Mad Hedge Technology Letter

April 9, 2018

Fiat Lux

Featured Trade:

(HOW TO LOSE MONEY IN TECHNOLOGY STOCKS),

(AAPL), (MSFT), (OFO), (UBER), (MOBIKE), (OneCoin), (BABA)

Every new bull market in technology brings its excesses, and this time is more different.

Today, I'll outline some of the more egregious cases, which you and your money should avoid like the plague.

Spoiler alert: You are better off just parking your money in Apple (AAPL) or Microsoft (MSFT) and then forgetting about it.

The thirst to own a little sliver of technology in the greatest bull market of all time has reached a fever pitch with capital allocating to marginal assets.

Serious investors need to avoid the madness.

The excess was bred from the realization of how valuable data extraction and generation is to profitability.

The investment climate is reminiscent of the dot-com bubble during the 1990s that spawned companies with no intention of ever turning a profit.

This time, loss-making is blatant.

Ride-share vehicle services such as Uber and Lyft are great at losing money, and passengers would stand aside if prices became exorbitant.

Paying a derisory sum to ride in someone else's car while being chauffeured around is part of the allure of this business model.

The result is an artificially low price for the benefit of consumers amid a vicious price war with competitors.

The biggest problem with these ride-share services is they create nothing.

They are not building a proprietary operating system or creating technology that did not exist before.

Hence, these types of companies execute risky strategies that backfire.

Any technology company that expects to be in the game long term must create something unique and organic that other companies value and cannot copy.

These ride-hailing companies simply use an app on a smartphone, and this smartphone app can be created by any half decent high school app programmer.

Uber lost $4.5 billion in 2017, and that was great news for CEO Dara Khosrowshahi because Uber is losing less than before.

If you thought a tech company glorifying an annual loss of $4.5 billion was strange, then analyzing the state of the ride-share business model for the industry one degree further out on the risk curve will leave you scratching your head.

And by the way, Uber will try to soak your wallet when it launches its initial public offering next year.

Enter dockless ride-sharing bicycles.

Dockless bike-sharing has mushroomed around the world, spreading like wildfire fueled by grotesquely large injections of venture capital.

Ofo, a Chinese firm, initially raised more $1.2 billion and another $866 million from Alibaba (BABA) from a recent round of fundraising. CEO Dai Wei has stated that his company is worth north of $2 billion.

Mobike lured in more than $900 million in venture capital.

China is the epicenter of the bicycle ride-sharing experiment. More than 40 firms have sprouted up creating a bizarre scenario in major Chinese cities because of these companies dumping bicycles on every public street corner.

According to Xinhua News Agency, more than 2.5 million bikes are littered throughout the city by 15 companies in Beijing alone.

Local American firms have jumped on the bandwagon, too, with examples such as LimeBike, based in San Mateo, CA, that raised $12 million from Andreessen Horowitz in 2017, and topped up another $50 million from Coatue Management.

Meanwhile, Spin, the first stationless bikeshare company in the US, raised $8 million led by Grishin Robotics.

More than 40 bike-sharing companies have beat down the price of renting a bicycle to the paltry rate of 1 RMB (renminbi) ($0.15 USD) per 30-minute trip.

The intentional dumping at absurd price levels is not sustainable. The business model is predicated on collecting an initial deposit of $15 before a customer can hop on a bike.

The deposit has proved high risk as some companies have disappeared or gone bust.

Bluegogo, the third leading company in this space, emptied out its headquarters office, locked the doors, and failed to notify employees who claimed their wages had been garnished.

By last count, Bluegogo had distributed roughly 700,000 bicycles, and was estimated to have 20 million users, each paying $15 deposits to use the service.

Bluegogo was considered a legitimate competitor in the space along with Mobike and Ofo.

The $300 million dollars in Bluegogo deposits floated up to money heaven, and the deposits will never be repaid to customers.

Didi Chuxing, China's version of Uber and subsidiary of Tencent and Alibaba (BABA), purchased the bankrupt bike-sharing company, paid the work staff, and slipped them inside its portfolio of emerging tech firms in January 2018.

Mingbike, which failed in Shanghai and Beijing, migrated to emptier pastures in third and fourth tier Chinese cities and sacked 99% of its staff.

All told, $3 billion to $4 billion has been funneled into these bicycle-share monstrosities in the past 18 months.

It gets a lot worse in terms of high risk.

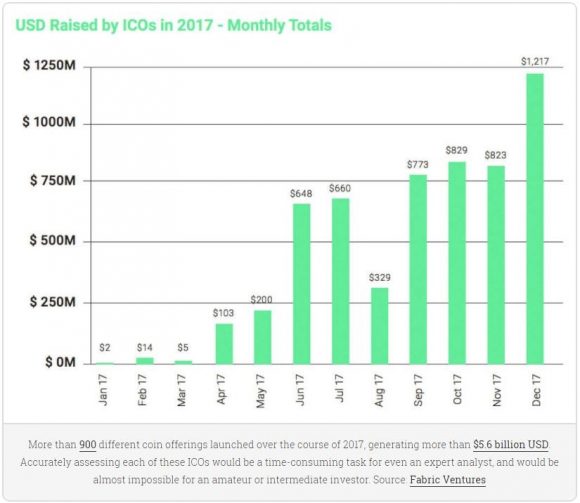

Another frontier of interest that has gone absolutely bananas is the ICO (Initial Coin Offering). ICOs are an unregulated new cryptocurrency venture raising funds by crowdfunding. A certain percentage of coins is sold to early investors in exchange for legal tender or Bitcoin.

This controversial means of raising money is a hotbed for scams galore. Of 1,000 that now exist, maybe 10 are legit.

These criminals are taking advantage of the headline effect of cryptocurrencies, promising every Joe and Jane early retirements and an easy way to provide college funds for children.

It's true that a founder of a cryptocurrency demonstrably benefits financially from leading this new form of payment.

Simply put, these ICOs function as Ponzi schemes with the last one to buy holding the bag when the sushi hits the fan after the founders run for the exits.

These fraudulent ICOs take on some of the characteristics of real Ponzi schemes such as guaranteed profits, promising their blockchain technology will solve all of the world's ills, no detailed roadmap except collecting funds, and lack of an online digital footprint.

Adding to the outsized risk is the confusion of which jurisdiction these companies are in and absence of any proper compliance.

OneCoin was a cryptocurrency promoted by offshore companies OneCoin Ltd (Dubai) and OneLife Network Ltd (Belize), founded by Ruja Ignatova. Many of the shady characters crucial to OneCoin were architects of similar Ponzi schemes, which was a dead giveaway to authorities.

Bulgarian enforcement officials raided and hauled away servers and other sensitive evidence at OneCoin's office in Sofia, Bulgaria, at the request of the prosecutor's office in Bielefeld, Germany.

German police and Europol also busted 14 other companies connected to OneCoin.

OneCoin CEO Ignatova was imprisoned in India for swindling investors after being investigated by Indian authorities in 2017.

The Ministry of Planning and Investment of Vietnam even issued a rebuttal that a forged document OneCoin used as proof to show it was the official licensed cryptocurrency in Vietnam was fake. It stated there was no possibility this document could ever exist.

SEC chairman Jay Clayton recently chimed in after being asked if all ICOs are fraudulent, boldly stating, "Absolutely not."

Uber and Ofo also are not frauds, but that does not mean investors should take a flier on it.

The strength of technology has attracted the marginal character to its doorstep; separating the wheat from the chaff is more important than ever.

These nascent industries can look good in the shop window, and slick advertising campaigns numb our rational decision making, but investors need to stay away at all costs.

The bicycle-sharing industry is a way for cash-rich venture capitalists to hoard data for applications irrespective of operating at a profit. The ICOs are charlatans attracted to the fluid cash flow tech companies command desiring a share in the spoils.

Keep your money in your pockets and wait for my next actionable trade alert.

__________________________________________________________________________________________________

Quote of the Day

"Stay away from it. It's a mirage, basically." - said legendary investor Warren Buffett when asked about cryptocurrency.

Mad Hedge Technology Letter

April 6, 2018

Fiat Lux

Featured Trade:

(THE IMPLICATIONS OF INTEL'S LOST APPLE CONTRACT),

(INTC), (AAPL), (AVGO), (QCOM), (AMD), (NVDA)

There is plenty of turmoil in chip land these days.

Investors should not freak out, or worse, dump their Intel (INTC) shares on pain of death.

Take a deep breath ... and I'll explain why Intel is still a great stock into which you should dip your toes.

Apple (AAPL) reportedly plans to replace Intel processors in Mac computers with its own proprietary chips starting around 2020. It is useless for investors to prognosticate the worst-case scenario playing out because this announcement will not put Intel out of business.

This is not the first phase of the death of Intel and represents a fabulous entry point into a beacon of tech stability.

Apple started placing Intel CPUs into its MacBook Pro and iMac in 2006 and have enjoyed a fruitful relationship since then.

As technology mutates at lightning speed, Apple justifiably desires more control over its chip design to create the innovative end product it envisions and provide a smoother experience between mobile and desktop devices.

Intel's engineers cannot match the pace of Apple's chip improvements that use ARM-based processors, which Apple has stuck into devices using the iOS system, including the Apple Watch and the Apple TV.

Apple's latest gadgets are more powerful than its past Macs, and its future is better served by tailor-making its chip architecture for its devices.

Security will be bolstered by procuring more control over design construction.

Intel still boasts the world's most popular CPU chip line for laptops and desktop computers, and hyper-increasing global demand for silicon chips will fail to disrupt Intel's growth trajectory.

Remember that the CPU chip line is Intel's legacy business, and this lump of the operation will slowly fade away into oblivion anyway.

Apple's top-end computers will still use Intel's chips such as the iMac Pro and Mac Pro revision until they can transition to in-house chips.

This trend has staying power with Apple designing its own iPhone chips partially due to removing its heavy reliance on Qualcomm (QCOM). It also has locked horns in court for years adding tension to the relationship.

On a relative basis, iMacs are just a fragment of the overall laptop market at 7.3% during the fourth quarter of 2017.

Apple's announcement could shed $1.8 billion in annual gross profit from Intel's earnings.

Intel accumulated $62.8 billion in sales in 2017, and losing Apple's business is only a small hiccup in the bigger scheme of things.

In late 2017, Intel poached the former head of AMD's (AMD) graphics business to head up a new high-end graphics division.

Raja Koduri, the new chief architect and senior vice president of the newly formed Core and Visual Computing division at Intel, will enable the company to directly compete with AMD and Nvidia (NVDA) in the GPU market.

The competition with AMD is a big deal because AMD has caught up with Intel and could steal CPU market share.

AMD has built its own comprehensive lineup of PC CPU chips while Intel unveiled its eighth generation Core processors on April 3.

Acquiring new segments with its cash hoard is another way to move forward.

Rumors were rife with reports suggesting Intel would acquire Broadcom (AVGO) to create the biggest chip maker in the world.

This was a defensive maneuver to combat the possible combination of a Broadcom-Qualcomm merger that would damage Intel's market share in chips for mobile phones and cars.

By getting into bed with Broadcom, Intel could scrap the construction of the world's third-largest chipmaker, after Intel itself and Korea's Samsung.

Altera and Mobileye are companies Intel added to its lineup using its egregiously large cash hoard.

Mobileye, an Israeli company, provides advanced driver assistance software that prevents collisions. This purchase clearly bolsters its autonomous vehicle technology division.

Altera, a San Jose, Calif.-based company, manufactures integrated circuits.

Intel is likely to remain the dominant force at the very high end of computing.

It would be foolish to only analyze Intel based on its legacy business as it has veered into a different growth mode and is not just a chip company anymore.

Intel has been weaning itself from the secular downtrend of computer chips and strategically established an unmovable position in the massive cloud data center and server business.

The Data Center Group, Intel's second largest segment and most vital, grew 20% YOY, with $5.6 billion in revenue. Investors must keep close tabs on how this area performs because it is the lynchpin to emerging technologies such as artificial intelligence and 5G in terms of overall infrastructure.

Intel's data center performance represents the harbinger of success, and Intel is doubling down on this future growth driver.

Cloud capital expenditures will rise 30 percent in 2018 because chunks of money must be thrown at this segment to stay relevant from cutthroat competition.

Computing is at an inflection point in 2018. Priorities have rotated to the data-centric phase of development. And Intel's CEO Brian Krzanich, who just received a nice pay rise to $21.5 million per year, will fill us in at Intel's next earnings call on April 26.

To visit Intel's website please click here.

__________________________________________________________________________________________________

Quote of the Day

"Quality is much better than quantity. One home run is much better than two doubles." - said former Apple CEO, Steve Jobs in 2006.

Mad Hedge Technology Letter

April 5, 2018

Fiat Lux

Featured Trade:

(GOOGLE IS FIRING ON ALL CYLINDERS ... BUY THE DIP),

(GOOGL), (FB), (AMZN), (AAPL), (MSFT)

Google (GOOGL) makes bucket loads of money and even makes Facebook's (FB) business model look dwarfish.

Total revenue in 2017 came in at more than $110 billion, up 23% YOY and almost three times larger than Facebook's annual revenue of $40.65 billion in 2017.

It's easy to comprehend why the big keep getting bigger if you understand the basic trajectory of technology companies.

A new report from the search consulting firm Adthena chronicled the flow of ad dollars into digital e-commerce and found that retailers are spending 76.4% of total ad budget on Google shopping ads.

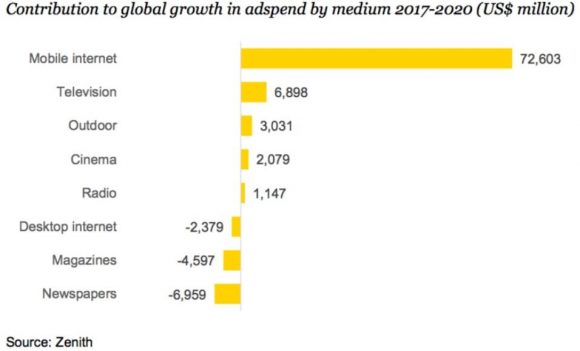

Last year was a record-breaking year for total digital ad revenue, and this year the industry is slated to grow another 20%.

Young people aren't watching television as they used to and are more comfortable using computers, tablets, and smartphones to gorge on their entertainment and work.

By 2020, digital ads will comprise 44.6% of total ad revenue as cord-cutting by consumers accelerates and broadband streaming becomes the norm across all of America and the world.

Mobile is the triumphant victor here as the majority of dollars will migrate to smartphone platforms.

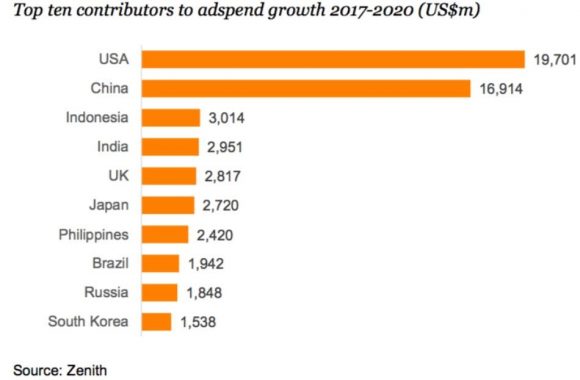

China and America will overwhelmingly make up the bulk of digital ad spend, and Europe will remain a distant third.

Last quarter, Alphabet missed Wall Street expectations on the bottom line failing to reach earnings per share (EPS) targets of $9.98. The $9.70 miss wasn't a total failure but disappointing enough for Alphabet shares to nosedive.

Alphabet has positioned itself perfectly for the future and has many irons in the fire.

Google's ad business remains its go-to segment totaling $27.27 billion in revenue in Q4, a main driver of outperformance.

Cost per click (CPC) decreased slightly less than what analysts expected, but that was the trigger for a quick dip in share prices even though Alphabet beat on the top line.

In total, it is immaterial if Alphabet misses slightly on this metric. And, coincidentally, Alphabet is changing the way it calculates ad fees by switching over to cost per impression (CPI), which charges advertisers for raw viewing of an ad.

This pricing mechanism will create higher margins that slightly suffered last quarter because advertisers now are charged for users not clicking an ad as well.

(CPC) has been eroding for years. Alphabet attributes the slight dip to the widespread migration to mobile and the importance of YouTube ads, which yield lower rates than desktop ads.

Alphabet's "other revenues" segment, including its burgeoning enterprise business, hardware sales, and app store Google Play, posted $4.69 billion in revenue, bringing total Google revenue to $31.91 billion in Q4 2017.

Google search, the premier legacy business in tech, still comprises 85% of total revenue. Crucially, the cash mountain procured aids in capital allocation. Alphabet heavily reinvests back into different parts of the business or M&A.

Certainly, it has laid some eggs such as the Google glasses and its attempt at social media through Google+, which flamed out, too.

Many of these new projects originate from the 20% of work time that is allocated to free-spirited entrepreneurship. This initiative has harvested benefits spawning from Google news and other supplementary projects.

Alphabet's innovative qualities feedback into their core product as well, but management understands it needs to evolve to meet the capricious needs of users.

Google founders Sergey Brin and Larry Page thirst for a fresh injection of vivacity into their business and added several outside valuable pieces that include YouTube, Motorola, and Nest Labs for around $17 billion.

These growth engines will fit nicely under the umbrella of firms that Google has collated.

The cloud segment has become a "billion dollar per quarter business." It is dwarfed by the ad revenue but is still the glue that holds the firm together because of the heavy reliance of big data storage to power its firm.

The cloud is still a small sliver of the business and trails Amazon (AMZN), and Microsoft's (MSFT) cloud businesses, but Google drive cloud platform was "the fastest growing major public cloud provider" in 2017.

Apple (AAPL) has even subcontracted Google to store iPhone data on its Google cloud. I bet you didn't know that.

The cloud will continue to gain momentum for Google. Developing the best search engine in the world makes the company specialists in harvesting data because refining a search engine takes an extraordinary amount of data to fine-tune the user searches to perfection.

There are a few headwinds Alphabet is coping with, predominantly traffic-acquisition costs (TAC) as a percentage of revenue will continue to rise, but the increase in velocity will taper off by mid-2018.

Google's total (TAC), which includes funds it pays to phone manufacturers such as Apple that integrates its services, such as search, hit $6.45 billion, or 24% of Google's advertising revenues.

The rising cost of finding eyeballs will squeeze margins.

Another bogey on the horizon is Amazon's foray into the digital ad sphere. It possesses the quality of data to claw away market share and could damage the comprehensive duopoly that Alphabet enjoys with Facebook.

Large cap tech is competing with each other in almost every critical industry guided by the invisible hand of a massive treasure trove of big data. This is unavoidable.

Alphabet's other gambles such as smart-home hardware maker Nest Labs and health-care company Verily are bets on the future as all big tech firms position themselves to compete in a myriad of emerging industries.

These products aren't expected to harvest profits for years and lost Alphabet a combined $500 million last year.

There are a few companies that are perfectly aligned with the direction of future business and technological development, and Alphabet is one of them.

Whether the autonomous vehicle subsidiary Waymo or its smart-home investment in Nest Labs, Alphabet is diversified into most of the cutting-edge trends moving forward.

If the sushi hits the fan with its up-and-coming segments, Alphabet can always fall back on what it knows best - selling ads.

__________________________________________________________________________________________________

Quote of the Day

"We want Google to be the third half of your brain." - said co-founder of Google and president of Alphabet, Sergey Brin.

Mad Hedge Technology Letter

April 4, 2018

Fiat Lux

Featured Trade:

(SPOTIFY KILLS IT ON LISTING DAY),

(SPOT), (DBX), (GOOGL), (AAPL), (AMZN), (CRM), (NFLX), (FB)

The banner year for the cloud continues as Dropbox's (DBX) blowout IPO passed with flying colors.

Investors' voracity for anything connecting to big data continues unabated.

Big data shares are now fetching a big premium, and recent negative news has highlighted how important big data is to every business.

Let's face it, Spotify (SPOT) needs capital to reinvest into its platform to achieve the type of scale that deems margins healthy enough to profit, even though it says it doesn't.

Big data architecture takes time to cultivate, but more importantly it costs a huge chunk of money to construct a platform worthy enough to satisfy consumers.

The daunting proposition of competing with the FANGs for users only makes sense if there is a reservoir of funds to accompany the fight.

Spotify CEO Daniel Ek has milked the private market for funding, making himself a multibillionaire in the process. And as another avenue of capital raising, he might as well go to the public to fund the venture in the future.

Cloud and big data companies have identified the insatiable investor appetite for their services. Crystalizing this sentiment is Salesforce's (CRM) recent purchase of MuleSoft - integration software that connects apps, data, and devices - for 18% more than its original offer for $6.5 billion.

The price was so exorbitant, analysts speculated that a price war broke out, but Salesforce paid such a high price because it is convinced that MuleSoft will triple in size by 2021. That is another great trading opportunity missed by you and me.

An 18% premium to the original price will seem like peanuts in five years. The year 2018 is unequivocally a sellers' market from the chips up to the end product and everything in between on the supply chain.

Spotify cannot make money if it's not scaled to 150 million users, compared to its current 76 million. And 200 million and 300 million would give CEO Daniel Ek peace of mind, but it's a hard slog.

Pouring gas on the fire, Spotify is going public at the worst possible time as tech stocks have been the recipient of a regulatory witch hunt pounding the NASDAQ, sending it firmly into correction territory.

Next up was Spotify's day to shine in the sun directly listing its stock.

Existing investors and Spotify employees are free to unload shares all they want, or load up on the first day. In addition, no new shares are being issued. This is unprecedented in the history of new NYSE listings.

Spotify is betting on its brand recognition and massive desire for big data accumulation. It worked big time, with a first day's closing price of $149, verses initial low ball estimates of $49.

Cloud companies are the cream of the big data crop, but Spotify's data hoard will contain every miniscule music preference and detail a human can possibly exhibit for potentially 100 million-plus people.

Spotify's data will become the most valuable music data in the world and for that it is worth paying.

But at what price?

Spotify has no investment bankers, and circumnavigating the hair-raising fees a bank would earn is a bold statement for the entire tech industry.

Sidestepping the traditional process has ruffled some feathers in the financial industry.

The mere fact that Spotify has the gall to execute a direct listing is just the precursor to big banks being phased out of the profitable investment banking sector.

Goldman Sachs (GS) was the lead advisor on Dropbox's (DBX) traditional IPO, and it was a resounding success rocketing 40% a few days after going public.

IPOs are not cheap.

The numbers are a tad misleading because Spotify paid about $40 million in advisory to the big investment banks leading up to the big day.

This is about a $28 million less than when Snapchat (SNAP) went public last year.

Uber and Lyft almost certainly would consider this option if Spotify nails its IPO day.

Banks are being squeezed from all sides as nimble, unregulated tech firms have proved better adaptable in this quickly changing environment.

Spotify's business model is based on spectacular future growth, which may occur.

It is a loss-making company that produces no proprietary solutions but is overlooked for its valuable data.

The company is the market leader in paid subscribers at 76 million, far outpacing Apple Music at 39 million and Pandora at 5.5 million.

Total MAUs (Monthly Active Users) expect to reach more than 200 million users, and paid subscribers could hit the 96 million mark by the end of 2018.

Spotify's business model bets on transforming the free subscribers who use Spotify with ad-supported interfaces into paid subscribers that are ad-free. Converting a small amount would be highly positive.

Gross margin is a number that sheds light on the real efficiencies of the company, and Spotify hopes to hit the 25% gross margin point by the end of 2018.

I am highly skeptical that gross margins can rise that high unless they solve the music royalty problem.

Royalty costs are killer, forcing Spotify to shell out a massive $9.75 billion in music royalties since its inception in 2006.

Spotify is paying too much for its content, but that is the cruel nature of the music industry.

The ideal solution would eventually amount to producing high quality original entertainment content on its proprietary platform akin to Netflix's (NFLX) business model with video content.

Spotify's capital is being drained by royalty fees amounting to 79% of its revenue.

This needs to be stopped. It's a losing strategy.

Considering Google (GOOGL) and Facebook (FB) do not pay for their own content, it frees up capital to pile into the pure technical side of the operations, enhancing their ad platforms luring in new users.

This is why the Mad Hedge Technology Letter sent you an urgent Trade Alert to buy Google yesterday when it was trading at $1,000.

All told, Spotify has managed to lose $2.9 billion since it was created 12 years ago - enough capital to create a new FANG in its own right.

Dropbox was an outstanding success and attaching itself to the parabolic cloud industry is ingenious.

However, potential insane volatility should temper investors' expectations for the first day of trading.

The lack of a road show, no lockup period, and no underwriting or book building will sacrifice stability in the short term.

There is incontestably a place for Spotify, and the expected 30% to 36% growth in 2018 looks attractive.

But then again, I would rather jump into sturdier names such as Lam Research (LRCX), Nvidia (NVDA), and Amazon (AMZN) once markets quiet down.

The private deals that took place before the IPO changed hands were in the range of $99 to $150. Considering the reference point will be set at $132, nabbing Spotify under $100 would be a great deal.

The market will determine the opening price by analyzing the buy and sell orders for the day with the help of Citadel Securities.

It's a risky proposition that 91% of shares are tradable upon the open. Theoretically, all these shares could be sold immediately after the open.

Legging into limit orders below $140 is the only prudent strategy for this gutsy IPO, but better to sit and observe.

__________________________________________________________________________________________________

Quote of the Day

"One of the only ways to get out of a tight box is to invent your way out." - Amazon CEO Jeff Bezos

Mad Hedge Technology Letter

April 3, 2018

Fiat Lux

Featured Trade:

(THE BIG WINNER FROM THE PHOENIX CAR CRASH),

(WAYMO), (TSLA), (GOOGL), (AAPL), (AMZN), (UBER), (GM), (FB)

In 2014, the juicy sound clips recorded by NFL legend Chris Carter at the annual NFL rookie symposium would be enough for those at league headquarters to have nervous breakdowns.

During a keynote speech, Chris Carter recommended that every rookie about to kick-start a sports career should find a "fall guy" just in case they found themselves on the wrong side of the law.

Carter later rescinded his comments and sincerely apologized for insinuating marginal tactics.

Lo and behold, it seems the most attentive listeners at the symposium weren't the players but the swashbuckling chauffeur-share service that has become the "fall guy" of Big Tech, none other than Uber.

The great thing (read: sarcastic here) for Uber about killing a pedestrian with autonomous vehicle technology is that it does not need to change its Silicon Valley mind-set of "move fast and break things."

Everything Uber touches seems to turn to mush. At least lately.

This revelation is extremely bullish for the other big players in the A.I. (Artificial Intelligence) driverless car space, mainly Waymo and General Motors (GM).

Granted, Uber came late to the party, but that cannot be an excuse for the myriad of shortcuts it promotes to build its business.

Waymo, the autonomous subsidiary of Google (GOOGL), has been honing its software, algorithms, and sensors for the past nine years like a sage samurai swordsmith from Kyoto. This type of detailed nurturing has led Waymo to rack up more than 5 million miles of testing on live roads.

The company recently commenced the first niche ride-hailing service in Phoenix, AZ, and just announced that it will purchase up to 20,000 electric cars from Jaguar Land Rover in a $1 billion deal to outfit with its cutting-edge technology.

Every day is a joyous day for Waymo because the first mover advantage is in full effect.

GM, another laggard, though considered in the top three, won't commence its robotic car fleet until late 2019. However, by that time, Waymo could be on the verge of mass rollouts if there are no setbacks.

The cherry on top for Waymo is Uber's knack of making a dog's breakfast of anything it pursues, magnifying an insurmountable lead for Waymo to possess.

Granted, the autonomous vehicle brain trust expected casualties, and the firm that made news for this mishap would be stuck with this label along with suspended operations.

Waymo missed a direct hit thanks to Uber and Tesla.

Tesla also took a direct hit when it announced that Walter Huang, an Apple engineer, sadly was killed in a Model X accident last weekend while his car was on autopilot.

It capped a horrible week by announcing a comprehensive recall of every Model S made before April 2016 for a faulty part. After fighting tooth and nail to maintain the $300 support level, Tesla swiftly sold off down to $250.

The disruption fetish permeating the ranks of the tech industry has its merits. Often the end result manifests through cheaper prices and better consumer services.

However, Uber's over-aggressiveness has placed it at the forefront of the regulation backlash along with Facebook (FB).

Google has certainly been playing its cards right, and having not run over a pedestrian consolidates its leading position

Luckily, the National Transportation Safety Board does not punish every participant using this technology.

No news is good news.

An extensive review of internal processes will hit team morale, and the burden of blame with fall upon the engineers.

The fallout from the tragic incidents will set back Tesla and Uber at least three to six months.

The suspension of their operations is akin to a white flag because Waymo is currently leaps ahead and plans to ramp up the mass rollout in the next two years with technology that is best of breed.

The running joke in the industry is that Uber's autonomous vehicle engineers are comprised of Waymo rejects.

Waymo already has more than 600 for-profit vehicles in operation in Arizona. And as every day without a fatality is considered a success, the Jaguars are next in line to be tricked-out with sensors and software.

Unceremoniously, Waymo has focused on safety as the pillar of its autonomous driving operation. Its conservative attitude toward danger will serve it well in the future. Waymo even spouted that its technology would have avoided the Uber accident.

Waymo has no desire to physically produce cars, but it aspires to sell licenses to the technology that could be installed in trucks and delivery vehicles, too.

The licenses could act as de-facto SaaS (software as a service) reoccurring revenue that has catapulted cloud companies to untold heights.

Google would also be able to integrate Google Maps, Google Docs, and all Google services into the robot-cab experience. The robo-taxi would merely serve as an incubation chamber to use the plethora of Google services while being transported from point A to point B.

And with Uber temporarily wiped off the map, Waymo seems like a great bet to monetize this segment at massive scale.

Google is truly on a roll as of late, even finding the perfect fall guy for the big data leak that has roiled the tech world, inducing a wicked tech sell-off - Facebook.

Instead of extracting data from user-posted content, Google's search builds a profile on users' search tendencies, and it is just as culpable in this ordeal.

Ironically, all the heat is coming down on Facebook's plate, and Mark Zuckerberg's lack of tactical PR noise is cause for investor concern.

The mountains of cash vaulted up over the years has made barriers of entry into new fields simple.

For example, Amazon's desire to lead health care came out of left field, and 10 years ago nobody ever thought the iPod company would make smart watches.

The interesting development in broader tech is the disintegration of unity that once supported the backbone of these firms.

Tim Cook, chief executive officer of Apple, railed on Facebook's business model and trashed Mark Zuckerberg's blatant disregard for privacy in order to profit from people's personal lives.

Large cap tech has never had as much overlap as it does now, and the new normal is throwing others under the bus.

If Google is dragged into the Facebook regulatory orbit, the silver lining is that the world's best autonomous driving technology will soon transform its narrative and put its incredibly profitable search business on the back burner.

Markets are forward looking and reward outstanding growth stories.

Tech is growth.

Morgan Stanley issued a report claiming the repercussions of mass-integrating this technology would be to the tune of about half a trillion dollars. That includes the $18 billion saved in annual health costs to automotive injuries. Also, 42% of police work ignites from a simple traffic stop. This would vanish overnight as well as concrete parking garages that blight cities. Car insurance is another industry that will be swept into the dustbin of ancient history.

Yes, tech has evolved that fast when Google can start claiming its revered search business as the daunted L word - legacy business.

The fog of war is starting to burn off and the visible winner is Waymo.

The shaping of its autonomous vehicle business is starting to take concrete form and although this won't affect earnings in the next few years, it will be a game changer of monumental proportions.

Uber is seriously in the throes of having an existential problem because of Waymo's outperformance. Venture capitalists heavily invested in Uber because of the promises of autonomous vehicle technology.

This is its entire growth story of the future.

Without it, it is a simple taxi company run on an app. There is no competitive advantage.

Waymo is on the verge of creating a scintillating growth business that is effectively Uber without a driver while simultaneously destroying Uber.

Ouch!

It speaks volumes to the ascendancy. And if Waymo miraculously capitulates, Google can always call Chris Carter and find another "fall guy."

__________________________________________________________________________________________________

Quote of the Day

Asked what he would do if he was Mark Zuckerberg, Apple CEO Tim Cook said, "I wouldn't be in this situation."

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.