. Some 95% of our viewers watch the recordings, especially those overseas in weird time zones like Australia and India. You need to be logged in to access it. Just go to www.madhedgefundtrader.com, log in, go to My Account, then Global Trading Dispatch, then click on the Webinars button. It’s there in all its glory.

Q: Does Invesco DB US Dollar Index Bullish Fund ETF (UUP) make sense (the dollar basket)?

A: No, I'm staying out of the currency market because there are no clear trends right now and there are much clearer trends in other asset classes, like stock and bonds.

Q: How do you see General Electric (GE)?

A: There are a lot of people shouting accounting fraud like Harry Markopolos, the whistleblower on Bernie Madoff. Sure, they had a good today, up a buck, but their problems are going to take a long time to fix. So, don't think of this as a trading vehicle, but rather a long-term investment vehicle.

Q: Could the Saudi Aramco IPO push the price of oil up?

A: You can bet they're going to do everything humanly possible to get the price of oil (USO) up and to get this IPO off their hands—that's why you shouldn't buy the IPO. The Saudis are desperate to get out of the oil business before prices go to zero and are pouring money into alternative energy and technology through Masayoshi Son’s Vision Fund. When you have the chief supplier of oil rigging the price, you don’t want to be anywhere near the distributor and that’s Saudi Aramco.

Q: What about selling the (SPG) (Simon Property) REIT?

A: It’s kind of too late to sell, but what you might think of doing is selling short just one deep out-of-the-money put, just to bring in a small amount of income. These things don’t crash, they grind down; so, it could be a good naked put shorting situation, but only on a very small scale. If you want to play REITs on the long side, look at the Vanguard Real Estate ETF (VNQ), which pays a handy 3.12% dividend. Guess what its largest holdings are? 5G cell tower REITs.

Q: Is General Motors (GM) a buy on the union detent?

A: Only for a trade, but not much; the auto industry is the last thing you want to buy into going into a recession, even just a growth recession.

Q: Have we topped out on Apple (AAPL) for the year at $250?

A: If we did, it’s probably just short term. Remember their 5G phone is coming out next September and I expect the stock to go to $300 dollars just off of that. Any dips in Apple won’t last more than a month or two.

Q: Could we get another leg up for the end of the year?

A: Yes, not much, maybe another 5% from here, and I wouldn't do that until we get another 5% drop in the market first which should happen sometime in November. If that happens, then you’ll have a shot at making another 10% by the end of the year, which is exactly what I plan on doing for myself. That would take our 2019 performance from 50% to 60%.

Q: Is the Fed’s printing infinite money going to lead to runaway inflation crashing the value of the dollar?

A: Yes, but it may take us a couple of years to get to that point. So far, no sign of inflation, except inflation of things you want to buy, like healthcare, a college education, and so on. For anything you want to sell, like your labor or service, the prices are collapsing. That’s the new inflation, the type that screws you the most.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

October 17, 2019

Fiat Lux

Featured Trade:

(UPDATING THE MAD HEDGE LONG TERM MODEL PORTFOLIO),

(USO), (XLV), (CI), (CELG), (BIIB), (AMGN), (CRSP), (IBM), (PYPL), (SQ), (JPM), (BAC), (EEM), (DXJ), (FCX), (GLD)

Global Market Comments

October 3, 2019

Fiat Lux

Featured Trade:

(GOOGLE’S MAJOR BREAKTHROUGH IN QUANTUM COMPUTING),

(GOOGL), (IBM)

(AI AND THE NEW HEALTHCARE),

(XLV), (BMY), (AMGN)

The first major industry to be fundamentally disrupted by artificial intelligence will be healthcare, America’s last 19th-century industry.

Major diseases are being cured at such a dramatic pace that if you can survive the next decade, chances are you can live forever.

DNA is the software of life and spending $3 billion to decode it by 2003 was the best investment the U.S. government ever made.

These are the opinions expressed by longtime friend Dr. Ray Kurzweil. These ideas may seem like the ravings of a mad lunatic. However, Kurzweil long ago became used to such criticisms. The funny thing is, his very long-term predictions have a nasty habit of coming true.

For Kurzweil is the head of engineering at Google (GOOG), the co-founder of the Singularity University, and an early AI evangelist.

The outer shell of the human brain, the neocortex, is where we do all of our higher thinking, problem-solving and imagining. It first appeared in our pre-mammalian ancestors some 200 million years ago.

The neocortex enjoyed a sudden growth spurt 2 million years ago for reasons no one understands. Maybe that’s when we came out of the trees. This gave homo sapiens a huge advantage over all other life forms on earth.

The next step in our intellectual evolution will be carried out by AI. By connecting our neocortex to the Internet, we will improve our intelligence by a billion-fold. Imagine everyone you come in contact with is a billion times smarter than they are today.

Ironically, such advances in human bionic connections have been greatly advanced by our recent wars in the Middle East, which created large numbers of quadriplegic veterans desperate for contact with the outside world.

Defense research dollars have poured in to meet this need. Last year, I saw a classified video of a disabled soldier operating a computer just by thinking about keystrokes.

Kurzweil calls such a connection the Singularity, where humans and computers become one. He envisions this taking place on a large scale by the mid-2040s.

We already know how this will affect civilization because the billion-fold improvement in intelligence is already available in our hand in the form of a smartphone. All that is missing is the human/machine connection.

Over the past 1,000 years, human life expectancy has improved fourfold, from 19 to 80. As a result, a raft of new diseases has appeared only in the past century that show up late in life, such as cancer, diabetes, arthritis, Parkinson’s disease, and dementia.

The problem with this is that a millennium is but a nanosecond in the course of human evolution. Human T-cells have not had the time to evolve to fend off an attack from a cancer cell, which is why the disease is ravaging the human race today. Cancer rates are up exponentially from the 19th century.

Fortunately, there is a way to speed up the evolutionary process. Microscopic nanobots the size of red blood cells can be designed to go after specific cancers, and then injected in swarms in your bloodstream to attack them.

Such technologies require precise manufacturing at the atomic level and will be available in the early 2030s. I have seen pictures of such nanobots myself under an electron microscope in the scientific literature.

Alternatively, with some diseases, such as diabetes, all we need to do is to reprogram our software (DNA) to produce more insulin. This can be done with monoclonal antibodies, whereby a length of bad DNA is excised and a good one installed.

By the end of 2017, the Food and Drug Administration had approved nearly 100 such molecules to deal with a whole range of genetic diseases. Click here for the list.

Such advances will soon lead to what Kurzweil calls “Longevity Escape Velocity,” where advances in medical research are taking place faster than the natural aging process. Then we will only have to deal with senescence cells, which are internally programmed to turn themselves off at a certain age. Presumably, monoclonal antibodies will be able to turn these back on as well.

Of course, the investment implications of all of this will be prodigious. Perhaps, that’s why the shares of the entire healthcare sector (XLV) and big pharma (XPH) have been on an absolute tear for the past two years.

I believe that technology and healthcare stocks will overwhelmingly be the major outperformers over the next two decades. We are seeing the profits from these revolutionary advances sill into companies such as Pfizer (PFE), Bristol Myers Squibb (BMY), and Merck (MRK).

However, all the healthcare advances in the world are not going to help you if you keep eating cheeseburger for lunch every day. One study I always like to cite took place during WWII when the global food supply shrank dramatically, and everyone was put on a strict mandatory diet. The incidence of every major disease fell by 30%.

At the end of the day, plenty of sleep, healthy eating, and exercise will always remain the greatest life extenders. Kurzweil himself has been an ardent vegetarian for most of his life.

As for me, I rather have a good steak once a month and settle for living only to 120.

Keep renewing those newsletter subscriptions!

Global Market Comments

May 17, 2019

Fiat Lux

Featured Trade:

(APRIL 15 BIWEEKLY STRATEGY WEBINAR Q&A),

(MSFT), (GOOGL), (AAPL), (LMT), (XLV), (EWG), (VIX), (VXX), (BA), (TSLA), (UBER), (LYFT), (ADBE),

(HOW TO HANDLE THE FRIDAY, MAY 17 OPTIONS EXPIRATION), (INTU),

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.