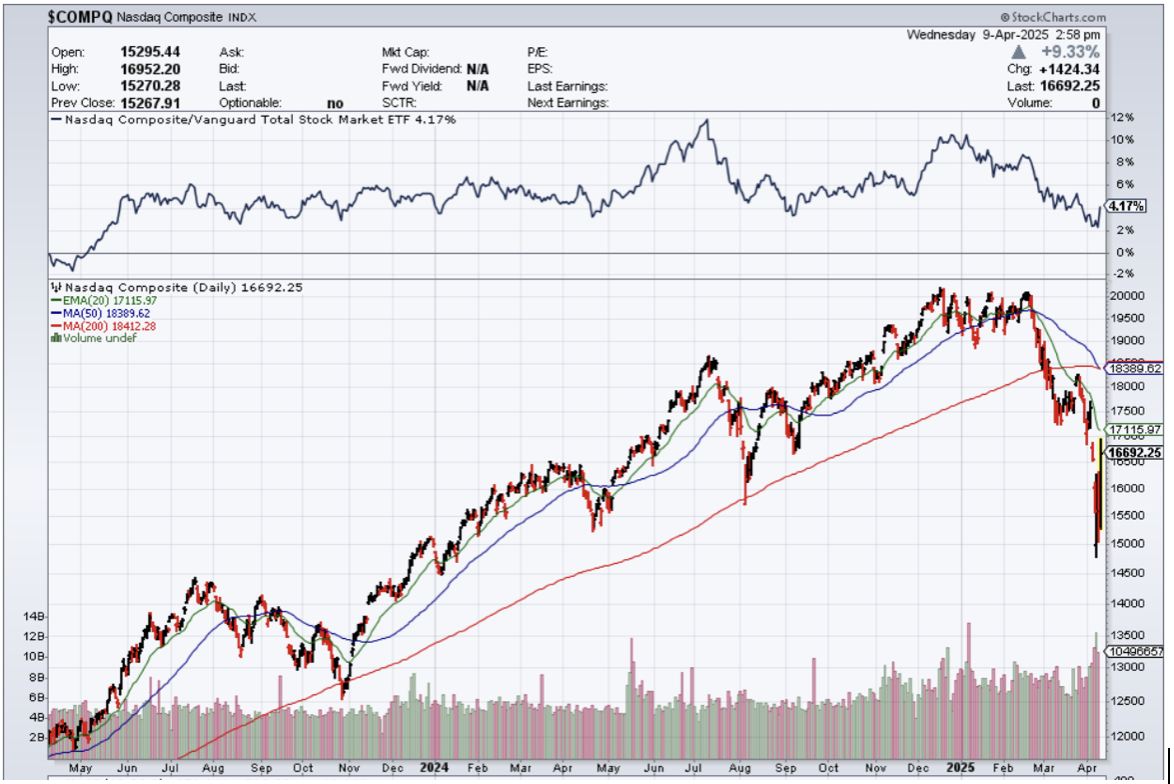

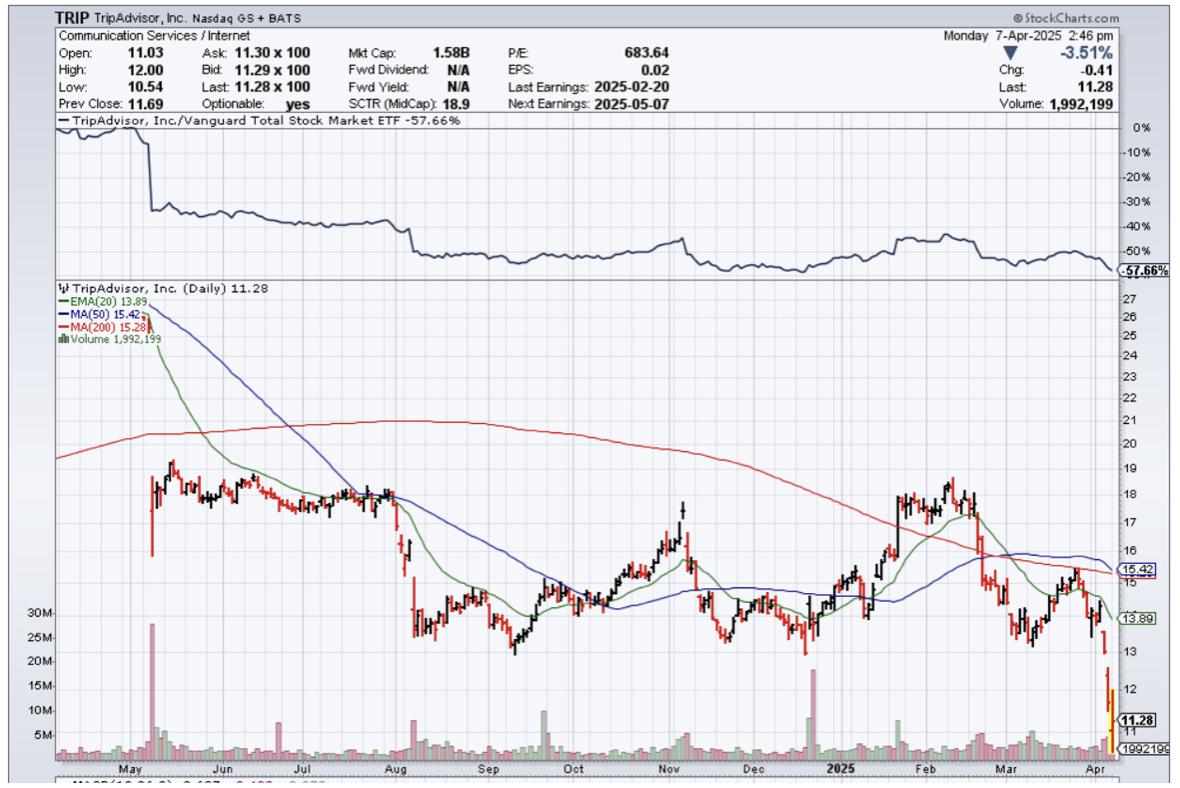

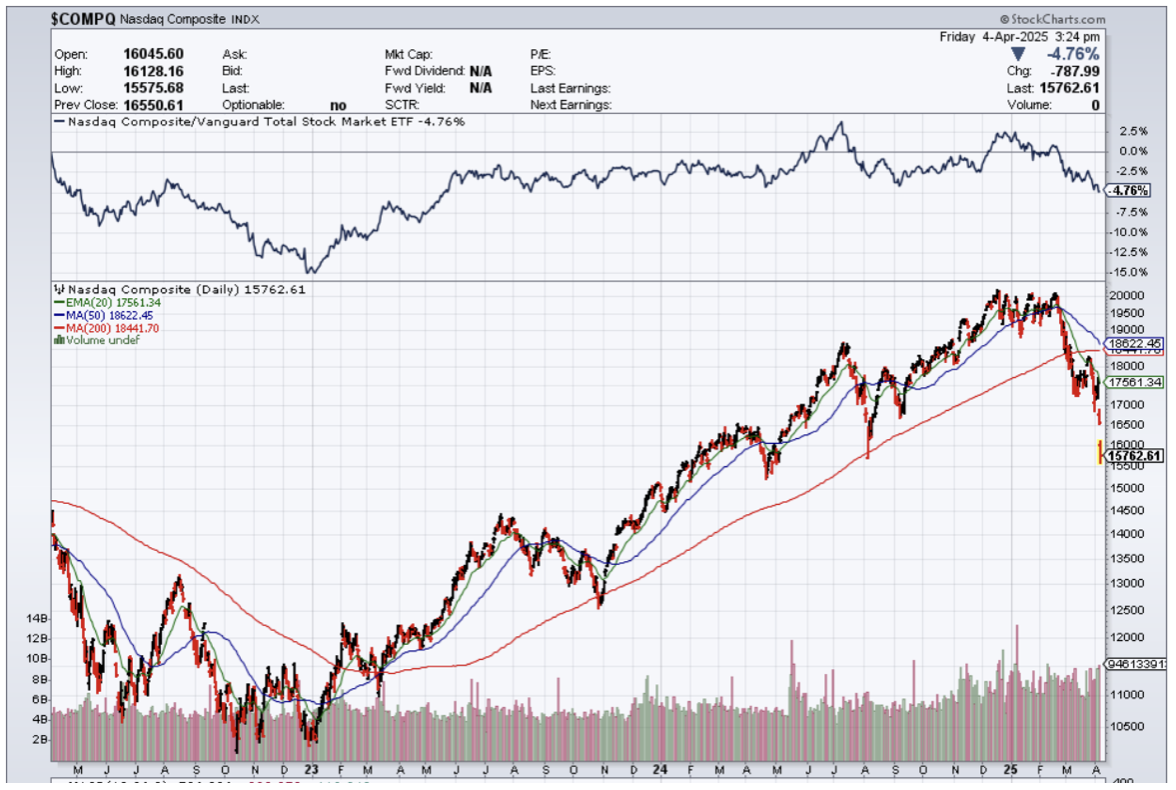

At this pace, nobody knows what the government policies will look like, and if this doesn’t change, the uncertainty will bleed into lower tech stocks ($COMPQ).

Tech has had a hard short-term run, and the unstable backdrop will lead to investors pausing on big tech stock purchases.

Tech businesses are also reigning in their investment spend, waiting to see what happens.

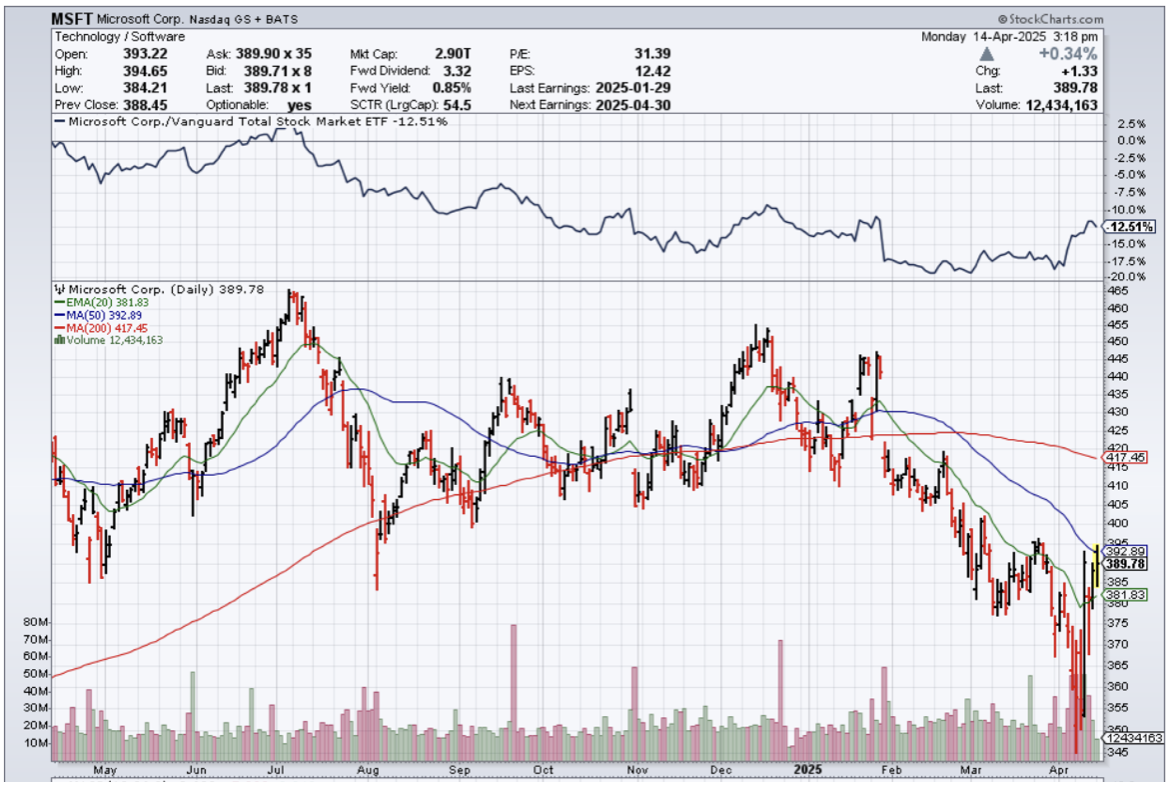

Microsoft (MSFT) has already made announcements on pausing its AI database build out and that has really chilled momentum in the wider AI trade.

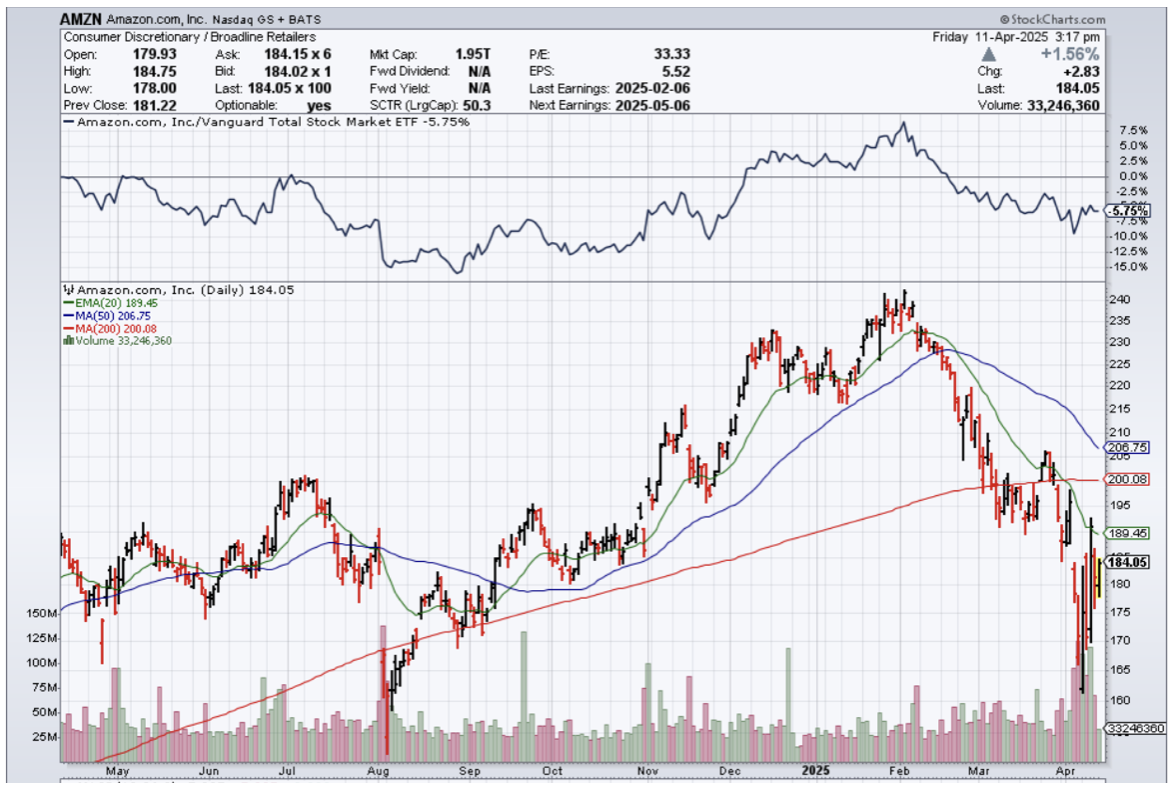

If this electronics exemption announced Friday night is true, it represents an important temporary win for Apple (AAPL) and other China-dependent technology giants.

News reports that producing the iPhone in America could cause the price of a new iPhone to double send shockwaves throughout the investment community.

The federal government might have to pull back their aggressive policies when factoring in surging yield in interest rates and a short-term collapse of the dollar.

The president said these products are simply moving to a different tariff "bucket," telling reporters that a separate rate for semiconductor tariffs will be announced over this week.

Trump added that his goal is to "uncomplicate" things by moving production to the US but that companies will have a say.

Either way, the fact remains that Trump has offered at least a temporary boost to companies with close links to China, and investors are responding by sending stocks of directly impacted companies like Apple and Dell (DELL) higher this morning.

These technology companies' goods are still subject to 20% blanket tariffs on China over fentanyl and likely face legacy sector-specific tariffs from Trump 1.0 and the Biden era, but they are now able to sidestep the lion's share of the 145% rate that is now in place for other goods.

The move is also a significant walk back of Trump's overall tariff plans, with electronics representing the top exports from China to the US.

This weekend's move means the overall effective tariff rate on US imports is now 22% — down from 27% just last week.

The smaller the tech company is, the bigger they are impacted with this whipsawing strategy of threatening all your trading partners.

Larger companies certainly have more options than small businesses to dodge the tariffs due to their worldwide networks and political relationships.

Apple, as one example, also gained attention in recent days for reportedly chartering cargo flights to move as many as 1.5 million iPhones to the United States from India quickly to get ahead of tariffs there.

Tech shares are pricing in nothing positive emerging in the short-term.

Management doesn’t want to get burned by moving in one direction, only to see a product get wiped out due to high costs.

It is hard to change the issue of how the U.S. relocated the supply chain to cheaper foreign countries.

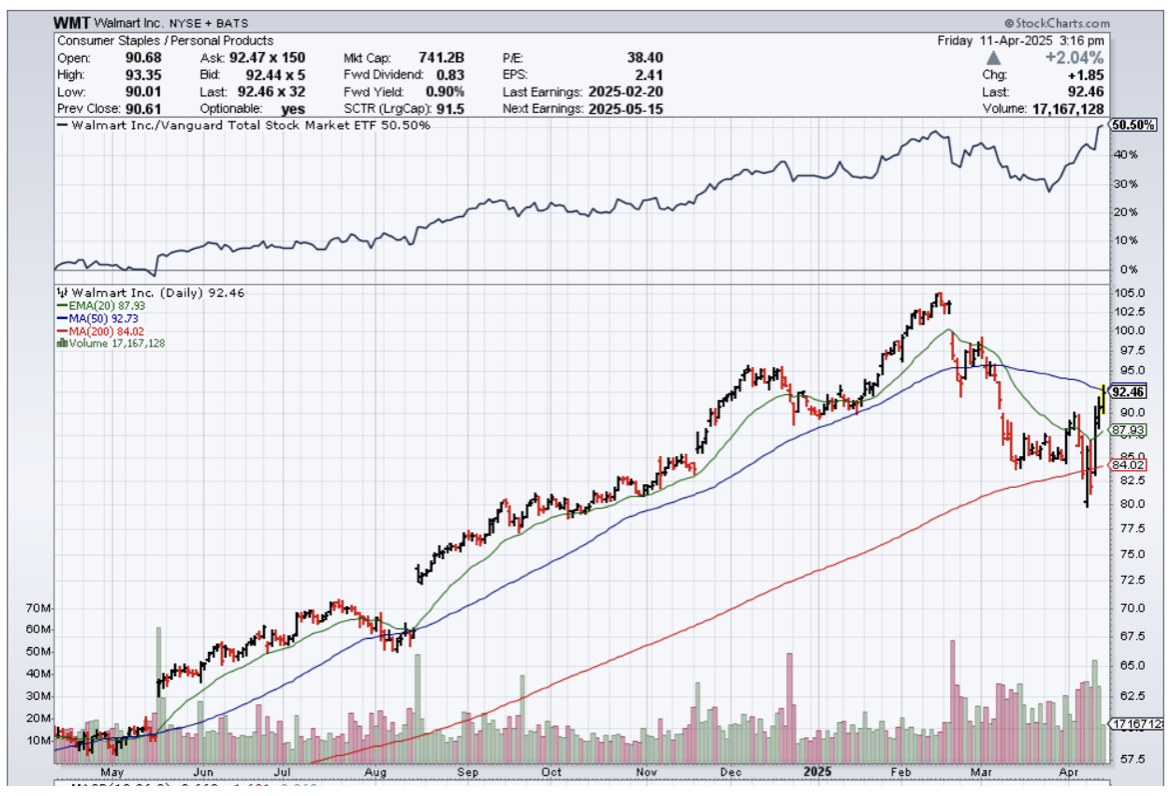

The consensus of higher prices comes after Americans have been dealing with uncontrollable inflation since 2020.

The extra price increase preceding Trump’s tariff crusade has consumers in a hole.

Even compared to 2024, I don’t see where the incremental dollar comes into the tech sector when margins are being squeezed in real time.

At best, we could experience a bear market or choppy sideways price action to reflect a tougher environment for doing tech businesses, whether it is streaming, software, hardware of EVs.