Mad Hedge Technology Letter

April 2, 2018

Fiat Lux

Featured Trade:

(WHY THERE WILL NEVER BE AN ANTITRUST CASE AGAINST AMAZON)

(AMZN), (WMT), (MSFT), (FB), (DBX), (NFLX)

Mad Hedge Technology Letter

April 2, 2018

Fiat Lux

Featured Trade:

(WHY THERE WILL NEVER BE AN ANTITRUST CASE AGAINST AMAZON)

(AMZN), (WMT), (MSFT), (FB), (DBX), (NFLX)

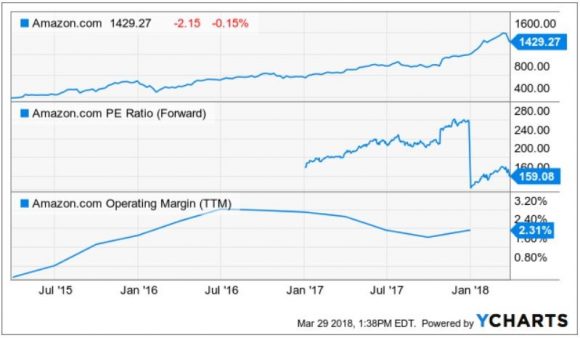

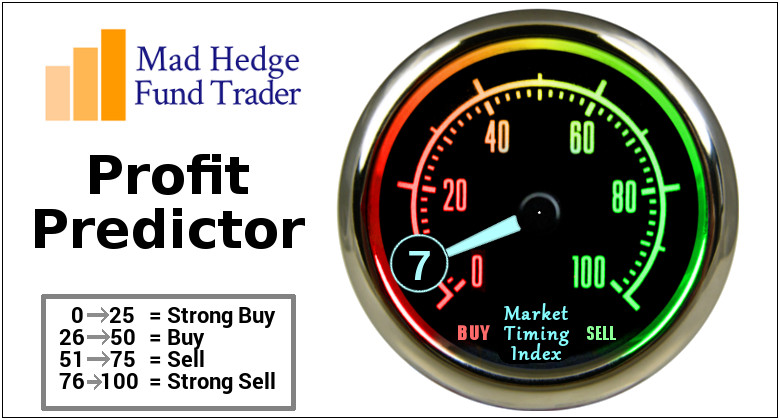

POTUS's Amazon tweet of March 29 has given investors the best entry point into Amazon (AMZN) since the January 2016 sell-off. Since then, the stock has essentially gone up every day.

Entry points have been few and far between as every small pullback has been followed by aggressive buying by big institutional money.

The 200-point nosedive was a function of the White House's dissatisfaction of leaked stories that would find their way into the Washington Post owned by Amazon CEO Jeff Bezos, my former colleague and good friend.

Although there are concerns about Amazon's business model, notably its lack of actual profits, there is no impending regulatory action. And, if there is one company that's in hotter water now, it's Facebook (FB), which inadvertently sells every little detail about your personal life to third-party Eastern European hackers.

Amazon's e-commerce business does not violate the Federal Trade Commission Act of 1914 of "deceptive" or "unfair practices."

The American economy has rapidly evolved thanks to hyper-accelerating technology, and the jobs required to support the modern economy have changed beyond all recognition.

The Clayton Antitrust Act of 1914 addressing harmful mergers that destroy competition hasn't been breached either since Amazon has grown organically.

Analyzing the most comprehensive law, the Sherman Antitrust Act of 1890, which was originally passed to control unions, espouses economic freedom aimed at "preserving free and unfettered competition as the rule of trade."

And, in a way, Amazon could be susceptible, but it would be awfully difficult to persuade the U.S. Department of Justice (DOJ) Antitrust Division and would take a decade.

Amazon's business model will change many times over by the time any antitrust decision can be delivered, or even entertained.

Helping Amazon's case even more is the DOJ interpretation of the three antitrust rules. It is the company's duty to first and foremost protect the consumer and ensure business is operating efficiently, which keeps prices low and quality high. Antitrust laws are, in effect, consumer protection laws.

Amazon's e-commerce segment epitomizes the DOJ's perception of these 100-year-old laws.

The controversial part of Amazon's business model is funneling profits from its Amazon Web Services (AWS) division as a way to offer the lowest prices in America for its e-commerce products.

This strategy has the same effect as dumping since it is selling products for a loss, but it is not officially dumping.

POTUS has usually delivered more bark than bite. The steel and aluminum tariffs went from no exceptions to exceptions galore in less than a week. Policies and employees change in a blink of an eye in the White House.

The backlash is a case of the White House not being a huge admirer of Amazon, but individual government workers probably have Amazon boxes stacked to the heavens on their doorsteps.

It is true that Amazon has negatively affected retail business. It is doing even more damage to traditional shopping malls, which it turns out are owned by close friends of the president. The mom-and-pop stores have disappeared long ago. But Amazon could argue this trend is occurring with or without Amazon.

In addition, Walmart (WMT) was the original retail killer, and it currently is morphing into another Amazon by investing aggressively into its e-commerce division. Does the White House go after (WMT) next?

Unlikely.

Amazon didn't create e-commerce.

Amazon also didn't create the Internet.

Amazon also does pay state and local taxes, some $970 million worth last year.

Technology has been a growth play for years.

Investors and venture capitalists are willing to fork over their hard-earned cash for the chance to own the next Google (GOOGL) or Apple (AAPL).

Many investors do lose money searching for the next unicorn. A good portion of these unicorns lose boatloads of money, too.

Spotify, slated to go public soon, is a huge loss-maker and investors will pay up anyway.

Investors went gaga for Dropbox (DBX), already up 40% from its IPO, and it lost $112 million in 2017.

The risk-appetite is hearty for these burgeoning tech companies if they can scale appropriately.

Should investors be prosecuted for gambling on these cash-losing businesses?

Definitely not. Caveat emptor. Buyer beware.

It is true that Amazon pumps an extraordinary percentage of revenues back into product development and enhancement.

But that is exactly what makes Amazon great. It not only is focused on making money but also on making a terrific product.

The bulk of its enhancement is allocated in warehouse and data center expansion. Splurging on more original entertainment content is another segment warranting heavy investment, too, a la Netflix (NFLX). Did you spot Jeff Bezos at the last Oscar ceremony?

Contrary to popular belief, Amazon is in the black.

It has posted gains for 11 straight quarters and expects a 12th straight profitable quarter for Q1 2018.

The one highly negative aspect is profit margins. It is absolutely slaughtered under the current existing model.

However, investors continually ignore the damage-to-profit margins and have a laser-like focus on the AWS cloud revenue.

Amazon's AWS segment could be a company in itself. Cloud revenue last quarter was $5.11 billion, which handily beat estimates at $4.97 billion.

Amazon's cloud revenue is five times bigger than Dropbox's.

The biggest threat to Amazon is not the administration, but Microsoft (MSFT), which announced amazing cloud revenue numbers up 98% QOQ, and has grown into the second-largest cloud player.

(MSFT) is equipped with its array of mainstay software programs and other hybrid cloud solutions that lure in new enterprise business.

(MSFT) has the chance to break Amazon's stranglehold if it can outmuscle its cloud segment. However, any degradation to Amazon's business model will not kill off AWS, considering Amazon also is heavily investing in its cloud segment, too.

Lost in the tweet frenzy is this behemoth cloud war fighting for storage of data that is somewhat lost in all the political noise.

This is truly the year of the cloud, and dismantling Amazon is only possible by blowing up its AWS segment. The more likely scenario is that AWS and MSFT Azure continue their nonstop growth trajectory for the benefit of shareholders.

Antitrust won't affect Amazon, and after every dip investors should pile into the best two cloud plays - Amazon and Microsoft.

__________________________________________________________________________________________________

Quote of the Day

Mad Hedge Technology Letter

March 29, 2018

Fiat Lux

Featured Trade:

(TECHNOLOGY'S UPSIDE IN THE TRADE WAR)

(RHT), (DBX), (SPOTIFY)

After watching the performance of technology stocks over the past two weeks, you may be on the verge of slitting your wrist, overdosing on drugs, and then jumping off the Golden Gate Bridge.

However, the results reported by tech companies this week say you should be doing otherwise.

As tech companies confront upcoming regulation and an overseas trade war, it has felt like a death by a thousand cuts.

It almost is starting to feel as if being a technology company is akin to drinking from a poisoned chalice.

I beg to differ.

I will tell you why the destiny of tech is quite positive.

The long-term secular growth drivers will prevail of accelerated earnings amid a backdrop of global economic synchronized expansion.

Assiduous capital reallocation programs will attract investors instead of detract from them.

The ironic angle to the precarious diplomatic tumult is that regulation will ultimately benefit the current pacesetters and culprits of technology because the barriers of entry become insurmountable.

The trade war has the same effect as the data regulation because it is ultimately for the betterment and protection of domestic, made-in-USA technology.

Washington knows the FANGs all too well, and the bull market will cease to exist if Beijing buys out our technological expertise.

Short-term pain for long-term gain. That's it in a nutshell.

The White House further understands that it's better to start a trade war now when it holds a stronger hand. No doubt after 20 more years of an ascending China, the Middle Kingdom will leverage its economic clout for diplomatic power dictating the outcome more ruthlessly.

Effectively, Trump's trade fracas is a one step back and two steps forward policy. During the one step back phase simply seems as if the economy is taking a nosedive into the ocean floor.

Love it or hate it, technology is becoming more (and not less) ubiquitous. However, it's gone too far too fast, and society and public officials require time to absorb the new environment or you risk the current backlash.

Simultaneously, America is in the one step back phase of data regulation, trade laws, and society's backlash of encroaching tech.

Bad timing.

The teething problems will gradually subside, the stock market will re-ignite, and tech will advance further into regular life.

The market even has seen some green shoots with the blockbuster Dropbox (DBX) IPO up over 40% intraday on the first day of trading.

In the S-1 filing required for IPOs, (DBX) stated that it may "not be able to achieve or maintain profitability" because of increasing expenses. The disclosure also prefaced its "history of net losses" to justify the business direction.

(DBX) lost $111.7 million in 2017, on revenues of just over $1 billion.

Technology must be doing something right if loss-making firms are treated with a 40% gain on IPO day; and, Spotify, an even bigger money loser, will go public next week.

If investors are smitten with loss-making tech companies, I imagine they feel quite comfortable with the ones earning billions in quarterly profits and growing at a pace where analysts cannot hike their price targets quick enough, making them look foolish.

The outstanding gains by (DBX) was for one reason and one reason only.

It's a pure cloud play, and pure cloud plays have been rewarded in spades.

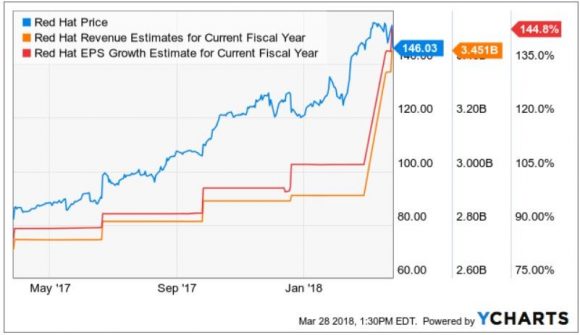

Red Hat's (RHT) stellar earnings were on the heels of the (DBX) IPO success.

Red Hat is a medium-size unadulterated cloud play that lacks the financial resources of the FANGs but is still turning a profit.

It is the poster boy for enterprise cloud companies flourishing in an unrelenting fierce environment.

If the world is going to hell in a handbasket, then how did Red Hat achieve aggregate billings growth of 25%?

Everyone and their uncle expect tech companies to start floundering, but the opposite is true. They overpromise then over deliver to the upside every quarter.

Red Hat booked the most deals over $1 million in Q4 2017 in its history.

Cross-selling cloud applications was especially strong with 81% of deals over $1 million spending on multiple software services.

The critical subscription revenue comprised 88% of Q4 revenue and is up 15% YOY. Application development-related subscriptions were up 42% YOY, higher than the infrastructure-related subscription revenue growing 17% YOY.

Companies are churning out innovation on top of their existing platforms using various software solutions. And every company in the world is migrating toward cloud software and infrastructure. There has never been a better time to be a pure cloud company.

The most poignant telltale sign was that Red Hat renewed 99 out of 100 of its top deals and disclosed that multiyear deals were healthy.

Ansible, its software for automating data center operations, OpenShift, its software for container-based deployment and management, and OpenStack, an infrastructure-as-a-service (IaaS) for cloud computing are the underpinnings to Red Hat's supreme business.

The reoccurring revenue salted away is legion.

The FY 2018 guidance was even more impressive than the quarterly earnings report. Red Hat expects a revenue range between $800 million and $810 million, up from the $748 million last quarter and expects quarterly EPS at $0.81, up from $0.70 last quarter.

Toward the end of the earnings call, Red Hat CEO Jim Whitehurst described the cloud growth environment as "very, very, very fast growth."

Market conditions and heightened volatility could stay irrational for longer than expected but leadership stocks are always the last to fall.

If (DBX) can catch a bid, and headway is made on political issues, then jump back into the cloud names that perform like Red Hat and about which I have been beating the drum.

And don't forget that these regulatory and political hindrances all point toward giving big cap tech cozier conditions and an elevated runway from which to operate.

__________________________________________________________________________________________________

Quote of the Day

"We know where you are. We know where you've been. We can more or less know what you're thinking about." - said Eric Schmidt in 2010, the former executive chairman of Google from 2001-2017

Mad Hedge Technology Letter

March 28, 2018

Fiat Lux

Featured Trade:

(HOW THE COBALT SHORTAGE WILL LEAD TO THE $2,000 IPHONE)

(AAPL), (SSNLF), (CMCLF), (FCX), (VALE), (GLNCY), (VLKAY), (BMWYY)

Hello $2,000 iPhone.

Flabbergasted consumers reacted last holiday season when Apple dared offer a $1,000 smartphone.

How confident this company has become!

Well, this is just the beginning.

Apple (AAPL) will be the first smartphone maker to offer a $2,000 phone, and I will tell you why!

The tech industry is going through a cumbersome wave of repricing after several high-profile debacles that have cast the light on the true value of data.

The upward revision of data has seen more players pour into the game attempting to carve out a slice of the pie for themselves.

The reason why tech companies will start offering their products at higher price points is because the inputs are rising at a rapid clip.

Apple's Development and Operations (DevOps) costs to design and maintain this outstanding product is going through the roof.

Apple's DevOps employees earn around $145,000 per year and compensation is rising. Granted, the technology is developing and batteries smaller, but salaries are rising at a quicker relative pace because of the dire shortage of DevOps talent in Silicon Valley.

It's possible that living in a shoebox at $4,200 per month in Mountain View, Calif., is off-putting for potential staff.

The most expensive part of an iPhone X is the OLED screen.

Apple estimated costs of $120 per screen manufacturing the Apple iPhone X. The cost doubled from LCD panels from $60 per screen.

Samsung (SSNLF) has been best of breed for screens for a while, and it is currently working on the next generation of Micro LED tech, which is the next gap up from the OLED displays of today.

Samsung has an inherent conflict of interest with Apple, creating tension between these tech stalwarts. Apple made the contentious decision to procure in-house screens at a secret manufacturing facility in Santa Clara, Calif., to avoid the constant friction.

It's common knowledge that the average price of technology shrinks over time, but the American smartphone industry has defied gravity with expected prices to shoot up 6% to $324 in 2018.

The Apple iPhone X raw costs were around $400 per phone. There is zero chance that a next gen, enhanced Apple smartphone will cost this low ever again.

Confirming this trend are Chinese smartphones retail prices rising at 15% last year.

The cost of memory, DRAM and NAND chips, rose dramatically this past year. As more memory is designed into these devices, the costs keep trending higher.

Lithium-ion batteries only add up to 1% to 2% of OEM (Original Equipment Manufacturers) cost and probably only bumps up the cost of iPhones incrementally.

The more skittish situation is the EV (Electric Vehicles) snafu.

Volkswagen (VLKAY) announced it will transform its entire fleet of 300 models into electrified versions by 2025.

In order to achieve this lofty objective, Volkswagen has earmarked $25 billion for batteries from Samsung, LG, and Contemporary Amperex. Volkswagen hopes to have 16 up and running (EV) factories by 2022, up from three today.

The goal is unattainable because of a lack of in-house battery production.

CEO Matthias Muller said the reason for not manufacturing in-house batteries was, "Others can do it better than we can."

Muller will rue the decision down the line as a myriad of companies migrate toward in-house solutions, giving firms more control over the process and overhead.

More importantly, Muller will have to rely on the ebb and flow of rising cobalt prices.

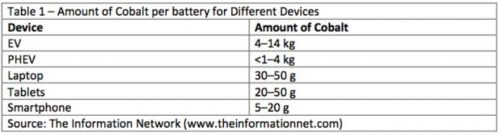

A battery for an (EV) ranges between $8,000- to 20,000, comprising the largest input for the (EV) makers such as Tesla (TSLA) and Ford (F).

Making matters worse, companies cut from all cloth are hoarding cobalt reserves based on anticipating the potential demand.

This phenomenon will cause all big tech players to replenish any reserves of base materials immediately.

Apple has had chip shortage problems in the past. This year is even worse than 2017, with NAND and DRAM chip supply trailing the demand by 30%. Tech companies have been hastily locking down contracts in advance to ensure the necessary materials to produce their flashy gadgets.

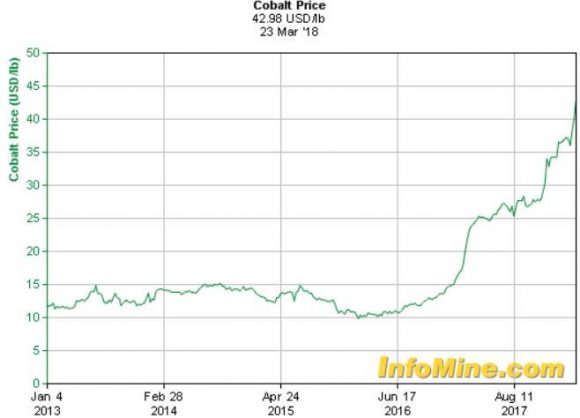

Lithium battery demand is expected to rise 45% between 2017 and 2020, and there has been no meaningful large-scale investment into this industry.

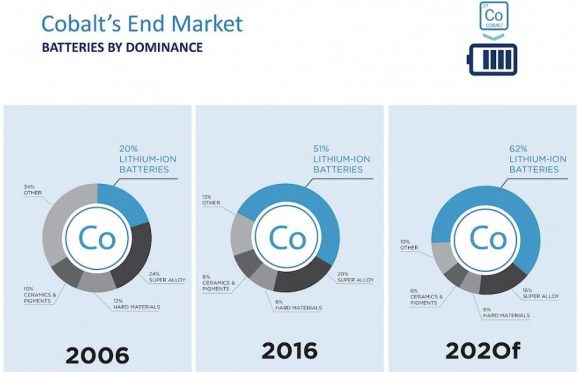

Battery production made up 51% of cobalt demand in 2016 and will hit around 62% by 2022.

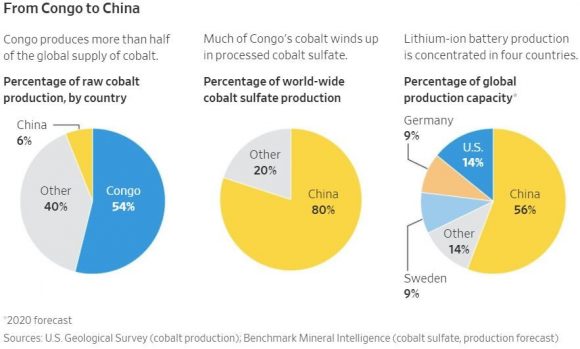

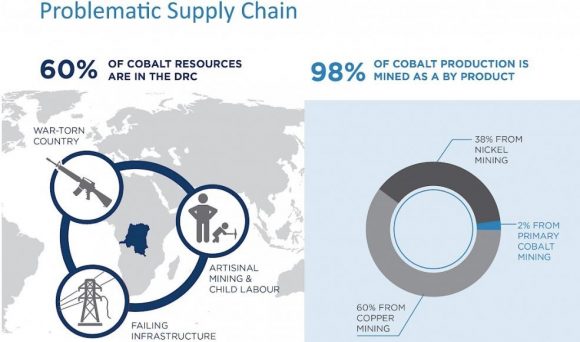

Compounding the complexity is 60% of global cobalt production is found in one country - the Democratic Republic of the Congo (DRC).

DRC is a hotspot for geopolitical fallout and its history is littered with civil war, internal conflict, and poor infrastructure.

The 21st century will be dependent on a chosen group of valuable materials. Cobalt is shaping up to be the leader of this pack and is needed in a plethora of business applications such as EV, lithium-ion batteries, and PCs.

Cobalt is vital in metallurgical applications that include aerospace rotating parts, military and defense, thermal sprays, prosthetics, and much more.

The DRC recently proposed a revised mining law increasing taxes on cobalt and other precious metals. The legislation has yet to be written into stone and would certainly jack up the price of cobalt.

Glencore's (GLNCY) management has noted this mining tax is "challenging" at a time it is just completing its Katanga expansion.

Katanga has the potential to become the largest global copper and cobalt producer.

Copper is equally important to cobalt since cobalt production is a by-product of copper and nickel mining. Only 2% of cobalt results directly from cobalt mining, and 60% via copper mining, and 38% via nickel mining.

Last year, Freeport-McMoRan (FCX) was dangling its cobalt project to outside investors in the DRC but was unable to fetch a premium price.

In a blink of an eye, China Molybdenum Co. (CMCLF) swooped in and (FCX) accepted an offer of $2.65 billion. (FXC) used the sale to pay down debt while the price of cobalt has taken off to the moon.

It gets worse, China owns 80% of refined global cobalt production and 90% of its operations are in the DRC.

China is attempting to corner the cobalt market in the DRC, gaining a stranglehold on future technological devices, (EV)s, and big data.

The keys to future technological hegemony lie in the jungles of the DRC, and China has the first mover advantage and backing of the communist party as (CMCLF) strives to be a global leader in cobalt production.

China has smartly wriggled its way down to the bottom of the supply chain capturing cobalt resources, and if a trade war ensues, China can simply cut off cobalt supply lines to whomever.

There is nothing CFIUS or Donald Trump can do.

America's 14% of global cobalt production will be insufficient to produce the new (EV)s, iPhone 11s, gizmos and gadgets that American consumers demand for daily life.

Analysts expected Apple to acquire some supplementary companies that will aid in expansion following the overseas repatriation.

A thriving software outfit or a company of cloud developers would have sufficed. However, reports streaming in that Apple has entered into negotiations to buy a five-year supply of cobalt directly from miners for the first-time underscore where Apple's priorities lie.

Cobalt demand expects to increase by 30% from 2016 to 2020.

Apple is scared it will be locked out of the cobalt market or forced to pay ludicrous prices for its cobalt needs.

Considering the price of cobalt has quadrupled since June 2016, and smartphones are 25% of the cobalt market, it's a strategically prudent move by Apple's CEO Tim Cook in light of BMW (BMWYY) announcing the need of 10X more cobalt by 2025.

Going forward anything comprised of cobalt-based technology will garner a higher premium resulting in higher prices for consumers including that $2,000 iPhone.

(FCX) is a must buy for those who believe precious metals are the foundation to all future technology. Other intriguing names include Brazilian company Vale S.A. (VALE), and Glencore, the largest Swiss company by revenue.

Or if you have the cash, plunk it down on a cobalt mine in the DRC. But only if you're insane.

__________________________________________________________________________________________________

Quote of the Day

"Heavier-than-air flying machines are impossible." - Lord Kelvin, President of the Royal Society, in 1895

Mad Hedge Technology Letter

March 27, 2018

Fiat Lux

Featured Trade:

(SUDDENLY, INTERACTIVE BROKERS IS A LOT MORE VALUABLE)

(IBKR), (SCHW), (AMTD)

Longtime followers of the Mad Hedge Technology Letter know that I rely on Interactive Brokers (IBKR) for my pricing and execution.

It is fast, accurate, user friendly, and cheap.

Recently, more traders have been discovering these benefits. A lot more.

The halcyon days of January 2018 brought investors euphoria and hockey stick shaped charts.

Bitcoin even tickled the $20,000 mark.

Every risk asset minus interest rate sensitive stock relentlessly exploded skyward.

Then a funny thing happened.

The short volatility industry vanished in the space of one night and unleashed a new epoch of wild market gyrations.

One clear victor rises from the embers of the pandemonium and that is online broker Interactive Brokers Group, founded by Hungarian entrepreneur, Thomas Peterffy.

The all-important gauge of Daily Average Revenue Trades (DARTs), the income stream from generated commission, will hoist the stock to new plateaus.

Total (DART)s rose 14% YOY with historic low volatility in 2017, down 27% from 2016 and (IBKR)'s stock still muscled out performance from $37 to $64, almost doubling.

The recent inflow of February reports indicates fixed-income revenue and currency trading set record highs.

TradeWeb, one of the largest bond trading platforms in the world, reported a 73% February YOY boost of European corporate and financial bonds. Bonds usually are traded via phone, and new trends show the push into electronic trading is advancing unabated.

A return to "normal" levels of volatility will propel online brokers to new heights. Low volatility diminishes trade volume while increased volatility spurs on trading volume.

As more trading traverses to digital platforms, the digitization of buying and selling stocks and the advent of crypto trading will entice risk-adverse Millennials to pile into risk assets.

Numbers show that Millennials have an affinity for options trading, suggesting the dynamic short termism of options provides the experiential thrill they seek in life.

Interactive Brokers was voted best of breed of online brokers in 2018 by the prominent financial publication Barron's. This annual edition gives the skinny on online trading platforms and a rough guide to which service best suits each investor.

I single out (IBKR) as a stellar company because the e-broker industry is experiencing a mammoth period of consolidation amid a price war.

E-brokers such as Fidelity slashed its commission rates from $7.95/trade to $4.95/trade in February 2017. As trading becomes commoditized, it's a race to the bottom and whoever is a volume leader with the best platform technology will be the last one standing.

This trend all favors (IBKR) which is positioned for scale like the FANGs. If customers do not possess the scale, the ultra-cheap commissions are unavailable.

The backdoor strategy here is the access e-brokers have to customer data flows. The treasure trove of trade flow data will become even more valuable with the upward re-pricing of data following the Cambridge Analytica mess.

Online brokers profit off customers' data by selling the information to High Frequency Traders (HFT) that input the data into evolving proprietary algorithms, which legally front run retail and institutional money.

(IBKR) fits (HFT) like a glove and the synergies are robust. The most lucrative accounts derive from the new batches of prop desks and hedge funds that trade heavily, desiring the best online platform technology for minimal slippage and smooth execution. (HFT)s trade in milliseconds and comprise 60% to 70% of daily trading volume, signifying immense bullishness for (IBKR).

The strategy so far is a winner, increasing customer accounts by 25% YOY, up to 483,000 in Q4 2017. Profit margins benefited as well, rising 15% to 71% YOY.

The second part of (IBKR)'s handiwork is net interest. Margin accounts due to fractional banking allow brokers to lend to clients. Any serious trader is using leverage to amass profits. At the height of financial malpractice in 2007, too-big-to-fail banks boasted leverage of 50x.

Total customer equity elevated by 46% YOY to $124.80 billion. IBKR also profits from the cash sitting in its own accounts, which accumulate higher relative returns from higher interest rates.

(IBKR)'s margin rates are lowest in the industry and still incredibly lucrative.

Every time the Fed raises the Fed funds rate, (IBKR) can ring in the cash register. The Fed is on an aggressive quantitative tightening agenda and a good omen for the upcoming earnings' report.

The trends ongoing in this industry overwhelmingly favor (IBKR). The shift to mobile will become more pervasive. Only a few years ago, mobile platforms were arcane and unintegrated with desktop platforms, forcing traders to disregard the mobile method.

Times have changed and (IBKR) cannot find enough developers to head its operations. The shortage of talented developers is causing a backlog of new projects, but this highlights the growing emphasis on its trading platform technology.

Offerings don't stop at trading execution. (IBKR) has built out a robo-advising service called IB Asset Management and via iBot, an A.I. assistant, traders can use prop-desk level algorithms to nimbly dip in and out of positions. The analytical features to dissect price data is breathtaking these days and will satisfy chart lovers.

The runway is long as the eye can see because many of these offerings can be transformed into reoccurring subscription services. Furthermore, brokers make money if the market ascends or declines as long as traders do something to stockpile data.

Other competitors to consider are Charles Schwab (SCHW), which recently acquired optionsXpress and TD Ameritrade (AMTD), which purchased Scottrade for $4 billion. (AMTD) cut 1,100 employees in the St. Louis, MO, branch lately and, in return, will replace them with a handful of techies to work on platform enhancement.

The broad-based consolidation reflects the grab for market share since many of the players have come to terms with the market's obsession for scale. Implementing scale directly means snagging more client accounts as the marginal cost per client barely budges with the tech infrastructure already established for all the big players.

__________________________________________________________________________________________________

Quote of the Day

"I think there is a world market for maybe five computers." - IBM Chairman Thomas J. Watson, 1943

Mad Hedge Technology Letter

March 26, 2018

Fiat Lux

Featured Trade:

(MICRON TECHNOLOGY KNOCKS THE COVER OFF THE BALL)

(MU), (WDC)

Micron (MU) was my inaugural stock pick for the first issue of the Mad Hedge Technology Letter on February 1, 2018, and it's time to check this neck of the woods after yesterday's earnings call.

Since I urged readers to jump into this stock at $40, it has skyrocketed to an intraday high of $61.85.

Not bad for a seven-week return.

A bet on Micron is a bet on its visionary leader, Micron CEO and UC Berkeley graduate, Sanjay Mehrotra, who has the propensity to be brilliant.

Mehrotra individually holds 70 chip patents.

He initially was credited for driving outperformance as SanDisk's CEO until Western Digital (WDC) acquired SanDisk in 2016.

Mehrotra has worked at every point on the supply line and knows the industry inside out. He is a pathfinder in a sea of cutthroat competition, and I drop everything to listen to his earnings call. You should do the same.

Rattling off numbers will not do justice to the brilliance of Micron. The great metrics are endless not to mention EPS growth up 15% QOQ, and up over 200% YOY. Cash flow generated from operations was $4.3 billion representing 59% of revenue, which compares to $1.8 billion a year earlier.

Almost every number outperforms sequentially with raised guidance.

The key takeaways were SSD (Solid State Drive) sales up 80% YOY, and the sale of cloud and enterprise solutions more than tripled YOY. Particularly, DRAM chips are Micron's bread and butter, and the DRAM market is suffering from tight supply.

DRAM comprised 71% of total quarterly revenue, and DRAM revenue was up 14% QOQ and 76% YOY.

Shipment volume rose while ASPs (Average Selling Price) increased in the low double-digits. DRAM gross margin was 66% in the quarter and up 22% YOY.

Roaring demand for DRAM and NAND products ushered in record quarterly revenues for the automotive market segment. Strong numbers came from ADAS (Advanced Drive Assistance Systems) and in-vehicle experience applications.

An expanding smorgasbord of DRAM and NAND solutions mean Micron is well-positioned to continue to captain the ship in this rapidly growing market.

A surge in the percolating industrial IoT (Internet of Things) market, expanding factory automation, and surveillance applications mesh nicely with Micron's product offerings.

The newest standards in mobile, automotive devices require rapid data analysis in storage, enterprise and cloud servers, including machine learning, training and inferencing to supplement the computing taking place at the edge.

Automotive clients will thrive from Micron's highest speed LPDDR4 (Low Power Double Data Rate Memory) solutions and other upcoming memory technologies such as the high-bandwidth GDDR6 graphics memory.

The fostering of AI materializes in AI smart cockpits in new automotive models. The instrument dashboard integrates with infotainment and telematics systems with a centralized computer and storage architecture to create a data center on wheels.

Voice and gesture recognition mixed with driver alert monitoring capabilities forge more intelligent and computer intensive automobiles requiring more powerful memory and higher capacity.

Micron has plowed significant investments into the data center to jack up memory and high-performance storage. An important sign is Micron's embedment into the heart of smart car development.

Smartphone makers paraded around high-end smartphones with bigger 4K displays, multiple high-resolution cameras, and 4K HDR video recording at the Mobile World Congress.

Capacity for SSDs are rising in new flagship models using 64GB of flash memory at a minimum. Micron's NAND solution is tailor-made to meet the demand, and Micron is best of breed in TLC (Thin Layer Chromatography) utilization.

Consumers will see a new emphasis on the implementation of A.I. and A.R. into new phones by OEMs (Original Equipment Manufacturer).

It soon will be standard to include facial and voice recognition, real-time translation, fast image search, and scene detection. This is the next gap up for smartphones.

Micron is perfectly positioned for the onslaught of fresh data the world will grapple with soon. High-end smartphones are traversing toward 6GB of LPDRAM, boding well for Micron considering Micron's preeminence in LPDRAM.

The hallmark of this technology is power efficiency essential for optimizing battery life. The LPDDR4's goal is to double data rates (up to 3200 Mb/s) over last generation RAM. Faster memory speeds will support the new migration toward this progression.

Capital investments of $7.5 billion will sustain Micron's leadership status, and Micron targets R&D at 30% to total revenue. Cost will incur transforming to high-value solutions and accelerate with revenue. Steps have been put in place to begin execution of funding the development of the fourth generation of 3D NAND technology.

Micron is in the midst of improving its R&D facilities to accommodate the future of 3D NAND nodes. The trend of higher R&D costs is universal in the semiconductor area as optimal bit growth makes a huge difference in how products are formulated.

The only hiccup in an extraordinary quarter was a maintenance issue at a Taiwan DRAM fab plant, reducing production and dragging down revenue for next quarter by 2%.

However, if you stand back a few feet, Micron's results were nothing short of spectacular. Mehrotra's way of laying out the awe-inspiring future, and Micron's ability to cross-intersect with almost every major secular trend especially pinpoint attention to automotive vehicles is genius.

Micron sold off hard on the earnings and was down more than 8% aftermarket, but this is certainly a case of rising too far too fast mixed with the broad-based China tariff sell-off.

This stock is a tap in to pierce the $100 mark and is pivotal to the future of American technology. It should be at the vanguard of any serious portfolio, and a slew of Micron Trade Alerts is waiting in the pipeline.

The fascinating thing here is that the dynamics of the chip industry are totally changing. It used to be highly cyclical and volatile. But chips are becoming so endemic to the modern economy that they are stabilizing the industry on a long-term basis.

These earnings are no flash in the pan, no one-hit wonder.

Load up on Micron shares on any serious dip.

__________________________________________________________________________________________________

Quote of the Day

"Two years from now, spam will be solved." - said Bill Gates, founder of Microsoft, at the World Economic Forum in 2004

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.