"If you're gonna make connections which are innovative... you have to not have the same bag of experiences as everyone else does," - said the former co-founder of Apple, Steve Jobs.

Mad Hedge Technology Letter

December 31, 2018

Fiat Lux

Featured Trade:

(NEWSPAPERS REALLY KNOW WHO YOU ARE),

(TPCO), (AMZN), (FB), (GOOGL), (USPS), (SFTBY)

Mad Hedge Technology Letter

December 27, 2018

Fiat Lux

Featured Trade:

(THE ARTIFICIAL INTELLIGENCE CONUNDRUM),

(TSLA), (AMZN), (FB)

Anti-A.I. physicist Professor Stephen Hawking was a staunch supporter of preserving human interests against the future existential threat from machines and artificial intelligence (A.I.).

He was diagnosed with motor neuron disease, more commonly known as Lou Gehrig's disease, in 1963 at the age of 21 and sadly passed away March 14, 2018 at the age of 76.

Famed for his work on black holes, Professor Hawking represented the human quest to maintain its superiority against quickly advancing artificial acculturation.

His passing was a huge loss for mankind as his voice was a deterrent to A.I.'s relentless march to supremacy. He was one of the few who had the authority to opine on these issues. Gone is a voice of reason.

Critics have argued that living with A.I. poses a red alert threat to privacy, security, and society as a whole. Unfortunately, those most credible and knowledgeable about A.I. are tech firms. They have shown that policing themselves on this front is remarkably unproductive.

Mark Zuckerberg, CEO of Facebook (FB), has labeled naysayers as "irresponsible" and dismissed the threat. After failing to prevent Russian interference in the last election, he is exhibiting the same defensive posture translating into a de facto admission of guilt. His track record of shirking accountability is becoming a trend.

Share prices will materially nosedive if A.I. is stonewalled and development stunted. Many CEOs who stake careers on doubling or tripling down on A.I. cannot see it die out. There is too much money to lose.

The world will see major improvements in the quality of life in the next 10 years. But there is another side to the coin which Zuckerberg and company refuse to delve into...the dark side of technology.

Defective Amazon (AMZN) Alexa recently produced unexplained laughter because of a mistaken command to start laughing. Despite avoiding calamity, these small events show the magnitude of potential chaos capable of haywire A.I. functions. If one day a user attempts to order a box of tissues and Alexa burns down the house, who is liable?

Tesla's (TSLA) CEO Elon Musk has shared his anxiety about robots flipping the script on humans. Elon acknowledges that A.I. and autonomous vehicles are important factors in the battle for new technology. The winner is yet to be determined as China has bet the ranch with unlimited resources from Chairman Xi.

The quagmire with China has been squarely centered around the great race for technological supremacy.

A.I. is the ultimate X factor in this race and whoever can harness and develop the fastest will win.

Musk has hinted that robots and humans could merge into one species in the future. Is this the next point of competition among tech companies? The future is murky at best.

Bill Gates noted that robots should be taxed like humans. This reflects the bubble in which the ultra-elite reside. This comment implies that humans and robots are at the same level. It shows a severe lack of empathy for the 40% of working Americans who will be replaced by machines over the next 10 years.

The West is comprised of a deeply hierarchical system of winners and losers. Hawking's premise that evolution has inbuilt greed can be found in the underpinnings of America's economic miracle.

Wall Street has bred a culture that is entirely self-serving regardless of the bigger system in which it finds itself.

Most of us are participating in this perpetual money game chase because our system treats it as a natural part of life. A.I. will help more people do well in this paper chase to the detriment of the majority.

Quarterly earnings performance is paramount for CEOs. Return value back to shareholders or face the sack in the morning. It's impossible to convince anyone that America's capitalist model is deteriorating in the greatest bull market of all time.

Wall Street has an insatiable hunger for cutting-edge technology from companies that sequentially beat earnings and raise guidance. Flourishing technology companies enrich the participants creating a Teflon-like resistance to downside market risk.

The issue with Professor Hawking's work is that his timeframe is too far in the future. Professor Hawking was probably correct, but it will take 25 years to prove it.

The world is quickly changing as science fiction becomes reality. The year 2019 will signal the real beginning of A.I. in tangible form when autonomous fleets flood main streets and is another step in the direction of human's overreliance on machines.

People on Wall Street are a product of the system in place and earn a tremendous amount of money because they proficiently execute a specialized job. Traders are busy focusing on how to move ahead of the next guy.

Firms building autonomous cars are free to operate as is. Hyper-accelerating technology spurs on the development of A.I., machine learning, and enhanced algorithms. Record profits will topple, and investors will funnel investments back into an even narrower grouping of technology stocks after the weak hands are flushed out.

Professor Hawking said we need to explore our technological capabilities to the fullest in order to avoid extinction. In 2018, exploring these new capabilities still equals monetizing through the medium of products and services.

This is all bullish for equities as the leading companies associated with A.I. will not be subject to any imminent regulation, blowback, or government intervention.

And let me remind you that technology is still the least regulated industry on the planet.

It has its cake and is eating it too. Hence, technology is starting to cross over into other industries demonstrating the powerful footprint tech has extracted in economics and the stock market.

The only solution is keeping companies accountable by a function of law or creating a third-party task force to regulate A.I. In 2018, the thought of overseeing robots sounds crazy.

However, by 2019, it might be as normal as uncontrollable laughter from your smart home.

"The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge," said the late Professor Stephen Hawking.

Mad Hedge Technology Letter

December 27, 2018

Fiat Lux

Featured Trade:

(THE HIGH COST OF DRIVING OUT

OUR FOREIGN TECHNOLOGISTS),

(EA), (ADBE), (BABA), (BIDU), (FB), (GOOGL), (TWTR)

There is only so much juice you can squeeze from a lemon before nothing is left.

Silicon Valley has been focused mainly on squeezing the juice out of the Internet for the past 30 years with intense focus on the American consumer.

In an era of minimal regulation, companies grew at breakneck speeds right into families' living quarters and it was a win-win proposition for both the user and the Internet.

The cream of the crop ideas was found briskly and the low hanging fruit was pocketed by the venture capitalists (VCs).

That was then, and this is now.

No longer will VCs simply invest in various start-ups and 10 years later a Facebook (FB) or Alphabet (GOOGL) appears out of thin air.

That story is over. Facebook was the last one in the door.

VCs will become more selective because brilliant ideas must withstand the passage of time. Companies want to continue to be relevant in 20 or 30 years and not just disintegrate into obsolescence as did the Eastman Kodak Company, the doomed maker of silver-based film.

The San Francisco Bay Area is the mecca of technology but recent indicators have presaged the upcoming trends that will reshape the industry.

In general, a healthy and booming local real estate sector is a net positive creating paper wealth for its local people and attracting money slated for expansion.

However, it's crystal clear the net positive has flipped and housing is now a buzzword for the maladies young people face to sustain themselves in the ultra-expensive coastal Northern California megacities.

The loss of tax deductions in the recent tax bill makes conditions even more draconian.

Monthly rental costs are deterring tech's future minions. Without the droves of talent flooding the area, it becomes harder for the industry to incrementally expand.

It also boosts the costs of existing development/operations staffers whose capital feeds back into the local housing market buying whatever they can barely afford for astronomical prices.

Another price spike ensues with first-time home buyers piling into already bare-bones inventory because of the fear of missing out (FOMO).

After surveying HR tech heads, it's clear there aren't enough artificial intelligence (A.I.) programmers and coders to fill internal projects.

Compounding the housing crisis is the change of immigration policy that has frightened off many future Silicon Valley workers.

There is no surprise that millions of aspiring foreign students wish to take advantage of America's treasure of higher education because there is nothing comparable at home.

The best and brightest foreign minds are trained in America and a mass exodus would create an even fiercer deficit for global dev-ops talent.

These U.S.-trained foreign tech workers are the main drivers of foreign tech start-ups.

Dangling carrots and sticks for a chance to start an embryonic project in the cozy confines of home is hard to pass up.

Ironically enough, there are more A.I. computer scientists of Chinese origin in America than there are in all of China.

There is a huge movement by the Chinese private sector to bring everyone back home as China vies to become the industry leader in A.I.

Silicon Valley is on the verge of a brain drain of mythical proportions.

If America allows all these brilliant minds to fly home not only to China but everywhere else, America is just training these workers to compete against American workers.

A premier example is Baidu co-founder Robin Li who received his master's degree in computer science from the State University of New York at Buffalo in 1994.

After graduation, his first job was at Dow Jones & Company, a subsidiary of News Corp., writing code for the online version of the Wall Street Journal.

During this stint, he developed an algorithm for ranking search results that he patented, flew back to China, created the Google search engine equivalent, and named it Baidu (BIDU).

Robin Li is now one of the richest people in China with a fortune of close to $20 billion.

To show it's not just a one-hit-wonder type scenario, three of the top five start-ups are currently headquartered in Beijing and not in California.

The most powerful industry in America's economy is just a transient training hub for foreign nationals before they go home to make the real moola.

More than 70% of tech employees in Silicon Valley and more than 50% in the San Francisco Bay Area are foreign, according to the 2016 census data.

Adding insult to injury, the exorbitant cost of housing is preventing burgeoning American talent from migrating from rural towns across America and moving to the Bay Area.

They make it as far West as Salt Lake City, Reno, or Las Vegas.

Instead of living a homeless life in Golden Gate Park, they decide to set up shop in a second-tier American city after horror stories of Bay Area housing starts to populate their friends' Instagram feeds and are shared a million times over.

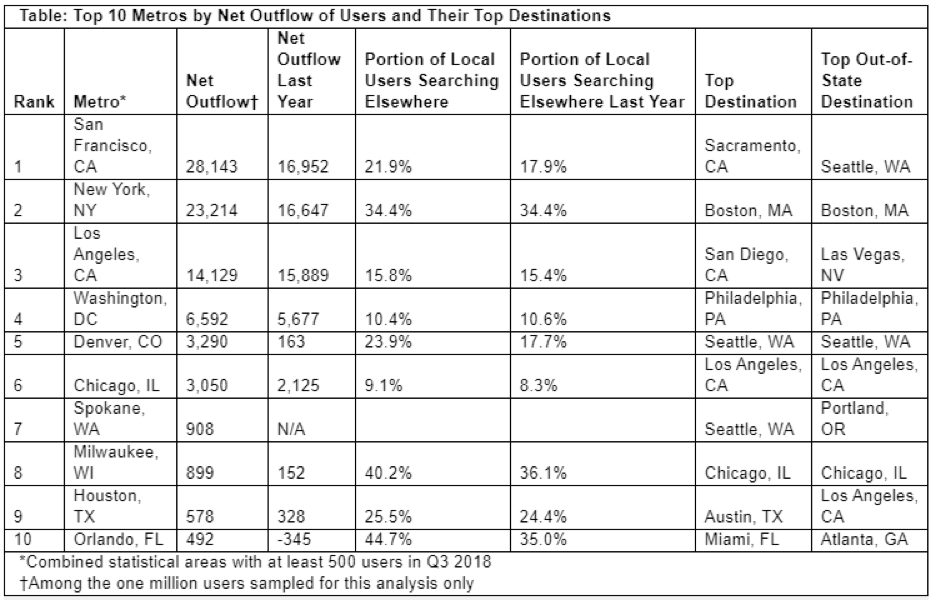

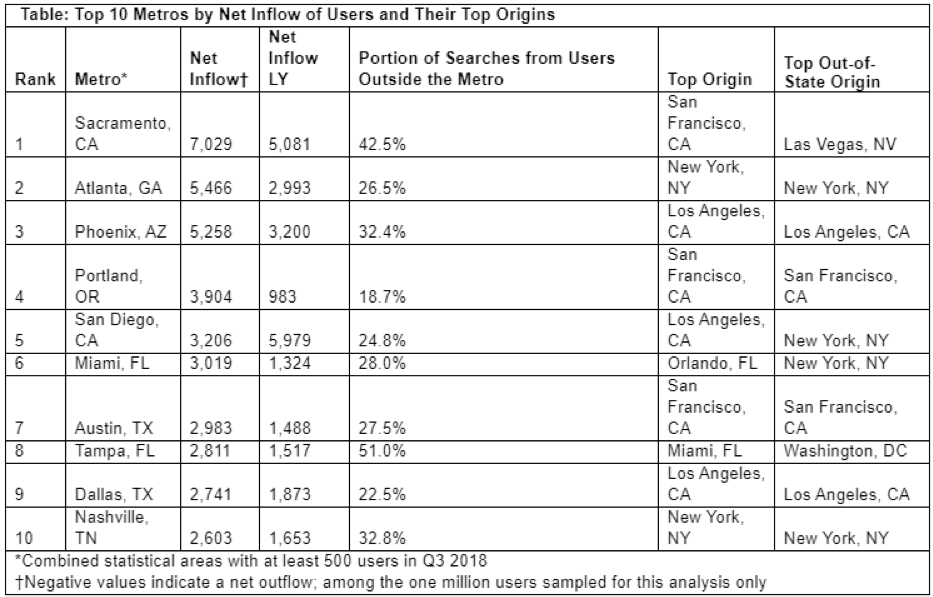

This trend was reinforced by domestic migration statistics.

Between 2007 and 2016, 5 million people moved to California, and 6 million people moved out of the state.

The biggest takeaways are that many of these new California migrants are from New York, possess graduate degrees, and command an annual salary of more than $110,000.

Conversely, Nevada, Arizona, and Texas have major inflows of migrants that mostly earn less than $50,000 per year and are less educated.

That will change in the near future.

Ultimately, if VCs think it is expensive now to operate a start-up in Silicon Valley, it will be costlier in the future.

Pouring gasoline on the flames, Northern California schools are starting to fold like a house of cards due to minimal household formation wiping out student numbers.

The dire shortage of affordable housing is the region's No. 1 problem.

A 1,066-sq.-ft. property in San Jose's Willow Glen neighborhood went on sale for $800,000.

This would be considered an absolute steal at this price but the catch is the house was badly burned two years ago. This is the price for a teardown.

When you combine the housing crisis with the price readjustment for big data, it looks as if Silicon Valley has peaked or at the very least, it's not cheap.

Yes, the FANGs will continue their gravy train but the next big thing to hit tech will not originate from California.

VCs will overwhelmingly invest in data over rental bills. The percolation of tech ingenuity will likely pop up in either Nevada, Arizona, Texas, Utah, or yes, even Michigan.

Even though these states attract poorer migrants, the lower cost of housing is beginning to attract tech professionals who can afford more than a burned down shack.

Washington state has become a hotbed for bitcoin activity. Small rural counties set in the Columbia Basin such as Chelan, Douglas, and Grant used to be farmland.

The bitcoin industry moved three hours east of Seattle for one reason and one reason only - cost.

Electricity is five times cheaper there because of fluid access to plentiful hydro-electric power.

Many business decisions come down to cost, and a fractional advantage of pennies.

Globalization has supercharged competition, and technology is the lubricant fueling competition to new heights.

Once millennials desire to form families, the only choices are regions where housing costs are affordable and areas that aren't bereft of tech talent.

Cities such as Las Vegas and Reno in Nevada; Austin, Texas; Phoenix, Arizona; and Salt Lake City, Utah, will turn into hotbeds of West Coast growth engines just as Hangzhou, China-based Alibaba (BABA) turned that city into more than a sleepy backwater town with a big lake at its center.

The overarching theme of decentralizing is taking the world by storm. The built-up power levers in Northern California are overheated, and the decentralization process will take many years to flow into the direction of these smaller but growing cities.

Salt Lake City, known as Silicon Slopes, has been a tech magnet of late with big players such as Adobe (ADBE), Twitter (TWTR), and EA Sports (EA) opening new branches there while Reno has become a massive hotspot for data server farms. Nearby Sparks hosts Tesla's Gigafactory 1 along with massive data centers for Apple, Alphabet, and Switch.

The half a billion-dollars required to build a proper tech company will stretch further in Austin or Las Vegas, and most of the funds will be reserved for tech talent - not slum landlords.

The nail in the coffin will be the millions saved in state taxes.

The rise of the second-tier cities is the key to staying ahead of the race for tech supremacy.

"Twitter is about moving words. Square is about moving money," - said CEO of Twitter, Jack Dorsey, to The New Yorker, October 2013

Mad Hedge Technology Letter

December 24, 2018

Fiat Lux

Featured Trade:

(THE CLOUD FOR DUMMIES)

(AMZN), (MSFT), (GOOGL), (AAPL), (CRM), (ZS)

If you've been living under a rock the past few years, the cloud phenomenon hasn't passed you by and you still have time to cash in.

You want to hitch your wagon to cloud-based investments in any way, shape or form.

Microsoft's (MSFT) pivot to its Azure enterprise business has sent its stock skyward, and it is poised to rake in more than $100 billion in cloud revenue over the next 10 years.

Microsoft's share of the cloud market rose from 10% to 13% and is catching up to Amazon Web Services (AWS).

Amazon leads the cloud industry it created and the 49% growth in cloud sales from 42% in Q3 2017 is a welcome sign that Amazon is not tripping up.

It still maintains more than 30% of the cloud market. Microsoft would need to gain a lot of ground to even come close to this jewel of a business.

Amazon (AMZN) relies on AWS to underpin the rest of its businesses and that is why AWS contributes 73% to Amazon's total operating income.

Total revenue for just the AWS division is an annual $5.5 billion business and would operate as a healthy stand-alone tech company if need be.

Cloud revenue is even starting to account for a noticeable share of Apple's (AAPL) earnings, which has previously bet the ranch on hardware products.

The future is about the cloud.

These days, the average investor probably hears about the cloud a dozen times a day. If you work in Silicon Valley you can triple that figure.

So, before we get deep into the weeds with this letter on cloud services, cloud fundamentals, cloud plays, and cloud Trade Alerts, let's get into the basics of what the cloud actually is.

Think of this as a cloud primer.

It's important to understand the cloud, both its strengths and limitations. Giant companies that have it figured out, such as Salesforce (CRM) and Zscaler (ZS), are some of the fastest growing companies in the world.

Understand the cloud and you will readily identify its bottlenecks and bulges that can lead to extreme investment opportunities. And that's where I come in.

Cloud storage refers to the online space where you can store data. It resides across multiple remote servers housed inside massive data centers all over the country, some as large as football fields, often in rural areas where land, labor, and electricity are cheap.

They are built using virtualization technology, which means that storage space spans across many different servers and multiple locations. If this sounds crazy, remember that the original Department of Defense packet-switching design was intended to make the system atomic bomb proof.

As a user, you can access any single server at any one time anywhere in the world. These servers are owned, maintained and operated by giant third-party companies such as Amazon, Microsoft, and Alphabet (GOOGL), which may or may not charge a fee for using them.

The most important features of cloud storage are:

1) It is a service provided by an external provider.

2) All data is stored outside your computer residing inside an in-house network.

3) A simple Internet connection will allow you to access your data at any time from anywhere.

4) Because of all these features, sharing data with others is vastly easier, and you can even work with multiple people online at the same time, making it the perfect, collaborative vehicle for our globalized world.

Once you start using the cloud to store a company's data, the benefits are many.

- No Maintenance

Many companies, regardless of their size, prefer to store data inside in-house servers and data centers.

However, these require constant 24-hour-a-day maintenance, so the company has to employ a large in-house IT staff to manage them - a costly proposition.

Thanks to cloud storage, businesses can save costs on maintenance since their servers are now the headache of third-party providers.

Instead, they can focus resources on the core aspects of their business where they can add the most value, without worrying about managing IT staff of prima donnas.

- Greater Flexibility

Today's employees want to have a better work/life balance and this goal can be best achieved by letting them telecommute. Increasingly, workers are bending their jobs to fit their lifestyles, and that is certainly the case here at Mad Hedge Fund Trader.

How else can I send off a Trade Alert while hanging from the face of a Swiss Alp?

Cloud storage services, such as Google Drive, offer exactly this kind of flexibility for employees. According to a recent survey, 79% of respondents already work outside of their office some of the time, while another 60% would switch jobs if offered this flexibility.

With data stored online, it's easy for employees to log into a cloud portal, work on the data they need to, and then log off when they're done. This way a single project can be worked on by a global team, the work handed off from time zone to time zone until it's done.

It also makes them work more efficiently, saving money for penny-pinching entrepreneurs.

- Better Collaboration and Communication

In today's business environment, it's common practice for employees to collaborate and communicate with co-workers located around the world.

For example, they may have to work on the same client proposal together or provide feedback on training documents. Cloud-based tools from DocuSign, Dropbox, and Google Drive make collaboration and document management a piece of cake.

These products, which all offer free entry-level versions, allow users to access the latest versions of any document so they can stay on top of real-time changes which can help businesses to better manage workflow, regardless of geographical location.

- Data Protection

Another important reason to move to the cloud is for better protection of your data, especially in the event of a natural disaster. Hurricane Sandy wreaked havoc on local data centers in New York City, forcing many websites to shut down their operations for days.

The cloud simply routes traffic around problem areas as if, yes, they have just been destroyed by a nuclear attack.

It's best to move data to the cloud, to avoid such disruptions because there your data will be stored in multiple locations.

This redundancy makes it so that even if one area is affected, your operations don't have to capitulate, and data remains accessible no matter what happens. It's a system called deduplication.

- Lower Overhead

The cloud can save businesses a lot of money.

By outsourcing data storage to cloud providers, businesses save on capital and maintenance costs, money that in turn can be used to expand the business. Setting up an in-house data center requires tens of thousands of dollars in investment, and that's not to mention the maintenance costs it carries.

Plus, considering the security, reduced lag, up-time and controlled environments that providers such as Amazon's AWS have, creating an in-house data center seems about as contemporary as a buggy whip, a corset, or a Model T.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.