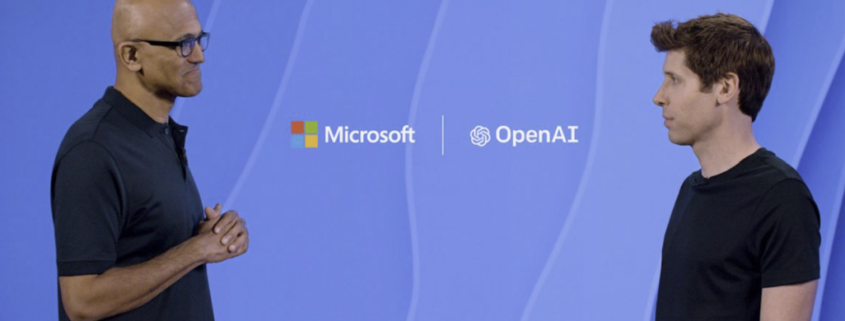

Sure, the narrative out there is that generative AI will transform the technology sector and the companies that coalesce around it.

That doesn’t always mean it will be great for everyone.

Many jobs can be mundane and boring.

AI is supposed to solve all that by unlocking time for these workers to do other tasks.

However, one trend that is picking up speed that could turn into a runaway freight train is the evolution of AI destroying most of the human job market.

It’s happening faster than people think.

If everyone loses their jobs except for a handful of CEOs running a company with AI, who will pay rent to small or corporate landlords?

Who will partake in a trip to a sports bar when these patrons lack salaries that are replaced by AI.

The next battleground of AI job removal is now reaching up to the middle manager echelon.

Confidence among middle-managers dropped to its worst-ever reading in February, pushing a broader index of US employee sentiment down to a record low.

The group’s confidence is now similar to that of entry-level workers, which fell last month to the lowest in seven years.

Decades after automation began taking and transforming manufacturing jobs, artificial intelligence is coming for the corporate management.

The list of white-collar layoffs is growing almost daily and includes jobs cuts at Google, Duolingo and UPS in recent weeks.

While the total number of jobs directly lost to generative AI remains low, some of these companies and others have linked cuts to new productivity-boosting technologies such as machine learning and other AI applications.

Generative AI could soon upend a much bigger share of white-collar jobs, including middle and high-level managers,

Generative AI speeds up routine tasks or make predictions by recognizing data patterns.

It has the power to create content and synthesize ideas—in essence, the kind of knowledge work millions of people now do behind computers.

Across all ranks, employee confidence fell to 45.1%, the lowest in data back to 2016.

Middle managers have to both direct more junior employees and answer to the senior ranks, making the position uniquely prone to burnout in the corporate ladder.

Tech firms like Meta and Google zoned in on those positions for cuts last year.

In announcing the job cuts, the companies cited similar themes around productivity and efficiency.

At some big tech firms, that can be gauged by how many people work under you, providing an incentive to overdo the staffing levels.

Companies that did just that are increasingly reducing staff and driving confidence down with it.

Although highly positive for revenue estimates, human workers will need to adjust to a modern cutthroat working environment where they need to do more and get paid less in technology.

The ironic thing about this is that the very technology they lusted over is the same technology putting the same workers out of a job.

Better be careful what you wish!

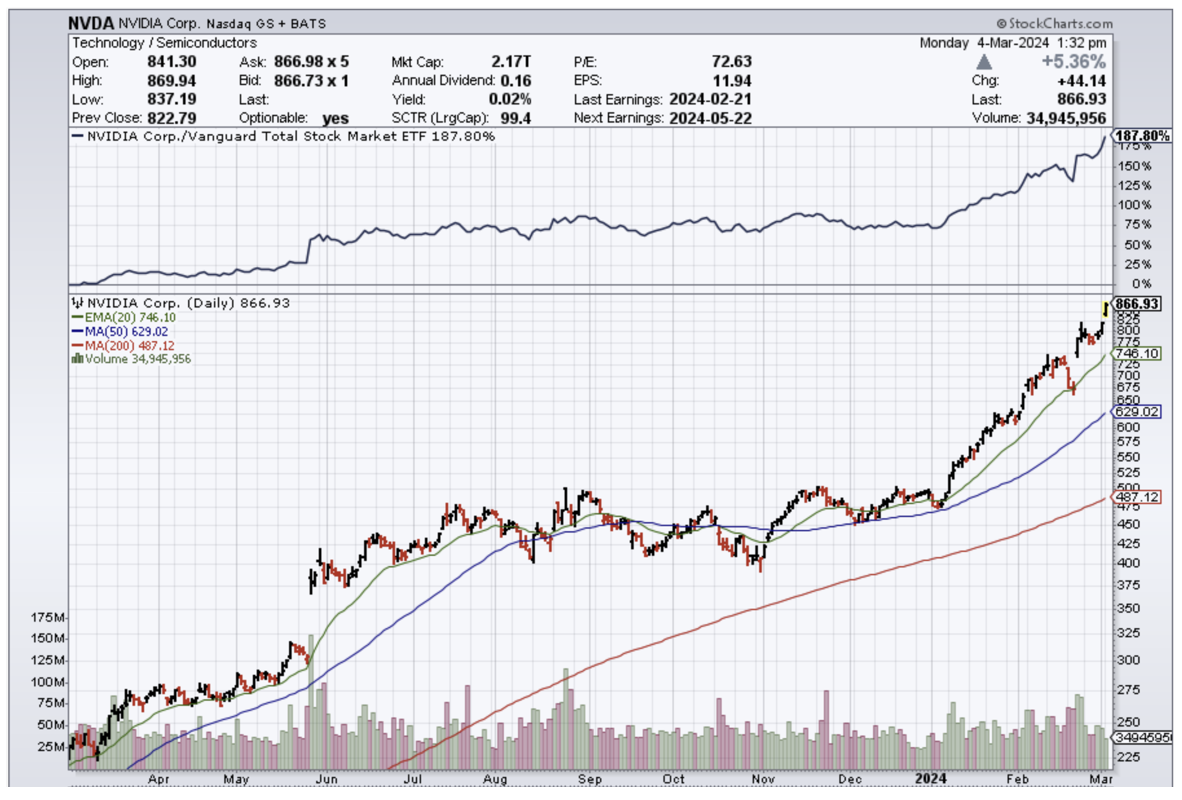

At a stock market level, this is highly positive and will lead to higher shares in tech companies like Nvidia and Super Micro computers.

Remember that wages are usually the highest expense and reducing them will almost always result in higher share prices.

It’s good that low confidence doesn’t affect the execution or existence of AI.

This is significantly bullish tech stocks short and long term and I expect every quarterly earnings transcript to talk about reducing staffing levels and higher efficiency.