Dreams don't often come true - but they do frequently these days.

Highly disruptive transformative companies on the verge of redefining the status quo give investors a golden chance to get in before the stock goes parabolic.

Traditional business models are all ripe for reinvention.

The first phase of reformulation in big data was inventing the cloud as a business.

Amazon (AMZN) and its Amazon Web Services (AWS) division pioneered this foundational model, and its share price is the obvious ballistic winner.

The second phase of cloud ingenuity is trickling in as we speak in the form of companies that focus on functionality, performance, and maintenance on the cloud platform.

This is a big break away from the pure accumulation side of stashing raw data in servers.

However, derivations of this type of application are limitless.

Swiftly identifying these applied cloud companies is crucial for investors to stay ahead of the game and participate in the next gap up of tech growth.

The markets' reaction to Spotify's (SPOT) and Dropbox's (DBX) hugely successful IPOs was head-turning.

Both companies finished the first day of trading firmly well above their respective, original opening prices -- or for Spotify, the opening reference price.

The pent-up momentum for anything "Cloud" has its merits, and these two shining stars will give other ambitious cloud firms the impetus to go public.

If Spotify and Dropbox laid an egg, momentum would have screeched to a juddering halt, and companies such as Pivotal Software would reanalyze the idea of soon going public.

Now it's a no-brainer proposition.

There are more than 40 more public cloud companies that are valued at more than a $1 billion, and more are in the pipeline.

To understand the full magnitude of the situation, evaluating recent IPO performance is a useful barometer of health in the tech industry.

The first company Zscaler (ZS) is an enterprise company focused on cloud security that closed 106% above its opening price when it went public this past March 16.

It opened up at $16 a share and finished the day at $33.

Zscaler CEO, Jay Chaudhry, audaciously rebuffed two offers leading up to the March 16 IPO. Both offers were more than $2 billion, and both were looking to acquire Zscaler at a discount.

The decision to forego these offers was a prudent move considering (ZS)s current market cap is around $3.3 billion and rising.

One of the companies vying for (ZS) was Cisco Systems (CSCO), which is also in the cloud security business. Cisco is looking to add another appendage to its offerings with the cash hoard it just repatriated from abroad.

Cisco has been willing to dip into its cash hoard by buying San Francisco-based AppDynamics for $3.7 billion in 2017, which specializes in managing the performance of apps across the cloud platform and inside the data center.

Cloud security is critical for outside companies to feel comfortable implementing universal cloud technology.

Storing sensitive data online in a storage server is also a risk and difficult to migrate back once on the cloud.

Without solid security to protect data, data-heavy companies will hesitate to vault up their data in a public place and could remain old-school with external data locations storing all of a firm's secrets.

However, this traditional approach is not sustainable. There is just too much generated data in 2018.

Cybersecurity has expeditiously evolved because hackers have become greatly sophisticated. Plus, they are getting a lot of free PR.

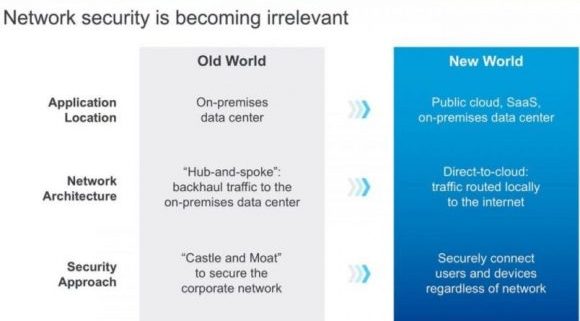

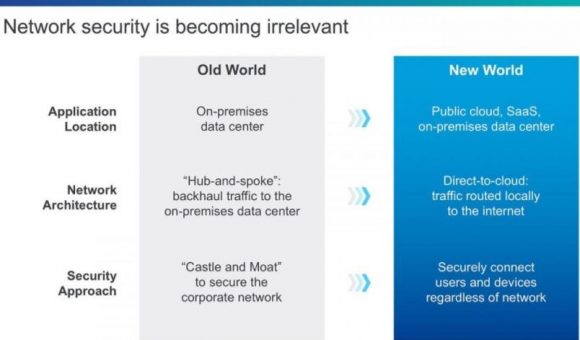

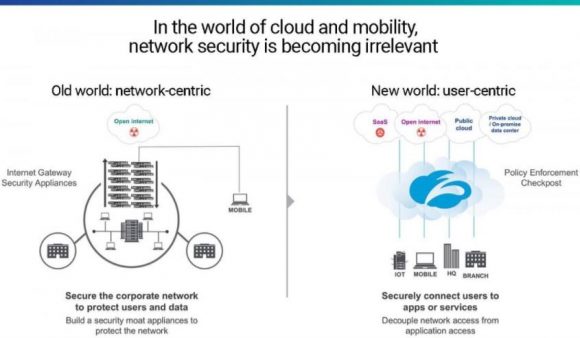

Data center and in-house applications secured operations by managing access and using an industrial strength firewall.

This was the old security model.

Security became ineffective as companies started using cloud platforms, meaning many users accessed applications outside of corporate networks and on various devices.

The archaic "moat" method to security has died a quick death, as organizations have toiled to ziplock end points that offer hackers premium entry points into the system.

Zscaler combats the danger with a new breed of security. The platform works to control network traffic without crashing or stalling applications.

As cloud migration accelerates, the demand for cloud security will be robust.

Another point of cloud monetization falls within payments.

Tech billing has evolved past the linear models that credit and debit in simplistic fashion.

SaaS (Software as a Service), the hot payment model, has gone ballistic in every segment of the cloud and even has been adopted by legacy companies for legacy products.

Instead of billing once for full ownership, companies offer an annual subscription fee to annually lease the product.

However, reoccurring payments blew up the analog accounting models that couldn't adjust and cannot record this type of revenue stream 10 to 20 years out.

Zuora (ZUO) CEO Tien Tzuo understood the obstacles years ago when he worked for Marc Benioff, CEO of Salesforce (CRM), during the early stages in the 90s.

Cherry-picked after graduating from Stanford's MBA program, he made a great impression at Salesforce and parlayed it into CMO (Chief Marketing Officer) where he built the product management and marketing organization from scratch.

More importantly, Tzuo built Salesforce's original billing system and pioneered the underlying system for SaaS.

It was in his nine years at Salesforce that Tzuo diagnosed what Salesforce and the general industry were lacking in the billing system.

His response was creating a company to seal up these technical deficits.

Other second derivative cloud plays are popping up, focusing on just one smidgeon of the business such as analytics or Red Hat's container management cloud service.

SaaS payment model has become the standard, and legacy accounting programs are too far behind to capture the benefits.

Zuora allows tech companies to seamlessly integrate and automate SaaS billing into their businesses.

Tzuo's last official job at Salesforce was Chief Strategy Officer before handing in his two-week notice. Benioff, his former boss, was impressed by Tzuo's vision, and is one of the seed investors for Zuora.

These smaller niche cloud plays are mouthwateringly attractive to the bigger firms that desire additional optionality and functionality such as MuleSoft, integration software connecting applications, data and devices.

MuleSoft was bought by Salesforce for $6.5 billion to fill a gap in the business. Cloud security is another area in which it is looking to acquire more talent and products.

If you believe SaaS is a payment model here to stay, which it is, then Zuora is a must-buy stock, even after the 42% melt up on the first day of trading.

The stock opened at $14 and finished at $20.

One of the next cloud IPOs of 2018 is DocuSign, a company that provides electronic signature technology on the cloud and is used by 90% of Fortune 500 companies.

The company was worth more than $3 billion in a round of 2015 funding and is worth substantially more today.

These smaller cloud plays valued around $2 billion to $3 billion are a great entry point into the cloud story because of the growth trajectory. They will be worth double or triple their valuation in years to come.

It's a safe bet that Microsoft and Amazon will continue to push the envelope as the No. 1 and No. 2 leaders of the industry. However, these big cloud platforms always are improving by diverting large sums of money for reinvestment.

The easiest way to improve is by buying companies such as Zuora and Zscaler.

In short, cloud companies are in demand although there is a shortage of quality cloud companies.

__________________________________________________________________________________________________

Quote of the Day

"The great thing about fact-based decisions is that they overrule the hierarchy." - said Amazon founder and CEO, Jeff Bezos