Mad Hedge Technology Letter

March 23, 2018

Fiat Lux

Featured Trade:

(HOW ENVIRONMENTALISTS MAY KILL OFF BITCOIN)

(BTC), (ETH), (TWTR), (SQ)

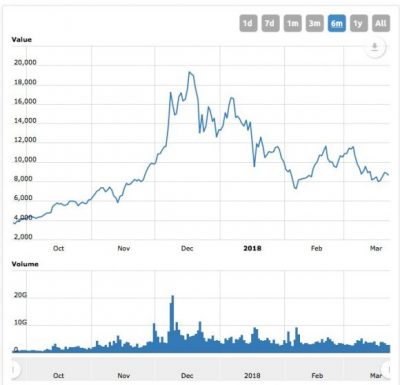

If Jack Dorsey's proclamation that bitcoin will be anointed the global "single currency," it could spawn a crescendo of pollution the world has never seen before.

In a candid interview with The Times of London, Dorsey, the workaholic CEO of Twitter (TWTR) and Square (SQ), offered a 10-year time horizon for his claim to come to fruition.

The originators of cryptocurrency derive from a Robin Hood-type mentality circumnavigating the costly fees and control associated with banks and central governments.

Unfolding before our eyes is a potential catastrophe that knows no limits.

Carbon emissions are on track to cut short 153 million lives as environmental issues start to spin out of control while the world's population explodes to 9.7 billion in 2050, from 8.5 billion people in 2030, up from the 7.3 billion today. All these people will need to barter in bitcoin, according to Jack Dorsey.

Cryptocurrency is demoralizingly energy intensive, and the recent institutional participation in crypto server farms will exacerbate the environmental knock on effects by displacing communities, destroying wildlife, and climate-changing carbon emissions.

This seemingly controversial means to outmaneuver the modern financial system has transformed into a murky arms race among greedy crypto currency miners to use the cheapest energy sources and the most efficient equipment in a no-holds-barred money grab.

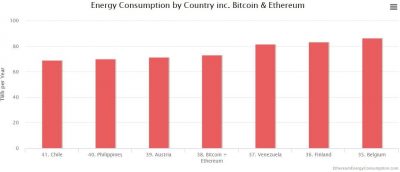

Bitcoin and Ethereum mining combined energy consumption would place them as the 38th-largest energy consuming country in the world - if they were a country - one place ahead of Austria.

Mining a bitcoin adjacent to a hydropower dam is not a coincidence. In fact, these locales are ground zero for the mining movement. The common denominator is the access to cheap energy usually five times cheaper than standard prices.

Big institutions that mine cryptocurrency install thousands of machines packed like a can of sardines into cavernous warehouses.

In 2015, a documentary detailed a large-scale foreign mining operation with an electricity outlay of $100,000 per month to create 4,000 bitcoins. These are popping up all over the world.

An additional white paper from a Cambridge University study uncovered that 58% of bitcoin mining comes from China.

Cheap power equals dirty power. Chinese mining outfits have bet the ranch on low-cost coal and hydroelectric generators. The carbon footprint measured at one mine per day emitted carbon dioxide at the same rate as five Boeing 747 planes.

The Chinese mining ban in January set off a domino effect with the Chinese mining operations relocating to mainly Canada, Iceland, and the United States. Effectively, China has just exported a tidal wave of new pollution and carbon emissions.

Bitcoin is mined every second of every day and currently has a supply of from approximately 17 million today, up from 11 million in 2013. Bitcoin's electricity consumption has been elevated compared to alternative digital payment currencies because the dollar price of bitcoin is directly proportional to the amount of electricity that can profitably be used to mine it.

To add more granularity, miners buy more servers to maintain profitability then upgrade to more powerful servers. However, the new calculating power simply boosted the solution complexity even faster. The mine was practically outdated upon launch, and profitability could only occur by massively scaling up.

Consumer grade personal computers are useless now because the math problems are so advanced and complicated.

Specialized hardware called Application-Specific Integrated Circuit (ASIC) is required. These mining machines are massive, hot, and guzzle electricity.

Bitcoin disciples would counter, describing the finite number of bitcoins - 21 million. This was part of the groundwork laid down by Satoshi Nakamoto (a pseudonym), the anonymous creator of bitcoin, when he (or they) constructed the digital form of money.

Nakamoto could not have predicted his digital experiment backfiring in his face.

The bottom line is most people use bitcoins to literally create money out of thin air in digital form, rather than using it as a monetary instrument to purchase a good or service. That is why people mine cryptocurrency, period.

Now, excuse me while I go into the weeds for a moment.

Enter hard fork.

A finite 21 million coins is a misnomer.

A hard fork is a way for developers to alter bitcoin's software code. Once bitcoin reaches a certain block height, miners switch from bitcoin's core software to the fork's version. Miners begin mining the new currency's blocks after the bifurcation, creating a new chain entirely and a brand spanking new currency.

Theoretically, bitcoin could hard fork into infinite new machinations, and that is exactly what is happening.

Bitcoin Cash was the inaugural hard fork derived from the bitcoin's blockchain, followed by Bitcoin Gold and Bitcoin Diamond.

Recently, the market of hard fork derivations include Super Bitcoin, Lightning Bitcoin, Bitcoin God, Bitcoin Uranium, Bitcoin Cash Plus, Bitcoin Silver, and Bitcoin Atom. All will be mined.

The hard fork phenomenon could generate millions of upstart cryptocurrency server farms universally planning to infuse market share because new currencies will be forced to build up a fresh supply of coins.

If Peter Theil's prognostication of a 20% to 50% chance of bitcoin's price rising in the future is true, it could set off a cryptocurrency server farm mania. By the way, Theil also believes that there is a 30% chance that Bitcoin could go to zero.

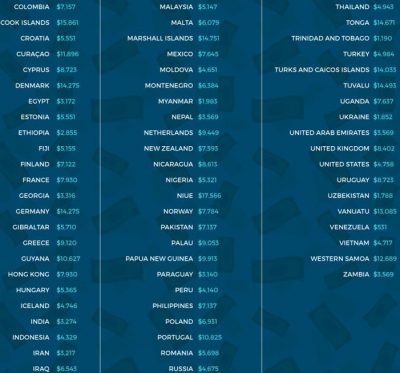

A surge in price of bitcoin results in mining cryptocurrency operations everywhere by any type of electricity, especially if the surge maintains price stability. Even mining in Denmark, where one finds the world's costliest electricity at $14,275 per bitcoin, would make sense.

Recently, miners' appetite for power is causing local governments to implement surcharges for extra infrastructure and moratoriums on new mines. Even these mines built adjacent to hydro projects are crimping the supply lines, and consumers are forced to buy power from outside suppliers. Miners are often required to pay their utility bills months in advance.

By July 2019, mining will possibly need more electricity than the entire United States consumes. And by February 2020, bitcoin mining will need as much electricity as the entire world does today, according to Grist, an environmental news website.

Geographically, most locations around the world could be profitable based on today's bitcoin price of $9,000. The few places that are exorbitant are distant, tropical islands, such as the Cook Islands at $15,861, to mine one bitcoin. If you'd like to drop your life and make a fortune mining bitcoin, then Venezuela is the most lucrative at $531 per bitcoin.

Who doesn't like free money? Set up a few devices, crank up the power, collect the coins, pay off the electricity bill, pocket the difference and hopefully the world hasn't keeled over by then.

__________________________________________________________________________________________________

Quote of the Day

"If privacy is outlawed, only outlaws will have privacy," - said Philip R. "Phil" Zimmermann, Jr., creator of the most widely used email encryption software in the world.

Mad Hedge Technology Letter

March 22, 2018

Fiat Lux

Featured Trade:

(HOW LAM RESEARCH HAS CORNERED THE MARKET FOR SEMICONDUCTOR MANUFACTURING EQUIPMENT)

(LRCX), (MU)

Micron Technology (MU) is one of the hottest semiconductor stocks of 2018, and the Wafer Fab Equipment (WFE) used to produce the chips comes from Lam Research (LRCX) - a bedrock recommendation of ours for the past several years.

I have been shouting from the mountain tops for investors to not only dip their toe in but dive head first into Lam Research.

The chipmakers are allocating greater funds into WFE to keep pace with the vigorous consumer demand. Micron Technology (MU), Samsung Electronics and SK Hynix each amount to more than 10% of Lam's annual sales.

Overall, Lam's total shipments rose nearly 37% YOY reflecting the thirst for WFE.

The memory segment of 3D NAND flash, which you find in SSDs, flash cards, and arrays, and DRAM constituted 77% of shipments, up 11% from the previous quarter, highlighting the industry's shift to non-volatile memory - meaning big data.

The momentum shows no sign of slowing down. During a recent analyst meeting, Martin Anstice, president and CEO of Lam Research, gushed about expected "record levels" of WFE shipments in 2018. Higher WFE shipments are the most pronounced indicator of promising upcoming earnings results. It doesn't get any better than that.

Lam expects next quarter shipments of $3.175 billion. Gross margins should remain impressive at 46%.

Semiconductor equipment is truly a capital-intensive proposition, and bankrolling strategic R&D programs to maintain a technological edge as well as productivity leadership will continue full speed ahead.

These investments are key to the primary objective of growing at a faster pace relative to the industry.

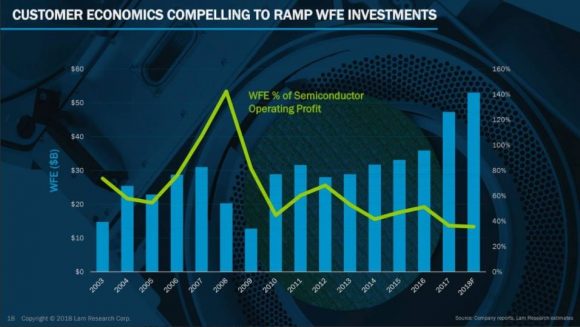

Lam's WFE capital investments in 2017 were a gargantuan $47 billion, up approximately 30% from the prior year. In 2017, 55% of investments leaned primarily toward NAND flash.

Exponential demand for data will support chip business, which includes a vast expansion in the need for silicon for autonomous vehicles, A.I., and the Internet of Things.

None of this could happen without the outperformance of the chipmakers. Lam Research is riding an influx of spending by its chipmaker customers taking advantage of higher ASPs (Average Selling Price) of DRAM chips, used in PCs and servers, and NAND chips, used in smartphones.

Mainstay customer Micron Technology said last month that it expected capital expenditure around $7.5 billion for 2018, up from $5.1 billion in 2017. Record amounts of cash flow allow Micron to double down on technology refinement as it positions itself for the next generation set of chips.

Equipment investment by clients is at a 15-year low as a percentage of profits. Money is raining down on the chip sector, and the economics that scale juice up profit margins to 47.6%.

To add more color, DRAM is the recipient of meaningfully higher levels of investments required to drive similar levels of bit supply growth compared to historical levels.

Lam leads the industry in enhancing performance and bit growth with annual increases in the low 20% for DRAM and high 40% for NAND.

The server phone content in DRAM and the smartphone bit growth for NAND will help facilitate the mass amounts of data going forward.

The average smartphone today has capacity of around 40GB of NAND content, and higher-grade phones have 256GB, and this number will only increase.

Lam's key markets in NANDs are growing faster as customers transition from 64-layers to 96-layer fabrication investments starting late in 2018 and into 2019.

NAND is such a decisive cog in the tech ecosphere that Lam has no choice but to oblige and invest in this space.

Undoubtedly, NAND is probably the poster child for a market with elasticity of demand. The sector adopted new technology and it is scaling it, which will result in relative cost reduction.

Chips with 3D NAND technology are relatively efficient, reducing the cost per GB (gigabyte) of storage and lowering power consumption.

Basically, chip companies won't gobble up Lam's products if the productivity yields are suboptimal, causing Lam to push the envelope with enhanced bit technology.

Carefully planned cost road maps create opportunities to carve out incremental demand for companies such as Micron and Samsung, and enhanced bit performance boost the degree of chip capacity.

Often overlooked but equally relevant is that 25% of Lam's business is perpetuating equipment. For example, it buys back used equipment, refurbishes it, and turns around and sells it as "certified pre-owned," such as a used-car or used computer business. This service side of the business harvests a higher margin than other segments at 75%.

Ultimately, humans live in a world where smart devices require the capacity to store collected data efficiently and cost effectively. Lam's equipment is one small input that goes into inventing these high-performance computing contraptions that create value either in an enterprise or in a consumer context.

The incredible profits amassed have given Lam the impetus to implement an aggressive, broad-based capital allocation policy.

Lam boosted capital returns to a more-than-doubling of the dividend from 50 cents to $1.10 per share per quarter, or $4.40 annually along with another $2 billion in buybacks on top of an existing $2 billion authorization. The catalyst was the US tax reform freeing up $6 billion in overseas cash.

Lastly, Lam expects double-digit growth in overall memory WFE in 2018 combined with annual growth in overall WFE shipments in the low-double-digit percentages. The year 2018 will be a great year for holders of Lam Research stock with no signs of disruption on the horizon.

The shares were up around 300% in the past 16 months and well deserved. The parabolic move is vindicated by sequential earnings' beats, boosting forward guidance and product improvement.

Investors finally realize the precious value in semiconductor companies and the equipment makers. Buy Lam Research on any weakness because entry points are few and far between.

__________________________________________________________________________________________________

Quote of the Day

"Jeff Bezos is opening a retail store and owns a newspaper. Turns out everything we thought about the Internet is wrong." - Aaron Levie, the co-founder and CEO of Box.

Mad Hedge Technology Letter

March 21, 2018

Fiat Lux

Featured Trade:

(HOW THE FANGS WILL MAKE A KILLING ON NEW GOVERNMENT REGULATION)

(FB), (GOOGL), (BIDU), (BABA)

What a late Christmas gift!

It's three months late, but I am sure Mark (Zuckerberg) will take it.

The cost of data just spiked thanks to UK-based Cambridge Analytica, and the FANGs are popping bottles of Champagne.

The embedded regulatory premium increased one full magnitude on the news of the data leak, and regulation will certainly be brought forward.

This is fabulous news for the FANGs because they are the ones that benefit from new data regulation because it builds a bigger moat around their businesses.

Sensational claims over third-party data extraction is just the tip of the iceberg. We haven't wrapped our heads around the full extent of Pandora's Box either because the hijacking of data has gone on unabated for years.

Remember, Facebook (FB) is just a "distribution platform."

Years of grabbing market share and dominating business was well worth it because tech regulation will kill off future competition as the lubrication of free-flowing data will be scrutinized adding to costs.

Mark Zuckerberg will pay lip service, noting he didn't know perpetrators would use data in an unscrupulous way, and the world will move on. He might even have to testify in front of various governments and put in some face time. Case closed.

Meanwhile the market doesn't blink an eye, but whispers of tech regulation tears the market to shreds.

The ugly truth is Facebook does not care what users post on its distribution data platform as long as users post, gifting free data on themselves. Herd-like advertisers have no choice but to comply and pony up for potential clicks driving business.

The real news is in the ramifications to the FANGs, Big Data and data regulation.

Tech companies and corporate America make executive decisions based on data, and without it operations are run less efficiently and with less precision.

Big data cuts across every single big trend in tech. The unearthing of bad actors only highlights the desire for big data and the widespread monetizing opportunities of data extraction.

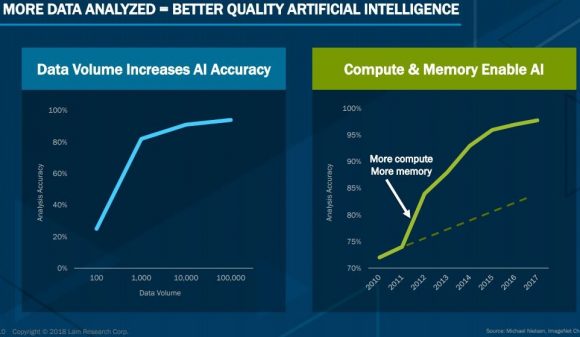

The volume of data is integral to the accuracy of the applications. Minimal degree of error yields higher quality A.I. technology, translating into better performance.

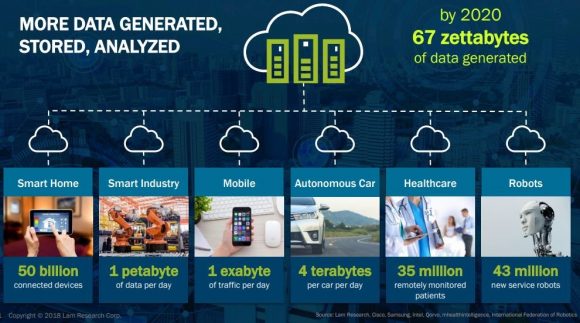

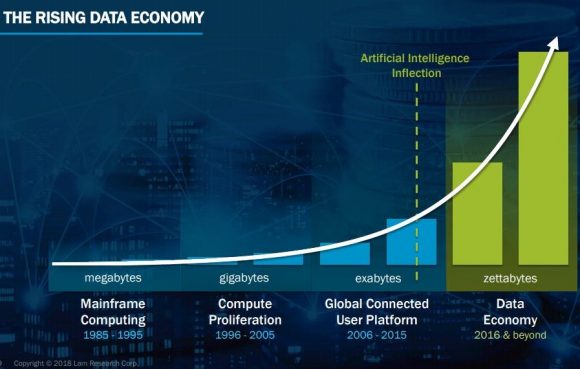

The data economy produces zettabytes of data now, up from exabytes, and before that, up from gigabytes.

The technological development expected by 2020 is mind-numbing. Autonomous cars will generate 4 terabytes of data per day per car. There will be 50 billion connected smart devices in operation.

Smartphones will consume more than 1 exabyte of data each day. Oh, did I mention the 43 million robots in the workplace and all the data they will produce?

The White House has missed the boat on regulation, hence the wrist slapping.

Which FANGs are most susceptible to regulation?

The FANGs that are closely aligned with the proliferation of data - Facebook and Google (GOOGL).

These two FANGs are in the firing line and disastrous headlines exacerbate an already tense situation in the short term. They will be fine long term.

Facebook and Google don't charge their customers to circumvent the antitrust dilemma. The result is charging through a back-door method of building up user data for the means of hyper-targeting advertisements.

In general, the aftermath may lead to payment of user data - but not yet, not even close.

Until harvesting data is illegal, FANGs should be bought on the dip after the brouhaha settles down and the stock finds solid support levels.

This is hands down the best entry point into Facebook in 2018.

Big data for implementing business decisions will never go away, but the rules on how to responsibly handle it will. This is where the government is likely to step in and put its stamp on the situation. How these rules are fleshed out is a moot point because either way, Facebook will avoid any direct hits.

Any data costs related to building hyper-targeted user profiles easily will be passed on to advertisers boosting earnings. The beauty of a duopoly is that Facebook can charge more, and advertisers have no choice but to stump up the extra ad cash. Facebook would even be able to pass off the higher ad prices as a function of improved ad tech, which it is the absolute best of breed in the world.

Facebook should want more regulation.

Regulation also is necessary to steward the user-ship of 2.2 billion users. The plan for Facebook is raising revenue per user after digesting the low-hanging fruit. Facebook is perfectly placed to execute, and advertisers will grumble about additional price hikes.

The reality is that American big tech is coddled because of the American fight for technological supremacy against China. It supersedes any data harvesting blip.

The White House needs the FANGs to be powerful enough to counter the emerging threat on the other side of the Pacific. The Chinese BATs (Baidu, Alibaba and Tencent) are right on the heels of the FANGs in a full-out arms race.

Disabling the FANGs would sway the power pendulum overwhelmingly in favor of the Middle Kingdom. Washington cannot destroy the FANGs because it would give Chairman Xi the green light to dominate future technology and, in turn, the future of mankind. Trump would never let that happen, and he likes his social media too much.

Buy Facebook after the smoke clears and the dust settles.

__________________________________________________________________________________________________

Quote of the Day

"I've expressed how upset I am that the Russians tried to use our tools to sow distrust. What they did is wrong and we are not going to stand for it." - Facebook CEO Mark Zuckerberg

Mad Hedge Technology Letter

March 20, 2018

Fiat Lux

Featured Trade:

(THE BATTLE FOR CONTROL OF CRISPR TECHNOLOGY IS OVER AND YOU WON!)

(EDIT), (NTLA), (CRSP), (XLV),

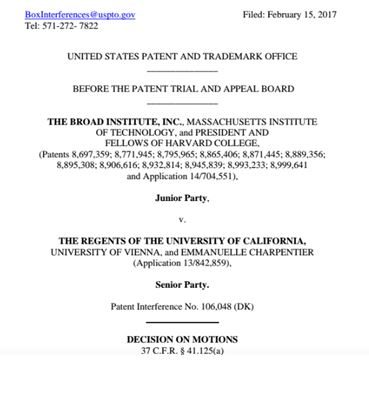

It was the battle of the Titans: Harvard versus the University of California.

At stake was who would control the patent for the most important biotechnology of the century, that for CRISPR-Cas9 gene editing.

Harvard won. And you did, too.

Tens of billions of dollars of potential profits are up for grabs.

The decision also sets up stock investment opportunities that are nothing less than spectacular. Pick the right company, and a 100-fold return on your capital is possible.

For the uninformed, CRISPR stands for "clustered regularly interspaced short palindromic repeats."

Say that fast three times.

The outline of the original CRISPR technology was published by UC Berkeley professors Jennifer Doudna, Ph.D., and Emmanuelle Charpentier, Ph.D., in 2012 in the prestigious Science Magazine.

It was widely applauded as the scientific breakthrough of the century, on par with Newton's discovery of calculus and Einstein's theory of relativity.

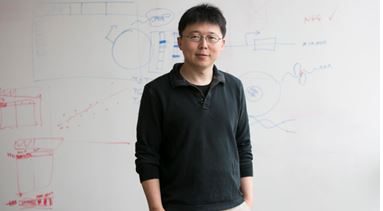

Building on their research, Feng Zhang, Ph.D., a Chinese immigrant, of Harvard University's Broad Institute (of real estate developer Kaufman and Broad fame) filed 14 patents the following year on derivative downstream processes.

However, because the Broad Institute used a fast track application process, it beat Berkeley to the patent.

A year of litigation ensued at the beginning of 2016, with the Unlisted States Patent & Trade Office holding an extremely rare "interference" hearing.

The Broad Institute argued that Feng Zhang conceptualized using the CRISPR system in human and mouse cells in February 2011, well before Doudna's 2012 patent application.

The USPO ruled in the Broad Institute's favor on February 14, 2017, setting off a firestorm in the scientific community. The Berkeley team still has the right to appear, potentially taking the dispute out several more years.

The decision sets up investment opportunities that are nothing less than spectacular. Pick the right company, and a 100-fold return on your capital is possible.

As a biochemist myself, I have been following with utter fascination the evolution of the groundbreaking CRISPR technology since Berkeley's Doudna/Charpentier team published its first paper.

If you have been living in a cave for the past five years, let me take a brief time-out and explain what is CRISPR-Cas 9 technology.

If you are the average Joe stock trader, which are most of you, suffice it to say that CRISPR technology is being developed that will enable you to edit your own DNA on a customized basis and then pass the changes on to your future generations.

This will eventually allow you to become immune to all diseases, increase your intelligence, and possibly enable you to live forever. Just cut out a bad gene and put in a new one and you, and all your future decedents are fixed for good.

You only have to make it five or 10 more years at the most with your current vintage DNA, and you can easily live another century.

The potential value of this technology is therefore immense.

CRISPR technology is moving forward so fast that amateurs can now rent labs by the hour, such as at Genspace in Brooklyn, NY, and use them to create the designers' DNA for yeasts that will brew out-of-this-world beers.

In other words, CRISPR has gone retail.

I gave readers my last update in August with my research piece on "How CRSPR Technology May Save Your Life"?(click here for the link at https://madhedgefundtrader.com/how-crispr-technology-may-save-your-life/).

With the patent issue decided, at least temporarily, it is now easier to pick the winner in the race to profitability.

That would be Cambridge, Mass., Editas Medicine (EDIT), in which the winner of the patent dispute, Feng Zhang, is a major shareholder.

Editas Medicine has been granted an exclusive license for the use of Cpf1 and other advanced Cas9 forms in relation to human genetic therapies.

Editas also has the coolest website I have ever seen (click here for its stunning home page at http://www.editasmedicine.com).

Editas already has a half dozen CRISPR-generated treatments in its pipeline, including those for cancer, Usher syndrome, sickle cell anemia, muscular dystrophy and cystic fibrosis.

The patent win will enable Editas Medicine to attract the additional capital it needs to expand both the breadth and depth of its product lineup.

Dozens of companies are lining up to license the revolutionary technology from the Broad Institute and Editas, including Monsanto, GE Healthcare and Germany's Evotec.

The ruling has big consequences for a phalanx of biotech start-ups racing to commercialize CRISPR technology.

Companies that backed the wrong horse will have to scramble to shore up their intellectual property portfolio.

Berkeley, Calif.-based Caribou Biosciences, Inc., holds the exclusive license on the CRISPR-Cas9 inventions made by Doudna and her colleagues, while Basel, Switzerland-based CRISPR Therapeutics licensed essentially the same inventions from the University of Vienna, where Charpentier once worked and which sided with UC in the patent case.

Even though they came out on the wrong side of the patent dispute, other companies bear consideration when looking for CRISPR investment targets.

The market for this technology is going to be so enormous that any participants, no matter what their position on the patent ladder, will reap financial windfalls.

In other words, even the losers will become winners.

Those would include Intellia (NTLA) (click here for its site at http://www.intelliatx.com) and Crisper Therapeutics (CRSP) (its site is at http://crisprtx.com).

We will continue to hear a lot more about CRISPR technology and the investment implications therein.

I will keep a laser-like focus on the sector and update my research pieces when I can.

The Winner, For Now

___________________________________________________________________________________________________

Quote of the Day

"Insanity is doing the same thing over and over again and expecting different results," said the Nobel Prize winner and theoretical physicist Albert Einstein.

Mad Hedge Technology Letter

March 19, 2018

Fiat Lux

Featured Trade:

(DON'T BUY THE SPOTIFY IPO ON PAIN OF DEATH)

(IHRTQ), (AMZN), (FB), (GOOGL), (P)

The music business has long been a graveyard for new startups and their business models, and it looks like we are about to get another victim.

Investors should avoid the upcoming Spotify initial public offering (IPO) as if it were the Black Plague.

Streaming live music is an impractical business and makes it impossible to turn a profit.

The model is a gift to consumers because unlimited music for $9.99 per month is a steal, and the service is free if users can endure annoying ads.

Apple music (AAPL) and Amazon prime music (AMZN) complicate Spotify's future because competing with Goliath is a guaranteed money loser.

These two FANGs also have the luxury of not worrying about losing money in music streaming, as it's just one miniscule slice of their overall business.

Apple music is second in market share with 37 million subscribers. However, Apple offers a multitude of integrated services, and its synergistic end products far surpass Spotify's music-only business.

Recent legislation has not cooperated either.

The Copyright Royalty Board (CRB) elevated royalty payments for songwriters from 10.5 percent to 15.1 percent of total revenue constituting a 43.8 percent increase.

The aftermath will stoke more operational losses for Spotify.

The modification is the largest in CRB increase in history and is a big win for the music industry against tech.

The 71 million Spotify subscribers are indeed formidable, but history is cluttered with examples of music streaming platforms gone astray.

Internet radio firm iHeartRadio (IHRTQ), mired in $15 billion of crushing debt, is the latest on the verge of bankruptcy.

Let's look at the only pure music streaming stock out there in Pandora (P): The original architect of this industry is a dud. Pandora's total subscribers peaked in Q4 2014 along with its share price at $37.42 and has taken investors on a downhill toboggan ride to $5 today.

Dispensing the former CEO and changing direction with new management were obvious considering Pandora is a bad business model. But there is only so much the board of directors with an inferior business model can do.

Spotify's most recently reported loss more than doubled YOY as the exorbitant royalty costs ate into gross margins. Compare Spotify with Facebook (FB), which pays nothing for its content and has terrific growth margins.

Spotify's royalty and distribution costs to the music industry amounts to 79% of total revenue. Ouch! In brief, it's incredibly expensive to corral together new users into the Spotify ecosystem.

Spotify has hyped up scale as its one-way ticket to profits, but scale is FANG's secret weapon along with unlimited cash flow to spruce up any desirable business. Apple and Amazon could easily target Spotify and dismantle their user ship.

To reach the scale desired, Spotify will have to really dig deep and splurge on adding incremental subscribers. This type of strategy is futile against deep pocketed Apple and Amazon.

YouTube, owned by Google (GOOGL), is the last part of the equation where music is completely free, and if you download an ad-blocker application, ads are removed as well.

In 2018, there is no reason to ever pay for music and that's why YouTube enjoys 1 billion monthly users. Users have voted with their wallets.

Spoiled Millennials, having grown up with Napster, expect and demand a world of downloadable free music.

Spotify's unconventional decision to directly list is also grounds to abstain.

Usually a company offers shares to the market to raise cash. Spotify isn't raising any cash, and the company must raise cash at some point. Any share dilution will occur after stock purchases, not before as in a normal IPO.

In a normal IPO banks normally put up their own capital to close the deal. They are responsible to make a market for the new shares once it is priced. However, in an unusual IPO process, banks have been completely shut out of the Spotify deal, which could result in a wave of extreme volatility on the first day.

Banks also "Build a book" to solicit interest from potential investors at specific prices leading up to the IPO day. Investors miffed at pricing will give an incentive to wait out the madness. The end result could be a disaster for this IPO.

Shareholders usually are subject to a lockup period to limit the potential shares offered for sale by "flippers." This new unconventional process allows investors to unload all Spotify shares anytime, which increases the downside risk on IPO day. This irregular method will lack a stable set of shareholders who buy and wait out the initial frenetic price movement.

The lack of a road show will harbor more confusion about the inner workings of the business.

Spotify is gambling that its brand is widespread enough to stir up a risky appetite, but this strategy could blow up in its face.

There is one way to save Spotify. Using an injection of funds to reinvest into enhancing the platform to gain more subscribers. Subscriber growth must outperform royalty costs on a relative basis or it never will recoup the losses. Ultimately, it's an insufficient endeavor because anything Spotify can do, the FANGs can do better.

The long-lasting benefit of making it to FANG status is that FANGs can disrupt their competition better than anyone since they are the Original Disruptors.

It makes no sense for Spotify to skimp on the IPO process just to circumvent paying investment bankers their usual excessive fees. The wild card in this experiment is that an unequivocal IPO success could spell the imminent doom of the investment banking business.

A smooth IPO would mobilize Uber, which has a similar loss-making, user growth sensitive business to follow in Spotify's path and bypass the traditional route.

In one day, big banks could be condemned to the graveyard of tech victims in a blink of an eye.

Spotify could be a great buy after the dust settles, but it would be a mistake to get caught up in the pandemonium that will ensue the day Spotify goes public.

I did the same with Tesla (TSLA) many years ago, only buying after the IPO flopped. It turned out to be a stroke of genius.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.